“There’s no perfect mathematical formula for pricing a business.” — says Warren Buffett, an American businessman and the world’s tenth richest person as of 2024.

That’s why most business owners have trouble finding that sweet spot between pricing their services correctly and attracting a loyal clientele.

So, how do you cross this bridge?

In this article, we’ll explore tried-and-tested ways for business owners to build the perfect roadmap for pricing services.

Define the value of your business idea

Before you take out your calculator to define your pricelist, identify what your business idea brings to the table — this can help determine your business’s value. In turn, you may feel more comfortable setting your prices.

So, how do you define the value of your business idea?

Well, first you’ll need to prove it’s worth your while to begin with.

You can approach the process of validating your business idea by considering the following factors:

- Your objective — Understand your true motivations behind the idea.

- The profitability of your idea — Know that every product or service needs to turn a profit for the business to grow.

- The existing demand — Decide whether the demand for your idea is growing.

- Your personal qualities — Examine how your passion, skill set, and experience can help carry out the idea.

- Your team — Ensure you’re working with skilled and equally passionate team players.

Next, you’ll need to prove the idea brings something new to the market, making it worthwhile for potential buyers.

Naturally, expect that any idea you come up with may already exist. So, execution is key.

Ask yourself: What makes your service stand out?

In practice, long-standing businesses have 2 ways of identifying and evaluating a unique idea. They either discover a new need and devise a solution or recognize poorly met needs in the market and offer a better way to fulfill them.

In the end, the sooner you validate what your business idea is worth, the closer you get to pricing services or products right.

Consider whether it’s different to price services compared to products

As a service provider, you’re probably interested in whether selling services is different from selling products — and how these differences may influence your approach to setting a price.

Well, the answer isn’t so black and white.

Whether you’re a service business or a product company shifting toward selling services, you need to consider 2 important aspects:

- The objective aspect: Products and services have an objective function — solving a problem for the customer. However, services are typically intangible compared to products.

- The subjective aspect: Products depend on the customer’s feelings about objective utility, e.g., whether the smartwatch tracks steps or not. On the other hand, service businesses rely more heavily on the user experience during service — such as whether your accounting consultant was helpful enough in answering client questions.

Moreover, the marketability of your business idea plays a huge role in determining how to price your services.

In contrast to services, marketing products is generally easier. Buyers can usually touch or test them out in person. For instance, a company will decide if a data-entry tool fits their employees’ needs after a free trial.

But services often don’t have that luxury, leaning heavily on external impressions of the business.

For example, clients are more likely to purchase your company’s translation services if it has many positive customer reviews.

So, figuring out a pricing plan for services depends on your customer feedback and engagement. Their public praise will help you build credibility and allow you to set prices that reflect the quality of the service.

Remember: Selling services hinges more on personalized customer experience than tangible goods. Likewise, marketing relies on addressing issues and interacting with your audience. As a result, pricing services depends on how much your customers value your service — whether that’s objective or not.

Conduct a price analysis

While pricing services, everyone’s first impulse is to study competitors and lowball their prices. But undercutting competitors can backfire, attracting low-paying customers and sending the wrong signal about service quality.

Still, knowing competitors’ prices is crucial for mastering service pricing.

That’s why you should perform a competitive pricing analysis.

First, study the market by taking a look at your competitors.

For example, imagine you’re an IT support service agency. Your competitor charges $250 per hour and offers a $3,000 monthly package including 30 hours of IT support. So, you conclude that customers look for stable fees and regular assistance. Lowering hourly rates and adding more support hours to your monthly package can raise attention to your services.

Observing competitors’ pricing strategies helps identify customer expectations about prices and how competitors meet them. This way, you’ll make more accurate decisions about pricing services.

Next, always know where you stand by tracking your market position.

Frequent market changes force business owners to tweak prices. So, monitoring competitors’ offers and clients’ responses to price changes will help you determine your position.

By doing regular pricing analyses, you successfully avoid having your competitors surpass you with better deals.

Calculate the profitability of your services

Every business owner has to spend money to make money — but if you’re spending more than you’re making, your business is bound to go bust eventually.

To avoid having expenses higher than sales, look into your costs before defining prices for your services.

