How to calculate labor cost + labor cost calculators

All business revolves around turning labor into profit. Here's everything you need to consider to set the right price for your labor-based services, plus labor-cost calculators to get the estimation right.

The cost of labor is an important topic, as everything revolves around turning labor into profit in the world of business.

However, the complexity of the topic varies by industry type due to differences in 2 main categories of costs — direct and indirect.

The article will cover all the relevant factors business owners need to consider to set the right price for their labor-based services.

That estimation is of utmost importance while they are preparing the annual budget. Moreover, it will have a direct impact on their profit.

But before we go into details in our step-by-step guide, you can check our labor-cost calculators to get the estimation.

Once you read the rest, you will be able to adjust the calculation to your specific business model and get the precise total cost.

Labor cost

Since our topic is the pricing of labor, first, we ought to explain the term "labor" — it refers to the cost of services that involve human resources.

According to Eurostat, there are 3 main indicators of labor cost:

- Average monthly labor cost — This should be the total labor cost for compensating all the full-time employees. Besides their net salary, other costs, such as taxes and benefits, need to be counted as well.

- Average hourly labor cost — Once you calculate the average monthly cost, you can divide it by the total number of hours for all the employees. That way, you’ll get an estimate of how much you ought to pay for one hour of work.

- Structure of labor cost — The structure refers to the percentage of labor cost compared to the total labor cost. Meaning — it’s an estimate made to guide you when you’re segmenting your budget.

Labor costs are related to and depend on the specific:

- Markets,

- Industries, and

- Companies.

There’s also an interesting relationship between labor costs and living costs, which heavily depends on the specific region, especially the urban-rural opposition.

But, before we go over the total labor cost formula, let’s look into:

- Several definitions,

- The main differences between direct and indirect labor costs, and

- Relevant variables.

In the introductory part, we’ll provide the answers to frequently asked questions to help you grasp the big picture of calculating labor costs.

What is the cost of labor?

Although several variables help determine direct and indirect costs, the cost of labor is more than the cost of the employees' wages.

For starters, there are other employee-related costs, such as:

Some industries or companies include covering the costs of:

- Materials,

- Equipment,

- Transportation,

- Health care, or

- Benefits and bonuses.

In accordance with their specific situation, business owners must include them all in their calculations.

The cost of labor is an integral aspect of the total production cost and is closely related to employees' productivity levels.

After all, human capital is the greatest and the most valuable asset of a company, so one needs to nurture it to get the greatest results.

How tracking time can help you get the pricing right

In order to get the best results in terms of profit (and the most from their human resources), business owners need to track their team's productivity.

Once they analyze the data, they'll be able to compare how different employees spend their time on the same tasks, therefore spotting the weak links.

Bear in mind that we're not suggesting that the weak links should be laid off — but rather just to understand why some people take more time than others.

Also, business owners save money by tracking time, while employees themselves have access to their personal data. Those insights will help your employees improve the way they allocate time to different tasks.

As a result, employees will:

- Understand their routines in a better way,

- Find their biological prime time, and

- Stay motivated to improve further.

Does labor cost more than materials?

In short — yes, it does.

Materials are among the most significant areas of expenditure for industries such as the construction or food industry. But, even in those, employees need to deal with the actual execution of tasks.

The nature of a specific task will further dictate the ratio between the total cost and materials-only cost.

For example, the latest data on building a house in the US points out that the architect's fee only consumes between 8% and 12% of the total cost.

Additionally, the constructor management fees will consume from 5% to 15% of the total budget.

Also, construction employees must be adequately compensated for their work too.

So, it’s definitely not only the material cost, and business owners must learn to accurately keep track of expenses.

Once again, we’re emphasizing the fact that it's vital to include all the relevant factors while setting the price for a product or service in order to earn profit.

What are labor costs?

The demand for labor depends on both micro- and macro-level factors.

The only way to know how much a new employee will cost your company and whether or not it is profitable to start recruiting is to include every aspect of both categories.

Here are some relevant examples.

Micro-level factors:

- Minimum wage,

- The cost of materials, and

- Industry-specific factors.

Macro-level factors:

- The economy,

- The demand in the specific area, and

- Competition.

