Being your own boss is a dream come true for many. You build valuable relationships with your clients, determine your own work hours, and at the end of the day, you take the profit just for yourself.

However, this comes with many expenses you might not be aware of. Expenses such as insurance, meals, internet, and others can quickly pile up and lower your profits. On top of that, you must pay taxes.

Therefore, let’s get you familiar with the tax deductions for self-employed people to lower your taxable income, decreasing the amount you must pay to the IRS.

In this article, we’ll go over 15 self-employment tax deductions you must know if you are a 1099 worker.

- Tax deductions lower your taxable income, thus reducing your tax bill.

- The self-employment tax rate amounts to 15.3%, and you can deduct 50% of it as a self-employment tax deduction.

- If you use your home or vehicle for business purposes, you can write off a portion of your expenses as a tax deduction.

- Premiums for health and business insurance are tax-deductible and can significantly lower your taxable income.

- Internet and phone expenses can count as tax deductions if used for business purposes.

1. Self-employment tax deduction

All self-employed individuals have to pay the self-employment tax. This tax combines the Social Security and Medicare (FICA) taxes, amounting to 15.3% of your net income (gross earnings minus expenses and deductions). This amount is distributed in the following way:

- 12.4% of the self-employment tax funds Social Security — in 2024, this amount has a limit of $168,600, and any additional income an individual earns above won’t count as taxable, and

- 2.9% of the self-employment tax funds Medicare — this amount doesn’t have a limit, and individuals can pay it based on the full amount of their earnings.

In addition, certain self-employed individuals can pay an added 0.9% Medicare taxes if their annual earnings exceed the following thresholds:

| Status | Annual threshold |

|---|---|

| Married filing jointly (with a spouse) | > $250,000 per year |

| Married filing individually | > $125,000 per year |

| Single | > $200,000 per year |

| Surviving spouse with a child | > $200,000 per year |

| Householder | > $200,000 per year |

The FICA tax is divided by the employer and the employee, meaning both sides pay 7.65% of the amount. Employers deduct this percentage from the employees’ payroll and send it to the IRS on the employees’ behalf.

As self-employed individuals don’t have an employer, they carry the burden of paying the whole amount by themselves. However, self-employed workers can deduct 50% of this tax as an income tax deduction to reduce their taxable income.

Here’s how our expert contributor Zaher Dehni, an Enrolled Agent (EA) with an IRS license, described the self-employment tax deduction:

“The self-employment deduction is a tax break for people who work for themselves, like freelancers, gig workers, and small business owners. Since these individuals pay both the employee and employer portions of Social Security and Medicare taxes, the self-employment deduction helps by allowing them to write off half of these tax payments.”

How do you claim a self-employment tax deduction?

To claim it, you’ll need to fill out 2 forms:

- Schedule SE (Form 1040) — where you report your self-employment tax and deduction on lines 12 and 13, and

- Schedule 1 (Form 1040) — where you claim the deduction as an income adjustment on line 15.

Example of a self-employment tax deduction

Suppose that your income minus expenses for the year is $40,000. This is the amount you’ll report on the Schedule SE form.

Multiply this amount by 0.9235 (92.35%) to determine your net income. This is because self-employed individuals are deducted 1/2 of the FICA taxes, as they’re taxed only on the employer part (15.3% / 2 = 7.65%, which is 100% – 7.65% = 92.35%):

$40,000 x 0.9235 = $36,940 (net income)

The amount of $36,940 is subject to your self-employment tax (Social Security + Medicare).

To calculate your Social Security tax, multiply the above amount by 0.124 (12.4%):

$36,940 x 0.124 = $4,580.56 (Social Security tax)

Next, calculate your Medicare tax by multiplying your net income by 0.029 (2.9%):

$36,940 x 0.029 = $1,071.26 (Medicare tax)

To calculate your self-employment tax, combine both taxes. This is the amount you’ll write down on Schedule SE line 12:

$4,580.56 + $1,071.26 = $5,651.82 (self-employment tax)

Now that you have your self-employment tax, multiply it by 0.5 (50%) to determine your deduction. Enter this amount on Schedule SE form’s line 13 and Schedule 1 form’s line 15:

$5,651.82 x 0.5 = $2,825.91 (self-employment tax deduction)

You can deduct $2,825.91 from your taxable income as a self-employment tax deduction and lower your adjusted gross income (AGI).

