Travel costs, office supplies, software, marketing — the list of business expenses can seem endless. Add an unpredictable income to the mix, and you have a recipe for a financial disaster.

If you’re struggling with overspending or haven’t built a sufficient emergency fund for your business, your budget management strategy needs a re-evaluation.

Here’s an overview of the popular budgeting methods you can implement to better manage your expenses and reach your financial goals.

#1: Minimize overspending with the Envelope Method

Envelope Budgeting means you sort expenses into categories. Theoretically, you withdraw all cash each month, categorize it, and put it in envelopes.

For personal use, physical envelopes could work, but a business needs a digital envelope system. It can be in the form of separate accounts or a budgeting app.

By categorizing your expenses and determining how much you should spend on each expense category, you’ll likely curb your spending habits.

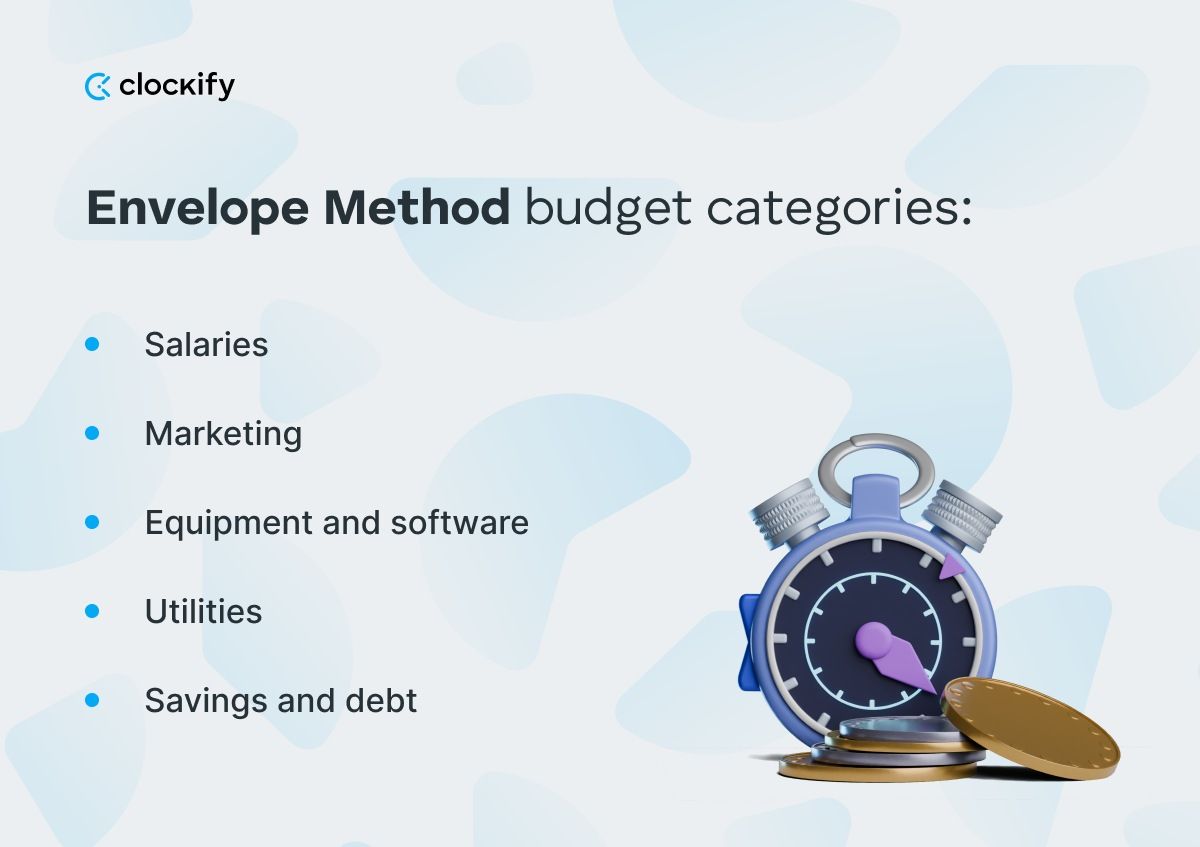

Below are some of the most common budget categories:

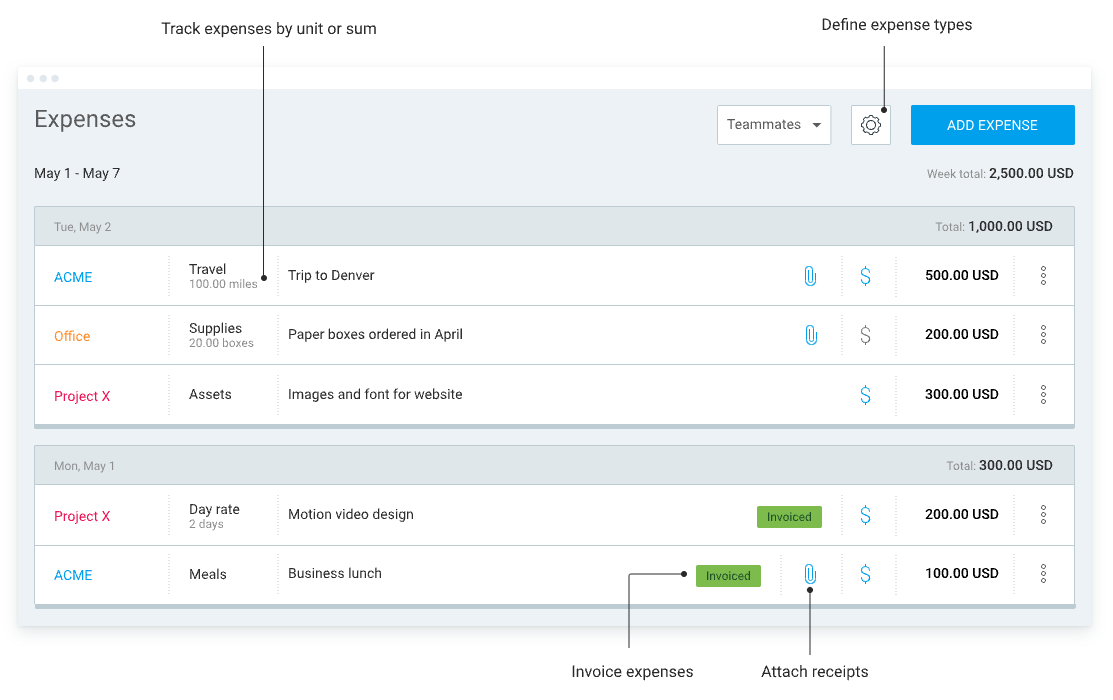

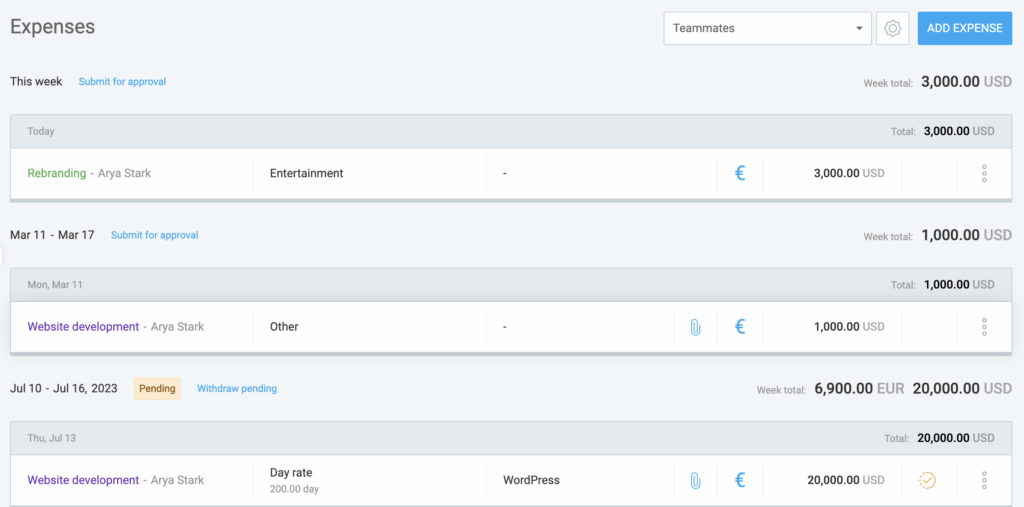

Apart from being a powerful time and invoicing app, Clockify by CAKE.com can help with expense tracking. It has features that allow you and your team to add and categorize all expenses.

By creating expense categories, you can easily keep track of costs and determine how much money you need to allocate for each budget category.

#2: Maintain financial stability with the Profit First Budget Method

Profit First is a budgeting technique that focuses on profit rather than on revenue. Revenue encompasses all the income generated from sales of goods or services. On the other hand, profit is what is left when you deduct expenses.

This budgeting method is based on behavioral psychology principles like Parkinson’s law. According to this principle, “work expands so as to fill the time available for its completion.”

Although Parkinson’s law is geared toward time management, it can also be applied to budgeting. In other words, you’re likely to spend all the money you have at your disposal if you don’t categorize it according to purpose.

Therefore, setting aside a specific amount of money to go toward your business’ profit will ensure a budget surplus each month.

The Profit First Budget Method requires you to subtract profit from sales and use the remaining amount on expenses. The formula looks like this:

Revenue – Profit = Expenses

To properly implement this budgeting system, we recommend separate accounts. You can find examples of separate accounts in the following illustration:

This technique can be compared to some other budgeting methods, like the Envelope Method, but its main goal is to always set profit aside first.

💡 CLOCKIFY PRO TIP

If you’re a restaurant owner, check out this article that breaks down how to create a budget for a restaurant:

#3: Build an emergency fund with the Proportional Budgeting Method

About 43% of businesses surveyed by Clutch stuck to their budget in 2020. According to that same study, as many as 35% went over budget.

So, having an emergency fund for your business is a no-brainer. You never know when a financial crisis could strike.

However, it’s easier said than done — after all, you have all these expenses to cover each month.

Enter Proportional Budgeting Method.

