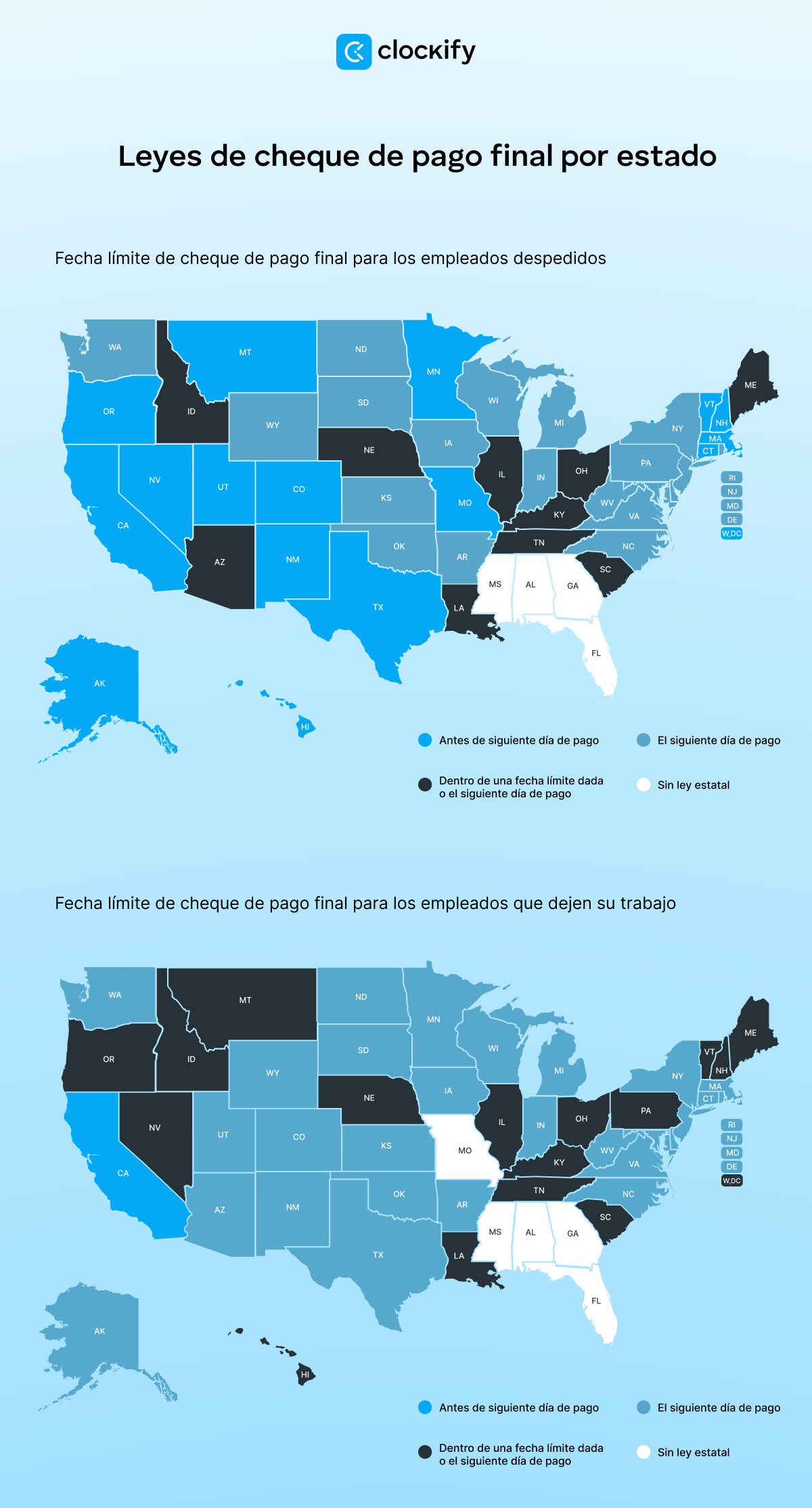

Una relación laboral puede terminar por diversos motivos. La ley federal claramente indica que los empleadores deben emitir el cheque de pago final a todos los empleados despedidos antes del siguiente día de pago programado.

Sin embargo, las leyes estatales pueden exigir que el cheque de pago final tenga una fecha de vencimiento dentro de un período especificado y más corto, y la mayoría de las leyes estatales sí lo exigen.

