Crafting a Competitive Employee Compensation Plan Guide (with Templates)

Last updated on: January 29, 2024

If you want to hire and retain top talent, improve employee productivity, and build trusting relationships with your employees, then crafting a competitive compensation plan is what you need.

Still, a compensation package involves far more than just an employee salary or pay rate, and it is equally important to both employees and business owners.

This text will cover everything you need to know about crafting a compensation package and benefits, including:

- The definition of compensation plan,

- Benefits of crafting a compensation package,

- Types of compensation,

- Steps on how to create compensation plans, and

- Compensation plan templates and examples.

Let’s begin!

- A compensation plan is a formal document that outlines the components of an employee’s pay structure.

- Effective compensation plans help attract top talent, boost employee morale and productivity, promote a healthy company culture, and more.

- Direct compensation is financial or monetary compensation given to an employee for the time worked, such as hourly wages, salary, commissions, and bonuses.

- Indirect compensation, on the other hand, is non-monetary compensation that includes a retirement plan, time off, health insurance, and other employee benefits.

- Crafting a competitive compensation package includes several steps, such as deciding on your company’s compensation philosophy, researching the job market, defining the compensation structure, and including employee benefits.

- Time tracking is crucial for your business as it covers keeping track of your employees’ work hours, PTO, and more.

Table of Contents

What is a compensation plan?

A compensation plan is a formal document that includes all the components of the employee compensation packages. This involves:

- Hourly wages,

- Salaries,

- Commissions and bonuses, as well as

- Employee benefits and other incentives.

Compensation plans are somewhat flexible, as it’s up to the employers to decide what they want to offer to their employees in order to stay competitive in the labor market.

Nowadays, as more employees work remotely, companies must make sure they offer competitive compensation packages that cater to their remote workers. For some, that may be offering location-based or location-agnostic compensation. While location-based pay will require you to pay your employees based on the cost of living in their place of residence, location-agnostic pay calls for equal pay no matter the location.

The 2 types of compensation

There are 2 major types of employee compensation for an employer to consider when setting up a compensation plan:

- Direct compensation, and

- Indirect compensation.

Apart from these 2 major types of compensation, there is an additional type that doesn’t fall into any of these categories and which we’ll discuss in more detail below.

Let’s break down each in more detail.

Type #1: Direct compensation

Direct compensation is financial compensation given to an employee for time worked. It can be in the form of a salary, overtime pay, bonuses, or commissions (we’ll go over each more thoroughly in The 4 types of direct compensation section below).

Type #2: Indirect compensation

As opposed to direct or financial compensation, indirect compensation is the non-monetary payment provided to an employee. This type of compensation usually involves the benefits an employee receives in addition to the direct compensation, commonly known as employee benefits.

Such benefits may include health insurance, life insurance, vacation or paid time off, retirement funds, fringe benefits, etc. Some companies may also offer company stocks and profit-sharing in their benefits packages.

💡 Clockify Pro Tip

Want to know how to request time off and track it properly? Stick around and read the following blog post on the matter:

Bonus compensation type: Incentives

Speaking of the additional type of compensation, incentive pay is also a form of employee compensation — one that doesn’t strictly fall under the above-listed categories.

Incentive pay is a form of compensation that is usually either indirect or non-financial and based on performance rather than on time worked. Incentives serve as a form of encouragement and motivation for employees to strive for excellence in their work. They usually imply a specific goal — if an employee reaches the said goal, they get the incentive, which may be in the form of travel, merchandise, or even cash.

💡 Clockify Pro Tip

If you want to learn more about goals, their types, and most importantly, how to achieve them, pay attention to the following text:

The 4 types of direct compensation

As we mentioned earlier, direct compensation is monetary or financial employee compensation, and these are main types of direct compensation:

- Hourly compensation,

- Salary compensation,

- Commissions, and

- Bonuses.

Direct compensation type #1: Hourly compensation

Hourly compensation is a type of direct compensation associated with base pay, meaning companies pay their employees a predetermined rate for each hour worked.

Unless additional rules apply (some hourly workers are exempt from minimum wage and overtime), hourly employees are treated as non-exempt as they are entitled to the federal minimum wage under the Fair Labor Standards Act. In addition to the hourly wage, the same act entitles hourly workers to receive overtime compensation — 1.5 times their standard hourly rates. This rule applies for each hour they spend working beyond 40 hours per week.

The required federal minimum wage in the US is $7.25 per hour worked. Still, if a state law requires a higher minimum wage per hour worked, then the more favorable law for the employee prevails.

