How to calculate work hours: A step-by-step guide to calculating payroll and hours worked

Are you tired of spending hours calculating payroll and tracking hours worked? Learn how to easily calculate work hours, or automate the process with a payroll hours calculator and get accurate payroll calculations within seconds! Streamline your payroll process and free up your time for more important tasks.

Two crucial steps for calculating work hours

Calculating work hours is an integral part of your business operations, and that is why you need to do it correctly. To make the process easier, you should follow two essential steps we’ll now cover.

- Tracking hours worked

- Calculating payroll

Step #1: Tracking hours worked

The first step in the payroll calculation involves tracking the time spent on each activity.

Employees can track their time in several ways. They could either use:

- Electronic timesheets,

- Punching time clocks,

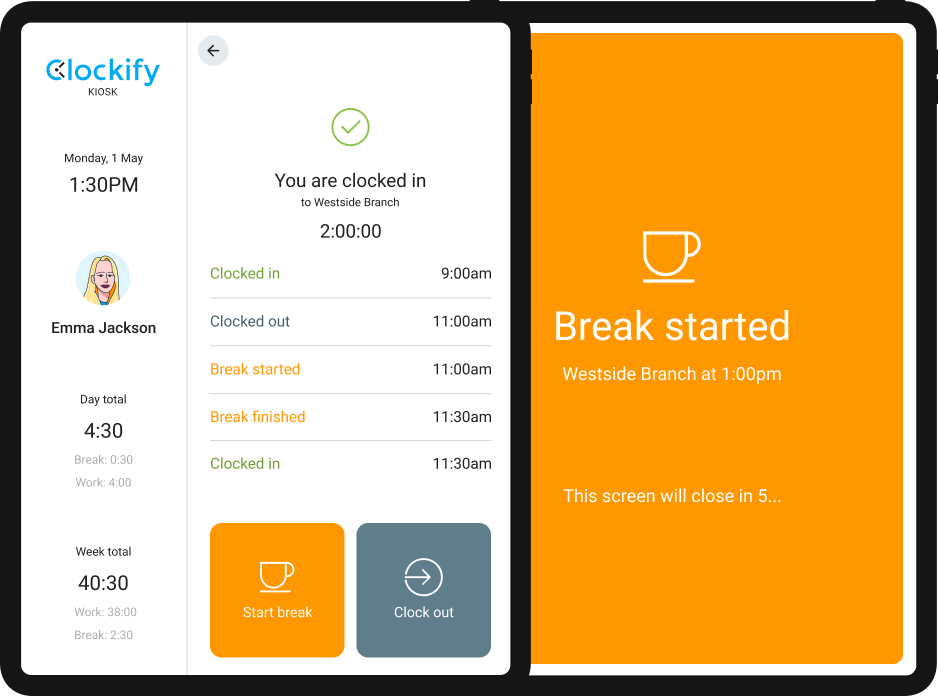

- A time clock kiosk, or

- A timer app.

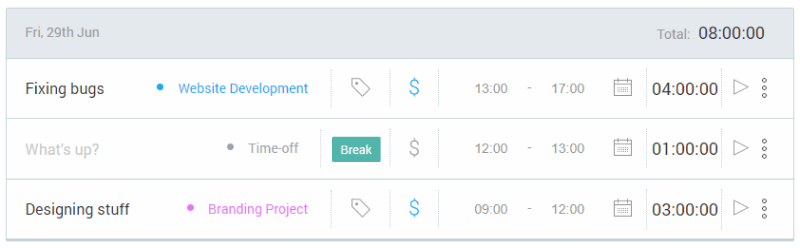

Modern timesheets, for instance, can show you an overview of employees’ activities during the day, sorted by project.

Step #2: Calculating payroll

Once you’ve obtained the data regarding your employees’ hours worked, you can use it to calculate payroll. You could do that manually or use payroll tracker software.

How to calculate payroll hours and minutes manually

If you prefer calculating payroll on your own, you can do that by following these steps:

- Convert all start and end times to a 24-hour format.

Then, subtract the start time from the end time for each time card to get the number of hours worked.

Let's say that you started working at 8 a.m. and finished your job at 5 p.m, which is 17:00 converted to the 24-hour format. Your calculation for the number of hours you worked goes like this:

17:00 - 08:00 = 9

So, you worked 9 hours.

- Convert from clock time format to decimal number format by dividing the minutes worked by 60.

