In general terms, full-time equivalent (or FTE) is a unit of measure that plays an important role in calculations used in businesses, project management, or federal programs for eligibility purposes.

For instance, in terms of business, calculating FTEs can be useful in determining how many hours part-time employees should work to equal the number of hours full-time employees work. Such calculations facilitate accounting processes such as estimating wages, payroll, costs, etc.

In this article, we’ll talk about:

- FTE basics,

- How to calculate FTEs (+ examples),

- Different FTE calculators,

- FAQs about FTEs, and more.

Let’s start!

- A full-time equivalent (FTE) is the sum of full-time hours employees work in a company.

- To calculate FTEs, you must divide employees’ scheduled hours with their official full-time work week hours.

- To calculate the FTE within your entire organization, you must follow certain steps, such as listing your employees, determining your standard work week hours, calculating the total number of hours worked by all employees, etc.

- FTE calculations may be of great assistance for project managers, estimating salary, determining eligibility for different federal programs and benefits, such as Applicable Large Employers (ALE), and more.

- A 100% FTE equals 1.0 FTE.

- Tracking work hours is a crucial step before using the FTE calculation.

What is the full-time equivalent (FTE)?

A full-time equivalent (FTE) — also known as a whole-time equivalent or WTE — represents the sum of all full-time hours employees work in a certain company.

Along with counting the hours worked, FTEs show how many full-time employees a particular company employs within a fiscal year or needs to employ to carry out a project.

The calculation is straightforward — divide the employee’s scheduled hours by the number of hours that represent an official weekly full-time schedule in a company (e.g., 40 hours per week).

Employee’s scheduled hours / Official weekly full-time workweek = FTE

40 / 40 = 1.0 FTE

Therefore, an FTE for a standard full-time worker working 40 hours per week is 1.0 FTE.

Bear in mind that the FTE is based on the total number of hours worked — it may not indicate the actual number of people working in a company.

For example, here are 2 scenarios where full-time and part-time employees may equal 1 full-time equivalent employee in your company based on the above formula (taking the standard 40-hour work week into the calculation):

Scenario #1:

2 part-time employees working exactly half of the company’s official full-time schedule = 1 full-time equivalent employee:

2 x 20 hours worked / 40-hour workweek = 1.0 FTE

Scenario #2:

4 part-time employees working exactly a quarter of the company’s official full-time schedule = 1 full-time equivalent employee:

4 x 10 hours worked / 40-hour workweek = 1.0 FTE

How to calculate FTEs for your company? (+ examples)

Whether you want to calculate an FTE for an individual employee (part-time or full-time) or determine the FTE within your entire organization, take a look at the following calculations for further information.

Calculating FTEs for individual employees

To calculate the full-time equivalent in your company for an individual employee, you’ll need to account for:

- The hours of a full-time weekly schedule, and

- The actual hours your employees are scheduled to work.

Let’s say that a full-time weekly schedule in your company is 40 hours per week, and your employees are scheduled with 40 hours of work a week (which makes them full-time employees). This is a straightforward example since each employee who works 40 hours per week in your company has a 1.0 FTE.

40 / 40 = 1.0 FTE

But what about the employees whose contracts mandate they work less, such as part-time workers?

Say that a worker named Karen works 20 hours per week in the same company. To calculate her FTE, simply divide the actual hours Karen is scheduled to work by the full-time weekly schedule of your company:

20 / 40 = 0.5 FTE

Arthur, however, works 25 hours in a company where 38 hours is considered a full-time schedule. Here’s how you can calculate his FTE:

25 / 38 = 0.6 FTE

💡 Clockify Pro Tip

Learn about the difference between full-time and part-time employees here:

Calculating FTE for an entire company

Now, if you would like to calculate FTEs company-wise, make sure you adhere to the following steps below.

Step #1: List your employees

First and foremost, make a list of all your employees within an organization. Make sure you classify them based on their weekly work hours.

Therefore, if your standard work week consists of 40 work hours (you will set your standard work week in the next step), then a full-time employee who works 40 hours per week (or more) is considered a full-time employee. An employee who works less than the standard hours (in your case 40 hours) is a part-time employee.

Make sure you don’t count in 1099 contractors since they are not considered employees.