As we've mentioned, there are 2 broad categories of costs when it comes to the total price of labor — direct and indirect costs.

Therefore, it's essential to determine your hourly, monthly, and annual calculations based on your company's unique combination of direct and indirect labor costs.

Direct labor costs

Direct labor costs refer to the total compensation of all the employees, the cost of materials, as well as other company-provided elements for employees.

What matters is to understand that the term compensation does not only include net salaries for employees. Compensation is a blend of multiple components, such as:

- Payroll taxes,

- Coverage of a certain number of sick leave days,

- Bonuses, and

- Other company-provided benefits — meals, phones, equipment, or vehicles.

How to calculate direct labor cost

Let’s start by mentioning the most common direct labor costs.

The 3 most common categories are:

- Employees’ wages — including taxes, PTOs, and bonuses,

- Materials, and

- All other company-provided benefits.

So, the right formula for direct labor cost calculation must be in accordance with what your company provides to employees.

Total labor costs for US employers

The latest statistics from the US Bureau of Labor indicate that wages and salaries account for the range between 61.7% and 70.5% of total employers’ costs, depending on the sector.

Now let’s see how the compensation costs are distributed in the US as of June 2022, published in September 2022.

This is the breakdown of the total labor cost for the employer in terms of compensation:

- For civilian workers — $41.03 per hour worked on average.

- For private industry workers — $38.91 per hour worked on average.

- For government workers — $55.47 per hour worked on average.

You can find the percentages for the wages and salaries, as well as the most important categories of benefits in the table below.

| Compensation component | Civilian workers | Private industry workers | Government workers |

|---|---|---|---|

| Wages and salaries | 69% | 70.5% | 61.7% |

| Paid leave | 7.4% | 7.4% | 7.5% |

| Supplemental pay | 3.1% | 3.5% | 1% |

| Insurance | 8.3% | 7.6% | 11.6% |

| Retirement and savings | 5.1% | 3.4% | 12.8% |

| Legally required benefits | 7.2% | 7.5% | 5.5% |

Indirect labor costs

As for the indirect labor costs, those are much more flexible and dependent on the specific industry of labor.

An example of an indirect cost would be occasional maintenance of a vehicle or a piece of equipment.

The most common indirect costs are:

- Company‘s overhead costs (office space rent, utilities, and equipment necessary for administrative tasks),

- Recruitment costs,

- Vocational training and education costs, and

- Maintenance of equipment costs.

How to estimate direct and indirect labor costs

To estimate the total cost, you must thoroughly examine the specifics of both categories we’ve mentioned.

In the following sections, we’ll provide an overview of our imaginary company’s costs, helping you understand the importance of each segment.

According to Accounting Tools, direct costs can be oriented to job and process cost environments.

In a job costing environment, time tracking is extremely significant for employers — such environments imply that workers spend their time on various tasks.

On the other hand, the process cost environment implies the production of the same item in large quantities. Still, parts of the process can surely be streamlined in a better way.

What is a labor cost example?

Here's an example of a fictional company in the construction industry.

We chose to focus on construction labor costs in our examples because such work includes and requires all the elements we’ve mentioned.

Our imaginary company’s name is “Builders INC.” and it employs 10 full-time workers.

There’s an office space for administrative tasks, while the workers spend most of their time on site.

So, how to calculate labor cost for our company?

The total labor cost formula includes the following steps:

- Calculate net hours per employee per year,

- Calculate gross pay per employee per year,

- Calculate the total additional cost per employee per year,

- Calculate the total cost per employee per year, and

- Calculate the total profit per year.

Read on, as we’ll not only provide you with examples for each step, but calculators you can use for free as well.

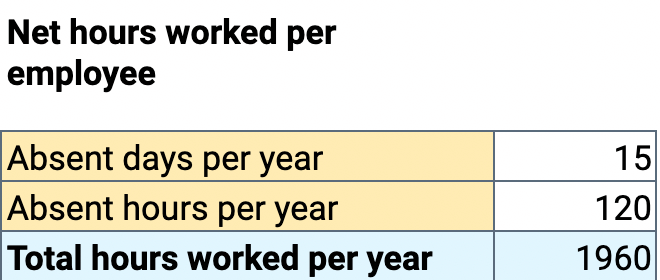

Calculating net hours per employee per year

To calculate the total number of hours an employee works per year, we need to determine the number of hours they are expected to be absent.

