Massachusetts Labor Laws Guide

Ultimate Massachusetts labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Massachusetts Labor Laws FAQ | |

| Massachusetts minimum wage | $14.25 |

| Massachusetts overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($21.37 for minimum wage workers) |

| Massachusetts breaks | 30-minute unpaid break |

Table of contents

Massachusetts wage laws

Concerning the highest minimum wage in the US, Massachusetts takes fourth place with $14.25 per hour. Back in 2015, the minimum wage was $9, but each following year, it kept increasing.

| MASSACHUSETTS MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $14.25 | $6.15 | $4.25 |

Massachusetts minimum wage

As of January 1, 2022, the minimum wage in Massachusetts is $14.25.

Under Massachusetts minimum wage law, a wage less than $14.25 is considered “oppressive and unreasonable”.

Good news for Bay Staters → the minimum wage in Massachusetts will reach $15 per hour in January 2023.

Exceptions to the minimum wage in Massachusetts

Under federal and state laws, certain employees are exempt from the minimum wage. To qualify for the exemption, employees must meet certain requirements.

Here is the list of the employees who are exempt from the minimum wage in Massachusetts (federal and state provisions):

- Executive and administrative employees, as well as learned and creative professionals who earn a salary that is not less than $684 per week

- Computer employees (who earn $684 per week) or by the hour (as long as it is at least $27.63 per hour)

- Highly compensated employees (those who earn $107,432 or more a year)

- Outside sales employees (no minimum salary requirement)

- Members of a religious order

- Employees working in certain educational, nonprofit, or religious organizations

- Minors

Agricultural and farm workers minimum wage in Massachusetts

Employees who are agricultural or farm workers are also exempt from the minimum wage provisions. Therefore, they are entitled to the “agricultural wage” of $8 per hour.

This rule doesn't apply to minors 17 years of age or to those whose employers are immediate family members.

Tipped minimum wage in Massachusetts

Tipped employees in Massachusetts are those who make more than $20 a month in tips. Employees who receive most of their earnings in tips are entitled to the “service rate”, i.e., tipped minimum wage of $6.15 an hour.

However, such employees must receive at least the state minimum wage of $14.25 per hour when actual tips and wages combine. If the tipped employee doesn't make at least the stated minimum wage, the employer must make up the difference.

To make sure each tipped employee earns at least the state minimum, as of January 1, 2019, employers are required to calculate the hourly earnings of every tipped employee at the end of each shift.

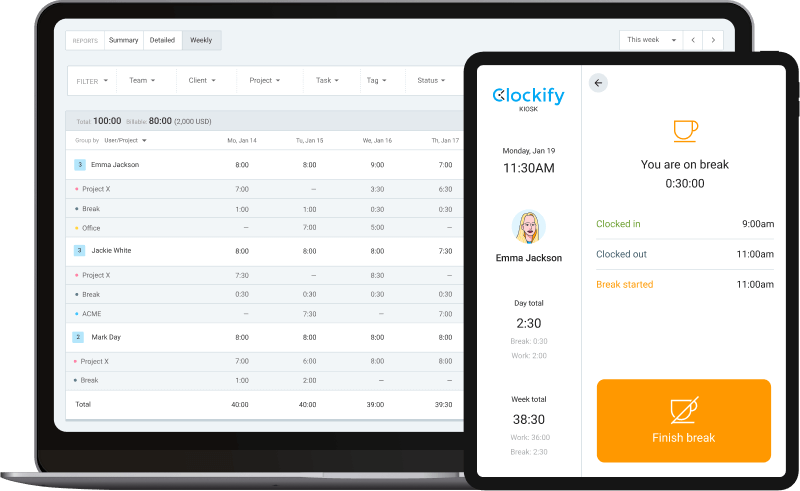

Track work hours and calculate hourly pay with ClockifyTip pooling in Massachusetts

Employers are forbidden from distributing tips to anyone who is not considered “wait staff” — employers, managers, supervisors, and those who don't serve customers directly.

This is applicable even if someone who is not a wait staff occasionally helps to serve customers.

Massachusetts subminimum wage

Massachusetts employers may pay employees under the age of 18 the federal youth wage of $4.25 per hour for the first 90 days of employment.

