How to keep track of expenses

Last updated on: November 9, 2021

Are you good with money or it seems to just slip through your fingers?

Do you assign a job to every dollar you earn or do you just go with the flow when it comes to money management?

Do you control your finances or do they control you?

You don’t have to answer out loud — if you choose at least one of the latter options, just keep reading.

In this article, we’ll learn what expense tracking is, why you should do it, and we’ll offer you some resources that can help you regain control of your finances, both personal and business.

Table of Contents

What is expense tracking?

Whether you’re unsure where exactly your paycheck goes (and why it goes so fast) or you are aiming to take the wheel of your business finances, tracking your expenses can come to your rescue. In a nutshell, expense tracking is a budgeting method for keeping a record of all expenditures throughout a period of time and avoiding getting off-track in your budget.

In order to avoid budget overspending or even underspending, a distinction between booking and posting processes must be made (we’ll talk more about this in the Categorize your expenses section in this blog post):

- Booking stands for recording the expenditures

- Posting is the act of “assigning expenses to a specific account” or placing the expenses in the right category

On this blog, we talk a lot about time tracking and how it helps you become aware of how you spend your time and if you need to implement some changes in your schedule. Similarly, expense tracking helps you have a clear overview of where your money goes, what expenses you can cut off, and helps you create a good weekly or monthly budget.

Expense tracking as an individual

You may think that minor expenses such as getting a bottle of water or a cup of coffee to go seem irrelevant, but when you accumulate all those expenses monthly, the sum you get doesn’t seem irrelevant anymore. Try it for yourself — the average price for a cup of coffee in the US (without milk and tip) is roughly $2.70. Let’s say you purchase a cup of coffee 20 days a month — $2.70 multiplied by 20 is $54 monthly for “just” a cup of coffee now and then. And perish the thought you drink mocha every morning!

Expense tracking for businesses

Businesses are sometimes not aware of the huge amounts of money they give to pay credit card fees and rates (not to mention interest rates and debts due to late payments). As with cups of coffee, they seem irrelevant when you look at them separately, but when accumulated they can cause major headaches to the business owners.

Minor expenses only seem harmless because we don’t look at them as a whole, aggregated cost. Therefore, expenses, whether minor or major, should be noted and tracked to stay on top of our finances and develop better money management skills.

6 Reasons why you should track your expenses

Meticulous expense tracking can bring along a wide range of benefits. If you are a small business owner, tracking your expenditures (office supplies, utilities, salaries, subscriptions, mileage, etc.) helps you run your business smoothly and efficiently. The same goes for individuals. When you are aware of expenses such as food, bills, mortgage payments, entertainment, taxes, and similar expenses, you develop better money management skills.

Apart from better managing your cash flow, reducing your tax liability, and making sure your business runs smoothly, we’ve listed 6 additional reasons why expense tracking is important.

1. Puts you in control of your finances

As Francis Bacon said, “Money is a good servant, but a bad master.”

While “just go with the flow” is not a bad motto to have, it can’t be applied to managing money (at least not if you want to keep it). You have to control your money instead of letting your money control you. Tracking your expenses will help you stay on top of your budget and not overspend or waste money on things you don’t need.

2. Keeps you focused on your financial goals

Being in control of your finances makes you more focused and more confident when it comes to reaching your financial goals. Expense tracking will ensure you’re on the right path and putting money towards your priorities, whether that’s getting out of debt, saving for a house, or investing in a new business venture. Having a long-term financial goal will make expenditure monitoring more bearable and even joyful — depending on what your goal is.

3. Reveals spending issues

The first step to solving a problem is knowing what the problem is.

When you start tracking your expenses, you can see if you have some bad spending habits (no judgment, we all do) or a budget category that you need to reevaluate.

It will also make you catch personal expenses you forgot about, such as unnecessary monthly subscriptions for a magazine you don’t really read or a streaming service you barely use. The same goes for business expenses. Office supplies are necessary but they can cost a fortune especially if you don’t control its replenishment. Assign a few people from your company to be in charge of buying office supplies and making detailed estimates and reports on them.

