Payroll management is a tricky process that needs to be done right from the start.

For small businesses, it can be especially stress-inducing, as it requires knowledge of a myriad of laws and regulations, which are commonly state or even area-specific.

To top it all off, you handle the livelihood of everyone under your employment, which is no small thing. So, payroll in itself requires meticulous work and data-keeping.

But no worries, we’re here to help with that. In this blog post, we guide you through the essentials of how to do payroll for your small business.

Read on, as we’ll cover the following topics:

- What payroll management is,

- Vital aspects of managing payroll, and

- Useful tips on managing payroll.

Table of Contents

What is payroll management?

Payroll management is the process of calculating and distributing payroll, keeping up to date with compensatory laws and regulations, tax, etc.

This process also includes overtime assessment and calculations, flex time, and other details related to wages.

This is all done to make sure your employees are compensated fairly and on time.

If you’re new to all this and your main question is Can I do my own payroll for my small business? — simply put, the answer is yes. So, read on!

💡 Clockify Pro Tip

Need some tips on improving your compensation strategy? Here’s a detailed guide with free, downloadable templates you can use:

2 Aspects of managing payroll for a small business

To learn to do payroll in the first place, you need to understand how pay is calculated in the workplace.

Moreover, you need to be aware of the differences between gross and net pay while making a compensation plan for your employees, as well as how to calculate pay raises for your employees.

However, not all wages are the same, as there are different types of employees, especially in the knowledge work industry.

So, the 2 vital aspects of managing payroll are:

- Wage types, and

- Employment/contract types.

Aspect #1: Wage types

Depending on the specific industry, wage calculation and payout can include:

- Salary wage (full-time employees),

- Hourly wage (contractors and freelancers),

- Commission (contractors and freelancers),

- Tip wage (food and service industries),

- Overtime, and

- Paid time off (PTO).

💡 Clockify Pro Tip

Want a cheat sheet? Here are 14 free and downloadable templates to help you streamline processes for managing payroll:

So for starters, managing payroll will differ for salaried and hourly employees. Each carries both advantages and disadvantages for small business owners, but most importantly — each comes with different regulations for payment days.

But if your business mainly employs knowledge workers, the chances are — the payroll process will be less complicated. In this instance, there are 2 ways to pay your employees:

- Weekly or monthly for full-time workers, and

- As determined by the contracts of contingent workers (hired based on demand, usually consultants and freelancers, not tied to the company).

💡 Clockify Pro Tip

What about the instances when you need to compensate workers after the payroll due date? Here’s a guide on arrears in payroll, so check it out:

Aspect #2: Employment/contract types

There are also substantial differences between contractors, freelancers, and employees, so sorting out who is who might be the best first step for managing payroll.

Then, get to know the following:

- Who needs which paperwork,

- How they are paid for overtime, and

- Whether they are eligible for time off (if so, when).

Keep in mind that lapses in this department can lead to employee lawsuits.

💡 Clockify Pro Tip

Here’s everything you need to know and consider when paying contractors and freelancers:

7 Tips on how to manage payroll for a small business

Several key things are necessary for successful and effective payroll management.

Here’s to name a few examples of what needs to be done prior to payday:

- Submit all the necessary tax forms on time,

- Track your employees’ work hours and overtime, and

- Check all the contracts thoroughly.

Now let’s take a look at each aspect of the payroll process and how to go about it.

Without further ado, here are 7 valuable tips on how to set up payroll for small businesses.

💡 Clockify Pro Tip

Overtime hours are compensated at a higher rate, but what’s the deal with overtime tax? Check out this guide and find out:

Tip #1: Keep payroll documents in check

Although many of you reading this probably know which documents are needed for payroll, it’s always good to refresh your memory.

Besides, it helps solidify the schedule, so the process is easier. There are 3 vital steps to keeping your payroll documentation up to date, so let’s check out what those steps are.

💡 Clockify Pro Tip

If you often find yourself struggling to create schedules to help you align work and all the team members, here’s a perfect article you can use and recommend to them as well:

Step #1: Sort out onboarding paperwork for new employees ASAP

Contracts required for each new employee include:

- W-4 for full-time employees and W-9 for freelancers and contractors,

- Form I-9 (maximum 3 days after the hiring date), and

- Direct Deposit authorization form.