Por ejemplo, un empleado de Colorado que deja el trabajo debería ser compensado por lo que se le debe el día siguiente del pago programado.

Conocer los requisitos estatales beneficia tanto a los empleadores como a los empleados, ya que los empleados pueden saber cuándo recibirán su cheque de pago final y los empleadores pueden cumplir con las leyes laborales.

Si estás interesado en aprender más detalles, continua leyendo, ya que hemos investigado detalladamente el tema y recopilado los datos de las leyes de cheque de pago final por estado para 2025.

- El cheque de pago final es la cantidad final de salario que un empleado puede obtener del empleador.

- La ley federal indica que los empleadores deben pagar los cheques de pago final el siguiente día de pago regular o antes.

- Muchos estados tienen sus propias reglas sobre las fechas límites para el pago de cheque de pago final.

- La fecha límite para pagar el cheque de pago final al empleado dependerá de si el empleado renunció o fue despedido.

*Nota: La información sobre las leyes y regulaciones de cheques de pago finales por estado ha sido verificada y actualizada para 2025.

¿Qué son los cheques de pago finales?

Un cheque de pago final es la cantidad de dinero que un empleado recibe de su empleador. Habitualmente contiene salarios del empleado no remunerados y otras ganancias.

Como parte de su cheque de pago final, los empleados pueden recibir lo siguiente:

- Salarios no pagados,

- Horas extras,

- El PTO no usado y/o vacaciones,

- Las comisiones debidas,

- El pago adicional, y

- La indemnización por despido.

🎓 ¿No estás seguro de cómo calcular el PTO acumulado? Aquí tienes una guía completa sobre el tema — Las leyes de pago de PTO por estado

¿Cuáles son las fechas límites para emitir el cheque de pago final?

La terminación del contrato puede ocurrir por varias razones, tanto por parte del empleador como por parte del empleado. Algunas de estas razones pueden incluir una renuncia voluntaria del empleado por causa de una reubicación o terminación debido a una falta grave.

No obstante, es importante enfatizar que estas razones específicas (por ejemplo, la terminación debido a una falta grave anteriormente mencionada) no afectarán las fechas límites para la emisión de los cheques de pago finales.

Sin embargo, muchos estados determinan las fechas límites dependiendo de quién decide terminar la relación laboral.

Por lo tanto, la fecha límite del cheque de pago final será diferente para:

- Los empleados que entregan el aviso y renuncian a su trabajo a su voluntad propia, y

- Los empleados cuyos empleadores terminan su contrato por cualquier motivo.

Por ejemplo, en el Distrito de Columbia, empleados que renuncian a su trabajo a su voluntad propia se les deben los cheques de pago finales dentro de 7 días o al siguiente día de pago programado, lo que sea el primero. Sin embargo, los cheques de pago finales para los empleados que fueron despedidos vencen al día siguiente laborable.

Las leyes de cheque de pago final por estado

Según la ley federal, todos los cheques de pago finales vencen el siguiente día de pago programado a menos que la regulación estatal específica no especifique un período más corto. Puesto que los requisitos de terminación por estado pueden variar, algunos estados exigen que los empleadores paguen a los empleados inmediatamente, mientras que otros les proporcionan un período de tiempo para hacer el pago.

La tabla de abajo contiene toda la información que necesitas sobre las leyes de cheque de pago final por estado para 2025, así que pasemos a ella. Si el estado no tiene un enlace de referencia, es porque dicho estado sigue leyes federales de cheque de pago final.

| Estado | Cuándo un empleado está terminado | Cuándo un empleado ha dejado el trabajo | Sanciones por no emitir a tiempo el último cheque de pago final |

|---|---|---|---|

| Alabama | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Alaska | El cheque de pago final se debe emitir dentro de 3 días laborables del último día de trabajo del empleado. | El cheque de pago final vence el siguiente día de pago programado, lo que es al menos 3 días aparte del aviso de terminación del empleo del empleado. | Si un empleador no paga el cheque de pago final a tiempo, puede continuar pagándole al empleado su salario regular desde el día de la demanda hasta el día de pago. Este pago no puede exceder 90 días. |

| Arizona | El cheque de pago final vence dentro de los 7 días laborables del último día de trabajo o el siguiente día de pago programado del empleado (lo que ocurre primero). | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final a tiempo, será culpable de un delito menor. |