When you track your expenses, you see where your money goes and put an end to wasteful spending habits.

4. Makes business forecasting easier

If you are running a business, you need to make sure that business expenditures are regularly tracked and justified. Expense tracking makes business forecasting easier, as you can make more educated guesses based on all the data you gathered.

Also, it will facilitate calculating your business’ profitability. Therefore, you can easily see if you’re making money and how much, attract more investors, keep your employees happy, and fund your day-to-day expenses.

5. Helps you stick to your budget and cut out impulse spending

Expense tracking makes you aware of how much you’ve already spent and how much more you can spend in each budget category. Being aware of the amount of money you have at all times can help you cut unnecessary costs.

What is more, it will motivate you to spend your money consciously, instead of impulsively and recklessly. Knowing that you’ll have to write down that you wasted your hard-earned money on something trivial (those new pair of boots you’ve never worn yet) will make you think twice if you actually need that thing. So, next time you experience a quick dose of dopamine hits while out shopping, ask yourself a question: “Do I really need this?”

6. Helps you solve problems on time

When you track your expenditures, you know how much money you have at all times. That means that if a certain amount of money disappears from your bank account, you’ll notice. When it comes to finding out if your account was compromised, it’s better to know sooner rather than later. That way you can take the necessary steps to resolve the problem as soon as possible.

Frauds are not the only problem that can occur — unexpected costs can pop up anytime. When you’re in control of your finances, they’re not as big of an issue as they could be if you were freestyling your monthly money management.

How to track expenses?

Regardless if you are a small business owner or an individual, to balance the books and stay within the budget, you need to develop an efficient expense tracking system that will do the job for you. There is no strictly “fixed” or “defined” way on how exactly you should keep an eye on your expenditures. However, we’ve carefully selected 5 universal steps you can take to track your expenses efficiently, whether you are an individual or small business owner.

Step 1: Categorize your expenses

When you start categorizing your expenditures, you get a better grasp of your finances. Therefore, we want to introduce you to a seemingly old-fashioned but quite effective categorizing method — envelope budgeting.

This method helps you determine in advance how much money you can spend in each spending category — food, utilities, office supplies, entertainment, etc. When you carefully make budget estimates for each category, put them into an actual envelope. This way, you will have a clear insight into how much money is at your disposal and avoid overspending. In addition, if you prefer a more modern way to categorize your expenses, opt for a tech tool that works on the same principle. Categorizing your expenses will help you manage your budget more wisely, or even build up your saving account (if you are left with some money in a certain envelope, you can add it to your savings).

As far as a business is concerned, perhaps the actual envelope method for categorizing your expenses is not the most convenient. Conversely, find accounting software that will automatically organize your spendings into categories for better insight into trends over time.

Be that as it may, placing expenses into different categories helps you have a holistic view of your expenditures and breaks bad spending habits.

Step 2: Track your expenses regularly

Ideally, you should track your expenses as soon as you make them. All expenditures need to be accounted for and recorded without any further delay. You need to develop a regular habit to record those expenditures since sloppiness while doing so will do no good to you nor your budget.

With that being said, you can set daily or weekly reminders to build better budgeting habits and never overlook an expense again.

As a business owner, keeping track of your employees’ business hours manually sounds terribly inefficient. Conversely, use a time tracking software that will track your employees’ time (billable or non-billable) and log those hours in an online timesheet automatically. Setting reminders and tracking your or your employees’ time can help you monitor your expenses in an organized way. By doing so, you will never forget to pay your bills, for instance, or pay your employees on time.

Step 3: Keep a thorough paper trail

By this, we don’t mean you should pile up dozens of papers in your drawers. For starters, when managing personal expenses, gather up all financial documents and other valuable papers lying around the house. Then, organize them in a file folder by categories such as receipts, tax records, certificates, warranties, policies, etc. If you don’t prefer a traditional file folder, you can opt for cloud-computing technology and store your documents digitally.