Let’s say our workers are entitled to 10 vacation days per year and that they will be absent for an additional 5, due to sick and personal leave.

The starting point is 2,080 hours per year, from which we will reduce a total of 120 hours (15 days x 8 hours per day).

So the actual number of net hours per employee per year is 1,960.

🔽 Here’s the calculator to determine the total net hours worked per employee, per year, depending on the number of absent days.

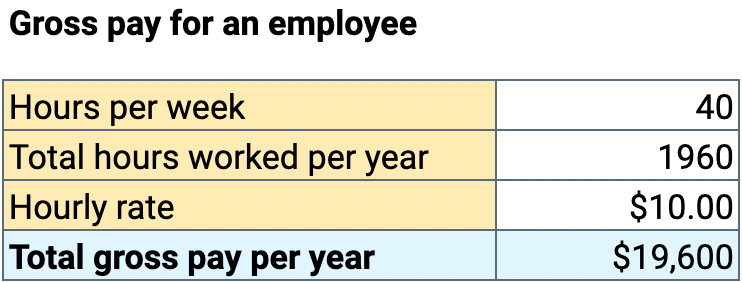

Calculating gross pay per employee per year

Now that we know the exact number of hours per year, we can calculate the gross pay for an employee per year.

We just need to multiply the number of hours by their hourly rate, which is $10 in our example. These employees will therefore earn a total of $19,600 per year.

🔽 Here’s the calculator to determine the gross pay for an employee per year.

To adequately compensate your employees for the work they've done AND gain profit, one must ensure the company's values promote productivity and efficiency.

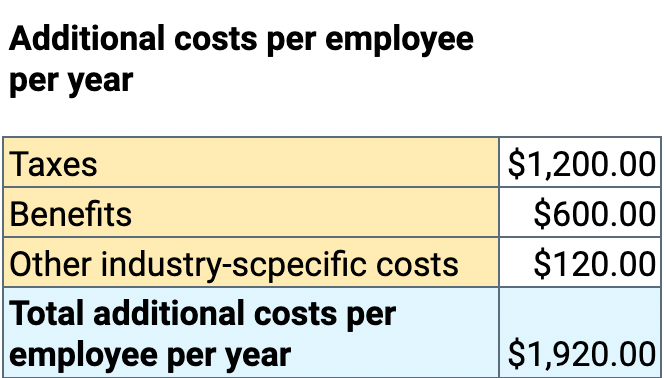

Calculating the total additional cost per employee per year

The total cost for the employer, however, will be different from an employee’s gross pay. It’s because each employee comes with a set of other costs, some of which we’ve mentioned earlier.

Let us remind you, additional costs include:

- Taxes,

- Benefits, and

- Other industry-specific costs.

To get the total additional cost, we must first determine the value of additional costs on top of the base salary.

In our example, additional costs equal $1,920 per employee per year. We’ve included taxes, benefits, as well as other industry-specific costs.

🔽 Here’s the calculator to determine the sum of all additional costs per employee per year.

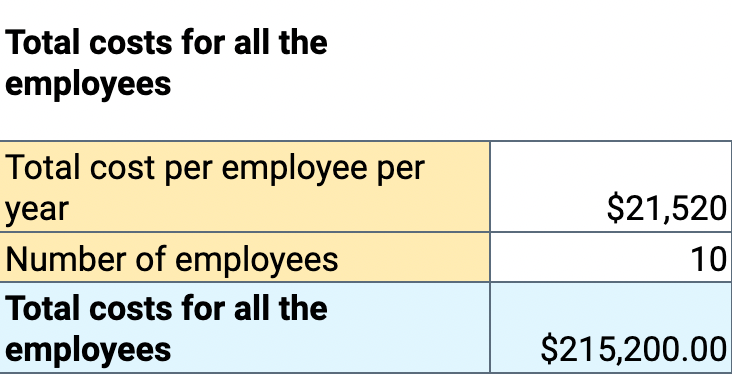

Calculating the total cost per employee per year

Now that we have both, we can add those up, and get the total cost for the employer per employee per year.