On the other hand, students who are trainees in hospitals or laboratories are entitled to 80% of the basic minimum wage.

In addition, minors attending secondary schools who work part-time in hospital wards, school or college dining rooms and dormitories receive 80% of the basic minimum wage.

Massachusetts “show up” pay

Massachusetts “show up” pay — also referred to as the “reporting pay” → entitles employees who work for 3 hours or more and get sent home to receive regular wages for those hours.

The employer sets the employee's work schedule and must pay for at least those 3 hours at the state minimum wage of $14.25.

Yet, charitable organizations don't qualify for this type of pay.

Massachusetts payment laws

In Massachusetts, every hourly worker must be paid either:

- Weekly, or

- Biweekly (every other week).

Therefore, if an hourly employee works 5-6 days a week, such an employee must be paid within 6 days of the termination of the pay period. If an employee works 1–4 days or 7 days, the employer must pay the wages due to that employee within 7 days after the termination of the pay period.

On the other hand, salaried employees may be paid:

- Biweekly

- Semi-monthly (twice a month)

- Monthly (only if such an employee chooses to be paid monthly)

Massachusetts overtime laws

Under federal law, each employee who works more than 40 hours in a workweek is entitled to overtime pay of one and a half (1.5) times the regular rate of pay. The same overtime regulations apply to Massachusetts.

However, tipped employees who receive a “service rate” are entitled to one and a half times the basic minimum wage — not the service rate.

Also, the state law of Massachusetts doesn't oblige certain jobs and workplaces to pay overtime (see the exemptions in the next section).

But, even when an employee doesn't have a right to overtime pay under state law, they may receive overtime pay under federal law.

In such cases — the law with more benefits for the employee prevails.

Track employee overtime in Massachusetts with ClockifyOvertime exceptions and exemptions in Massachusetts

This is the list of employees and occupations that are exempt from state overtime pay in Massachusetts:

- Janitors or caretakers of residential property provided with lodging and earning not less than $30 weekly

- Golf caddies, newsboys, child actors or performers

- Executive, administrative or professional workers or qualified trainees earning more than $80 weekly

- Outside salesmen or outside buyers

- Learners, apprentices or handicapped people under a special license

- Fishermen, seamen, or employees employed in the catching or taking of any kind of fish, or other aquatic forms of animals or vegetables

- Switchboard operators in a public telephone exchange

- Drivers or helpers on a truck to whom the Interstate Commerce Commission has power to establish maximum hours or employees subject to the provisions of the Interstate Commerce Act or the Railway Labor Act

- Seasonal jobs performed during a period or accumulated periods not in excess of 120 days in any year

- Gasoline station employees

- Restaurant staff

- Garagemen except for parking lot attendants

- Employees in hospitals, sanitorium, convalescent or nursing home, infirmary, rest home or charitable home for the aged

- Employees in a non-profit school, college or summer camps

- Agricultural laborers and farmers

- Employees in amusement parks who work not more than 150 days a year

This is the list of employees and occupations that are exempt from overtime pay under the Fair Labor Standards Act (FLSA):

- Executive employees who earn a salary and make not less than $684 per week

- Administrative employees who earn a salary and make not less than $684 per week

- Highly compensated employees who make more than $107,432 a year

- Learned and creative professionals who receive a salary and earn not less than $684 per week

- Computer employees who work on a salary basis and earn no less than $684 weekly

