It may seem like you have no control over when your clients pay for your services.

While there is some truth to that, you can still encourage timely payments.

So, stop what you’re doing — and let’s see how you can tweak your invoicing habits to get your clients to pay on time.

Be prompt when sending out invoices

First things first: To get paid on time, always send out invoices promptly. The longer it takes you to send an invoice, the longer you’ll wait to get paid.

Obvious, right?

Sure, but if you have lots of clients, it’s easy to get lost in a pile of uninvoiced projects. It can happen to the best of us. Even now — when invoicing has evolved so much.

To never forget to invoice a client again, you can use Clockify by CAKE.com — a reliable time tracker with tons of invoicing features.

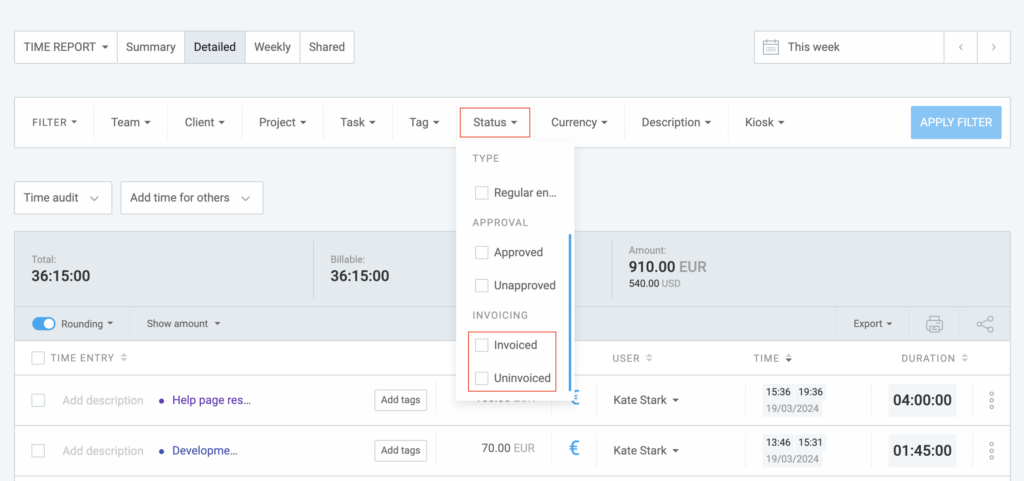

When creating invoices in Clockify, you’ll always know what has been invoiced and what hasn’t. That’s because the software allows you to add status labels to tracked time and expenses —and mark them as invoiced or uninvoiced.

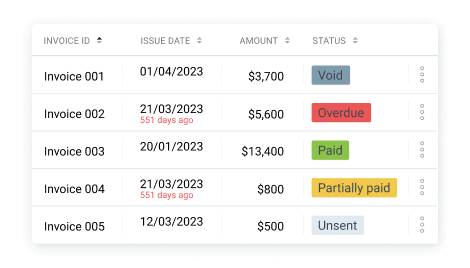

To top it off, you can categorize your existing invoices according to the payment status — the labels include:

- Paid,

- Partially paid,

- Overdue,

- Unsent, and

- Void.

If you have a clear overview of the status of your invoices, you can make sure they are sent promptly. This way, clients will never again have an excuse to pay late.

💡 CLOCKIFY PRO TIP

Inaccurate invoices are a major reason why some invoices are past due. To learn how to invoice your clients accurately, here’s a quick read:

Offer incentives to clients who pay early

Early payment incentives can be a powerful strategy for motivating clients to pay early and continue requesting your services.

The most common form of early payment incentives is the early payment discount.

To illustrate how this discount works in practice, here’s a hypothetical scenario:

All your clients are given 30 days to pay the invoice. You offer a 3% discount to clients who pay within the first 10 days. One client is eligible for the discount; the total amount due is $2,000. This client pays $1,940 instead of the full amount.

But what makes this incentive so effective?

Licensed Clinical Psychologist Ehab Youssef explains that one of the reasons early payment discounts work well is closely related to how people make decisions:

“Early payment discounts simplify decision-making. Paying early with a clear financial benefit reduces the cognitive load on the customer, making the decision-making process easier and more straightforward. People are naturally inclined to choose options that require less mental effort, and the clarity of an early discount can provide just that.”

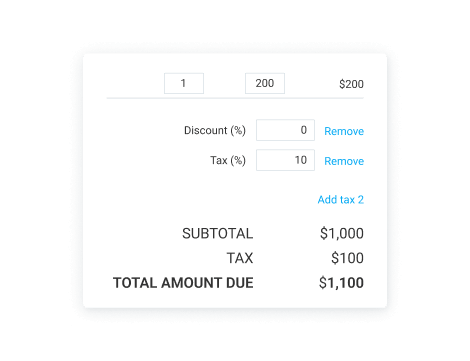

Sure, the early payment discount clearly has major benefits. Still, calculating this discount each time can be time-consuming and may lead to errors.

