Is number-crunching your favorite pastime?

If yes, one of the suitable career options to explore is cost accounting.

As a vital aspect of financial management that focuses on measuring, analyzing, and controlling costs, cost accounting is an intriguing career pathway for those with a flair for numbers and precision.

In this article, we take a close look at the principles, advantages, and various methodologies associated with cost accounting.

We also explore the key differences between cost accounting and financial accounting, and the skills you need to become a cost accountant.

But first, let’s look at what cost accounting means.

What is cost accounting?

Cost accounting involves determining all the costs a company incurs when manufacturing a product (a smartphone, a car, or steel, etc.) or delivering a service (bookkeeping, social media management, etc.).

The primary aim of cost accounting is to help the management understand their costs and make informed decisions on controlling expenses and maximizing profit.

Cost accountants classify costs into different categories, such as:

- Direct costs (the cost involved in manufacturing a product or delivering a service), and

- Indirect costs or overhead costs (such as administration, taxes, and insurance that are not directly related to production).

Now, let’s look at what the practice of cost accounting involves.

According to the Statements of Federal Financial Accounting Standards (SFFAS) that describes the accounting standards and terms, cost accountancy is:

“Any disclosed or established accounting method or technique which is used for measurement of cost, assignment of cost to accounting periods, and assignment of cost to cost objects.“

But, what are cost objects and accounting periods?

Let’s go over these and other key terms used in this field:

- Cost object — any product, item, activity, or department in an organization whose cost you measure.

- Cost centers — a specific location, department, function, activity, or individual in an organization that contributes to the costs.

- Cost driver — a factor that influences the cost of a product or activity (for example, the number of raw materials you order, the quality of a product, etc.).

- Cost allocation — involves assigning a company’s total costs to specific cost centers or cost objects.

- Accounting period — also called the financial period or reporting period, the accounting period is the time span for which a company prepares its financial statements.

Now, let’s look at what a cost accountant’s role is.

What is the role of a cost accountant?

The primary role of a cost accountant is to calculate, track, and manage the costs associated with a company’s products or services. Cost accountants play a crucial role in helping the management make informed financial decisions.

Some key responsibilities of a cost accountant include:

- Cost analysis — understanding the various costs a company incurs in manufacturing a product or delivering a service, including direct and indirect costs.

- Cost allocation — assigning costs to different cost centers, products, departments, or projects.

- Budgeting and forecasting — helping the management prepare budgets and financial forecasts by providing data on costs and revenue.

- Inventory management — monitoring inventory levels to help the management identify inventory control issues, such as low stock or overstocking.

- Variance analysis — calculating the differences between actual costs and budgeted costs.

- Pricing decisions — providing support in determining product or service prices by considering the cost structure, market conditions, and competition.

- Process improvement — identifying areas of inefficiency and recommending process improvements.

- Financial reporting — preparing cost-related reports, cost sheets, and financial reports.

- Compliance and regulation — ensuring compliance with accounting standards, industry regulations, and tax laws.

- Cost control — suggesting ways to control costs and helping implement cost control strategies to maximize profit.

- Strategic decisions — assisting management in evaluating the financial viability of potential projects, investments, or business decisions.