In our example, it’s $19,600 + $1,920, or $21,520.

We can further multiply that total by the number of employees to get the total cost for all the employees per year, as shown in the table below.

🔽 Here’s the calculator to determine the total annual cost for the employer for all the employees.

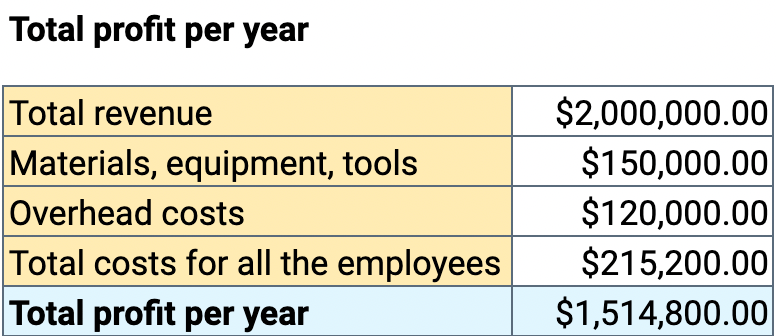

Calculating the total profit per year

After we’ve calculated net hours, gross pay, total additional cost and total cost per employee per year, what’s left?

Well, it’s only natural that you might want to check how much your profit for the year is once you’ve dealt with total costs.

Total annual profit can also point to your availability to hire new employees, so let’s crunch the numbers for our “Builders INC.” company.

What we need to do is insert our total revenue and deduct the following annual costs for:

- The materials, equipment, and tools,

- Overhead costs, and

- Total cost for all the employees.

🔽 Here’s the calculator to get the amount of profit per year, based on your annual revenue and costs.

As you can see in our example, this fictional company did well.

If your numbers reflect a similar situation, you might consider expanding your team to get more work done. Consequently, you’ll earn higher profit.

What are the steps to calculate labor-based pricing?

Now that you understand the aspects you need to pay attention to, we can start with our step-by-step guide.

These are the 6 steps you should take if you want to calculate labor-based pricing:

- Step #1 — Determine the total payroll cost,

- Step #2 — Determine the total cost of materials, equipment, and permits,

- Step #3 — Determine the overhead costs,

- Step #4 — Determine some other possible expenses,

- Step #5 — Consider the issue of time theft, and

- Step #6 — Think of ways to reduce the total cost.

Determine the total payroll cost

Although employees’ compensation should always be a starting point, it’s important not to t forget about all the aspects we’ve mentioned besides their salary.

But, what are the components other than the base salary that comprise the total payroll cost?

There are 5 categories of benefits for full-time employees:

- Paid leave

- Vacation

- Holiday

- Sick leave

- Personal leave

- Supplemental pay

- Overtime

- Shift differential

- Non-production bonuses

- Insurance

- Life

- Health

- Short-term disability

- Long-term disability

- Retirement and savings

- Defined benefits

- Defined contributions

- Legally required benefits

- Social security

- Medicare

And why are these categories vital for employees and their productivity? Well, for starters, nobody should be expected to work 40 hours per week, 52 weeks a year, and still remain productive.

People need to take regular breaks both on a daily and a yearly basis to avoid being overworked and ending up exhausted. Taking regular breaks especially applies to construction workers, who often deal with heavy machinery and work at heights.

However, even with regular breaks training your employees properly is essential and will significantly reduce the margin of human error.

Determine the cost of materials and equipment

Once you’ve covered an integral section related to employee wages and benefits, you need to think about all the:

- Equipment,

- Tools,

- Vehicles, and

- Other company-provided elements that the employees will use.

Determining the cost of materials and equipment includes both categories of costs — direct and indirect.

That’s because you need to take into account aspects such as maintenance of equipment, fuel for the vehicles, and similar. Another thing to consider, especially relevant for estimating construction labor costs, is the category of licenses and permits.

So, the second most important aspect in estimating labor costs is associated with supplies of any kind.

There are 4 major and broad categories of such costs and those are:

- Materials,

- Vehicles,

- Tools and other equipment, and

- Other company-provided elements.

Determine the cost of materials

Some industries we’ve mentioned, such as construction, manufacturing, and the food industry primarily depend on materials, so the material costs are higher.