But there’s a silver bullet.

Clockify’s invoicing feature calculates the discount automatically. Simply type in the percentage of the discount, and the total amount due will be instantly updated.

Include payment information in the invoice

Although you should discuss payment terms with your clients from the get-go, it’s always a good idea to highlight terms in the invoice.

So, your invoice should contain the following payment information:

- Payment due date,

- Total amount due, and

- Payment terms.

Under payment terms, you can mention accepted payment methods, instructions, and any discounts you offer.

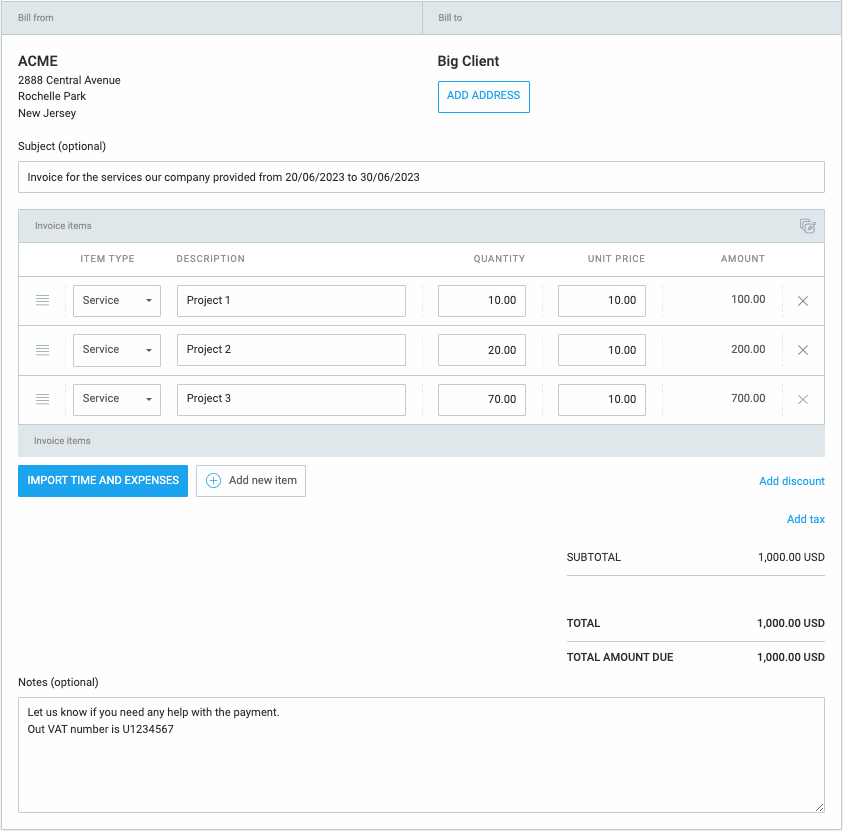

As a powerful time tracking and invoicing software, Clockify by CAKE.com makes it easy to include all that information. When creating an invoice, you’ll be prompted to provide the payment due date. The app also automatically calculates the total amount due by adding up all the separate costs you’ve included in the invoice.

As for other payment details, you can use the Notes section to clearly state payment terms.

All the fields in Clockify-generated invoices are distributed in a way that makes the information easy to read.

As a result, clients are more likely to pay on time since they won’t have to look for that information elsewhere, such as in contracts or by contacting you. That way, all the payment details are easily accessible to facilitate the payment process.

💡 CLOCKIFY PRO TIP

Even if you do everything by the book, you’ll occasionally have to deal with outstanding invoices. Instead of waiting and hoping the client will remember to pay you eventually, you can send payment requests. For more information on how to politely ask for payment, check out this article:

Generate invoices with Clockify

Upgrade your invoicing habits — with Clockify by CAKE.com

Sure, there’s no magical solution that guarantees timely payments in 100% of the cases. But a little bit of encouragement goes a long way.

Changing habits, including the way you invoice your clients, can cause headaches. In contrast, generating invoices using Clockify is convenient because it:

- Minimizes the risk of billing errors,

- Allows you to create your invoices more quickly, and

- Enables you to add status labels to expenses so you never forget to invoice your clients on time.

Finally, if you want to explore in more detail how to use Clockify for invoicing, you can:

- Visit Clockify help pages for step-by-step instructions,

- Watch easy-to-follow Clockify video tutorials, and

- Contact Clockify customer support via email, live chat, or phone.