Free Hourly Rate Calculator

Use this hourly rate calculator to determine your hourly rate based on your business expenses, work hours, and desired salary. Find the ideal freelancer or contractor rate with ease.

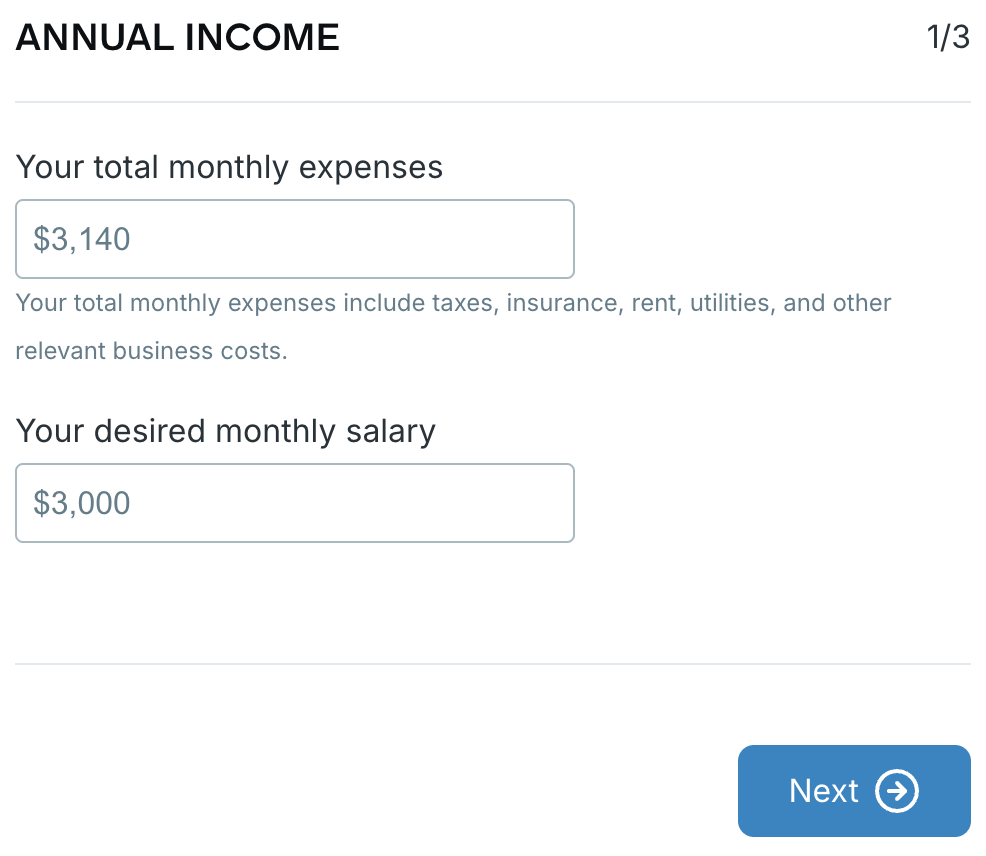

ANNUAL INCOME

1/3

Your total monthly expenses include taxes, insurance, rent, utilities, and other relevant business costs.

What is an hourly rate calculator?

An hourly rate calculator is a tool that helps you determine the right hourly rate for your freelancing services — whether you’re in IT, marketing, consulting, or other industries.

With the freelance rate calculator, you can determine your hourly rate based on your:

- Expenses,

- Work hours, and

- Ideal salary.

This enables you to stay both competitive and profitable.

How does our hourly rate calculator work?

Our freelance rate calculator consists of 3 sections. To determine your hourly rate, fill out the first and second sections, providing relevant information about your expenses, desired salary, and estimated time off.

The purpose of the first section is to calculate your target annual income. To enable our calculator to do this, enter your:

- Total monthly expenses (e.g., $3,140), and

- Desired monthly salary (e.g., $3,000) in the appropriate fields.

To move on to the second section, click the Next button located in the lower right corner.

