There might come days when employees experience unpleasant events, like severe personal health conditions or health problems of an immediate family member who requires continuous caregiving.

In such situations, many employees aren’t eligible for compensation and must continue working to earn a living.

For this reason, many states have introduced the Paid Family and Medical Leave (PFML) policy that provides wage replacement for employees who experience qualifying events, such as treating a severe illness, caring for a family member, or childbirth.

In this article, we’ll look at US paid family and medical leave regulations and give you a thorough overview of this type of leave.

- Employees can use paid family and medical leave to treat their severe health conditions, care for a family member, or bond with a newborn child.

- As of December 2024, 13 US states and the District of Columbia have paid family and medical leave laws.

- The paid family and medical leave differs from the Family and Medical Leave Act (FMLA) and paid sick leave.

- Paid family and medical leave provides employees with a wage replacement during their time off.

- Paid family and medical leave functions as insurance, and both employers and employees contribute to it.

What is paid family and medical leave (PFML)?

Paid family and medical leave (PFML) is a policy that allows employees to take paid leave for family or medical reasons. This policy protects workers who need a longer leave than sick or PTO leave to care for themselves or a family member without losing pay.

In some states, employers and employees fund the paid family and medical leave, while in others, either the employees or employers are responsible for the funding.

The PFML is quite similar to the Family and Medical Leave Act (FMLA), which is a federal law that regulates medical and family leave but is an unpaid leave of absence, unlike the PFML.

Paid family and medical leave has 2 essential parts:

- Paid family leave — includes paid time off to take care of an ill family member or a newborn child, and

- Paid sick leave — includes paid time off in case of an injury or a severe health condition.

Probably the biggest advantage of the PFML is that eligible employees get paid during their absence, which can vary from 60% to 100% of their wages. The duration of absence depends on the specific circumstances and state, but it usually lasts up to 12 weeks.

Since the US still has no federal law for this leave, many states have decided to enact their own paid family and medical leave laws.

States with paid family and medical leave

As of August 2024, 13 states and the District of Columbia have mandatory paid family and medical leave laws. Nine states and the District of Columbia have enacted and implemented them, while 4 states have passed them but have yet to implement them.

Now, let’s take a detailed look at PFML regulations for each state.

🎓 For a comprehensive overview of the PFML regulations in the US, visit — Interactive Overview of Paid Family and Medical Leave Laws in the United States

Paid family and medical leave in California

Status: Effective since 2004.

Weekly benefits: Employees receive 60-70% of their average weekly salary, with a maximum of $1,620. At the start of 2025, these percentages will rise to 70-90% of the weekly average wage.

Length of benefits: Up to 8 weeks for family leave and up to 52 weeks for personal medical reasons.

Unpaid waiting period: 7 days for disability leave.

Who is eligible: Employees who earn at least $300 during the base period, which includes the first 4 out of the 5 most recently completed quarters or earlier quarters if they were unemployed.

Official website: California paid family and medical leave

In California, paid medical leave is known as disability insurance (DI), and employees can use it for personal injury or illness. They can use paid family leave for several reasons, such as:

- Bonding with a child within one year of its birth,

- Caring for a family member with a health problem, and

- Handling family responsibilities due to a family member’s military obligations.

Employees fund the paid family and medical leave in California, as they receive a single premium deduction of 1.1% of their salary.

Track your payroll with Clockify

Paid family and medical leave in Colorado

Status: Effective since 2024.

Weekly benefits:

- For the amount that is equal to 50% of the average state weekly wage, employees will receive 90% of their average weekly salary, and

- For the amount that exceeds 50% of the average state weekly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is $1,100.

Length of benefits: Up to 12 weeks.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Employees who earn at least $2,500 during the base period, which is the first 4 out of the 5 recently completed quarters — or the 4 recently completed quarters.

Official website: Colorado paid family and medical leave

Employees can use the paid family and medical leave for the following reasons:

- For their own severe health problem,

- To bond with a newborn child within one year of its birth,

- To take care of an ill family member,

- For specific family military needs,

- For addressing medical and non-medical needs that are a result of domestic violence, stalking, or sexual abuse. This is also known as “safe leave.”