- Outside sales employees

Fluctuating Workweek Method (FWW) in Massachusetts

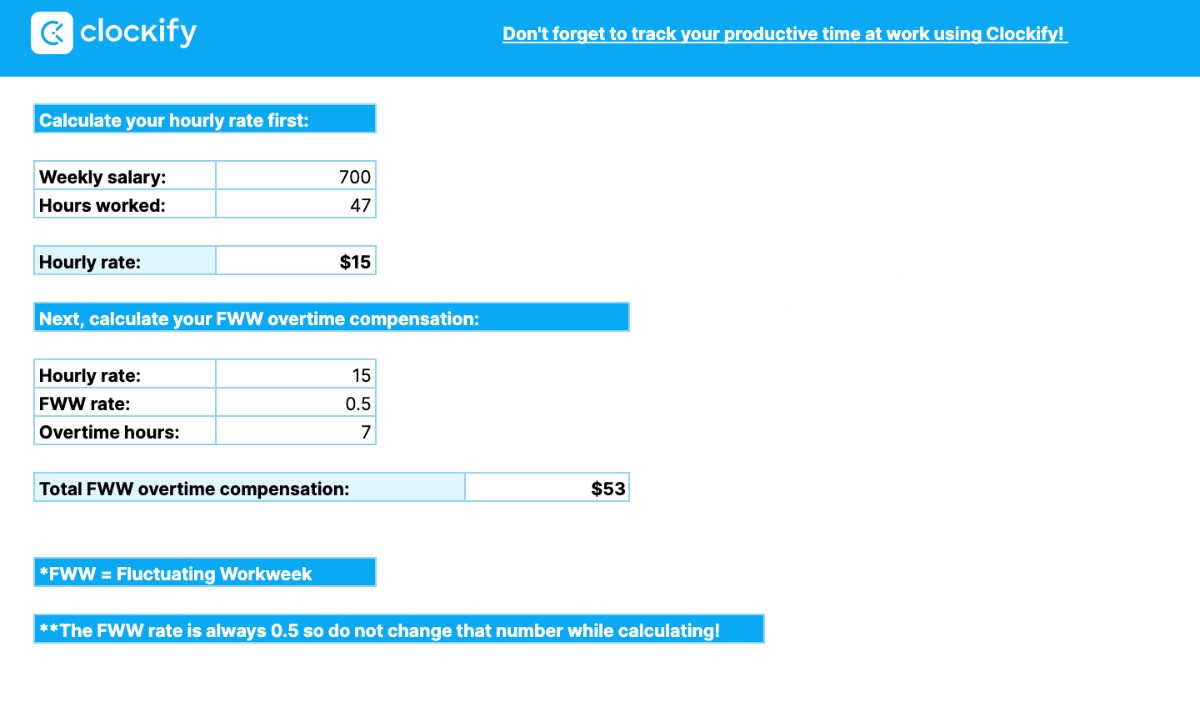

Most salaried workers in the US are not eligible for overtime pay. However, with the Fluctuating Workweek Method (FWW), certain nonexempt salaried employees may receive overtime.

Therefore, eligible employees are entitled to overtime pay of one-half (0.5) times their regular hourly pay rate for each extra hour worked.

Employees are eligible for the FWW method if they:

- Have a fluctuating workweek (sometimes they work less or more than 40 hours a week)

- Receive a fixed salary (no matter if they work more or less than 40 hours a week)

- Get at least the federal minimum of $7.25 per hour

In addition, employees who use the FWW are entitled to additional pay or benefits such as:

- Bonuses

- Commissions

- Hazard pay

Let's calculate overtime compensation for an eligible employee whose workweek fluctuates. To do so, we need to calculate the hourly pay first.

Let's say an employee's weekly income is $950 a week, and, in the preceding week, the employee worked 44 hours (4 overtime hours).

$950 / 44 = $22 per hour

Therefore, the overtime compensation per hour, in this case, is →

$22 per hour x 0.5 = $11 for each overtime hour worked

Total overtime compensation during that week →

$11 x 4 overtime hours = $44

To calculate your fluctuating workweek overtime pay hassle-free, we've provided a free calculator for your convenience → Fluctuating Workweek Calculator

Massachusetts break laws

Even though federal law doesn't require employers to provide break or meal periods to their workers — Massachusetts law says otherwise.

For that reason, employees in Massachusetts have a right to at least a 30-minute unpaid meal break for working more than 6 hours a day.

Employees must be free of all duties during a meal break and are allowed to leave the work area, too. If an employee works through their meal period — the employer must compensate for that time.

Furthermore, under Massachusetts law — the meal break can be used for other activities, such as praying, for instance.

Massachusetts breastfeeding laws

Massachusetts forbids any discrimination against employees due to pregnancy or conditions related to pregnancy — morning sickness, lactation, expressing milk, etc.

That being the case, employers must grant an employee a “reasonable accommodation” which allows the employee to perform “essential functions”.