Each of these tax and labor law documents has its own deadlines for submission on a yearly basis. Set up a custom schedule that will let you know weeks in advance when the deadline is approaching, so you can sort out your documents in time.

Step #2: Sort out paperwork relating to employee benefits

In addition, if you’re covering employee benefits and insurance, you’ll also have to think about:

- Paid time off,

- Sick leave,

- Overtime wages,

- Life and/or health insurance, and

- Pension plan.

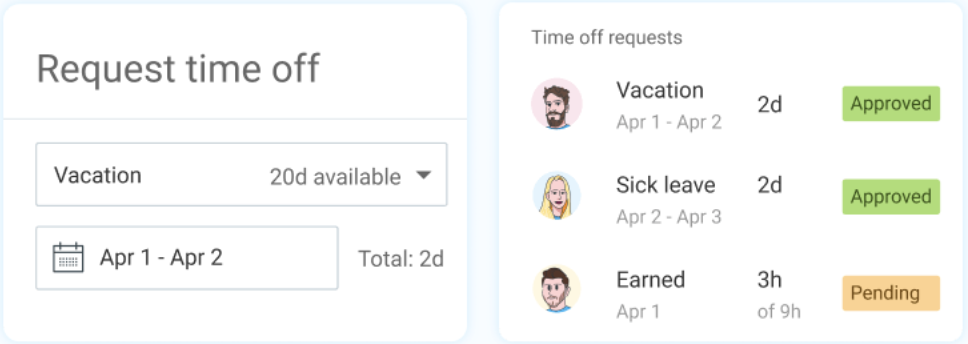

You can get most of this information (sick leave, time off, vacation, and overtime) by using time tracking software.

💡 Clockify Pro Tip

Looking for an easy solution to track your employees’ paid time off? Check out these 11 downloadable and free templates you can use:

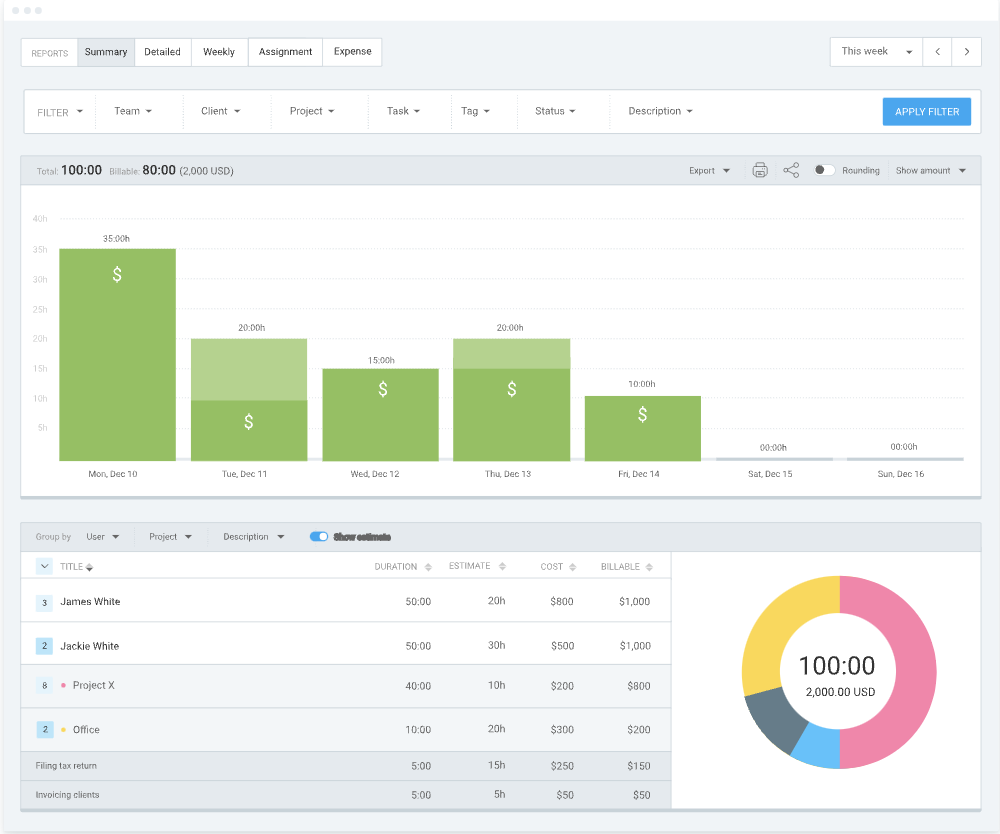

You’ll be happy to hear that, nowadays, most quality time trackers are already equipped with basic payroll calculation options. The best part about using payroll software and digitizing this data is that no matter when you need it, you can generate a thorough report with all the necessary data in just a few clicks.

