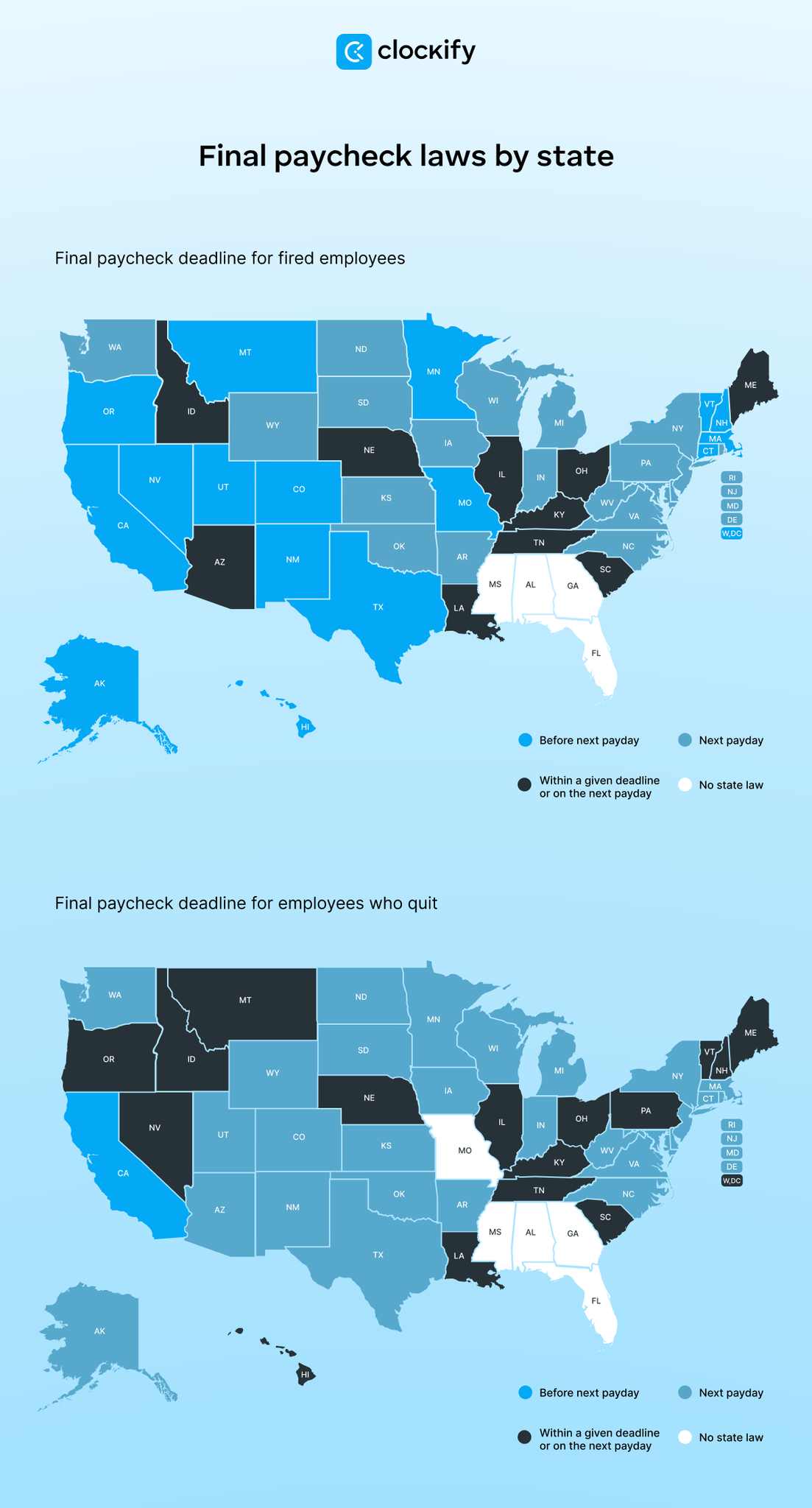

An employment relationship can end due to various reasons. As for the federal law, it clearly states that employers must issue a final paycheck to all terminated employees by the next scheduled payday.

However, state laws can (and many do) require final paychecks to be due within a specific, shorter deadline.

For example, a Colorado employee who quits must be compensated for their work on the next payday.