🎓 For more information on how to pay taxes as a self-employed worker, check out our guide — How to pay taxes as an independent contractor

2. The home office deduction

The home office tax deduction can include utility bills, mortgage interests, insurance, rent, repairs, and maintenance related to the part of your home that you use for trade or business purposes.

To qualify for the business use of home deduction, you must meet certain requirements, including:

- Exclusive use requirement — you must use the specific area of your home for business purposes (exceptions include using the specific area as a storage or daycare facility).

- Regular use requirement — you must regularly use the particular part of your home.

- Trade or business use requirement — activities you perform in this area must be related to a business or a trade.

- Principal place of business requirement — you must use the part of your home as a principal place of business and perform management or executive activities.

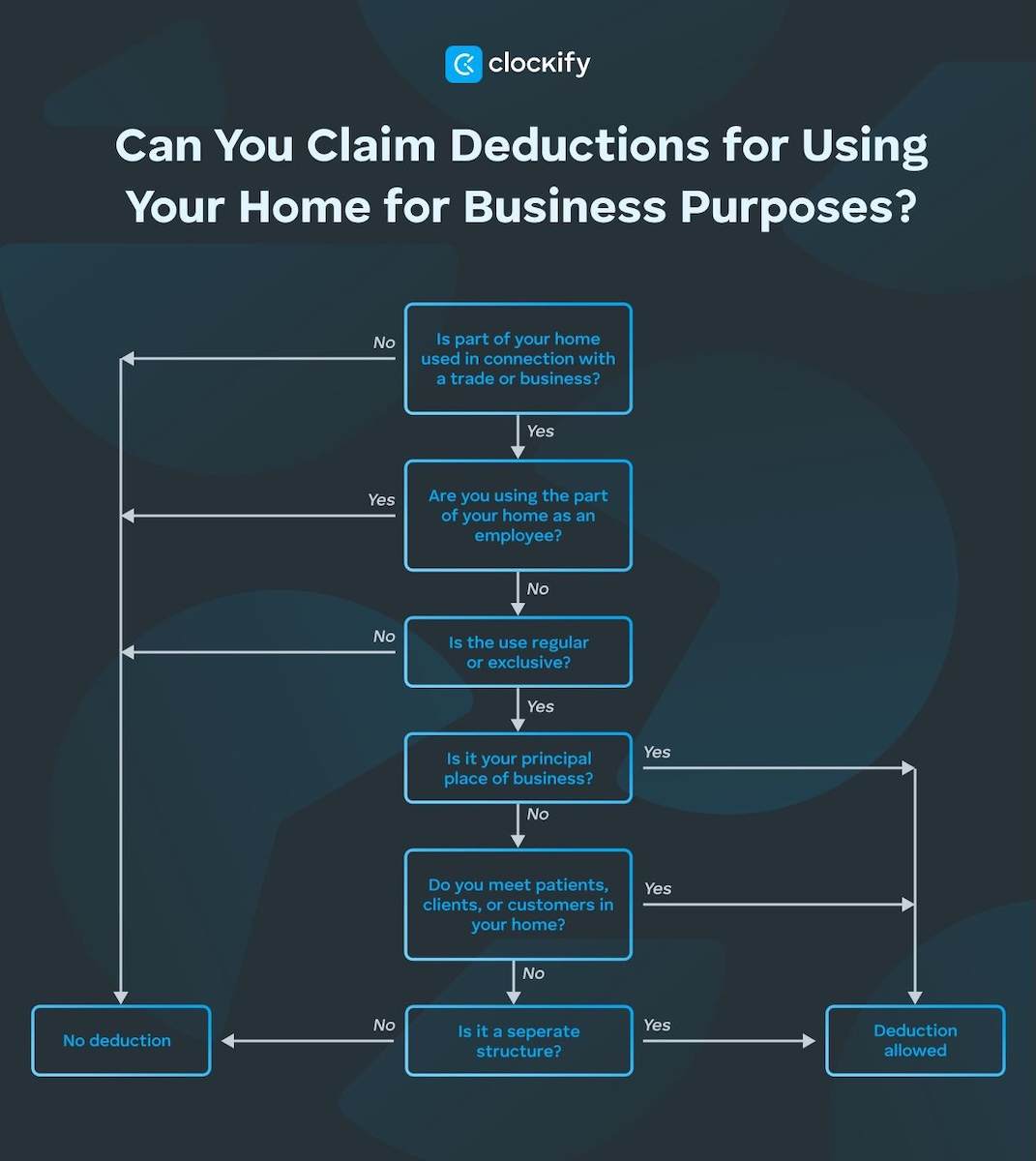

Here’s a scheme to help you determine if you qualify for this deduction:

How do you claim the home office deduction?

You can use 2 methods to calculate your business use of home tax deduction:

Regular method:

This method calculates the actual expenses for the business use of your home.

First off, calculate the percentage of your home that you use for business purposes by using the following formula:

(square footage you use for business / total area of the home) x 100

When you have the percentage, you can fill out Form 8829 by multiplying the rate by the amount you spent on each allowable deduction.

After that, claim the deduction on Schedule C (Form 1040), line 30.

Simplified method:

With the simplified method, you multiply the square footage used for business purposes by $5 (300 square feet maximum, up to $1,500), the current allowable amount for taxpayers. Once you calculate this amount, claim the deduction on Schedule C (Form 1040), line 30.

🎓 If you are having trouble filling out the form 8829, check out — Instructions for Form 8829

Example of home office deduction

Now, we’ll give you a practical example of calculating business use of home tax deductions with the simplified method.

Suppose you own a 900-square-foot apartment and use 200 square feet as your home office. Your total expenses for the year are $15,000. Here’s how the deduction might look with the simplified method:

200 (area of the home used for business) x $5 = $1,000

