Employees can incur various work-related expenses (e.g., travel expenses, phone expenses, internet expenses, etc.) during their work. Depending on the circumstances, employers may be obliged to cover these expenses.

Many states in the US have enacted laws requiring employers to reimburse employees for expenses incurred during work. This helps employees preserve their income.

Although cost refunds are usually associated with on-site workers, with the rise of remote work, employees working from home can also receive reimbursement for their expenses.

Some of these can come in the form of cell phone reimbursement, internet stipends, electricity reimbursements, and others.

In this article, we’ll review current federal and state legislation on expense reimbursement legislations in the US.

- Expense reimbursement is when costs that employees receive during their work are refunded.

- Federal law states that all expenses employees incur throughout their work, which would bring their earnings below the federal minimum of $7.25 per hour, must be reimbursed by the employer.

- Currently, 12 states, plus the District of Columbia and Seattle, have expense reimbursement laws.

- To better manage employee expense reimbursements, companies should create expense reimbursement policies.

Federal law on expense reimbursement

Although no federal law administers expense reimbursement, the Fair Labor Standards Act (FLSA) may come into play. Namely, employers must reimburse employees for expenses they incur throughout their work if said expenses would bring the employee’s earnings under the federal minimum of $7.25 per hour (which is a matter regulated by the FLSA).

This reimbursement applies to remote and on-site workers and covers work expenses incurred by the employee.

For instance, an employee earns $9.00 per hour but has work-related expenses that amount to $3.00 per hour (e.g., internet, electricity, etc.). These expenses bring the employee’s earnings to $6.00 per hour, which means he earns less than the federal minimum, and the employer must reimburse these costs.

Expense reimbursement laws by states

Due to the federal law covering only employees who earn less than $7.25 per hour when their expenses apply, many US states have enacted their own expense reimbursement laws.

These laws generally apply to on-site employees but can also apply to remote workers who are unable to perform their jobs on-site.

Let’s take a more detailed look at expense reimbursement laws by state in the table below:

| State | Legislation | Expense reimbursement regulations |

|---|---|---|

| California | California Code, LAB 2802. | Necessary expenditures or losses which are a direct consequence of the employee performing their duty (e.g., taxi driver paying for fuel). |

| District of Columbia | D.C. Municipal Register Rule 7.910.1 | Expenses incurred for purchasing and maintaining tools required for work in the employer’s business. |

| Illinois | Wage Payment and Collection Act | Necessary expenditures or losses the employee incurs during their job directly related to the employer’s business. |

| Iowa | Iowa Code 91A.3 | Employee expenses authorized by the employer must be paid in advance or reimbursed within 30 days of the employee claiming the expense. |

| Massachusetts | Massachusetts General Law Chapter 148 | Expenses that would bring the employee’s earnings below the state minimum of $15 per hour. Also, the Massachusetts Attorney General’s Office recommends reimbursing unnecessary and unavoidable expenses employees incur during their work. |

| Minnesota | Minnesota Statute 177.24 | Once the employee’s contract is terminated, the employer must reimburse the total amount the employee spent on purchasing or renting the tools required for work, except for tools that can be used outside of their employment. |

| Montana | Montana Code 39-2-701 | Necessary expenses that are a direct consequence of the employee performing their work duties. |

| New Hampshire | New Hampshire Revised Statutes Title 23 | Expenses that the employee incurs in connection with their employment, if not paid in advance, must be reimbursed by the employer within 30 days of the employee’s claim. |

| New York | New York Labor Law 198-C | If an employer agrees to reimburse employee expenses, they must refund them within 30 days of the request. |

| North Dakota | North Dakota Century Code | Necessary expenses the employee incurs as part of their work for the employer. |

| Pennsylvania | Wage Payment and Collection Law | If an employer agrees to reimburse employee expenses, they must refund them within 60 days of the request. |

| South Dakota | South Dakota Codified Laws | Necessary expenses the employee incurs as part of their work for the employer. |

| Washington | Washington Department of Labor & Industries | Reimbursements aren’t required except the ones stated in the FLSA. However, unreimbursed expenses are tax deductible, and employees can use them to lower their taxable income. |

| Seattle, Washington | Seattle Wage Theft Law | Expenses that incur as a reason for the employee’s employment. |

What is considered a necessary expense?