Some examples of reasonable accommodations include:

- More frequent or longer breaks

- Providing equipment or seating in the workplace

- Private space, other than a bathroom, for expressing milk (with enough electrical outlets for breast pumps, tables, or other surfaces to hold breast pumps)

The Massachusetts law doesn't specify or limit how often an employee can take a break to breastfeed or express milk during a workday. Employers must be aware of each employee's needs thus allowing them to express milk or breastfeed as often as they need.

The US Department of Health and Human Services suggests that breaks may last 15 to 20 minutes, plus the time to get to and from the break room and set up and break down equipment.

When it comes to compensation, it's a matter of employee and employer mutual understanding.

The Massachusetts law doesn't require employers to pay such breaks.

Massachusetts leave requirements

Massachusetts is quite generous when it comes to time off and leave benefits.

Even though some businesses remain open on Sundays or weekends, the majority of them are entitled to additional premium rates — unlike in many other US states.

Massachusetts offers the following types of leave:

- Required leave

- Non-required leave

Massachusetts required leave

The following are leave benefits that Massachusetts employers are required to provide to their employees:

- Earned sick time

- Holiday leave (public employers)

- Holiday leave (private employers)

- Paid Family and Medical Leave (PFML)

- Military leave

- Donor leave

- Jury duty leave

- Voting leave

- Court leave due to witness summons

- Leave for victims of domestic violence, sexual assault, and stalking

- Volunteering leave

- Bereavement leave

- Inclement weather leave

- Vacation leave

Earned sick time

Massachusetts employers must provide earned sick time to their employees, and the employees may earn up to 40 hours of sick leave per year.

However, employers with 11 or more employees must provide 40 hours of paid sick time and those who have less than 11 employees must provide up to 40 hours of sick leave but unpaid.

Who is eligible for earned sick time?

Full-time, part-time, seasonal, per-diem or temporary workers in the state of Massachusetts are eligible for earned sick time.

Still, there are some exceptions to this rule.

Workers who are not eligible for earned sick time:

- US government employees

- Students attending private or public institutions of higher education who participate in a federal work-study program or scholarship program and those exempt from the Federal Insurance Contribution Act (FICA)

- School-aged students under 20 years of age

- Adults participating in educational or vocational training programs

- Independent contractors

- Municipal employees

Employees can accrue time as they work — 1 hour of earned sick time is accrued for every 30 hours worked.

Holiday leave (public employers)

In Massachusetts, both public and private employees have a right to either paid or unpaid holiday leave, yet with some restrictions for private employees.

This is a list of all legal holidays recognized by Massachusetts public offices:

- New Year's Day (January 1)

- Martin Luther King Jr. Day (3rd Monday in January)

- Presidents' Day (3rd Monday in February)

- Patriots' Day (3rd Monday in April)

- Memorial Day (last Monday in May)

- Juneteenth (June 19)

- Independence Day (July 4)

- Labor Day (1st Monday in September)

- Columbus Day (2nd Monday in October)

- Veterans Day (November 11)

- Thanksgiving Day (Fourth Thursday in November)

- Christmas Day (December 25)

If a legal holiday falls on a Sunday — employees get the following Monday off. In the event a legal holiday falls on a Saturday — all public offices will remain open to the public on a Friday that precedes any Saturday holiday.

Managers and confidential employees are not required to work on such Friday, and those who work are given an additional day off instead.

Holiday leave (private employers)

When it comes to private workers, the majority of them are entitled to holiday leave thanks to the Massachusetts “Blue Laws”.

These laws control working hours for some businesses and even require some employers to pay premium pay on Sundays and some legal holidays.

Sundays working limitations

These are certain private businesses' working regulations and obligations when working on Sundays:

- Retail establishments → They may be open at any time on Sundays without obtaining a work permit. Employers with more than 7 workers must pay their employees a premium rate of 1.1 times the regular rate (in 2022) for working on Sundays.

- Non-retail establishments → Such businesses can't operate on Sundays except for some exemptions, and a work permit is required in those establishments.

- Manufacturers → They need to obtain a work permit if they wish to be open on Sundays. However, they can operate on Sundays without a permit in limited circumstances.