For example, if you have worked 38 hours and 27 minutes, you can convert the minutes to decimal format by dividing 27 by 60:

27 / 60 = 0.45,

Then, add the fraction you got to full hours to get the final number. Based on the previous example, your calculation will go like this:

38 + 0.45 = 38.45,

In Excel, you can convert from clock format to decimal format by multiplying a cell with 24 (e.g. =A1*24) and formatting the resulting cell as a number,

- Next, reduce the total duration by unpaid breaks (if any).

- Then, add up all of the hours in the week to get the total hours for the weekly payroll.

So, if you worked 8 hours Mon-Thu, and 6.45 hours on Friday, you'll calculate the total weekly hours like this:

8 + 8 + 8 + 8 + 6.45 = 38.45

- Finally, multiply the hourly rate by the total hours for each employee to determine gross pay.

Let's say that your hourly rate equals the US average of $11.01. Your weekly gross earnings will be:

38.45 x $11.01 = $423.33

How to calculate payroll hours automatically using software

If calculating payroll hours manually sounds like a time-consuming process, you can opt for a time tracking software. Introducing time tracking to your team ultimately helps you acquire the most accurate payroll data, and ensures your employees receive adequate pay for their hours worked.

In case you decide to go for a time tracking app such as Clockify by CAKE.com, here's how you can obtain the most accurate numbers:

- Define the default hourly rate for each employee,

- Define special rates if you have projects that use a different rate,

- In the time report, select the time range for which you need calculated hours (week, month, or a custom period),

- Filter out time entries for an unpaid break or lunchtime,

- The software will automatically get the total hours worked for each employee and calculate how much you need to pay them, and

- Export the report as PDF or Excel in case you need to perform more advanced calculations.

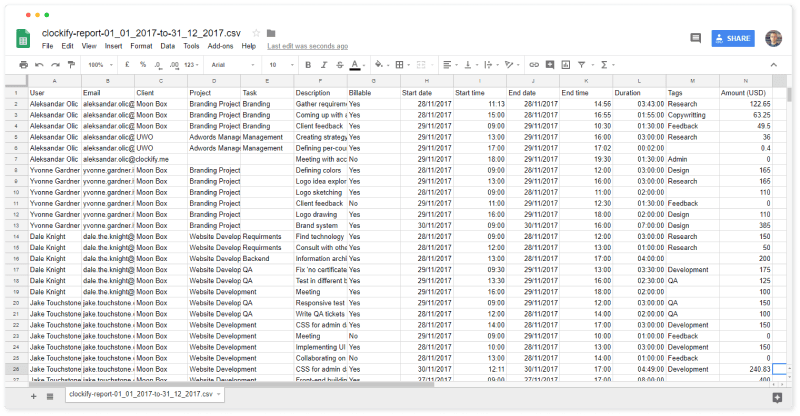

If you opt for time tracking using Clockify, you can get reports on your all time entries from all employees by going to Detailed report:

- In the report's filter, select the team member for whom you need to calculate the payroll and press Filter,

- Select the date range in the upper right corner (you can change the first day of the week in the User Settings),

- Click on the Save icon to create a new saved report,

- In the report's name field, write the employee's name and the date when the payment was made (eg. Jamie Davis 06/24/2022),

- Repeat the process each week or month, and

- Select the date range from the day after the last payment was made to the current day (eg. 06/24/2022 to 07/01/2022), to check how many hours have been accumulated after the last payment.

4 Tips to successfully calculate payroll hours

Calculating payroll can take a lot of time, but there are ways to simplify this process. Let's go over 4 tips to keep in mind if you want to speed up your payroll calculation.

Tip #1: Use time rounding

To make payroll calculation simpler, employers are legally permitted to round employee hours worked to the nearest quarter or tenth of an hour for payroll purposes.

If you are working with employees and not independent contractors, you won't always be able to round down your employees' time to the nearest quarter hour, according to the Fair Labor Standards Act. That's because, in certain instances, rounding down employees' time could go against overtime regulations or minimum wage rates. As both of these types of regulations are protected by the law, breaking them could have legal consequences for employers.

The Code of Federal Regulations states: “Employee time from 1 to 7 minutes may be rounded down, and thus not counted as hours worked, but employee time from 8 to 14 minutes must be rounded up and counted as a quarter hour of work time.”

What about rounding intervals? You can round time to the nearest five minutes, or one-tenth or a quarter of an hour (5, 6, 15).

Some businesses opt for rounding to a tenth of an hour instead of a quarter. As a result, the final numbers are cleaner when converted to the decimal format.

Is rounding necessary these days?

