Are you working with an independent contractor or a freelancer and aren’t sure how to pay them? Paying independent contractors can be tricky, as you have to:

- Classify them correctly and determine their employment status to avoid misclassification consequences,

- Select a suitable payment method and agree on the payment terms, and

- Gather the right documentation for the IRS.

Independent contractors are commonly referred to as 1099 workers due to an IRS form that has to be filed for them. They don’t fall under the same legal umbrella as regular employees.

Thankfully, we’re making the process of paying independent contractors much easier with our 5 simple steps!

Table of Contents

How should you pay a 1099 employee?

According to the latest McKinsey survey, 36% of the US workforce consists of independent workers. This is a 9% increase from 2016 data.

So, chances are, you’ll need the services of independent workers at some point.

If you follow these steps, paying them doesn’t have to be complicated at all.

Step #1: Properly classify the worker

Always make sure the people you work with are legally classified as either regular employees or 1099 contractors (independent).

Regular employees are individuals under a contract of employment (expressed or implied, oral or written) that specifies employees’ rights and duties. They are employed for a salary or wages, and classified as W-2 employees – all their taxes, benefits, and insurance are handled by the employer they work for.

On the other hand, independent contractors are self-employed. They pay their taxes, benefits, and insurance. When you work with them, you need to fill out special independent contractor forms.

Attorney at Michael & Associates, Benjamin Michael, explains that independent contractors’ work is usually tied to a specific project:

“Independent contractors are individuals who are self-employed. Once the project is complete, the working relationship is also complete, unless both parties choose to continue with another project.”

Regular employee vs. independent contractor: IRS rules

There are several rules that help you determine whether a professional is an employee or an independent contractor:

- Behavioral rules — is the company that hired the worker in control of how the worker does their job? If it is, the worker is a regular employee, if not, the worker is likely an independent contractor.

- Financial rules — is the payer (the person who hired an independent contractor) in control of the economic aspects of the hired worker’s job, such as how they’re paid and whether all their expenses are reimbursed? Payers are in control of the economic aspects for regular employees, while that’s not the case for independent contractors.

- Type of relationship — is the payer-worker relationship based on a written contract and includes employee benefits? Is the relationship permanent (like for regular employees), or will it stop after the assigned work is done (which is the case for independent workers)?

→ Note: If you’re still unsure how to correctly classify a worker, you can file Form SS-8 with the IRS, which will officially determine the status of your worker.

💡 Clockify Pro Tip

Check out our blog post for a more detailed explanation of the differences between these types of workers:

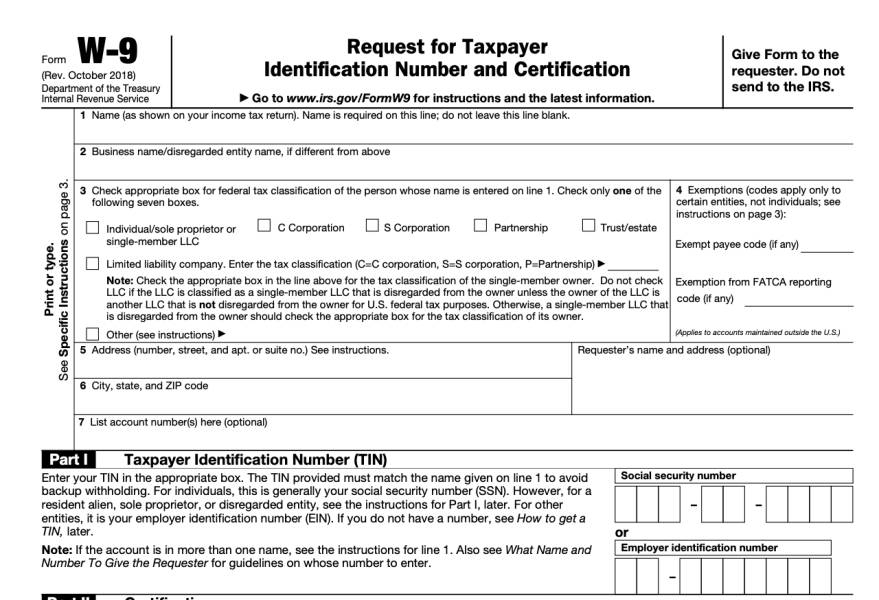

Step #2: Have the independent contractor fill out a W-9 form

In essence, the W-9 form helps you obtain all the independent contractor’s identifying information, including:

- Name,

- Type of business (sole proprietor, corporation, partnership, etc.),

- Taxpayer Identification Number (TIN), and

- Certification (confirming the info provided).

Founder & CEO at Ninebird Properties, Mark Buskuhl, notes that obtaining the W-9 form is a must for anyone working with an independent contractor:

“Independent contractors are responsible for paying their own taxes, so it’s important to obtain a W-9 form from them before making any payments. This form provides their tax identification number and other necessary information for tax purposes.”

You should double-check every piece of information the independent contractor’s provided, especially the TIN.

In case the TIN is missing or incorrect, you need to deduct backup withholding taxes from the contractor’s paycheck (more on this in Step #4).

Step #3: Agree on the payment terms

You and the independent contractor usually determine the payment terms between yourselves — and there are no prescribed rules here.

Common methods of independent contractor payment terms include:

- Upfront payment,

- Payment after job completion, and

- Payment divided into parts or milestones.

To get a clear overview of the costs, you could ask the independent contractor to send you the receipts for project-related expenses.

General Manager at Digital Minds Group, Lija Wilson, advises to always sign a contract and agree on important terms:

“Clearly define the scope of work, deliverables, deadlines, and payment terms in a written contract.”

So, for the best possible client/contractor relationship, you should lay out the ground rules about what happens if:

- The contractor doesn’t deliver work by the agreed deadlines and expected project outcomes, and

- Payments are not delivered on time.

Bear in mind — many contractors ask for at least one installment before the project is done. Also, contractors with less experience may not have the means to pay all project costs without getting paid for the materials upfront (alternatively, contractors may also pay for their own materials, and later request such costs from their client).

Step #4: Make payments

Depending on the agreed payment terms, you’ll either have to pay the contractor a lump sum or divide the payment into installments. You should also discuss the best payment method to use to reimburse the contractor for their work.

Buskuhl suggests keeping records of all payments:

“It’s important to keep accurate records of all payments made to independent contractors. This includes the amount paid, the date of payment, and any additional expenses that were reimbursed. These records will be necessary for tax purposes and in case of any disputes.”