💡 Clockify Pro Tip

To find out if you are eligible for either federal or state minimum wage, read the following text that will give you more insight into the topic:

Direct compensation type #2: Salary compensation

Salary compensation is another type of direct compensation associated with base pay, meaning employees receive a fixed amount of money each pay period (weekly, monthly, bi-weekly, etc.).

This fixed salary is always based on a salary range defined for a particular job position.

A salary range is the pay range defined by the employer that describes the minimum and maximum pay rate for a job position. It also includes a series of mid-range pay increases employees may expect to get during their time at a company.

In case salaried employees are exempt from the FLSA, they do not get paid either minimum wage or overtime for the hours they spend working past 40 hours per week. This is the case if they earn more than $684 per week or $27.63 per hour. If they earn less than this amount, they are treated as non-exempt and are entitled to minimum wage and overtime pay.

💡 Clockify Pro Tip

To learn more about the differences between hourly and salaried employee compensation, as well as their pros and cons, check out our blog post on the subject:

Direct compensation type #3: Commission

Compensation based on commission is a type of direct compensation associated with variable pay. It is common among people in the sales industry who get paid in this manner based on the sales quotas, sales percentages, and goals they reach.

Commission rates may be based on:

- Revenue — for example, if a sales professional gets 5% worth of commission for each sale, and they make a $50,000 sale, they get $1,000 worth of commission for that sale,

- Gross margins or profit — the higher a sales professional sells a product or service, the higher the commission rate, and

- Commission fee — the sales professional makes a fixed commission amount regardless of the monetary value of the sales they made.

Direct compensation type #4: Bonuses

Compensation based on bonuses is another direct type of compensation associated with variable pay. Professionals who have precise goals to reach — such as managers and salespeople — usually receive bonuses.

Bonuses are frequently paired up with other types of compensation, such as commissions or salary.

In some companies, bonuses may be implemented as an incentive meant to help employees reach higher performance standards at their jobs. In such companies, employees usually receive bonuses when they live up to certain metrics (such as company OKRs or KPIs).

How do I create an employee compensation plan?

In this section, we’ll talk about the steps you need to undertake in order to design a competitive compensation package properly.

The following steps will help your organization stay competitive in the market and attract the top-talent professionals you need.

Let’s go over each step in more detail.

Step #1: Define the company’s compensation philosophy

Competitive compensation is based on market pay rates. Therefore, when defining the compensation in your company, you can choose to:

- Lead,

- Lag, or

- Match the market.

While leading the market would entail offering higher compensation than the competitors, lagging would include offering lower compensation as compared to competitors. Finally, matching the market would mean giving the same compensation as the competitors.

Establishing the company’s compensation philosophy is completely up to you, but bear in mind that if you want to attract and retain top talent, you should at least match the numbers on the market.

You can always offer additional, non-monetary compensation such as more days off or other employee benefits that may sound more appealing to a job candidate than the actual monetary compensation.

Step #2: Define the type of employees you will hire

When outlining your compensation strategy, it’s also important to decide which employees you tend to hire. Remember that, as an employer, you must be aware of the different legal regulations and obligations concerning each type of worker.

Therefore, when choosing which employees to hire, you ask yourself the following questions:

- Are your employees full-time or part-time employees?

- Will you tap into the gig economy and employ contractors and freelancers?

- What are the average hourly rates you’ll need to offer to your freelancers and contractors?

- Does your business need to hire seasonal workers during peak times such as summer or winter holidays?

💡 Clockify Pro Tip

In case you’re wondering how to pay contractors and freelancers, here’s a text that will help you:

Step #3: Research and analyze the job market

As said above, you need to scrutinize the market before defining your compensation package and benefits since it’s crucial for attracting top talent.

If you are operating in the US, you can obtain useful general compensation statistics from the US Bureau of Labor Statistics.

Still, the best way to do so is to analyze and research salary data and market surveys — this is also known as compensation benchmarking.

When looking for market surveys and salary data to buy and analyze, make sure you pay close attention to the following elements:

- Industries — look for surveys that cater to your company’s industry,

- Location — look for surveys that cater to the country, state, or city your company is operating in,

- Employee size — look for surveys that cater to the size of your company,

- Revenue size — look for surveys that show data from companies that have a similar business volume as you, or

- Job summaries — look for the job summaries closest to the positions you need.

Furthermore, if you want to find compensation statistics on salary-focused websites, bear in mind that this data is not the true representation of the market, as anyone can edit it.