🎓 Clockify Pro Tip

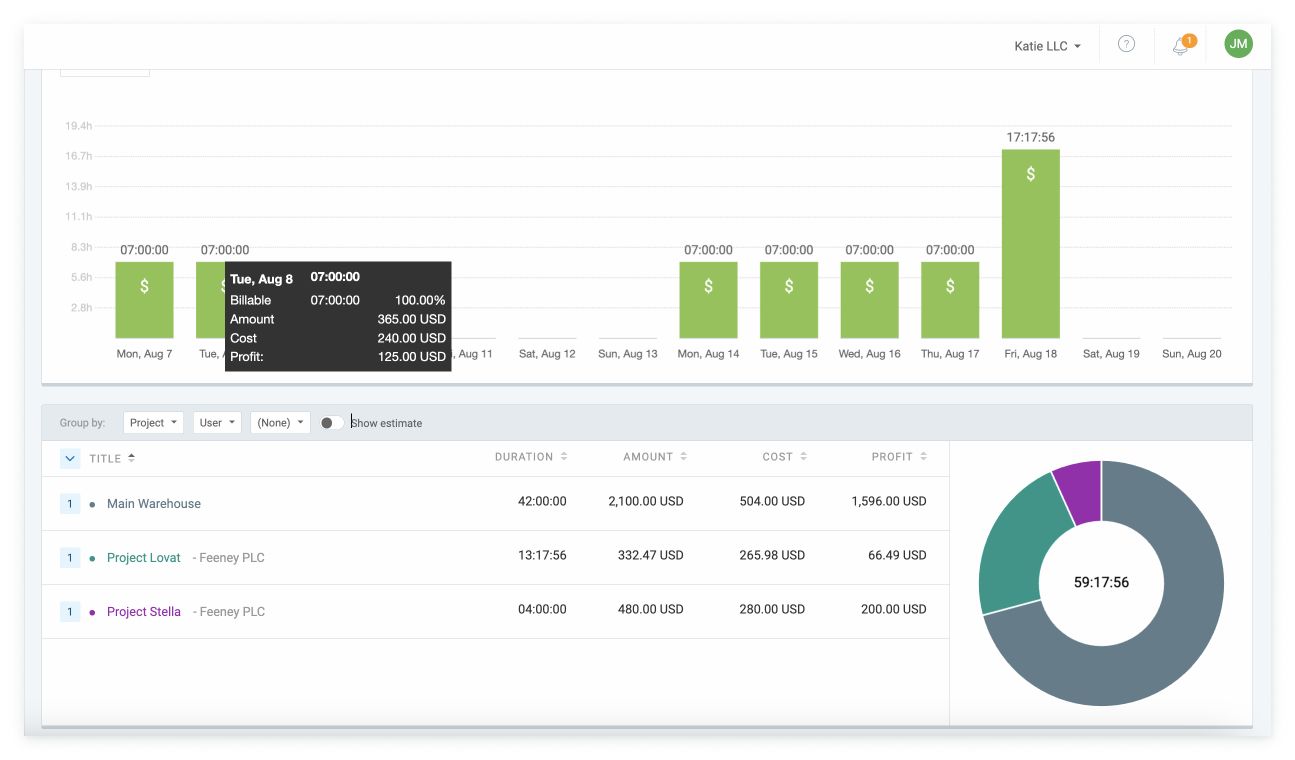

Take control of your projects and costs with this smart project forecasting software:

Elements of cost accounting

According to statistician and author of Cost accounting and costing methods, Harold J. Wheldon, the cost of manufacturing a product or delivering a service can be grouped under 4 different categories: materials, labor, direct expenses, and overheads.

These types of costs are also known as the ‘elements of cost accounting.’

Let’s see what each of them means:

- Material — the expenses related to purchasing materials used in the production process. It includes the cost of raw materials, components, packaging, and any other materials that form part of the finished goods/services.

- Labor — expenses related to employing workers directly involved in the production or service delivery. Labor includes wages, salaries, benefits, and other direct labor costs.

- Other direct costs — these are directly linked to specific cost units but are not categorized as materials, labor, or overhead costs. Examples include subcontractor fees, equipment rental, transportation costs, and specialized services.

- Overhead (indirect costs) — the indirect expenses that support production or service delivery but cannot be directly linked to production. These costs include rent, utilities, administration, depreciation, maintenance, etc.

When you add up the cost of direct materials, direct labor, and direct expenses that are involved in the production of goods, you get prime cost. When you add the prime cost and overhead/indirect costs, you get works cost or factory cost. In other words, works cost is the sum of all the elements of cost accounting.

Next, by adding the works cost to the cost of administration, selling, and distribution, you get the total cost of sales, which is the cost of manufacturing a product or delivering a service.

Here is an image that makes it easy to understand these costs:

How cost accounting works

Cost accounting starts with the process of recording costs involved in producing goods or services. These costs include direct costs (e.g., raw materials, direct labor) and indirect costs (e.g., overhead expenses like rent, utilities, and depreciation).

Let’s look at the steps of cost accounting to understand how it works.

Step #1: Classify costs and calculate direct costs

As described in the book titled Cost Accounting: Principles & Practice, the first step in cost accounting should be classifying labor, materials, and other expenses as direct and indirect costs.

However, it’s important to note that materials, labor, and other expenses can be both direct and indirect.

Direct costs are the ones you would directly incur when producing goods or services.

Here are some examples of direct costs in each of the categories:

- Direct materials — lumber, steel, fiber, or wood required for production (that become part of the finished goods/services),

- Direct labor — carpenter, machine operator, designer, etc., involved in the production, and

- Other direct expenses — rental of machinery/equipment, transportation of machines.

Indirect costs, while being important for operations, are not directly linked to production activities.

These are the examples of indirect costs in each of the categories:

- Indirect materials — fuel for transport, stationary, consumables, office furniture (that are not part of the finished goods/services),

- Indirect labor — management, office administration, security personnel, etc., and

- Other indirect expenses — utilities, sales, marketing, depreciation, taxes, insurance, etc.

