Producing financial statements and processing payroll has always been a hassle, even for large companies, let alone small businesses. Luckily, the rise of accounting software has offered much needed help for everyone that has to dabble in finances, tax, and accounting processes.

But, it’s now the wide selection of such tools that’s the problem — how to choose the right one for you?

Well, we decided to help you out and scour the web to find the best accounting software that you can use for free. We tested loads of apps and carefully pin-pointed 6 we believe to be the best on the market right now.

Therefore, don’t fret, because the following segments include:

- The factors that went into our decision when choosing the best accounting apps,

- The list of tested apps with a detailed breakdown of how each app works,

- The necessary information regarding the intricacies behind the software (pricing, pros, and cons), and

- A small section explaining the modern-day application of the said software.

Table of Contents

What are the best accounting tools?

After testing some of the best accounting software with free trials and plans, we’ve narrowed it down to 6 apps that we believe take the crown:

- Clockify — best for expense management,

- Zoho Books — best for invoicing,

- ZipBooks — best integrations,

- Odoo — best for AI invoicing,

- Wave Accounting — best for payroll, and

- ProfitBooks — best for tracking account activities.

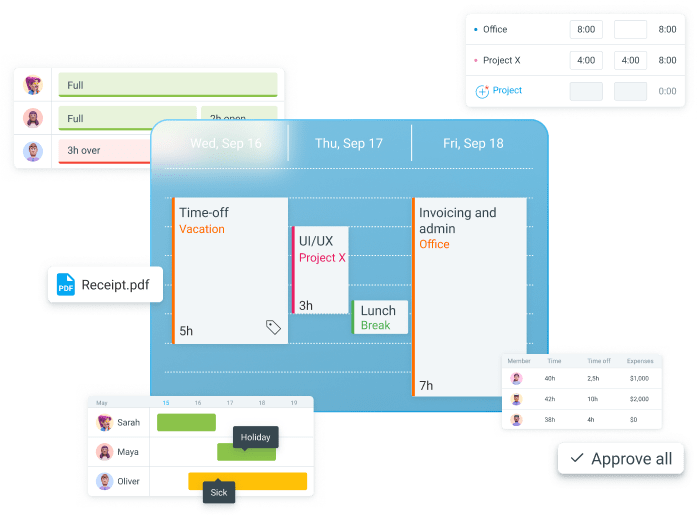

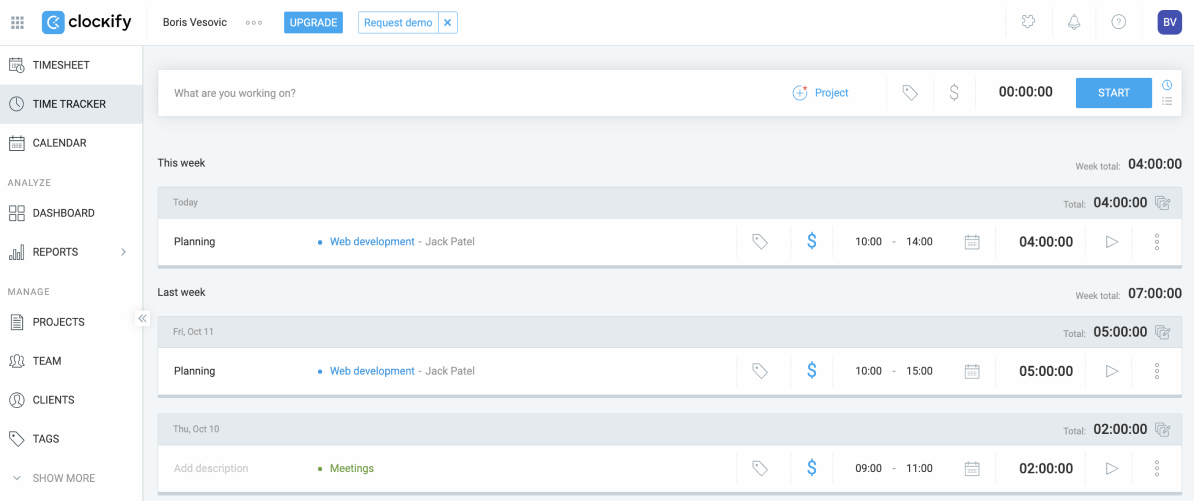

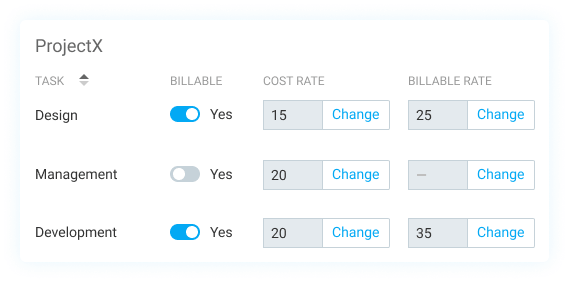

Clockify — best for expense management in accounting

Clockify is a time tracker that tracks your projects’ progress throughout the day. However, due to many integrated features, businesses can effortlessly track and manage expenses with Clockify as well.

What does Clockify offer?

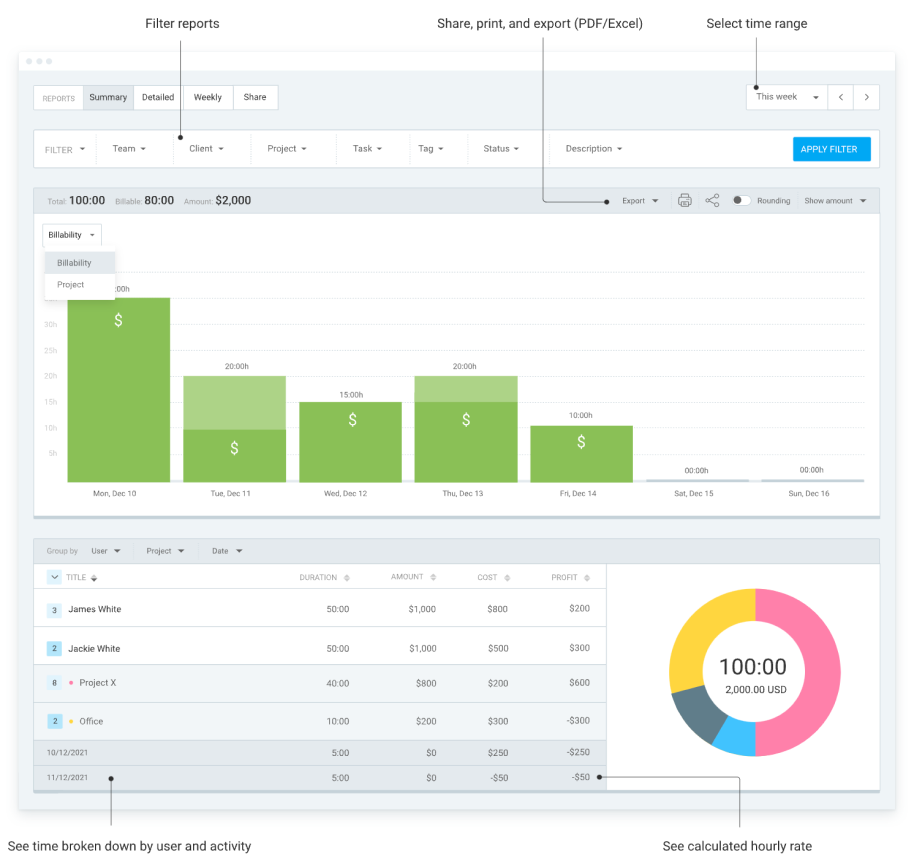

Using Clockify as an employer comes with several benefits that make your day-to-day extremely easy. Also, your accounting team won’t need separate accounting software since Clockify lets them:

- Set cost and billable rates,

- Mark hours as billable/non-billable,

- Track billable hours,

- See and analyze the time in reports,

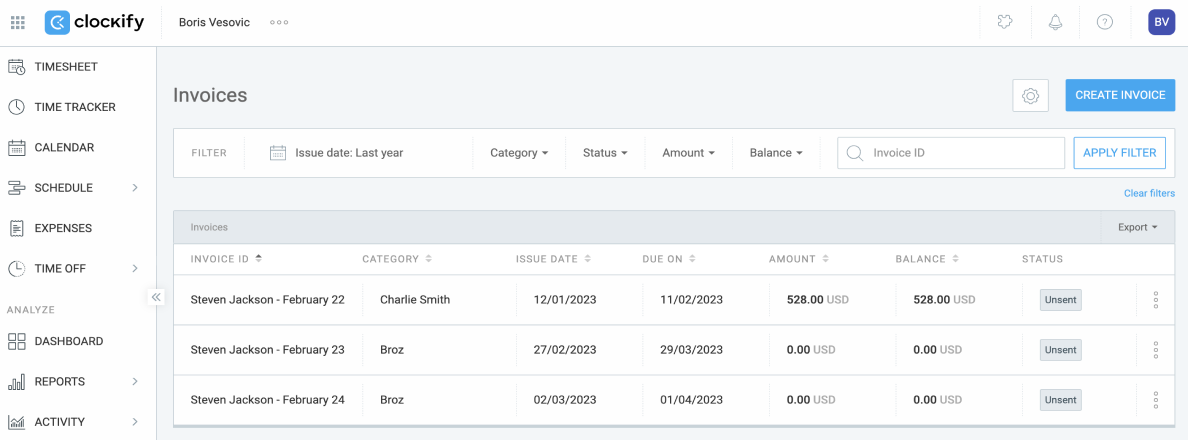

- Create invoices, and

- Send tracked time to integrated payroll software.

For starters, Clockify gives you an overview of your employees’ work hours that can be recorded through the timer (automatically) or timesheets (manually). You can mark time entries as billable or non-billable, too.

To get an accurate portrayal of billable hours, you should define hourly rates in Clockify.

In the end, all employee earnings are automatically calculated based on their billable time, and you can view them in reports. Either way, you get the numbers you need to prepare invoice documentation, as well as payroll calculations, all while staying compliant with FLSA and DCAA requirements.

Why is Clockify best for expense management in accounting?

As a Clockify user myself, I’ve always loved the number of things you can do within the app — from time tracking and requesting time off to creating invoices within minutes.

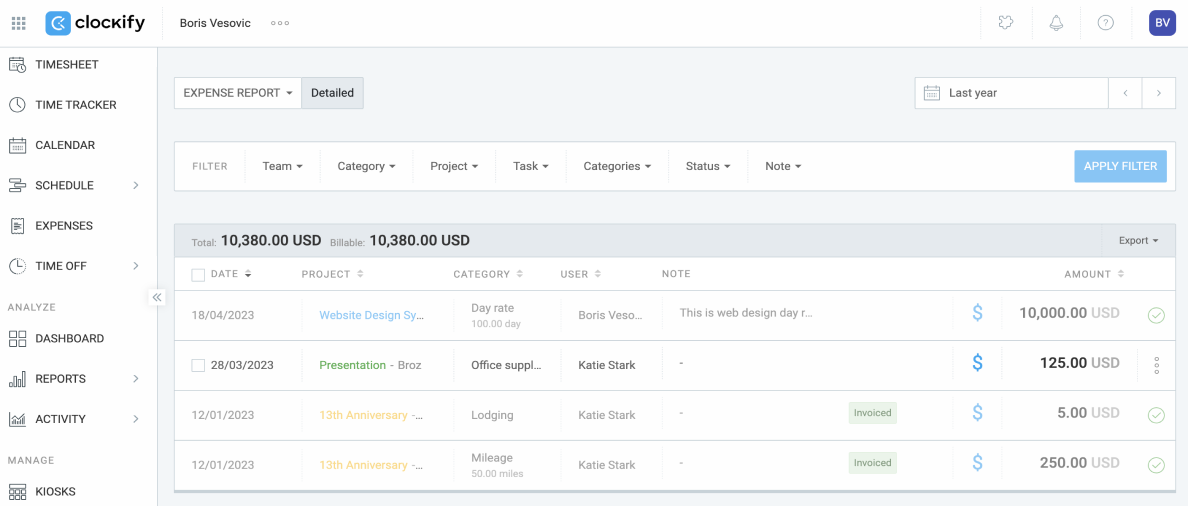

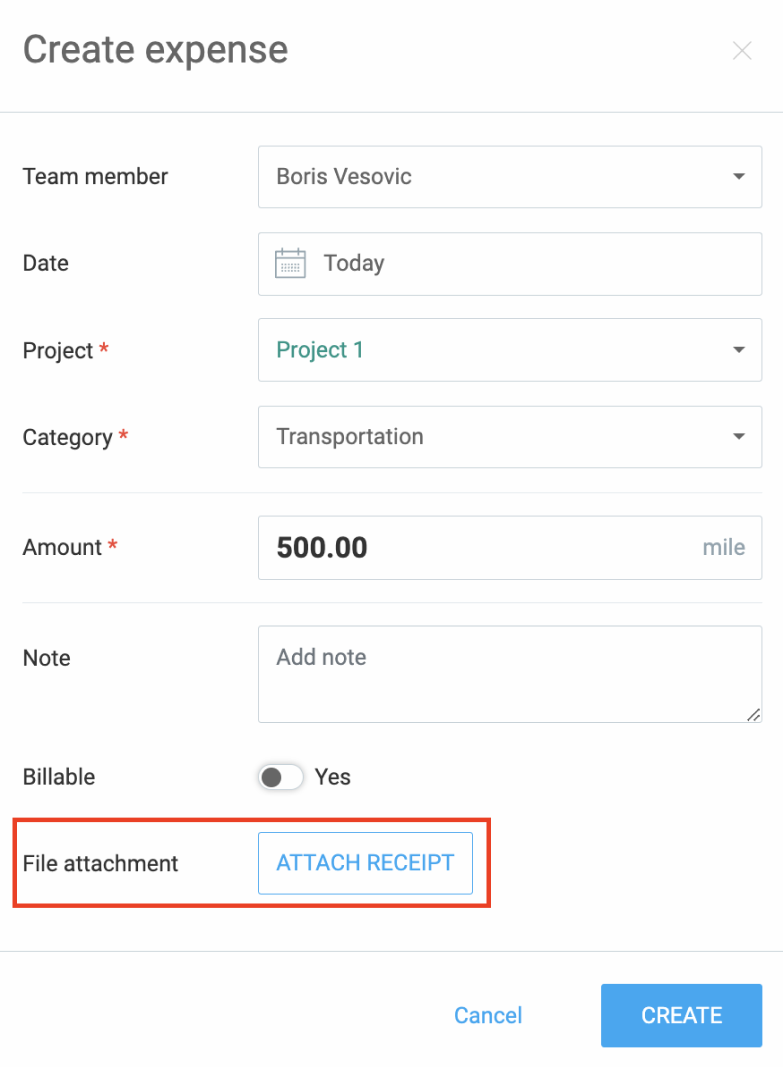

However, what I found most useful from an accounting perspective was the expense tracking functionality.