You can deduct $1,000 as a business use of home tax deduction.

3. Retirement plan contributions deduction

Using a retirement plan is another way to lower your tax bill.

To obtain a tax deduction, self-employed individuals can contribute to one of the following plans:

- Individual 401(k) plan,

- SEP-IRA (Self-employed pension) plan, and

- SIMPLE (Savings incentive match plan for employees) plan.

Individuals who choose 401(k) plans can make an annual salary deferral of up to $23,000 plus $7,500 if they’re older than 50. Maximum contributions for a self-employed 401(k) can’t exceed 25% of total net earnings or $69,000 for 2024.

How do you claim a retirement plan tax deduction?

To claim this deduction, you should first establish a retirement plan account. After that, you need to calculate your total contributions and write them down on Schedule 1 (Form 1040), line 16.

Example of a retirement plan contributions tax deduction

We’ll use the same number we used for calculating the self-employment tax, which is $40,000 in net earnings, and we’ll choose a 10% contribution rate for solo 401(k).

Start by calculating the taxable net earnings (92.5% of net earnings):

$40,000 x 0.9235 = $36,940 (taxable net earnings)

Now, multiply the above number by the contribution rate:

$36,940 x 0.1 (10%) = $3,694 (allowed contribution and deduction)

The allowed contribution and deduction amount is $3,694.

4. Health insurance deduction

Individuals who pay medical, dental, or long-term care premiums for themselves, their spouse, or a child under 27 can claim this as an adjustment to their gross income (AGI).

To qualify for this deduction, you must meet 2 requirements:

- You can’t have employer-sponsored health insurance — which means you aren’t working as an employee and already have existing health insurance.

- Your self-employed business must have a net profit — if your business has a net profit that exceeds your health insurance premiums, you can deduct up to 100% of those premiums. If not, you can only deduct the amount equal to your net profits.

Long-term care premium deductions have a limit based on the covered persons’ age at the end of the tax year. The limitations are as follows:

| Age | Deduction limit for 2024 |

|---|---|

| 40 years of age or less | $470 |

| 41 to 50 years of age | $880 |

| 51 to 60 years of age | $1,760 |

| 61 to 70 years of age | $4,710 |

| 71 or more years of age | $5,880 |

How do you claim a health insurance tax deduction?