Knowing the state requirements benefits both employers and employees, as employees can know when to expect their final paycheck and employers can stay compliant with labor laws.

If you’re interested in more details, read on, because we’ve meticulously researched the topic and gathered the final paycheck laws by state for 2025.

- Final paycheck is the last amount of wages an employee may get from the employer.

- The federal law states that employers must pay final paychecks on the next regular payday or before.

- Many states have their own rules regarding deadlines for the payment of final paychecks.

- The deadline for paying final paycheck to the employee will depend on whether the employee quit or was fired.

*Note: The information regarding final paycheck laws and regulations by state has been checked and updated for 2025.

What are final paychecks?

A final paycheck is the final amount of money an employee receives from their employer. It usually consists of the employee’s unpaid wages and other earnings.

As a part of their last paycheck, employees can receive the following:

- Unpaid wages,

- Overtime,

- Unused vacation or PTO days,

- Commissions owed,

- Bonus pay, and

- Severance pay.

🎓 Not sure how to calculate the accrued PTO? Here’s a comprehensive guide on the topic — PTO Payout Laws by State

What are the deadlines for issuing final paychecks?

The termination of an employment contract can occur for many reasons — both from the employer’s and the employee’s end. Some of these reasons may include an employee’s voluntary resignation due to relocation or termination due to gross misconduct.

Nonetheless, it’s important to emphasize that these specific reasons (e.g. the previously mentioned termination due to gross misconduct) won’t impact the deadlines for issuing final paychecks.

However, many states determine deadlines depending on who decides to terminate the employment relationship.

Therefore, the final paycheck deadline will be different for:

- Employees who give notice and resign at their own will, and

- Employees whose contracts are terminated for any reason.

For example, in the District of Columbia, employees who resign at their own will are due their next paycheck within 7 days or on the next scheduled payday. However, final paychecks for fired employees are due on the next business day.

Final paycheck laws by state

According to federal law, all final paychecks are due by the next scheduled payday unless state regulations specify a shorter period. As termination requirements by state can vary, some states require employers to pay employees immediately, while others give them a timeframe to make the payment.

The table below contains all the information you need regarding final paycheck laws by state for 2025, so let’s move on to it. If the state has no reference link to it, it’s because the said state follows federal final paycheck laws.

| State | When an employee is terminated | When an employee quits | Penalties for not issuing the final paycheck on time |

|---|---|---|---|

| Alabama | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Employers can face criminal and civil penalties. |

| Alaska | Final paycheck must be issued within 3 business days of the employee’s last work day. | Final paycheck due on the next scheduled payday — at least 3 days apart from the employee’s notice of termination. | If an employer fails to pay the final paycheck on time, they may continue to pay the employee their regular wage from the day of demand up to the day of payment. This payment can’t exceed 90 days. |

| Arizona | Final paycheck is due within 7 business days of the employee’s last work day or on the next scheduled payday (whichever occurs first). | Final paycheck is due on the next scheduled payday. | If an employer doesn’t issue the paycheck on time, they’ll be guilty of a petty offense. |

| Arkansas | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer fails to issue the final paycheck within 7 days of the scheduled payday, the amount they owe to the former employee doubles. |

| California | Final paycheck must be issued immediately. | Final paycheck is due immediately for employees who provide at least a 72-hour written notice. If an employee doesn’t give a 72-hour prior notice, the final paycheck is due within 72 hours of quitting. | If an employer fails to issue the final paycheck within that deadline, waiting time penalties will be added to the amount. |

| Colorado | Final paycheck is due immediately unless the payroll unit is closed (deadline extends to up to 6 hours into the next business day) or the accounting unit is based offsite (deadline extends to 24 hours). | Final paycheck is due on the next scheduled payday. | If an employer fails to pay the final paycheck on time, they may continue to pay the employee their regular wage from the day of demand up to the day of payment. This payment can’t exceed 10 days. |

| Connecticut | Final paycheck is due on the next business day. | Final paycheck is due on the next scheduled payday. | If an employer fails to pay the owed wages in time, they may pay a penalty of $200 to $5,000 per violation. |

| Delaware | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer doesn’t issue the final paycheck on time, they may pay the employee up to 10% of their regular wage for every day of being late or the amount equal to unpaid wages. |

