How to pay taxes as an independent contractor

Being self-employed comes with a lot of benefits, such as setting your own work hours and organizing your own schedule. However, as an independent contractor, you also need to handle your own taxes. Here's how to calculate and pay your taxes.

In this guide, we'll cover:

- Who an independent contractor is

- How to handle your taxes as an independent contractor

- What you can do to reduce your tax liability

- How you can budget for taxes

Who is an independent contractor?

An independent contractor is a self-employed individual hired by third-party entities to provide goods or services. In other words, independent contractors perform work for third parties as nonemployees.

Independent contractors are otherwise referred to as freelancers or 1099 workers. The latter term stems from the name of a form payers use to report the compensation paid to contractors (which we’ll explain in more detail later).

Sometimes, they’re also referred to as 1099 employees — which is a misnomer since they do not work under an employer.

According to the IRS, you are an independent contractor if your payer only has control over the results of your work, and you remain in control of what you do and how you do it.

On the other hand, you’re not an independent contractor if your payer (in this case, your direct employer) has the legal right to control how you do your work — even if you’re generally provided the freedom of action.

Difference between a freelancer, a contractor, and an employeeHow to file taxes as an independent contractor in 4 steps

As an independent contractor, you’re self-employed. Therefore, you’re in charge of reporting your earnings and handling your tax obligations, as there’s no employer to withhold taxes from your income.

So, how much should you set aside for taxes as an independent contractor?

The exact amount freelancers should pay in taxes varies on a case-by-case basis. But, they are generally advised to set aside 25% to 30% of their taxable yearly income to pay all their yearly taxes.

Tax filing for independent contractors can seem scary to beginners — but it doesn’t have to be difficult. You need to take the following steps:

- Report income

- Calculate self-employment tax

- Claim deductions

- Make quarterly tax payments

Here, we’ll explain each step in greater detail.

Step #1: Reporting income

As a freelancer, the IRS sees you as a self-employed individual, and you’re subject to different tax rules than employees.

In other words, for the purposes of paying taxes, you’re a one-person business. And, if your net earnings exceed $400, you need to report them.

Your net earnings equal your total income minus any deductions (we’ll get to them later).

Anyone who earns any taxable income in the course of a year, whether an employee or a self-employed person, reports their individual income through the master sheet tax return — Form 1040. The form is filed at the end of the year.