The health insurance tax deduction is counted as adjusted gross income (AGI) and isn’t considered a business expense. To claim this deduction, you must write it down on Schedule 1 (Form 1040), Part II, line 17.

To calculate the health insurance tax deduction, you must fill out Form 7206.

🎓 If you are having trouble filling out the form 7206, check out — Instructions for Form 7206

Example of a health insurance tax deduction

A self-employed photographer pays $3,000 for health insurance. They can deduct the full amount. If the photographer has a gross income of $40,000, they can deduct $3,000 as an income adjustment, leaving them with $37,000 of taxable income.

5. Business insurance deduction

Insurance premiums can be quite expensive for self-employed business owners, but these premiums come in handy as they can be counted as tax deductions.

Many types of business insurance premiums can be counted as a deduction, including:

- Insurance for fire, theft, flood, or other similar situations,

- Credit insurance,

- Hospitalization and medical insurance for employees,

- Liability insurance,

- Workers’ compensation insurance,

- Subsidies to a state unemployment fund if they’re considered taxes,

- Overhead insurance,

- Car and other vehicle insurance,

- Life insurance for employees, and

- Business interruption insurance.

However, some types of premiums aren’t considered deductions, such as:

- Self-insurance,

- Insurance for loss of earnings,

- Life insurance for yourself, and

- Insurance that secures a loan.

How do you claim a business insurance tax deduction?

To claim the business insurance tax deduction, you must write it down on Schedule C (Form 1040), line 15.

Before claiming the deduction, please read Publication 334 to ensure you do this correctly.

Example of a business insurance tax deduction

Your gross earnings are $40,000, and your business insurance amounts to $5,000. You can deduct the whole amount. Leaving you with $35,000 as your taxable net earnings.

6. Business use of vehicle deduction

Using your vehicle for business purposes is another 1099 tax write-off. With this tax deduction, you can deduct things such as:

- Gas,

- Oil,

- Fuel,

- Tires,

- Parking,

- Tolls,

- Repairs, and

- Other vehicle expenses.

However, the vehicle must be used exclusively for business purposes, and you can’t deduct personal trips. For this reason, you should keep the following records:

- Date of each business trip,

- Mileage for each business trip, and

- Purpose for each business trip.

How do you claim a business use of vehicle tax deduction?

To claim this type of deduction, write it down on Schedule C (1040), line 9.

Similar to the business use of home tax deduction, you can calculate the car expense deduction in 2 ways:

- Using standard mileage rates, or

- Using your actual expenses.

The standard mileage rates method uses a set amount of money you can deduct for each driven mile. The IRS establishes a standard mileage rate for each year, and the standard mileage rate for 2024 is $0.67 per business mile.

On the other hand, the actual costs method requires you to track all your car expenses. If you use your car for personal and business use, you must calculate the percentage of car use for business purposes.

For example, if you drove your car 4,000 miles, with 1,000 miles for business purposes, you can deduct 25% of your expenses as business expenses.

Please read Publication 463 to ensure you are calculating these deductions accordingly.

Example of a business use of vehicle tax deduction

We’ll use the standard mileage method for this example.

Let’s suppose that you drove 1,200 miles in a year:

$0.67 x 1,200 = $804

To this amount, you can add parking fees and tolls, which may amount to 300$. Don’t add leases, rent, or operating expenses. Like this:

$804 + 300$ = $1,104

This means that you can deduct $1,104.

7. Business travel deduction

If you frequently travel for business purposes, you can use business travel expenses as a 1099 tax write-off. However, these expenses must be ordinary and necessary to be deductible, and they can’t be lavish or used for personal reasons.

Moreover, business travel must require you to be away from your work for at least 1 ordinary workday.