Small businesses must have a workable record-keeping system to organize their invoices, bank statements, payroll records, and other business-related expenditures to be able to meet IRS requirements accordingly.

No matter what method you opt for, categorizing and storing your valuable papers is essential for tracking your expenses accordingly. You never know when you are going to need the receipt from the phone you bought recently (take advice from an expert in buying faulty goods and — successfully — returning them).

Step 4: Keep a monthly expense report

Now that you’ve recorded your expenses (by hand or digitally), it’s a wise thing to analyze and review them on a monthly basis. This way, you can see where your money went, consider if you need to implement any changes or alter your spending habits.

For that being said, you can track and write everything down (if you prefer more traditional report keeping) or opt for a budgeting app that will do the job automatically by exporting data into PDF, CSV, or Excel reports.

Business owners can also export reports digitally (doing it by hand in the digital era would be tedious), but also analyze their balance sheet, cash flow, profit, or potential losses at the end of each month. In such a way, they can have an insight into their equity, assets, liabilities, or remain prepared for unexpected expenses perhaps.

We can conclude that this step is crucial for sticking to a household budget or maintaining a successful business (or even reaching certain financial goals). Keeping records and analyzing your expenses monthly can surely bring you peace of mind.

💡 If you are a freelancer or a permanent employee working from home and running project expenses on your own, check this article out for hands-on tips and tricks → How to track project expenses when freelancing or working from home (+templates)

Step 5: Find a suitable tool for expense tracking

There is no one perfect way to record your expenses. While some people are comfortable using a simple expense ledger or a check register where they write down purchases by hand, others prefer feature-rich budgeting apps for tracking money on the go. You can use accounting software or spreadsheet software for both personal or business purposes. Find your “style” and what works best for you— the choice is all yours.

In this section, though, we want to present you with 8 expense tracking apps that we carefully reviewed and tried out ourselves. Not only these apps are time-saving but also applicable to both households and businesses. Let’s get started.

Clockify

Clockify lets you easily track and record your household’s or your employees’ unit-based expenses such as hours, mileage, days, project-related expenses, fixed fees like salaries, overtime pay, reimbursements, etc. If your expenses have a unit, the amount will be automatically calculated and you can change the unit price in the settings as well.

Additionally, attach a receipt for accounting purposes and choose between various save options (.png, .pdf, etc.) with up to 5MB file size.

Here’s how creating expenses in Clockify looks like:

Don’t worry if you can’t find an expense category you need in the drop-down menu. In Clockify, you can custom create expense categories that immediately become available when recording expenses. Edit or archive expense categories at your convenience without impacting existing expenses. Clockify offers admins to see, edit, or add new expenses for other people, or even lock adding or editing expenses for pass dates.

The expense tracking feature in Clockify also allows you to create:

- Invoices

Create custom invoices and choose the date range and how you wish to display them (by project, user, category, etc.). Edit them later on without affecting the tracked expenses. Bear in mind that only billable uninvoiced expenses are imported into invoices.

- Reports

Later, create predefined range reports (from this month, this year, etc.) or custom-made reports or filter them by any criteria such as user, category, status. Finally, export them in CSV or Excel files.

- Templates

Use free expense report templates to seek reimbursement for business-related expenses. There are various available templates for things like business travel expenses, project expenses, business lunch expenses with clients, or lodgings during business travels.

Clockify overview:

✅ Easily creates custom expense categories,

✅ Automatically calculates unit-based expenses,

✅ Creates custom invoices,

✅ Creates predefined or custom-made reports,

✅ Offers free expense report templates,

✅ Suitable for individuals, teams, businesses.