To determine the cost of materials, take all the materials needed for a project into account and calculate the 5%-10% of “extra”, just in case.

If you’re wondering why that is the case, the explanation is quite simple — accidents happen, things get spilled, etc.

Better safe than sorry, right?

Determine the cost of vehicles

Some companies have their own vehicles, while others rent them.

For the latter case, renting is their only cost but for the former, several other aspects need to be taken into account.

Two main categories are:

- Regular maintenance costs, and

- Coverage of fuel.

Determine the cost of tools and other equipment

Make a list of all the necessary tools and equipment needed for the project, and those costs will once again depend on whether you own the equipment or are just renting it.

Determine the cost of any other company-provided elements

Company-provided elements include phones, laptops, etc.

This is a pretty self-explanatory category and not every company will offer such perks. However, if yours does — you need to include the total cost of those, and multiply them by the number of employees.

Determine the overhead costs

The next step on our list is determining the overhead costs. The category is based on the idea that most businesses require office space.

This is applicable even when labor is mostly conducted on-site, such as with construction companies, since they’d also need an office space for administrative tasks and important meetings with the staff and clients.

Following that logic, calculating overhead expenses involves including the costs of:

- Rent,

- Utilities, and

- Office equipment.

Determine other possible expenses

Even though the first 3 categories might be everything you need to cover when calculating the costs of material and equipment, sometimes it’s necessary to include other possible expenses.

Think of instances where the materials are delivered late or a piece of equipment gets broken, for example. That can slow down or delay the whole process, resulting in lower profits, as you’ll get behind schedule.

One of the most important lessons from the global pandemic is that we need to take the omnipresent uncertainty into account.

However, some of the expenses falling into this category will be for positive reasons and occasions. For example — gifts for your employees or clients, interesting and relevant subscriptions, and charitable donations.

Consider the issue of "time theft"

We can generalize and sum up various definitions of time theft into the following — an employee getting paid for the time they did not spend working.

Time theft happens primarily due to “buddy punching,”, which is a common problem for employers worldwide.

Buddy punching refers to instances where one employee clocks in or signs on a timesheet for another (who might be running late or even skipping the whole day of work.)

Time theft is an important issue when it comes to several aspects of businesses, such as:

- Total compensation of workers,

- Productivity rates, and

- Overall profitability.

When we think of the term “theft,” most people won’t associate it with time.

According to the US Bureau of Labor Statistics, average weekly earnings for employees are $1,129.01. Meaning — if only 1 employee consistently shows up 15 minutes late, the loss for a company is over $2,000 per year.

Also, a Forbes article mentions a stunning result of the American Payroll Association study — in the US, almost 75% of companies are affected by the issue of time theft.

Apart from being extremely expensive for employers, time theft can also seriously damage the company’s reputation.

The estimation of a yearly loss due to time theft is a whopping $400 billion, again in the US only.

Ouch!

Here’s another example of time theft, presented in a different Forbes article — employees overall spend around 21% of their working time on social media, entertainment, and news.

This finding should not come as a surprise since the latest workplace productivity statistics point out that 56% of in-office employees claim social media platforms are a common distraction.

Shakespeare once said "The more, the merrier" — and in terms of business, it surely is true that great minds think alike. Bear in mind, if you aspire to become great, you ought to master your time management skills.

Dealing with the time theft issue

The issue of time theft may not seem important, especially since there are no labor laws in the US to restrict clocking in for other employees or taking super long lunch breaks.

Nevertheless, as you can see from the data above, time theft is a serious issue that negatively impacts company’s profit and reputation.

So, how can a business owner deal with that? What’s a possible solution?

It all starts with tracking your employees’ time by the individual project or a task, depending on the nature of the industry. The importance and benefits of time tracking come to light even in situations when you don’t need to deal with time theft.

Employee productivity can skyrocket once they learn to effectively allocate time, which will further be reflected in the company's profits.

Additionally, once you decide to introduce team timesheets too, it becomes much easier to improve on a large scale.

How to calculate the labor cost in construction?

Based on every factor we’ve mentioned, let’s put our knowledge into practice, specifically focusing on construction work.