Here are several business travel expenses that you can count as a tax deduction:

- Travel from home to the destination (plane, car, train, etc.),

- Transportation costs (e.g., taxi),

- Use of your car for the business trip,

- Lodging,

- Necessary meals,

- Dry cleaning,

- Business calls during the trip,

- Tips for services related to expenses (e.g., waiter tips for necessary meals), and

- Other ordinary and necessary expenses.

Travel expenses can be deducted only for employees, and you can’t deduct them for family members.

How do you claim a business travel tax deduction?

To claim a business travel tax deduction, you’ll need to keep track of your expenses and keep certain records (e.g., receipts). Once you have calculated your expenses, write them down on Schedule C, line 24a.

Example of a business travel tax deduction

Suppose you are traveling to San Francisco for 2 days to meet a client. On this trip, you spent $1,500 on transportation costs, $500 on lodging, and $500 on other expenses.

Add all these expenses together, and you’ll have $2,500 for business travel expenses to be deducted.

8. Business meals deduction

Business meals can also be considered a business expense and can be a hefty tax deduction.

Here are a few types of meals you can write off:

- Dinner with a business client,

- Catering for events,

- Meals purchased on a business travel for you and your employees, and

- Food for a business conference.

Although business meals are deducted at a 50% rate, as a self-employed individual, you can be an exception to this rule if you meet the following requirements:

- You have meal costs as an independent contractor or freelancer,

- Your client compensates you for your services, and

- You show all the required records to your client.

In this situation, your client can only claim a 50% tax deduction on meals, and you can claim the full 100% deduction.

How do you claim a business meal tax deduction?

To claim the business meal tax deduction, write it down on Schedule C, line 24b.

You can calculate it in 2 ways:

- Using your actual expenses, or

- Using standard meal allowance for M&IE (meals and incidental expenses).

With the actual expense method, you must keep all your receipts for meals and then deduct 50% of those receipts as a business meal tax deduction.

Using the standard meal allowance for meals and incidental expenses, you can deduct 50% of the meal allowance depending on where you’re traveling.

The M&IE rates are established each year by the General Service Administration (GSA), and the current rate is $59 for travel within the US. However, these rates vary, so please check the per diem rates on the official GSA website.

Example of a business meal tax deduction

We’ll use the actual expense method as an example. Suppose you went to a business dinner with a client, and your bill was $300 for the night. You can deduct half of that as a business expense, amounting to $150.

9. Internet and phone expenses deduction

Using the internet or phone for your business can also be considered a business expense and a great tax deduction for self-employed workers. The main requirement is to use the internet connection or phone for business purposes — not for personal use. If you use them for both purposes, you can deduct a percentage dedicated to business use.

It’s important to note that the IRS won’t allow you to deduct the cost of the first telephone line in your home, even if you have a home office. However, if you have long-distance business calls on this line or a second line exclusively for business, these can be counted as a business expense.

How do you claim a tax deduction for internet and phone expenses?

To claim these deductions, you’ll have to write them down on Schedule C, line 25.

Example of an internet and phone expenses tax deduction

Suppose you have a home office and use your internet for business 30% of the time. If your internet bill is $100, you can deduct $30 of that amount as a business expense.

10. Interest expense deduction

Interest expense deduction is another tax deduction for self-employed individuals.

Here are the requirements for interest to be regarded as a business expense:

- You have the obligation to pay the debt,

- Both sides expect the debt to be fully repaid, and

- There is a debtor-collector relationship between you and the lender.

This includes interest on mortgages, credit cards, and other types of loans.

How do you claim an interest expense tax deduction?

You can claim the interest expense tax deduction on Schedule C, line 16.

Example of an interest expense tax deduction

Suppose you took a loan of $500 to buy a new printing machine for your office, and $40 will be the interest amount. The whole interest amount on that loan will be deductible as a business expense.

11. Rent expense deduction

Rent is also considered a business expense, so you can use it to lower your tax bill.

You must meet 2 requirements to qualify for this tax deduction:

- You can’t have an interest or ownership in the space you want to rent, and

- You can’t deduct “unreasonable” rent, which is considered higher than the market value.

Moreover, if you decide to pay rent a few years in advance, you can only deduct the amount for the tax year.

How do you claim a rent expense tax deduction?