| Arkansas | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final dentro de 7 días del día de pago programado, la cantidad que le debe al ex empleado se duplica. |

| California | El cheque de pago final se debe emitir inmediatamente. | El cheque final vence inmediatamente para los empleados que proporcionen un aviso escrito con al menos 72 horas de antelación. Si un empleado no avisa con 72 horas de antelación, el cheque de pago final se deberá pagar dentro de las siguientes 72 horas de su renuncia. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, se añadirán las multas por tiempo de espera a la cantidad. |

| Colorado | El cheque de pago final vence inmediatamente a menos que la unidad de nómina esté cerrada (la fecha límite se extiende hasta 6 horas después del siguiente día laborable) o que la unidad contable se basa fuera del sitio (la fecha límite se extiende hasta 24 horas). | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no paga el cheque de pago final a tiempo, puede continuar pagándole al empleado su salario regular desde el día de la demanda hasta el día de pago. Este pago no puede exceder 10 días. |

| Connecticut | El cheque de pago final vence el siguiente día laborable. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no paga los salarios debidos a tiempo, podría pagar una multa entre $200 y $5000 por violación. |

| Delaware | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final a tiempo, podría pagarle al empleado hasta el 10% de su salario regular para cada día de retraso o la cantidad igual a los salarios no pagados. |

| Distrito de Columbia | El cheque de pago final vence el siguiente día laborable. | El cheque de pago final debe emitirse dentro de los 7 días posteriores al último día de trabajo del empleado o en el siguiente día de pago programado (lo que ocurra primero).Esto se aplica a los empleados sin contrato de trabajo escrito por un período superior a 30 días. | Si un empleador no emite el cheque de pago final dentro de ese plazo, debe pagar el 10% de los salarios impagos por cada día laboral o el triple de los salarios impagos, la cantidad que sea menor. |

| Florida | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Georgia | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Hawái | El cheque de pago final vence inmediatamente a menos que las condiciones no lo permitan, (por ejemplo, las vacaciones), en cuyo caso la fecha límite se extiende al siguiente día laborable. | El cheque de pago final vence el siguiente día de pago programado, excepto si el empleado ha presentado un aviso al menos un período de pago regular antes, en cuyo caso el cheque de pago final vence inmediatamente. | Si un empleador no paga los salarios debidos a tiempo, podría pagar una multa de $500 o $100 por violación. |

| Idaho | El cheque de pago final vence el siguiente día de pago programado, o dentro de los 10 días del último día del empleado (los fines de semana y vacaciones excluidos). Si un empleado presenta una solicitud escrita para el último pago anticipado, el cheque de pago final vence dentro de las 48 horas. | El cheque de pago final vence el siguiente día de pago programado, o dentro de los 10 días del último día del empleado (excluidos los fines de semana y los días festivos). Si el empleado presenta una solicitud escrita para el último pago anticipado, el cheque de pago final vence dentro de las 48 horas. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, se le puede exigir que pague una multa de hasta $750. |

| Illinois | El cheque de pago final se debe emitir a no más tardar el siguiente día de pago programado. | El cheque de pago final se debe emitir a no más tardar el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, se le puede exigir que pague una multa de hasta $500 por violación. |

| Indiana | El cheque de pago final vence el siguiente día del pago programado o antes. | El cheque de pago final vence el siguiente día del pago programado o antes. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, la cantidad que debe se puede duplicar si actuó en mala fé. |

| Iowa | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Kansas | A más tardar, el cheque de pago final vence el siguiente día. | A más tardar, el cheque de pago final vence el siguiente día. | Si un empleador no lo hace, pagará una multa adicional del 1% de los salarios no pagados para cada día laboral o el 100% de los salarios no pagados, cualquier cantidad que sea menor. |

| Kentucky | El cheque de pago final vence el siguiente día de pago programado o dentro de los 14 días del último día laborable del empleado (cualquier opción que ocurra más tarde). | El cheque de pago final vence el siguiente día de pago programado o dentro de los 14 días del último día laborable del empleado (cualquier opción que ocurra más tarde). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Louisiana | El cheque de pago final vence el siguiente día de pago programado o dentro de los 15 días del último día laborable del empleado (cualquier opción que ocurra primero). | El cheque de pago final vence el siguiente día de pago programado o dentro de los 15 días del último día laborable del empleado (cualquier opción que ocurra primero). | Si un empleador no paga el cheque de pago final a tiempo, puede continuar pagándole al empleado su salario regular desde el día de la demanda hasta el día de pago. Este pago no puede exceder 90 días. |

