La discriminación en el lugar de trabajo puede ser bastante común y hay muchas formas diferentes en que un empleado puede ser discriminado en el lugar de trabajo o incluso durante el proceso de contratación.

Una de las formas más comunes en que un empleado puede ser discriminado es en los términos de igualdad de pago. Ciertos grupos de empleados (por ejemplo, mujeres) a veces cobran menores salarios que sus compañeros trabajando en los mismos trabajos.

Además, a veces los empleadores ofrecen salarios menores a los candidatos de trabajo durante el proceso de contratación, por lo tanto discriminándolos.

Debido a eso, los países de todo el mundo han empezado a implementar la transparencia salarial. Estas regulaciones protegen a los empleados requiriendo a los empleadores revelar la información de salario y otros detalles de compensación sobre el puesto de trabajo.

Por ejemplo, los empleadores deben revelar el salario mínimo y máximo para un cierto puesto de trabajo, y deben también incluir los beneficios y bonificaciones.

En este artículo, miraremos la transparencia salarial en general y leyes de transparencia salarial por estado en los EE.UU.

- Los salarios transparentes protegen a los empleados de cualquier tipo de discriminación salarial.

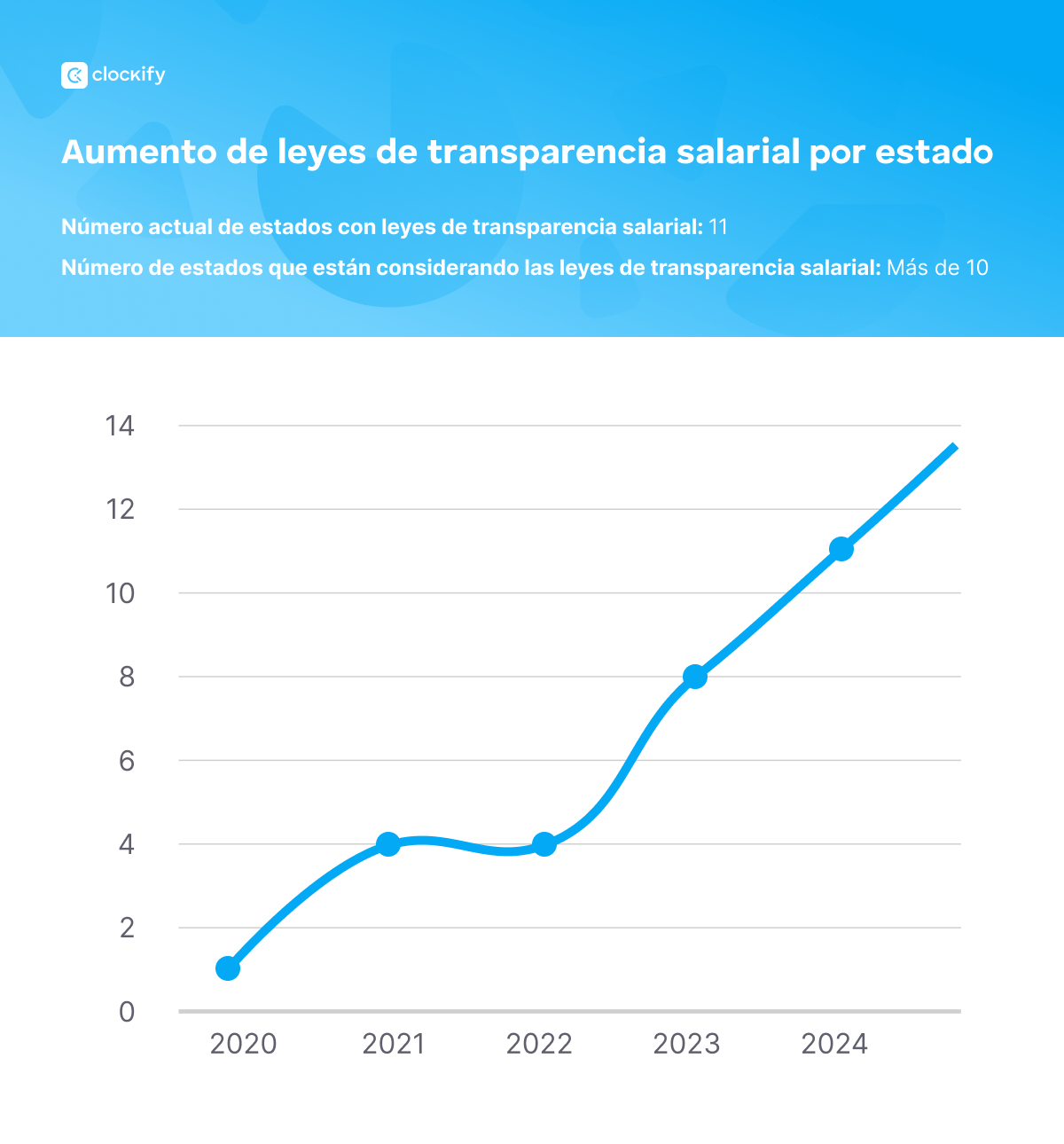

- Actualmente, hay un total de 10 estados con leyes de transparencia salarial en los EE.UU.

- Algunas ciudades tienen sus propias regulaciones de transparencia salarial (por ejemplo, la ciudad de Nueva Jersey).

- Muchos estados de los EE.UU. están considerando la implementación de leyes de transparencia salarial en el futuro.

- Una prohibición de historia de salario prohíbe a los empleadores preguntar sobre la historia salarial de un solicitante de trabajo.

¿Qué es la transparencia salarial?

La transparencia salarial es una práctica común que requiere que los empleadores compartan la compensación y otros detalles importantes (por ejemplo, los beneficios) con los candidatos y el público.