Namely, Clockify lets me record expenses in different categories:

- Fixed fees, and

- Unit-based expenses.

Expenses such as day rates, retainers, overtime pay, reimbursements, and salaries can easily be marked as fixed fees and reported to invoices. On the other hand, if you have to account for office materials that aren’t fixed fees, you can do so by marking them as unit-based expenses.

The expense tracking data can also be recorded and submitted via mobile if you’ve installed the Android or the iOS Clockify app.

Another handy option I liked was that I could create invoices that included travel expenses. What makes the process so appealing is that I get to attach receipts to my records and have all my expenses accounted for.

Moreover, I can also export all my expenses in PDF, Excel, or CSV format.

Overall, Clockify makes expense management easy as it provides all the necessary features for efficient expense tracking and organization.

Clockify’s pros

- It has an intuitive interface that makes time and expense tracking extremely easy.

- The integration with Quickbooks helps accountants send time entries directly to payroll processing.

Clockify’s cons

- There’s still no option to send invoices directly to Quickbooks.

- Advanced features like adding time for others or customizing exports are only available on paid plans.

What’s new in Clockify?

In September 2024, Clockify introduced the project budget chart feature that allows you to forecast whether your project will go over the estimated budget. Apart from that, Clockify has been rolling out many smaller improvements and bug fixes.

| Type of plan and availability | Clockify pricing and platforms |

| Free plan | Yes |

| Free trial | Yes, 7-day free trial |

| Cheapest paid plan | $3.99/seat/month (if billed annually) |

| Availability | Android, iOS, Web, Mac, Windows, Linux |

Best fit for: Businesses of all sizes in need of expense management.

Zoho Books — best for invoicing

If you’re in need of an all-around accounting software that puts the I in invoicing, you’ve found it. Zoho Books offers a variety of accounting solutions, from vendor bills and expenses to tracking billable and non-billable hours.

What does Zoho Books offer?

After signing up for Zoho Books, its users can fully customize their account with the specific needs for their business, all while using a double-entry accounting system — recording of financial transactions in two accounts (liability and equity).

The system helps ensure accuracy in recording financial data — If there is an error in one entry, it will result in an imbalance, making it easier to detect and correct mistakes.

Once set up, the users can perform some of the following:

- Create invoices,

- Upload expense receipts and track their payments,

- Upload stock details and keep track of them in the inventory, and

- Import bank statements and transactions directly into Zoho Books.

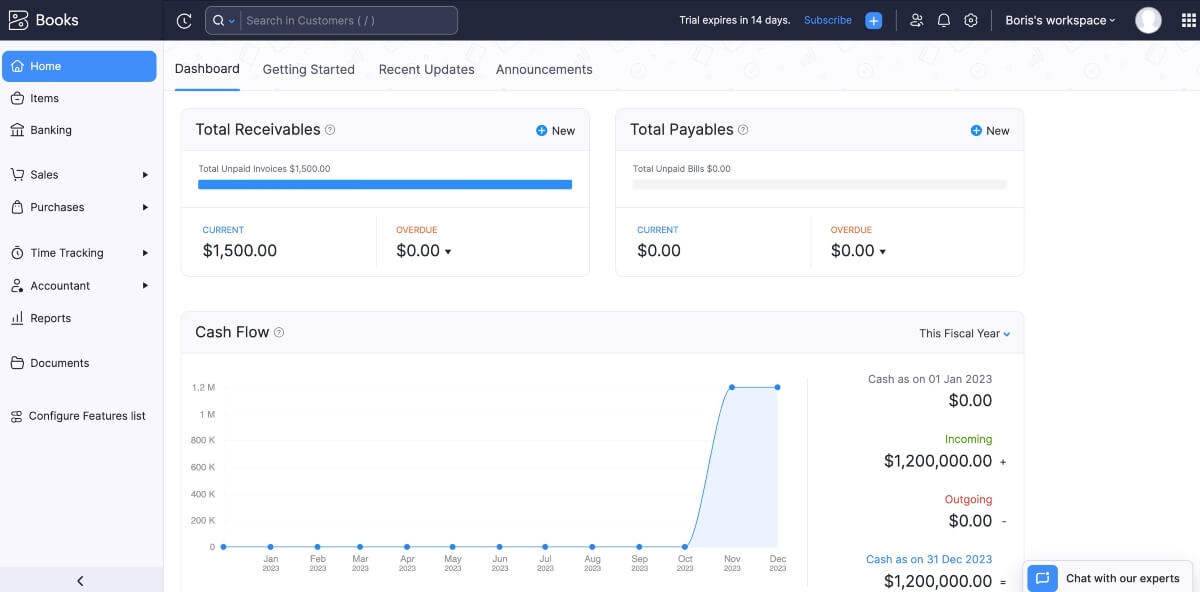

Thanks to Zoho Books’ integration with many payment gateways, users can import their bank statements and stay on top of their account activities at all times. When you combine that with time tracking capabilities that track your billable hours and seamless invoicing capabilities, you’ll be the master of managing receivables at all times.

Why is Zoho Books the best for invoicing?

Creating invoices has always been a drag for me, especially when I worked as a freelancer. Then, once I realized how incredibly easy the entire process can be, I regretted not finding this software earlier.

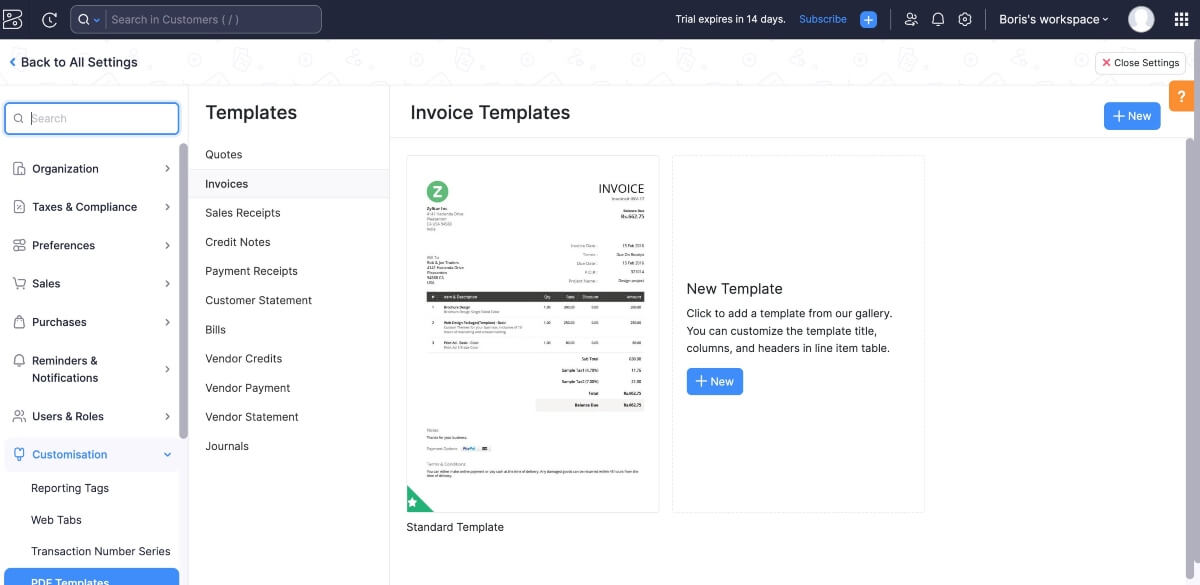

The first thing I noticed was how intuitive it was to make a simple invoice.

The software prompts you to choose one of the precrafted invoice templates that are tailored to individual needs. Once you choose one, categories start popping off such as dates and customizable entries.