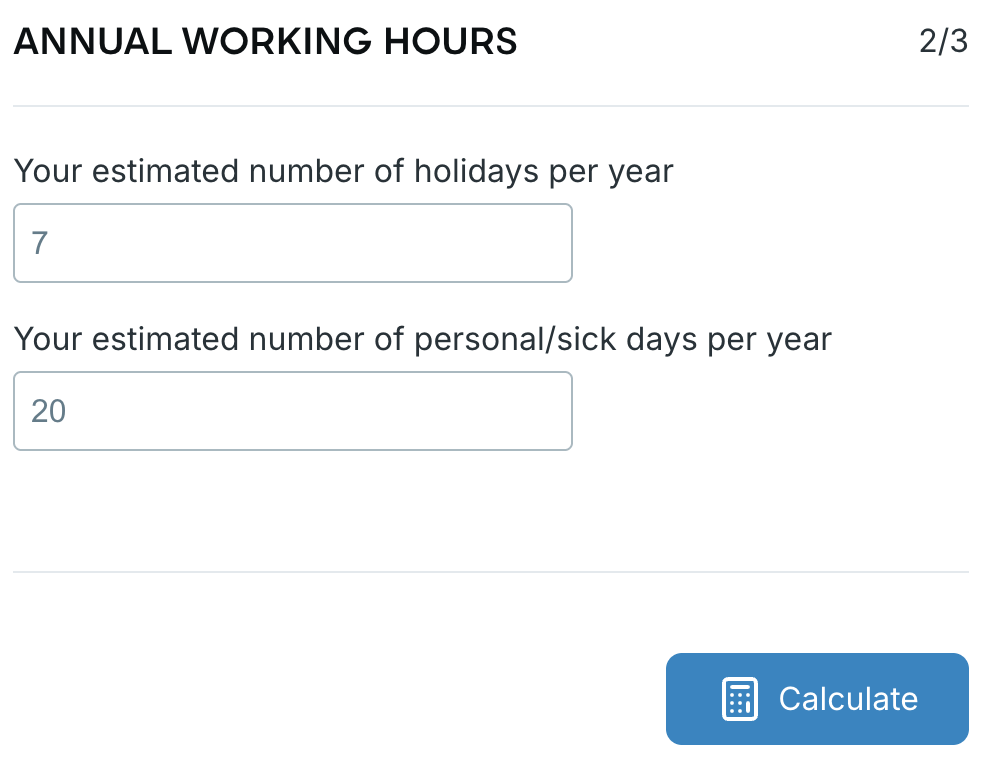

The purpose of the second section is to compute your total annual working hours. To enable our tool to do that, enter your estimated number of:

- Holidays per year (e.g., 7), and

- Personal/sick days per year (e.g., 20) in the right fields.

Finally, click on the Calculate button in the lower right corner to move on to the third section.