Los empleadores son requeridos a compartir esta información con los empleados o candidatos a empleo en la publicación de empleo o a pedido.

Esta práctica laboral hace que el proceso de contratación sea igual y justo para cada empleado potencial y disminuye la brecha salarial de género, discriminación de raza o cualquier otro tipo de discriminación en términos de compensación.

Para asegurar que esta regla se mantenga, algunos estados han adoptado las leyes de transparencia salarial. El primer estado que ha adoptado la ley de transparencia salarial fue California, en 2018.

Leyes de transparencia salarial pueden exigir que los empleadores revelan la información como:

- Información de salario — los estados con las leyes de transparencia salarial exigen que los empleadores proporcionen rangos de salarios para el puesto de trabajo. Los empleadores deben revelar el rango de salario a pedido y a veces incluso en la oferta de trabajo.

- Descripción general de los beneficios y bonificaciones— algunas posiciones de trabajo incluyen bonificaciones y beneficios adicionales que los empleados pueden recibir. Esta información también se debe revelar a pedido o en la oferta de trabajo.

- Remote employment — certain states require employers to disclose whether the job position includes remote work, on-site, or hybrid work.

En 2023, el Congreso introdujo la Ley de Transparencia Salarial. Si se promulga, esta ley requeriría que los empleadores revelen la información de salario a empleados potenciales y prohibiría a los empleadores tomar represalias contra los empleados que pregunten por el rango de salario.

Los estados con las leyes de transparencia salarial en 2024

Ciertos estados en los EE.UU. han promulgado sus propias leyes de transparencia salarial. De momento, hay 11 estados con leyes de transparencia salarial vigentes, y varios más los están considerando.