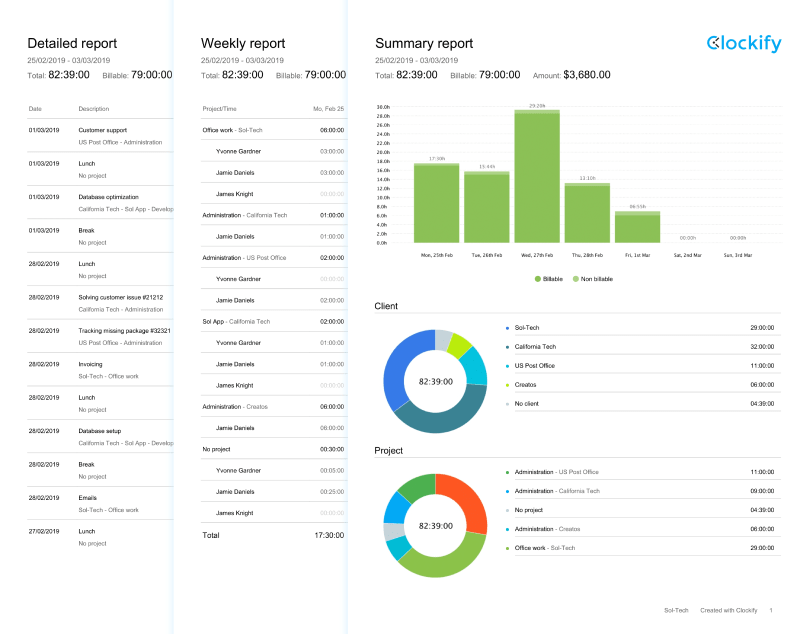

Good payroll tracker such as Clockify allows you to easily filter said data as well. For example, as you can see in the screenshot below, you can separate your billable and non-billable hours, and get a breakdown for a specific employee, or a project.

Step #3: Stay up to date with labor laws and tax regulations

Needless to say, it’s in everyone’s best interest (especially a business owner’s) to stay up to date with any and all changes — whether it’s tax regulations or labor laws.

To stay compliant and well-informed, here’s a tip from Nathan Claire, founder of Buying Jax Homes with the relevant experience on the topic:

“Regularly check the websites of relevant government agencies such as the Internal Revenue Service (IRS), the Department of Labor, and the Small Business Administration (SBA). The IRS provides extensive information on tax laws, regulations, and updates, including information on tax credits, deductions, and filing requirements. The Department of Labor provides information on wage and hour laws, employee benefits, and other labor-related issues. The SBA provides information on regulations and compliance requirements for small businesses.”

Expanding on the same idea, Haley Slade, the CEO and founder of the Slade Copy House, suggests that, aside from looking it up manually, you should:

- Subscribe to relevant newsletters,

- Attend seminars or webinars, and

- Regularly consult with a tax professional.

Seeking professional help is also a useful recommendation Nathan shared, while explaining how:

“Hiring an accountant or tax professional can provide you with valuable insights and advice on how to comply with regulations in the most effective way. A professional can help you understand the nuances of the law and how it applies to your specific business. They can also help you manage your finances, keep accurate records, and file your tax returns accurately and on time.”

Circling back to the idea of being the most effective you can be, Haley adds how leveraging the power of automation is simply a smart move:

“A reliable tax preparation software can help small business owners prepare and file their tax returns accurately and efficiently. It can also help identify potential deductions and compliance issues.”

💡 Clockify Pro Tip

Need some help when dealing with billing, taxes, invoices, and expense reports? Some of these software solutions can save you much trouble:

Tip #2: Have a set payroll time

First and foremost, you probably have a specific payout day for all your employees.

Whether it’s monthly, weekly, or every two weeks, having a set date makes it easier to schedule every other payroll task as you work around it.

It’s important to check the legally required minimum number of paydays for your country. If the law requires you to pay your employees twice a month, you have to be aware of this information. In case you don’t follow said regulations, you’re facing legal repercussions. For example, in New York, the law states that manual labor workers must be paid weekly, while for clerical workers, it’s twice a month.