Holidays working limitations for retail establishments

These are certain retail businesses' working regulations and obligations when working during holidays:

- Unrestricted holidays for retail establishments → During the following holidays, retail establishments may be open but without premium pay and a work permit on:

- Martin Luther King Day

- Presidents' Day

- Evacuation Day

- Patriots' Day

- Bunker Hill Day

- Partially restricted holidays for retail establishments → During the following holidays, retail establishments may be open but with premium pay of 1.1 times the regular rate and without a work permit on:

- New Year's Day

- Memorial Day*

- Juneteenth Independence Day*

- Independence Day*

- Labor Day*

- Columbus Day after 12:00 noon

- Veterans Day after 1:00 p.m.

Only those holidays followed by asterisks (*) are paid holidays if the retailer employs more than 7 workers (including the owner).

- Restricted holidays for retail establishments → During the following holidays, retail establishments may be open but with premium pay of 1.1 times the regular rate and with an obtained work permit on:

- Columbus Day before 12:00 noon**

- Veterans Day before 1:00 p.m.**

- Thanksgiving Day

- Christmas Day

Only those holidays followed by asterisks (**) require premium pay for work performed before 12:00 noon and 1 p.m.

Holiday working limitations for non-retail establishments

Non-retail businesses may operate without a permit and without pay on the following legal holidays:

- New Year's Day

- Martin Luther King Day

- Presidents' Day

- Evacuation Day

- Patriots' Day

- Bunker Hill Day

- Juneteenth Independence Day

- Columbus Day after 12:00 noon

- Veterans Day after 1:00 p.m.

Non-retail businesses must remain closed on any other legal holidays unless in exempt situations → Exemptions: Sports, games and entertainment

Holiday working limitations for manufacturers

These are certain working regulations and obligations in the manufacturing industries when working during holidays:

- Unrestricted holidays for manufactures → Manufacturers may operate without a permit> and without premium pay on the following legal holidays:

- New Year's Day

- Martin Luther King Day

- Presidents' Day

- Evacuation Day

- Patriots' Day

- Bunker Hill Day

- Juneteenth Independence Day

- Columbus Day after 12:00 noon

- Veterans Day after 1:00 p.m.

- Restricted holidays for manufacturers → Manufacturers are prohibited from operating on the following legal holidays (unless granted a permit by the local police):

- Memorial Day

- Independence Day

- Labor Day

- Columbus Day before 12:00 noon

- Veterans Day before 1:00 p.m.

- Thanksgiving Day

- Christmas Day

Manufacturers can't require their employees to work on legal holidays unless the work is — " absolutely necessary" and "can lawfully be performed on Sunday".

Paid Family and Medical Leave (PFML)

Massachusetts's PFML differs from the federal Family and Medical Leave Act since it's sponsored by the employer and employee contributions.

PFML offers employees family or medical paid leave of up to the following number of weeks per benefit year (consisting of 52 weeks, starting on a Sunday before the first day of paid leave) for:

- Up to 26 weeks, for:

- Taking care of a family member who was injured serving in the armed forces

- Up to 20 weeks, for:

- Serious health conditions (mental or physical), illnesses or injuries

- Pregnancy or childbirth

- Up to 12 weeks, for:

- Taking care of a family member with a serious health condition, illness, injury or pregnancy/childbirth

- Taking care of a newborn or an adopted child

- Managing affairs while a family member is on active duty

PFML allows its users to take more than one kind of leave in a benefit year — but is limited to 26 weeks of paid leave in such a year.

To make use of PFML benefits, an employee must have earned at least $5,700 over the past 4 calendar quarters and at least 30 times the benefit amount that an employee is eligible for.

Also, the application for paid leave must be submitted 60 days before the leave begins, and the employer must be notified at least 30 days prior.

If you are a self-employed employee, you can also apply for PFML — check out this link for more information → Paid Family and Medical Leave for self-employed individuals guideWhen it comes to benefits payment — it depends on:

- The employee's average weekly earnings,

- The state average weekly earnings for Massachusetts workers, and

- The type of leave one is applying for.

The PFML maximum benefit amount per week is $1,084.31.