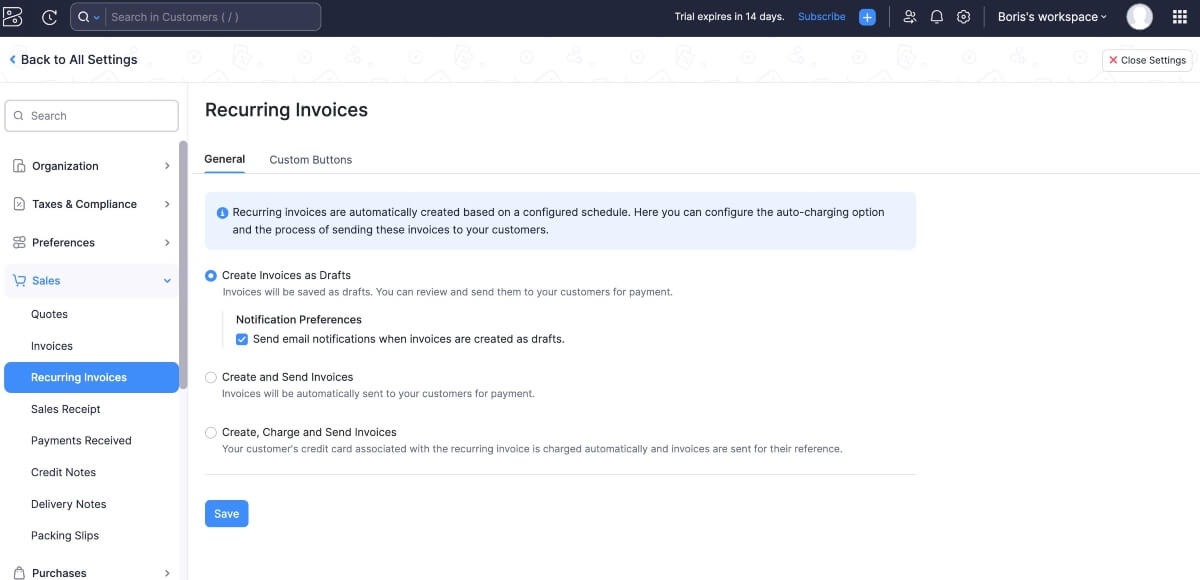

What’s more, if you frequently craft the same or similar invoices, you can check the Recurring Invoices option. It allows you to automatize the entire process and never worry about making invoices again.

Finally, the last thing I liked was the fact that you could mark the payment plan you wish:

- Cash,

- Cheque, and

- Web payment.

Zoho Books pros

- Incorporates all accounting features a business might need in one software, and

- Displays all financial information for its users in a simple format and offers automation features to save plenty of time.

Zoho Books cons

- The automation features that make Zoho Books special, require some coding knowledge.

What’s new in Zoho Books?

As of October 13, 2023, Zoho Books users can integrate with Zoho Notebook and enable their employees to have their very own notepad within the app.

Also, the October update now allows users to import up to 2GB of CSV files and export user files in CSV, XLS, XLSX, and TSV, allowing them to choose the format most suitable for their requirements.

| Type of plan and availability | Zoho Books pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | 14-day free trial |

| Cheapest paid plan | $10.00/month/organization (if billed annually) |

| Availability | Android, iOS, Web, Mac, Windows |

Best fit for: Large businesses in need of versatile invoicing software

ZipBooks — best integrations

Are you in need of a software that lets you share and work on financial documents with your team? ZipBooks is a top choice when it comes to integrating with other team collaboration software.

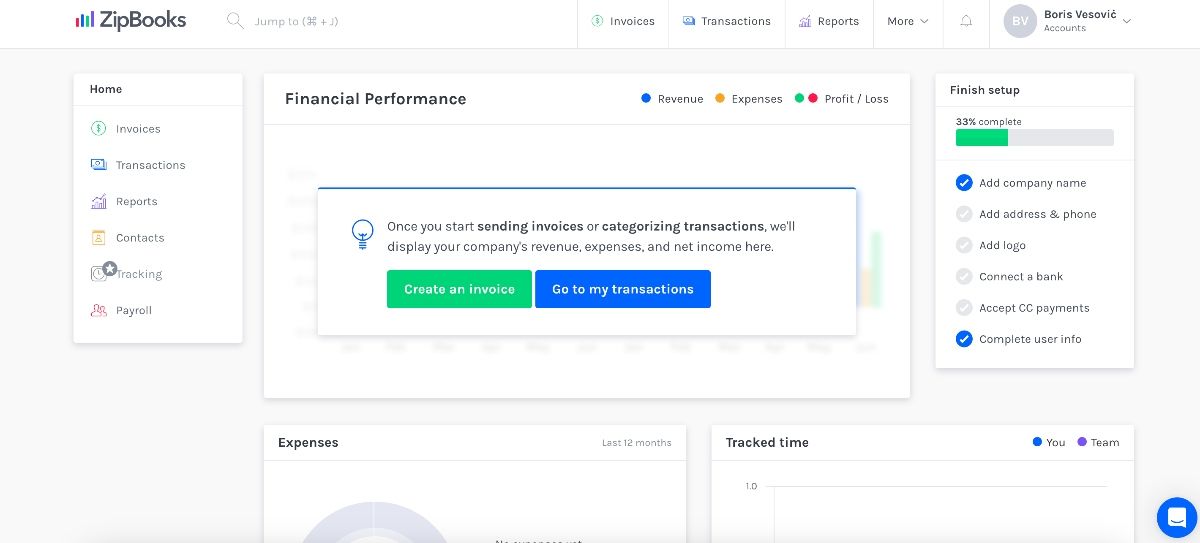

What does ZipBooks offer?

The first thing that appealed to me was ZipBooks’ easy-to-use platform — everything you need is displayed right from the home dashboard. The dropdown menu offers a variety of functions, such as:

- Payments,

- Documentation,

- Reports,

- Invoices, and

- Billing.

When it comes to managing expenses, ZipBooks is one of the top applications to do it effortlessly. Their Expense Management functionality lets users record and report all payments while saving receipts for future transactions.

Another excellent point of this software is smart accounting. In other words, features such as Business Health and Invoice Quality Score help you:

- Practice clean bookkeeping with smart suggestions,

- Measure your “success” by keeping track of payments and repeating customers, and

- Craft a quality invoice by suggesting edits to your document.