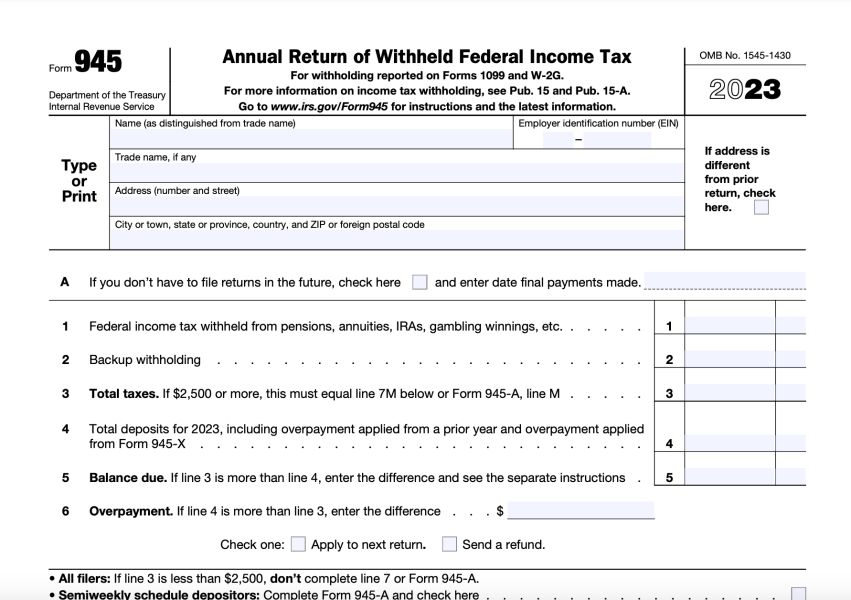

When an independent contractor doesn’t provide their TIN, you have to deduct backup withholding taxes from their earnings at the rate of 24%. If the contractor doesn’t pay their taxes on their own, you’ll be responsible for doing that using the backup taxes you withheld from them.

You report the withheld taxes by filling out Form 945. This form is due on January 31st of each year for withholding during the year prior.

Step #5: Fill out Form 1099-NEC

You report any non-employee compensation to the IRS by completing Form 1099-NEC. This form is mandatory if you’ve paid $600 or more to an independent contractor during the year.

You need to fill out the form and send copies both to the IRS and the independent contractor by January 31 of the following tax year.

Filing Form 1099-NEC is fairly simple:

- Collect the required information about the contractor through Form W-9,

- Fill out Copy A and Copy B of Form 1099-NEC — the former is for the IRS, the latter for the contractor,

- Send Copy A to the IRS — you can do it either by mail or electronically, through the IRS FIRE (Filing Information Returns Electronically) system,

- Send copy B to the independent contractor — you can do so either via mail or email (for the latter, you need to obtain consent from the contractor),

- Send a copy to the state tax department, if needed, and

- Submit Form 1096 — if you submit 1099-NEC by mail, you also need to send Form 1096 to the IRS (used for tracking all the physical copies of the 1099 employee forms submitted via mail).

Misclassification of employees: How important is it to properly classify workers?

Employee misclassification can lead to serious financial and legal consequences. The most frequent misclassification is treating regular employees as independent contractors and failing to pay their benefits.

Wilson helped us name some of the dangers of misclassifying employees as independent contractors:

- Employers may be liable for unpaid employment taxes and face penalties including back pay and fines,

- Workers may file lawsuits for benefits they were denied as independent contractors, and

- Employers may face audits and investigations from tax authorities.

Wilson also notes that employment classification regulations vary. Thus, contacting the IRS in case of uncertainty is the best way to ensure you don’t misclassify a worker.

6 Best payment methods for independent contractors

Not every payment method will suit you or the contractor you’re working with.

The first step in choosing the right payment method is determining what’s important to you, whether that’s speed of payment processing, processing fees, security, or something else.

For instance, 54% of JP Morgan survey respondents claimed that speed is the main factor they consider when they choose a payment method.

On the other hand, 32% of organizations participating in a 2022 Global Payments Survey highlighted cost (rebate) as the top driver of their payment method choice.

Once you determine your priorities, you can go over our list of payment methods to choose one that works best for your priorities.

Method #1: Direct deposit (ACH payment)

Direct deposits are a great way to transfer money domestically. If you and your contractor are in the same country, direct deposit is a safe and convenient way to pay them.

In the US, direct deposits are arranged through the ACH system, which allows you to transfer money directly to your contractor’s bank account.

Executive Director and Founder of the Association of Ghostwriters, Dr. Marcia Layton Turner, has two preferred payment methods for her work:

“I’m an independent contractor who works as an S corporation, so I routinely bill clients through my business and am paid either by check or ACH (bank deposit).”