Both employees and employers fund this program, and employers can deduct up to 50% of the premium from the employees’ wages. Self-employed individuals or local government workers are required to pay only 50% of the premium. If an employer has fewer than 10 employees, they’re not required to pay the employer part of the premium.

The premium deduction is 0.9% of the employee’s wages.

Paid family and medical leave in Connecticut

Status: Effective since 2022.

Weekly benefits:

- For the amount that is equal to 40 times the minimum state hourly wage, employees will receive 95% of their average weekly salary, and

- For the amount that exceeds 40 times the minimum state hourly wage, employees will receive 60% of their average weekly salary.

The maximum amount of weekly benefits is $941.40 (60 times the state hourly minimum).

Length of benefits: Up to 12 weeks.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Workers who earn at least $2,325 during the highest-earning quarter of the base period, which is 4 out of the 5 most recently completed quarters.

Official website: Connecticut paid family and medical leave

Employees can use medical leave for their personal severe health problems. They can use the family leave for the following reasons:

- Bonding with a child within one year of its birth,

- Caring for a family member with a severe health condition,

- Addressing family responsibilities due to a family member’s military obligations, and

- Handling medical or non-medical needs that are a result of domestic violence (safe leave).

The program is funded by employees, who contribute 0.5% of their wages.

Paid family and medical leave in Delaware

Status: The law was enacted in 2022, but the benefits will begin in 2026 (contributions start in 2025).

Weekly benefits: 80% of the employee’s average weekly salary, with the maximum benefit amount being $900.

Length of benefits: Up to 12 weeks for parental leave and 6 weeks (in 24 months) for medical and family caregiving leave.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Workers who meet 2 requirements:

- They must work for the employer for at least 12 months, and

- They must have at least 1,250 work hours for the said employer within those 12 months.

Official website: Delaware paid leave

Employees will be able to use medical leave for their personal severe health problems. Also, they’ll be able to use the family leave for situations such as:

- Caring for a family member with a severe health condition, and

- Handling family responsibilities due to a family member’s military obligations.

What’s more, employees will be able to use parental leave to bond with a newborn child within one year of the child’s birth.

Both employers and employees fund this program. Employers can deduct up to 50% of the premium contribution from the employee’s wages, for a total contribution of 0.4% of the employee’s wages.

Paid family and medical leave in the District of Columbia

Status: Effective since 2020.

Weekly benefits:

- For the amount that is equal to 40 times the 150% of the minimum state hourly wage, employees will receive 90% of their average weekly salary, and

- For the amount that exceeds 40 times the 150% of the minimum state hourly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is $1,118.

Length of benefits: Up to 12 weeks in a 52-week period.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Employees who have worked for the employer for some time during the 52 weeks before the qualifying event.

Official website: DC paid family leave

Employees can use paid family leave to:

- Treat their severe health condition,

- Take pregnancy care,

- Bond with a newborn child within 1 year of its birth, and

- Care for a family member with a severe health problem.

This program is funded by employers, who contribute 0.26% of employees’ wages.

Paid family and medical leave in Maine

Status: The law was enacted in 2023, but the benefits will begin in May 2026 (contributions start in 2025).

Weekly benefits:

- For the amount that is equal to 50% of the average state weekly wage, employees will receive 90% of their average weekly salary, and

- For the amount that exceeds 50% of the average state weekly wage, employees will receive 66% of their average weekly salary.

The maximum amount of weekly benefits is 100% of the average state weekly wage.

Length of benefits: Up to 12 weeks.

Unpaid waiting period: 7 days for medical leave.

Who is eligible: Employees who earn at least 6 times the average weekly wage throughout the base period, which includes the first 4 out of the 5 preceding quarters.