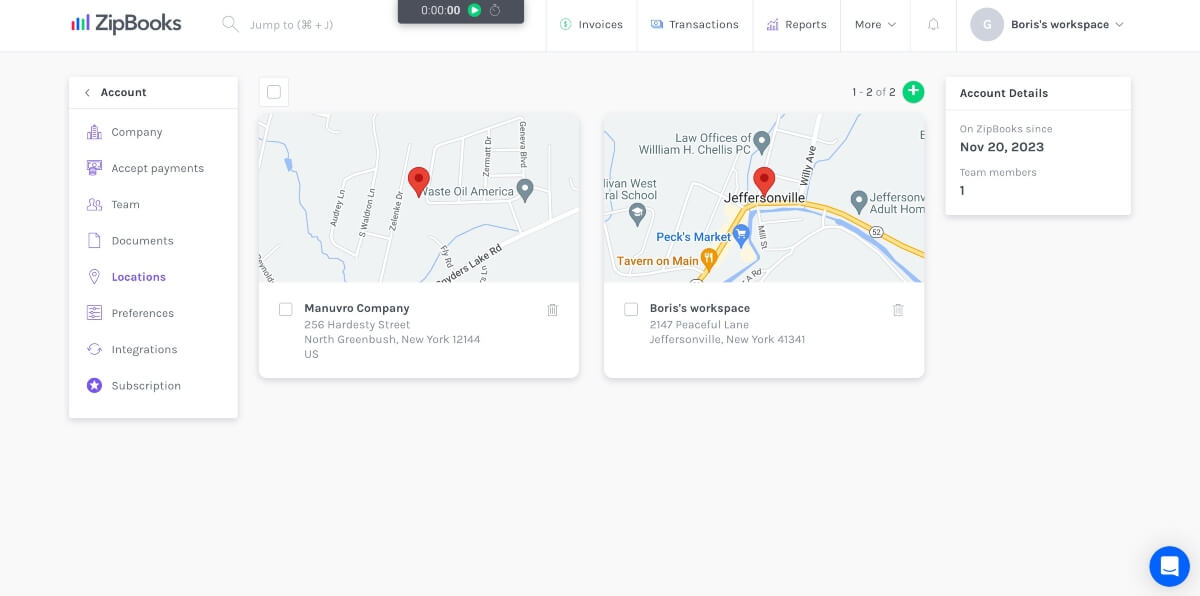

Finally, I noticed a unique feature — Location Tracking.

Namely, you can use this feature for locations that you’d like to track and identify matters such as unnecessary expenses and profits.

Firstly, choose the locations on the maps that you use for your businesses. Then, tag all the transactions when you click on the said locations and identify areas that need improvement by tracking time and expenses on a daily level.

Such a feature comes in handy when a company, for example, has multiple stores around the city and you want to investigate certain problems with bookkeeping or to find clues on how to improve the business.

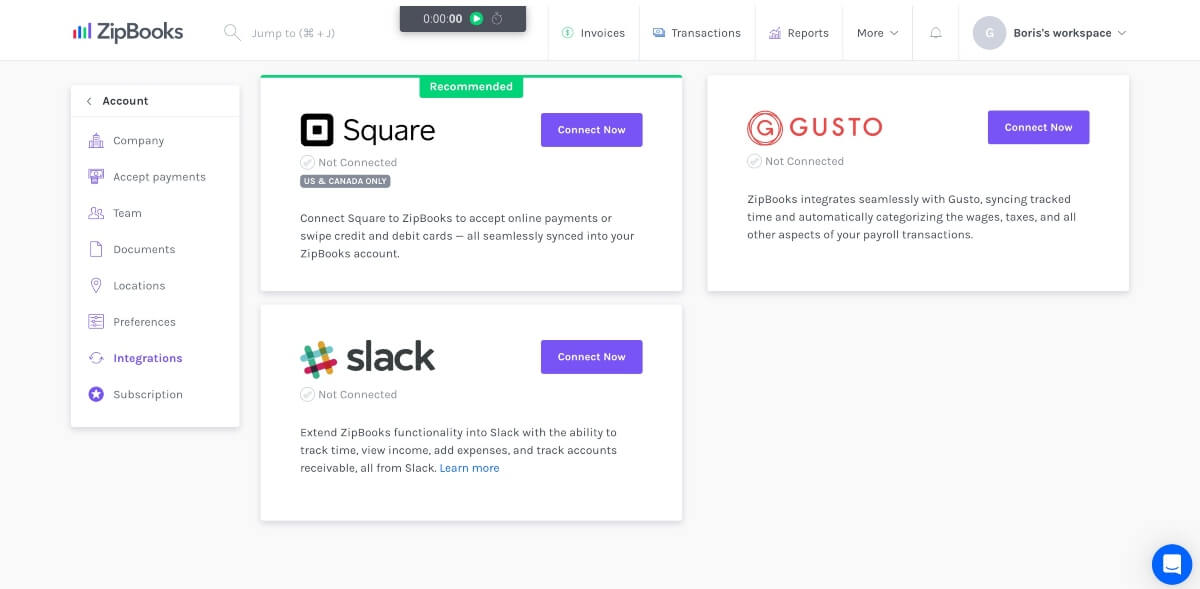

Why does ZipBooks have the best integrations?

Almost all accounting software I’ve tried have some ability to integrate with other team collaboration apps. However, ZipBooks seems to have the most diverse options available.

You’ve created an invoice and want to share the time tracking results with your team? Simply install the integration for Slack, and you’ll have the option to share your tracked time.

Speaking of Slack, the user experience is greatly improved with the use of quick commands. After you connect Slack to ZipBooks, typing simple commands that require no coding knowledge helps you get accounting data in seconds. How?

Well, for example, typing “/zb-who-owes-me” will give you a ZipBooks overview with a list of clients that have unpaid invoices.

Or, maybe you want to have your team members work on an assignment with you? ZipBooks’ integration with Google Workspace lets you use a variety of platforms such as Sheets and Docs.

ZipBooks pros

- Integrates with a number of different apps, such as Zapier, Slack, HubSpot, Google Workspace, Trello, and others.

ZipBooks cons

- ZipBooks mobile platform offers less range than the web version, and

- Free plan is quite limited in comparison to the premium versions.

What’s new in ZipBooks?

Even though the mobile version of ZipBooks is still limited, the 2023 updated version has gained better functionality in terms of improved time tracking results and marking paid payments from invoices.

| Type of plan and availability | ZipBooks pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | 30-day free trial |

| Cheapest paid plan | $15.00/month/organization |

| Availability | Web, Mac, iOS, and Android |

Best fit for: Large businesses with multiple offices which require expense tracking

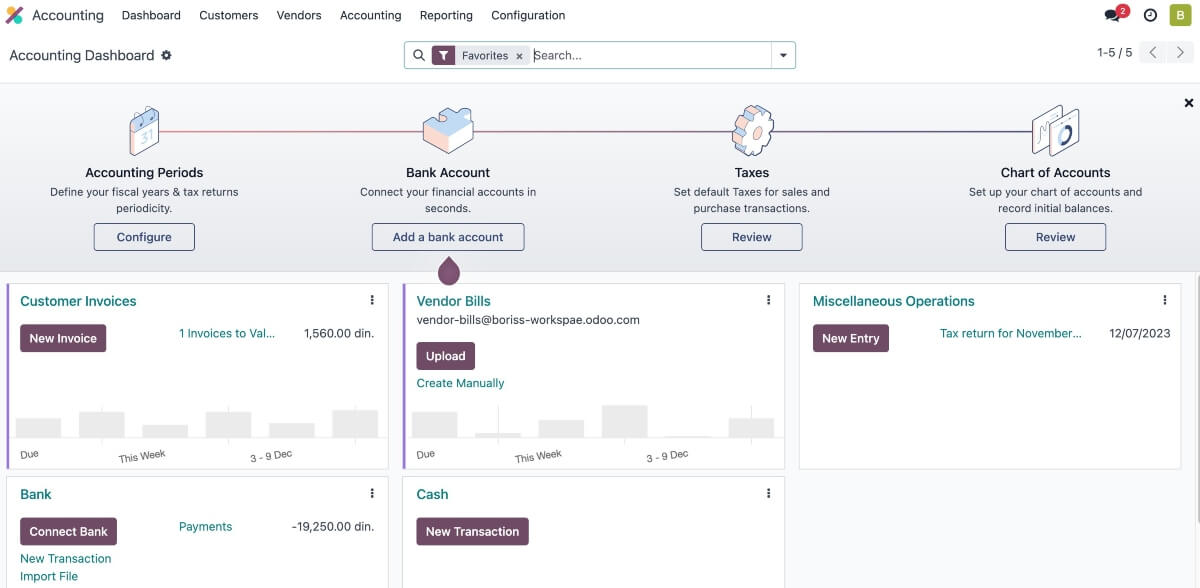

Odoo Accounting — best for AI invoicing

If you’re a small business owner and you’re looking to expand, you’ll want to cut back on unnecessary costs. Well, by investing in Odoo, you’ll get an open-source platform with a ton of business-related software.