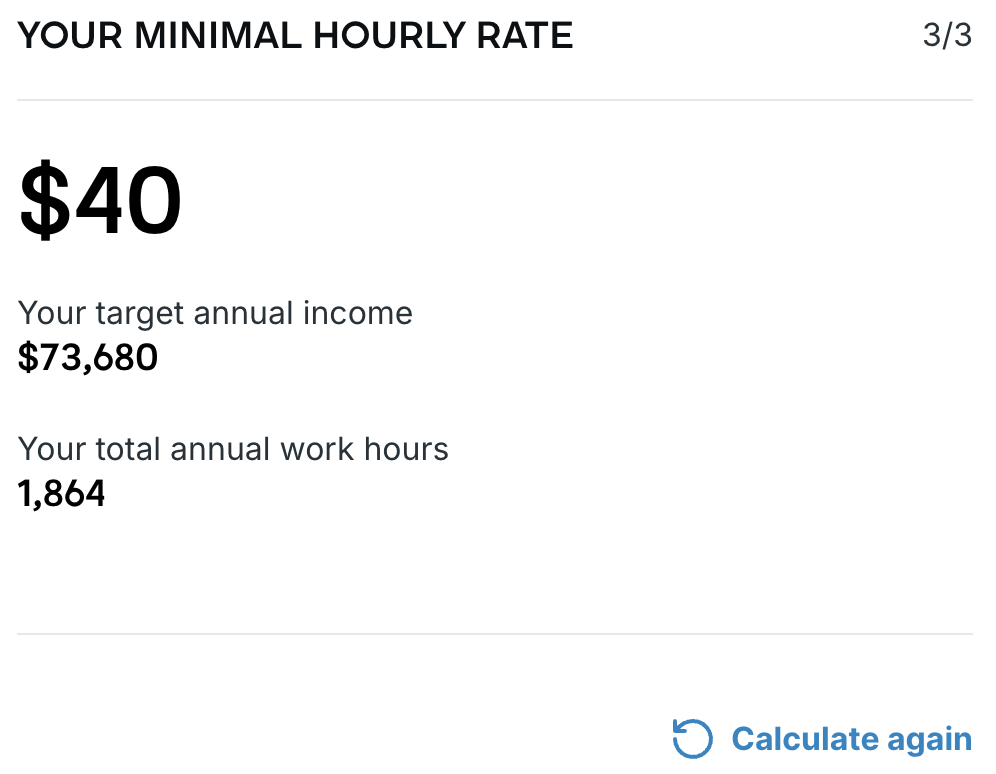

Here, you’ll be able to see:

- Your calculated minimum hourly rate (in this case, $40) under Your minimal hourly rate title,

- Your target yearly income (in this case, $73,680) under Your target annual income, and

- Your total yearly working hours (in this case, 1,864) under Your total annual work hours.

To start a new freelance rate calculation, click the Calculate again button in the lower right corner.

How to determine your hourly rate

Determining the right hourly rate is challenging for any freelancer — you’re always in danger of undercharging or overcharging, and both extremes affect your job prospects negatively.

If you overcharge, you may turn away clients, who’ll go to other freelancers — those who offer the same quality work but at a lower price.

Conversely, if you undercharge, you won’t be able to make all your hard work pay off and make a profit. Once you set rates that are too low in your field, it’s difficult to price up when you want to, as your existing clients get accustomed to your current low rates.

To avoid such pitfalls, you should determine the freelance rate that’s enough to:

- Cover your business expenses, and

- Reach your desired salary.

In the next section, we’ll explain how to calculate your hourly rate based on your ideal monthly salary.

Calculating the hourly rate based on the desired monthly salary

To find your hourly rate based on your ideal monthly salary, you need to determine:

- How much you want to earn per month,

- How many days you work per month, and

- How many hours you work per day.

Once you figure out all of the abovementioned, use the formula below to compute your rate per hour:

Desired monthly salary ÷ number of work days per month ÷ number of work hours per day = hourly rate

Say your ideal monthly salary is $10,000. We’ll also assume you work 22 days per month, 8 hours a day. In that case, you’ll calculate your hourly rate this way:

$10,000 per month ÷ 22 work days per month ÷ 8 work hours a day = hourly rate of $57

To avoid manual calculation, use our ideal hourly rate calculator below. Simply enter your desired monthly salary, the number of your work days per month, and the number of your work hours per day in the appropriate fields. Then, click Calculate to get the result.

Note: The hourly rate of $57 is enough to reach your desired monthly salary of $10,000. To cover your monthly expenses and still have a monthly salary of $10,000, you’ll have to adjust your ideal monthly salary and calculate your hourly rate based on that adjusted monthly salary.

Calculating the hourly rate based on the target annual salary

To find your contractor rate based on your target annual salary, you have to determine:

- How much you want to earn per year, and

- How many hours you work in a year.

For explanation purposes, we’ll say your target annual salary is $50,000.To learn how to calculate your annual work hours, refer to the section below.