| District of Columbia | Final paycheck is due on the next business day. | Final paycheck must be issued within 7 days of the employee’s last day of work or on the next scheduled payday (whichever is sooner). This applies to employees with no written contract of employment for a period over 30 days. | If an employer fails to issue the final paycheck within that deadline, they must pay 10% of the unpaid wages for every workday or triple the unpaid wages, whichever amount is smaller. |

| Florida | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Employers can face criminal and civil penalties. |

| Georgia | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Employers can face criminal and civil penalties. |

| Hawaii | Final paycheck is due immediately unless the conditions don’t allow for it (e.g., holidays), in which case the deadline extends to the next business day. | Final paycheck is due on the next scheduled payday, unless the employee gives notice at least one regular pay period in advance, in which case it is due immediately. | If an employer fails to pay the owed wages in time, they may pay a penalty of not less than $500 or $100 for each violation, whichever is greater. |

| Idaho | Final paycheck is due on the next scheduled payday or within 10 days of the employee’s last day (weekends and holidays excluded). If the employee submits a written request for an early last payment, the payment is due within 48 hours. | Final paycheck is due on the next scheduled payday or within 10 days of the employee’s last day (weekends and holidays excluded). If the employee submits a written request for an early last payment, the payment is due within 48 hours. | If an employer fails to issue the final paycheck within that deadline, they may be required to pay a penalty of up to $750. |

| Illinois | Final paycheck is to be issued no later than the next scheduled payday. | Final paycheck is to be issued no later than the next scheduled payday. | If an employer fails to issue the final paycheck within that deadline, they may be required to pay a penalty of up to $500 per violation. |

| Indiana | Final paycheck is due on or before the next scheduled payday. | Final paycheck is due on or before the next scheduled payday. | If an employer fails to issue the final paycheck within that deadline, the amount they owe can be doubled if they acted in bad faith. |

| Iowa | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | Employers can face criminal and civil penalties. |

| Kansas | Final paycheck is due on the next scheduled payday, at the latest. | Final paycheck is due on the next scheduled payday, at the latest. | If an employer fails to do so, they’ll pay an additional penalty of 1% of the unpaid wages for each work day or 100% of the unpaid wages, whichever amount is less. |

| Kentucky | Final paycheck is due on the next scheduled payday or within 14 days of the employee’s last working day (whichever option occurs later). | Final paycheck is due on the next scheduled payday or within 14 days of the employee’s last working day (whichever option occurs later). | Employers can face criminal and civil penalties. |

| Louisiana | Final paycheck is due on the next scheduled payday or within 15 days of the employee’s last working day (whichever occurs first). | Final paycheck is due on the next scheduled payday or within 15 days of the employee’s last working day (whichever occurs first). | If an employer fails to pay the final paycheck on time, they may continue to pay the employee their regular wage from the day of demand up to the day of payment. This payment can’t exceed 90 days. |

| Maine | Final paycheck is due on the next scheduled payday or within 2 weeks of the demand (whichever occurs first). | Final paycheck is due on the next scheduled payday or within 2 weeks of the demand (whichever occurs first). | If an employer fails to issue the final paycheck within that deadline, the amount they owe can be doubled. The total amount will also include a reasonable interest rate and the cost of the lawsuit. |

| Maryland | Final paycheck is due on the next scheduled payday, at the latest. | Final paycheck is due on the next scheduled payday, at the latest. | Employers can face criminal and civil penalties. |

| Massachusetts | Final paycheck is due immediately. | Final paycheck is due on the next scheduled payday or the following Saturday. | If an employer fails to issue the final paycheck within the deadline, they’ll pay up to 3 times the original amount. |

| Michigan | Final paycheck due on the next scheduled payday. | Final paycheck due on the next scheduled payday. | If an employer fails to issue the paycheck within the deadline, they may pay a penalty of up to 10% of the wages on an annual basis. For repeated violations, employers may pay up to twice the amount of the owed wages. |

| Minnesota | Final paycheck is due within 24 hours of submitting a written payment request, which is mandatory. If the written demand for payment isn’t submitted, the final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday, which is at least 5 days away. Nonetheless, the salary must be paid within 20 days of the separation. | If an employer fails to issue the final paycheck within that deadline, the amount may increase for up to 15 days’ worth of the employee’s wages. |

| Mississippi | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | Employers can face criminal and civil penalties. |