What does Odoo offer?

First off, Odoo is a multi-functional platform that offers a variety of apps that modern businesses use.

Such apps include:

- CRM (Customer Relationship Management),

- Project management,

- Accounting,

- Sales,

- Manufacturing,

- Inventory management, and

- Purchasing.

As an open-source platform, Odoo lets its users change the design and dabble in coding to make the software more accessible and user-friendly for their environment.

As a mere novice in coding, I couldn’t really experience the power of customization, but I could see the benefits of it for many developers, such as:

- Changing the appearance of the platform,

- Redesigning the dashboard, and

- Making the experience more user-friendly, tailored to their requirements.

When it comes to accounting, it’s important to note that Odoo integrates with over 28,000 banks around the world.

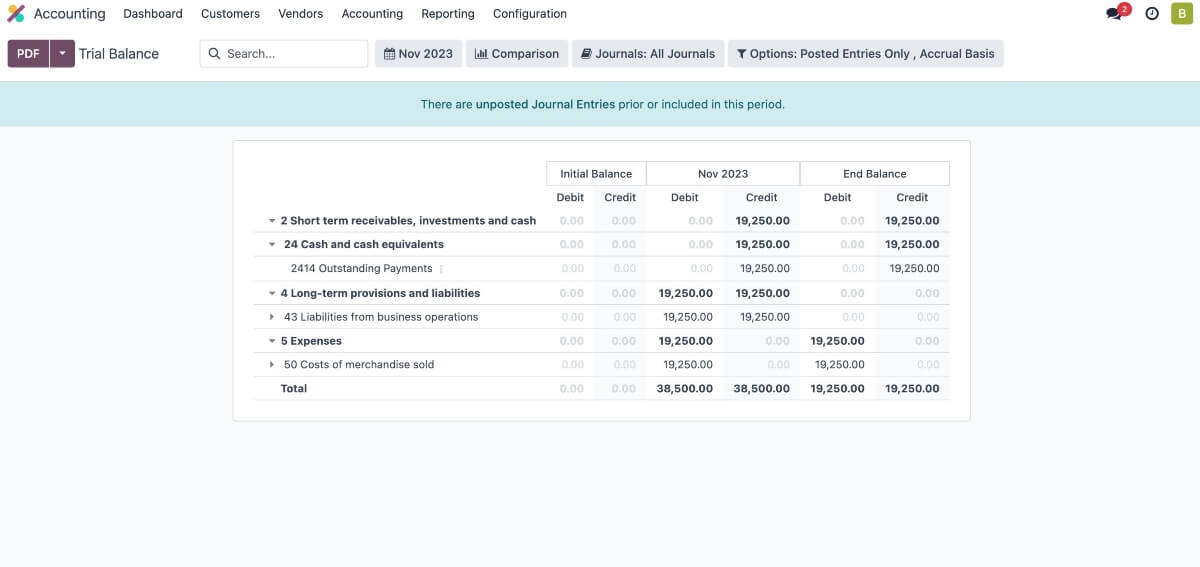

However, what I found beneficial when using this app was the Trial balance feature.

Simply put, a Trial balance offers a snapshot of a company’s financial position at a given moment, with an emphasis on the equality of debits and credits.

Odoo supports real-time data updates when it comes to Trial balance, which means that transactions entered into the system are noted in the financial reports. This real-time functionality is beneficial for obtaining an accurate and up-to-date trial balance.

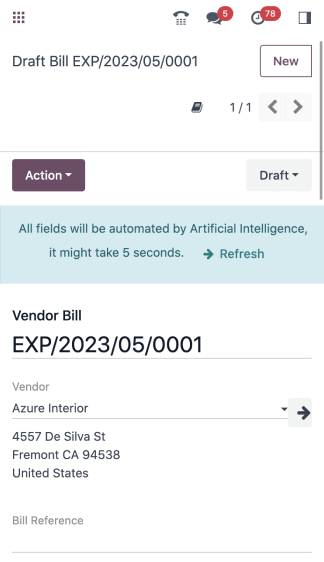

Why is Odoo the best for AI invoicing?

Speaking of accounting, Odoo is perfect when it comes to AI invoicing.

Getting used to the design and interface wasn’t intuitive at first, but I gave it a shot. Once I crafted my first invoice, Odoo’s AI-powered system kept track of all my entries for future processing. As I created more invoices, the software recognized the similarities and helped me create patterns in seconds.

Furthermore, the AI for mobile helps you create invoices by simply capturing an image of a receipt and taking the essentials such as dates, amounts, and names. Naturally, the type of receipt does influence the final outcome and a manual help is often required, but it still helps automate the entire process.

Odoo’s pros

- Importing and exporting accounting data to other Odoo apps which can later be shared in your workspace, and

- Affordable plans for moderate and large-scale businesses.

Odoo’s cons

- Even though Odoo comes with a free plan, it only allows one user to use one app, which presents an issue for smaller businesses.

What’s new in Odoo?

As of November 9, 2023, Odoo made the switch from its 16.0 to 17.0 version which brought upon many changes for all apps. When it comes to accounting, the most notable difference comes in the multi-page thumbnail that lets the users scan through all their previous invoices at a glance.

Also, Odoo’s Scam Protection checks vendors and clients’ bank information and searches for shady bank inputs and alerts you if it finds something suspicious.

| Type of plan and availability | Odoo pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | 15-day free trial |

| Cheapest paid plan | $11.90/month/user |

| Availability | On-Premise Installation (open-source), Web, Mac, iOS, and Android |

Best fit for: Moderate and large-size businesses

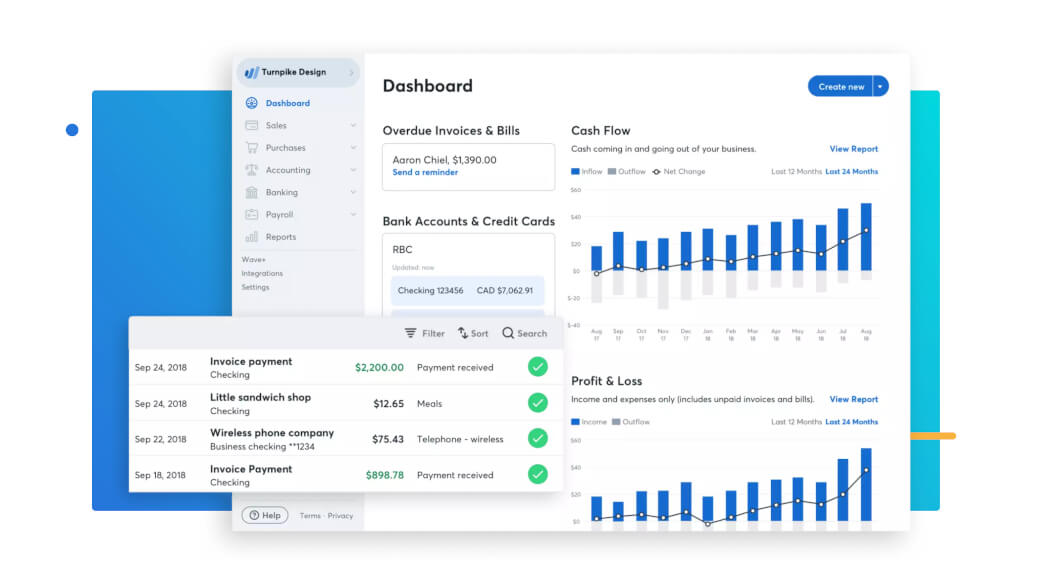

Wave Accounting — best for payroll

In order to get the most out of an accounting software, many opt for the one with the most features, usually the one with payroll. Well, if you’re in the same boat, Wave Accounting might be the best option.