Step #2: Calculate the prime cost

The next step is to calculate the prime cost using this formula:

Prime cost = Direct labor + Direct materials + Direct expenses

Step #3: Calculate the works cost

This is the sum of prime cost and production overheads. The formula goes as follows:

Works cost = Prime cost + Production/factory overheads

Step #4: Calculate the production cost

Next, calculate the cost of sales by adding up works (factory) cost and administration overheads.

Cost of sales = Works cost + administration overheads

Step #5: Calculate the total cost of sales

Now, add up all the above costs to arrive at the total cost of sales:

Total cost of sales = Production cost + marketing/advertising and distribution costs

Examples of cost accounting

These examples will help you better understand how cost accounting works.

Cost accounting example #1

XXX company has recorded these expenses in producing 2,000 units of smartphones in the first quarter of 2023:

- Raw material purchase — $12,000

- Direct wages — $50,000

- Other direct expenses — $10,000

- Factory overhead — $10,000

- Office rent and administration — $30,000

- Distribution — $25,000

- Advertising — $2,500

- Market research — $1,000

The company has earned a sales revenue of $130,000 in the same period.

The cost accountant now prepares a cost sheet to reflect the expenses and the revenue.

| Category of costs | Cost calculation |

|---|---|

| Prime cost (raw materials + direct wages + other direct charges) | $12,000 + $50,000 + $10,000 = $72,000 |

| Works cost (prime cost + factory overhead) | $72,000 + $10,000 = $82,000 |

| Production cost (total works cost + administration cost) | $82,000 + $30,000 = $112,000 |

| Cost of sales (advertising + market research + distribution + production cost) | $2,500 + $1,000 +$25,000 + $112,000 =$140,500 |

| Total revenue from sales | $130,000 |

| Net profit/loss (Total revenue from sales−cost of sales) | $130,000 – $140,500 = -$10,500 |

By looking at the cost sheet, we see that the cost of production of 2,000 units of smartphones ($140,500) is more than the sales revenue ($130,000), resulting in a loss of $10,500.

Let’s look at another example to understand how cost accounting works.

Cost accounting example #2

A company earned a revenue of $89,000 in June 2023 from the sales of product X. The company has a record of the costs of the raw materials purchased, salaries paid, and other expenses:

- Raw materials — $20,000

- Direct wages — $25,000

- Other direct expenses — $12,000

- Factory overhead — $5,000

- Administration — $11,000

- Marketing — $800

- Distribution — $15,000

Here’s what a cost sheet a cost accountant prepares to calculate the cost of production and the net profit would look like:

| Category of costs | Cost calculation |

|---|---|

| Prime cost (raw materials + direct wages + other direct charges) | $20,000 + $25,000 + $12,000 = $57,000 |

| Works cost (prime cost + factory overhead) | $57,000 + $5,000 = $62,000 |

| Production cost (works cost + administration cost) | $62,000 + $11,000 = $73,000 |

| Cost of sales (marketing + distribution + production cost) | $800 + $15,000 + $73,000 =$88,800 |

| Total revenue from sales | $89,000 |

| Net profit/loss (Total revenue from sales−cost of sales) | $89,000 – $88,800 = $200 |

The cost sheet shows that the company’s revenue ($89,000) is higher than the production costs ($88,800) allowing it to earn a profit of $200 in the month of June 2023.

When the revenue a company earns by selling its product is more than the cost it incurs in making the product, it earns a profit. On the other hand, when the cost of manufacturing a product is more than the revenue, the company suffers a loss.

As you can see from these examples, cost accounting can be done on a monthly basis (example #2), quarterly basis (example #1), or for any other time period to understand the cost of production and plan the budget for upcoming projects.

🎓 Clockify Pro Tip

Looking to learn the art of restaurant budgeting? Our blog post is just what you need to maximize business success:

Cost accounting vs. financial accounting and management accounting: Key differences

Let’s see how cost accounting compares with other branches of accounting — financial accounting and management accounting.

Financial accounting vs cost accounting

Financial accounting deals with assessing the overall financial health of a business.

Financial accountants specialize in:

- Recording,

- Summarizing, and

- Reporting a business’s financial transactions through financial statements.

These financial statements (including income statements, balance sheets, and cash flow statements) offer a detailed view of a company’s financial performance and status over a specific period.

The primary goal of financial accounting is to allow shareholders, investors, regulators, creditors, and the public to see how a company has performed in a specific time period. In contrast, cost accounting aims to determine and track the actual cost of production.

Financial accounting, unlike cost accounting, follows one of these accounting standards:

- Generally Accepted Accounting Principles (GAAP) that are the accounting standards, principles, and procedures that are practiced in the US, or,

- International Financial Reporting Standards (IFRS), which is a set of global accounting standards developed by the International Accounting Standards Board (IASB).