Expensify

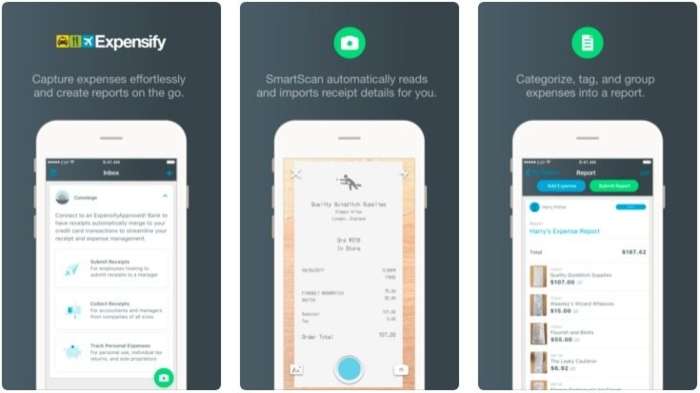

Expensify is a tool used for automating expense management and receipt tracking.

Expensify makes expense reports on the go, making it a great choice for those who take business trips frequently. Another standout feature is that you can both scan/take photos of the receipts and the app will automatically read the receipt and log the data while organizing the expenses by categories at the same time.

What’s more, you can link your bank account to Expensify to automatically import expenses or link it to your GPS to calculate your mileage expenses easily.

Finally, Expensify automatically generates and submits expense reports for sharing or downloading.

Expensify overview:

✅ Scans and automatically logs expense data,

✅ Exports reports automatically,

✅ Syncs with a bank account or GPS to track mileage expenses,

✅ Safe to use since it’s protected by world-class security standards,

✅ Suitable for businesses.

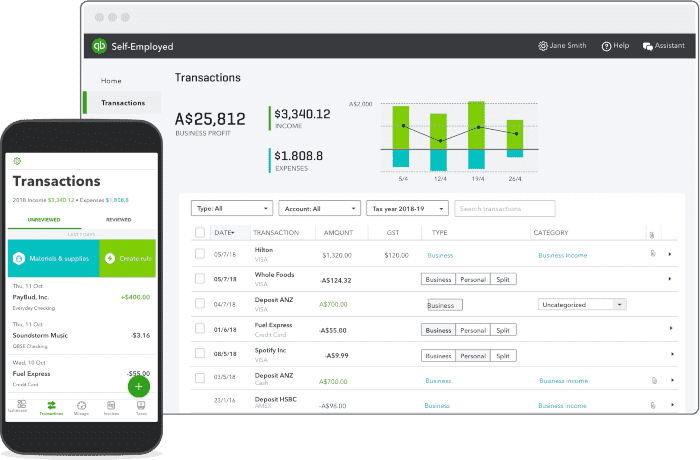

Intuit-Quickbooks

Intuit Quickbooks is a smart accounting tool for small and growing businesses. When you sign up, you need to answer a couple of questions, so that the site can accommodate your specific type of business. Quickbooks helps you stay organized with its user-friendly interface. Scan your receipts and attach them to business expenses or track your mileage making logging miles a breeze.

QuickBooks Self-Employed is an amazing additional feature if you’re (as the name of the app suggests) self-employed, as you can easily separate business and personal expenses while efficiently tracking and managing both. It also estimates your taxes and syncs with the tax-prep software TurboTax to ease the taxation process.

Intuit Quickbooks overview:

✅ Captures and scans receipts,

✅ Categorizes and organizes expenses automatically,

✅ Sorts business from personal expenditures,

✅ Reminds you of tax due dates,

✅ Suitable for individuals and businesses.