Step #4: Define your compensation structure

Compensation structure refers to the compensation strategy you will use to define how employees will be paid. No matter how you choose to compensate for your employees’ work, you’ll need to think carefully about how best to define the hourly rates, salaries, and salary ranges you want to offer.

Also, make sure you take the following elements into consideration before you make your decision:

- The industry you are operating in,

- The size of your company,

- The revenue your company makes,

- The specific job positions you are looking for, and

- The importance and worth of these positions for the successful operation of your company.

Here’s how you can best define the salaries and hourly rates in your company.

Defining employee salaries

If you’ve decided to compensate your employees through salaries, you’ll need to think about the salary ranges you want to offer.

To best define employee salaries, make sure you:

- Carry out job analysis — determining more information about the job position you are opening,

- Group the jobs into job families — grouping the jobs by department and type (such as executive, administrative, technical) or location,

- Gauge employee experience and expertise for a certain job position — focusing on the skillfulness and the collection of experiences that an employee possesses for the successful operations of the company,

- Group jobs by job grades — the US federal government recognizes 15 job pay grades, each characterized by the General Schedule (GS) payscale. For instance, for an entry-level position with a bachelor’s degree, the average pay rate in 2023 was from $40,082 to $52,106 per year,

- Calculate the actual salary ranges — most companies will use +/- 15% or 20%, starting from the midpoint, and

- Decide how you want employees to progress within their salary range — for example, you can base this progression on the number and difficulty of skills, duties, and responsibilities, on a preplanned schedule, etc.

Defining employee hourly wages

If you decide to hire hourly workers, you must make sure you determine hourly wages carefully. To be able to do that (and make sure you are offering competitive hourly rates), you must also take in factors such as your industry, skills, and the experience you are looking for in a candidate.

Here are some hourly rates effective for 2024 based on federal pay grades that you can use as a reference when defining your own compensation packages:

- Entry-level positions (an associate’s or bachelor’s degree) — hourly rates range from $18.10 to $23.52,

- Mid-level positions (a bachelor’s or master’s degree) — hourly rates range from $24.60 to $31.97, and

- Top-level positions (a master’s degree or Ph.D.) — hourly rates range from $42.41 to $55.14.

Step #5: Add in employee benefits

Apart from direct compensation, in order to attract top talent, you’ll also need to offer competitive benefits packages when crafting your compensation strategy.

Therefore, make sure you include the most common employee benefits in your employee compensation package. Such benefits include (but are not limited to):

- COBRA health insurance — additional 18 months of health coverage to eligible employees after job termination, either voluntary or involuntary (applicable to companies with 20 employees or more),

- Workers’ compensation insurance — medical insurance and compensation to employees who suffered an injury or illness in the workplace,

- Disability insurance — compensation benefits provided to employees due to ‘temporary disability’ that occurred in the workplace,

- Paid holidays — in order to stay competitive, employers may provide employees with paid holidays as a way to boost employee morale,

- Family and medical leave — includes maternal, paternal, and adoption leave (not required to be paid leave, by law),

- Flexible schedules — employers may choose to offer flexible work arrangements such as a 4-day workweek or a 9/80 work schedule that contribute to a better work/life balance,

- Hazard pay — provided to employees whose job duties require them to work in unsafe conditions (such as security and military professions),

- Regular work breaks — times off during work time provided for lunch breaks, short breaks, and others.

💡 Clockify Pro Tip

If you are not sure about the holidays (paid or unpaid) you are entitled to while living and working in the US, head on to the following blog post to learn more about it:

Bonus tip #1: Calculating commissions

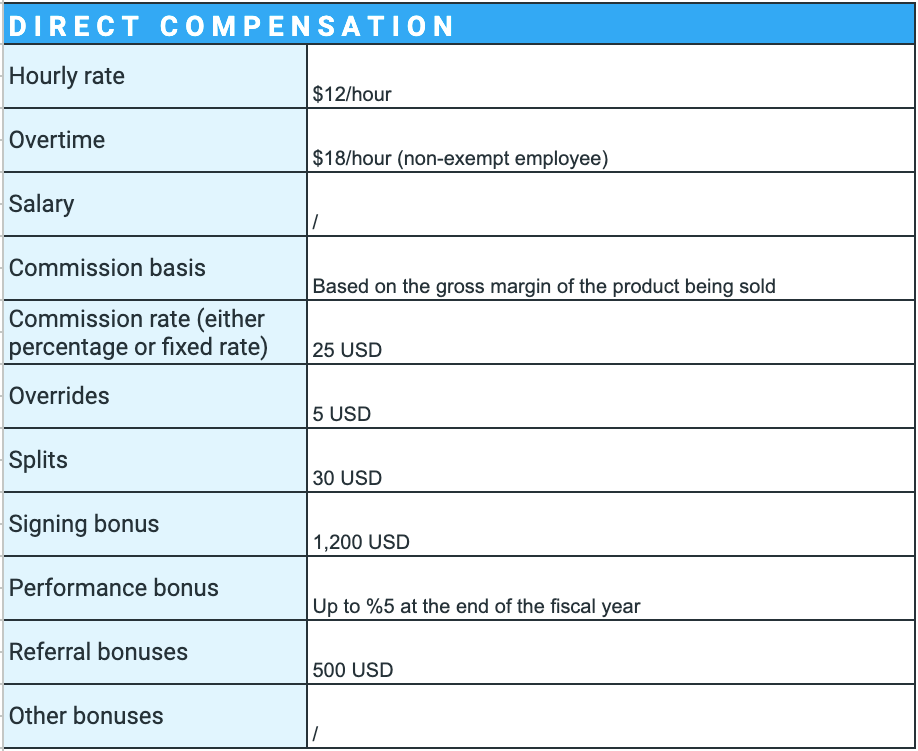

If you’ve decided to include commissions in your compensation planning (either as the only form of compensation or a supplementary form of compensation), there are several factors you should consider when defining commissions for your employees:

- The commission rate — this is the percentage (e.g., 5%) of fixed compensation (e.g.,$25) employees will get for each sale they make.

- The commission basis — a commission can be based on:

- The total number of sales,

- The gross margin of the product being sold,

- The total net profit of the product being sold (when you want to inspire your sales team to focus on selling more profitable products in your offer),

- The cash received from sales (when you want to inspire the sales team to collect all overdue receivables), and

- The inventory (when you’re looking to eliminate a product from stock).

- The overrides — one percentage (e.g., 5%) of fixed compensation (e.g., $25) may apply before the employees reach a certain goal, after which they can count on a higher percentage (e.g., 8%) or fixed compensation (e.g., $30).

- The splits — in the case when two or more employees are responsible for the sale they split the commission.

- The payment delay — commissions are usually calculated subsequently at the end of the month.

Bonus tip #2: Calculating bonuses

Sometimes, you’ll want to include bonuses in your employee compensation packages as additional incentives for high-quality performance.

Here are some of the bonuses you can consider offering:

- Signing bonuses — bonuses offered to job candidate executives as incentives to inspire them to accept positions,

- Salary-based bonuses — based on the amount of hourly wages or annual salaries the employees are making (the higher the wages or salaries, the higher the bonuses),

- Bonuses based on department goals — once a team or department meets the predefined goal, all members of the team receive bonuses,

- Referral bonuses — the higher the number of customers referred, the higher the bonuses for the employees who referred them,

- Performance bonuses — bonuses based on the employee’s overall performance or achieved specific goals at work,

- Holiday bonuses — non-performance-based bonuses typically paid around a beloved national holiday, such as Christmas,

- Quarterly or annual bonuses — if the company reaches a certain net profit goal, the employees receive a flat rate bonus or percentage,

- Retention bonuses — bonuses paid to top performers in order to keep them, and others.

Benefits of a fair compensation system

A fair compensation strategy must be developed and implemented without any prejudice or favor to anyone or anything, showing equity in the workplace.

As such, a compensation system has a handful of benefits for both the organization and the employees:

- It helps you attract top talent through competitive compensation packages,

- It helps employees understand exactly how valued they are within the organization,

- It motivates employees to perform better at work,

- It raises the morale and cooperation level among the people,

- It elevates employee satisfaction for a job well done, and

- It promotes workplace equity.

💡 Clockify Pro Tip

If you want to learn more about calculating work hours and streamlining your payroll processes, head to the following link:

Compensation plan template

Now that you know what you need to include in your compensation plan, here is an example of a compensation plan template that you can follow when defining your compensation packages.

You can download the template and choose the form that suits you best, whether that’s Google Sheets, Google Docs, PDF, Excel, or Word.

⏬ Download an Employee Compensation Plan in Google Sheets

⏬ Download an Employee Compensation Plan in Google Docs

⏬ Download an Employee Compensation Plan in PDF

⏬ Download an Employee Compensation Plan in Excel

⏬ Download an Employee Compensation Plan in Word

What is an example of a compensation plan?

