¿Es necesario proporcionar un aviso de separación laboral a los empleados en los Estados Unidos?

¿Cuáles son los requisitos federales de aviso de separación laboral?

Si tienes dificultades para responder a estas preguntas, no te preocupes, ¡lo tenemos cubierto! Como empleador estadounidense tienes que ser familiar con cada regulación laboral relevante en el país, y eso también incluye reglas de aviso de separación laboral.

Entonces, en esta guía exploraremos:

- Regulaciones de aviso de separación laboral de Estados Unidos,

- Requisitos de aviso de separación laboral por estado para 2025, y

- Los formularios de aviso de separación laboral que los empleadores deben proporcionar a todos los empleados despedidos.

*Nota: La información sobre las leyes y regulaciones de requisitos de aviso de separación por estado ha sido verificada y actualizada para 2025.

- El aviso de separación laboral es un documento formal que los empleadores proporcionan a sus empleados cuando se termina su empleo. Usualmente informa a los empleados que están separando sobre los detalles de terminación, cheque de pago final, y beneficios de seguro de desempleo.

- La ley federal no exige que los empleadores emitan avisos de separación tras la terminación (excepto en los casos que incluyen a trabajadores protegidos por WARN y la Ley COBRA).

- De momento, 22 estados tienen requisitos específicos de los avisos de separación laboral.

- Las razones más comunes por la separación laboral incluyen la renuncia, la violación de política y el despido.

- La duración del proceso de separación usualmente depende de los pasos especificados por la política de la empresa.

¿Qué es el aviso de separación laboral?

Un aviso de separación o una carta de separación laboral es un formulario legal declarando el fin de una relación laboral entre un empleador y un empleado.

En los EE.UU, los avisos de despido típicamente están conectados a los beneficios de seguro de desempleo (UI, en sus siglas en inglés). El programa de UI proporciona una asistencia financiera a los empleados que están desempleados “no por su culpa”. Las exactas reglas para acceder al seguro dependen del estado.

Por ejemplo, ciertos estados requieren que los empleadores informen a los empleados de los pasos requeridos para acceder a estos beneficios o proporcionar formularios reales que los empleados necesitan rellenar para recibir el UI.

Dependiendo del estado, la información sobre el seguro de desempleo se puede escribir en un póster presentado en el espacio de trabajo. Alternativamente, algunos estados requieren que los empleadores rellenen y distribuyan formularios de despido a los empleados despedidos.

¿Cuáles son los requisitos federales de aviso de separación laboral?

La ley de EE.UU. no contiene ningún requisito legal general sobre avisos de despido. Por lo tanto, cada estado tiene el derecho de hacer cumplir sus propios requisitos de aviso de separación laboral.

Sin embargo, hay 2 excepciones con respeto a los requisitos de aviso de separación laboral durante el despido laboral:

- Trabajadores cubiertos por la Ley de notificación de ajuste y reentrenamiento de trabajadores (WARN), y

- Empleados cubiertos por Ley Ómnibus Consolidada de Reconciliación Presupuestaria de 1986 (COBRA).

La ley WARN protege a los trabajadores en casos de cierre de fábrica y despido masivo. Para este tipo de despidos, los empleadores están requeridos a proporcionar un aviso de 60 días calendarios.

Por otra parte, la Ley Ómnibus Consolidada de Reconciliación Presupuestaria (COBRA) cubre planes de salud grupales del sector privado. Según el Departamento de Trabajo de EE.UU., se aplica a los empleadores que tienen 20 empleados que han trabajado en más de “50% de su días laborales típicos en el año calendario anterior”.

Básicamente, COBRA ofrece una continuación de la cobertura médica y está disponible en los siguientes eventos:

- Muerte de empleado,

- Pérdida de trabajo o reducción de horas de los trabajadores (excluye falta grave),

- El derecho de empleado cubierto a Medicate,

- El divorcio o separación legal de trabajador, y

- La pérdida de la condición de dependiente del niño (y cobertura) bajo el plan.

Si un empleador utiliza un administrador de plan COBRA externo (una persona responsable de garantizar que una empresa cumpla con la ley COBRA), debe notificar al administrador sobre el despido del empleado dentro de 30 días. Entonces, el administrador tiene que notificar al empleado de sus derechos COBRA dentro de 14 días. En caso de que el empleador sea el administrador de plan, tiene 44 días para emitir el aviso de elección COBRA al empleado.