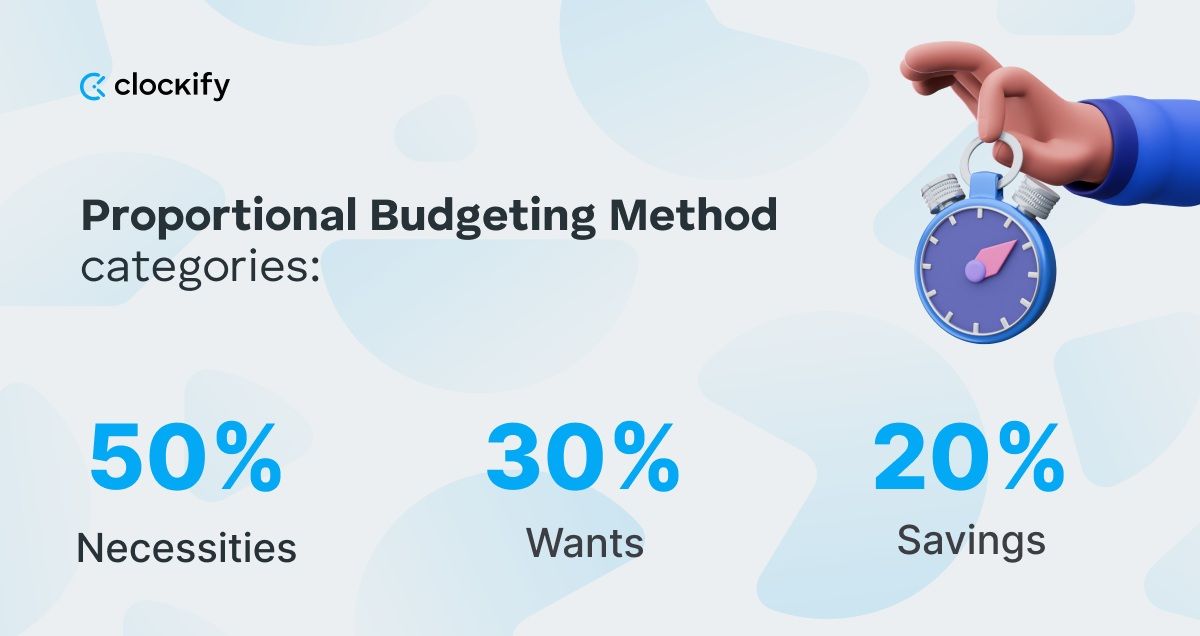

According to this strategy, you should divide the income into distinct categories, each making up a specific percentage.

One example of a proportional budgeting technique is the 50/30/20 Budget Method. It proposes that income should be divided into categories as shown below:

In a business sense, necessities are operational expenses, such as utilities, equipment, and salaries. These are non-negotiable and need to be paid each month.

In contrast, wants are discretionary expenses that usually involve business development. This could be money for:

- Marketing,

- Travel,

- Office improvement, and similar.

Invest the remaining 20% into your savings goals to build an adequate emergency fund. This way, you won’t have to bury your business in debt in case of unexpected costs.

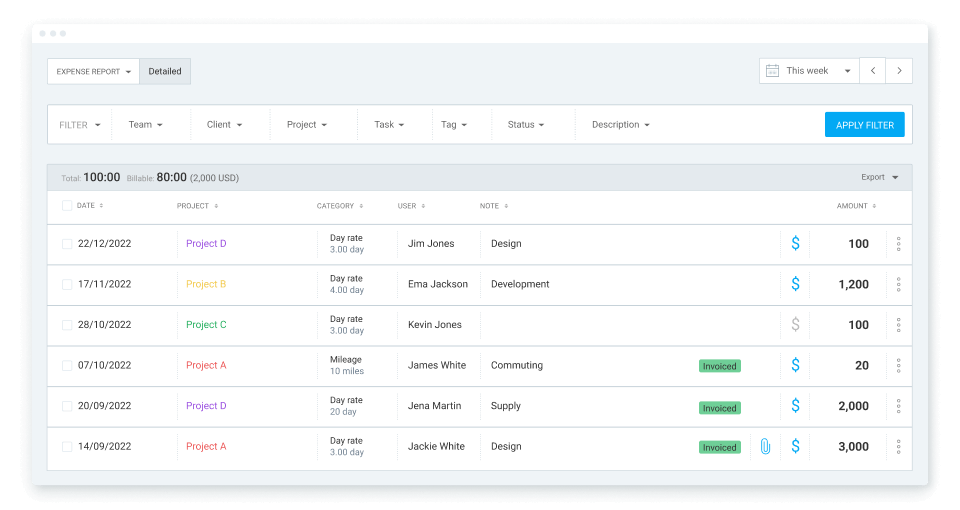

To track all your expenses accurately — use Clockify by CAKE.com.

If you create expense categories for necessities, wants, and savings, you can keep track of how much is being spent on each. Expense reports give you a clear overview of where the money is going.

Tracking your expenses this way allows you to better plan and organize your budget, as well as make sure you don’t overspend in either category.

Bonus: Start over with the Zero-based Budget Method

As the name suggests, Zero-Based Budgeting has you starting from zero, rather than working with the previous budget and only adjusting it. This method requires you to justify each expense.

Typically, you start from scratch and create a new budget plan for each upcoming period. Every cent of the income is allocated to a specific expense, including savings and debt.

For this technique to work, analyze past expenses and incomes. For businesses without a relatively steady monthly income and varying expenses, this can be challenging.