Veamos las leyes de transparencia salarial por estado.

| Estado | Requisitos y multas | A quién se refiere la ley y la legislación oficial |

|---|---|---|

| California | Los empleadores deben incluir un rango salarial en todas las ofertas de trabajo. Si lo solicitan, los empleadores deben proporcionar la información de rango salarial al empleado actual. Además, no se permite que los empleadores dependan de la información de la historia salarial como un factor determinante para el empleo. Multas: De $100 hasta $10 000, dependiendo de la violación. | Esta regla se aplica a los empleadores con 15 o más empleados. Los empleadores con al menos un empleado deben revelar el rango salarial si lo solicita el empleado. Explora más: Ley de Transparencia Salarial de California: SB 1162 |

| Colorado | Los empleadores deben incluir la compensación, los beneficios y la descripción del trabajo en sus ofertas de trabajo. Además, los empleadores no pueden: preguntar a los solicitantes sobre su historia salarial, o usarla como un factor determinante, prohibir que los empleados hablen sobre el salario, requerir que los empleados firmen un documento que les prohíbe hablar de pago, y tomar represalias contra cualquier empleado que ejerce sus derechos. Multas: De $500 hasta $10 000 dependiendo de la violación. | Esta regla se aplica a los empleadores con al menos un empleado trabajando en Colorado. Explora más: Ley de igualdad de remuneración por trabajo de igual valor — EPEWA |

| Connecticut | Durante el proceso de contratación, los empleadores deben revelar el rango salarial a los candidatos de empleo tan pronto como el solicitante lo solicita, y antes o después de ofrecer la compensación. Además, los empleadores deben compartir la información de salario con empleados actuales que lo soliciten o quieren cambiar sus posiciones. Preguntar por la historia salarial del empleado no se permite. Multas: Los empleados o solicitantes de trabajo pueden presentar una demanda civil contra el empleador, resultando en daños compensatorios y punitivos más costes. | Esta regla se aplica a los empleadores con al menos un empleado en Connecticut. Explora más: Ley Público 21-30 — HB 6380 |

| Hawái | Los empleadores deben compartir los rangos salariales en sus ofertas de trabajo. Estos rangos deben reflejar la compensación actual que los solicitantes de trabajo pueden esperar de la posición. Multas: Los empleados o solicitantes de trabajo pueden presentar una demanda civil contra el empleador, resultando en daños compensatorios y punitivos más costes. | Esta ley se aplica a los empleadores con 50 o más empleados. Sin embargo, esta ley no se aplica a lo siguiente: traslados internos o ascensos y posiciones donde el salario, la compensación y otros beneficios son determinados por un convenio colectivo de trabajo. Explora más: Ley de pago transparente de Hawái — SB 1057 |

| Illinois | Los empleadores deben compartir los rangos salariales y cualquier beneficio adicional en sus ofertas de trabajo. Multas: Los empleadores recibirán multas desde $500 hasta $10 000, dependiendo de cuántas violaciones tienen. Los empleadores tendrán 14 días para curar la violación por la primera infracción y 7 días para subsanar el incumplimiento por la segunda infracción. Si no lo hacen, se enfrentarán a una multa de hasta $100 por día para cada día de retraso. | Esta ley se aplica a los empleadores con 15 o más empleados. Explora más: Ley de Transparencia de Pago de Illinois — HB 3129 |

| Maryland | Los empleadores deben compartir los rangos salariales con los solicitantes de trabajo que lo solicitan. Además, los empleadores no deben solicitar la historia salarial de los solicitantes. Multas: Los empleadores recibirán una advertencia para la primera violación, una multa de hasta $300 para la segunda violación, y una multa de hasta $600 para la tercera y cada violación posterior. | Esta ley se aplica a todos los empleadores en Maryland. Explora más: Ley de igualdad de remuneración por trabajo de igual valor — HB 123 |

| Nevada | Los empleadores deben revelar el rango salarial a los solicitantes o empleados actuales que han: aplicado para una nueva posición, completado una entrevista para una posición y recibido una oferta para una posición de trabajo. Multas: Los empleados o solicitantes de trabajo pueden presentar una demanda civil contra el empleador. Además, el comisionado de trabajo puede imponer una multa de hasta $5000 por violación. | Esta ley se aplica a todos los empleadores en Nevada. Explora más: Ley de Transparencia Salarial de Nevada — SB293 |