🎓 Para aprender más sobre la Ley de Normas Justas de Trabajo (FLSA) y cómo cumplir con la FLSA, lee el siguiente recurso: Regulaciones de la Ley de Normas Justas de Trabajo (FLSA)

Requisitos de aviso de separación laboral por estado 2025

De momento, 22 estados tienen requisitos de separación laboral específicos para empleadores. Algunos obligan a los empleadores a rellenar formularios de despido, mientras que otros requieren que los empleadores solo informen a los trabajadores de su derecho a una cobertura de desempleo.

La tabla de abajo muestra tanto los estados con requisitos específicos de aviso de separación laboral de empleados como las reglas exactas y enlaces a los formularios que los empleadores necesitan proporcionar en el evento de separación laboral:

| Estado | Requisitos de separación laboral | Aviso de separación laboral o formulario de separación laboral | Consecuencias del incumplimiento de los requisitos de notificación de separación |

|---|---|---|---|

| Alabama | Tras la separación, los empleadores deben proporcionar a los empleados que se separan un Aviso de disponibilidad de compensación por desempleo y otros beneficios de desempleo en forma de carta, mensaje de texto, correo electrónico o volante. | Aviso de Disponibilidad de Compensación por Desempleo | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a la Agencia de Compensación por Desempleo de Alabama puede resultar en tarifas más altas contra la cuenta del empleador. |

| Alaska | Los empleadores deben proporcionar a los empleados que se separan el aviso de disponibilidad de beneficios laborales dentro de los 7 días posteriores a su último día laboral. | Aviso a los empleados | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a centro de reclamos de UI de Alaska puede resultar en pagos indebidos de beneficios y tarifas de impuestos más altas. |

| Arkansas | Los empleadores deben proporcionar a los empleados que se separan un aviso que detalle los beneficios de desempleo disponibles. | Aviso al empleado | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a División de Servicios de la Fuerza Laboral de Arkansas puede resultar en tarifas más altas contra la cuenta del empleador. |

| Arizona | Después de la separación laboral los empleadores deben proporcionar a los empleados que se separan un aviso impreso que detalle cómo solicitar beneficios de desempeño. | UIB-1241A | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a Departamento de Seguridad Económica de Arizona puede resultar en tarifas más altas contra la cuenta del empleador. |

| California | Los empleadores deben proporcionar a los empleados que se separan un aviso escrito inmediato junto con los siguientes folletos: – DE 2320, – DE 2515, y – DE 2511. | Un aviso a los empleados sobre el cambio en la relación (No se requiere un aviso escrito en el caso de la renuncia voluntaria, promoción o degradación, cambio en la asignación o ubicación laboral, o si el trabajo se detuvo debido a una disputa comercial) | El incumplimiento constituirá un delito menor. No proporcionar la información oportuna sobre la razón detrás de la separación laboral a Departamento de Desarrollo de Empleo de California puede resultar en pagos indebidos de beneficios y tarifas de impuestos más altas. |

| Colorado | Los empleadores necesitan proporcionar a los empleados que se separan un formulario de separación completado, en forma electrónica o de copia impresa. | 22-234 | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a Departamento de Trabajo y Empleo de Colorado puede resultar en pagos indebidos de beneficios. |

| Connecticut | Los empleadores deben proporcionar el paquete de separación del seguro de desempleo a los empleados que se separan o enviarlo a la última conocida dirección del empleado (si no puede proporcionar el paquete en el momento de separación). | Paquete de separación del seguro de desempleo | No proporcionar la información oportuna sobre la razón detrás de la separación laboral al Comisionado Laboral de Connecticut puede resultar en pagos indebidos de beneficios. |

| Georgia | Los empleadores deben entregar el formulario de separación al empleado que se separa en su último día de trabajo o enviarlo dentro de 3 días por correo a la última dirección conocida del empleado. | DOL-800 | No revelar la información relevante para denegar beneficios de desempleo puede resultar en sanciones (pena de prisión que no excederá de 1 año o una multa de no más de $1000, o ambos; cada uno de esos actos constituye un delito separado). |

| Illinois | Los empleadores necesitan proporcionar una copia de la publicación “Lo que cada trabajador debería saber sobre el seguro de desempleo” al empleado en el momento de separación o enviarlo a su última dirección conocida dentro de 5 días de la fecha de separación. | CLI111L (Lo que cada trabajador debería saber sobre el seguro de desempleo) | / |