To obtain more information on PFML leave, calculate your weekly benefit amount, learn about documentation requirements, and related, go to → Paid Family and Medical Leave BenefitsMilitary leave

Any person serving the armed forces of the Commonwealth or a county, city, or town is entitled to pay during the time of their service.

In addition, they are entitled to the same benefits as any other employee — leaves of absence or vacation with pay.

Any person serving the armed forces can receive payment for the maximum of 34 days in a state fiscal year and 17 days in any federal fiscal year as a member of a reserve component of the US armed forces.

Donor leave

Massachusetts offers its workers leave time for:

- Blood donation — State employees may donate blood 5 times a year during work hours between October 1 and September 30. Eligible employees may get up to 4 paid hours per donation.

- Bone marrow donation — Executive Department employees are allowed to take up to 5 paid days to donate bone marrow and recover.

- Organ donation — Executive Department employees are allowed to take up to 30 paid workdays a year for organ donation and recovery time.

Jury duty leave

Jury duty is a civic responsibility of each US citizen who needs to appear in court to serve as a juror during a court proceeding.

In Massachusetts, employees are granted jury duty leave and receive full regular pay.

Voting leave

Full-time and regular part-time employees must be granted a paid voting leave of up to 2 hours — if the voting is during working hours.

Court leave due to witness summons

Employees who receive an invitation i.e., summons, to appear at court as a witness for a government agency must be granted court leave and regular pay.

However, if they receive any witness fees — such fees must be returned to the agency.

Leave for victims of domestic violence, sexual assault, and stalking

Executive Department employees who are victims of domestic violence, sexual assault, or stalking may get:

- Paid leave — Up to 15 days for recovering, seeking counseling, etc.

- Unpaid leave — Up to 6 months with the right to regularly return to work receiving the same benefits as before.

Volunteering leave

Such leave is taken to serve as a member of a community or charitable organization. Volunteer time off benefits both the community and the employees by giving them additional time off or even paid leave.

Massachusetts offers eligible employees the following volunteering leaves and benefits:

- Red Cross Disaster Volunteer Leave — Executive Department employees may get up to 15 paid days if they serve as registered Red Cross volunteers to assist people and respond to emergencies.

- State Employees Responding as Volunteers Program (SERV) — Eligible employees must have at least 6 months of state service to receive up to 1 day per month to volunteer during working hours.

- National Disaster Medical System (NDMS) — State employees may volunteer as trained medical and paramedic workers and get unpaid leave time for that. Such volunteers receive compensation from the federal government and may return to their job as soon as they finish their service and are entitled to the same benefits as before.

Bereavement leave

Eligible employees may take this leave in the case of the death of a relative or a friend. In Massachusetts, Executive Department employees get 1 to 7 paid days off in the said situations.

Furthermore, managers and confidential employees who are veterans are also entitled to paid leave time to attend funerals of other veterans.

Inclement weather leave

Each state employee in Massachusetts is designated as “emergency personnel” or “non-emergency personnel”.

In the event of inclement weather, emergency personnel are required to assist at the assigned work site.

On the other hand, non-emergency personnel receive regular pay for lost work hours due to an emergency.

Small necessities leave

Workers in Massachusetts may take additional 24 hours of unpaid leave every 12 months to address certain family needs.

Working employees can make good use of such leave for:

- Child's school activities

- Child's dental or doctor appointments

- Elder relative's dental or doctor appointments (or other elder-related appointments)

Businesses must have 50 or more employees to qualify for such leave, and workers must have worked at least 1,250 hours for such a business in the last 12 months.

The small necessities leave is not the same as Family Medical Leave and should be used separately.

Massachusetts non-required leave

Massachusetts's leave policy distinguishes it from other states since the only leave employers are not required to grant to their employees is vacation leave.

Vacation time

No state law requires employers to provide their employees with vacation leave benefits.

Yet, if an employer chooses to provide paid vacation to their employees — such payments will be observed like regular wages.

Child labor laws in Massachusetts

Federal and state laws apply. Massachusetts law requires employers to obtain Youth Employment Permits if they wish to employ a worker under 18 years of age.

Work time restrictions for Massachusetts minors

Concerning working hours of minors in Massachusetts, limitations vary by age, type of work, and whether school is in session or not.

The state laws on child labor set strict provisions to prevent the exploitation of minors and put education first.

Time restrictions for minors aged 16 and 17:

- May work between 6 a.m. and 10 p.m. on regular school days, and if a business closes at 10 p.m., a minor may remain at work until 10:15 p.m.

- May work between 6 a.m. and 11:30 p.m. on nights not preceding school

- May work between 6 a.m. and 12:00 midnight at restaurants and racetracks on nights not preceding school

- May work 48 hours a week in total

- May work 9 hours a day

- May work 6 days a week

Time restrictions for minors aged 14 and 15:

- May work between 7 a.m. and 7 p.m. when school is in session but not during school hours

- May work between 7 a.m. and 9 p.m. during the summer (from July 1 through Labor Day)

- May work 18 hours a week when school is in session

- May work 3 hours a day on school days

- May work 8 hours a day on Saturdays, Sundays, and holidays

- May work up to 6 days a week on school days

- May work 40 hours a week when school is not in session

- May work 8 hours a day when school is not in session

- May work 6 days a week when school is not in session

All minors must have an adult supervisor in the workplace after 8 p.m. This doesn't apply to establishments such as shopping malls that have on-premise security guards.

Prohibited occupations for Massachusetts minors

Following the Secretary of Labor, no child under 18 years of age can be employed in any occupation, trade, or business that presents any physical, moral, or emotional hazard.

Prohibited occupations for minors under the age of 16:

- Operating, cleaning, or repairing power-driven machinery (except office machines or machines for retail, cleanup, or kitchen work not otherwise prohibited)

- Cooking (except on electric or gas grills with no open flame)

- Operating fryolators, rotisseries, NIECO broilers, or pressure cookers

- Operating clean or repairing power-driven food slices, grinders, choppers, processors, cutters, and mixers

Prohibited occupations for minors under the age of 18:

- Driving a vehicle, forklift, or work assist vehicle (except golf carts in some situations)

- Operating, cleaning, or repairing power-driven meat slicers, grinders, or choppers

- Operating, cleaning, or repairing power-driven bakery machines (except for certain countertop models and pizza dough rollers)

- Handling, serving, or selling alcoholic beverages

Minors under 14 are not allowed to work except in the following situations:

- Working as news carriers

- Working on farms

- Working in entertainment (with a permit)

- Working in family businesses

Posting requirements for employers employing minors in Massachusetts

Every person employing minors must keep a printed notice stating the number of hours such a minor is allowed to work.

The notice must be kept in a conspicuous place in the room where a minor is employed and must contain:

- Number of hours a minor is allowed to work each day

- Number of hours a minor is allowed to work a week

- Workday begin and end times

- Start and end time for rest or meal periods

Penalties for employers employing minors in Massachusetts

Anyone who tries to forge a birth certificate of a minor or other evidence of age with the purpose of obtaining a work permit will be punished by:

- A fine not less than $10 nor more than $500, or

- Imprisonment for not more than 1 year, or

- Both.

Massachusetts hiring laws

There are certain practices regarding employment in Massachusetts that are considered unlawful and discriminatory.

Unlawful employment practices in Massachusetts

Unlawful employment practices refer to any form of harassment, retaliation, or discrimination against an employee.

The following regulations apply to discrimination based on age, race, military, gender, pregnancy, and others.

Discrimination based on gender in the payment of wages

No employer can discriminate against an employee based on gender in the payment of wages or pay lesser wages to an employee of a different gender for the same work.

Prohibiting employees from discussing wages

An employer can't require a job applicant to refrain from asking about the wages — whether their own or other employees' wages.

Seeking pay history

It's considered unlawful for an employer to ask a job applicant or a former employer to provide an employee's wage or salary history.

Discrimination based on race, color, religion, nationality, sex, gender, identity, sexual orientation, genetic information, pregnancy, ancestry, handicap, or status as a veteran

No employer can refuse to hire a job applicant based on the foregoing discrimination policies.

Age discrimination

It's unlawful for an employer, labor organization, or employment agency to refuse to hire, expel from its membership, or discriminate against an applicant based on their age.

Military employment discrimination

An employer, employment agency, or the Commonwealth is not allowed to deny employment or any other benefit of employment to a person who is a member of the US military service or the National Guard based on that membership.

Pregnancy discrimination

It's considered unlawful for an employer to deny an employment opportunity to a person affected by pregnancy or pregnancy-related conditions (lactation, expressing breast milk, etc.).

Criminal conviction discrimination

It's considered unlawful for an employer to request on a job application form information about a criminal record.

This doesn't apply to positions for which any federal or state law creates mandatory disqualification based on a conviction for 1 or more types of criminal offenses.

Mental health discrimination

An employer can't refuse to hire a person who has been, voluntarily or involuntarily, admitted to a psychiatric institution provided that that person has been discharged from such institution and that they are mentally competent to perform the job.

Massachusetts termination laws

Massachusetts is another US state that recognizes at-will employment. This means that employers in Massachusetts are allowed to fire an employee at any time for no reason at all. At the same time, an employee can resign at any time without giving further explanation.

The following are some other regulations regarding termination of employment in Massachusetts.

Massachusetts final paycheck

Employees who voluntarily quit their jobs must be paid in full on the following regular payday or the following Saturday (in the absence of a regular payday).

In case an employee is discharged — they must be paid in full on the day of the discharge.

Health insurance continuation in Massachusetts

Municipal employees and their dependents in Massachusetts are covered by the federal Consolidated Omnibus Budget Reconciliation Act (COBRA), which allows them to temporarily continue their health care coverage.

Who is eligible for COBRA?

Eligible persons or qualified beneficiaries entitled to COBRA are:

- Former employees

- Retirees

- Spouses

- Former spouses

- Dependent children

What are the COBRA qualifying events?

Qualifying events for continuing health coverage under COBRA are:

- End of employment → voluntary or involuntary

- Reduction of work hours

- Death of employee/retiree/spouse

- Divorce or legal separation

- Loss of dependent child status

COBRA continuation coverage begins on the same day the previous health insurance ended, and it may last from 18 to 36 months — depending on the case.

Still, the COBRA law only covers businesses with 20 or more employees.

Luckily, Massachusetts has a state law called Mini-COBRA, which requires small businesses with 2–19 employees to provide continuation of health coverage benefits.

Occupational Safety and Health Administration (OSHA) in Massachusetts

Private-sector employers and their workers are covered by the Occupational Safety and Health (OSH) Act in Massachusetts. OSHA assures healthy and hazard-free working conditions for workers by setting safety standards and requirements that businesses must comply with.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

The authorities conduct regular inspections to ensure regulations and standards imposed by OSHA are in full compliance.

Also, workers may file a written complaint and require OSHA to inspect their workplace if they believe their employer doesn't comply with the regulations and standards.

Visit this website to find the nearest OSHA office → OSHA offices in MassachusettsMiscellaneous Massachusetts labor laws

In this section, we'll cover some of the miscellaneous labor laws concerning Massachusetts such as:

- Whistleblower laws

- Recordkeeping laws

Massachusetts whistleblower laws

Under the Massachusetts whistleblower act, a public employee may report any fraudulent activity, waste, or abuse in the workplace. The inspector general is in charge of receiving such complaints from the employee but must keep their identity a secret unless such disclosure is necessary during the investigation.

No person is allowed to take any vengeful action against an employee who “blows the whistle”, provided such an allegation is legitimate.

Furthermore, Massachusetts protects whistleblowers, witnesses, family members of such persons, or any other individual who is aware of information or records related to a violation from any type of:

- Harassment

- Physical, emotional, or economic injury, or

- Property damage.

Anyone who punishes, harms, or otherwise retaliates against any said person can be punished with not more than 10 years of imprisonment in the state prison or by a fine of not less than $1,000 or more than $5,000.

Massachusetts recordkeeping laws

Every employer must keep accurate records of each employee at the place of employment for at least 3 years after the entry date of the record.

The records of each employee should contain:

- Name

- Address

- Occupation

- Social security number

- The amount paid each pay period

- Hours worked each day and week

Employers must allow their employees to see their own records at reasonable times and places.

Conclusion/Disclaimer

We hope this Massachusetts labor law guide has been helpful. We advise you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Massachusetts labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).