To claim this deduction, write it down on Schedule C, line 20b.

Example of a rent expense tax deduction

Suppose that you paid $5,000 to rent an office space. This whole amount can be considered a business expense tax deduction.

12. Startup expenses deduction

If you’re starting a business as a self-employed entrepreneur, you’ll have a lot of expenses in the beginning. These expenses can be categorized as startup costs and a portion of them can be tax-free.

In general, startup costs are costs that’ll be necessary for your business to start operating, and they include:

- Market research,

- Lawyer fees,

- Accountant fees,

- Consultation services,

- Essential office equipment, and others.

You can write off up to $5,000 as a startup expense in the first year of your business. However, this deduction is reduced for each amount that exceeds $50,000.

You can amortize the remaining startup expenses in a period of 15 years.

How do you claim a startup expense tax deduction?

To claim the first-year deduction, write it down on Schedule C (Form 1040).

Regarding amortization costs, you’ll need to use Form 4562 and report costs on Schedule C.

🎓 If you have trouble with filling out the Form 4562, check out — Instructions for Form 4562

Example of a startup expense tax deduction

Suppose you are starting your personal hair salon business, and your startup costs are $51,000 initially. You can deduct up to $5,000 minus the amount that exceeds $50,000. The calculation will look like this:

$5,000 – ($51,000 – $50,000) = $4,000

You’ll deduct $4,000 as a startup expense on Schedule C under the “Other expenses” section, and you can amortize the remaining amount over 15 years.

13. Advertising expenses deduction

Promoting your business is necessary in today’s competitive market and can often be expensive. The good thing is that you can deduct advertising and marketing costs as a business expense.

This includes most expenses that are related to advertising your business, such as:

- Google, Facebook, and Instagram ads,

- Billboards,

- Fliers,

- Commercials, and others.

You can also deduct costs for promoting a goodwill event (e.g., blood donation) that advertises your business.

For these costs to qualify as a business expense, they must be ordinary and necessary for your business.

You can’t deduct advertising expenses used to promote political parties or candidates.

How do you claim an advertising expense deduction?

Advertising expenses are claimed on Schedule C, line 8.

Example of an advertising expense tax deduction

You spent $500 on a social media ads campaign to launch a new product; you can fully deduct this cost.

14. Qualified Business Income (QBI) deduction

In 2017, the Tax Cuts and Jobs Act introduced the qualified business income (QBI) deduction, or the 199A deduction, to help small businesses and self-employed individuals lower their taxable business income.

With the qualified business income deduction, you can lower your taxable business income by up to 20%, depending on your net earnings. This deduction applies to the so-called “pass-through” income (earnings from a business) and doesn’t apply to gains such as wages and investments.

To qualify for the QBI deduction, your total net earnings (adjusted gross income minus deductions) must be lower than $191,950 if you are a single filer or lower than $383,900 if you are a joint filer. If you exceed this threshold, you might get a smaller QBI deduction, or you might not qualify for the deduction at all.

Unfortunately for all self-employed workers, the QBI tax deduction is set to expire on December 31, 2025.

How do you claim a Qualified Business Income tax deduction?

The QBI deduction is claimed directly on your Individual Income Tax Return (Form 1040), line 13.

However, to calculate the deduction, you need to use the following forms:

- Form 8895 — use this form if you are below the threshold, and

- Form 8895-A — use this form if you are above the threshold.

🎓 If you are having trouble with Form 8895 and Form 8895-A, check out — Instructions for Form 8895 and Instructions for Form 8895-A

Example of a Qualified Business Income tax deduction

If you earn $100,000 as a sole proprietor for your business and have a total taxable income of $150,000, you can deduct 20% of the business income — that leaves you with $130,000 of total taxable income.

15. Education expenses deduction

Investing in yourself and increasing your expert knowledge is very important. This is why work-related education expenses are also considered a 1099 tax write-off.

To qualify for this deduction, you must meet 1 of 2 requirements:

- Education enhances or maintains the skills required for your job, or

- Education is a requirement for you to keep your current job, status, or salary.

Unfortunately, you can’t deduct education expenses related to a new profession that you wish to learn.