| Maine | El cheque de pago final vence el siguiente día de pago programado o dentro de 2 semanas de la demanda (lo que ocurra primero). | El cheque de pago final vence el siguiente día de pago programado o dentro de 2 semanas de la demanda (lo que ocurra primero). | Si un empleador no paga el cheque de pago final dentro de esta fecha límite, la cantidad que debe se puede duplicar. La cantidad completa también incluirá una tasa de interés razonable y el coste de la demanda. |

| Maryland | A más tardar, el cheque de pago final vence el siguiente día. | A más tardar, el cheque de pago final vence el siguiente día. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Massachusetts | El cheque de pago final vence inmediatamente. | El cheque de pago final vence el siguiente día de pago programado o el sábado siguiente. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, pagará hasta 3 veces la cantidad original. |

| Míchigan | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, podría pagar una multa de hasta el 10% del salario anual. Para las violaciones repetidas, los empleadores pueden pagar hasta el doble del salario adeudado. |

| Minnesota | El cheque de pago final vence dentro de las 24 horas de la presentación de una solicitud de pago escrita, la cual es mandatoria. Si la solicitud escrita por el pago no se presenta, el cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado, que es al menos en 5 días. De todos modos, el salario se debe pagar dentro de 20 días de la separación. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, la cantidad se puede aumentar por hasta el valor de 15 días de los salarios del empleado. |

| Misisipi | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Misuri | El cheque de pago final vence inmediatamente. | No está regulado por la ley estatal. Se aplica la ley federal (el cheque de pago final vence el siguiente día de pago programado). | Si un empleador no paga el último salario a un empleado, el empleador es responsable de pagar salarios adicionales. |

| Montana | El cheque de pago final vence inmediatamente, ya sea dentro de las 4 horas posteriores a la terminación o al final del día hábil, lo que ocurra primero. | El cheque de pago final vence el siguiente día de pago programado o dentro de los 15 días calendarios, lo que ocurra primero. | Si un empleador no paga el último salario dentro de esta fecha límite, podría pagar una multa de hasta el 110% del último salario. |

| Nebraska | El cheque de pago final vence el siguiente día de pago programado o dentro de las 2 semanas del último día laborable del empleado (cualquier opción que ocurra primero). | El cheque de pago final vence el siguiente día de pago programado o dentro de las 2 semanas del último día laborable del empleado (cualquier opción que ocurra primero). | Si un empleador no emite el cheque de pago final a tiempo, podría pagar multas adicionales de hasta el 10% de la cantidad adeudada. |

| Nevada | El cheque de pago final vence dentro de los 3 días del último día laborable del empleado. | El cheque de pago final vence el siguiente día de pago programado o dentro de los 7 días del último día laborable del empleado, cualquier opción que ocurra primero. | Los empleadores que no emiten el cheque de pago final a tiempo pueden enfrentarse a multas. |

| Nuevo Hampshire | El cheque de pago final vence dentro de las 72 horas del último día laborable del empleado. | El cheque de pago final vence el siguiente día de pago a menos que el empleado haya presentado el aviso al menos un período de pago antes, en cuyo caso la fecha límite es de hasta 72 horas. | Los empleadores que no emiten el cheque de pago final a tiempo pueden enfrentarse a multas. |

| Nueva Jersey | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no paga los salarios adeudados a tiempo, podría pagar una multa de $100 a $1000 por violación. |

| Nuevo México | El cheque de pago final vence dentro de los 5 días del último día laborable del empleado, con la excepción de los empleados basados en la comisión, en cuyo caso la fecha límite se extiende a 10 días. | El cheque de pago final vence el siguiente día de pago programado. | Los empleadores que no emiten el cheque de pago final a tiempo pueden enfrentarse a multas. |

| Nueva York | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Carolina del Norte | El cheque de pago final vence el siguiente día del pago programado o antes. | El cheque de pago final vence el siguiente día del pago programado o antes. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Dakota del Norte | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el último salario dentro de esta fecha límite, podría pagar una multa, que es de 10 días de los salarios adeudados o el 125% de la cantidad adeudada, lo que ocurra primero. |