| Iowa | No se requiere aviso a menos que el empleador quiera notificar al Desarrollo de la Fuerza Laboral de Iowa sobre un empleado que deja el empleo por un motivo que puede descalificarlo para recibir los beneficios del seguro de desempleo. | Aviso de separación o rechazo del trabajo Aviso de separación regular (voluntario): 552-0772 | / |

| Louisiana | Los empleadores deben presentar (en línea) un aviso de separación laboral dentro de 3 días después de la fecha de separación laboral. | LWC-77 | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a la Comisión de la Fuerza Laboral de Luisiana puede resultar en pagos indebidos de beneficios. |

| Maryland | Los empleadores deben mostrar los pósters sobre beneficios de desempleo y cobertura de seguro médico y proporcionar a los empleados que se separan un aviso de la disponibilidad de desempleo (en la forma de una carta, correo electrónico o mensaje de texto). | El aviso de la disponibilidad de la compensación de seguro de desempleo | No proporcionar la información oportuna sobre la razón detrás de la separación laboral al Departamento de Trabajo de Maryland puede resultar en pagos indebidos de beneficios. |

| Massachusetts | Los empleadores necesitan proporcionar una copia del folleto “Cómo presentar un reclamo de beneficios del seguro de desempleo” a los empleados que se separan dentro de 30 días desde la separación laboral. | 0590-A | No proporcionar la información oportuna sobre la razón detrás de la separación laboral a Departamento de Asistencia al Desempleo de Massachusetts puede resultar en tarifas más altas contra la cuenta del empleador. |

| Míchigan | Los empleadores deben proporcionar el aviso de compensación por desempleo completado en el momento de la separación a menos que los empleadores presenten reclamos en vez del empleado. | UIA 1711 | No proporcionar la información de separación a los empleados resulta en una multa de $10. |

| Misuri | Los empleadores necesitan proporcionar el aviso de separación. | M-INF-288-5-AI | No revelar la información relevante para denegar beneficios de desempleo puede resultar en sanciones (el 25% de la cantidad de los beneficios, y por cada ocurrencia posterior de fraude, la sanción aumenta hasta el 100% de la cantidad de los beneficios denegados). |

| Nevada | Los empleadores deben proporcionar la información de reclamo a los empleados en el momento de la separación. | NUCS-4139 | No proporcionar de manera oportuna todos los datos relevantes conocidos que pueden afectar los derechos a los beneficios del empleado a la División de Seguridad de Empleo de Nevada, puede resultar en mayores tarifas de beneficios. |

| Nueva Jersey | Los empleadores deben proporcionar un reclamo de desempleo a los empleados en el momento de la separación. A partir de julio de 2023, los empleadores también deberán informar electrónicamente la información de separación al Departamento de Trabajo y Desarrollo de la Fuerza Laboral de Nueva Jersey inmediatamente después de la separación del empleado. | BC-10 | No cumplir con los requisitos de aviso de separación puede resultar en sanciones (una sanción de $500 o el 25% del importe retenido fraudulentamente, lo que sea mayor; cada día de incumplimiento constituye un delito separado.) |

| Nueva York | Los empleadores deben proporcionar el formulario de Registro de Empleo completado a los empleados que se separan. Los empleadores deben informar a cualquier empleado terminado de la fecha de terminación así como la fecha de cancelación de los beneficios a los empleados relacionados con dicha terminación dentro de 5 días laborales. | IA 12.3 | No cumplir con los requisitos de aviso de separación puede resultar en sanciones. |

| Pensilvania | Los empleadores deben proporcionar el formulario de separación laboral completado a los empleados que separan y/o empleados que trabajan horas reducidas. | UC-1609 | No cumplir con los requisitos de aviso de separación puede resultar en tarifas más altas contra la cuenta del empleador. |

| Rhode Island | Los empleadores deben exhibir un póster sobre los beneficios de seguro de desempleo y proporcionar un aviso (folleto, texto, correo electrónico, carta, u otra forma de comunicación) de la disponibilidad de la compensación de desempleo en el momento de la separación a los empleados que se separan. | Rhode Island Aviso de muestra (pág.2) | Se podrán imponer multas por incumplimiento. |