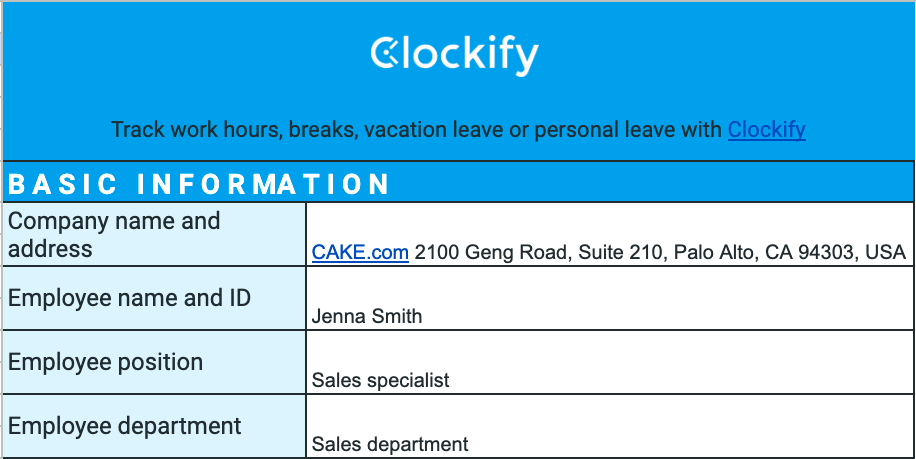

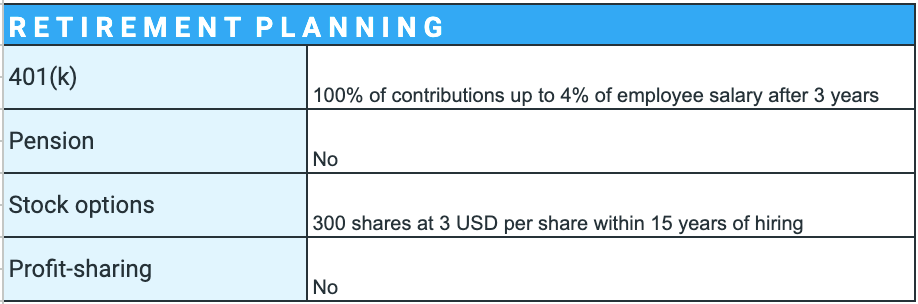

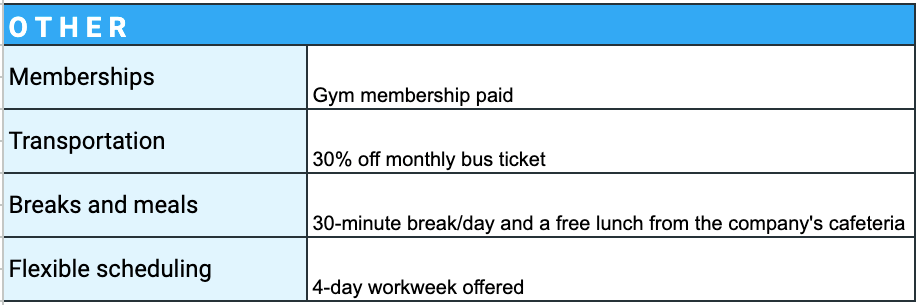

The following is an example of a filled out compensation package template. The example plan below contains some of the most important information when preparing a compensation package for your employees, including:

- Basic information,

- Direct compensation information,

- Benefits,

- Retirement planning, and

- Other relevant information.

Most of the information in the compensation plan example we already discussed in the above text, and we hope this example helps you craft your compensation package successfully and make sure you offer equity to your employees at the same time.

As for the direct compensation section in the template, you can see that the employee is an hourly worker hence there’s no salary information. Since she is a sales specialist, you can see all the details about her commission-based compensation, too.