| Nueva York | Los empleadores deben revelar los rangos salariales en sus ofertas de trabajo. Los empleadores deben también revelar a los empleados la compensación total, incluyendo los bonos. Multas: Los empleadores reciben una multa de hasta $1000 para su primera ofensa, hasta $2000 para su segunda ofensa, y hasta $3000 para su tercera y cualquier otra ofensa posterior. | Esta ley se aplica a los empleadores con cuatro o más empleados trabajando en el estado de Nueva York. Explora más: Ley de Transparencia Salarial de Nueva York — S01326 |

| Rhode Island | Los empleadores deben revelar el rango salarial a empleados actuales y solicitantes de trabajo en situaciones: donde se solicita, cuando nuevos empleados reciben una oferta de trabajo y cuando los empleados actuales se trasladan a una nueva posición de trabajo. Los empleadores tampoco pueden preguntar sobre el historial salarial de los empleados. Multas: Los empleadores pueden recibir una multa de hasta $1000 para la primera violación, hasta $2500 para la segunda y hasta $5000 para la tercera y cualquier otra violación posterior. | Esta ley se aplica a los empleados con al menos un empleado en Rhode Island. Explora más: Prácticas de Empleo Justo — S0270A |

| Washington | Los empleadores deben compartir la información de rango salarial en sus ofertas de trabajo. Para los cambios internos de posición, deben compartir el rango salarial según solicitado. Las ofertas de trabajo también deben incluir los beneficios y los bonos como parte de la compensación completa. Multas: Los empleadores pueden recibir multas desde $500 para la primera violación y hasta $1000 o el 10% de los perjuicios (cualquier que sea mayor) para violaciones repetidas. | Esta ley se aplica a los empleadores con 15 o más empleados en Washington, incluyendo los empleados remotos. Explora más: Ley de Pago y Oportunidades Justas — SB5761 |

| Distrito de Columbia | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas: De $1000 hasta $20000 dependiendo de la violación. | Esta ley se aplica a todos los empleadores. La ley de transparencia salarial de Alaska fue propuesta y aprobada en 2023. Está en vigor desde el 30 de junio de 2024. |

Leyes locales de transparencia salarial

En adición a los estados mencionados anteriormente que tienen sus propias leyes de transparencia salarial, algunas ciudades también las han pasado. Veamoslas en más detalles.

| Municipio | Requisitos y multas | A quién se refiere la ley y la legislación oficial |

|---|---|---|

| Ciudad de Jersey (Nueva Jersey) | Los empleadores deben compartir rangos salariales y la compensación total (bonos y beneficios) en todas las ofertas de trabajo. Multas: Las multas pueden llegar hasta $2000 por violación. | Esta ley se aplica a los empleadores con cinco o más empleados en la Ciudad de Jersey. Explora más: Ordenanza de la Ciudad de Jersey 22-045 |

| Ithaca (Nueva York) | Los empleadores deben revelar los rangos de salario mínimo y máximo en sus ofertas de trabajo o promociones para los trabajos que se realizarán en Ithaca. Multas: La ley de la ciudad no declara multas, así que se aplican las multas estatales. | Esta ley se aplica a los empleadores con cuatro o más empleadores en Ithaca. Explora más: Ordenanza 2022-03 |

| Ciudad de Nueva York (Nueva York) | Los empleadores deben compartir rangos salariales en todas las ofertas de trabajo para trabajos que se realizarán en la ciudad de Nueva York. Lo mismo aplica a las posiciones y transferencias internas. Multas: No hay una multa para la primera violación si el violador puede corregirla dentro de 30 días. Una primera o posterior violación no corregida puede llevar a las multas de hasta $250 000 por violación. | Esta ley se aplica a los empleadores con cuatro o más empleados en la ciudad de Nueva York. Explora más: Ordenanza de Nueva York |