Tip #3: Keep your records neat and safe by tracking time

The biggest issue with most payroll management processes is the lack of a proper record-keeping system, and this can come in many shapes and sizes, such as:

- Attendance tracking via pen and paper,

- Tracking time with a simple Excel spreadsheet, or

- Time-tracking software with basic functions.

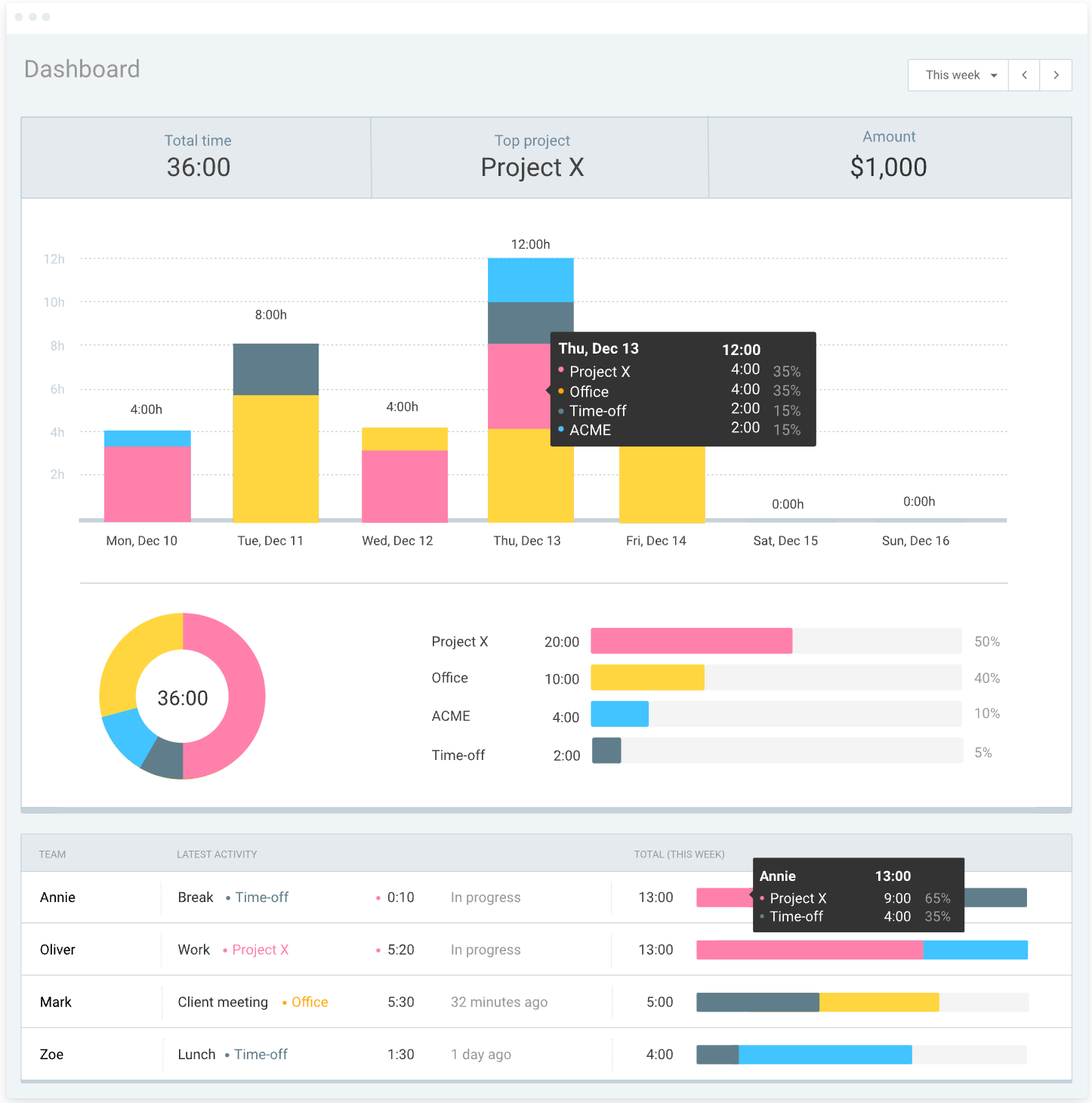

However, in the knowledge industry today, every business needs a reliable, robust payroll time tracker. Because aside from helping you follow hours worked, a payroll tracker makes processing payroll so much easier by letting you:

- Track expenses, project profitability, and progress,

- Separate billable and non-billable hours,

- Get insight into which areas cost you the most vs. the least,

- See how much time your team spends on projects and tasks, and

- Generate invoices and reports.