| Ohio | El cheque de pago final vence el siguiente día de pago programado o dentro de los 15 días del último día laborable del empleado (cualquier opción ocurra primero). | El cheque de pago final vence el siguiente día de pago programado o dentro de los 15 días del último día laborable del empleado (cualquier opción ocurra primero). | Si un empleador no emite el último salario dentro de esta fecha límite, podría pagar multas de hasta el 6% de los salarios no remunerados o $200, lo que sea mayor. |

| Oklahoma | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, podría pagar una multa de hasta el 2% de los salarios no remunerados por cada día de retraso. |

| Oregón | El cheque de pago final vence el siguiente día laborable. | El cheque de pago final vence el último día de empleo si un empleado proporciona un aviso de 48 horas. En el caso de un aviso más corto, el cheque de pago final vence dentro de los 5 días laborables o en el siguiente día de pago programado (lo que ocurra primero). | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, se le puede cobrar una multa salarial en la cantidad de 8 veces la tarifa regular del empleado por cada día de los salarios no pagados. |

| Pensilvania | El cheque de pago final vence el siguiente día de pago programado o dentro del período estándar establecido por el empleador (lo que ocurra primero). | El cheque de pago final vence el siguiente día de pago programado o dentro de 15 días (lo que ocurra primero). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Rhode Island | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Carolina del Sur | El cheque de pago final dentro de 48 horas del último día laborable del empleado o en el siguiente día de pago programado, lo que ocurra primero (el período intermedio no debe exceder 30 días). | El cheque de pago final dentro de 48 horas del último día laborable del empleado o en el siguiente día de pago programado, lo que ocurra primero (el período intermedio no debe exceder 30 días). | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Dakota del Sur | El cheque de pago final vence el siguiente día de pago programado, o si se aplica, cuando el empleado devuelve toda la propiedad de la empresa. | El cheque de pago final vence el siguiente día de pago programado, o si se aplica, cuando el empleado devuelve toda la propiedad de la empresa. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Tennessee | El cheque de pago final vence el siguiente día de pago programado o dentro de los 21 días del último día laborable del empleado (cualquier opción que ocurra más tarde). | El cheque de pago final vence el siguiente día de pago programado o dentro de los 21 días del último día laborable del empleado (cualquier opción que ocurra más tarde). | Si un empleador no paga los salarios adeudados a tiempo, podría pagar una multa de $100 a $500 por violación. |

| Texas | El cheque de pago final vence dentro de los 6 días del último día laborable del empleado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleado no emite el cheque de pago final dentro de esta fecha límite, los salarios del empleado continuarán al mismo ritmo, por hasta 60 días. |

| Utah | El cheque de pago final vence dentro de las 24 horas del último día laborable del empleado. | El cheque de pago final vence el siguiente día de pago programado. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Vermont | El cheque de pago final vence dentro de las 72 horas del último día laborable del empleado. | El cheque de pago final vence el siguiente día de pago programado. En caso de que no hay días de pago programados, la fecha límite es el viernes de la semana siguiente del último día del empleado. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Virginia | El cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día de pago programado. | Si un empleador no paga los salarios adeudados a tiempo, podría pagar una multa de hasta $1000 por violación. |

| Washington | El cheque de pago final vence el siguiente día del pago programado o antes. | El cheque de pago final vence el siguiente día del pago programado o antes. | Si un empleador no paga los salarios adeudados a tiempo, podría pagar una multa de hasta $1000 por violación o el 10% de los salarios adeudados, lo que sea mayor. |

| Virginia Occidental | El cheque de pago final vence el siguiente día de pago programado. En caso de despido, el cheque de pago final vence el siguiente día de pago programado. | El cheque de pago final vence el siguiente día del pago programado o antes. | Si un empleador no emite el cheque de pago final dentro de la fecha límite, la cantidad que debe a un ex empleado se duplica. |

| Wisconsin | El cheque de pago final vence de acuerdo con el horario regular del día de pago del empleador. | El cheque de pago final vence de acuerdo con el horario regular del día de pago del empleador. | Los empleadores pueden enfrentarse a sanciones penales y civiles. |

| Wyoming | El cheque de pago final vence de acuerdo con el horario regular del día de pago del empleador. | El cheque de pago final vence de acuerdo con el horario regular del día de pago del empleador. | Si un empleador no emite el cheque de pago final dentro de esta fecha límite, pagará una multa de hasta $200 por cada día de retraso. |

🎓 Para obtener más información sobre las leyes laborales en los estados de EE.UU., lee nuestras guías completas de leyes laborales — Guías de Leyes Laborales Estatales

Las leyes de cheque de pago final por estado: Preguntas frecuentes

Para que esta guía sea lo más completa posible, hemos incluido una sección de preguntas frecuentes donde responderemos a las preguntas frecuentes sobre este tema.