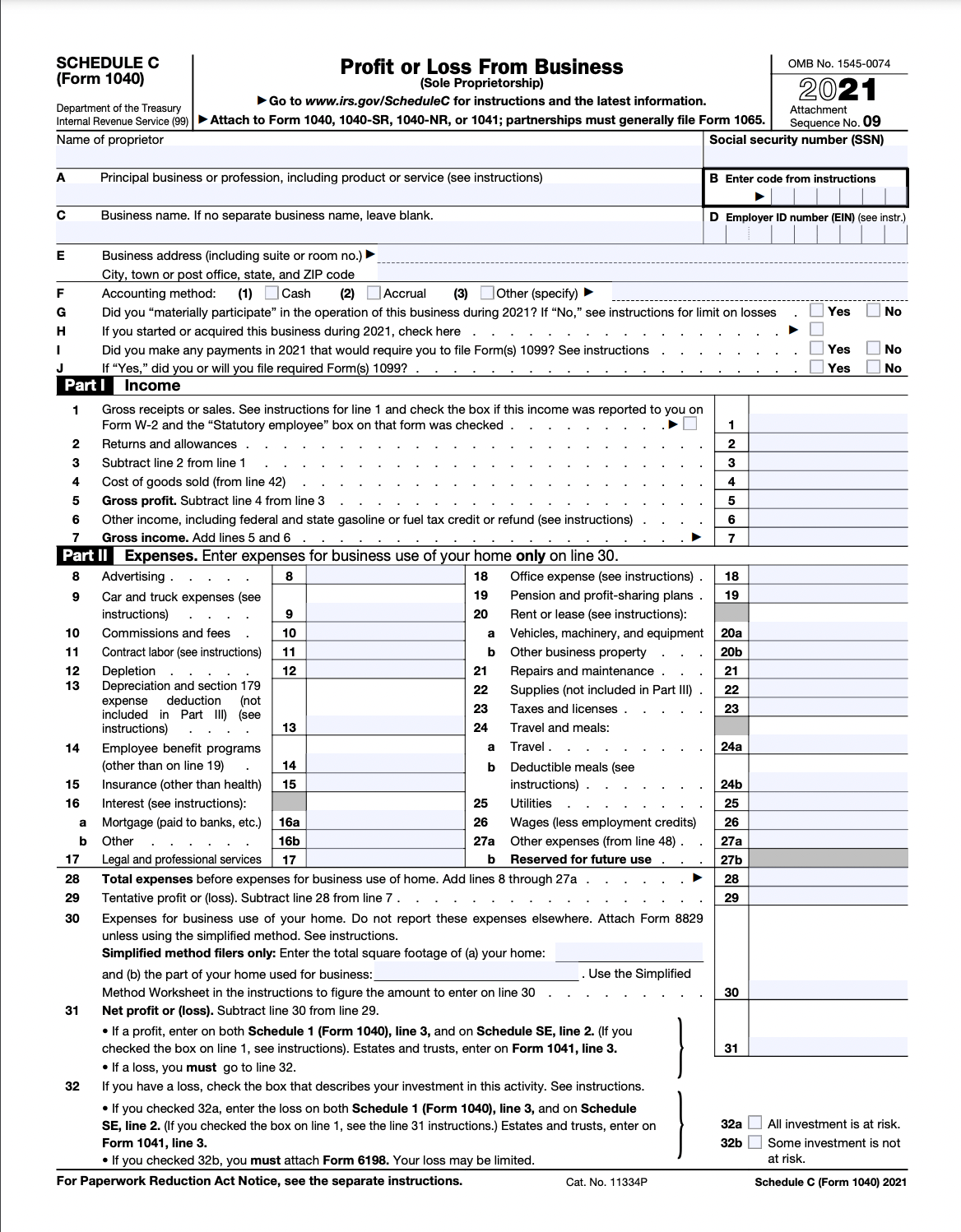

However, as an independent contractor, you also need to file Schedule C, an addition to Form 1040, detailing all your profit and loss, as well as deductible expenses, as a one-person business during the year.