Official website: Maine paid family and medical leave

Employees will be able to use medical leave for their personal severe health conditions. They’ll be able to use family leave to:

- Bond with a newborn child within 1 year of its birth,

- Care for a family member with a severe health problem,

- Handle family responsibilities due to a family member’s military obligations,

- Care for a family member who is a member of the military service, and

- Take a safe leave due to sexual abuse, domestic violence, harassment, or stalking.

Both employers and employees fund the program. Employers can withhold 50% of the premium from the employees’ wages. If an employer has fewer than 15 employees, the employer isn’t required to pay their part of the premium.

Paid family and medical leave in Maryland

Status: The law was enacted in 2022, but the benefits will begin in July 2026 (contributions start in October 2025).

Weekly benefits:

- For the amount that is equal to 65% of the average state weekly wage, employees will receive 90% of their average weekly salary, and

- For the amount that exceeds 65% of the average state weekly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is $1,000.

Length of benefits: Up to 12 weeks.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Employees who work at least 680 hours in the qualifying period, which includes the 4 most recent calendar quarters.

Employees will be able to use the family and medical leave to:

- Treat their own severe health condition,

- Bond with a newborn child within 1 year of its birth,

- Care for a family member with a severe health problem, and

- Handle family responsibilities due to a family member’s military obligations.

Both employers and employees fund the program. Employers can withhold 50% of the premium from the employees’ wages. If an employer has fewer than 15 employees, the employer isn’t required to pay their part of the premium. The total contribution rate amounts to 0.9% of the employee’s wage.

Track your payroll with Clockify

Paid family and medical leave in Massachusetts

Status: Effective since 2021.

Weekly benefits:

- For the amount that is equal to 50% of the average state weekly wage, employees will receive 80% of their average weekly salary, and

- For the amount that exceeds 50% of the average state weekly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is 64% of the state average weekly wage, amounting to $1,150 as of December 2024.

Length of benefits: Up to 20 weeks for medical leave, up to 12 weeks for family leave, and up to 26 for military caregiver leave.

Unpaid waiting period: 7 days unpaid waiting period.

Who is eligible: Workers who earn at least $6,300 during the base period, which is the 4 most recently completed quarters.

Official website: Massachusetts paid family and medical leave

Employees can take a medical leave for their personal severe health condition. They can take a family leave to:

- Bond with a newborn child within 1 year of its birth,

- Care for a family member with a severe health problem,

- Care for a family member injured during military duty, and

- Handle family responsibilities due to a family member’s military obligations.

Both employers and employees fund the program. Employers can withhold 40% of the premium from the employees’ wages. If an employer has fewer than 25 employees, the employer isn’t required to pay their part of the premium. The total contribution rate amounts to 0.88% of the employee’s wage.

Paid family and medical leave in Minnesota

Status: The law was enacted in 2023, but the benefits will begin on January 1, 2026 (contributions start in 2025).

Weekly benefits:

- For the amount that is equal to 50% of the average state weekly wage, employees will receive 90% of their average weekly salary,

- For the amount that exceeds 50% of the average state weekly wage, employees will receive 66% of their average weekly salary, and

- For the amount that exceeds 100% of the average state weekly wage, employees will receive 55% of their average weekly salary.

The maximum amount of weekly benefits is 100% of the state average weekly wage.

Length of benefits: Up to 12 weeks for medical leave, up to 12 weeks for family and safety leave, and a maximum of 20 weeks combined in a year.

Unpaid waiting period: 7 days unpaid waiting period, except for bonding with a newborn child.

Who is eligible: Employees who earn at least 5.3% of the average annual state wage during the base period, which includes 4 of the last 5 recently completed quarters — or the last 4 quarters.

Official website: Minnesota paid leave

Employees will be able to use family and medical leave to:

- Treat their personal severe health condition,

- Bond with a newborn child within 1 year of its birth,

- Care for a family member with a severe health problem,

- Handle family responsibilities due to a family member’s military obligations, and

- Take a safety leave due to sexual abuse, domestic violence, harassment, or stalking.

Both employers and employees fund the program. Employers can withhold 50% of the premium from the employees’ wages. If an employer has fewer than 30 employees, the employer isn’t required to pay their part of the premium. The total contribution rate amounts to 0.7% of the employee’s wage.