A typical service-providing business usually manages 2 different types of costs:

- Overhead costs — Non-labor costs necessary for managing your company. They can be fixed (like rent costs, utilities, etc.) and variable expenses (such as office supplies or marketing), and

- Cost of goods sold (COGS) — The direct costs of manufacturing products or providing services required for running a business. — e.g., fabrics for sportswear or software subscriptions. Freight and delivery costs also fall into this category.

So, if your business handles similar expenses, identifying the costs you can’t reduce helps you get one step closer to ensuring your business stays profitable.

But, to make sure your business doesn’t operate at a loss, you’ll need to define margins to see where profits fit into your service pricing plan.

Start by calculating your gross profit margin first:

Net sales − COGS = Gross profit margin

Next, look into your net profit margin:

Net sales – COGS and overhead costs = Net profit margin

After you’ve determined your net and gross profit margins you’ll be able to define better financial goals and concoct the best pricing structure.

Finally, knowing your total costs and margins lets you set prices that exceed the costs of providing services — and ensure comfortable profits.

💡 CLOCKIFY PRO TIP

Learn more about fixed costs, backed by examples and simple ways to calculate them:

Choose whether to charge hourly or fixed fees for your services

Another endless debate among service businesses is whether to charge hourly or fixed rates. Although both can be solid fee-measuring options, let’s comb through their differences and see how they can impact your service pricing.

First, a fixed fee is a set price clients pay for a service, no matter the time necessary to complete it. Fixed rates focus more on value than billable time, allowing business owners to prioritize clients’ needs by focusing on service quality.

However, experts on pricing trends note they lack flexibility when market prices shift. For example, you risk offering a fixed rate that may be too high for customers to pay during inflation.

So, when defining prices for your services, remember that a fixed rate can reflect service value but also endanger your profitability during a market crisis.

Second, an hourly rate — the amount charged or earned per hour, is appropriate for business owners who care more about getting paid for the exact time invested in providing services.

Compared to fixed fees, hourly rates are useful for handling unpredictable circumstances — i.e. if your projects tend to change over time.

However, they can devalue your skills and experience by highlighting the time and money spent providing services. In contrast to fixed rates, hourly rates don’t show your efficiency in satisfying clients’ needs.

Thankfully, shifting from one billing fee to another is possible. For example, a marketing company can switch from charging a fixed rate of $1,000 per project to charging a 100$ hourly fee if projects start varying in complexity.

Similarly, a web development agency can shift from hourly to fixed fees by offering several package deals at different prices.

Nevertheless, you should look into your previous projects and client interactions to assess which method would make your services most profitable.

Enter a fee agreement

Seal the deal on how much to charge for services via well-negotiated customer contracts.

Legal professionals specializing in client-company negotiations define fee agreements as legally binding written statements signed between your company and client. In other words, a fee agreement is meant to guarantee your agreed-upon prices.

Owner of a creative video studio, Andrew Cussens, summarizes the importance of fee agreements:

“[The fee agreement] spells out the scope of work, deliverables, terms of payment, alignment of prices, and terms of engagement between us and the client. It ensures that everyone knows what they are getting into from the beginning.”

But how do you negotiate the sweet spot?

Well, you should start with your own idea of the fee you’d charge and consider that number in relation to the client’s willingness to pay.

According to experts on pricing tests — i.e. tests meant to help decide the ideal price for goods or services — experimentation can help companies better estimate clients’ willingness to pay.

For example, some companies have adopted the Good-Better-Best pricing approach to avoid conflicts in prices between them and their clients. Essentially, you offer your customers three differently-priced bundles, varying in the number of features, targeting clients with different needs.

Not only does this pricing model attract new clientele, but it also draws customers who are fixated on the price. These price-obsessed clients will have an easier time picking between several offers than agreeing to a single one.

Through clearly defined service costs, fee agreements make you appear professional and trustworthy. Such transparency motivates clients to become repeat customers and promote your services.

In short, learn how service pricing and demand interact to make smooth fee negotiations possible. By implementing fee agreements, you gain customer loyalty and more control over your brand reputation.