💡 Clockify Pro Tip

Learn how to easily pay independent contractors here:

Step #2: Define your standard working hours per week

A typical or full-time work week usually consists of 40 working hours without paid or sick leave. So, if your standard work week consists of 40 work hours, your employees probably work 8 hours per day. Still, this doesn’t have to be the case in all organizations as certain employees may work 7 hours one day and 9 hours the next day.

Nevertheless, make sure you establish your ‘standard’ full-time work week hours.

💡 Clockify Pro Tip

If you wonder how overtime work is taxed, head to the text below for more info on the matter:

Step #3: Calculate the total annual work hours

The next step in the calculation is to determine how many work hours both full and part-time employees work.

Considering a year has 52 weeks, a full-time worker working the typical 40-hour work week will have 2,080 work hours a year (40 x 52 = 2,080).

On the other hand, a part-time employee working, for instance, 25 hours per week will clock in the total of 1,300 hours a year (25 x 52 = 1,300).

Bear in mind that in some cases, a year can have 53 weeks so the number of hours may be slightly different.

💡 Clockify Pro Tip

Curious to determine how many work hours your employees clock in during a fiscal year? Head to the following link for more info:

Step #4: Add the total annual work hours (for both part-time and full-time workers)

In this step, you have to add the total work hours worked by each full-time employee and total working hours worked by each part-time employee.

Let’s assume that you have 10 full-time employees working 40 hours per week and 3 part-time employees working 25 hours a week.

Here’s how you would add your full-time employees’ annual work hours:

Full-time employees: 10 x 2,080 = 20,800

Next, for your part-time employees working 25 hours per week each, here’s how you’ll obtain the exact number:

Part-time employees: 3 x 1,300 = 3,900

Step #5: Determine the part-time FTE

To be able to calculate the total FTE in your company, you need to determine the FTE of your part-time workers first. To do that, you need to divide the total number of hours worked by your part-time employees by the total number of annual hours worked by 1 full-time employee.

In our example we have 3 part-time employees working 25 hours per week, which equals to 1,300 work hours per year. The standard annual work hours of 1 full-time employee is 2,080. All things considered, here is how the calculation would go:

3,900 / 2,080 = 1,875 (1.875 FTE)

Therefore, 1.875 is the FTE of 1 part-time worker.

Step #6: Determine the total FTE

Finally, to be able to calculate the total FTE within your organization, add the number of FTEs worked by your full-time employees to the part-time FTE you calculated in the previous step. Since 1 full-time employee working 40 hours a week (40 hours being their standard work week) equals 1.0 FTE, in our case where we have 10 full-time workers, that will be:

10 full-time workers x 1.0 FTE = 10.0 FTE

Since, we already have the part-time FTE, here is the total FTE calculation within an organization employing 3 part-time employees and 10 full-time employees:

Total FTE = 10.0 FTE (full-time FTE) + 1.875 (part-time FTE)

Total FTE = 11.87

To easily calculate the FTE for all your employees — part-time and full-time — use our free calculators provided below:

⏬ Download the FTE calculator for all employees in Excel

⏬ Download FTE calculator for all employees in Google Sheets

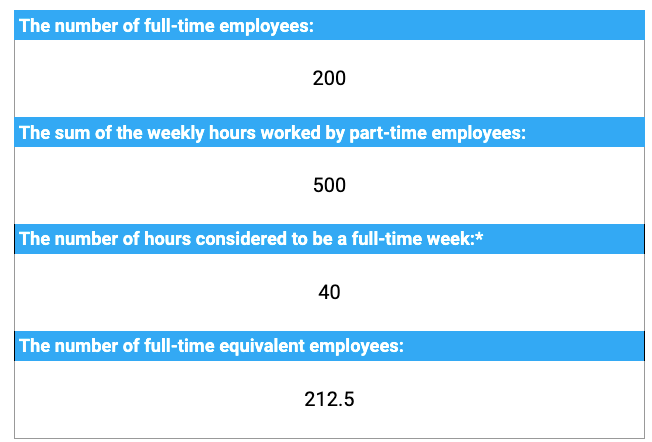

Simply enter the number of full-time employees, then add up all the hours worked by part-time employees (for the previous week), and don’t forget to enter the hours of your standard workweek (which is generally 40).

This way, you will be able to determine the number of full-time equivalent workers in your company even when you have part-time workers on-site.

Bear in mind that these are just simple FTE example calculations — project managers approach FTE from a different angle, while federal programs use different FTE calculation methods.