| Condado de Westchester (Nueva York) | Los empleadores deben compartir los rangos de salario mínimo y máximo en todas las ofertas de trabajos que se realizarán en el Condado de Westchester, incluyendo los trabajos remotos. Lo mismo aplica a las posiciones y transferencias internas. Multas: Las multas pueden ir hast $125 000 por violación y hasta $250 000 por violaciones intencionales. | Esta ley se aplica a todos los empleadores en el Condado de Westchester. Explora más: Ley de Transparencia Salarial de Condado de Westchester |

| Cincinnati (Ohio) | Los empleadores deben proporcionar la información de rango salarial a los solicitantes que lo soliciten durante el proceso de contratación. Además, los empleadores no pueden solicitar la historia salarial de los solicitantes. Multas: Los solicitantes pueden presentar una demanda civil contra el empleador, resultando en daños compensatorios y punitivos más costes. | Esta ley se aplica a los empleadores con 15 o más empleados en Cincinnati. Explora más: Ordenanza 83 de Cincinnati |

| Toledo (Ohio) | Los empleadores deben proporcionar la información de rango salarial a los solicitantes que lo soliciten durante el proceso de contratación. Además, los empleadores no pueden solicitar la historia salarial de los solicitantes. Multas: Los solicitantes pueden presentar una demanda civil contra el empleador, resultando en daños compensatorios y punitivos más costes. | Esta ley se aplica a los empleadores con 15 o más empleados en Toledo. Explora más: Ordenanza de la ciudad de Toledo |

Los estados sin leyes de transparencia salarial

Las leyes de transparencia salarial han ganado mucha popularidad en los últimos años, y los estados de todo Estados Unidos las están implementando.

Sin embargo, ciertos estados aún no tienen las regulaciones de transparencia salarial y no las están considerando. Estos estados incluyen:

- Alabama,

- Arizona,

- Arkansas,

- Delaware,

- Florida,

- Georgia,

- Idaho,

- Indiana,

- Iowa,

- Kansas,

- Louisiana,

- Minnesota,

- Misisipi,

- Nebraska,

- Nuevo Hampshire,

- Nuevo México,

- Carolina del Norte,

- Dakota del Norte,

- Ohio,

- Oklahoma,

- Pensilvania,

- Carolina del Sur,

- Tennessee,

- Texas,

- Utah,

- Wisconsin, y

- Wyoming.

🎓 Cómo hacer la nómina para las empresas pequeñas

Los estados que están considerando las leyes de transparencia salarial

Las leyes de transparencia de pago disminuyen la discriminación de pago proporcionando salarios transparentes a los empleados. En cuanto esta tendencia continúa creciendo, muchos estados están considerando convertirse en “estados de transparencia salarial”.

Veamos a los estados considerando regulaciones de transparencia salarial y sus versiones actuales a continuación.

| Estado | Requisitos y multas | A quién se refiere la ley y la legislación oficial |

|---|---|---|

| Alaska | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo y no se deberían preguntar por la historia salarial. Multas: Desde $100 hasta $2000 dependiendo de la violación. | Esta ley se aplicaría a los empleadores con un o más empleados. La ley de transparencia salarial de Alaska fue propuesta en 2021 pero aún no ha sido aprobada. |

| Kentucky | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas: No hay multas específicas en este borrador. | El proyecto de la ley sólo específica “los empleadores”.