Long-standing time trackers like Clockify can help your business by offloading all the difficult and tedious tasks.

All you have to do is motivate your employees to track their time, and — voila! Every possible information you’ll need for easy and hassle-free payroll.

💡 Clockify Pro Tip

Make sure you are able to accurately calculate your own and your employees’ payroll — here’s a step-by-step guide on the topic:

Tip #4: Assign a payroll manager

Payroll managers are people with expertise in business finance and human resources. They deal exclusively with payroll, additionally overseeing any related staff (if you have them).

If you don’t wish to hire separate counselors and accountants, you can always get a person on board to do all of that for you.

A payroll manager will:

- Keep all the documents in check,

- Update you on changes to taxes and labor laws,

- Calculate wages, insurance, and benefits,

- Track team’s time off, and

- Communicate any contract and payroll changes.

With their expertise, you can also work on expanding your benefits responsibly.

For example — you can focus on improving your PTO policy to make your business more tempting to potential employees.

💡 Clockify Pro Tip

Even though the terms PTO and vacation are often used interchangeably, there are many differences between the 2. Check out this article and learn everything there is to know about the topic:

Tip #5: Have HR and payroll managers work together

If you have an HR manager, it would benefit your business to connect them and the payroll manager.

Since HR is the bridge between the company and the employees, they are equipped with all the necessary expertise to relay information between the two.

The HR team should learn the details about the payroll process in case an employee wants to find out more about their salary or benefits, or forward their questions and concerns to the payroll manager.

💡 Clockify Pro Tip

If you’d like to learn more about workforce management, a process of maximizing the performance and competency levels of your employees, this article is a must-read:

Tip #6: Consider hiring an external agency

This advice goes out to business owners who hire contractors aside from full-time employees. Since contractors and freelancers require a whole slew of different documentation, it can become difficult to keep up with it all.

Payroll managers can still help you in this regard, but if you don’t wish to hire another person, you can outsource the work regarding payroll.

Here are some benefits of outsourcing payroll management to a specialized agency:

- You won’t worry about payroll processing software,

- You won’t have to go through a hiring process,

- You’ll have a pool of skilled people focused on your company,

- You’ll spend less to maintain payroll, and

- You’ll be updated on any tax laws and regulation changes.

In the end, whether you should do in-house payroll management or outsource depends on your:

- Business size,

- Scalability, and

- Finances.

Tip #7: Be transparent about the payroll process

Last but not least, you want to be transparent about the entire payroll process and thus create transparent and accountable teams.

There’s no harm in employees knowing all the details, such as:

- Which taxes are being paid,

- What the overtime regulations are,

- How the labor laws affect their pay and contracts, and

- How the payroll schedule goes (from the moment you start filing and processing documents, to when wages are distributed).

For example, here’s what you can do to be more transparent:

- Schedule occasional office-wide meetings with the payroll manager,

- Take any questions and concerns at any given moment, and

- Offer 1:1 consultations on a regular basis.

After all, wages should never be a taboo topic.

The more involved employees are in how their pay is processed and distributed, the more trust they will have in you and the business overall.

💡 Clockify Pro Tip

If you’re looking for some ideas to promote the importance of trust in the workplace, here’s an article you’ll find useful:

How to set up payroll in Clockify

Now, if calculating payroll and your employees’ salaries in less than a minute sounds like a dream come true, Clockify might be just the perfect solution.

Let’s see what are the steps to do payroll for your small business in Clockify.

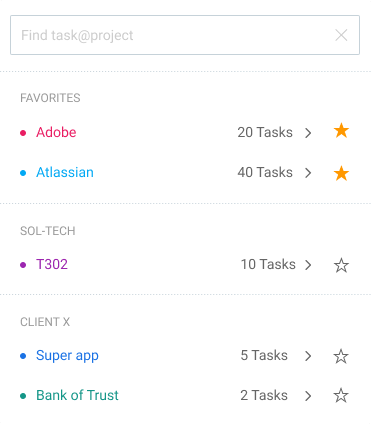

Step #1: Create an account and set up projects

First things first, create an account and your company’s personalized workspace. Once you’ve signed up and entered basic information, it’s time to set up your custom projects.