While the objectives and processes may differ between cost accounting and financial accounting, both are essential for management accounting, the next topic of our discussion.

🎓 Clockify Pro Tip

For more insights into profit and loss statements, check out our blog post:

Management accounting vs cost accounting

While cost accounting is concerned with tracking and comparing the cost of production, the primary goal of management accounting is to analyze and interpret the financial information (revenue, production costs, profit, loss, etc.) obtained through both financial and cost accounting.

The management accounting relies on the financial reports from cost accounting and financial accounting to make informed decisions on the company’s economic growth.

This table gives you an overview of the differences between cost accounting, financial accounting, and management accounting.

| Criteria for comparison | Cost accounting | Financial accounting | Management accounting |

|---|---|---|---|

| The primary goal | Cost control and providing information for internal decision-making | Recording and reporting the financial performance of the company | Decision-making on pricing, costs, investments, and forecasting |

| Method | Uses variance analysis to find the difference between standard costs and actual costs | Records only the actual transactions | Uses multiple tools and methods |

| Target audience | Internal management | External stakeholders | Internal management |

| Type of cost | Pre-determined and historical costs | Historical financial data | Both historic and current costs |

| Mandatory | Only for publicly-traded companies in the US | For all public and private companies in the US | Not mandatory |

| Frequency of reporting | On an ongoing basis (can be daily, weekly, monthly, etc.) | Fixed (annual or quarterly) | Both short and long-term reports |

| Standards | Companies can set their own standards of reporting | Follows GAAP and IFRS | Companies set their own standards of reporting |

🎓 Clockify Pro Tip

Discover an efficient way of allocating and tracking resources with this informative post:

What are the 4 types of cost accounting?

While businesses use many types of cost accounting methods to manage and analyze their costs efficiently, we are going to focus on 4 main types of cost accounting:

- Standard costing,

- Activity-based accounting,

- Marginal costing, and

- Lean accounting.

The choice of a method usually depends on the industry, the nature of the products or services, and the company’s resources, needs and goals.

Type #1: Standard costing

Standard costing is an approach to accounting that companies use to estimate expenses and revenue based on predetermined cost standards.

The cost standards are set for all aspects of operation or production, including the cost of materials, labor, overheads, and indirect costs.

Here’s an easy way to understand the concept of standard costing given by the authors of Managerial Accounting: Creating Value in a Dynamic Business Environment, Ronald. W. Hilton and David E. Platt.

They compare standard costs to a ‘thermostat.’ Just as you can set ‘standard’ temperatures using a thermostat, you can set standards for the company’s expenses and monitor them with standard costing.

According to Alexander Berger, the author of Standard Costing, Variance Analysis, and Decision-Making, standard costing is most suited for manufacturing companies where production activities tend to be repetitive. However, Hilton and Platt write that many firms in the service industry also use standard costing.

For instance, American Airlines sets standards for maintenance and fuel costs, while Allstate, an insurance company, sets standards for the time it takes to process an application.

Some commonly used methods to set cost standards include:

- Historical records of expenses,

- Engineering studies, and

- Consultation with cost accountants, suppliers, and other industry experts.

But, estimating the expenses and profit with standard costing is just one part of the story. The other part is about calculating the actual expenses and revenue (often different from the estimated numbers) at the end of the year.

This is where variance analysis comes into the picture.

What is variance analysis?

Variance analysis is all about finding out how the actual costs vary when compared with the planned or budgeted costs.

Here is the simple formula to calculate variance:

Variance = Actual costs/revenue – Planned costs/revenue

Based on the answer you get after this calculation, the variance can be:

- Favorable — the actual cost is lower than the planned cost (the result of the calculation is a positive number), or

- Unfavorable — the actual cost incurred is higher than the planned cost (the calculation result is a negative number).

Type #2: Activity-based accounting (ABC)

According to accounting expert and author, Peter B.B. Turney, activity-based accounting method (ABC) is based on the premise that“products require activities and each activity consumes a certain number of resources.”

In simple words, this means that some activities (such as, operating a machine) are involved in making a product, and each of these activities involve costs.

In contrast to standard costing, which assigns pre-determined costs to materials and labor, ABC assigns costs to the actual resources used up in each activity.

For example, to manufacture a mobile phone, the company needs to purchase raw materials. In addition to the cost of raw materials, the cost accountant also calculates the time the purchasing manager spends acquiring the raw materials.

Type #3: Marginal costing

To put it simply, marginal costs are the additional costs a company incurs when manufacturing or selling one unit more than the current level of production.