As you can see, most state laws mentioned above use the term “necessary expense.” The question is, what is actually considered a necessary expense?

Simply put, necessary expenses are costs that employees must pay throughout their work, which employers are required to reimburse. When it comes to on-site workers, a good example would be a salesman who has to travel from point A to point B as a part of their regular work schedule. In this case, the employer would have to reimburse the employee’s gas costs as a mandatory expense.

However, determining necessary costs is more challenging for remote employees, as they can have many expenses, such as:

- Internet bills,

- Cell phone bills,

- Electricity, and more.

Employees required to work remotely can consider these expenses as “necessary expenses” and ask their employer for reimbursement if required by their state law.

Moreover, employees who aren’t US citizens might require an EAD (Employee Authorization Document) reimbursement, as acquiring this document will incur several costs. This can also count as a necessary cost and be reimbursed, depending on the state.

🎓 Tracking expenses every month helps you save money and boost revenue! To learn more about this topic, check out our article: Smart Ways for Monthly Expense Tracking

How to create a reimbursement policy

Having a reimbursement policy is a great way to build employee trust and increase their satisfaction. This type of policy doesn’t have to be anything complicated, and it can simply outline business expenses that can be reimbursed.

For instance, a mobile reimbursement policy can include cell phone reimbursement for employees who use cell phones for work.

Here are several steps you should consider when making a reimbursement policy.

- Define reimbursable expenses — ensure that employees know which costs can be reimbursed and which can’t,

- Create a protocol for expense reporting — you must create a clear policy your employees can use to report their expenses. For example, you can require them to send you an expense report or a simple receipt, and

- Establish an approval process — create clear deadlines for reimbursement and ensure your employees know how long it will take you to cover their costs.

A reimbursement policy isn’t only beneficial for your employees, as you can also use reimbursement as a tax deduction. According to the IRS Publication 15, whether reimbursements can be tax-deductible depends on what reimbursement plan you choose:

- Accountable plan — amounts paid under this plan aren’t taxable. To qualify for an accountable plan, your employees must meet the following requirements:

- They must incur the expense as your employee,

- They must submit the expense within a reasonable time, and

- They must return the excess amount paid to them.

- Nonaccountable plan — amounts paid under this plan are taxable. Expenses are considered unaccountable if:

- The employee doesn’t have receipts or other documentation,

- The employee doesn’t return the excess amount if the reimbursement was paid in advance,

- The employee receives the funds upfront regardless of whether he has an expense or not, and

- The paid amount would otherwise be paid as wages to the employee.

Frequently asked questions about reimbursement policy laws

To make this guide as comprehensive as possible, we have included an FAQ section to review the most common questions about this topic.

Can my company refuse to reimburse expenses?

Yes, if your state doesn’t mandate expense reimbursement, your employer isn’t required to reimburse your expenses. This applies to expenses that aren’t considered necessary and that would not bring your wage below the federal minimum salary of $7.25 per hour.

What is an expense reimbursement policy?

An expense reimbursement policy is a set of rules and guidelines companies use to regulate expense reimbursement. This policy often includes regulations regarding what expenses can be refunded and how employees should report them.

Do reimbursements have to go through payroll?

This depends on whether the reimbursements are part of an accountable or nonaccountable plan:

- Reimbursements that are part of an accountable plan don’t go through payroll and aren’t subject to income taxes, and

- Reimbursements that are part of a nonaccountable plan go through payroll and are part of wages.

Use Clockify for comprehensive expense tracking and reporting

“You can’t manage what you don’t measure.”