| Missouri | Final paycheck is due immediately. | Not regulated by the state law. Federal law applies (final paycheck due on the next scheduled payday). | If an employer fails to pay the final wages to an employee, the employer is responsible for paying additional wages. |

| Montana | Final paycheck is due immediately, either within 4 hours of the termination or at the end of the business day, whichever comes first. | Final paycheck is due on the next scheduled payday or within 15 calendar days, whichever is sooner. | If an employer fails to issue the final paycheck within that deadline, they may pay a penalty of up to 110% of the final wages. |

| Nebraska | Final paycheck is due on the next scheduled payday or within 2 weeks of the employee’s last working day (whichever option occurs first). | Final paycheck is due on the next scheduled payday or within 2 weeks of the employee’s last working day (whichever option occurs first). | If an employer fails to issue the final paycheck on time, they may pay additional penalties of up to 10% of the owed amount. |

| Nevada | Final paycheck is due within 3 days of the employee’s last working day. | Final paycheck is due on the next scheduled payday or within 7 days of the employee’s last working day, whichever occurs first. | Employers who don’t issue the final paycheck on time can face fines. |

| New Hampshire | Final paycheck is due within 72 hours of the employee’s last working day. | Final paycheck is due on the next scheduled payday unless the employee gives notice at least one pay period ahead, in which case the deadline is 72 hours. | Employers who don’t issue the final paycheck on time can face fines. |

| New Jersey | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer fails to pay the owed wages in time, they may pay a penalty of $100 to $1000 per violation. |

| New Mexico | Final paycheck is due within 5 days of the employee’s last working day, except for commission-based employees, whose deadline is 10 days. | Final paycheck due on the next scheduled payday. | Employers who don’t issue the final paycheck on time can face fines. |

| New York | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | Employers can face criminal and civil penalties. |

| North Carolina | Final paycheck is due on or before the next scheduled payday. | Final paycheck is due on or before the next scheduled payday. | Employers can face criminal and civil penalties. |

| North Dakota | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer fails to issue the final wages within that deadline, they may pay a penalty, which is 10 days of owed wages or 125% of the owed amount, whichever is greater. |

| Ohio | Final paycheck is due on the next scheduled payday or within 15 days of the employee’s last working day (whichever option occurs first). | Final paycheck is due on the next scheduled payday or within 15 days of the employee’s last working day (whichever option occurs first). | If an employer fails to issue the final paycheck within that deadline, they may pay damages of up to 6% of the unpaid wages or $200, whichever is greater. |

| Oklahoma | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer fails to issue the final paycheck within that deadline, they may pay a penalty of up to 2% of the unpaid wages for every day of being late. |

| Oregon | Final paycheck is due on the next business day. | Final paycheck is due on the last day of employment if an employee provides a 48-hour notice. In the case of a shorter notice, the final paycheck is due within 5 business days or on the next scheduled payday (whichever is sooner). | If an employer fails to issue the final paycheck within that deadline, they may be charged a penalty wage of 8 times the employee’s regular rate for each day of unpaid wages. |

| Pennsylvania | Final paycheck is due on the next scheduled payday or within the standard established timeframe by the employer (whichever occurs first). | Final paycheck is due on the next scheduled payday or within 15 days (whichever occurs first). | Employers can face criminal and civil penalties. |

| Rhode Island | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | Employers can face criminal and civil penalties. |

| South Carolina | Final paycheck is due within 48 hours of the employee’s last working day or on the next scheduled payday, whichever occurs first (the period between mustn’t exceed 30 days). | Final paycheck is due within 48 hours of the employee’s last working day or on the next scheduled payday, whichever occurs first (the period between mustn’t exceed 30 days). | Employers can face criminal and civil penalties. |

| South Dakota | Final paycheck is due on the next scheduled payday, or if applicable, when the employee returns all company property. | Final paycheck is due on the next scheduled payday, or if applicable, when the employee returns all company property. | Employers can face criminal and civil penalties. |

| Tennessee | Final paycheck is due on the next scheduled payday or within 21 days of the employee’s last working day (whichever option occurs later). | Final paycheck is due on the next scheduled payday or within 21 days of the employee’s last working day (whichever option occurs later). | If an employer fails to pay the owed wages in time, they may pay a penalty of $100 to $500 per violation. |