Bonus FTE calculators

In this section, we wanted to help you calculate FTEs for different purposes (and for which FTEs are usually calculated). For that reason, we’ve made the following calculators:

- FTEs calculator for project managers,

- FTEs calculator for salary estimation,

- FTEs calculator for Applicable Large Employers (ALE),

- FTEs calculator for the small businesses tax credit program, and

- FTEs calculator for the Paycheck Protection Program (PPP).

FTEs calculator for project managers

To easily calculate how many full-time equivalent employees you need to finish a project, you can use the following calculator free of charge:

⏬ Download the FTE calculator for project managers in Excel

⏬ Download FTE calculator for project managers in Google Sheets

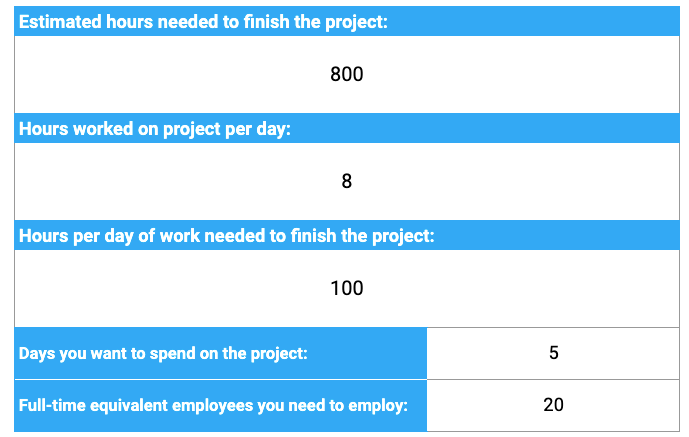

As you can see from the example above, you can easily calculate how many full-time equivalent employees you need to hire to successfully complete a project.

All you need to do is enter how many hours of work are required to complete the whole project (estimated time) and then how many hours a day your employees will work on that specific project.

💡 Clockify Pro Tip

To learn more about how to precisely estimate time to complete a project, take a look at the following text below:

FTEs calculator for salary estimation

The FTE salary is when you convert an employee’s salary into a full-time equivalent wage for a period of one year. To easily convert an employee salary into a full-time equivalent salary within a full working year, you can use the following calculators free of charge:

⏬ Download the FTE salary calculator in Excel

⏬ Download the FTE salary calculator in Google Sheets

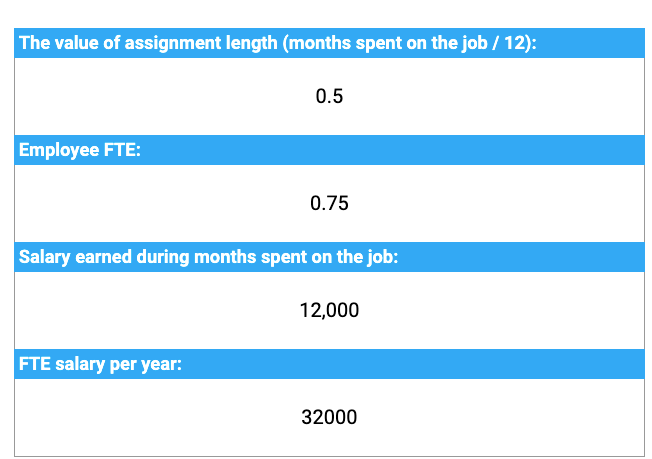

Let’s say that an employee works 6 months a year (from the designated 12 months, which is 6 / 12 = 0.5 from our example above) with an FTE of 0.75, and the salary that employee earned during those months equals $12,000.

To be able to convert your employee’s salary into an FTE salary, we must divide 12,000 by (0.5 x 0.75) which later equals 0.375. Therefore, the FTE salary’s calculation is: 12,000 / 0.375 = 32,000 as shown in the example above.