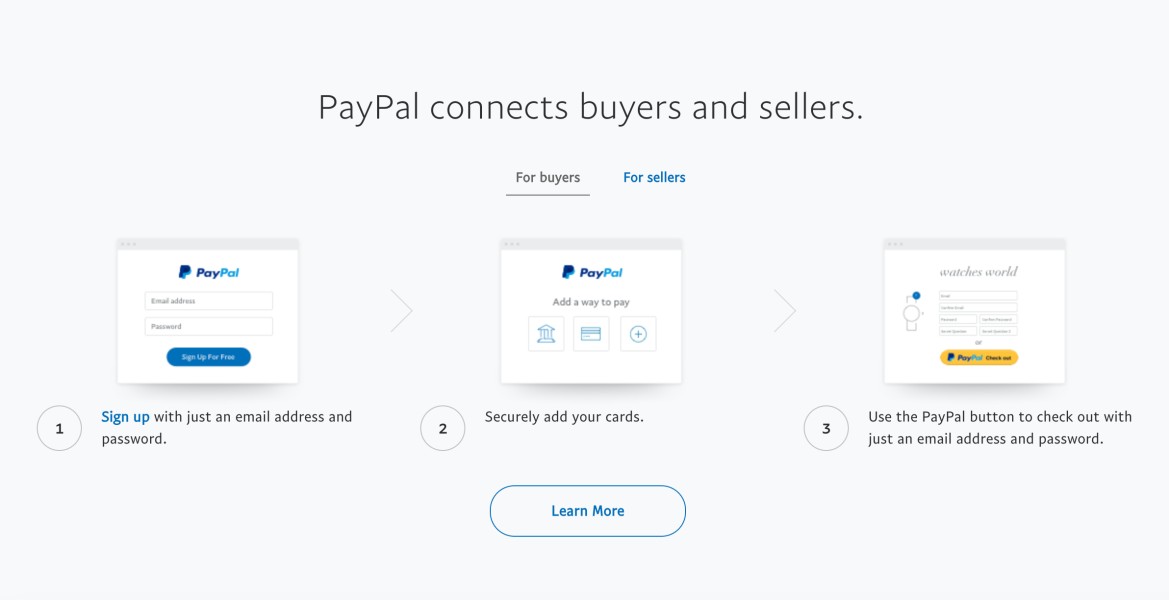

Method #2: Online payment systems

Many online payment systems make it easy to carry out transactions, both domestic and international.

Some of the most common payment processors include:

- PayPal,

- Payoneer,

- Bill.com,

- Transferwise, and

- Venmo.

CFP and founder of GoodFinancialCents.com, Jeff Rose, highlights speed as the main upside to using online payment systems:

“These methods are efficient, secure, and offer digital record-keeping for easy tracking.”

Namely, PayPal is probably the most popular payment system among freelancers, and your contractor most likely has a PayPal account. It’s a faster option than a check, considering the entire transaction is carried out online.

However, one con of PayPal and similar online payment systems is their often steep fees. For example, payment processing fees for PayPal can go up to 3.5% of the transaction.

💡 Clockify Pro Tip

Looking for more ways to make payments easier? Check out the top payment apps:

Method #3: Checks

Checks are a great payment option because they don’t come with fees.

One major downside of checks is that they take time to clear and contractors receive them via post, which means they have to wait longer for their payment.

Still, Rose believes checks are outdated:

“Some contractors may still prefer traditional checks, but electronic options tend to be faster and more convenient for both parties involved.”

You may eliminate some of the disadvantages of traditional checks by opting for eChecks. These work exactly similarly to regular checks, except they’re sent via email, and payments are processed via the ACH system, which speeds up the payment process.

Method #4: Wire transfer

Another type of bank transfer is wire transfer. According to the Consumer Financial Protection Bureau, wire transfers “move money electronically from one bank account to another.”

It’s a great option for time-sensitive payments and international transfers.

Co-founder and CMO of NCHC, Logan Nguyen, believes wire transfers are best for fast transfers:

“This payment method is preferred when payment speed is necessary. A wire transfer allows employers to make payments quickly. International transfers may take a few days, but domestic transfers often take 24 hours.”

Yet, the downside is that fees can be costly. So, if you’re not in a hurry, you may want to consider other options.

Method #5: Credit card

Credit card payments are appealing because they are highly secure and often easily reversible in case of fraud.