The construction industry has been heavily automated in the last couple of decades.

However, it still relies on people to perform the tasks or, sometimes, monitor how a job gets done.

After all, there’s no doubt that automation brings various positive changes and opportunities to the construction industry.

Materials vs. labor: the ratio within the total cost

As for the ratio between the materials and workers in construction, there’s an everlasting debate, and we can confirm that there’s no “one size fits all” rule available.

The ratio within the total cost will depend on:

- How specialized the job is,

- The competitor’s prices, and

- The overall consumer demand.

The range of material costs can be anywhere between 50% and 80% of the total cost, depending on the subcategory of work.

For example, for highly skilled requirements such as electrical, mechanical, plumbing, fitting, and roofing work, the cost for employees dealing with these delicate issues is 50%, while the other half goes to materials.

Other, not-so-delicate tasks (such as windows, doors, plaster, and walling) usually get divided into 20% for workers’ costs and 80% for materials.

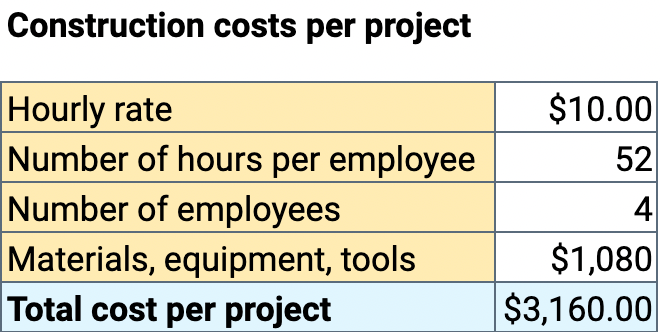

Construction project cost: relevant additional factors and the calculator

On top of all the other costs, there’s another thing to think about. The latest news points to the soaring cost of materials for the seventh consecutive quarter, which has been causing a decline in the construction projects demand, as well as in profit.

The decline is the only logical consequence of the prices on the rise, because once the materials are costly, the total price must be increased if you want to stay in a profitable business.

Consumers might not like that, and the only possible solution is to try to reduce some of the other costs.

The formula for calculating construction costs per project goes as follows:

(hourly rate x number of hours worked per employee x number of employees) + the cost of materials, equipment, tools

Here’s an example of the total cost for a project involving 4 employees, each of them working for 52 hours on it. They have an hourly rate of $10 and the cost of materials, equipment, and other necessary tools was $1,080.

As you can see, the total cost is $3,160.

Bear in mind that the formula doesn’t include overhead costs, as it can be hard to determine those if a project is shorter than a month.

🔽 Here’s a calculator so you can determine the total cost for your own projects.

Is there a way to reduce the total costs?

With that many factors in mind, what’s left?

Well, the only rational thing to do is to try to reduce the costs and increase the profit.

Once you’ve calculated the labor costs in the worst-case scenario (that everyone will use all of their sick days and you’ll have an unexpected one-time cost for a broken piece of equipment, for example), the total may seem too much.

Even though it’s unlikely that will happen, it’s always better to be safe than sorry, right?

So, business owners can (and should) be proactive and try to find ways to reduce the total costs.

Here are several tips and tricks that will help you with that.

Step 1: Use a time tracking system for individual employees

Tracking your employees’ time benefits everyone and is a proven method of boosting efficiency and productivity levels.

Moreover, not only can time tracking motivate employees to be more productive on a personal level, but it can also leave much less room for time theft.

Step 2: Conduct regular time audits (preferably on a monthly basis)

The process of investigating how time is allocated to specific tasks is called the time audit, and it helps business owners understand the daily routine of their employees.

By comparing the data from different months and for different projects or employees, it will become easier to spot where an improvement is needed.

Once you determine that, you can work on the necessary steps to increase productivity and identify the time wasters and inefficiency.

Step 3: Invest in employees’ training

Companies that don’t invest in adequate training are at a higher risk of their employees making mistakes.

This step is of utmost importance to reduce the possibility of an error and motivate employees to increase their productivity levels.

Step 4: Actively engage in networking

Networking and commitment to a distributor can save you a large amount of money if you have the right approach.

That’s why it’s never a bad idea to try and make a deal with a distributor of materials, supplies, and similar products for a discount on a yearly basis.