A ‘unit’ in this context can mean any measure of goods, such as a dozen cars or a single smartphone.

For instance, let’s say a company manufactures 500 pairs of shoes per month and their total cost of production is $1,000.

However, the company decided to step up production and make 1,000 pairs of shoes next month and their production cost is now $2,000.

In this case, the marginal cost of production of an extra pair of shoes is:

Change in production cost between the old level of production to the new level (2,000-1,000) ÷ change in the number of units produced (1,000-500) = 1000÷500 = $2

The marginal cost of manufacturing an extra pair of shoes is $2.

Companies use marginal costing to see how to step up production to maximize profit.

For instance, if the cost of manufacturing an additional unit is less than the revenue they earn by selling the unit, the company can make a profit.

Conversely, if the cost of manufacturing an additional unit is more than the revenue they can earn by selling it, they will suffer a loss. In this case, the company has to reduce production to remain profitable.

Type #4: Lean accounting

As another method of cost accounting, lean accounting is particularly suited for ‘lean organizations’ or companies that follow the ‘lean management’ practices.

The focus of lean management is to eliminate waste, make small, ongoing improvements in processes, and boost efficiency.

Instead of being a single ‘method’ of cost accounting, lean accounting involves a set of practices and principles designed to boost lean management.

One of the practices used in lean accounting is value stream costing, which visualizes and analyzes the entire value stream (all the processes and activities involved in production).

A technique used to visualize the processes is value stream mapping (VSM). This is a visual representation of all the components and processes required to manufacture a product or deliver a service.

Once you create a visual stream map, you can identify all the activities and resources required for each value stream. The next step is to prepare an income statement (the detailed cost breakdown for each value stream).

Finally, you can identify and eliminate waste and boost efficiency.

While these are some of the commonly used methods of cost accounting, there are also other forms of cost accounting, such as process accounting and project accounting.

What are the advantages of cost accounting?

By providing vital data on actual costs, cost accounting supports financial planning, cost control, pricing decisions, and much more.

Advantage #1: Cost accounting helps companies find the exact cost of product or service

To understand the importance of cost accounting, we contacted Michelle Delker, an experienced CPA and founder of The William Stanley CFO Group, a financial services firm. She explains that cost accounting has multiple benefits, such as helping companies find the exact cost of product or service:

“One of the main advantages of cost accounting is the ability to calculate the exact cost of a product or service, empowering companies to determine profitable selling prices. It also aids in understanding cost behavior, assisting businesses in making logical budgeting decisions, and identifying wasteful processes.”

Thus, cost accounting provides vital information about the cost of production — including a breakup of materials, plant capacity, labor, and costs.

This allows companies to:

- Calculate and forecast their expenses accurately,

- Allocate resources efficiently, and

- Set realistic financial goals.

By understanding the costs involved in different aspects of the business, managers can make informed decisions about resource allocation and budgeting.

Advantage #2: Cost accounting helps with identifying wasteful activities

One of the primary purposes of cost accounting is to identify profitable and unprofitable activities.

A case in point is the 2022 study titled Advantages of the Cost Accounting View for Entrepreneurs in Improving Productivity and Financial Stability.

In this study, 90.20% of the surveyed managers agreed that cost accounting helps them identify unprofitable activities. This, in turn, leads to improved financial risk management.

By analyzing costs and performance data, cost accountants can pinpoint areas where wastage, inefficiencies, or losses occur, such as idle time/idle capacity, sub-optimal utilization of resources, and wastage of materials.

Advantage #3: Cost accounting helps determine product pricing

According to a survey titled Cost Accounting System and Its Impact on Service Pricing in Vodafone, 77% of the participants agreed that cost accounting plays a key role in determining service pricing.

How does cost accounting help set product/service pricing?

As you know by now, cost accounting involves calculating the total cost of manufacturing a product or service by calculating the cost of direct materials, labor, and overheads.

Once you know the total cost, you can add a profit (or markup) to set the price of your product or service. For example, let’s say a company uses cost accounting to calculate the total cost of manufacturing one smartphone as $500. The company can now add a markup of $200 to set the price of the smartphone as $700.

The right pricing strategy is particularly important in competitive markets, where pricing decisions can impact a company’s profitability.

For instance, if you price your product too low, there is a risk of consumers perceiving the product to be inferior to your competitors’ products. If you price it too high, your consumers may opt to buy from your competitors who offer a lower selling price. In both cases, your company’s sales and profit can take a hit.

By calculating the actual cost of manufacturing a product or delivering a service (that involves materials, labor, overheads, and other direct expenses), cost accounting helps companies find the right selling price to ensure profit.