Calculate hourly rate with Clockify

Paid family and medical leave in New Jersey

Status: Effective since 2009.

Weekly benefits: 85% of the employee’s average weekly wage. The maximum amount of weekly benefits is 70% of the state average weekly wage, currently $1,055.

Length of benefits: Up to 26 weeks for medical leave, and up to 12 weeks for family leave.

Unpaid waiting period: 7-day unpaid waiting period, but workers can receive benefits for that period if eligible.

Who is eligible: Employees who earn at least 20 times the average hourly minimum wage ($283) in 20 weeks or earn at least 1,000 times the hourly minimum wage ($14,200) in a base period, which includes 4 of the last 5 recently completed quarters.

Official website: New Jersey paid family and medical leave

In New Jersey, medical leave is known as temporary disability insurance (TDI), and employees can use it for their severe injury or illness. They can use the family leave insurance (FLI) to:

- Bond with a child within 1 year of its birth,

- Care for a family member with a severe health problem, and

- Take a safety leave due to sexual or domestic violence.

Employers and employees fund the TDI program. Employees who earn more than $161,400 or less than $42,300 a year aren’t required to pay contributions.

When it comes to FLI, employees cover the total price. The premium amounts to 0.09% of their wages, which doesn’t apply to workers earning more than $161,400 per year.

Paid family and medical leave in New York

Status: Effective since 2018.

Weekly benefits:

- 50% of the employee’s average weekly wage for the employee’s own health problems, maximum of $170 per week, and

- 67% of the employee’s average weekly wage for caring for a family member, a maximum of 67% of the state average weekly wage, amounting to $1,151 as of December 2024.

Length of benefits: Up to 26 weeks for personal disability leave and 12 weeks for family leave. Maximum of 26 weeks in a year.

Unpaid waiting period: 7 days unpaid waiting period for personal disability leave.

Who is eligible: Employees who work at least 4 consecutive weeks for a single employer. For PFL, employees who work at least 26 straight weeks for their current employer.

Official website: New York paid family and medical leave

In New York, medical leave is known as temporary disability insurance (TDI), and employees can use it for their severe injury or illness. They can use the paid family leave (PFL) to:

- Bond with a child within 1 year of its birth,

- Care for a family member with a severe health problem, and

- Handle family responsibilities due to a family member’s military obligations.

Employees and employers fund the TDI program, and employers can withhold 0.5% of the employee’s salary for the coverage (up to $0.60 per week). Employees cover the full cost of the PFL program and are deducted 0,373% of their wages. This doesn’t apply to workers earning more than $1,718 weekly.

Beginning in January 2025, pregnant workers in New York can use an additional prenatal leave for doctor appointments, procedures, and other types of prenatal care.

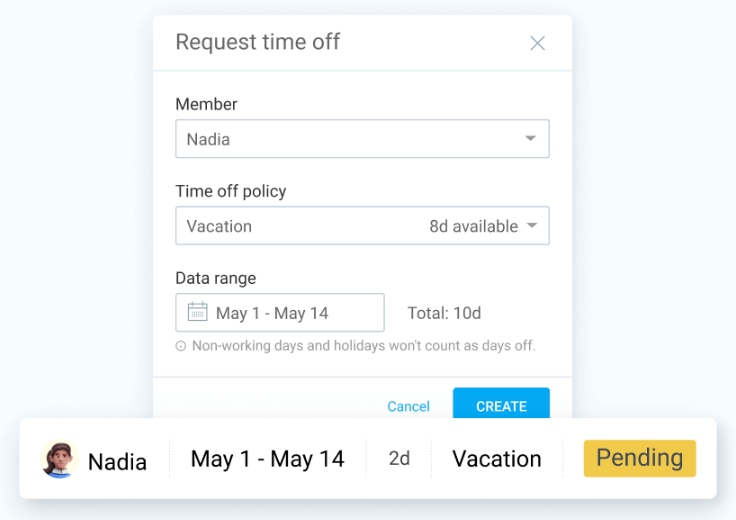

Request time off with Clockify

Paid family and medical leave in Oregon

Status: Effective since 2023.