Step 5: Start the green initiative to reduce the overhead costs

Sometimes it’s not about wasting time but rather resources. When it comes to a company’s overhead costs, there’s always something you can do to reduce those.

For example, you can go green with the lightning and therefore reduce electricity costs.

Many other eco-friendly solutions require an initial investment but don’t let this fact trick you into believing that it will bring you more costs — because, ultimately, you will end up saving money.

Use Clockify by CAKE.com to calculate labor costs and increase your profits

Adequately calculating labor costs has many benefits for companies — from understanding the basics behind your financial status to keeping your business afloat and, eventually, profitable.

However, combining everything to devise a single number is practically impossible, considering the multitude of factors involved in calculating labor costs and how they influence one another.

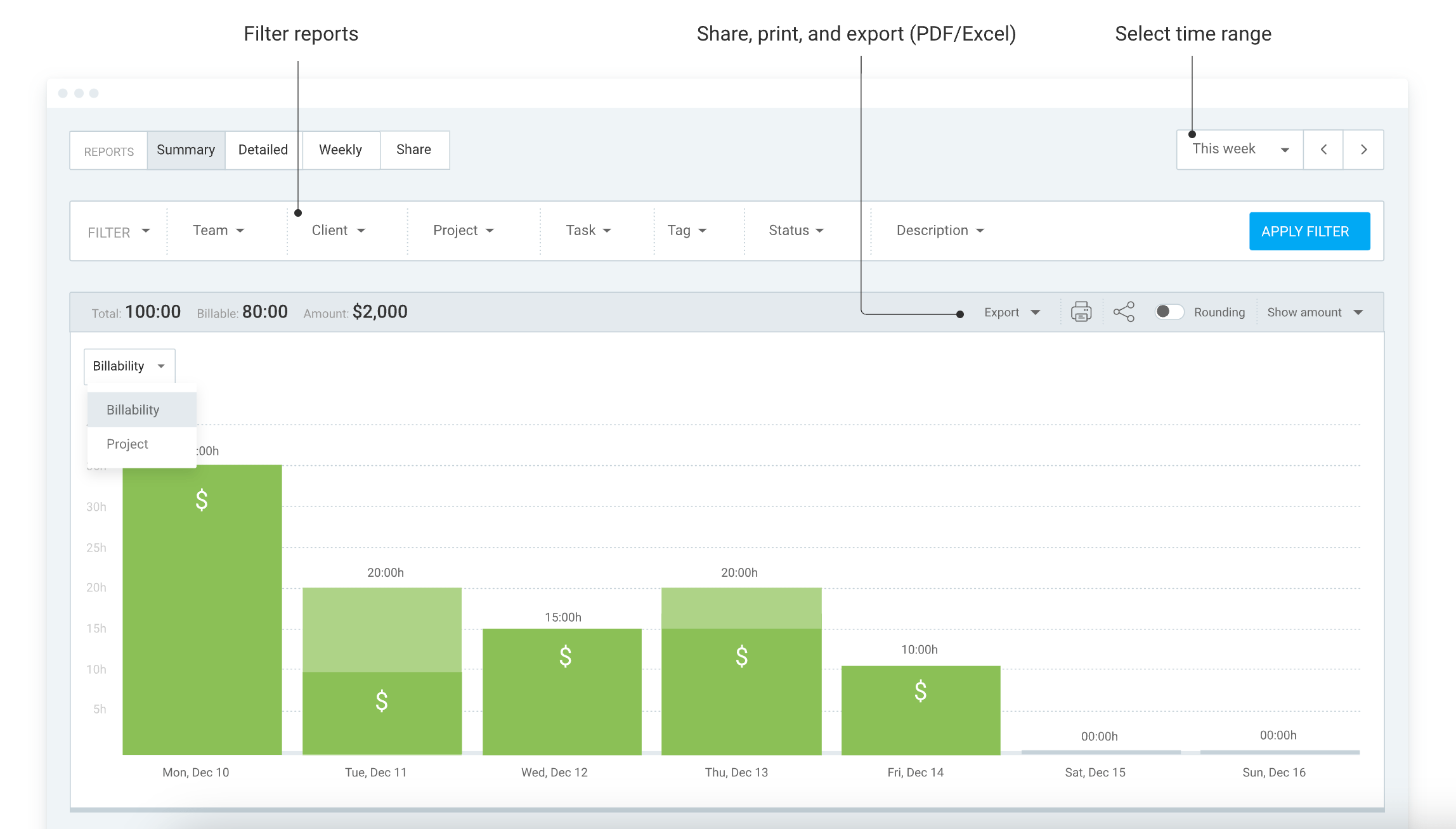

Therefore, the best thing business owners can do is track time spent on tasks and projects with Clockify and further evaluate how their employees spend time at work.