Leverage a precision tool to charge for services more accurately

Let me guess: you’ve got a pounding headache and still no clue about pricing services. True, processing the above information and forming an ideal pricing structure isn’t easy.

All pricing talk aside, you need a precision tool — something that’ll help you adjust your service prices to customer expectations through accurate data analysis.

On that note, let’s talk Clockify by CAKE.com.

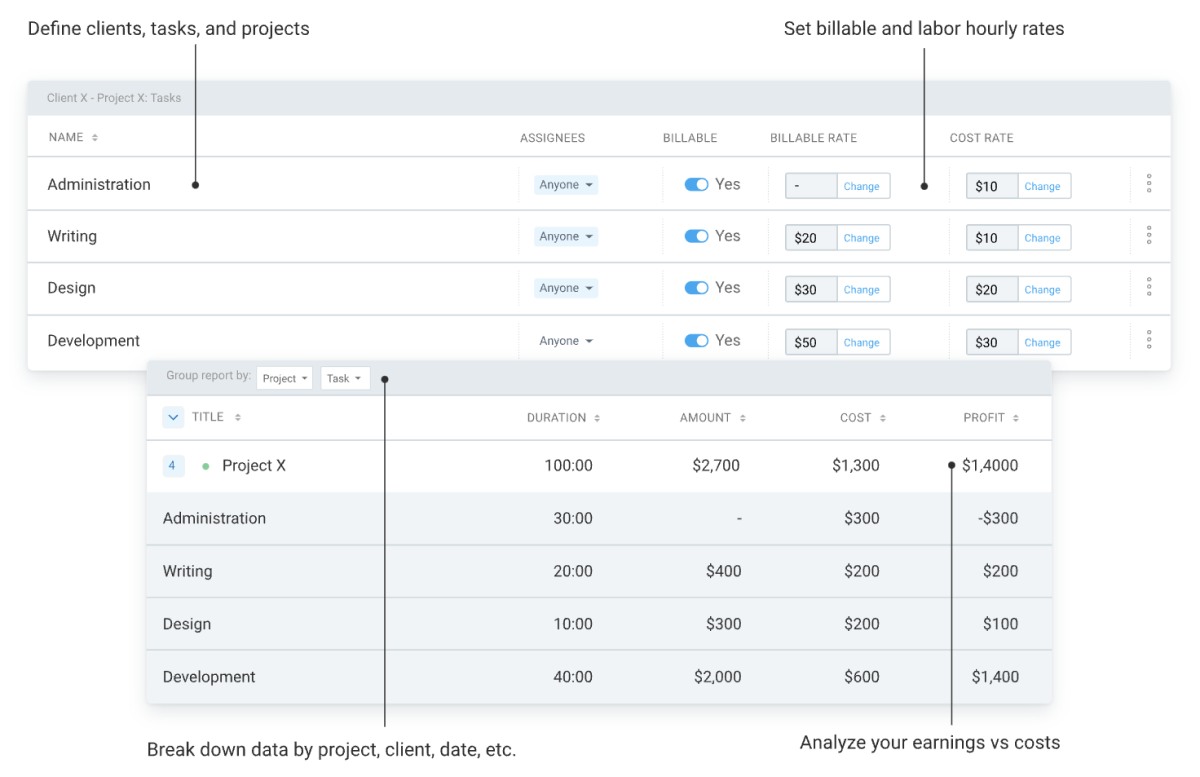

Our practical and cost-effective time tracker promotes factual decisions about hourly pricing. You can even predict future expenses and profit potential with precision.

How so? By letting you track:

- Billable time — for tracking how much you bill your clients hourly, and

- Cost rates — for tracking what you pay your staff for their work.

To top it off, Clockify offers the option to set multiple hourly rates when charging services:

- Workspace rate,

- Member rate,

- Project rate, and

- Task rate.

For service businesses charging the same hourly prices for all services, setting a workspace rate will do. However, those providing services as projects can use the project rate to charge clients individually.

If tasks vary from project to project, you can set task prices via the task rate. And to track labor costs, you can apply member rates to employees.

Service businesses charging per project will also find Clockify by CAKE.com useful. Comparing total hours per project with the project price can help you conclude if service prices are too low — and then modify them.