Weekly benefits:

- For the amount that is equal to 65% of the average state weekly wage, employees will receive 100% of their average weekly salary, and

- For the amount that exceeds 65% of the average state weekly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is 120% of the state average weekly wage, currently $1,523.

Length of benefits: Up to 12 weeks in a year.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Employees who earn at least $1,000 during the base year, which includes 4 of the last 5 recently completed quarters.

Official website: Oregon paid family and medical leave

Employees can take a medical leave to treat their severe health condition. They can use family leave to:

- Bond with a newborn child within 1 year of its birth,

- Take care of a family member with a severe health problem, and

- Address a problem that is a result of sexual assault, domestic violence, stalking, harassment, or bias crimes.

Both employers and employees fund the program. Employers can withhold 60% of the premium from the employees’ wages. If an employer has fewer than 25 employees, they’re not required to pay their part of the premium. The total contribution rate amounts to 1% of the employee’s wage.

Paid family and medical leave in Rhode Island

Status: Effective since 2014.

Weekly benefits: Up to 4.62% of the wages in the highest quarter of the base period (around 60% of the employee’s average weekly salary). The maximum amount of weekly benefits is 85% of the state average weekly wage, currently $1,070.

Length of benefits: Up to 30 weeks for personal health problems, up to 6 weeks for caring for a family member, and a total of 30 weeks in a year.

Unpaid waiting period: No unpaid waiting period.

Who is eligible: Employees who meet the following requirements:

- Earn at least $16,800 during the base period, or

- If earnings are lower, earn at least $2,800 in one quarter of the base period and $5,600 throughout the base period.

The base period includes 4 of the last 5 recently completed quarters.

Official website: Rhode Island paid family and medical leave

In Rhode Island, paid family and medical leave is known as temporary disability insurance (TDI) and temporary caregiver insurance (TCI). Employees can use TDI to treat their severe illness or injury. They can use TCI to:

- Bond with a newborn child within 1 year of its birth, and

- Care for a family member with a severe health problem.

Employees cover the total cost of this leave, and the premium amounts to 1.2% of their wages. This doesn’t apply to employees earning more than $87,000 annually.

Paid family and medical leave in Washington

Status: Effective since 2020.

Weekly benefits:

- For the amount that is equal to 50% of the average state weekly wage, employees will receive 90% of their average weekly salary, and

- For the amount that exceeds 50% of the average state weekly wage, employees will receive 50% of their average weekly salary.

The maximum amount of weekly benefits is 90% of the state average weekly wage, currently $1,456.

Length of benefits: Up to 12 weeks in a year per leave and a total of 16 weeks in a year.

Unpaid waiting period: 7 days unpaid waiting period, except for the birth of a child.

Who is eligible: Employees who work at least 820 hours throughout the qualifying period, which includes 4 of the last 5 recently completed quarters or the last 4 quarters.

Official website: Washington paid family and medical leave

Employees can use medical leave to treat a severe health condition. They can use the family leave to:

- Bond with a newborn child within 1 year of its birth,

- Care for a family member with a severe health problem, and

- Handle family responsibilities due to a family member’s military obligations.

To qualify for this leave, employees must work at least 820 hours throughout the qualifying period, which includes 4 of the last 5 recently completed quarters or the last 4 quarters.

Differences between PFML and other leave programs

In addition to paid family and medical leave, there are other leave programs available to US employees. The 2 most common are the Family and Medical Leave Act (FMLA) and paid sick leave.

Now, we’ll look at the differences between these programs and the PFML.