Advantage #4: Cost accounting helps with tracking inventory on an ongoing basis

The process of cost accounting involves continuously updating inventory levels. This helps management get real-time information about the quantity and value of the stock on hand.

Thanks to these insights, companies can:

- Better manage inventory,

- Prevent stock outs or overstocking, and

- Make timely purchasing decisions.

The findings of the above-cited study on advantages of cost accounting confirms this benefit of cost accounting.

In this study, 85% of the surveyed financial managers said cost accounting helps reduce the cost of inventory by enabling stock control.

Advantage #5: Cost accounting tracks cost behavior enabling cost comparison

By tracking costs on an ongoing basis, cost accountants can compare:

- The cost of each product a company manufactures,

- The cost incurred in different time periods, and

- The costs incurred by each department in a company.

How does it help you make these comparisons?

Let’s say a company makes two products: X and Y. Using cost accounting, the company calculates the total cost of manufacturing X as well as Y. By comparing the costs, the company can understand which product is more profitable and which one needs pricing adjustments or cost control.

Similarly, if an organization has several departments (production, engineering, sales, design, etc.), cost accounting helps calculate the overheads incurred by each department. Management can then identify the departments that have higher overhead costs and look at ways to reduce these costs.

Finally, by recording cost data for each year (or month), cost accountants can compare what the cost of production has been for the selected period.

These comparisons offer valuable insights into cost trends, cost efficiencies, and the organization’s overall financial performance. Cost accounting methods, such as marginal costing, also helps understand cost behavior which refers to how costs change in response to changes in production volumes.

Managers can then use this information to benchmark against competitors and make data-driven decisions about resource allocation and process optimization.

Advantage #6: Cost accounting helps with identifying areas with higher profit potential

Unlike financial accounting, which is typically carried out annually, cost accounting is carried out on an as-needed basis to help the management understand and compare the cost of production.

Frequent analysis offers insights into the profitability of different products, services, or projects. As a result, companies can rely on cost accounting to understand which products or services are more profitable and which ones need tweaking in terms of pricing or production efficiency.

Advantage #7: Cost accounting assists in informed budget and investment decisions

Whether it is determining the optimal output levels, deciding whether to make or buy certain components, replacing old equipment, or introducing new products — cost accounting helps the management evaluate the financial impact of each decision.

This reduces the risk of making hasty decisions and allows management to align their choices with the organization’s long-term goals.

Advantage #8: Cost accounting supports performance evaluation

Cost accounting involves comparing actual costs against standard costs. Management can set performance targets based on the results of this comparison to motivate their staff. Apart from providing a clear direction on what the staff should work towards, the standards used in cost accounting also help design incentives based on performance evaluation.

🎓 Clockify Pro Tip

Ready to boost workplace performance? Read our post to unlock the secrets of performance improvement plans.

What are the disadvantages of cost accounting?

Cost accountancy has been developed through a process of trial and error, which means instead of being an exact science, it is an acquired skill based on practice.

Here are the disadvantages of cost accounting to keep in mind.

Disadvantage #1: Cost accounting is not a standardized system of accounting

Unlike financial accounting, cost accounting is not compliant with GAAP or IFRS and does not use a standard format or procedure to prepare the cost information.

As each company uses its own format for cost accounting, it can be difficult to compare cost data of different companies or different departments. Besides, as there is no uniform method followed, there is a possibility of two different cost accountants obtaining different results with the same information.

In addition, there is no uniform way of determining the standard costs that cost accounting methods, such as standard costing, rely on. When cost standards are inaccurate, the final cost data and analysis can also be inaccurate.

Disadvantage #2: Cost accounting does not give a holistic picture of costs

Financial experts, such as Michelle Delkercost, warn that cost accounting may not give a complete view of the company’s financial situation in addition to being a resource-heavy accounting method:

“One of the disadvantages is that cost accounting may not always provide a holistic view of the company’s financial condition as it primarily focuses on individual costs rather than the entity’s overall financial performance. Additionally, it can be time-consuming and require significant resources, like experienced accountants and advanced accounting systems.”

Some methods of cost accounting, such as standard accounting and marginal costing, assume variable costs (costs that change when the production volume changes, such as raw materials or labor) to be constant.

In addition, these methods of cost accounting also ignore fixed costs (costs that remain constant regardless of changes in production volume, such as monthly office rent or insurance premiums).

As no cost is exact or constant at any given time, these assumptions can lead to suboptimal decisions on budget planning, pricing, etc.

Traditional methods of cost accounting are based on ‘standard’ costs and historical data. As said above, costs do not remain constant and using past/historical data to calculate the current cost of production can increase the chances of the results of cost accounting being inaccurate.