Since you’re paying with a line of credit, you don’t have to worry about fraud affecting your actual money. Moreover, many credit card companies offer zero fraud liability. However, to be able to pay your contractor via credit card, contractors need to have a merchant account with the bank or alternative merchant service.

Method #6: Accounting software

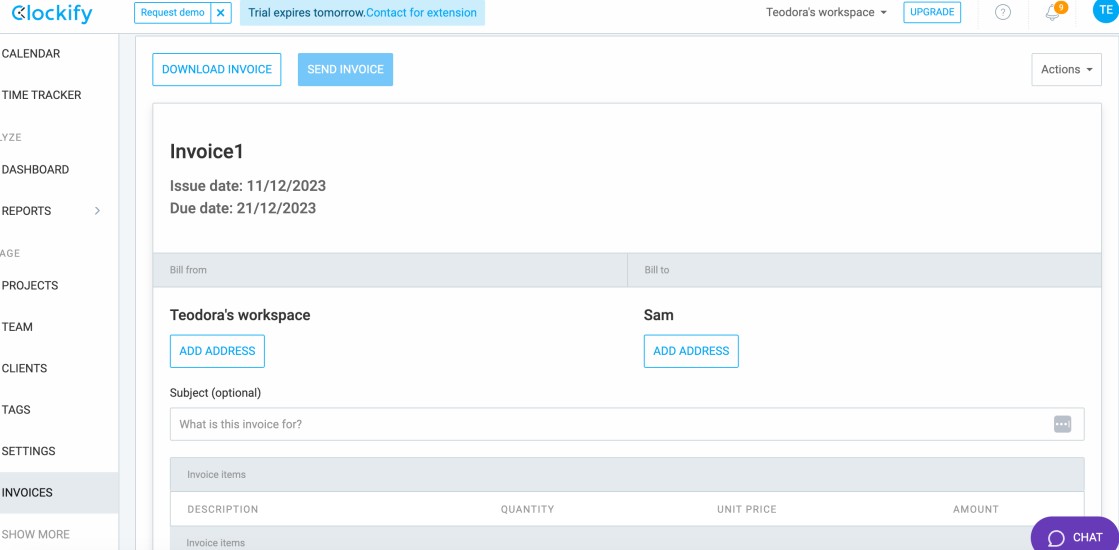

While accounting software is not a payment method per se, it can help you speed up the payment process immensely. Accounting tools can be used to calculate billable hours and generate invoices which make payments much easier.

Once you agree on the hourly rate for the project, you can instruct the contractor to track the time spent on your project and invoice you based on their time worked.

You could also ask them to input the specific tasks they performed, to better understand the work they’re performing for you.

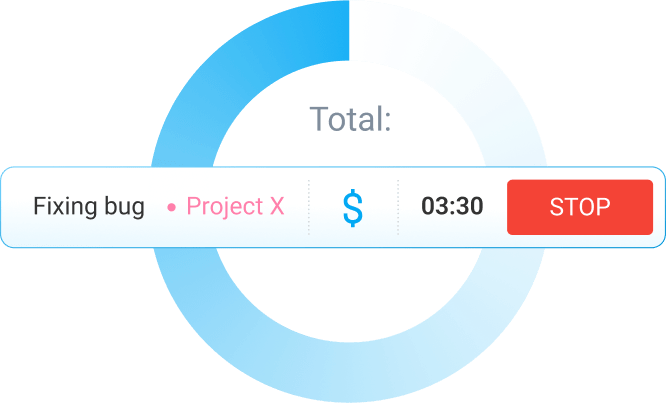

To make the process of tracking their tasks and invoicing easier, you can recommend Clockify to the independent contractor.