Not really. Time rounding was a time-saving practice back when clerks processed payroll by hand. But thanks to modern technology, time rounding doesn't lessen the administrative cost of calculating payroll as it used to.

Instead, the software can track time to the minute and calculate payroll down to a cent.

If you rely on time rounding for other reasons, the software can still round each time entry to the nearest interval automatically. It will then use the rounded values when calculating payroll.

Tip #2: Include the overtime work

All of the hours worked above the regular 40-hour workweek count as overtime work.

According to FLSA, it is typically paid at a 50% higher rate than regular work for non-exempt workers. For example, if an employee's hourly rate for regular hours is $10, their overtime rate will be:

$10 x 1.5 =$15

A higher hourly rate for working during weekends or holidays is generally a matter of agreement between the employer and the employee. As long as the total hours worked don't exceed 40 hours per week, the pay rate isn't subject to federal or state laws. That is, unless you have a contract that stipulates otherwise, or you want to give employees financial incentives to work during holidays or weekends.

When calculating payroll for these more advanced scenarios, it's best to export raw time data in Excel. Excel will then calculate payroll based on that data.

In Clockify by CAKE.com, employees can attach an "overtime" tag to an entry. That way, employers can use the Reports feature to access details on the overtime work of every employee.

Calculating overtime can be a pretty complicated process. To make it easier, you can use various overtime calculators.

Tip #3: Don't forget to factor in breaks

Breaks usually last from 5 to 20 minutes for rest and 30 to 60 minutes for meals.

Rest breaks are included in the total time an employee works. On the other hand, meal breaks can but don't have to be included. To account for breaks in the time tracking software like Clockify, you can use a Break kiosk feature.

Alternatively, you could create a separate entry for breaks and categorize them either by project or using a tag:

- Create a separate project by the name Time-off where you'll put all time entries for breaks, sick leave, holidays, etc. (e.g. spent 5h on Project A, 3h on ProjectB, and 1h on Time-off), or

- Create a break, sick leave, or holiday tag. Employees can then create a 1h time entry, leave it without a project, mark it as non-billable, and attach the appropriate tag. Later in reports, you can filter out entries with those tags so they're not included when you calculate payroll or billable hours.

By keeping breaks separate from project time logs, employees can account for all of their required eight-hour days. In addition, managers can see exactly how long their projects actually lasted.

Tip #4: Use timesheets

Filling out timesheets at the end of each workday is one of the best practices because it leaves much less room for error.

Employees can change start and end times for each task, apply tags, leave notes, etc. To do that, they should select a task from the timesheet and enter the time they spent working on that specific task in total. The process shouldn't take longer than a minute.

In case someone forgot to fill their timesheets, you can easily see that in the weekly report. The weekly report shows you how much time each employee tracked in total for each day in the week.

However, keep in mind that although being able to edit timesheets is a handy option, you should lock timesheets after a certain time so no more changes can be made. Depending on how often you process payroll, you can lock timesheets for the previous period every week or month.

That way, people have the chance to get their timesheets in order. Once timesheets are locked, you can export data. Then, you can start calculating work hours and payroll safely, knowing nothing will change.

Conclusion: Calculating payroll does not have to wear you out

Calculating payroll is an important task for any business! It involves tracking your employees’ hours and determining their pay.

By following our essential steps and tips, you can ensure that payroll is calculated accurately and efficiently and that your employees are paid correctly and on time. In case you want to make the process easier, you opt for payroll calculating software and let the program do everything for you!

Sources:

- Fact Sheet #53 – The Health Care Industry and Hours Worked. (n.d.). US Department of Labor. https://www.dol.gov/agencies/whd/fact-sheets/53-healthcare-hours-worked

- Fact Sheet #56B: State and Local Scheduling Law Penalties and the Regular Rate under the Fair Labor Standards Act (FLSA). (n.d.). US Department of Labor. https://www.dol.gov/agencies/whd/fact-sheets/56b-scheduling-penalties-regular-rate

- Hours Worked. (n.d.). Code of Federal Regulations. https://www.ecfr.gov/current/title-29/subtitle-B/chapter-V/subchapter-B/part-785#785.48

- Overtime Pay. (n.d.). US Department of Labor. https://www.dol.gov/general/topic/wages/overtimepay

- Real average hourly earnings for all employees in the United States from January 2011 to December 2022. (n.d.). Statista. https://www.statista.com/statistics/216259/monthly-real-average-hourly-earnings-for-all-employees-in-the-us/