| Carolina del Sur | Los empleadores deben proporcionar un Aviso de disponibilidad de beneficios de seguro de desempleo en persona, por correo electrónico, o texto, a los empleados. | El Aviso de la disponibilidad de los beneficios de seguro de desempleo | Failure to supply the South Carolina Department of Employment and Workforce with the reason behind the employee’s separation may result in increased benefit charges and higher unemployment insurance taxes. |

| Tennessee | Los empleadores deben proporcionar a los empleados salientes (excepto para aquellos que han estado empleados por menos de una semana) el formulario de separación completado dentro de 1 día de la separación (en persona o electrónicamente). | LB-0489 | No cumplir con los requisitos de aviso de separación puede resultar en tarifas más altas contra la cuenta del empleador. |

Preguntas frecuentes sobre requisitos de aviso de separación laboral

¿Alguna vez te has preguntado cuáles son los motivos más comunes para la separación laboral? ¿Qué pasa con los pasos que un empleador tiene que tomar cuando un empleado se marcha?

¡Estamos respondiendo las preguntas más frecuentes sobre el aviso de separación laboral!

¿Cuáles son las razones más comunes para la separación laboral?

La separación laboral se presenta de muchas formas. Las razones más populares de separación son:

- Renuncia o abandono del trabajo,

- Violaciones de políticas o conductas,

- Bajo rendimiento,

- Problemas de salud, y

- Despido.

¿Cuánto tiempo dura el proceso de separación laboral?

El proceso de separación laboral depende de varios factores, incluyendo:

- Regulaciones federales,

- Regulaciones estatales, y

- Prácticas establecidas por el empleador.

Generalmente, la duración del proceso de separación laboral depende de los pasos que especifica la política de la empresa, incluyendo los pasos involucrados en salidas voluntarias e involuntarias y la documentación de despido requerida.

En algunos estados con aviso de separación obligatorio, como Massachusetts, los empleadores pueden tener hasta 30 días para enviar el aviso. Esto extiende la duración del proceso de separación.

🎓 Para aprender más sobre las leyes laborales en Massachusetts, lee nuestra guía completa de las leyes laborales de Massachusetts: Guía de leyes laborales de Massachusetts

¿Qué es lo que el empleador debe hacer cuando un empleado se marcha?

En la mayoría de los casos, los empleadores siguen algunos pasos generales cuando un trabajador se marcha. Para simplificar cosas para ti, aquí tienes una lista de verificación de separación laboral:

- Informa a RRHH sobre la renuncia de trabajador,

- Proporciona un aviso de separación laboral dentro de tiempo legal, si se requiere,

- Haz un plan para la transición,

- Empieza el proceso de reemplazo del empleado,

- Realiza una entrevista saliente con el empleado que se separa, y

- Elimina el acceso a cualquier información confidencial y cobra los activos de la empresa del empleado.

🎓 Puedes asegurarte de seguir cada paso esencial en el proceso de separación laboral creando una lista de verificación. Lee el texto siguiente para encontrar el mejor método de lista de verificación para tus necesidades: He probado 6 métodos de lista de verificación: Aquí está mi veredicto

¿Necesitas un aviso de separación laboral para solicitar el seguro de desempleo?

Ya que el aviso de separación laboral no es requerido en la mayoría de los estados, probablemente no necesitarás proporcionar el aviso cuando aplicas para el seguro de desempleo. Cuando se trata de los estados con aviso de separación legal obligatorio, los pasos para recibir el seguro de desempleo dependen de las reglas específicas de este estado.

Algunos avisos de separación laboral solo contienen pasos para presentar el reclamo de seguro. En este caso, probablemente no tendrás que proporcionar un aviso cuando entregues tu solicitud. En otros estados, los empleadores están requeridos a brindarte el exacto formulario de seguro que debes presentar cuando solicitas el seguro.

Puedes leer más sobre los pasos que tienes que tomar en cada estado en el sitio web del Departamento de Trabajo de EE.UU..

Compensa a tus empleados de manera justa con Clockify

Para asegurar una compensación adecuada para todos los empleados, incluyendo a los despedidos, asegúrate de seguir sus horas laborales de manera correcta.

La manera más efectiva de rastrear las horas de los empleados es usar una herramienta de control del tiempo simple como Clockify.