| Texas | Final paycheck is due within 6 days of the employee’s last working day. | Final paycheck is due on the next scheduled payday. | If an employer fails to issue the final paycheck within that deadline, the employee’s wages will continue at the same rate, for up to 60 days. |

| Utah | Final paycheck is due within 24 hours of the employee’s last working day. | Final paycheck is due on the next scheduled payday. | Employers can face criminal and civil penalties. |

| Vermont | Final paycheck is due within 72 hours of the employee’s last working day. | Final paycheck is due on the next scheduled payday. If there are no scheduled paydays, the deadline is Friday the week after the employee’s last work day. | Employers can face criminal and civil penalties. |

| Virginia | Final paycheck is due on the next scheduled payday. | Final paycheck is due on the next scheduled payday. | If an employer fails to pay the owed wages in time, they may pay a penalty of up to $1000 per violation. |

| Washington | Final paycheck is due on or before the next scheduled payday. | Final paycheck is due on or before the next scheduled payday. | If an employer fails to pay the owed wages in time, they may pay a penalty of up to $1000 per violation or 10% of the owed wages, whichever is greater. |

| West Virginia | Final paycheck is due on or before the next scheduled payday. In case of a layoff, the final paycheck is due the next scheduled payday. | Final paycheck is due on or before the next scheduled payday. | If an employer fails to issue the final paycheck within that deadline, the amount they owe to a former employee doubles. |

| Wisconsin | Final paycheck is due according to the regular employer’s payday schedule. | Final paycheck is due according to the employer’s payday schedule. | Employers can face criminal and civil penalties. |

| Wyoming | Final paycheck is due according to the employer’s regular payday schedule. | Final paycheck is due according to the employer’s regular payday schedule. | If an employer fails to issue the final paycheck within that deadline, they’ll pay a penalty of up to $200 for each day of being late. |

🎓 For more information on labor laws in US states, read our comprehensive labor law guides — State Labor Laws Guides

Frequently asked questions about final paycheck laws

To make this guide as comprehensive as possible, we’ve included an FAQ section where we’ll answer common questions about this topic.

What is the federal final paycheck law?

Final paychecks in the US are regulated by the federal Fair Labor Standards Act (FLSA) and by individual state laws. Under federal law, employers must issue final paychecks to all terminated employees on the next regularly scheduled payday, if not sooner.

Several states in the US don’t have state laws regarding final paychecks. Therefore, they rely solely on federal law. These states include:

- Alabama,

- Florida,

- Georgia,

- Mississippi, and

- Missouri (federal regulations apply only to employees who quit).

Federal employment laws establish rights and responsibilities for all US employees, while state laws apply only within the particular state borders. So, which one governs if both exist?

If a state law doesn’t conflict with federal regulations, state law governs, overriding federal law. In rare instances when there’s a conflict between the two, The Supremacy Clause dictates that federal law takes precedence.

What is the Wage Payment and Collection Act?

Put simply, the Wage Payment and Collection Law regulates employers’ rights, limitations, and requirements regarding:

- Compensation and benefits,

- Payroll period and processes, and

- Deductions.

The law was introduced in Pennsylvania in 1961 to ensure all employees are fairly and timely compensated for their work. Specifically, it refers to the right of an employee to request help in the recovery of unpaid wages, as outlined in an employment contract.

The law is an extension of the FLSA and is still in force today. Although it doesn’t apply on the federal level, many other US states have adopted this Act.

Can an employer withhold a final paycheck?

Technically, the answer is yes. However, that applies only if the employee has previously agreed to certain terms and conditions, enabling the employer to take deductions from the final paycheck.

Below are a couple of examples of when employers are legally allowed to withhold a final paycheck from former employees:

- Employers are claiming a debt/reimbursement (e.g., for cash shortages, lost, broken, or missing equipment, etc.), or

- Employers have authorized the employee by signing a contract agreeing to certain deductions (e.g., court-ordered wage garnishments, insurance payments, personal loans, etc.).

In such (and similar) instances, employers may hold onto the amount in question, provided they have proof of such an agreement.

Can an employer hold your last paycheck if you quit?

No, employers can’t hold your final paycheck if you quit.

Regardless of the state and reason for the employment termination, all US employers are legally required to issue final paychecks to their former employees.

Although there’s no exception to the rule, conditions and legal requirements for final paychecks vary by state. Therefore, it’s crucial to be familiar with the ones applicable to your situation.