This deduction allows you to write off the following expenses:

- Books,

- Tuition,

- Seminars,

- Courses,

- Private classes, and

- Other types of education.

How do you claim an education expense deduction?

To claim the education costs tax deduction, write it down on Schedule C, line 27a (Other expenses).

Example of an education expense tax deduction

Suppose that you are working as a freelance graphic designer. To improve your skills, you decide to purchase a course in Adobe Illustrator, which costs you $500. This whole amount is deductible as a business expense.

3 most important tips for self-employed taxpayers

To help you pay your business taxes, we have gathered the 3 most important tips you should know as a self-employed individual.

Tip #1: Track your expenses

Tracking your expenses is essential if you are self-employed. This helps you stay on top of your taxes, and it helps you when calculating potential tax deductions.

Doing this on your own can be quite stressful and time-consuming, which is why you should use software such as Clockify by CAKE.com.

This tool will help you create and track expenses easily and save you time.

Watch this video to learn more about how Clockify can help you track expenses:

Tip #2: Keep your receipts

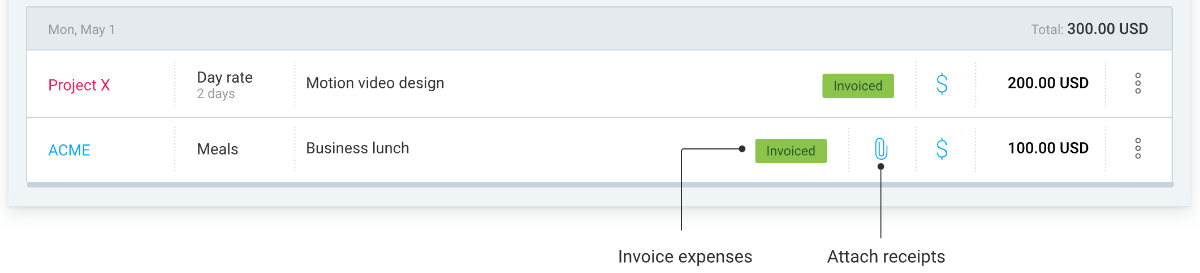

Whenever you have a business-related expense, it’s wise to keep your receipts, as they can later be used for tax deductions.

If you have trouble keeping all your receipts in one place, you can use Clockify to attach them to each expense as a PDF file. This way, you don’t have to worry about losing them.

Tip #3: Pay your taxes on time

The last thing you want is the IRS coming after you for unpaid taxes. Due to this, you should always pay your taxes on time to avoid penalties.

If you owe more than $1,000 in taxes, you’ll have to pay them quarterly, and they’ll be due in the following months:

- April,

- June,

- September, and

- January of the following year.

Frequently asked questions about tax deductions for self-employed individuals

To make this guide as comprehensive as possible, we’ve included an FAQ section where we’ll answer the most common questions on this topic.

What is the 20% self-employment deduction?

The 20% self-employment tax deduction is the Qualified Business Income (QBI) deduction. This tax deduction allows you to deduct up to 20% of your taxable income if your earnings are below the threshold of $191,950 if you’re filing alone and below $383,900 if you’re filing jointly.

What deduction can I claim without receipts?

Although it’s recommended to keep all of your receipts, there are some tax deductions you can claim without them, such as:

- Self-employment tax deduction,

- Business use of a vehicle (standard mileage rates) tax deduction,

- Business use of home (simplified method) tax deduction, and

- Health insurance premiums tax deduction.

How much is the deductible part of self-employment tax?

The self-employment tax rate amounts to 15.3%; you can deduct 50% of it from your taxable income.

Make invoicing simple with Clockify by CAKE.com

As a sole proprietor, billing your clients correctly and accurately can help you get paid on time and save money.

Unfortunately, if you’re doing this on your own, you’ll have to calculate your work hours and send invoices to each client.