Determining your number of annual work hours

The average number of work hours per year, according to the traditional figures, is 2,080. This is based on the assumption that you work 40 hours per week, for 52 weeks (52 x 40 = 2,080). However, this number doesn’t include your sick and vacation days.

To calculate your annual work hours accurately, you need to take into account any:

- Vacation days,

- Holidays, and

- Sick days you take in a year.

Say you work 8 hours a day and take 15 days of vacation per year. That amounts to 120 hours of vacation per year (8 x 15 = 120).

Say you also have 7 holidays per year. That’s 56 holiday hours per year (8 work hours/day x 7 holidays/year = 56 holiday hours/year).

If you also take 5 days for sick leave in a year, that’s 40 sick hours per year (8 work hours/day x 5 sick days/year = 40 sick hours/year).

To determine your number of yearly work hours, subtract your total number of time off hours (120 + 56 + 40 = 216) from the total number of work hours per year (2,080).

Here’s the calculation:

2,080 work hours per year - 216 time off hours in a year = 1,864 working hours per year

The total annual expenses and hourly rate

To calculate your total annual expenses, multiply your monthly expenses by 12 (the number of months per year). If we take $3,147 as your total monthly operating costs, that amounts to $37,764 of annual expenses:

3,147 x 12 = 37,764

To cover $37,764/year in expenses and still have an annual salary of $50,000, your hourly rate will have to reflect your adjusted yearly salary of $87,764 (= 50,000 + 37,764).

To calculate the minimum hourly rate you should charge to reach the annual salary of $87,764, use the formula below:

Adjusted annual salary ÷ number of work hours in a year = minimum hourly rate

Here’s the calculation:

$87,764 per year ÷ 1,864 work hours per year = minimum hourly rate of $47

Business considerations for freelancers

To plan and manage your freelance business properly, you need to consider several business aspects. These include:

- Defining your niche and services,

- Choosing a business entity,

- Creating a freelance rate card,

- Managing taxes,

- Obtaining insurance,

- Sending client proposals, and

- Creating freelance contracts.

After defining your niche and services, you should choose a suitable legal structure for your business. This is important because it allows you to:

- Protect your personal assets,

- Manage taxes more effectively, and

- Maintain a professional image.

Freelancers primarily use sole proprietorships and limited liability companies (LLCs) as their legal business structures. As a sole proprietor, you (as an individual) and “the business” are considered the same entity. This means that your personal assets could be at risk if the business incurs debts, since your personal and business finances aren’t legally separated.

On the other hand, LLCs offer liability protection but require more setup compared to sole proprietorships.

You should also consider getting health insurance. It helps cover unexpected medical bills (e.g., in case of an injury), reducing your financial worries. Having health insurance also encourages freelancers to be more proactive about their health and do regular checkups. This helps them maintain their well-being.

🎓 How to Be Proactive and Take Control of Your Work and Life

A freelance rate card (or a freelance rate sheet) is a document that outlines a freelancer’s pricing for their services. This document provides rate transparency to potential clients and is used when a freelancer doesn’t have time for a detailed client proposal.

Sending client proposals is essential for securing new projects and growing your freelance business. A good client proposal includes:

- Your understanding of the client’s specific needs,

- Your proposed solution,

- Your pricing structure and payment terms, and

- Your portfolio and a brief overview of your experience and expertise.

After securing a project, you should also create a freelance contract and send it to your client. This helps you:

- Avoid legal pitfalls,

- Manage expectations, and

- Foster a smooth client relationship.

FAQs about freelance rates

In this section, we’ll provide answers to some frequently asked questions about freelance rates — so read on.

What is a reasonable rate for freelancers?

Since freelance pricing depends on various factors, like your skills, experience, and the type of project, there’s no universal answer to what a reasonable hourly rate for freelancers is.

For example, if you’re an experienced freelancer with proven results, you can set higher rates compared to someone who has just started freelancing.

🎓 How to Start Freelancing in 2025 (Even While Employed)

Also, you can charge more for complex projects that require more effort, or increase your rates for projects with tight deadlines.