FTEs calculator for Applicable Large Employers (ALE)

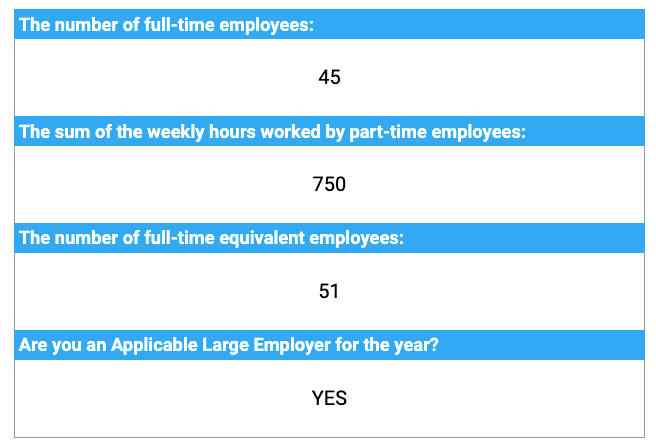

Applicable Large Employers (ALE) must have at least 50 full-time equivalent employees, including part-time employees. To calculate whether you qualify as an Applicable Large Employer quickly, you can use the following calculators free of charge:

⏬ Download the FTE calculator for ALE in Excel

⏬ Download the FTE calculator for ALE in Google Sheets

The calculation is straightforward — enter the number of full-time employees together with the total number of hours worked by part-time employees per week and the number of full-time equivalent employees employed in your company. The calculator will then tell whether you are an Applicable Large Employer or not.

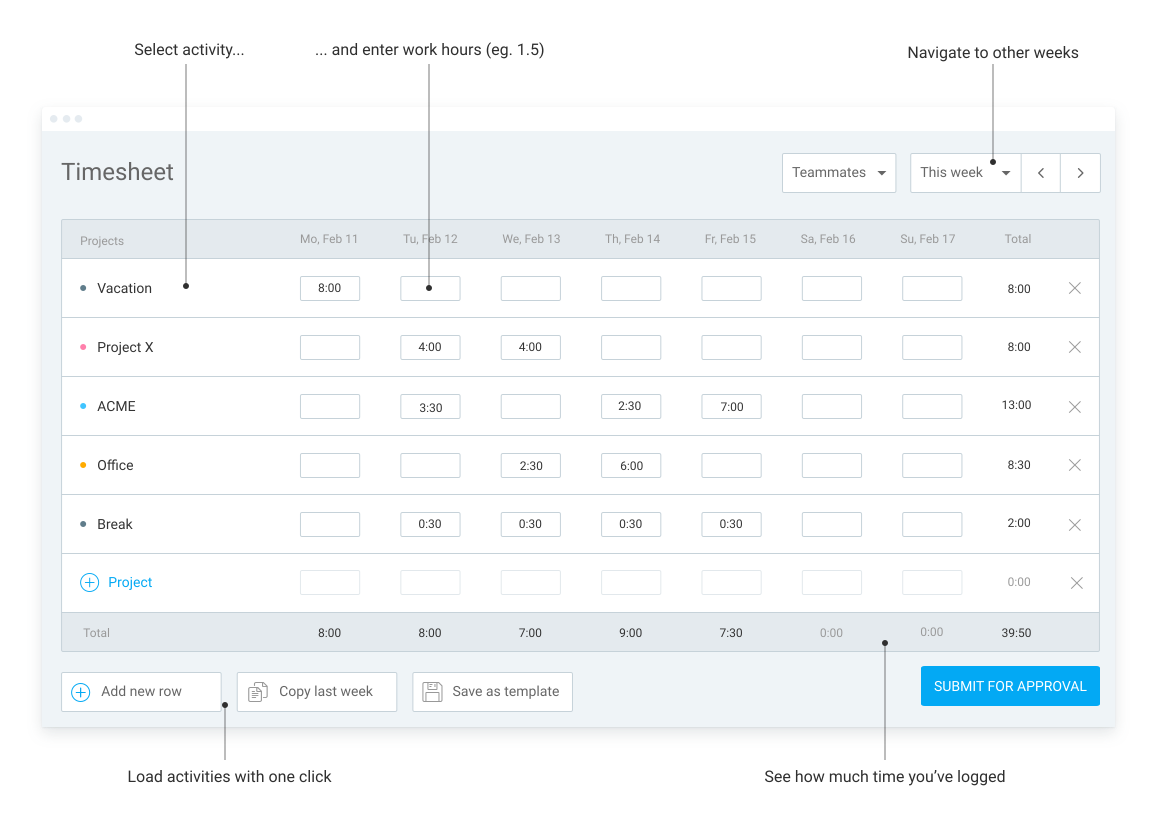

FTEs calculator for the small businesses tax credit program

For small businesses to actually be eligible to qualify for the small business tax credit program, one of the conditions is to have fewer than 25 full-time equivalent (FTE) employees. To easily calculate the hours of service per employee in your small business and see if you qualify for a tax credit, you can use the following calculators free of charge:

⏬ Download the FTE calculator for small businesses tax credit program in Excel

⏬ Download the FTE calculator for small businesses tax credit program in Google Sheets

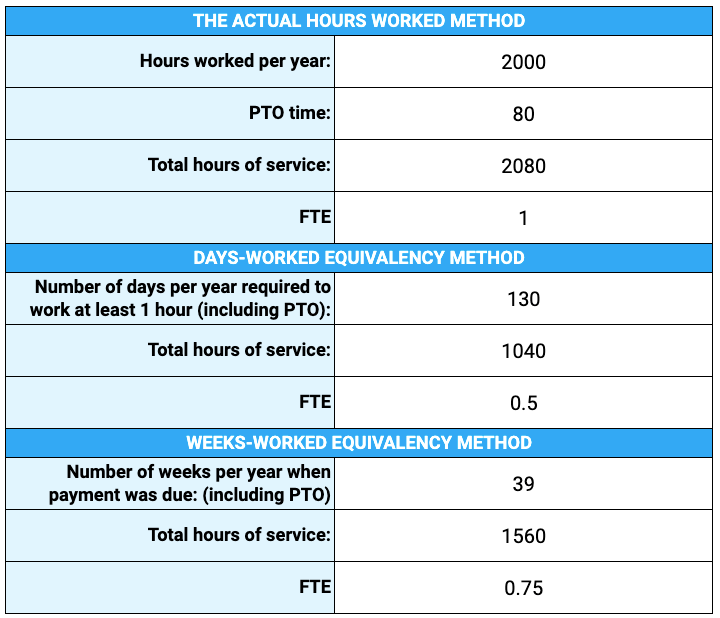

To calculate FTEs and see if you qualify for tax credit, you can choose one of the said methods — either The actual hours worked or Days-worked equivalency methods (we’ve provided calculators for each). If you, for instance, choose the first method, enter all the actual hours worked (including PTO) and divide that number by 2,080 to get the final FTE.

FTEs calculator for the Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP) provides funds for small business owners to help them cover up to 24 weeks of payroll or other costs such as utilities, rent, etc.

Furthermore, such businesses may have their loans fully forgiven if they maintain the same number of FTEs during the period for which they receive financial assistance.

To easily calculate FTE to check eligibility for full forgiveness in the Paycheck Protection Program, you can use the following calculators free of charge:

⏬ Download FTE calculator for PPP in Excel

⏬ Download FTE calculator for PPP in Google Sheets

To be able to use this calculator smoothie, simply follow the instructions for both SBA calculation methods. For the SBA calculation method #1, to get the FTE, enter the number of full-time employees and the total sum of work hours by part-time employees.

As for the calculation method #2, enter the number of full-time employees again and just the number of part-time employees to calculate the FTE.

FAQ about FTE

In the following section, you will find out about the great number of purposes FTEs can be used for.

What is the purpose of FTE?

Businesses use the FTE calculations for a variety of purposes, and the most common ones are:

- FTEs for federal programs and benefits — FTE calculations help determine eligibility for different federal programs and benefits, such as Paycheck Protection Program (PPP) or Small Business Health Care Tax Credit Program that helps small businesses provide health insurance to their employees. Eligible employees may obtain affordable and minimum health insurance coverage under this program (which is also part of the Affordable Care Act). Also, calculating FTEs help determine if an employer qualifies for an Applicable Large Employer (ALE).

- FTEs in project management — project managers also use FTEs to estimate the length of a project and resources needed for a project. By using the FTE formula, project managers can determine exactly how many full-time employees need to be hired for a certain project and make sure they stay within the agreed budget.

- FTEs in hiring — using the FTE model, businesses can have a better understanding of their hiring needs. If, for instance, hiring specialists have a budget allocation of 10 FTEs during a fiscal year, they can either hire 10 full-time employees (1 full-time employee equals 1.0 FTE) or 20 part-time employees (1 part-time employee is 0.5 FTE).

- FTEs used in the workplace — calculating FTEs in the workplace helps employers determine the effectiveness of employees within a company (especially part-time employees). FTEs help them determine work hours, calculate expenses and profits per employee, estimate labor cost, determine wages, and more.

💡 Clockify Pro Tip

Speaking of labor cost, there’s more to it than meets the eye. Read the following article that covers all the relevant factors one should take into consideration to establish the right labor rates:

What is a typical full-time schedule?