Disadvantage #3: Cost accounting can be resource-heavy

Yet another limitation of cost accounting is that it can be expensive to implement, particularly for smaller businesses. Companies need to invest in hiring experienced cost accountants and advanced tools to record, track, and report costs. The additional expenditure may reduce the profit the company earns.

FAQs about cost accounting

Have more questions about cost accounting as a career option? In this section, you can find the answers to those questions.

How can I learn cost accounting easily?

While there is no short-cut to learning cost accounting, you can become a successful cost accountant by following these steps:

- Obtain a bachelor’s degree — if you want to learn more about cost accounting, try pursuing a bachelor’s degree in accounting, finance, or a related field, such as business. Some universities offer specialized programs in cost accounting or management accounting.

- Gain practical experience — seek internships or entry-level positions in accounting or finance departments to gain practical experience and exposure to cost accounting principles.

- Pursue master’s degree (optional) — consider pursuing a master’s degree in accounting or a related field to enhance your knowledge and career prospects.

- Acquire professional certifications — certifications, such as Certified Management Accountant (CMA) offered by the Institute of Management Accountants (IMA) can help you showcase specialized expertise. If you want to work in businesses that are publicly traded, you will need to obtain a Certified Public Accountant (CPA) certification by passing the CPA exam conducted by the American Institute of Certified Public Accountants (AICPA).

- Attend workshops and take up additional courses — deepen your understanding of cost accounting principles through self-study, workshops, or professional development courses.

- Join professional associations — by joining relevant professional associations in the accounting field, you can network, access resources, and stay updated with industry trends.

- Gain experience — seek opportunities to work in cost accounting roles within organizations where you can apply your knowledge and skills in real-world scenarios.

- Stay updated with the latest developments — subscribe to journals and research materials to stay updated on any changes in accounting regulations and cost accounting practices. You may also need to take continuing education courses to maintain your license.

Are cost accountants in demand?

Yes! There are a number of sources that confirm that cost accountants are in demand and will continue to be sought after over the next decade.

For instance, the Bureau of Labor Statistics (BLS) projects an employment growth rate of 6% for accountants and auditors. Considering that the average growth percentage is 5% for all occupations, you can see that accountants have no reason to worry about finding open positions.

Between 2021 and 2031, 81,800 new positions are set to be available in this field, according to BLS data.

That’s not all. According to the list of the Best Business Jobs for 2023 accounting gets a ranking of #14, making it one of the best business jobs.

Yet another proof comes from Robert Half’s survey. This survey shows that cost accountants are the most sought-after experts among all finance and accounting professionals.

What skills are needed for cost accounting?

Cost accountants need to be able to manage and analyze financial data.

But, given the fast-paced changes in the business world, what are the other skills cost accountants need to be future-ready?

Here are some essential skills needed for cost accounting:

- Math and analytical skills: Cost accountants must also have strong analytical abilities to understand complex financial data, follow cost trends, and make informed decisions.

- Attention to detail: As even small errors can have significant implications, attention to detail is vital to ensure accuracy in cost calculations and reporting.

- Digital skills and data analysis: According to AICPA and CIMA (The Chartered Institute of Management Accountants), cost accountants can gain a competitive advantage by keeping pace with new technological trends, such as data analytics and cybersecurity.

- Communication: Cost accountants should be able to effectively communicate complex financial information to managers, investors, and other decision-makers.

- Ethical conduct: Ethical behavior is critical for cost accountants to maintain the integrity of financial information and ensure compliance with accounting standards and regulations.

- Familiarity with blockchain/cryptocurrency: Accountants need to know how to account for and report digital assets in financial statements. A survey conducted by Blockdata shows that 81 out of the world’s top 100 public companies actively carry out transactions involving blockchain.

- Accounting tools: Proficiency in accounting software is important for error-free and efficient cost data management. The right tools can help cost accountants get a unified view of costs and revenue data across all operations and departments.

🎓 Clockify Pro Tip

Streamline your accounting processes with the perfect tool. Check out our blog post to pick the best one for your needs:

Why is time management important for cost accounting?

