Workplace discrimination can be quite common, and there are many ways an employee can be discriminated against in the workplace or even during the hiring process.

One of the most common ways an employee can be discriminated against is in terms of pay equity. Certain groups of employees (e.g., female workers) sometimes earn smaller salaries than their male colleagues working on the same jobs.

Moreover, employers sometimes offer smaller wages to job candidates during the hiring process, therefore discriminating against them.

Due to this, countries worldwide have started to implement pay transparency. These regulations protect employees by requiring employers to disclose salary information and other compensation details about job positions.

For example, employers must disclose the minimum and maximum salary for a certain position, and they must also include benefits and bonuses.

In this article, we will look at pay transparency in general and pay transparency laws by state in the US.

- Transparent salaries protect employees from any type of salary discrimination.

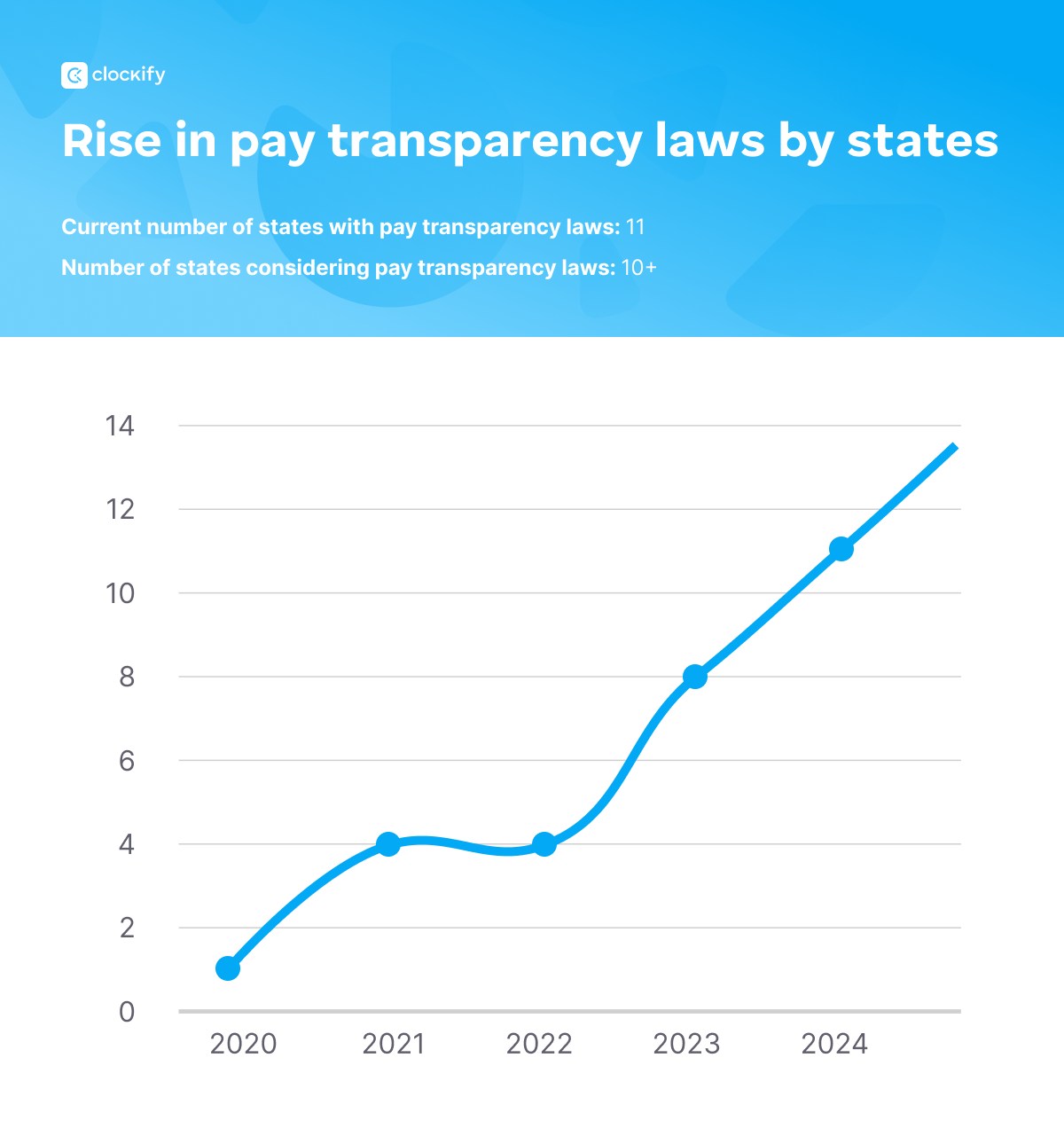

- Currently, there are a total of 10 states with pay transparency laws in the US.

- Some cities have their own pay transparency regulations (e.g., New Jersey City).

- Many US states are considering implementing wage transparency laws in the future.

- A salary history ban forbids employers from inquiring about the salary history of job candidates.

What is pay transparency?

Pay transparency is a common practice that requires employers to share compensation and other important details (e.g., benefits) with job candidates and the public.

Employers are required to share this information with employees or job candidates in the job postings or upon request.

This employment practice makes the hiring process equal and fair to every potential employee and decreases the gender wage gap, race discrimination, or any other type of discrimination in terms of compensation.

To ensure that this rule is upheld, some states have adopted pay transparency laws. The first state to adopt a wage transparency law was California, back in 2018.

Pay transparency laws may require employers to disclose information such as:

- Salary information — states with wage transparency laws require employers to provide salary ranges for job positions. Employers must disclose the salary range upon request and sometimes even in the job posting.

- General description of benefits and bonuses — some job positions include bonuses and additional benefits employees can receive. This information must also be disclosed upon request or in the job posting.

- Remote employment — certain states require employers to disclose whether the job position includes remote work, on-site, or hybrid work.

In 2023, the Salary Transparency Act was introduced to Congress. If enacted, this bill would require employers to disclose salary information to potential employees and prohibit employers from retaliating against employees who inquire about salary ranges.

States with pay transparency laws 2024

Certain states in the US have enacted their own wage transparency laws. Currently, there are 11 states with pay transparency laws in place, and several more are considering them.

Let’s look at pay transparency laws by state.

| State | Requirements & penalties | Who does the law apply to & official legislation |

|---|---|---|

| California | Employers are required to include a salary range in all job postings. Upon request, employers must provide salary range information to current employees. Moreover, employers aren’t allowed to rely on salary history information as a determining factor for employment. Penalties: $100 to $10,000 depending on the violation. | This rule applies to employers with 15 or more employees. Employers with at least 1 employee must disclose the salary scale if the employee requests it. Explore more: California Pay Transparency Law — SB 1162 |

| Colorado | Employers must include compensation, benefits, and job descriptions in their job postings. Moreover, employers aren’t allowed to: ask applicants about salary history or use it as a determining factor, forbid employees from talking about salary, require employees to sign a document that forbids them from discussing pay, and retaliate against any employee who exercises these rights. Penalties: $500 to $10,000 depending on the violation. | This rule applies to employers with at least 1 employee working in Colorado. Explore more: Equal Pay for Equal Work Act — EPEWA |

| Connecticut | During the hiring process, employers must disclose the salary range to job candidates as soon as: the applicant requests it, and before or after offering compensation. Moreover, employers must share salary information with current employees who request it or want to change their positions. Inquiring about the employee’s salary history isn’t allowed. Penalties: Employees or job candidates can file a civil lawsuit against the employer, resulting in compensatory and punitive damages plus costs. | This rule applies to employers with at least 1 employee in Connecticut. Explore more: Public Act 21-30 — HB 6380 |

| Hawaii | Employers are required to share salary ranges in their job postings. These ranges must reflect the actual compensation that job candidates can expect for that position. Penalties: Employees or job candidates can file a civil lawsuit against the employer, resulting in compensatory and punitive damages plus costs. | This law applies to employers with 50 or more employees. However, this law doesn’t apply to the following: internal transfers or promotions, and positions where salary, compensation and other benefits are determined by a collective bargaining agreement. Explore more: Hawaii Pay Transparency Law — SB 1057 |

| Illinois | Employers must share salary ranges and any additional benefits in their job postings. Penalties: Employers will receive fines from $500 to $10,000, depending on how many violations they have. Employers will have 14 days to cure the violation for the first offense and 7 days to cure the breach for the second offense. If they don’t, they will face a penalty of up to $100 per day for each day of being late. | This law applies to employers with 15 or more employees. Explore more: Illinois Pay Transparency Law — HB 3129 |

| Maryland | Employers must share salary ranges with job candidates who request it. Moreover, employers aren’t allowed to request salary history from job candidates. Penalties: Employers will receive a warning for their first violation, a fine of up to $300 for their second violation, and a fine of up to $600 for their third and each subsequent violation. | This law applies to all employers in Maryland. Explore more: Equal Pay for Equal Work Law — HB 123 |

| Nevada | Employers must disclose the pay range to job candidates or current employees who have: applied for a new position, completed an interview for a position, and received an offer for a job position. Penalties: Employees or job candidates can file civil lawsuits against the employer. Moreover, the Labor Commissioner may impose a penalty of up to $5,000 per violation. | This law applies to all employers in Nevada. Explore more: Nevada Wage Transparency Law — SB293 |

| New York | Employers must disclose salary ranges in job postings. Employers must also disclose total compensation to employees, including bonuses. Penalties: Employers receive a fine of up to $1,000 for their first offense, up to $2,000 for their second offense, and up to $3,000 for their third and any consecutive offense. | This law applies to employers with 4 or more employees working in the state of New York. Explore more: New York Pay Transparency Law — S01326 |

| Rhode Island | Employers must disclose salary range to current employees and job candidates in situations: where it is requested, when new employees receive a job offer, and when current employees are transferred to a new position. Employers are also not allowed to inquire about employees’ wage history. Penalties: Employers may receive a fine of up to $1,000 for the first violation, up to $2,500 for the second violation, and up to $5,000 for the third and every consecutive violation. | This law applies to employees with at least 1 employee in Rhode Island. Explore more: Fair Employment Practices — S0270A |

| Washington | Employers are required to share salary range information in their job postings. For internal position changes, they must share the salary range upon request. Job postings must also include benefits and bonuses as part of the total compensation. Penalties: Employers may receive fines from $500 for the first violation and up to $1,000 or 10% of damages (whichever is greater) for repeated offenses. | This law applies to employers with 15 or more employees in Washington, including remote employees. Explore more: Equal Pay and Opportunities Act — SB5761 |

| District of Columbia | Employers are required to disclose salary ranges in job postings. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties: $1,000 to $20,000 fines depending on the violation. | This law would apply to all employers. The Wage Transparency Omnibus Amendment Act was proposed in 2023 and has passed. It is effective since June 30, 2024. |

Local pay transparency laws

In addition to the states mentioned above that have their own wage transparency laws, some cities have also passed them. Let’s look at them in more detail.

| City | Requirements & penalties | Who does the law apply to & official legislation |

|---|---|---|

| Jersey City (New Jersey) | Employers must share pay ranges and total compensation (bonuses + benefits) in all job postings. Penalties: Fines can go up to $2,000 per violation. | This law applies to employers with 5 or more employees in Jersey City. Explore more: Jersey City Ordinance 22-045 |

| Ithaca (New York) | Employers must disclose minimum and maximum salary ranges in job postings or promotions for jobs that will be performed in Ithaca. Penalties: The city law doesn’t declare penalties, so the state penalties apply. | This law applies to employers with 4 or more employees in Ithaca. Explore more: Ordinance 2022-03 |

| New York City (New York) | Employers must share minimum and maximum salary ranges in all job postings for jobs that will take place in New York City. The same applies to internal positions and transfers. Penalties: There’s no penalty for the first violation if the violator can correct it within 30 days. An uncorrected first or subsequent violation can lead to fines of up to $250,000 per violation. | This law applies to employers with 4 or more employees in New York City. Explore more: NYC Ordinance |

| Westchester County (New York) | Employers must share minimum and maximum salary ranges in all job postings for jobs that will take place in Westchester County, including remote jobs. The same applies to internal positions and transfers. Penalties: Penalties can go up to $125,000 per violation and up to $250,000 for willful violations. | This law applies to all employees in Westchester County. Explore more: Westchester County pay transparency law |

| Cincinnati (Ohio) | Employers must provide salary range information to job candidates who request it during the hiring process. Moreover, employers aren’t allowed to inquire about the job candidate’s salary history. Penalties: Job candidates can file a civil lawsuit against the employer, resulting in compensatory damages plus costs. | This law applies to employers with 15 or more employees in Cincinnati. Explore more: Cincinnati Ordinance 83 |

| Toledo (Ohio) | Employers must provide salary range information to job candidates who request it during the hiring process. Moreover, employers aren’t allowed to inquire about the job candidate’s salary history. Penalties: Job candidates can file a civil lawsuit against the employer, resulting in compensatory damages plus costs. | This law applies to employers with 15 or more employees in Toledo. Explore more: City of Toledo Ordinance |

States without pay transparency laws

Pay transparency laws have gained a lot of popularity in the last several years, and states all over the US are implementing them.

However, certain states still don’t have pay transparency regulations and aren’t considering them. These states include:

- Alabama,

- Arizona,

- Arkansas,

- Delaware,

- Florida,

- Georgia,

- Idaho,

- Indiana,

- Iowa,

- Kansas,

- Louisiana,

- Minnesota,

- Mississippi,

- Nebraska,

- New Hampshire,

- New Mexico,

- North Carolina,

- North Dakota,

- Ohio,

- Oklahoma,

- Pennsylvania,

- South Carolina,

- Tennessee,

- Texas,

- Utah,

- Wisconsin, and

- Wyoming.

🎓 How to do payroll for small business

States that are considering pay transparency laws

Pay transparency laws reduce payment discrimination by providing transparent salaries to employees. As this trend continues to grow, many more states are considering becoming pay-transparent states.

Let’s look at the states considering pay transparency regulations and their current drafts below.

| State | Requirements & penalties | Who does the law apply to & official legislation |

|---|---|---|

| Alaska | Employers are required to disclose salary ranges in job postings, and they aren’t allowed to inquire about salary history. Penalties: $100 to $2,000 fines depending on the violation. | This law would apply to employers with 1 or more employees. The Alaska pay transparency law was proposed in 2021 but has yet to pass. |

| Kentucky | Employers are required to disclose salary ranges in job postings. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties: No specific penalties are included in the draft. | The proposed bill only specifies “employers.” The Kentucky House Bill 198 was introduced as an amendment to the official employment legislation in 2023 but hasn’t moved forward. |

| Maine | Employers are required to disclose salary information. Penalties: No specific penalties are included in the draft. | This law would apply to all employers, depending on the number of employees they have: employers with fewer than 10 employees must share salary ranges on request, employers with more than 10 employees must share salary ranges on all job postings, and all employers must share salary ranges with current employees. The Maine LD936 was proposed in 2023 but has yet to pass. |

| Massachusetts | Employers are required to disclose salary ranges in all job postings, including transfers and internal promotions. Penalties depend on the offense: a warning for the first offense, a fine of up to $500 for the second offense, and a fine of up to $7,500 for every unintentional third or subsequent offense, or $15,000 if the offense was intentional. | This law would apply to employers with 25 or more employees. The Frances Perkins Workplace Equity Act H.B. 4890 was proposed in 2023 and is supposed to pass this year. |

| Michigan | Employers are required to disclose salary ranges in job postings. Moreover, they must make the job posting available to any current employee. Penalties: A fine of up to $1,000, depending on the violation. | This law would apply to employers with 5 or more employees. The SB 142 is currently awaiting a decision in the Michigan Senate. |

| Missouri | Employers are required to disclose salary ranges to job applicants: who request it, and who were previously offered a job. Employers are also required to share salary ranges with current employees: who request it, and who have completed a job interview or have been offered a job promotion. Penalties: A fine between $1,000 and $5,000, depending on the violation. | The proposed bill only specifies “employers.” The SB 64 was proposed in 2023 but has yet to pass. |

| Montana | Employers are required to disclose salary ranges in job postings. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties: A fine between $500 and $10,000, depending on the violation. | This law would apply to employers with 15 or more employees. The SB 146 was proposed in 2023 but hasn’t passed. |

| New Jersey | Employers are required to disclose pay ranges in job postings. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties: Employees or job candidates can take civil action against the employer, resulting in compensatory damages and costs. | This law would apply to all employers in New Jersey. The NJ S2310 is currently awaiting a decision from the Governor to sign it into law. |

| Oregon | Employers are required to disclose salary ranges in job postings. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties depend on the offense: a fine of up to $1,000 for the first offense, and a fine that increases in the amount of $1,000 for each subsequent offense, up to $10,000. | This law would apply to all employers in Oregon. The SB 925 was proposed in 2023 but hasn’t passed. |

| South Dakota | Employers are required to disclose pay ranges in all job postings, including internal transfers and promotions. Moreover, employers must include any additional bonuses and benefits in job advertisements. Penalties: $500 fine for each offense. | This law would apply to private employers with 100 or more employees. The SB 109 was proposed in 2023 but hasn’t passed. |

| Vermont | Employers are required to disclose salary ranges to job candidates and current employees. Penalties: The bill doesn’t specify any consequences for offenders. | There are no specifications to which employers the bill would apply. The Vermont pay transparency law has passed and is set to take effect on July 1, 2025. |

| Virginia | Employers are required to disclose salary ranges to job candidates and current employees upon request. Penalties: A fine between $1,000 and $10,000 per violation. | This law would apply to all employers in Virginia. In 2023, SB 370 passed the Virginia State’s Senate but was detained in the House Commerce and Energy Committee. |

| West Virginia | Employers are required to disclose salary ranges to job candidates and current employees upon request. Moreover, employers must disclose any additional bonuses and benefits upon request. Penalties: Employees or job candidates can take civil action against the employer, resulting in compensatory damages and costs. | This law would apply to all employers in West Virginia. The SB 156 was proposed in 2023 but it wasn’t passed yet. |

Salary history ban in the US

The salary history ban is similar to pay transparency regulations. This practice forbids employers from inquiring about the employee’s salary history during the hiring process.

The salary history ban protects employees from potential discrimination based on their previous earnings, and salary history bans are much more common in the US than pay transparency laws.

Here’s a list of all the US states with a salary history ban:

- Alabama,

- California,

- Colorado,

- Connecticut,

- Delaware,

- District of Columbia,

- Georgia,

- Hawaii,

- Illinois,

- Kentucky,

- Louisiana,

- Maine,

- Maryland,

- Massachusetts,

- Michigan,

- Mississippi,

- Missouri,

- Nevada,

- New Jersey,

- New York,

- North Carolina,

- Ohio,

- Oregon,

- Pennsylvania,

- Rhode Island,

- South Carolina,

- Utah,

- Vermont,

- Virginia, and

- Washington.

Frequently asked questions about pay transparency laws

To make this guide as comprehensive as possible, we’ve included an FAQ section covering the most common questions about pay transparency in the US.

What is the federal law on pay transparency?

There’s no official pay transparency regulation in the US. However, under Executive Order 11246, employees have the right to inquire about their own salaries or the salaries of other employees. Any retaliation against employees is prohibited.