El Proyecto de ley 198 de la Cámara de Representantes de Kentucky se presentó como una enmienda a la legislación laboral oficial en 2023 pero no ha avanzado desde entonces.se presentó como una enmienda a la legislación laboral oficial en 2023 pero no ha avanzado desde entonces. |

| Maine | Los empleadores deben revelar la información de salarios. Multas: No hay multas específicas en este borrador. | La ley se aplicaría a todos los empleadores, dependiendo del número de empleados que tienen: los empleadores con menos de diez empleados deben compartir rangos de salarios en todas las ofertas de trabajo, y todos los empleados deben compartir rangos con empleados actuales. La Maine LD936 fue propuesta en 2023 pero aún no ha sido aprobada. |

| Massachusetts | Los empleadores deben revelar rangos salariales en todas las ofertas de trabajo, incluyendo las ofertas de transferencia y promoción. Multas dependen de la violación: la advertencia para la primera violación, una multa de hasta $500 para la segunda violación, y una multa de hasta $7500 por cada tercera o subsecuente violación involuntaria, o $15 000 si la violacíón es voluntaria. | Esta ley se aplicaría a los empleadores con 25 o más empleados. La ley de Igualdad en el Lugar de Trabajo de Frances Perkins H.B. 4890 fue propuesta en 2023 y se supone que pasará este año. |

| Míchigan | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, deben hacer que las ofertas de trabajo estén disponibles para cualquier empleado actual. Multas: Una multa de hasta $1000, dependiendo de la violación. | Esta ley se aplicaría a los empleadores con cinco o más empleados. La SB 142 está actualmente esperando la decisión del Senado de Míchigan. |

| Misuri | Los empleadores deben revelar los rangos salariales a los solicitantes de trabajo, quiénes lo solicitan, y a quiénes se les ofreció un trabajo anteriormente. Los empleadores también deben compartir los rangos salariales con empleados actuales, quiénes lo solicitan o a quiénes se les ofreció una promoción de trabajo. Multas: Un multa entre $1000 y $5000, dependiendo de la violación. | El proyecto de la ley sólo específica “los empleadores”. La SB 64 fue propuesta en 2023 pero aún no ha sido aprobada. |

| Montana | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas: Una multa entre $500 y $10 000, dependiendo de la violación. | Esta ley se aplicaría a los empleadores con 15 o más empleados. La SB 146 fue propuesta en 2023 pero aún no ha sido aprobada. |

| Nueva Jersey | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas: Los empleados o solicitantes de trabajo pueden emprender una acción civil contra el empleador, resultando en daños y costes compensatorios. | Esta ley se aplicaría a todos los empleadores en Nueva Jersey. La NJ S2310 está actualmente esperando una decisión del gobernador para convertirlo en una ley. |

| Oregón | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas dependen de la violación: una multa de hasta $1000 para la primera violación, y una multa que aumenta en la cantidad de $1000 por cada violación posterior, hasta $10 000. | Esta ley se aplicaría a todos los empleadores en Oregón. La SB 925 fue propuesta en 2023 pero aún no ha sido aprobada. |

| Dakota del Sur | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Además, los empleadores deben incluir cualquier bono y beneficios adicionales en las ofertas de trabajo. Multas: Una multa de $500 por cada violación. | Esta ley se aplicaría a los empleadores privados con 100 o más empleados. La SB 109 fue propuesta en 2023 pero aún no ha sido aprobada. |

| Vermont | Los empleadores deben revelar los rangos salariales en las ofertas de trabajo. Multas: El proyecto de la ley no específica ninguna consecuencia para los infractores. | No hay especificaciones a qué empleadores se aplicaría. el proyecto de la ley. La ley de transparencia salarial de Vermont ha sido aprobada y entrará en vigor el 1 de julio de 2025. |

| Virginia | Los empleadores deben revelar los rangos salariales a los solicitantes de trabajo y a los empleados actuales cuando lo soliciten. Multas: Una multa entre $1000 y $10 000 por violación. | La ley se aplicaría a todos los empleadores de Virginia. En 2023, SB 370 fue aprobado por el Senado del Estado de Virginia pero fue derogado por el Comité de Comercio y Energía de Representantes. |

| Virginia Occidental | Los empleadores deben revelar los rangos salariales a los solicitantes de trabajo y a los empleados actuales cuando lo soliciten. Además, los empleadores deben revelar cualquier bono y beneficios adicionales cuando lo soliciten. Multas: Los empleados o solicitantes de trabajo pueden emprender una acción civil contra el empleador, resultando en daños y costes compensatorios. | Esta ley se aplicaría a todos los empleadores en Virginia Occidental. La SB 156 fue propuesta en 2023 pero aún no ha sido aprobada. |

Prohibiciones de historia salarial en los EE.UU.