This is a famous quote by educator, author, and management consultant, Peter Drucker, that emphasizes the importance of tracking and measuring something to manage and improve it more effectively.

Although you can apply this quote to many aspects of your business, it is especially useful for tracking finances and expenses.

However, tracking expenses on your own isn’t easy, as you can easily make mistakes when calculating large numbers.

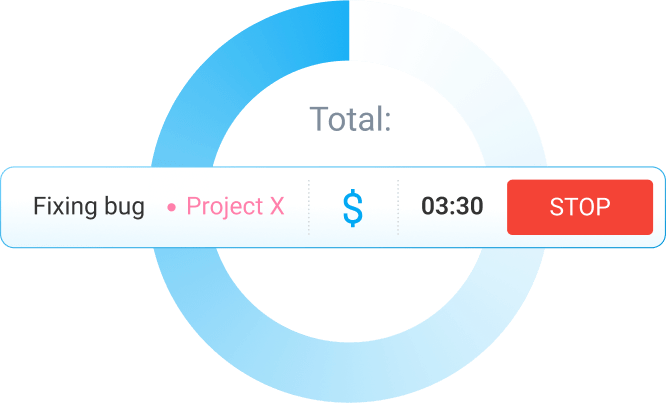

That’s where time and expense tracking software such as Clockify comes in!