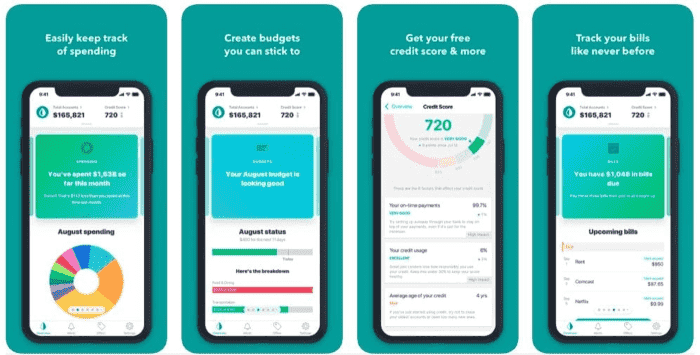

Intuit-Mint

Continuing with everyone’s favorite app by Intuit — Mint is a personal finance tool. This powerful app allows you to:

- Connect all of your accounts (checking or savings accounts, credit cards, loans, investments, mortgages, etc.), and show transactions across all linked accounts,

- Get notified if subscription costs increase or when your bills are due,

- Create a personalized budget,

- Track spendings by categories,

- Monitor your credit score.

All of that is packed in a user-friendly interface available to everyone. Mint is great for maintaining a household budget and improving your spending habits with custom goals such as saving for a house, preparing for the future, etc.

Intuit Mint overview:

✅ Organizes your budget and controls your cash flow in a streamlined way,

✅ Monitores bill due dates,

✅ Encourages saving,

✅ Easy-to-use interface,

✅ Shapes your budget according to your spendings,

✅ Suitable for personal use, self-employed individuals.

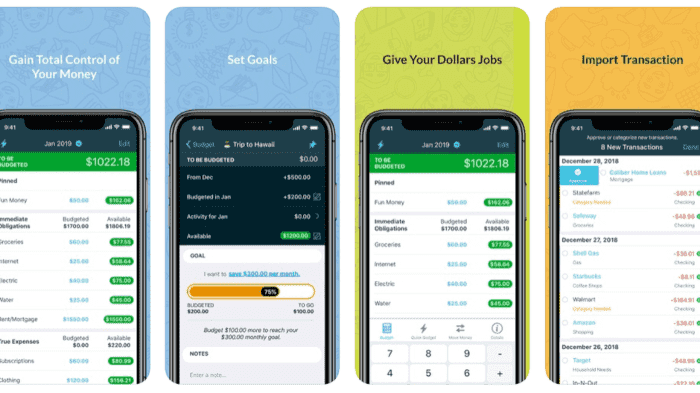

YNAB

YNAB stands for You Need A Budget — and you really do. If you’re not sure how to create one, this award-winning app may be your cup of tea. Their strategy has four rules:

- Every dollar should be given a “job” / a purpose even before it’s spent.

- Break down your big, less frequent expenses (e.g. Christmas gifts) into smaller chunks that you can pay monthly.

- Think ahead — if you are left with, for example, $50 in the bills category at the end of the month, leave it for the upcoming bills. This way, you build up your budget for paying bills so that you don’t leave your account overdrawn.

- Be purposeful with your spending and live within your means.

YNAB uses the zero-based budgeting system which proposes you assign your entire monthly income to your expense categories until you’re left with $0 on your account. The features of the app include tracking your spending, flexible data export, switching between multiple budgets, as well as syncing with multiple devices and a large number of banks.

YNAB overview:

✅ Helps you prioritize your expenses,

✅ Great for managing bills and achieving financial goals,

✅ Takes a forward-looking approach in managing your finances,

✅ Suitable for personal use.

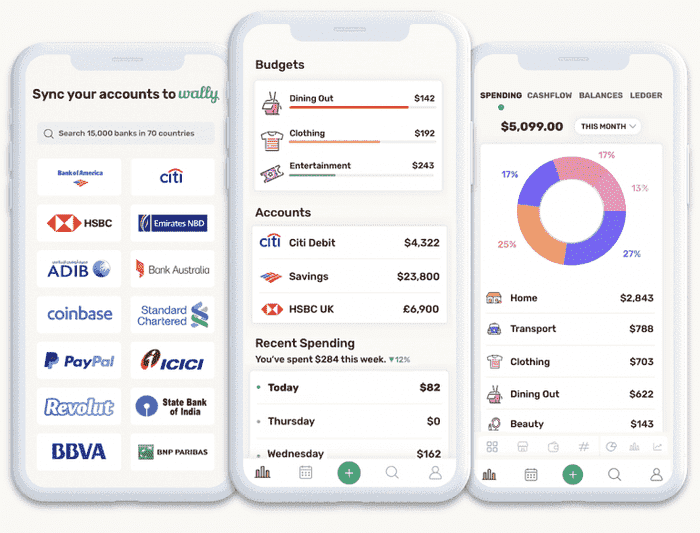

Wally

Wally is an app for managing your personal finances and maybe even your side hustles. You can track your expenses, either manually or by taking photos of receipts, and categorize them.