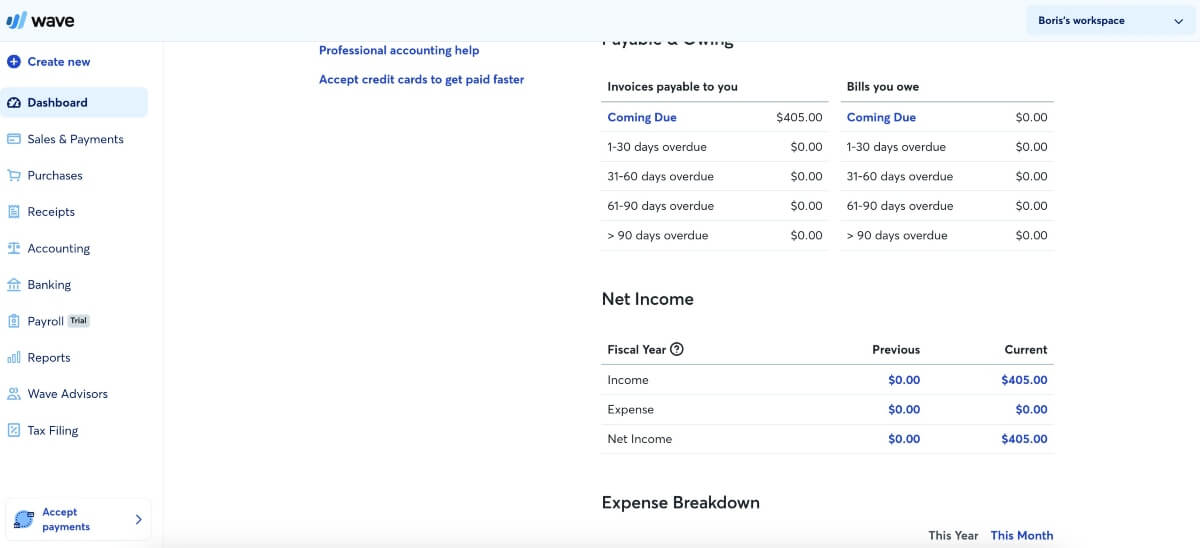

What does Wave Accounting offer?

In general, Wave Accounting is often the preferred software by many freelancers and small businesses. Why? It’s due to its simplicity, number of features, and most importantly, free plan.

I was able to test out both Invoicing and Accounting functionalities in its free plan, while Payments and other pro features come in the paid plans.

After dabbling around the software, my eyes came across the Mobile Receipt feature. Namely, by using the mobile app, users can scan receipts by utilizing OCR (Optical Character Recognition) technology and import the numbers directly into invoices. Furthermore, the data is stored on a cloud server for further use.

Also, Wave Accounting can connect to users’ bank accounts and facilitate the transaction operations. This feature makes it easier for users to reconcile their financial records and keep track of transactions without manual data entry.

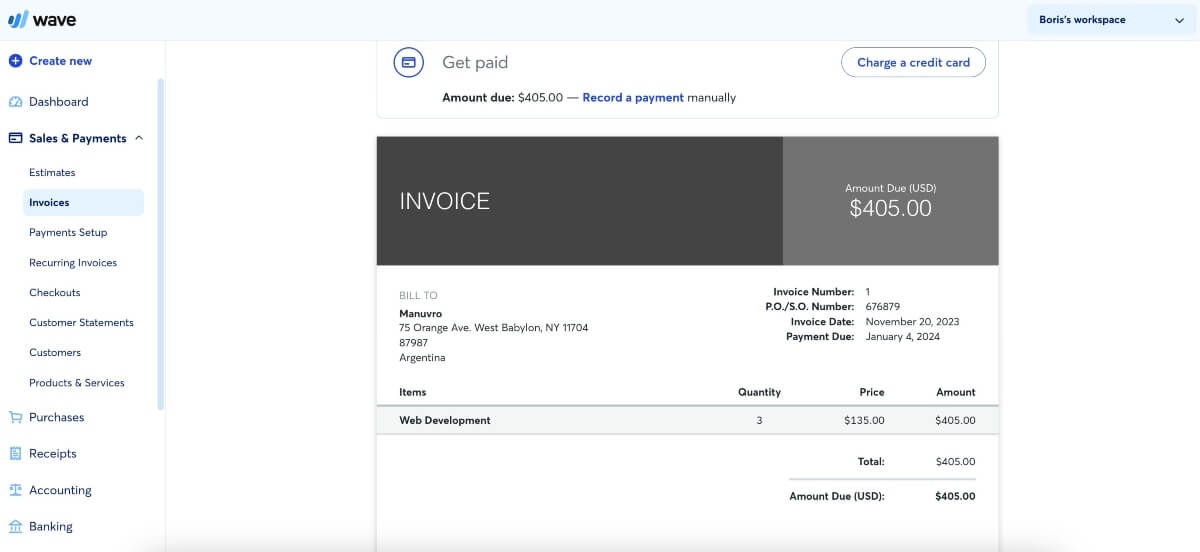

Why is Wave Accounting the best for payroll?

Firstly, it’s important to note that not many accounting software include payroll in their feature repertoire. They usually integrate with other payroll software, so it was great seeing an “all-in-one” software such as Wave Accounting.

Furthermore, I noticed that Wave lets you generate W2 and 1099 forms for tax season, which is a huge plus for US employees.

Also, your employees can input their bank information into the payroll system and get paid within minutes, without needing additional software to calculate payments.

Wave Accounting’s pros

- Wave Accounting offers financial consultation to its customers. Essentially, you choose a paid plan to get personalized help from Wave Accounting accountants.

- Navigating around Wave Accounting is quite intuitive and everything is represented simplistically, eliminating the need for any prior training to use the software.

Wave Accounting’s cons

The software is capable of filing and paying state and federal taxes in the US, but only for businesses in certain states:

- Arizona,

- California,

- Florida,

- Georgia,

- Illinois,

- Indiana,

- Minnesota,

- New York,

- North Carolina,

- Tennessee,

- Texas,

- Virginia,

- Washington, and

- Wisconsin.

What’s new in Wave Accounting?

The newest update released in November of 2023 presented Wave Checkouts — a new feature that delivers solutions for upfront payments or standardized payments without creating invoices every single time.