As you can see in the screenshot above, your projects will comprise tasks, which you’ll be able to assign to specific employees.

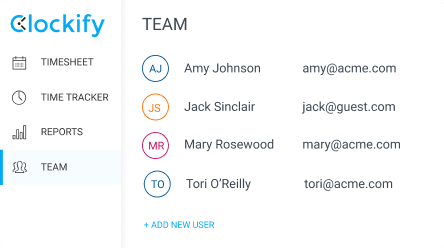

Step #2: Invite your team to join the workspace

Once your workspace is active, you can send an e-mail invitation to all your employees. As soon as they join, you can assign them roles and add them to projects and tasks.

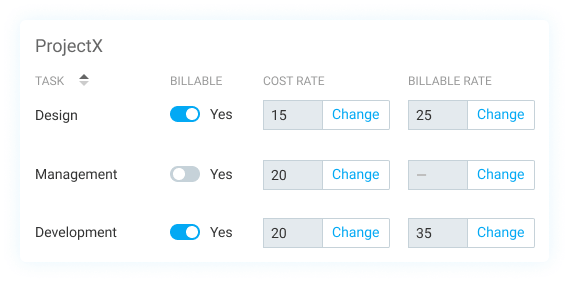

Step #3: Set hourly rates

Not all your employees earn the same wage, so it’s vital to define accurate hourly rates for each.

No worries, if a specific project has a different rate, you’ll be able to apply the change.

Step #4: Have employees log their hours

Now that the rates are determined, your employees can start tracking their work hours. They can choose to use a timer, an automated time tracker, or enter their time manually.

Bonus tip — you can set automatic reminders in Clockify, in case someone forgets to log their work hours.

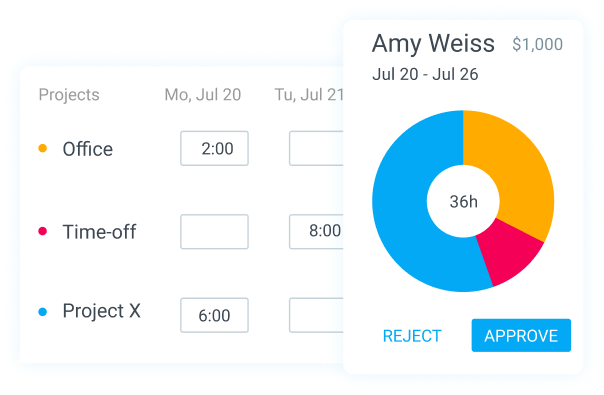

Step #5: Use the reports to fairly compensate your employees

Once the payroll is due, simply access your employees’ time cards and see what they’re due.

Employees themselves will have access to their time cards, so the whole process is fully transparent.

Last but not least, you can export your payroll reports as PDF, CSV, Excel, and API files, for keeping track of your business expenses and finding room for improvement.

Let’s wrap it up: Small business owners can learn to do payroll

As you can conclude from the article, the best payroll practice is often the simplest — or at least as simple as it can allow.

To revise, the biggest concerns for small business owners managing payroll are:

- Keeping track of the laws and regulations that mandate how and when they’re supposed to pay wages and benefits, and

- Making sure all of their contracts, work time, and additional data are in one place and up to date.

However, if you are a small business owner, you’ll be thrilled to find out that good time-tracking software and a payroll consultant can help you manage both.

Apart from a quality time tracking tool, consider having a project management app, together with a team chat app for more transparent and accountable teams. Running simultaneously, such software may help you manage payrolls even more efficiently. You can get them all at a special bundle price and save 53% on subscriptions, too.

So the main conclusion is — all business owners can learn to do payroll and manage the payroll process themselves.

However, admittedly, managing the payroll process is not everyone’s cup of tea.

If you’re still not sure you can follow the steps we’ve explained above, then hiring a payroll manager or an agency is the solution. That way, you will offload most of the work (and resulting stress) to someone who is an expert.

✉️ Did you find this overview helpful? We aim to be as informative as possible, so if you know of any additional tips or comments, let us know! Contact us at blogfeedback@clockify.me and we might feature you in this or one of our future articles. And, if you liked this post and found it useful, share it with someone you think would benefit from it.