According to the IRS, a US employee who works at least 30 hours per week or 130 hours per month is considered to be a full-time employee.

In practice, these numbers fall somewhere between 30 and 40 hours per week, with 40 hours per week (8 hours per day, 5 days per week) being the most common norm for a full-time schedule.

According to the US Bureau of Labor Statistics’s newest data from March 2024, private-sector US employees (excluding the farm sector) work 34.4 hours per week on average.

💡 Clockify Pro Tip

Here are some tips on how to make the most of your 8-hour workday:

What is 100% FTE?

A 100% FTE is the same as a 1.0 FTE, therefore, 100% = 1.0 FTE.

This number may point to one person working a full-time schedule or several people fulfilling the duties of one full-time position.

In one company, a full-time schedule may be 40 hours per week. In another, it may be 37.5 hours per week. Since both are considered to be full-time schedules in their respective companies, both count as 100% or 1.0 FTE.

What is 75% FTE? When is 75% FTE or higher considered full-time?

An employee with a regular budgeted assignment of 75% of a full-time job position has a 0.75 FTE.

This usually amounts to:

- The total of 28 hours per week for non-exempt positions who work 37.5 hours per week under normal conditions, or

- The total of 30 hours for exempt positions who work 40 hours per week under normal conditions.

However, temporary job positions are excluded from this rule.

Whether an FTE of 0.75 is considered full-time will depend on the company policy made by the employer. If 0.75 FTE is considered full-time in a company, such employees may qualify to apply for the Public Service Loan Forgiveness (PSLF) program — eligible employees don’t have to pay out their federal student loans.

However, bear in mind that this only applies to positions that work 30 hours per week when assigned a 0.75 FTE position, i.e., the IRS minimum for a full-time definition.

In contrast, non-exempt positions who typically work only 28 hours per week on a 0.75 FTE schedule do not qualify, even if the employer policy defines them as full-time.

What does FTE mean in salary?

An FTE salary is an employee salary converted into a full-time equivalent salary within a full year, regardless of whether the said employee holds a full-time or part-time position. The actual workload is not taken into consideration for this calculation.

Example: Let’s say that an employee has held a job for 6 months (0.5 times of a full year) at an FTE of 70% (0.7) and earned $12,000 during this time.

The FTE salary calculation for this employee goes as follows:

$12,000 / ( 0.5 x 0.7 ) = $34,285 per year

Why is FTE important for PTO?

FTEs may also influence how many hours employees can accrue for PTO. The actual PTO an employee can accrue may depend on several factors, including years of employment that dictate an employee’s hourly PTO accrual rate. These rates will depend on the PTO accrual rate policies of a company, organization, or institution.

💡 Clockify Pro Tip

Use pre-made PTO templates created to suit your business and implement an employee time off request system here:

Checking an employee’s FTE with Clockify

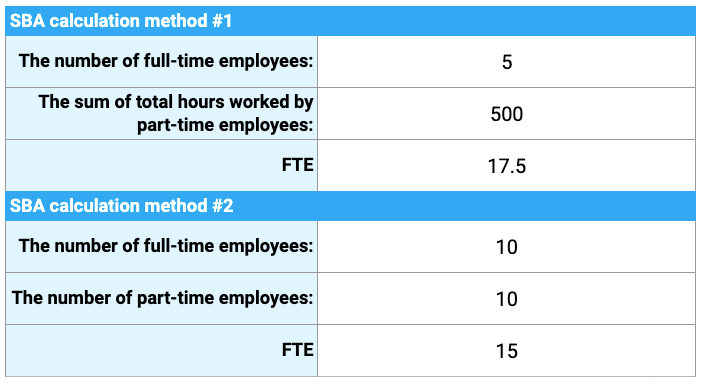

To easily calculate your employees’ FTE, try out Clockify — a time tracking tool that can also be of great help for identifying your employees’ FTEs.