You’ll have to enter specific information for your payments such as descriptions and amounts and, once you’re done, you’ll go to Checkouts and generate a link or QR code that you can share with your customers and make payments much easier.

| Type of plan and availability | Wave Accounting pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | 30-day free trial |

| Cheapest paid plan | $8.00/month/user (if billed annually) |

| Availability | Web, Android, and iOS |

Best fit for: Mid-sized businesses looking for a all-in-one software

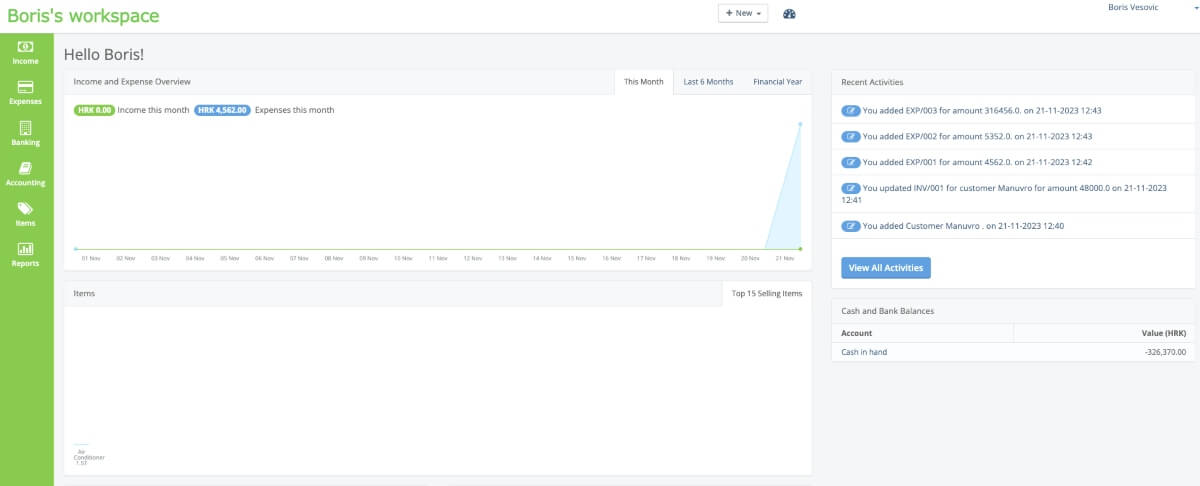

ProfitBooks — best for tracking accounting activities

Finally, we’re down to the last software that most people will choose due to its simplicity and lack of complicated features. Even though it’s not the obvious choice for larger businesses, most smaller entrepreneurs and freelancers will undoubtedly benefit from using ProfitBooks due to its free plan.

What does ProfitBooks offer?

When it comes to invoicing, ProfitBooks surely does offer a lot in the free plan. Namely, users can create an unlimited number of invoices. Similar to Clockify, ProfitBooks lets their users dabble with different currencies, which is a fine solution for freelancers that work for different clients.

Every invoicing document that ProfitBooks lets you create contains the SAC (Service Accounting Code that applies to all the services rendered within India) code, place of supply, contact details of a customer, tax breakup, etc. Therefore, you can rest assured knowing that your invoices will be free of human error and on point.

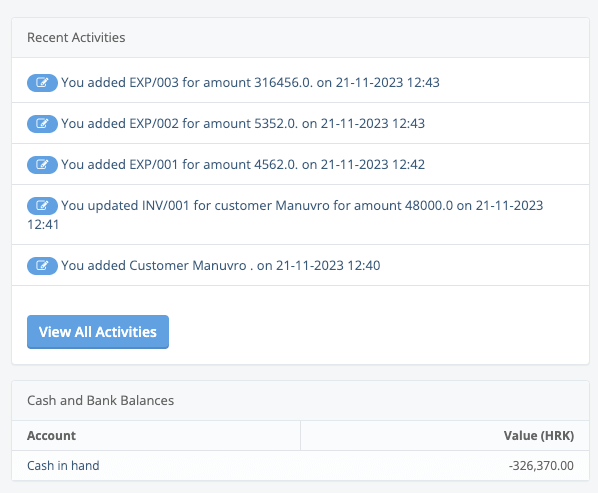

Why is ProfitBooks the best for tracking accounting activities?

The thing that immediately caught my attention as soon as I created the account was the fact that audit logs were displayed right there on the dashboard. Generally, recent activity and audit logs are included in the paid versions of accounting software, which is why I was pleasantly surprised.

Furthermore, as I inspected the functionalities of the app, I noticed that Inventory Management is one of the key features that ProfitBooks offers. Namely, it allows you to track your entire inventory lifecycle, as well as manage product stock levels. You can further track your inventory status’ from the dashboard as well, thanks to the recent activity panel.

What’s new in ProfitBooks?

The Goods and Services Tax (GST) is a value-added tax levied on goods and services that are sold for domestic consumption. Users from India can rest assured knowing that ProfitBooks is designed to be GST-compliant.

ProfitBooks’ pros

- Enables users to match their bank transactions with entries in the accounting system, ensuring accuracy in financial records.

Profitbooks’ cons

- Lacks pro accounting features and payroll.

| Type of plan and availability | ProfitBooks pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | Yes |

| Cheapest paid plan | $15.00/month/user (if billed annually) |

| Availability | Web, Windows, macOS, and Linux |

Best fit for: Smaller entrepreneurs and freelancers will undoubtedly benefit from using ProfitBooks due to its free plan.

Why are accounting tools useful?

Even if you’re not tech-savvy, you can use accounting tools to deal with mundane tasks that would generally take a lot of time to finish.

In general, accounting tools are great for:

- Tracking expenses,

- Producing financial reports,

- Reviewing and auditing accounting records,

- Performing tax calculations, and

- Collaborating with your accounting team.

With them, you’ll automate and speed up your accounting tasks, as well as minimize the risk of errors, and even save money.

In conversation with CAKE.com’s Renewal Specialist Gordana Veljković, we found out that accounting software do not only help businesses automate their processes, but they also minimize human error:

“In many conversations I had with our clients, I almost always encountered the same issues — customers complained how manual accounting often caused errors in calculations and damages ensued to both their business and their customers.”

Furthermore, she shared her thoughts on Clockify and how it helps her customers resolve these issues:

“Once I explained the benefits that automation brings in accounting, my clients found true relief once they realized they can perform pretty much everything with Clockify — from calculating billable hours to exporting data.”

What criteria helped determine the accounting apps we chose?

According to CAKE.com’s accounting specialist, Marijana Stojković, most accounting software serve a similar purpose, and choosing the right one is a rather difficult task:

“All accounting software are similar and choosing the right one boils down to what you need exactly. The key is in the small intricacies and details that affect your day-to-day as an accountant.”

She further noted that tasks seem effortless if the software in question covers a variety of core operating functions:

“What makes my life easier is the ability to create a database within the software where I can store additional data and information regarding payments, accounts, etc. Also, exporting files in various formats and general customizability is crucial in choosing an accounting software.”

Therefore, we decided to search for the little details by testing the apps and using them as an accountant would, thus paying attention to the following and finding the good and the bad along the way:

- User-friendly interface — due to the abundance of features, finding your way around the app is crucial, especially when dealing with a number of invoices and financial statements,

- Core functions — every good accounting software should possess a number of functionalities that seamlessly help the user track expenses, produce financial reports, review records and taxes, and process payments, and

- Integrations — every business’ needs expand way beyond accounting. Most modern businesses use various software for time tracking, project management, and payroll that often integrate with accounting software, and thus lighten the workload and make processes more efficient.

Choose the accounting tool that will best fit your business

Although there are many different tools that can help you manage your company’s finances, only one tool offers a complete solution for your business.

From tracking payroll hours and managing employee costs to creating invoices, Clockify time tracking software offers plenty of options to make your day as a business owner much easier.

With Clockify, you can calculate employee payroll hours for easier payroll processing. All you need to do is:

- Set up projects,

- Invite employees to your workspace, and

- Define hourly rates for each employee, project, and task in Clockify.

When your employees start tracking their work hours, Clockify will automatically calculate their earnings based on their hourly rate. You can see a summary of hours worked and employees’ payroll in Clockify Reports.

After that, you can export the reports as PDF, CSV, or Excel.

With Clockify, you can also record work expenses and project-related fees and create invoices for your clients — so don’t wait any longer.