Las prohibiciones de historia salarial son similares a las regulaciones de transparencia salarial. Esta práctica prohíbe a los empleadores preguntar por la historia salarial de los empleados durante el proceso de contratación.

Las prohibiciones de historia salarial protegen a los empleados de discriminación potencial según sus previas ganancias, y son mucho más comunes en los EE.UU. que las leyes de transparencia salarial.

Aquí está la lista de los estados de EE.UU. con las prohibiciones de historia salarial:

- Alabama,

- California,

- Colorado,

- Connecticut,

- Delaware,

- Distrito de Colombia,

- Georgia,

- Hawái,

- Illinois,

- Kentucky,

- Louisiana,

- Maine,

- Maryland,

- Massachusetts,

- Míchigan,

- Misisipi,

- Misuri,

- Nevada,

- Nueva Jersey,

- Nueva York,

- Carolina del Norte,

- Ohio,

- Oregón,

- Pensilvania,

- Rhode Island,

- Carolina del Sur,

- Utah,

- Vermont,

- Virginia, y

- Washington.

Preguntas frecuentes sobre las leyes de transparencia salarial

Para hacer esta guía lo más completa posible, hemos incluido una sección de preguntas frecuentes cubriendo las preguntas más frecuentes sobre la transparencia en los EE.UU.

¿Cuál es la ley federal sobre la transparencia salarial?

No existe una regulación oficial de la transparencia salarial en los EE.UU. Sin embargo, bajo la Orden Ejecutiva 11246, los empleados tienen el derecho de preguntar por sus propios salarios o los salarios de otros empleados. Cualquier represalia contra los empleados está prohibida.

¿Cuántos estados tienen leyes de transparencia salarial?

Actualmente, hay 11 estados con las leyes de transparencia salarial vigentes, incluyendo:

- California,

- Colorado,

- Connecticut,

- Hawái,

- Illinois,

- Maryland,

- Nevada,

- Nueva York,

- Rhode Island,

- Washington, y

- Distrito de Columbia.

¿Qué países tienen leyes de transparencia salarial?

Muchos países de todo el mundo tienen regulaciones de transparencia salarial vigentes, como:

- Países de UE,

- Estados Unidos,

- Canadá,

- Reino Unido,

- Japón,

- Australia, y otros.

Rastrea las horas laborales de los empleados con Clockify

Rastrear manualmente horas laborales puede ser bastante ineficiente y largo. Además, puede llevar a innumerables errores y dolores de cabeza una vez que llegue la nómina.

Debido a esto, usar un software de control de tiempo como Clockify puede hacer que el proceso sea mucho más simple y agradable.