🎓 For a comprehensive list of differences between leave programs, read the official — U.S. Department of Labor leave comparison

Differences between FMLA and PFML

These 2 programs are quite similar, as employees can use them for the same reasons. However, we’ll look into some key differences below.

| Benefits | Family and Medical Leave Act | Paid family and medical leave |

|---|---|---|

| Compensation | Employees receive unpaid leave. | Employees receive paid leave, and the amount varies from state to state. |

| Job protection | Employees are guaranteed job protection and must be returned to the same or similar position. | Employees aren’t guaranteed job protection. |

| Eligibility | To qualify for the FMLA, employees must work at least 12 months for the employer and at least 1,250 hours during that period. | To qualify for the PFML, employees usually must earn a certain amount in a given period, but this varies from state to state. |

| Coverage | Covers private employers with 50 or more employees. | Covers various employers, but the requirements vary from state to state. |

| Administration | Federal administration. | State administration. |

| Funding | The FMLA requires no funding from employees or employers. | Employees and employers both fund the PFML program, but this varies from state to state. |

Differences between paid sick leave and PFML

Depending on the circumstances, employees can take paid sick leave or paid family and medical leave. Although they’re both paid, there are some major differences between the two.

| Benefits | Paid sick leave | Paid family and medical leave |

|---|---|---|

| Purpose | Paid sick leave is used for minor injuries or illnesses. | Paid family and medical leave can be used for a severe health problem of the employee or the employee’s family member. |

| Duration | A short-term leave that lasts several days. Employees accrue sick leave hours during their work. | A long-term leave usually lasts 12 weeks and sometimes can last up to 26 weeks. |

| Job protection | Employees are guaranteed job protection when returning from paid sick leave. | Employees aren’t guaranteed job protection. |

| Compensation | Employees are paid their regular rate of pay during time off. | Employees are usually paid a percentage of their regular wages during the time off period, though this varies from state to state. |

| Funding | Employers pay for the paid sick leave. | Employees and employers fund the PFML program, but this varies from state to state. |

| Administration | Administered by employers. | State administration. |

| Coverage | Although the requirements vary from state to state, paid sick leave usually covers employers with more than 15 employees. | Covers various employers, but the requirements vary from state to state. |

Frequently asked questions about paid family and medical leave

To make this guide as comprehensive as possible, we’ve included an FAQ section where we’ll answer the most common questions about this topic.

What is considered a base period for paid family and medical leave?

A base period represents the period in which your paid family and medical leave eligibility will be determined. Many states determine the base period as the first 4 out of the last 5 recently completed quarters.

For example, if you are applying for a paid family and medical leave in July of 2024, your base period will look like this:

Q5: April, May, and June of 2024.

Q4: January, February, and March of 2024.

Q3: October, November, and December of 2023.

Q2: July, August, and September of 2023.

Q1: April, May, and June of 2023.

If your state uses the first 4 out of the last 5 recently completed quarters method, you’ll calculate your earnings throughout Q1 to Q4. On the other hand, if your base period is the previous 4 quarters, you’ll calculate the base period for Q2 to Q5.

Keep in mind that each state has its own base period, and make sure to check what it refers to.

How to apply for paid family and medical leave?

The application process for paid family and medical leave will heavily depend on the state where you’re applying. Some states have straightforward processes that you can finish relatively quickly online, while others will take longer.

For example, the application process in Washington looks like this:

- Notify the employer at least 30 days before taking a leave,

- Experience a qualifying event,

- Apply for the leave within 30 days,

- Acquire a decision letter,

- Start the unpaid waiting period, and

- Start receiving wage replacements by filing weekly claims.

Does the US have paid family and medical leave?

Yes, 13 US states and the District of Columbia currently have mandatory paid family and medical leave. Some states have the laws already active, and some will have them in the near future. These states include:

- California (active),

- Colorado (active),

- Connecticut (active),

- Delaware (not active yet),

- District of Columbia (active),

- Maine (not active yet),

- Maryland (not active yet),

- Massachusetts (active),

- Minnesota (not active yet),

- New Jersey (active),

- New York (active),

- Oregon (active),

- Rhode Island (active), and

- Washington (active).

Request time off with Clockify

How long is paid family leave in the United States?

The duration of paid family leave in the US varies from state to state. However, paid family leave usually lasts 12 weeks, and in some cases, it can last up to 26 weeks, depending on the circumstances.