Step #2: Paying self-employment taxes

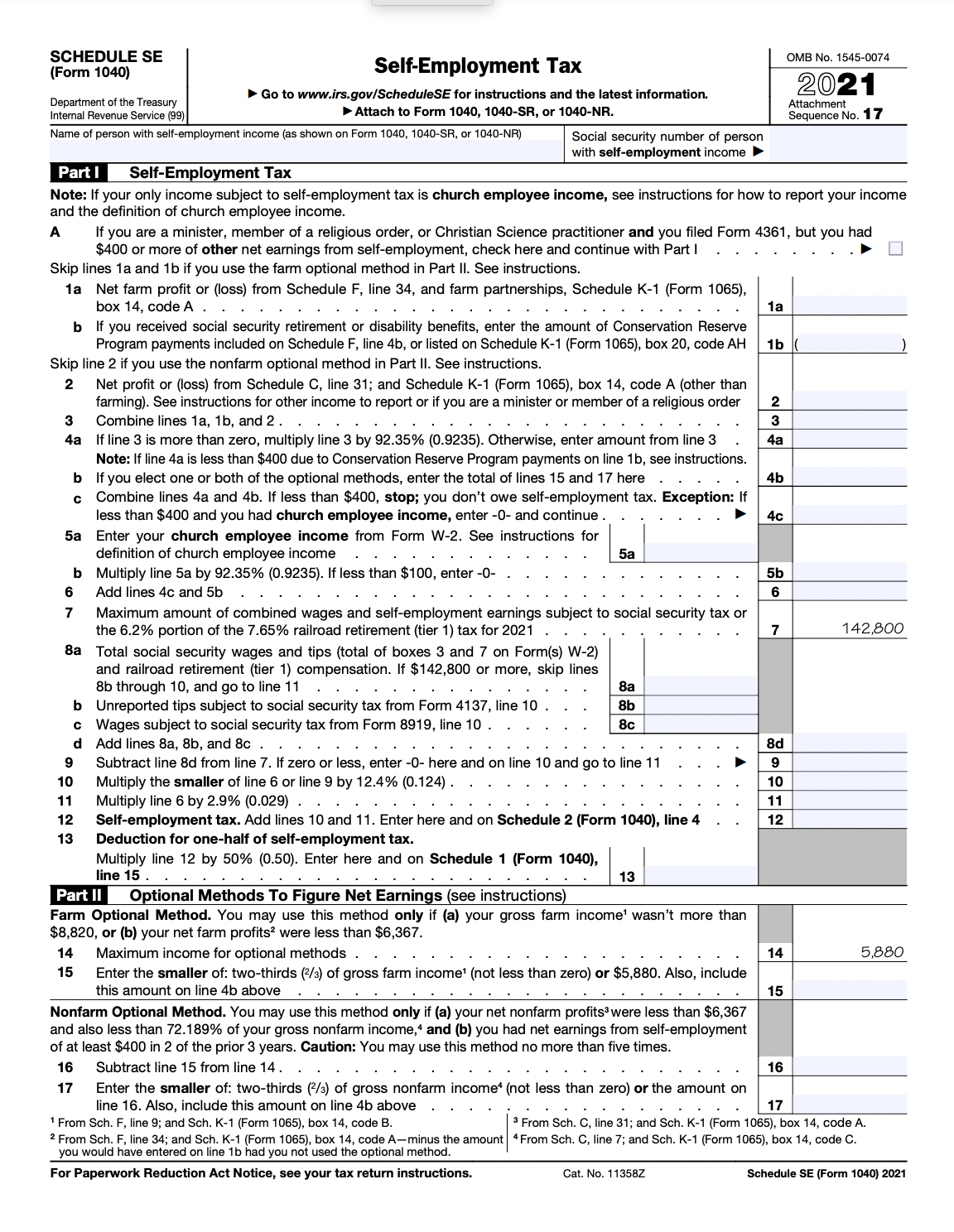

Another form you need to file with the IRS is Schedule SE — i.e. the self-employment tax form.

Since you don’t have an employer who can withhold money from your paycheck for FICA (Federal Insurance Contribution Act) taxes, you need to do it yourself.

You’re subject to the self-employment tax if your net earnings for the year equal or exceed $400.

These taxes include your Social Security and Medicare contributions. Regular employees normally pay half of the amount for FICA, and their employer provides the other half.

But, as an independent contractor, you pay the entire sum yourself through the SE tax.

Self-employment taxes are probably the most dreaded type of taxes for freelancers, as they can be quite steep. At the time of writing this (July 2022), the self-employment tax rate equals 15.3% (12.4% for Social Security and 2.9% for Medicare) of 92.35% of your net earnings.

Beware that you may also be subject to Additional Medicare Tax of 0.9% if your income exceeds the threshold amount prescribed by the IRS. The threshold depends on your filing status:

- For those married, filing jointly, it amounts to $250,000.

- For those married, filing separately, it amounts to $125,000.

- For the rest, the threshold is $200,000.

You file Schedule SE at the end of the year, together with your individual tax return (Form 1040).

Self-employment tax calculator

The easiest way to gauge your SE tax liability is to use our self-employment tax calculator.

Simply enter your net earnings in USD (e.g. 100,000), and the calculator will provide you with the correct tax rate based on 92.35% of the amount you entered — so there’s no need to pre-calculate the taxable base, the calculator will do it for you.

You also need to choose your filing status from the drop-down menu (e.g. married, filing jointly). This way, the calculator can determine whether the Additional Medicare Tax applies based on the above criteria, and take it into account.

Once you enter your net earnings and filing status, the calculator will tell you:

- Your total SE tax,

- The Medicare portion of the amount, and

- The Social Security portion of the tax.

Step #3: Claiming tax deductions

There’s also an upside to paying taxes as an independent contractor — ample business deductions.

You report these deductions via Schedule C, alongside your income.

One of the most important deductions you can claim is the self-employment tax deduction, which allows you to write off half of your SE tax (i.e. the employer-equivalent portion).

Self-employed taxpayers can write off a variety of business expenses, including:

- Gas and car mileage

- Business insurance

- Home office expenses

- Internet and phone bill

- Advertising

- Rent or lease

- Equipment purchase

- Education expenses

- Mortgage for home office space

All of these deductions come with special guidelines (and sometimes, limitations) on how to account for them. We’ll touch on some of these later.

For now, here’s a quick example to illustrate how tax deductions for independent contractors work.

Independent contractor tax deductions example — dog groomer

To illustrate how deductions work, let’s look at an example of a freelance dog groomer.

A dog groomer may require a license, and they may deduct any fees for obtaining it as education expenses.

They may work from a “home office” and claim a home office deduction per square foot.

The groomer’s job also requires them to buy equipment, such as different brushes, clippers, shears, shampoos, and a grooming table. All of these expenses can be written off.

Let’s say the groomer also does “field work”, visiting dogs at the owners’ location — this means they may also deduct any travel expenses.

Step #4: Making quarterly tax payments

If you’re expected to owe $1,000 or more in taxes for the year, you have to make quarterly tax payments.

These quarterly tax payments are estimated, i.e. you need to make a calculated guess on how much you will owe, either based on your current income stream or your previous year’s tax obligations.

To calculate the quarterly amount you need to pay, you can use Estimated Tax Worksheet — Form 1040-ES.

The four tax payments are due in the following months:

- April

- June

- September

- January the following year

Of course, you won’t know the exact amount you’re due until you file the personal tax return at the end of the year — so be careful with your estimates.

If you miss a quarterly payment or underestimate the amount, you may face penalties.

NOTE: The above are your federal tax obligations, but make sure not to neglect your state taxes as well.

What about independent contractor form 1099?

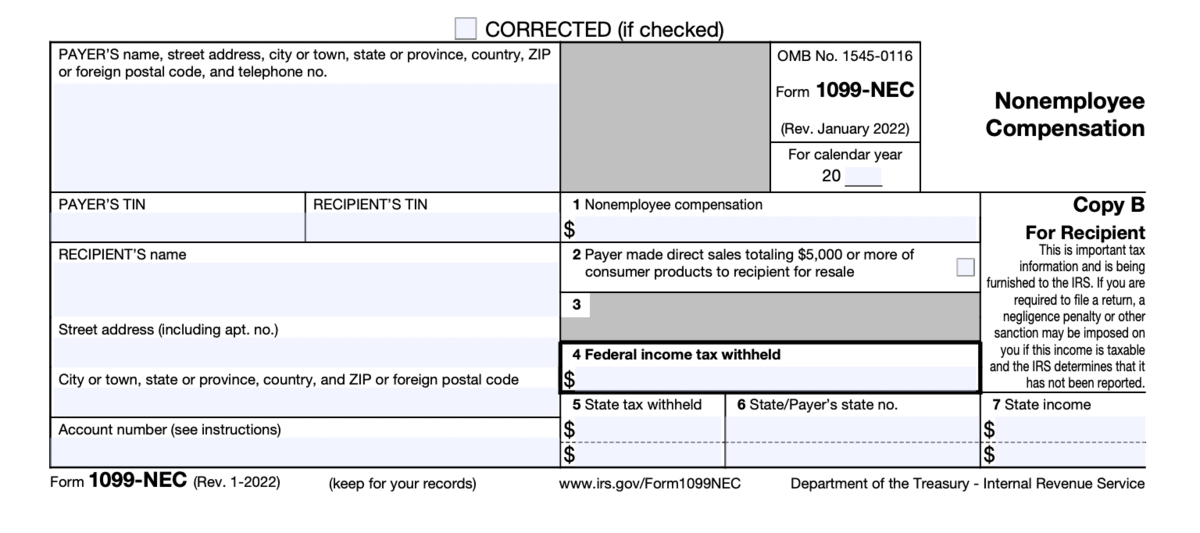

As an independent contractor, you don’t fill out Form 1099 — you receive it from your clients.

In other words, business owners need to report payments to nonemployees through Form 1099-NEC if the payment totaled $600 or more per tax year.

So, if you’ve received $600 or more from a single client during the year, they are obliged to file Form 1099-NEC to the IRS and provide you with a copy as well.

You can then use the information in the form to report your income and calculate your taxes.

If the payer neglects to send you Form 1099-NEC, be sure to remind them on time.

However, bear in mind that if a client paid you more than $600 during the year and didn’t send you a 1099, you’re in no trouble. Form 1099 is their tax obligation, and they’re the one who will be facing penalties for neglecting to report nonemployee compensation.

NOTE: Even when a client doesn’t have to report yearly payments to you (if they’re lower than $600), you still need to report all your income, even if you did not receive a 1099 for it. Likewise, if you are due a 1099 (for payments of $600 and more) and don’t receive it, you still need to report the payment to the IRS.

How to ask for payment professionally (+ templates) How to pay contractors and freelancers in 5 simple stepsA quick look at the tax forms an independent contractor should know about

If you’re just starting out as an independent contractor, all the forms we’ve mentioned can seem a bit scary.

So, here’s a quick rundown of the most important tax forms you need to know about.

| Tax form | Summary |

| Form 1040 | Main tax sheet, individual income tax return |

| Schedule C (Form 1040) | For reporting profit and loss as a one-person business, and any deductible expenses |

| Schedule SE (Form 1040) | Self-employment tax (Social Security and Medicare) |

| Form 1040-ES | For calculating and paying estimated tax |

| Form 1099-NEC | The form you receive from payers detailing payments made to you during the year |

How to avoid paying taxes as an independent contractor (legally)

Nothing is certain but death and taxes, so you can’t really avoid paying them — that would be tax evasion that could earn you a hefty fine and even land you in jail.

However, there are ways to significantly reduce your tax liability, mostly through one of the following methods:

- Taking advantage of deductions

- Meticulously tracking your business expenses

- Knowing when to switch your business structure

Tip #1: Take advantage of tax write-offs for self-employed

As we’ve said, self-employed individuals can take advantage of many deductions and drastically lower their tax bills. Even so, many freelancers miss out on great opportunities for write-offs.

We’ve already mentioned one of the biggest deductions — i.e. the one for the self-employment tax — as well as those related to business expenses. But there are others to know about.

We’ll mention some of the most important ones you may have missed.

Qualified Business Income (QBI) deduction

One of the newest tax breaks independent contractors can claim is the Qualified Business Income (QBI) deduction.

This write-off is the one you don’t want to miss, as it can take as much as 20% off your taxable income.

To qualify for this type of deduction, your total taxable income — not just business income — needs not exceed:

- $170,050 for single filers, and

- $340,100 for joint filers.

Even if your income goes above these numbers, you may still qualify — but probably won’t be entitled to the full 20%.

Health care premiums deduction

As a self-employed person, you need to buy your own health insurance premiums. But, the good news is that you may claim a deduction for medical, dental, and long-term care insurance.

You can also deduct the medical coverage you paid for your spouse or other dependents.

Home office deduction

You are likely to work from home, so it’s good to know that you can deduct costs related to this space from your tax.

Bear in mind that the space needs to be used exclusively for work, and it mustn’t be larger than 300 square feet.

This yearly deduction can be complicated to calculate, but you can go for a simplified option, which allows you to write off $5 per square foot.

For example, if you work from a 15 ft by 10 ft home office, the total size is 150 square feet. If you multiply the square footage by $5 you can deduct per square foot — you get $750 in yearly home office deductions.

IRS Publication 587: Business Use of Your HomeRetirement plan deduction

Not only is it wise to save for old age by contributing to a retirement plan, but it also allows you to defer taxes on the amount you put in until you cash out your retirement.

You can get this deferral by contributing to a variety of different plans, including:

- Solo 401 (k)s

- SEP-IRA-s

- SIMPLE IRAs

The amount of the deferral depends on the plan you choose, but you can take a look at the IRS guidelines for details.

Tip #2: Keep track of your business expenses

Apart from some larger tax write-offs we mentioned above, you can deduct a variety of smaller business expenses — which can add up quickly and sneakily.

That’s why it’s essential to keep meticulous records of all your business costs — together with receipts — so that you can easily add them up come tax season.

These can be anything from your internet and phone bills to workday meals.

How to track project expenses when freelancing or working from home (+templates)Tip #3: Consider switching your business structure

If you’ve been in the game for a while and earn a solid income (e.g. more than $80,000 per year), you may look into becoming an S corporation.

An S corporation is a tax designation for a formal business organization that can reduce your tax liability.

As an S corp with one employee (i.e. you), you can assign yourself a salary and pay your FICA taxes only on that salary, instead of the entire business income.

For example, if your business income equals $120,000 and your salary is $90,000, you don’t pay taxes for the remaining $30,000.

However, bear in mind that becoming an S corp can be a complicated process (which can cost you a lot of money). So, it’s not advisable unless you are an established one-person business with a steady income stream.

NOTE: If you’re thinking about transitioning to S corp, paying yourself a $10 salary, and beating the system — it’s not going to work. The IRS has thought of the loophole, and it requires you to pay yourself a reasonable salary for the type of work you do. This means they have a final say as to what that salary can be, and they won’t allow you to make it too low.

How to budget for taxes as an independent contractor

Now you know two essential things that will help you budget for your taxes:

- You need to pay taxes in 4 yearly increments

- Your taxes will eat up about 25–30% of your yearly income

So, here’s what you can do to prepare for the tax season.

Step #1: Set up dedicated bank accounts

The best way to stay on top of your income and expenses is to have at least 3 separate bank accounts:

- A personal account

- A business account

- A savings account

With the first and second, you can easily separate your personal and business expenses. This will also help you with record-keeping.

The savings account can come in handy for allocating funds for taxes in advance, instead of waiting for the tax season.

Step #2: Compare your business income stream to the previous year

If you’ve been in business for a while, it will be much easier to calculate your taxes. This is especially true if your income stream is pretty steady, as you can make proper estimates based on your tax obligations from the previous year.

If you’ve expanded your business, your fiscal information from the previous year can still help you estimate your taxes for the current one, as you’ll have a reference point to start from.

Step #3: Consider saving as you go

If your income stream is inconsistent, it may be best for you to save as you go — this is where a savings account can come in handy.

Instead of waiting for your earnings to accumulate, set aside a percentage of each payment you receive and put it in your savings account. It’s best to go for the 25–30%, if feasible.

This way you’ll also make sure to save for taxes before you start paying your bills and potentially run out of funds.

Step #4: Set up a system to track your income

The best way to ensure you’re always ready come tax season is to have a system for tracking your inflow.

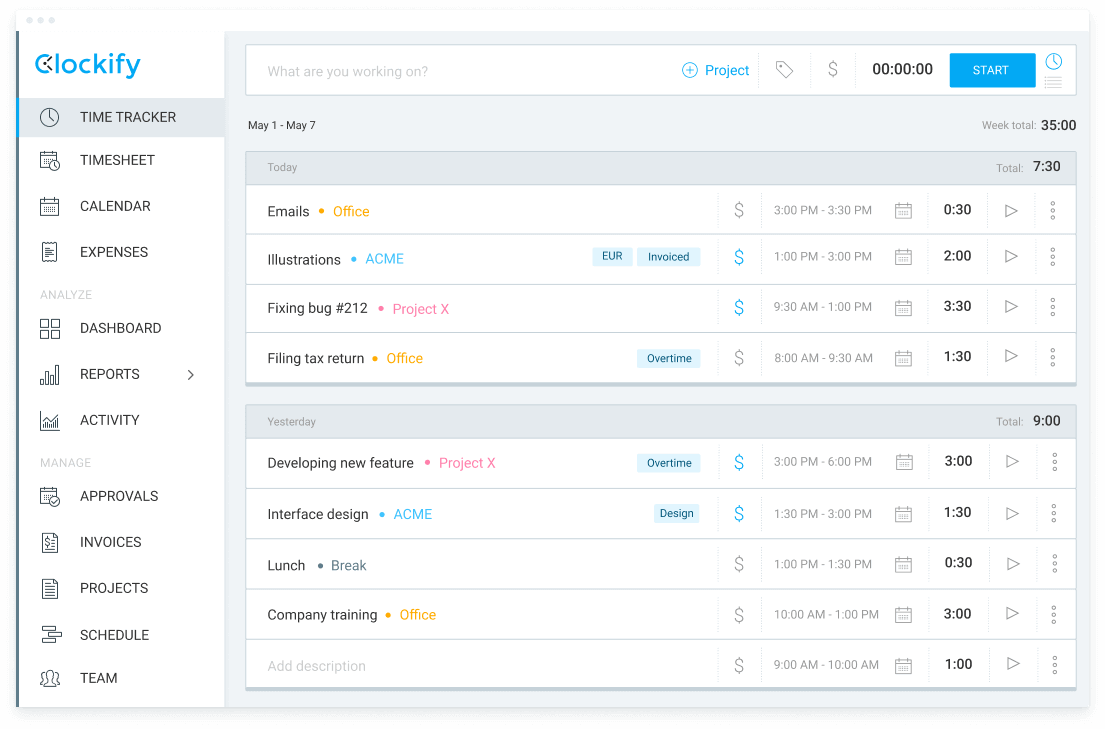

As an independent contractor, you may want to consider using a freelance time tracking system, such as Clockify.

Clockify is great for these purposes, as it allows you to account for all your work hours with minimal effort.

With Clockify, you can:

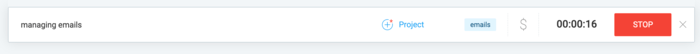

- Track the time you spend on each client task using a timer

- Set hourly rates for each task

- Have the app automatically calculate your billable hours

- Get reports

- Create invoices

Track your work time

Since you don’t have an employer to keep track of how much you work, it’s best to do it yourself and have a record of how many hours you spent on each project and client.

In the Clockify time clock app, you can easily track your time by starting a timer when you begin working on a task.

If you want to take a break, simply pause the timer and resume when you continue working.

If you don’t feel like tracking activities in real-time, you can input them manually using Clockify’s timesheet view.

Calculate billable hours

Freelancers tend to work less than 30 hours per week, but the truth is not all of that time is spent on billable activities.

Clockify helps you keep track of billable vs. non-billable activities in the following way:

- Create a time entry for a billable task

- Set up hourly rates for the task

- Track time spent on the task by starting the timer whenever you work on the task

- Let Clockify automatically calculate your billable time

Check out how you can easily track billable hours with Clockify in the video below.

Generate reports

If you track your billable time, you can also generate reports which can tell you how much time you spent on each task or project and how much you earned in the process.

This way, you’ll always be aware of your earnings, which will help you make much better tax estimates.

Create invoices

Clockify is also an invoicing app, and it allows you to automatically generate invoices based on your billable hours, which you can then send to your clients.

Using the invoicing feature will ensure you have all the records of your earnings neatly organized, which will make tax filing much easier.

In a nutshell — there’s no need to worry about collecting your paperwork manually when you can use an app for that.

Wrapping up: Taxes don’t have to be scary

Although tax filing as an independent contractor can seem intimidating at first, all you need to do is take it one step at a time.

Simply follow the instructions we’ve outlined in this guide, and you’ll stay on top of your tax obligations throughout the year.

Furthermore, don’t forget to take advantage of all the deductions for self-employed individuals — they can significantly lower your tax bill.

Keep track of your earnings and expenses, and make sure to set aside about 25–30% of your income for taxes.

Most importantly, don’t forget to use time tracking software, as it will make the entire process more efficient and manageable.

How to issue 1099

Filing Form 1099-NEC is fairly simple.

Just follow these steps:

- Collect the required information about the contractor through Form W-9 (See Step #1).

- Fill out Copy A and Copy B of Form 1099-NEC — the former is for the IRS, the latter for the contractor.

- Send Copy A to the IRS — you can do it either by mail or electronically, through the IRS FIRE (Filing Information Returns Electronically) system.

- Send copy B to the independent contractor — you can do so either via mail or email (for the latter, you need to obtain consent from the contractor).

- Send a copy to the state tax department, if needed — there’s also a Copy 1 of the document you can send to your state, if required.

Submit Form 1096 — if you choose to submit 1099-NEC by mail, you’ll also need to send Form 1096 to the IRS, which is used for tracking all the physical copies of the 1099 forms you submit for the year.