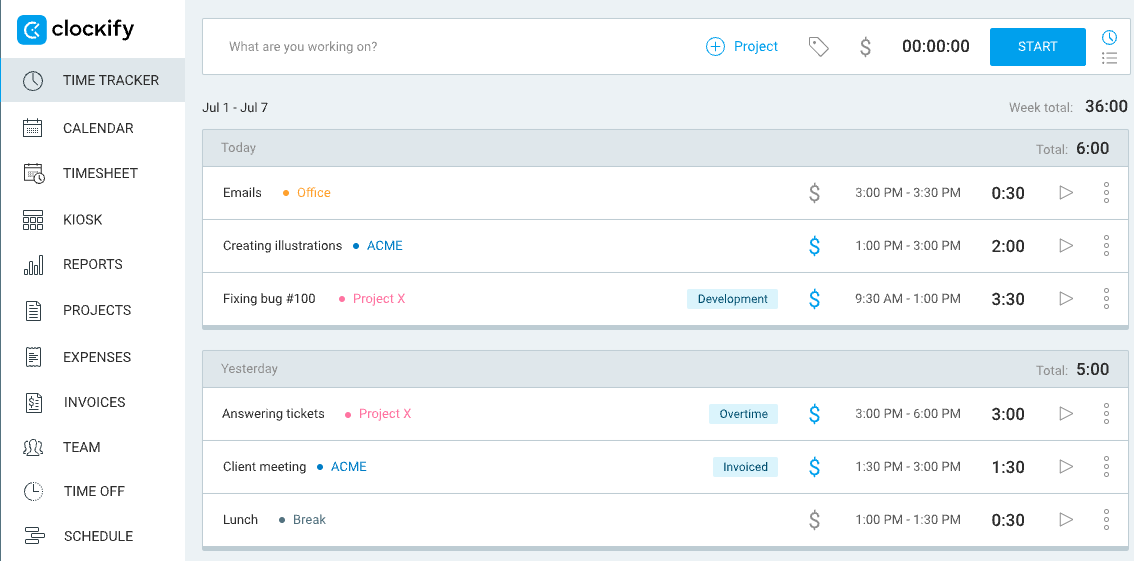

To be able to determine your employee or employees’ FTE, you must first introduce a time tracking tool into your organization’s workflow. Luckily, Clockify offers a reliable solution, and you may track your employees’ work hours in 3 ways:

1. Using a Time tracker — Clockify starts tracking work hours automatically as soon as you click on the Start button (but don’t forget to choose a project and write what you are working on),

2. Using Timesheets — if your employees prefer logging time manually, than the Timesheet option is the best choice (simply select a project and enter work hours using digits), and

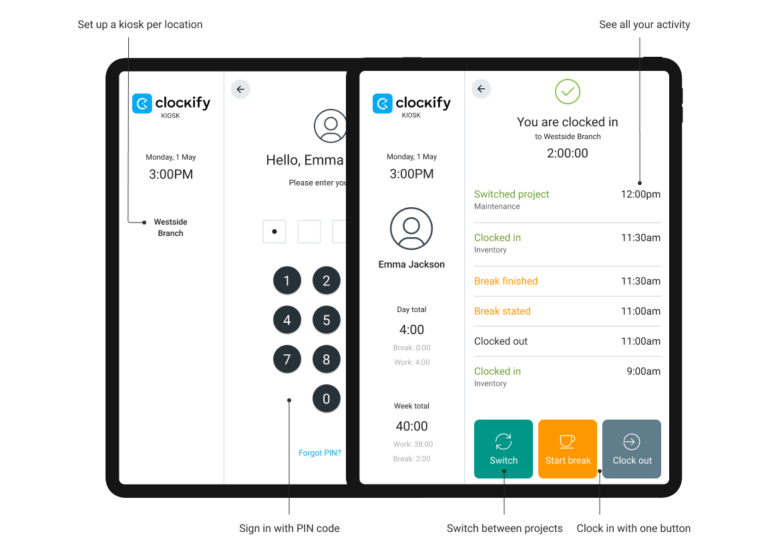

3. Using a Kiosk — for more advanced time management, choose the time clock Kiosk in Clockify where employees can clock in with their PIN code (just make sure you enable it in the Settings section).

After you have all your employees’ work hours in one place, make sure you follow the steps in the How to calculate FTE for your company? (+ examples) section in this text for further FTE estimation. Since Clockify basically did most of the job by tracking your employees’ work hours — the other part of the FTE calculation will be quite straightforward.

As easy as that, Clockify can be your ally in estimating your employee FTE for your specific needs.

Apart from time tracking, Clockify offers other solutions such as:

- Managing Time off,

- Tracking billable hours,

- Creating or joining multiple workspaces,

- Using assignment reports, and more.