It sometimes happens that employees get injured or develop a certain illness while working.

In such situations, employees need protection to cover their expenses and help them return to work as soon as possible.

For this reason, employers must provide workers’ compensation insurance to all employees who suffer from a work-related injury or illness.

This form of insurance protects both employees and employers, as it eliminates unnecessary lawsuits and costly legal fees.

In this article, we will cover the most important information about workers’ compensation insurance and give you the requirements for each state.

- Workers’ compensation is an insurance that employees can receive if they are injured in the workplace or develop a particular illness due to the nature of their job.

- Employers are obligated to purchase workers’ compensation for their employees, while employees aren’t required to participate financially in that purchase.

- Workers’ compensation insurance has benefits for both employees and employers.

- There are 2 types of workers’ compensation coverage — A and B.

- Every state has its own workers’ compensation law, which defines requirements and exceptions for this type of insurance.

What is workers’ compensation insurance?

In case of a work-related injury or illness, employees are eligible to receive workers’ compensation insurance, which is a form of social insurance.

In such a situation, employees (or their inheritors) who are eligible for workers’ compensation insurance have the right to receive the following benefits:

- Payment for lost wages,

- Rehabilitation therapy,

- Medical expenses,

- Healthcare benefits, and

- Beneficiary benefits in case of employee death.

Employees can receive only some of the benefits listed above or all of them combined, depending on the case. The employees’ negligence doesn’t decrease the amount they will receive, nor does the employers’ culpability increase it.

Nonetheless, an employee can lose the right to workers’ compensation if their injury is a consequence of alcohol or drug intoxication or if the injury happened due to reckless behavior (e.g., not respecting safety measures in the workplace).

Each US state has its own regulations regarding workers’ insurance compensation. These regulations include different requirements and exemptions, which we will cover later in the guide.

How does workers’ compensation insurance work in the US?

Employers are legally obligated to ensure a safe workplace for their employees.

Therefore, employees who suffer a work-related injury or illness should immediately report it to their employer. After that, this employee can fill out a workers’ compensation claim form that contains information such as:

- Injury details,

- When did the injury happen,

- Where did the injury happen, and

- How did the injury happen.

Once an employee has completed the form, the employer can submit the claim to the insurance carrier. In addition to the workers’ compensation claim form, the employer might be required to submit additional forms that vary from state to state.

After that, employers must report the injury to the state’s division workers’ compensation board. All workplace injuries must be reported, even if the employee is not pursuing workers’ comp. The deadline for submitting all forms is typically 7 days.

Then, when the workers’ compensation claim is made, an insurance carrier will determine whether they will accept it or not. If they approve the claim, the employee can either take the compensation or try to negotiate a higher amount.

However, if the insurance carrier declines the workers’ compensation claim, the employee can either ask for a reconsideration or file a formal appeal through the state workers’ compensation board.

When the employee recovers from the injury and can return to work, they must submit a written notice to the employer and the insurance provider.

🎓 Federal Employee’s Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation (CA-1)

🎓 Notice of Occupational Disease and Claim for Compensation

Who pays workers’ compensation in the US?

Employers buy the workers’ compensation coverage from their insurance provider, and the employees aren’t required to contribute to the compensation cost. If an accident occurs and the employee is injured, the insurance carrier then pays the employee.

Employers can buy workers’ compensation coverage through:

- Workers’ compensation state funds, or

- Private insurance companies.

Although employers pay workers’ compensation, this comes with a specific tradeoff. Employers with workers’ compensation insurance are protected from lawsuits from employees who suffer work-related injuries or illnesses.

This makes workers’ compensation coverage a mutual agreement between employers and employees — and protects both sides.

Benefits of worker’s compensation

Workers’ compensation has benefits for both workers and employers.

Regarding employees, workers’ compensation covers their medical expenses and lost wages in case of a work-related injury or illness. Moreover, injured workers can get additional benefits, such as rehabilitation therapy or healthcare.

On the other hand, employers are protected in situations where employees are injured on the job. This protection means that employees can’t file civil lawsuits against employers.

For example, an employee might fall from a ladder during work hours and break their leg, which could require surgery. If the employer doesn’t have workers’ compensation insurance, the employee can sue the employer and get compensation.

With workers’ compensation insurance, employers pay a monthly premium to the insurance provider, who handles situations like these.

Who is covered by the workers’ compensation insurance in the US?

In general, most employees will be covered by workers’ compensation insurance. However, this varies from state to state, and each state has its own workers’ compensation laws.

Some factors (e.g., number of employees) affect whether or not workers’ compensation will cover certain types of employees. For example, workers’ compensation isn’t required in Alabama for businesses with fewer than 5 employees.

Moreover, some states exclude workers’ compensation for employees, such as:

- Independent contractors,

- Sole proprietors,

- Family members,

- Farmers, and

- Real estate agents.

Workers’ compensation insurance doesn’t cover federal employees. Nevertheless, certain programs protect these types of employees and other specific employee groups.

The most important employee protection programs include:

- Federal Employees’ Compensation Program (FECA),

- Longshore and Harbor Workers’ Compensation Program,

- Federal Black Lung Program, and

- Energy Employees Occupational Illness Compensation Program.

These programs are administered by the US Department of Labor’s Office of Workers’ Compensation Programs (OWCP), which provides wage replacement, medical care, rehabilitation, and other benefits to employees with work-related injuries or illnesses.

Workers’ compensation coverage types

There are 2 types of workers’ compensation coverage:

- Workers’ compensation coverage A, and

- Workers’ compensation coverage B.

Let’s look at them in more detail.

Workers’ compensation Coverage A

Workers’ compensation Coverage A, also known as Part One of the compensation policy, includes all state-mandatory employee benefits.

This coverage provides medical expenses, lost wages, rehabilitation, and other benefits to employees regardless of liability.

For example, a cashier can slip on their job and injure their arm. Coverage A can cover parts of their medical expenses, rehabilitation, and lost wages.

Workers’ compensation Coverage B

Workers’ compensation Coverage B, or Part Two of the compensation policy, includes additional benefits that coverage A may not cover. Employees can receive these benefits as part of a successful lawsuit against the employer.

Although employees usually waive their right to file a civil suit against the employer when they use the workers’ compensation insurance, in some cases, employees might have the right to sue their employer.

These are mostly cases where the injury or illness happened due to gross negligence from the employer. That’s why workers’ compensation Coverage B is also known as liability insurance for employers.

For example, a construction worker notices a broken ladder and tells his employer. The employer doesn’t fix the ladder, and the employee falls from it while working, thus breaking his leg. In this case, workers’ compensation coverage A won’t be enough to cover potential surgery and months of rehabilitation, in which case the employee might sue the employer for gross negligence.

Employers who purchase workers’ compensation insurance that covers both A and B types protect themselves from these lawsuits, as coverage B can provide up to 100% of medical expenses and 2/3 of lost wages.

Workers compensation laws by state

In this part, we will examine workers’ compensation laws for every US state and provide information about their workers’ compensation officials and requirements.

| State | Workers’ compensation division | Requirements | Workers’ Compensation Law |

|---|---|---|---|

| Alabama | Department of Labor, Workers’ Compensation Division | Coverage is required for all employers with 5 or more employees. | Alabama Code §25-5-1 et seq. |

| Alaska | Department of Labor & Workforce Development, Division of Workers’ Compensation | Coverage is required for employers with more than 1 employee. | AS §23.30.005, et. seq. |

| Arizona | Industrial Commission of Arizona, Claims Division | Coverage is required for employers with more than 1 employee. | Arizona Revised Statutes Annotated §§23-901, et seq. |

| Arkansas | Arkansas Workers’ Compensation Commission | Coverage is required for most employers that have 3 or more employees. | Arkansas Code Annotated § 11-9-101 et seq. |

| California | Department of Industrial Relations, Division of Workers’ Compensation | Coverage is required for all employers. | California Labor Code Division 3, section 2700 through Division 4.7, section 6208 |

| Colorado | Department of Labor and Employment, Division of Workers’ Compensation | Coverage is required for employers with 1 or more employees. | Colorado Revised Statutes §8-40-101, et seq. |

| Connecticut | Workers’ Compensation Commission, Capitol Place | Coverage is required for employers with 1 or more employees. | Connecticut General Statutes Sections 31-275 through 31-355a, et seq. |

| Delaware | Department of Labor, Division of Industrial Affairs | Coverage is required for employers with 1 or more employees. | Delaware Code Annotated Title 19, §§2301-2397 |

| District of Columbia | Department of Employment Services, Labor Standards Bureau | Coverage is required for employers with 1 or more employees. | District of Columbia Code Annotated §32-1501, et seq. |

| Florida | Department of Financial Services, Division of Workers’ Compensation | Coverage is required for construction businesses with 1 or more employees. It is also required for regular companies with 4 or more employees and for agricultural businesses with 6 or more regular workers or 12 or more seasonal workers. | Chapter 440, Florida Statutes, et seq. |

| Georgia | Georgia State Board of Workers’ Compensation | Coverage is required for employers who employ 3 or more workers. | Official Code of Georgia Annotated §§34-9-1, et seq. |

| Hawaii | Department of Labor and Industrial Relations, Disability Compensation Division | Coverage is required for employers with 1 or more employees. | Hawaii Revised Statutes, Chapter 386 |

| Idaho | Industrial Commission | Coverage is required for employers with 1 or more employees. | Idaho Code §72-101, et. seq. |

| Illinois | Illinois Workers’ Compensation Commission | Coverage is required for all employers, even those with only 1 part-time employee. | 820 Illinois Compiled Statutes Annotated 305/1, et seq. |

| Indiana | Workers’ Compensation Board of Indiana | Coverage is required for all employers. | Ind. Code §22-3-1-1 et seq. |

| Iowa | Iowa Workforce Development, Division of Workers’ Compensation | Coverage is required for most employers. | Iowa Code §85.1 et seq. |

| Kansas | Department of Labor, Division of Workers’ Compensation | Coverage is required for all employers who employ employees and have a gross payroll of more than $20,000 annually. | Kansas Statutes Annotated §44-501 et seq. |

| Kentucky | Kentucky Labor Cabinet, Department of Workers’ Claims | Coverage is required for all employers with 1 or more employees. | Kentucky Administrative Regulations 25:009 et seq. |

| Louisiana | Louisiana Workforce Commission, Office of Workers’ Compensation | Coverage is required for all employees, whether part-time, full-time, or contractors. | Louisiana Revised Statutes Annotated §23:1021 et seq. |

| Maine | Workers’ Compensation Board | Coverage is required for employers who employ 1 or more employees. | Maine Revised Statutes Annotated, title 39-A, or 39-A M.R.S.A. §101 et seq. |

| Maryland | Workers’ Compensation Commission | Coverage is required for employers who employ 1 or more employees. | Maryland Code Ann., Lab & Empl. §9-101 (2014) et seq. |

| Massachusetts | Department of Industrial Accidents | Coverage is required for all employees, even for employers who are employees at the same time. | Massachusetts General Laws, Chapter 152 |

| Michigan | Department of Licensing and Regulatory Affairs, Workers’ Compensation Agency | Coverage is required for all employers who employ 1 or more employees. | Michigan Compiled Laws Annotated 418.101-941 |

| Minnesota | Department of Labor and Industry, Workers’ Compensation Division | Coverage is required for all employees, even non-US citizens and minors. | Minnesota Statutes Annotated Ch. 175A and 176, et seq. |

| Mississippi | Workers’ Compensation Commission | Coverage is required for all employers who employ 5 or more employees. | Section 71-3-1 et. seq., MISS. CODE ANN |

| Missouri | Department of Labor and Industrial Relations, Division of Workers’ Compensation | Coverage is required for all employers who employ 5 or more employees. Moreover, it is required for construction businesses with 1 or more employees, including part-time, full-time, and seasonal workers. | Chapter 287 R.S.Mo. 2005 |

| Montana | Department of Labor and Industry, Employment Standards Division | Coverage is required for all employers. | Mont. Code Ann. §39-71-101, et.seq |

| Nebraska | Workers’ Compensation Court | Coverage is required for all employers who employ 1 or more employees, including part-time and minor employees. | Nebraska Revised Statutes §48-101 et. seq. |

| Nevada | Department of Business & Industry, Division of Industrial Relations | Coverage is required for all employers who employ 1 or more employees. | Nev. Rev. Stat. Chapters 616A-616DNev. Rev. Stat. Chapter 617 |

| New Hampshire | Workers’ Compensation Division, Department of Labor | Coverage is required for all employers who employ workers, including part-time employees and family members. | New Hampshire Revised Statutes Annotated 281-A |

| New Jersey | Department of Labor and Workforce Development, Division of Workers’ Compensation | Coverage is required for employers who employ 1 or more employees. | New Jersey Statutes Annotated 34:15-1 et seq. |

| New Mexico | Workers’ Compensation Administration | Coverage is required for employers who employ 3 or more employees. | New Mexico Statutes Annotated §§52-1-1, et seq. |

| New York | Workers’ Compensation Board | Coverage is required for all employees, even family members, minors, and part-time workers. | Workers’ Compensation Law of the State of New York |

| North Carolina | Industrial Commission | Coverage is required for employers who employ 3 or more employees. | N.C. Gen. Stat. §97 |

| North Dakota | Workforce Safety and Insurance | Coverage is required for all employees, including part-time and seasonal employees. | North Dakota Century Code Title 65 |

| Ohio | Bureau of Workers’ Compensation | Coverage is required for all employers who employ 1 or more employees. | Ohio Revised Code §4121.01 et. seq. Ohio Administrative Code §4121-01 et. seq. |

| Oklahoma | Workers’ Compensation Court | Coverage is required for all employers, even those who employ only 1 part-time employee. | Okla. Stat. tit. 85, §§301-413 |

| Oregon | Workers’ Compensation Division | Coverage is required for employers who employ 1 or more employees. | Workers’ Compensation Law. Or. Rev. Stat. §656.001 |

| Pennsylvania | Bureau of Workers’ Compensation, Department of Labor and Industry | Coverage is required for all employers who employ 1 or more employees, regardless of their work status or hours worked. | Worker’s Compensation Act of June 24, 1996, P.L. 350, No. 57 |

| Rhode Island | Department of Labor & Training, Division of Workers’ Compensation | Coverage is required for all employers who employ 4 or more employees. | R.I. Gen. Laws. 27-7.1-1, et. seq. |

| South Carolina | Workers’ Compensation Commission | Coverage is required for employers who employ 4 or more part-time or full-time employees. | S.C. Code Ann. §42-1-110 et seq. |

| South Dakota | Department of Labor and Regulation, Division of Labor & Management | Coverage is required for all employers, no matter how many employees they have. | SDCL Title 62 |

| Tennessee | Department of Labor and Workforce Development, Division of Workers’ Compensation | Coverage is required for all employers in the construction and coal mining industries. Moreover, it is required for all regular employers who employ 5 or more employees. | T.C.A. §50-6-101, et seq. |

| Texas | Department of Insurance, Division of Workers’ Compensation | Workers’ compensation insurance is not mandatory in Texas. However, it is required for employees working in construction companies employed by the government. | Texas Labor Code Annotated § 401.001 et. seq |

| Utah | Labor Commission, Division of Industrial Accidents | Coverage is required for all employees, including directors, officers, and LLC members. | Utah Code Annotated §34A-2-101, et seq. |

| Vermont | Department of Labor, Workers’ Compensation Division | Coverage is required for all employers who employ 1 or more full-time or part-time employees. | Vermont Statutes Annotated title 21, § 601 et seq. |

| Virginia | Workers’ Compensation Commission | Coverage is required for employers with 2 or more employees, including part-time and minor employees. | Virginia Workers’ Compensation Act, Title 65.2 Code of Virginia 1950 |

| Washington | Department of Labor and Industries, Insurance Services Division | Coverage is required for all employers with 1 or more employees. | RCW 51.04.010 to 51.98.080 |

| West Virginia | Office of the Insurance Commission | Coverage is required for most employers, although there are some exceptions. | W. Va. Code §23-1-1 et seq. |

| Wisconsin | Department of Workforce Development, Workers’ Compensation Division | Coverage is required for employers with 3 or more full-time or part-time employees. | Wis. Stat. §102.01-.89 (2011) |

| Wyoming | Department of Workforce Services, Workers’ Compensation Division | Coverage is required for all employees, including minors and part-time employees. | Wyoming Statutes §27-14-101, et seq. |

Note: You can find all the links concerning each workers’ compensation law by state in the sources section below the text.

Frequently asked questions about workers’ compensation

To make this guide as comprehensive as possible, we have included an FAQ section where we will answer the most common questions about workers’ compensation.

Do all 50 states have a workers’ compensation system?

No, not all states have a workers’ compensation system. For instance, Texas doesn’t require employers to purchase workers’ compensation insurance for their employees.

Is workers’ compensation mandatory in the USA?

Yes, it is mandatory. Almost all employers in the US must purchase workers’ compensation insurance for their employees — the only exception being the state of Texas.

Where to file for workers’ compensation?

If you suffer a work-related injury or illness, the simplest way to file a workers’ compensation claim is through your employer. Moreover, you can file it through your doctor by telling them that your injury/illness is work-related.

If, for any reason, your employer refuses to file a workers’ compensation claim, you can report it to the state workers’ compensation board.

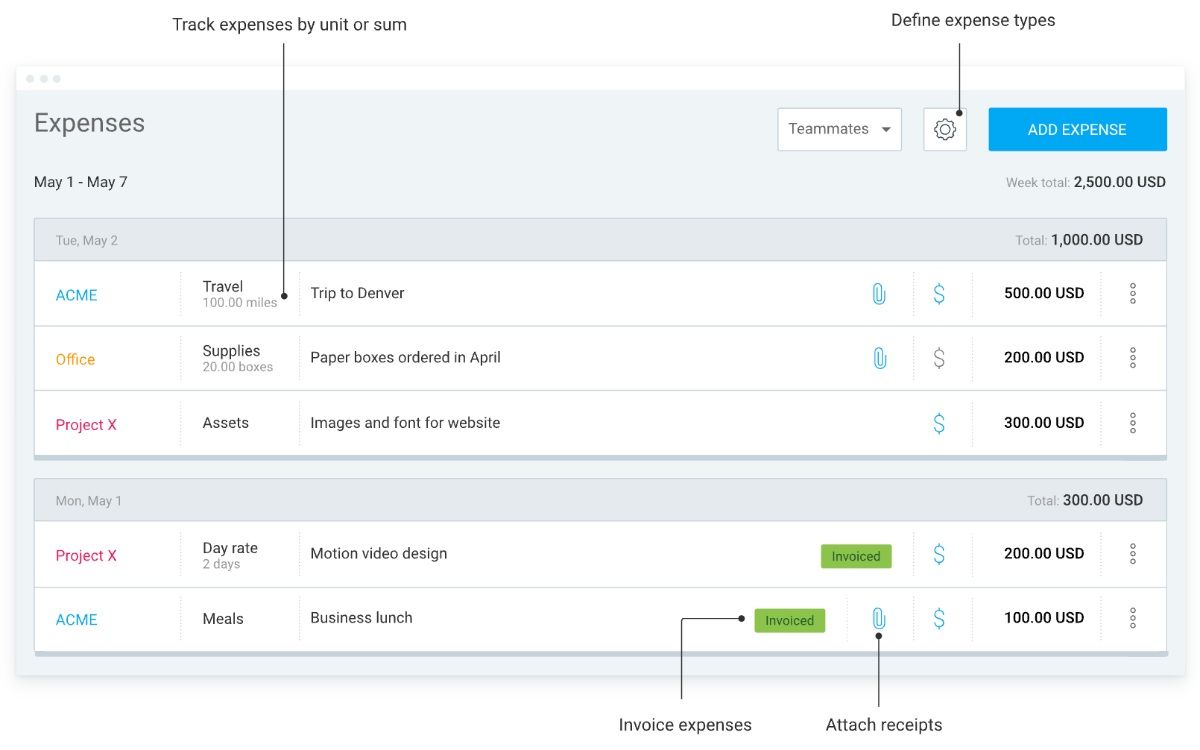

Track your expenses with Clockify

Business owners perform many tasks while running their businesses, but one task that needs extra attention is handling finances, especially expenses.

Expenses come in all shapes and sizes, from employee salaries to daily operating costs and workers’ compensation insurance, and handling all these numbers can be quite stressful and challenging.

For that reason, using software such as Clockify can make this easier for you and save you both time and money.

With Clockify’s expenses feature, you and your employees can add expenses to projects and keep track of them in an expense report, which you can later export as a PDF, CSV, or Excel file.

Moreover, you can categorize your expenses to track them more easily.

For example, if you are paying a monthly workers’ compensation insurance fee and any other type of insurance fee, you can categorize them all as insurance expenses.

What are you waiting for? Start saving time and money by using Clockify!

SOURCES FOR THE TABLE:

- 820 Illinois Compiled Statutes Annotated 305/1, et seq.

- Alabama Code §25-5-1 et seq.

- Arizona Revised Statutes Annotated §§23-901, et seq.

- Arkansas Code Annotated § 11-9-101 et seq.

- AS §23.30.005, et. seq.

- California Labor Code Division 3, section 2700 through Division 4.7, section 6208

- Chapter 287 R.S.Mo. 2005

- Chapter 440, Florida Statutes, et seq.

- Colorado Revised Statutes §8-40-101, et seq.

- Connecticut General Statutes Sections 31-275 through 31-355a, et seq.

- Delaware Code Annotated Title 19, §§2301-2397

- District of Columbia Code Annotated §32-1501, et seq.

- Hawaii Revised Statutes, Chapter 386

- Idaho Code §72-101, et. seq.

- Ind. Code §22-3-1-1 et seq.

- Iowa Code §85.1 et seq.

- Kansas Statutes Annotated §44-501 et seq.

- Kentucky Administrative Regulations. 25:009 et seq.

- Louisiana Revised Statutes Annotated §23:1021 et seq.

- Maine Revised Statutes Annotated, title 39-A, or 39-A M.R.S.A. §101 et seq.

- Maryland Code Ann., Lab & Empl. §9-101 (2014) et seq.

- Massachusetts General Laws, Chapter 152

- Michigan Compiled Laws Annotated 418.101-941

- Minnesota Statutes Annotated Ch. 175A and 176, et seq.

- Mont. Code Ann. §39-71-101, et.seq

- N.C. Gen. Stat. §97

- Nebraska Revised Statutes §48-101 et. seq.

- Nev. Rev. Stat. Chapter 617

- Nev. Rev. Stat. Chapters 616A-616D

- New Hampshire Revised Statutes Annotated 281-A

- New Jersey Statutes Annotated 34:15-1 et seq.

- New Mexico Statutes Annotated §§52-1-1, et seq.

- North Dakota Century Code Title 65

- Ohio Administrative Code §4121-01 et. seq.

- Ohio Revised Code §4121.01 et. seq.

- Okla. Stat. tit. 85, §§301-413

- Official Code of Georgia Annotated §§34-9-1, et seq.

- RCW 51.04.010 to 51.98.080

- R.I. Gen. Laws. 27-7.1-1, et. seq.

- S.C. Code Ann. §42-1-110 et seq.

- SDCL Title 62

- Section 71-3-1 et. seq., MISS. CODE ANN

- T.C.A. §50-6-101, et seq.

- Texas Labor Code Annotated § 401.001 et. seq

- Utah Code Annotated §34A-2-101, et seq.

- Vermont Statutes Annotated title 21, § 601 et seq.

- Virginia Workers’ Compensation Act, Title 65.2 Code of Virginia 1950

- W. Va. Code §23-1-1 et seq.

- Wis. Stat. §102.01-.89 (2011)

- Worker’s Compensation Act of June 24, 1996, P.L. 350, No. 57

- Workers’ Compensation Law of the State of New York

- Workers’ Compensation Law. Or. Rev. Stat. §656.001

- Wyoming Statutes §27-14-101, et seq.

Published: October 29, 2024

Published: October 29, 2024