You can easily view this in Clockify with the Reports feature. To get to the Reports section, click on it in the menu on the left side.

Timesheet report in Clockify

This feature lets you see the time spent on projects, billable and non-billable hours, and the total amount. Furthermore, you can filter reports by several criteria and share, print, and export them in PDF, CSV, or Excel format.

You can benefit from several reports in Clockify, such as:

- Summary report,

- Detailed report, and

- Weekly report.

With Clockify by CAKE.com, you’ll ensure:

- Your employees are productive and engaged, and

- Your pricing covers all the expenses while earning you a profit.

Furthermore, you can use Clockify to set billable and non-billable hours and see exactly how each department in your company contributes to the overall growth.

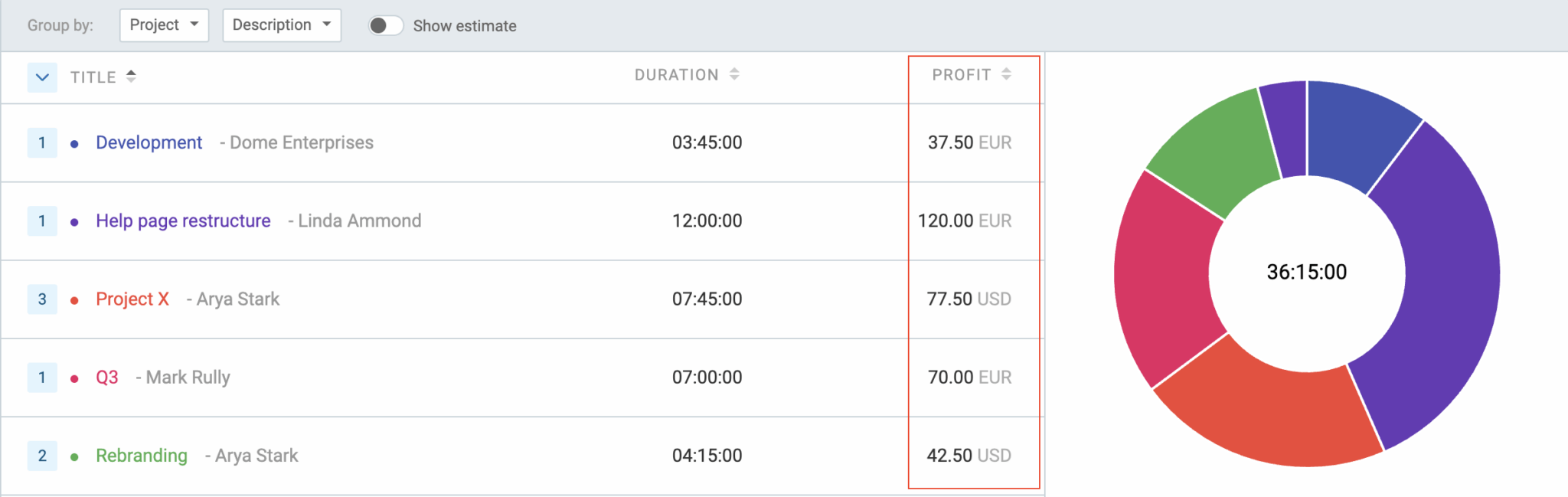

Use Clockify to see profit from billable hours

To see the profit from billable hours in Clockify, click the Reports section in the menu on the left side and scroll down. From there, you can see the duration of each project and its profit.

Taking control of your business and costs has never been easier. The variables that go into tracking labor costs are available in Clockify — all it takes to start using them is a single click.