Con el rastreador de horas laborales de Clockify, puedes:

- Registrar el tiempo que tus empleados dedican a las tareas,

- Seguir el tiempo libre,

- Establecer tarifas horarias, y

- Analizar el tiempo rastreado en informes.

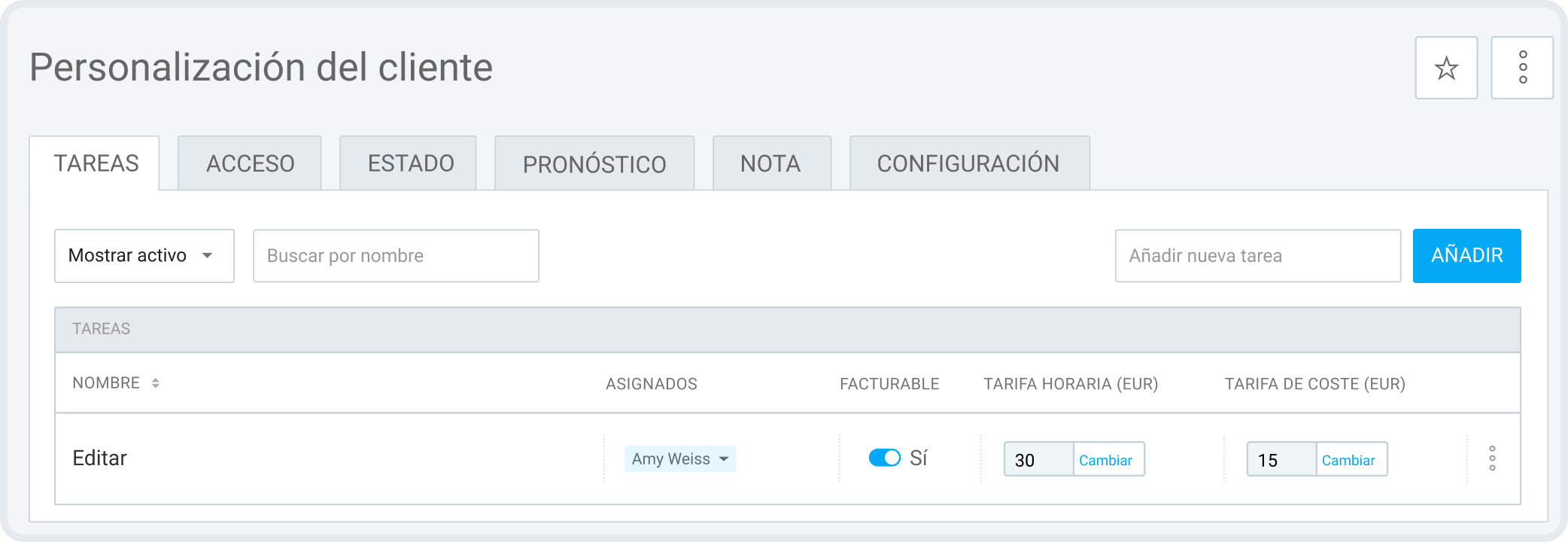

Además, en Clockify puedes definir tarifas horarias para cada tarea, proyecto o empleado.

Una vez que establezcas las tarifas horarias, tus empleados pueden seguir sus horas laborales y Clockify calculará sus ganancias en acordancia.