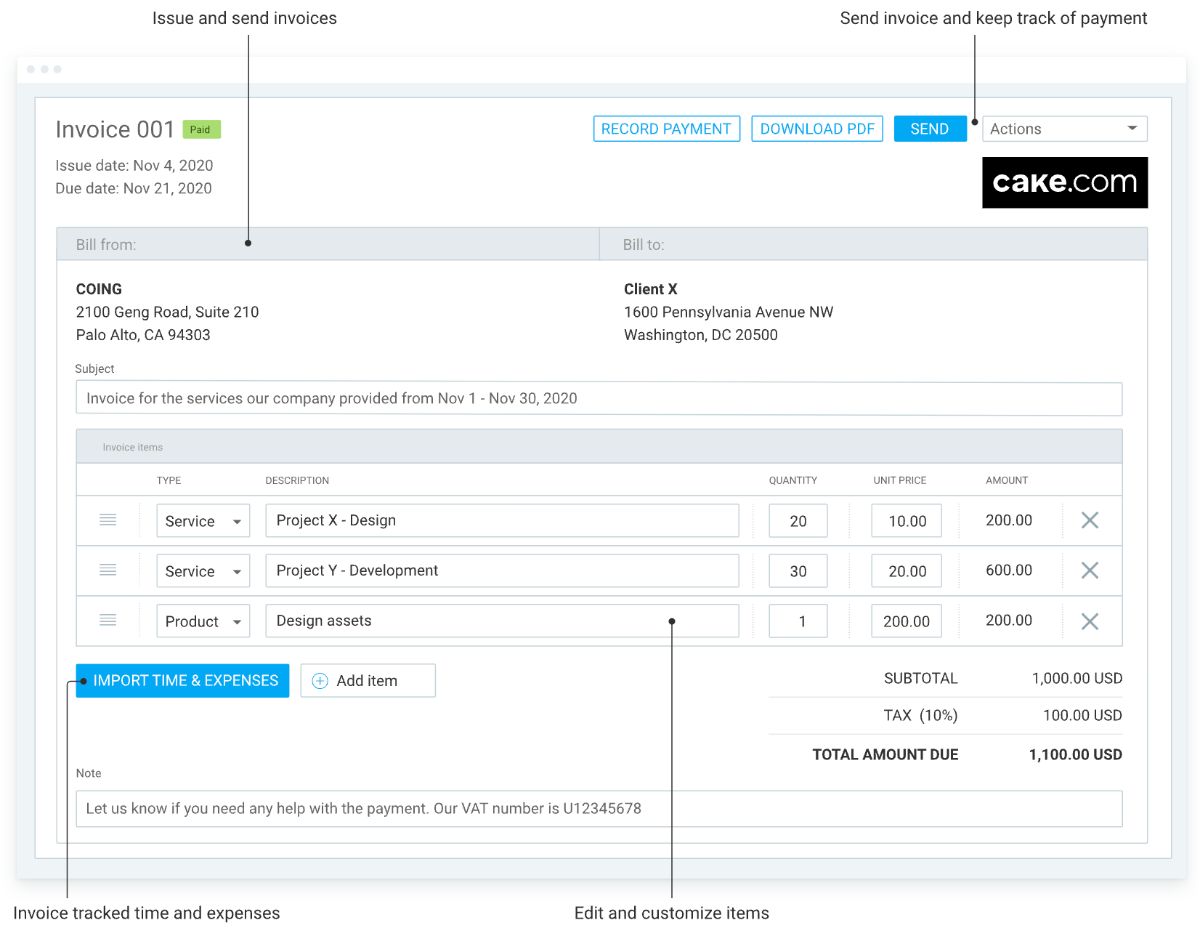

Clockify’s invoicing feature makes this much easier, as you can create and send invoices to your clients.

You can track all your invoices in one place and even apply discounts and taxes. Once the client pays you, you can record their payment in Clockify.

Moreover, you can see which invoices are paid, partially paid, overdue, or unpaid.

Conclusion/Disclaimer

We hope these 15 self-employment tax deductions will be helpful. Please pay attention to the links provided, which will lead you to the official government websites and other relevant information.

Please note that this guide was written in November of 2024, so any changes in the tax laws that were included later than that may not be in this guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: November 13, 2024

Published: November 13, 2024