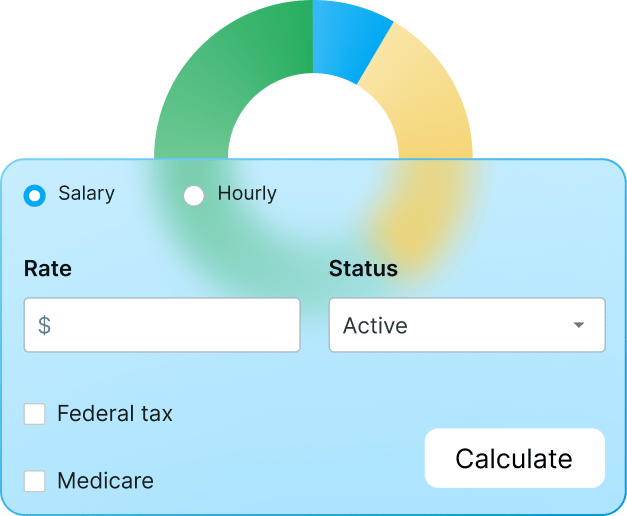

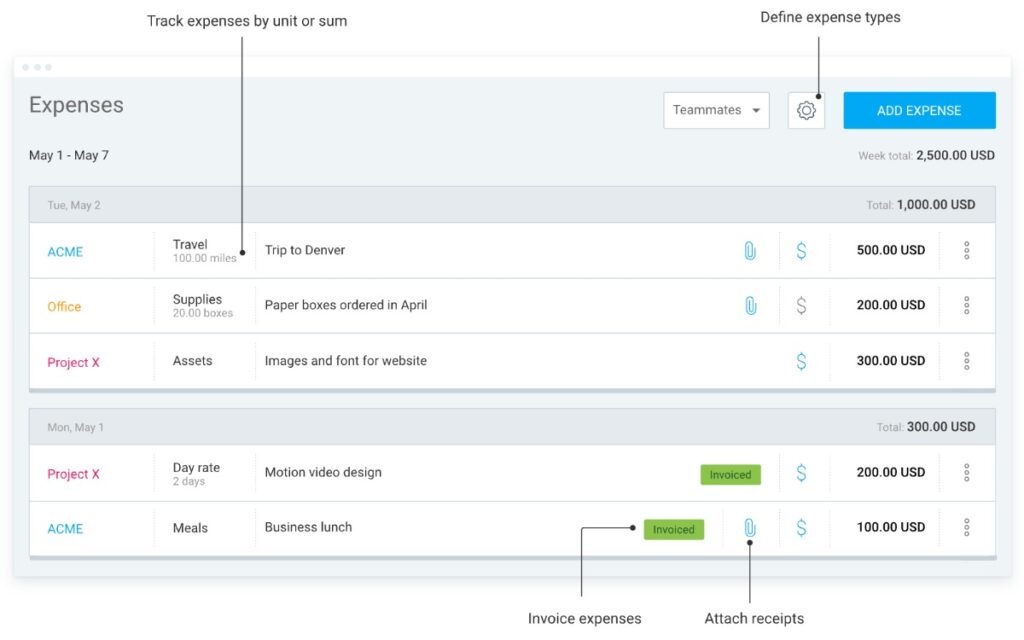

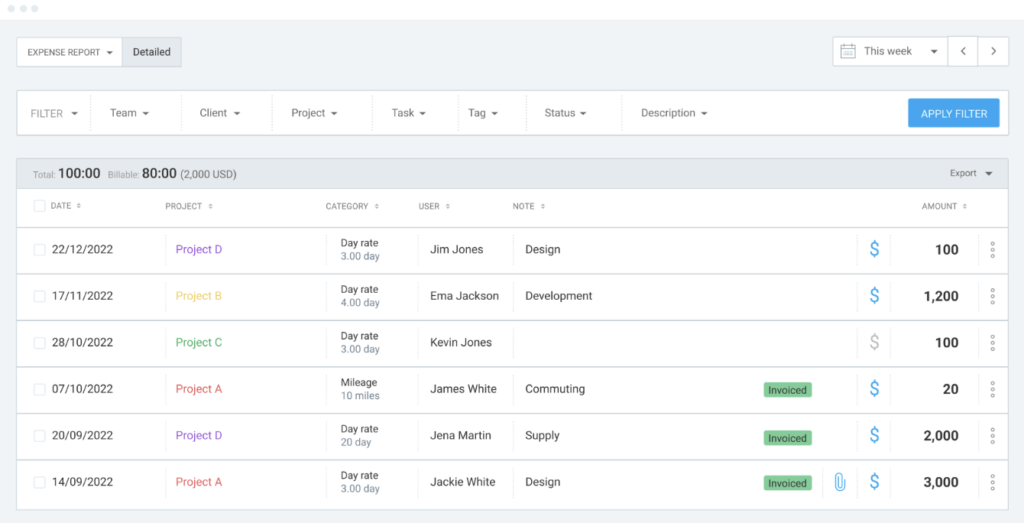

With its expenses feature, Clockify allows you to track and categorize all your costs.

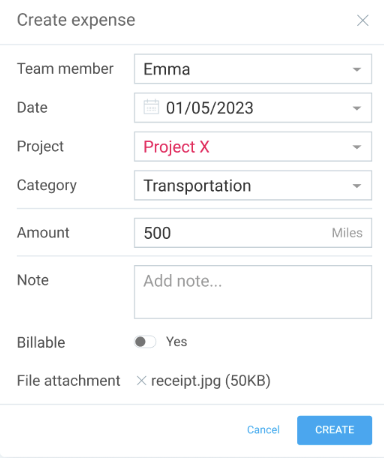

You can easily add new expenses by clicking the “Add expense” button. Every expenditure has its individual details, such as:

- Who is it for,

- Date,

- Project,

- Category,

- Amount, and

- Receipt.

Once you have all your business expenditures in one place, you can download them from your expense report with a single click.

The report shows you all the necessary details, such as user, date, category, and amount.

To learn more about tracking your expenses in Clockify, watch the video below.

Clockify is simple, efficient, and reliable! Everything you need from time and expense tracking software.

Start tracking your expenses for FREE today

Conclusion/Disclaimer

We hope this expense reimbursement guide covering US states will be helpful. Please pay attention to the links provided, which will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q1 of 2025, so any changes in the laws that were included later may not be in this guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: January 28, 2025

Published: January 28, 2025