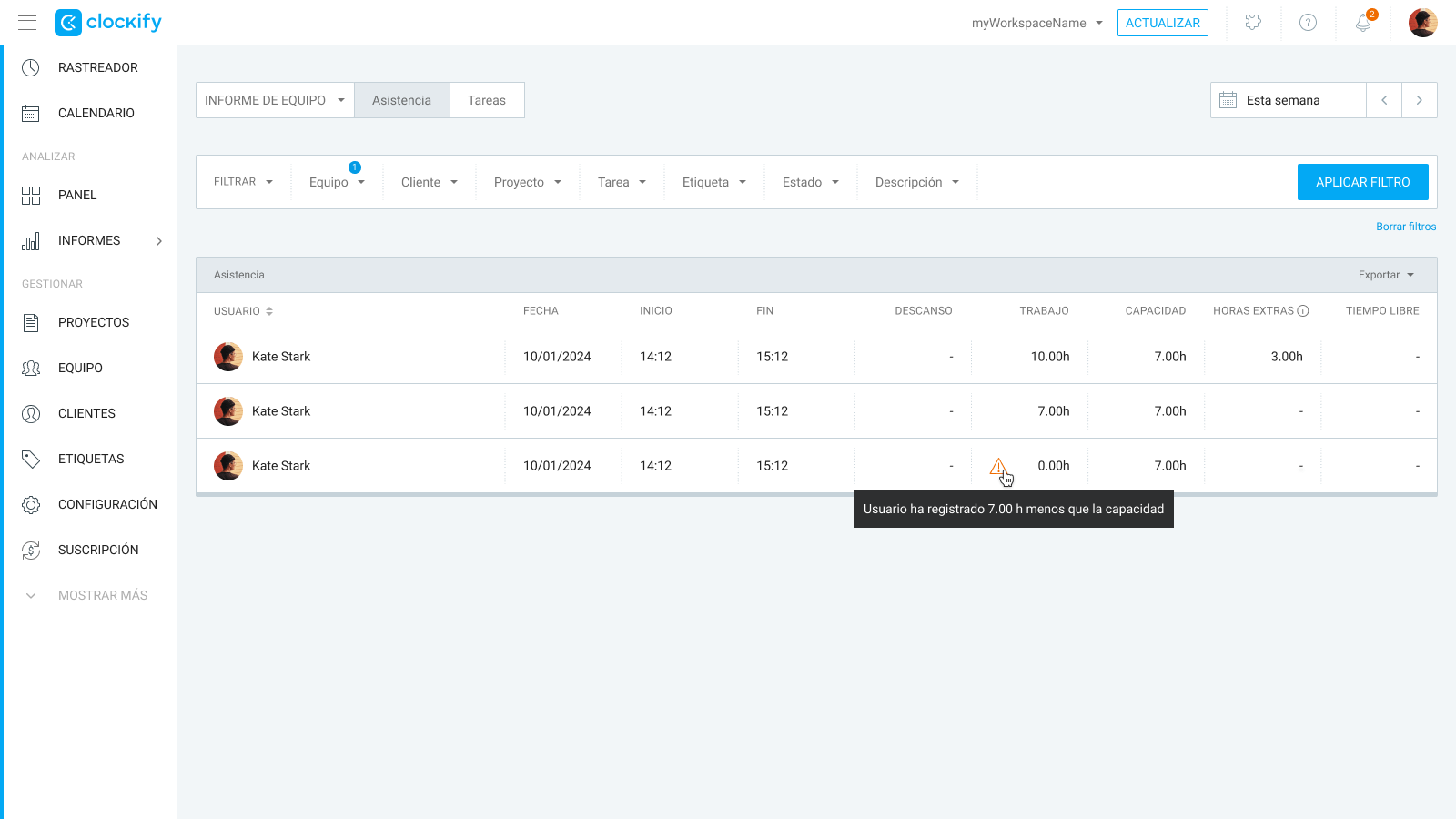

Clockify tiene un sistema de rastreo de asistencia integrado que puedes usar para rastrear las horas laborales de los empleados. Yendo a la sección informes y haciendo un clic en asistencia, podrás ver las horas de inicio y finalización, los descansos y la capacidad total de trabajo de tus empleados.

Controla el tiempo con Clockify

Clockify ayuda a tus empleados a rastrear sus horas laborales con solo un clic.

Una de sus funciones es el controlador de tiempo, que te permite rastrear el tiempo manualmente o con un temporizador.

¿Estás listo para revolucionar tu rutina de control de tiempo con Clockify? ¡Regístrate GRATIS hoy!

Cómo revisamos esta publicación: Nuestros escritores y editores monitorean las publicaciones y las actualizan cuando hay nueva información disponible, para mantenerlas frescas y relevantes. Publicado: 6 de noviembre de 2024

Publicado: 6 de noviembre de 2024