1. ¿Cuál es la ley federal de cheque de pago final?

Los cheques de pago finales en los EE.UU. están regulados por la Ley de Normas Justas de Trabajo (FLSA, por sus siglas en inglés). Bajo la ley federal, los empleadores deben emitir los cheques de pago finales a todos los empleados despedidos el siguiente día de pago regularmente programado, si no antes.

Varios estados en los EE.UU. no tienen leyes estatales sobre los cheques de pago finales. Por lo tanto, dependen exclusivamente de la ley federal. Estos estados incluyen:

- Alabama,

- Florida,

- Georgia,

- Misisipi, y

- Misuri (las regulaciones federales se aplican sólo a los empleados que renuncian).

Las leyes federales de empleo establecen reglas y responsabilidades para todos los empleados de los EE.UU., mientras que las leyes estatales se aplican sólo dentro de fronteras estatales particulares. Entonces, ¿cuál de las dos gobierna si ambas existen?

Siempre que la ley estatal no entra en conflicto con las regulaciones federales, la ley estatal rige, prevaleciendo la ley federal. Solo en casos raros donde existe un conflicto entre las dos, haciendo imposible cumplir ambas, la cláusula de supremacía dicta que la ley federal tiene prioridad sobre las leyes estatales y aún constituciones.

2. ¿Qué es la Ley de pago y cobro de salario?

En pocas palabras, la Ley de Pago y Cobro de Salario regula los derechos, las limitaciones y requisitos de empleadores con respeto a:

- La compensación y los beneficios,

- El período y los procesos de nómina, y

- Las deducciones.

La ley fue introducida en Pensilvania en 1961 para asegurar que todos los empleados están compensados para su trabajo de manera justa y oportuna. Específicamente, se refiere al derecho de un empleado a solicitar ayuda en la recuperación de salarios no pagados, según lo establecido en el contrato de trabajo.

Esencialmente, la ley es una extensión de la FLSA, y sigue vigente hoy. Aunque no se aplica a nivel federal, muchos otros estados de EE.UU. han adoptado esta ley.

3. ¿Un empleador puede retener un cheque de pago final?

Técnicamente, la respuesta es sí, pero esto aplica solo si el empleado ha acordado previamente ciertos términos y condiciones, habilitando que el empleador tome deducciones de su cheque de pago final.

A continuación se muestran un par de ejemplos de cuándo los empleadores pueden legalmente retener el cheque de pago final de los ex empleados:

- Los empleadores reclaman una deuda/reembolso (ej., por escasez de efectivo, el equipo perdido, roto o faltante, etc.), o

- Los empleadores han autorizado al empleado firmando el contrato en el que acuerda con ciertas deducciones (ej., los embargos de salario ordenados por el tribunal, los pagos de impuestos, los préstamos personales, etc.).

En tales (o similares) casos, los empleadores tienen derecho a retener la cantidad en cuestión, siempre que tengan la prueba de dicho acuerdo.

4. ¿Un empleador puede retener tu último cheque de pago si dejas tu trabajo?

No, los empleadores no pueden retener tu último cheque de pago si dejas tu trabajo.

Independientemente del estado y las razones por la terminación del empleo, todos los empleadores de EE.UU. están legalmente obligados a emitir los cheques de pago finales a sus (en el momento ex) empleados.

A pesar de que no hay excepciones a la regla, las condiciones y los requisitos legales por los cheques de pago finales pueden variar. Por lo tanto, es crucial estar familiarizado con los que se aplican a tu situación.

5. ¿Cuándo un empleado debería recibir su cheque de pago final?

No existe una respuesta única a esta pregunta, dado que existen varios escenarios posibles, dependiendo de:

- Las regulaciones estatales — muchos estados usan sus propias fechas límites para los cheques de pago finales. Si un estado no tiene regulaciones sobre este asunto, se aplica la ley federal (los cheques de pago finales vencen el siguiente día de pago programado, o antes), y

- La razón por la cese del empleo — las fechas límites variarán dependiendo de si el empleado fue despedido o ha renunciado voluntariamente.