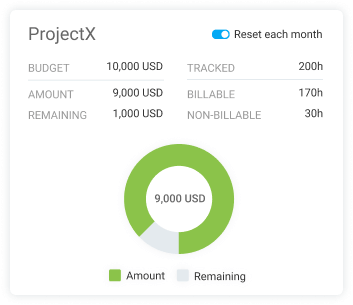

Among other uses, Clockify is a freelance time-tracking tool that allows independent contractors to:

- Define hourly rates,

- Start the timer when a project begins,

- Have earnings calculated automatically,

- Get a report on billable time, and

- Use the report to create an invoice.

💡 Clockify Pro Tip

Not sure how to differentiate between billable and non-billable hours and find the perfect balance between them? Read this post:

FAQs about independent contractors

Looking for more clarification on who falls under the independent contractor category? Do you need advice on paying contractors from another country?

This section has all the answers.

What’s the difference between freelancers, independent contractors, and regular employees?

According to the Office of Federal Contract Compliance Programs, freelancers “perform temporary, flexible jobs and are paid per service provided or task completed.”

Wilson explains that job freedom and tax responsibility differentiate freelancers from regular employees:

“Freelancers are responsible for their own taxes and may not receive benefits like health insurance or retirement plans. They often work on short-term projects and may work with multiple clients simultaneously.”

As a freelancer’s payer, you have “the right to control or direct only the result of the work and not what will be done and how it will be done”, according to the IRS. This sets freelancers and independent contractors apart from regular employees.

Freelancers are usually paid by the hour or by project, as they don’t have a monthly salary regular employees have. They are often classified as 1099 independent contractors, who have to pay their own taxes, benefits, and insurance.

Independent contractors are self-employed workers (subject to the self-employment tax) who perform temporary tasks for an employer and are in control of how their work-related tasks are performed.

💡 Clockify Pro Tip

Want to start freelancing but aren’t sure what your hourly rate should be? Use this article as a reference:

Are all contractors independent?

The term ’contractor’ is a more “loose” term without an official definition as it can include independent contractors and those who don’t have that status.

Rose notes that the contractor’s status depends on the situation:

“Independent contractors are like free agents — they work on specific projects, often independently. Contractors, though, can be a bit of a chameleon. They can be independent or on the company’s payroll, depending on the situation.”

So, contractors may or may not be self-employed. When contractors are outsourced by a base company or agency (staffing, temp, or employment agency), such agency usually provides them with some benefits and insurance. If that’s the case, they’re paid as W-2 workers, just like regular employees.

If this isn’t the case, these workers are considered independent contractors. Unlike the rest of the contractors, independent contractors are never tied to an outsourcing-based company, and they handle their taxes.

How do I pay an independent contractor in another country?

If the independent contractor is working remotely from another country, you have fewer payment methods to choose from.

You can opt for an international bank transfer, which is usually facilitated by SWIFT. SWIFT is a bank messaging system that allows people to send and receive money internationally. It works as a regular wire transfer.

Based on the Global Payments Survey we previously mentioned, 43% of organizations believe SWIFT has an increasing role in global connectivity, while 38% think it will remain dominant in the next decade.

Alternatively, you can opt for one of the online payment systems we mentioned. Nearly every online payment system is available internationally, and they typically don’t differentiate between domestic and international transactions.

For that purpose, PayPal, Payoneer, and Transferwise are among the most popular platforms for international transfers.

Paying independent contractors is easier with Clockify

In the end, it’s crucial to correctly classify workers before paying them.

You have to determine whether the worker is a W-2 employee or a 1099 independent contractor. Then, you’ll know if you need to cover their taxes, insurance, and benefits.

Hopefully, you now understand the steps necessary to pay your contractors and freelancers. Remember that a proper payment method and good software make the payment, time tracking, and invoicing process much easier!

If you’re looking to speed up the process of paying for independent contractors, a tool such as Clockify is a great choice.

Clockify allows independent contractors to track the time and projects they work on, as well as differentiate between billable and non-billable hours. When payment is due, they can quickly create an invoice and even attach hours worked for an even easier billing and invoicing process!