To ensure your hourly rate reflects your experience and expertise, you should assess your value, research competitor rates, and communicate your worth to your clients effectively.

Can I change my freelance hourly rate?

Yes, you can change your freelance hourly rate. This is a standard practice as freelancers gain more experience or as their operating costs increase.

For instance, if your skills have enhanced, you’ll be able to command higher rates, based on your improved value as a professional in your field.

Moreover, your expenses may increase when you buy new equipment or hire associates. In this case, you’ll need to recalculate your overhead costs to get new hourly rates corresponding to your new expenses.

What other types of freelance pricing models exist?

Besides hourly billing, some alternative billing models include:

- Project-based pricing,

- Value-based pricing, and

- Retainer.

Project-based pricing (or fixed pricing) is a billing method where, instead of basing your fee on the number of hours spent working, you charge a fixed fee for the entire project.

For value-based pricing, you charge based on the perceived value your service offers to the client. For example, if a project you do for a client might bring them $100,000 in new sales, you can charge 25% of that (which is $25,000).

Finally, retainer pricing involves a client paying a pre-agreed recurring fee for your services over a specific period.

Some retainer agreements are time-based, where a client pays in advance for a set number of hours worked per month, for instance. Others are project-based, meaning that a client pays for a set of specific project-related tasks within a certain period.

🎓 How to Maximize Billable Hours as a Freelancer

What is a good day rate for a freelancer?

A good day rate for a freelancer varies depending on the experience, industry, and specific skills or services you offer. To find your ideal day rate, you should:

- Decide how much you want to earn (per year),

- Determine your business expenses (per year), and

- Calculate your total working days (in a year).

Once you figure out all of the abovementioned, use the formula below to calculate your ideal rate per day:

(Desired annual salary + annual business expenses) ÷ the number of work days per year = day rate

Say your desired annual salary is $50,000, and your yearly expenses equal $35,000. We’ll also say you work 260 days per year (excluding weekends). In this case, you’ll calculate your day rate this way:

($50,000 + $35,000) ÷ 260 = $85,000 ÷ 260 = a day rate of $327

Note: The example above is based on the assumption that you work 260 days per year (52 weeks/year x 5 days/week = 260 days/year). To determine your day rate more accurately, you’ll need to factor in the total days off you take per year.

How to politely tell someone your hourly rate?

To politely share your hourly rate, you should state it directly but also provide a brief explanation of what your rate covers (e.g., “My rate is based on my time, expertise, and the quality of my work.”). This way, you’ll present your rate as a fair reflection of the value you provide.

You can also say something like “My standard rate is [your rate], but I’m happy to discuss it and potentially adjust it based on the specific project requirements.”, to express flexibility.

🎓 Average Hourly Rate Insights (2025): Freelancers & Consultants

Use Clockify by CAKE.com to calculate your earnings accurately

After you’ve determined your hourly rate, how exactly can you calculate your earnings and deliver the payment information to your client?