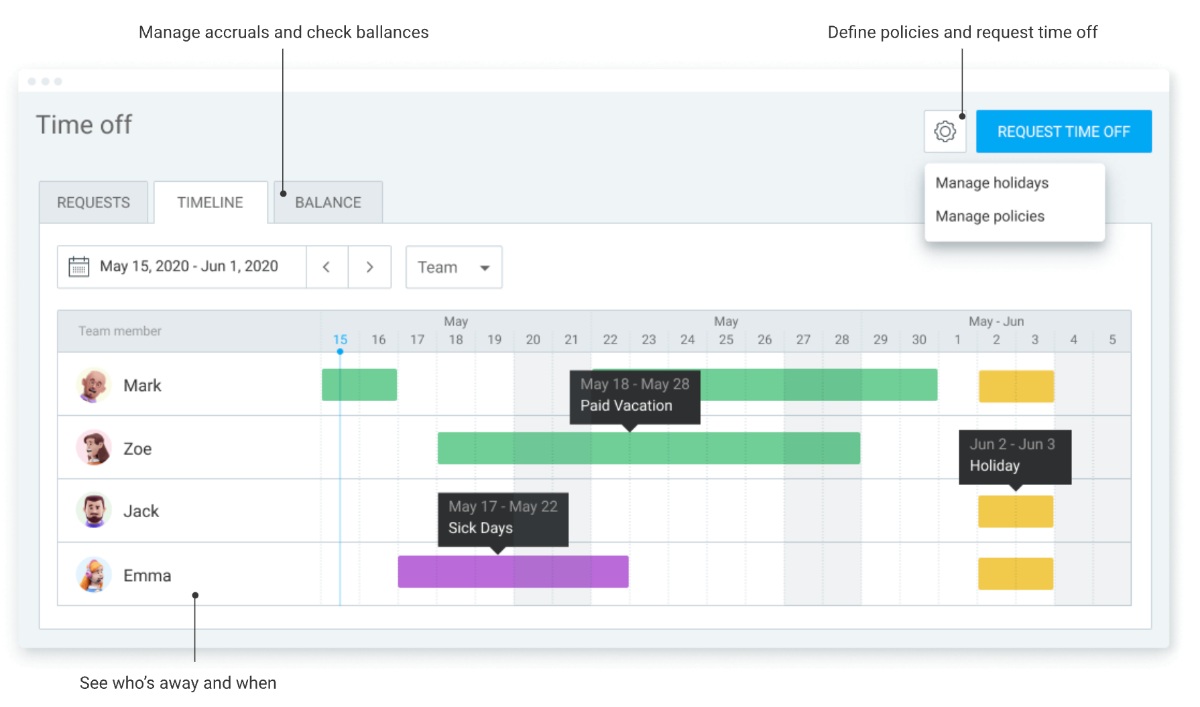

Manage leave policies with Clockify by CAKE.com

Employees have the right to take various types of leaves during their employment, and staying on top of this can be complicated for employers.

Managing leave requests, arranging documents, and tracking attendance reports can be a hefty challenge for even the most experienced managers. That’s why utilizing software that automates this process for you is the key to long-term success.

With Clockify’s time off feature, managing leave policies becomes straightforward, as you can:

- Approve time off requests,

- Manage policies and accruals,

- Send notifications,

- Track attendance reports, and much more.

Moreover, employees can use this feature to request time off. They can select the type of leave they want (vacation, paid sick leave, PTO, PFML, etc.) and the duration.

Later, you can approve or decline the requested leave and notify them via email.

If you want to learn more about Clockify’s time off feature, watch the video below. It provides a detailed explanation of how this feature works:

Start managing your leaves with Clockify today!

Conclusion/Disclaimer

We hope this paid family and medical leave guide will be helpful. Please pay attention to the links provided, which will lead you to the official government websites and other relevant information.

Please note that this guide was written in December 2024, so any changes in the laws that were included later may not be in this guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: December 6, 2024

Published: December 6, 2024