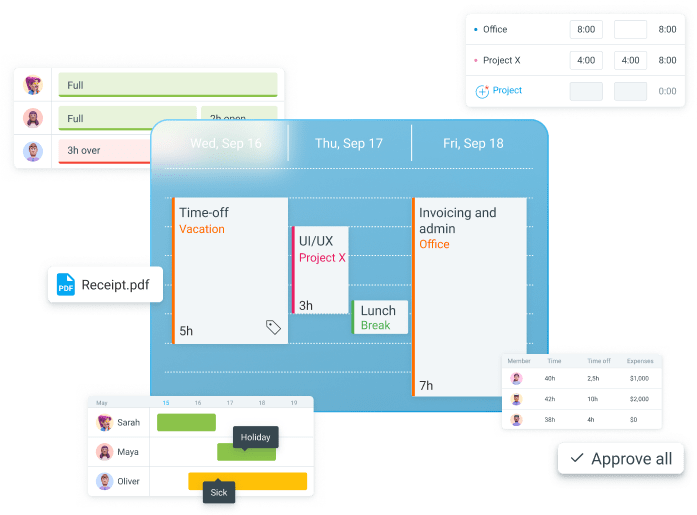

Cost accountants often work on multiple projects, clients, or tasks. As a result, these professionals need to cultivate time management skills to be able to:

- Prioritize projects, clients, and/or tasks,

- Track costs of materials, labor, and other direct and indirect expenses,

- Ensure accurate client billing, and

- Meet the monthly or yearly deadlines for reporting.

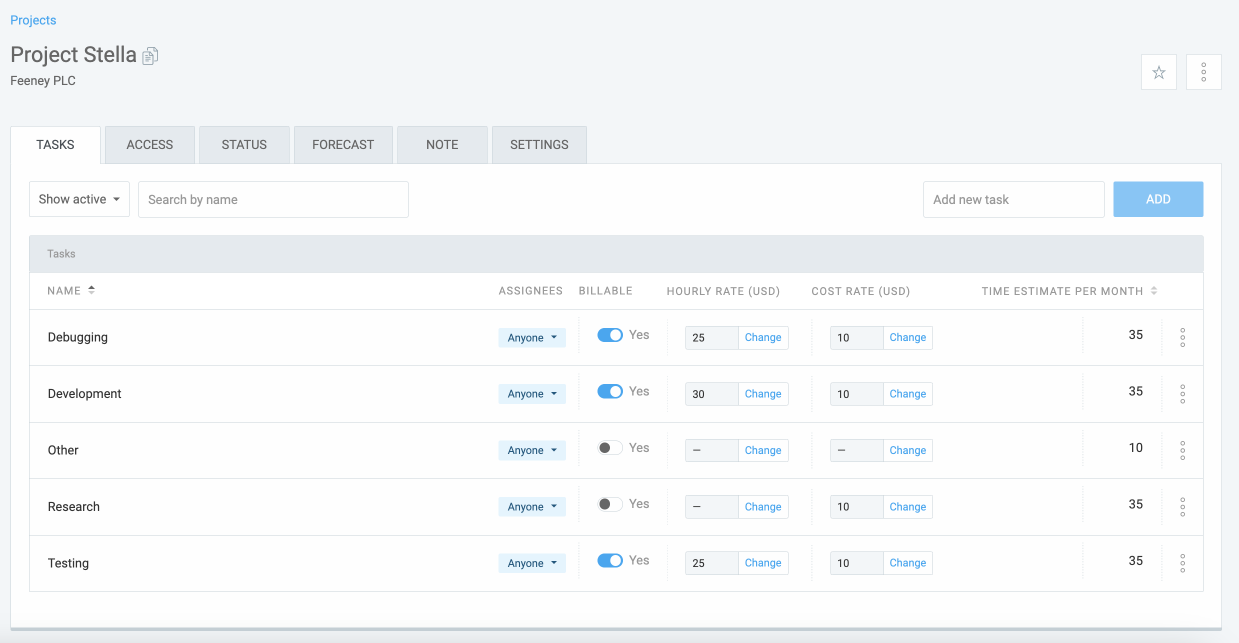

This is where time tracking and billing software, such as Clockify by CAKE.com, can help. With this free tool, you can prioritize tasks by adding multiple projects and tasks, set time estimates, and filter them to know which ones to prioritize.

You can also create and track costs related to different cost components like materials, labor, and other direct and indirect costs.

Clockify also allows you to set hourly rates for employees, projects, or tasks and calculate billable hours accurately.

In addition, cost accountants can share reports with clients and give them access to data in real-time using Clockify.

Final thoughts: Mastering cost accounting is easy with the right knowledge and tools

Cost accounting, as you have probably already realized by now, is an indispensable part of any company’s financial management.

In this guide, we have explored the basic concepts of cost accounting with real-life examples. We have also looked at the difference between financial accounting and cost accounting while touching upon the skills you need to become a cost accountant.

Beyond technical competencies, aspiring cost accountants should know how to use the right accounting software and sharpen their skills related to communication, data analysis, and time management.

Armed with the right skills and knowledge, you can make a meaningful impact within the organization and the broader financial landscape.

Sources for the table:

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: August 24, 2023

Published: August 24, 2023