In fact, according to a study conducted by the U.S. Bank, 82% of small businesses fail due to cash flow mismanagement.

Therefore, accurate and consistent income and expense tracking is essential for you to manage your cash flow correctly.

This is substantially easier to achieve when you have a proper tool.

The Zero-based strategy is suitable for businesses that need better control over their budget. It helps make sure that your plan is up to date and in line with your current budget needs.

Keep track of your budget with Clockify by CAKE.com

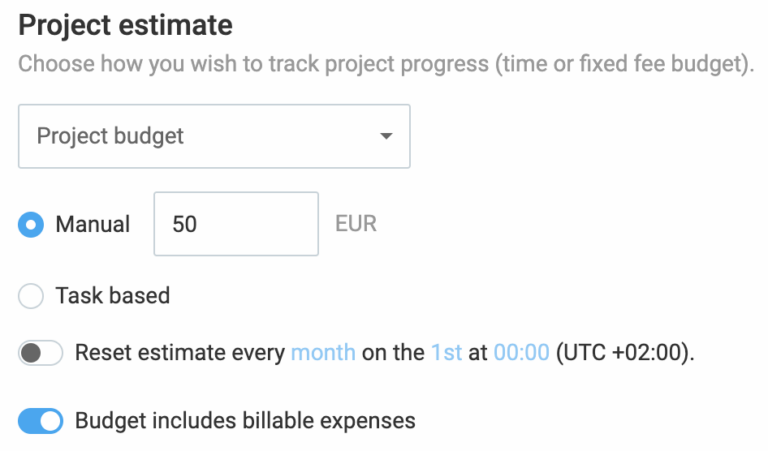

To incorporate budgeting methods, you’ll need to create and monitor your budget estimate.

You can do it all with Clockify, a reliable app for budget tracking.

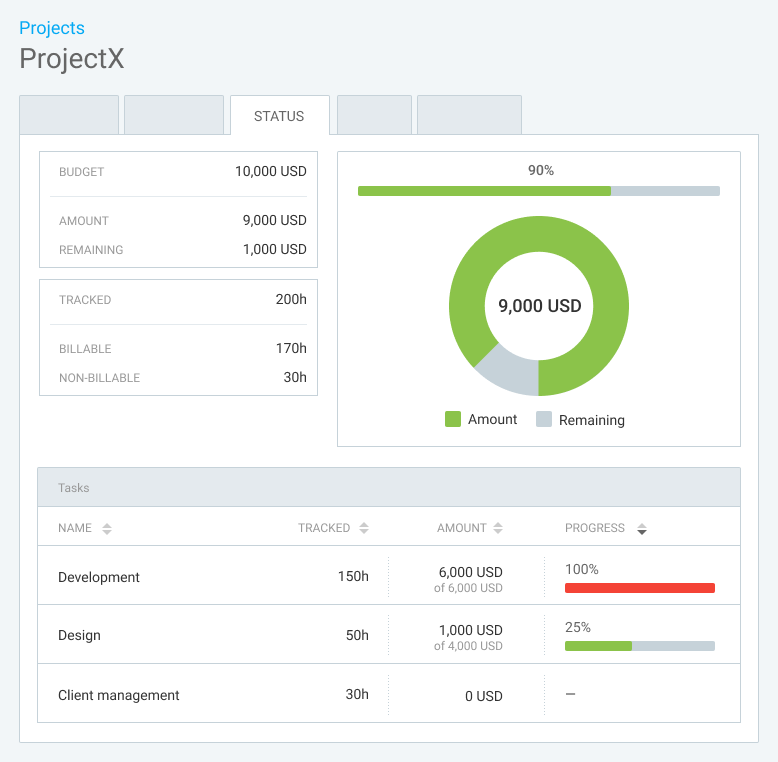

After you’ve entered your budget, the progress bar in Clockify will show the billable hours tracked vs. your budget amount.

This feature lets you monitor the progress of each project in real time and see how much of the budget is being used compared to the estimated amount. This information can help you adjust future budgets.