They aim to help you save up, so you can:

- Track your income and see your projected savings for each month,

- Budget to suit your needs,

- Track your progress,

- Stay accountable with real-time updates, among many other features.

Wally overview:

✅ Promotes saving habits by setting saving goals (buy a new car, renovate a house, etc.),

✅ Bank syncing,

✅ Keeps an eye on your budget,

✅ Provides its users a holistic view of their finances and spendings,

✅ Suitable for personal use.

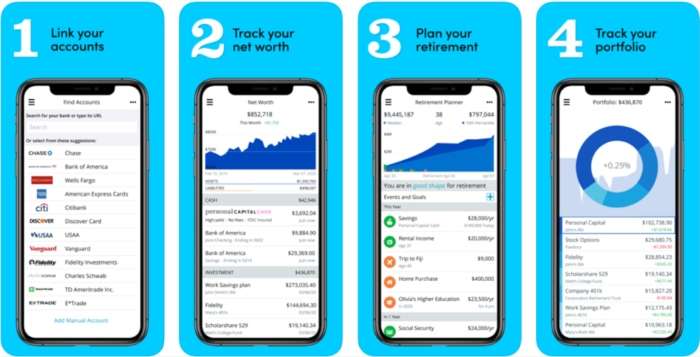

Personal-Capital

Personal Capital is stated to be the number one budgeting app by Forbes magazine itself. Apart from tracking your expenditures and cash flow, it distinguishes itself from other apps thanks to its outstanding saving tools, advisory system, investment analysis, and more. Create your retirement plan by linking your accounts to this app and following its meticulous analysis and target recommendations. Or, use their investment checkup tool that shows you how to rebalance your investments in order to achieve better financial results. They even have their own capital advisors whom you can contact to discuss your portfolio.

Personal Capital overview:

✅ Great for managing your net worth,

✅ Provides hands-on advice on your investments,

✅ Amazing analysis charts,

✅ Helps develop investment strategies and achieve long-term financial goals,

✅ Suitable for investors, planning a retirement fund.

PocketGuard

PocketGuard is another budgeting app that earned an enviable position on the Forbes best budgeting apps list. Spreadsheet lovers will enjoy using this app since, among other options, you can export your transactions to Excel as well. You don’t have to worry about security issues because this app is secured with biometrics and a PIN code. PocketGuard offers a holistic view of finances and expenses using a pie chart that helps you customize expense reports.

PocketGuard “guards” your pocket as the name itself proposes. It gives you a clear insight into how much money you have after paying all bills and other expenses. If, for instance, you pay your monthly bills, PocketGuard will notify you about your current balance and help you reach your saving goals.

They have an amazing blog where you can find out practical tips and tricks on how to manage your money better, avoid debt, stay on budget, and more.

PocketGuard overview:

✅ Keeps you from overspending,

✅ Helps set long-term saving goals,

✅ Suitable for personal use.

Conclusion

Expense tracking is a useful practice whether you need to do it for your business or you’re just trying to take your personal finances to the next level. It puts you in control of your finances, keeps you focused on your financial goals, reveals spending issues, makes business forecasting easier, and helps you stick to your budget and solve eventual problems that may occur as quickly as possible.

✉️ Do you track your expenses? What way of doing it do you find the most efficient? Do you have any tools to recommend? Write to us at blogfeedback@clockify.me for a chance to be featured in this or one of our future articles.