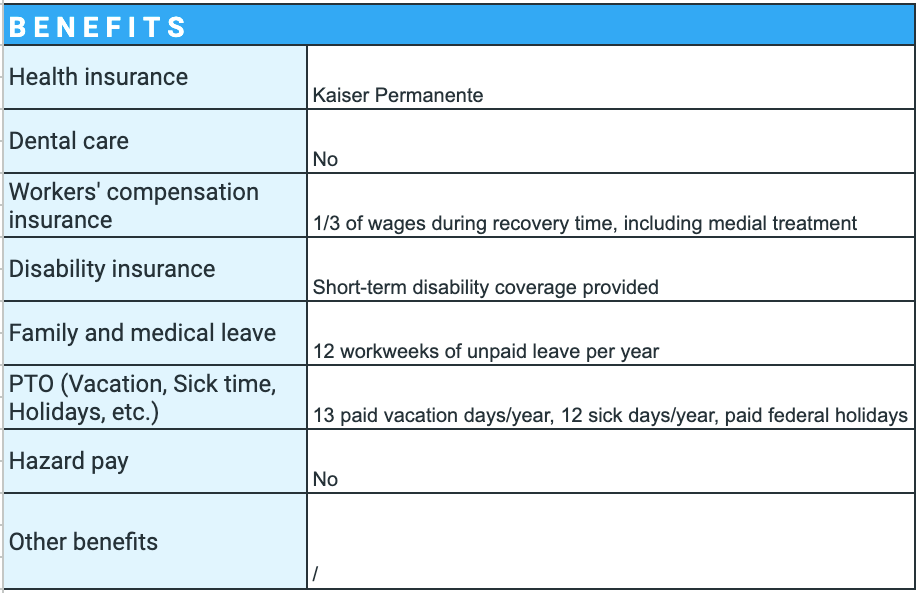

The next section in the template is about the employee’s benefits — whether the employee in question is given dental care, information about medical insurance, time off, and others.

As for the retirement planning section, the template provides information about the employer-paid retirement savings plan, eligibility to buy shares of the companies and under which conditions, or whether the employee may obtain a percentage of the company’s total earnings or not.

Finally, the template allows you to write any additional information about certain benefits, break and meal periods, reimbursement of transportation, and others.

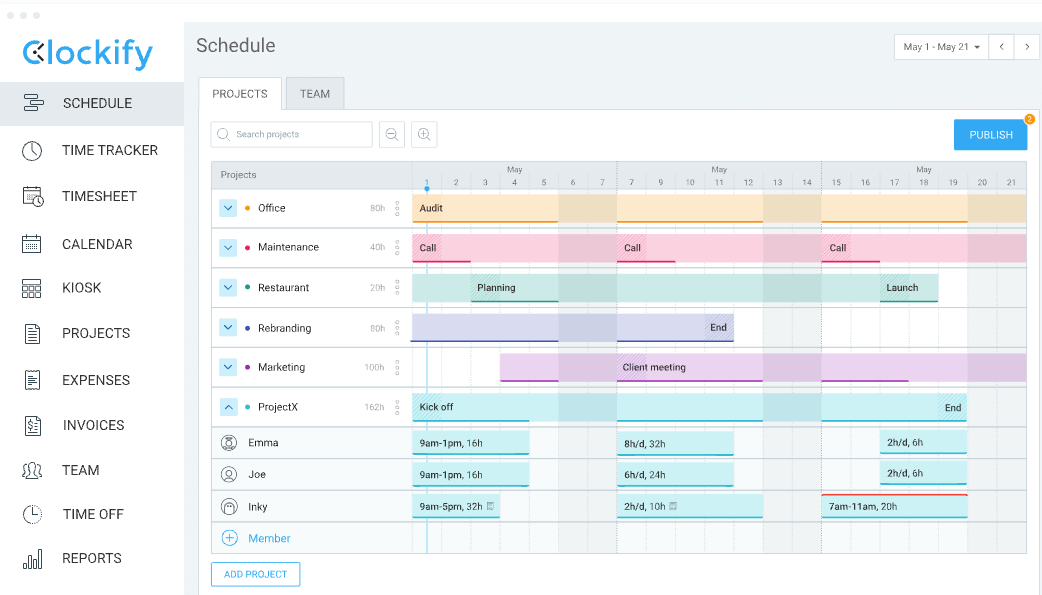

Tracking work hours vigilantly is the cornerstone of fair employee compensation

Whether you need to fill in employee timesheets, track overtime, PTO, or billable hours, having a reliable tool is critical. Clockify is an efficient business solution that can help you with that, as it allows employees to track their work time in real-time (with a timer), add it manually afterward, or enter it in a timesheet template.

With Clockify, you’ll also be able to define hourly rates for all people within your company and have their pay calculated automatically based on the number of hours they worked in a given time period.

What’s more, no matter if you hire salaried or hourly workers, exempt or non-exempt, Clockify’s free employee hours tracker will also help you stay on top of compensatory time (provided that your employees are eligible for comp time, of course).

Clockify can be your ally in making sure your employees are compensated accurately and timely, no matter which employees you hire.