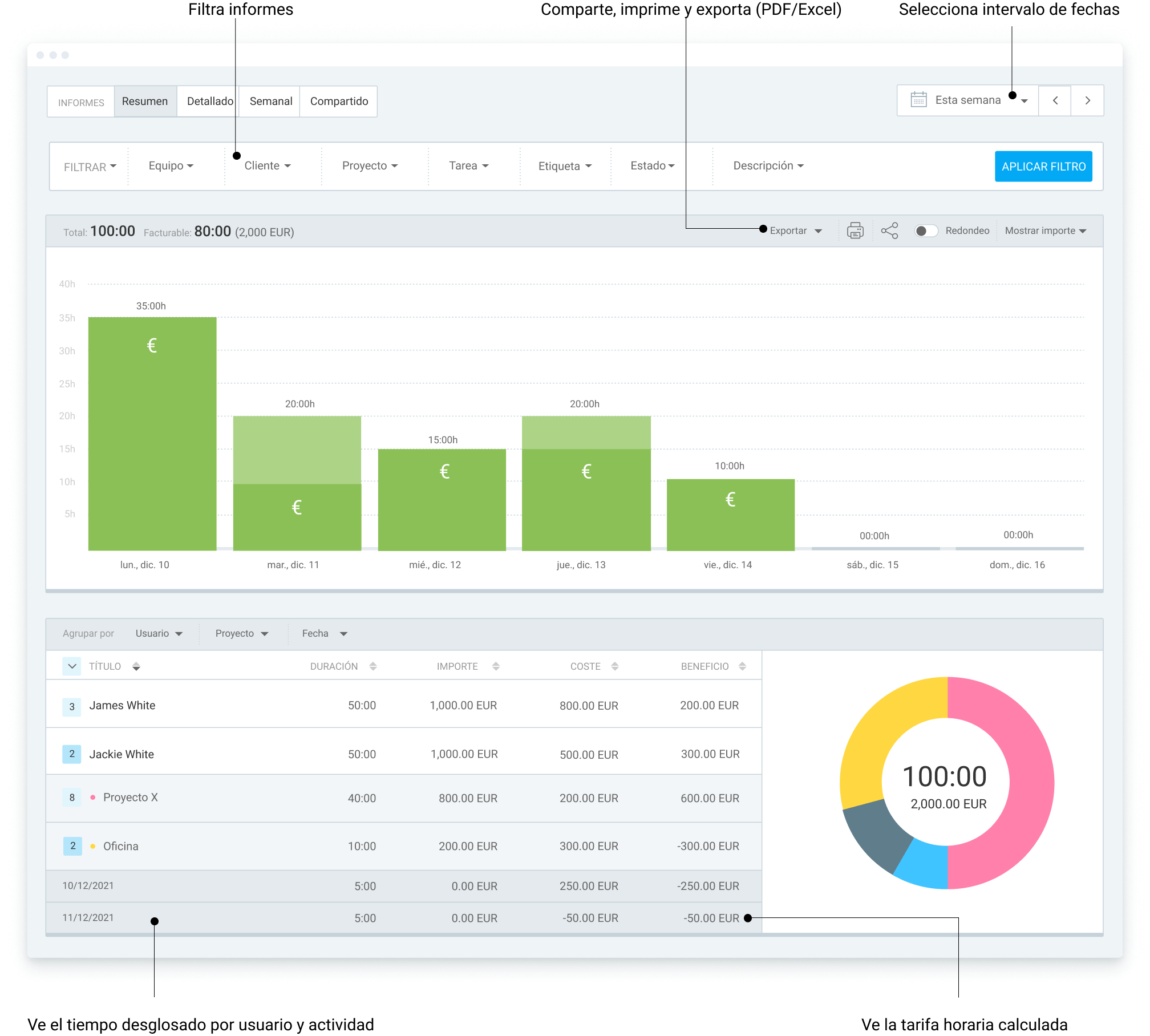

Para verificar quién trabajó en qué y por cuánto tiempo, puedes usar el resumen del informe de Clockify. También puedes seleccionar el rango de tiempo que deseas que cubra el informe (puede ser esta semana, las últimas dos semanas, este mes, etc.).

Además, puedes navegar por los datos usando filtros y exportarlos en los formatos PDF, CSV o Excel.

Usa Clockify para seguir las horas laborales de los empleados de manera fácil y precisa.

Conclusión y descargo de responsabilidad

Esperamos que nuestra guía de aviso de separación para 2025 te haya ayudado entender mejor las reglas y regulaciones sobre la separación laboral en los Estados Unidos.

Para obtener más datos sobre regulaciones de leyes laborales para cada estado:

- Sigue los enlaces proporcionados como fuentes, y

- Visita la sección de Leyes Laborales Estatales de nuestro sitio web.

Por favor ten en cuenta que este artículo fue actualizado en T1 de 2025. Por lo tanto, puede que no incluya cambios introducidos después de su publicación.

Te recomendamos consultar las instituciones adecuadas y/o los representantes certificados antes de tomar acciones legales.

Clockify no es responsable de ningunas pérdidas o riesgos incurridos si esta guía se usa sin la orientación legal.

Cómo revisamos esta publicación: Nuestros escritores y editores monitorean las publicaciones y las actualizan cuando hay nueva información disponible, para mantenerlas frescas y relevantes. Actualizado: 10 de febrero de 2025

Actualizado: 10 de febrero de 2025