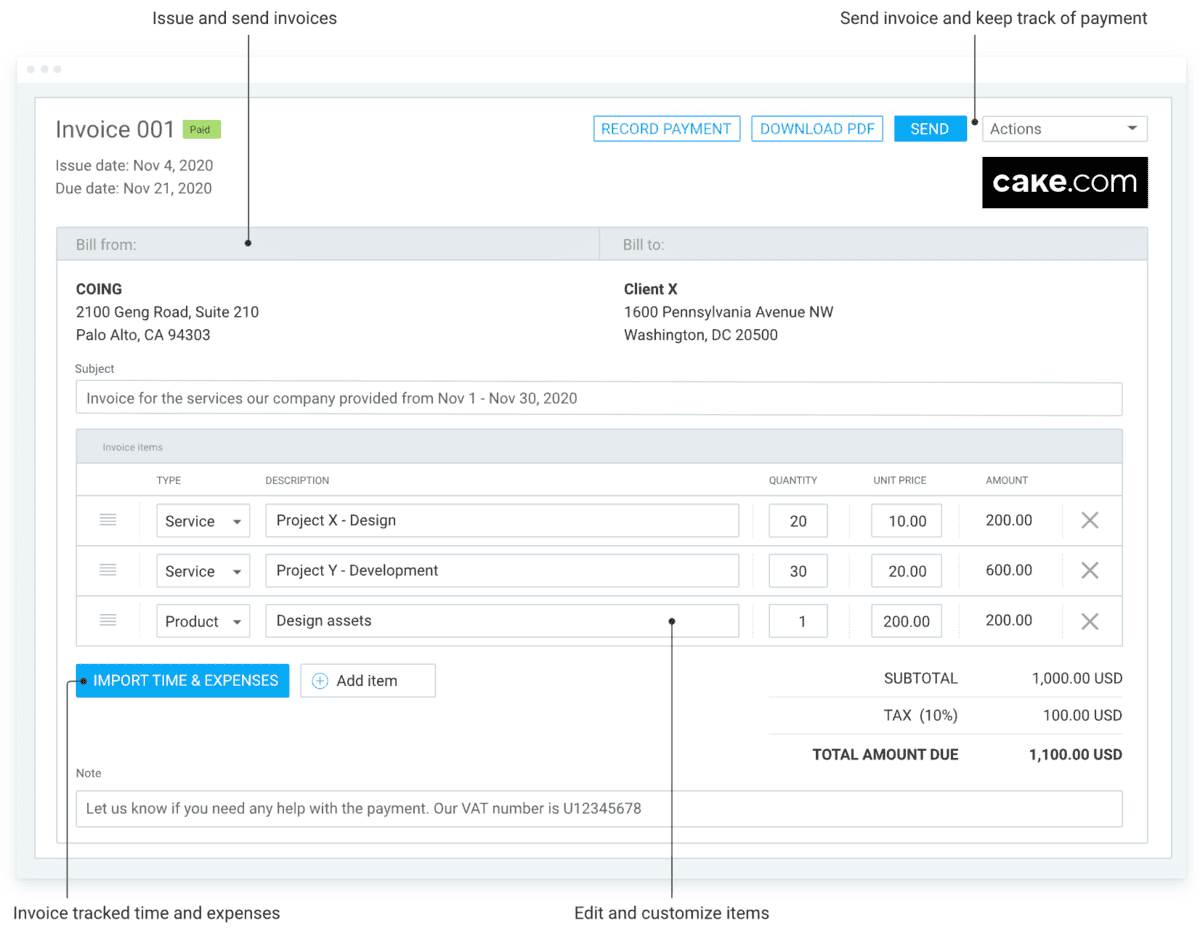

Try Clockify by CAKE.com — a powerful time tracker that allows you to set hourly rates, track billable hours in line with those rates, and create client invoices based on tracked time.

Once you’ve created your Clockify account, you can:

- Set up your projects and tasks,

- Define hourly rates,

- Track time spent on your projects and tasks via Clockify’s timer or timesheets, and

- Mark your time entries as billable for easy and efficient billable time tracking.

To track time via Clockify’s timer, choose the Time tracker option from the sidebar in Clockify, enter what you’re working on, and select the project. To mark your time entry as billable, click the dollar sign close to the Start/Stop button. Finally, start the timer to begin tracking time. Once you finish working, simply stop the timer.

Clockify also offers an invoicing feature that lets you create invoices based on tracked billable time and send them to your clients.

Here’s how you can create an invoice in Clockify:

- Choose the Invoices option from the sidebar,

- Click on Create invoice,

- Select a client and fill out the required fields,

- Click Create, and

- Download the PDF version and send it to your client.

The bottom line: you’ll never worry about calculating labor costs again.

Whether you’re a freelancer or an employer looking to provide accurate payroll, Clockify does all the heavy lifting for you.

And, if you want to boost your employees’ productivity, check out CAKE.com’s Bundle!