How many states have salary transparency laws?

Currently, there are 11 states with salary transparency laws in place, including:

- California,

- Colorado,

- Connecticut,

- Hawaii,

- Illinois,

- Maryland,

- Nevada,

- New York,

- Rhode Island,

- Washington, and

- District of Columbia.

What countries have pay transparency laws?

Many countries around the world have pay transparency regulations in place, such as:

- Countries of the EU,

- United States,

- Canada,

- United Kingdom,

- Japan,

- Australia, and others.

Track employee work hours with Clockify

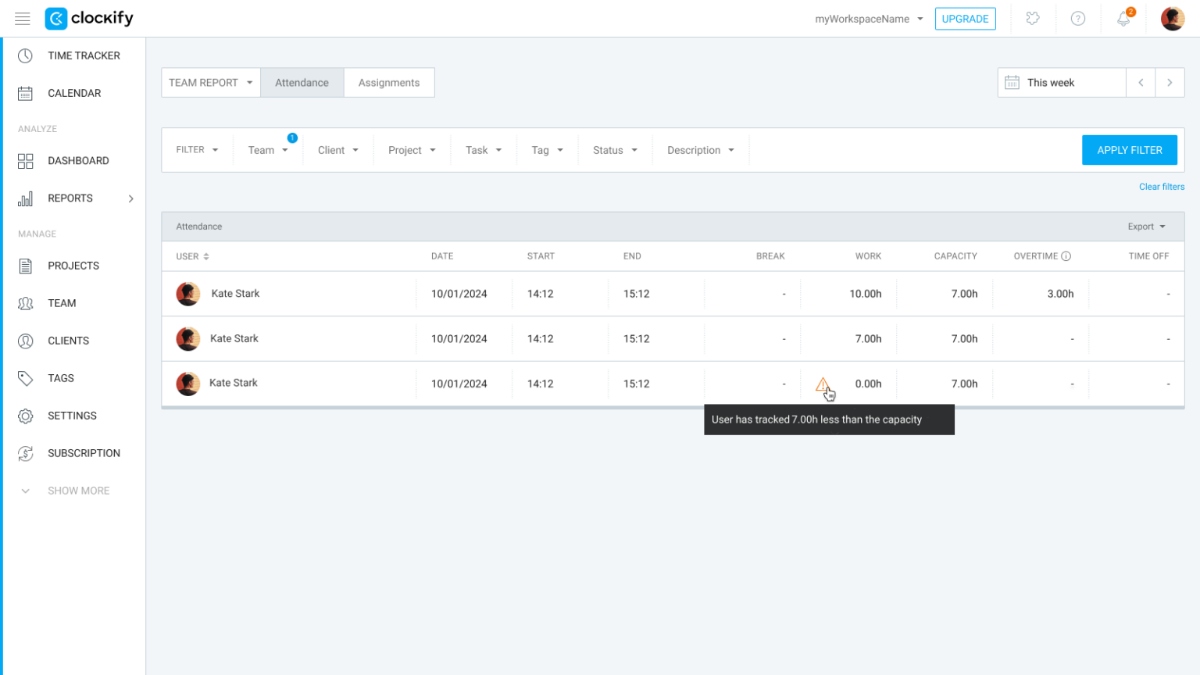

Manually tracking work hours can be very inefficient and time-consuming. Moreover, it can lead to countless errors and headaches once payroll comes.

Due to this, using time tracking software such as Clockify can make this process much simpler and more enjoyable.

Clockify has a built-in attendance report system that you can use to track employee work hours. By going to the reports section and then clicking on attendance, you can view your employee start/end times, breaks, and total work capacity.

Clockify helps your employees track their work hours with just a few clicks.

One of its features is the time tracker, which allows you to track time manually or with a timer.

Are you ready to revolutionize your time tracking routine with Clockify?

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: November 6, 2024

Published: November 6, 2024