Dependiendo del escenario, algunos empleados están elegibles para un pago inmediato, mientras que otros pueden esperar su cheque de pago final el siguiente día de pago programado, o dentro de cierto período de tiempo.

6. ¿El cheque de pago final del empleado será depositado directamente?

Este asunto depende de cómo te hayan emitido previamente la nómina: recibirás el pago de la misma manera como antes, cuando hayas recibido todos tus previos cheques de pago.

Esto significa que si estabas recibiendo pago a través del depósito directo, tu cheque de pago final también será depositado directamente. Sin embargo, las empresas pueden ofrecer a los empleados una opción adicional de tipo de pago solo por el cheque de pago final.

Por ejemplo, incluso un empleado que usualmente estaba recibiendo los cheques a través de correo puede optar por la opción de depósito directo para su cheque de pago final.

Como hemos mencionado anteriormente, esto se regula con la política de la empresa, y ten en cuenta de que los empleadores sólo pueden añadir más opciones. Los empleados que no están seguros de lo que es aplicable a su situación deberían simplemente revisar su contrato de empleo.

🎓 Si estás propietario de un negocio pequeño en necesidad de una orientación con la gestión de la nómina, la siguiente guía será útil — Cómo hacer la nómina para pequeños negocios

7. Has dejado tu trabajo y nunca has recibido tu último cheque de pago. ¿Qué puedes hacer?

El hecho de que fue la decisión del empleado de terminar el contrato no cambia el hecho de que es ilegal que los empleadores retengan los salarios no pagados de sus ex empleados.

Si tal caso ocurre, los empleados están elegibles para presentar una queja oficial a la División de Salario y Horas del Departamento de Trabajo de EE.UU..

Los empleados que quieren recuperar los salarios no pagados deben rellenar la aplicación de los Salarios Debidos a los Trabajadores y presentarla a la base de datos del gobierno para su procesamiento.

Para algunas preguntas y consultas adicionales, es mejor comunicarse directamente a la oficina de trabajo estatal.

8. ¿Por cuánto tiempo un empleador puede retener el último cheque de pago si dejas tu trabajo?

Los empleados cuyos contratos han sido terminados, tanto voluntariamente como involuntariamente, se le puede vencer su cheque de pago final:

- Inmediatamente,

- Dentro de las 72 horas,

- El siguiente día de pago programado, o

- Una vez que hayan devuelto todo el equipo de la empresa.

La tabla que hemos proporcionado en la sección anterior contiene toda la información relevante sobre los estados individuales.

Usa Clockify para un seguimiento preciso de la nómina

Seguir la nómina es crucial para cada empresa, ya que garantiza que tus empleados siempre reciben la cantidad adecuada y a tiempo.

Realizar un seguimiento propio puede llevar a varios errores y comprometer los salarios de los empleados.

Es por eso que el uso de un software de seguimiento de nómina como Clockify facilita la nómina para ti y tu equipo.

Con Clockify puedes configurar tarifas de salarios para cada tarea, proyecto o empleado.

Una vez que configures los salarios, tus empleados pueden rastrear sus horas laborales y Clockify calculará sus salarios en acordancia.

En Clockify fácilmente puedes ver las horas laborales de tus empleados, horas de inicio/fin, horas extras y mucho más.

¡Comienza usando Clockify hoy y revoluciona tu control de tiempo!

Conclusión y descargo de responsabilidad

Esperamos que nuestra guía completa por estado te haya ayudado a familiarizarte con toda la información importante sobre las leyes de cheque de pago final en los Estados Unidos. Puedes obtener más datos sobre las leyes de cheque de pago final para cada estado siguiendo los enlaces oficiales que hemos proporcionado.

Por favor ten en cuenta de que la guía de leyes de cheque de pago final fue comprobada y actualizada en T1 de 2025. Por lo tanto, puede que no incluya cambios introducidos después de su publicación.

Te aconsejamos consultar las instituciones apropiadas y/o representantes certificados antes de tomar algunas acciones legales.

Clockify no es responsable de ningunas pérdidas o riesgos incurridos si esta guía se usa sin la orientación legal.

Cómo revisamos esta publicación: Nuestros escritores y editores monitorean las publicaciones y las actualizan cuando hay nueva información disponible, para mantenerlas frescas y relevantes. Actualizado: 27 de enero de 2025

Actualizado: 27 de enero de 2025