When should an employee receive their final pay?

Well, there’s no one-size-fits-all answer to this, as several possibilities exist, depending on:

- State regulations — many states use their own deadlines for final paychecks. If a state has no regulations on this matter, federal rules will apply (final paychecks are due on the next scheduled payday, or sooner), and

- Reasons for employment termination — deadlines will vary depending on whether the employee was fired, laid off, or resigned voluntarily.

Depending on the scenario, some employees are eligible for immediate payment, while others can expect their final paycheck on the next scheduled payday, or within a certain time period.

Will an employee’s last paycheck be directly deposited?

This depends on how you were previously issued your payroll — you will receive the payment in the same manner as when you received your previous paychecks.

If you’ve been receiving payment via direct deposit, your last paycheck will also be directly deposited. However, companies can offer employees an additional choice of payment type for the final paycheck only.

For example, even an employee who’s usually been receiving checks via mail can opt for the direct deposit option for the final paycheck.

As we mentioned, this is regulated by the company’s policy. Employers are only allowed to add more options. Employees who are unsure of what applies to their situation should simply revise their employment contract.

🎓 If you’re a small business owner in need of some guidance with payroll management, this guide will be useful — How to Do Payroll For Small Business

I quit my job and never got my last paycheck. What can I do?

The fact that an employee decided to terminate the contract doesn’t change the fact that it is illegal for employers to withhold unpaid wages from former employees.

If such an instance occurs, employees are eligible to file an official complaint to the Wage and Hour Division of the US Department of Labor.

Employees who want to recover unpaid wages must fill out the Workers Owed Wages application and submit it to the government database for processing.

For any additional questions and inquiries, it’s best to contact your state labor office directly.

How long can an employer hold your last paycheck if you quit?

Employees whose contract has been terminated — both voluntarily and involuntarily — may be due their final paycheck:

- Immediately,

- Within 72 hours,

- On the next scheduled payday, or

- Once they have returned all company equipment.

The table we’ve provided in the section above contains all the relevant information regarding individual states.

Use Clockify for accurate payroll tracking

Tracking payroll is essential for every business, as it ensures that your employees are always paid the right amount and on time.

Tracking payroll on your own can lead to multiple errors and compromise the wages of your employees.

That’s why using a payroll tracking software such as Clockify makes payroll easier for you and your team.

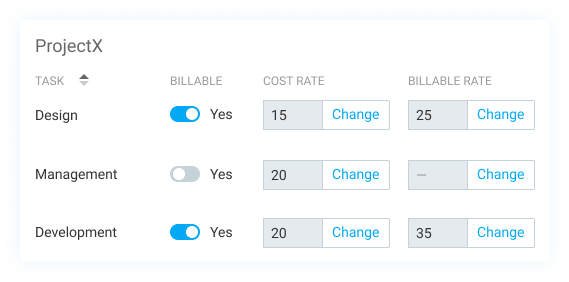

With Clockify you can set wage rates for every task, project, or employee.

Once wages are set, your employees can track their work hours and Clockify will calculate their wages accordingly.

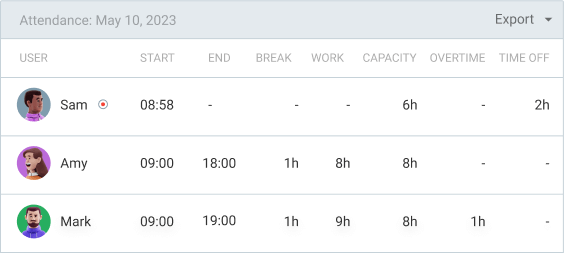

In Clockify you can easily see your employee work hours, start/end times, overtime hours, and much more.

Start using Clockify today and revolutionize your time tracking!

Conclusion/Disclaimer

We hope that our thorough guide has helped you become familiar with all the relevant information about final paycheck laws in the United States. You can get more data on final paycheck laws for each state by following the official links we provided.

Please bear in mind — this final paycheck laws guide was checked and updated in Q1 of 2025. Thus, it may not include changes introduced after it was published.

We strongly advise you to consult the appropriate institutions and/or certified representatives before taking any legal action.

Clockify is not responsible for any losses or risks incurred should this guide be used without legal guidance.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant.