Giving tips for certain jobs is standard in the US. Employees such as waiters, waitresses, or bartenders usually receive tips from their customers as a sign of appreciation for their services.

If you want to find out how much, for instance, a server in the US can earn and whether tipped wages vary from state to state, stick with us.

In this tipped minimum wage by state guide for 2025, we’ll cover:

- Basic information regarding wages for tipped employees in the US,

- Current minimum tipped wages for states in the US, and

- Frequently asked questions about tipped minimum wage by state.

*Note: State laws and regulations for tipped minimum wages have been checked and updated for 2025.

- The federal law states that tipped employees are workers who receive more than $30 in tips every month.

- Tips are additional payments that customers leave to employees for their services.

- A tip credit allows employers to include tips in the employee’s earnings, therefore paying them a smaller wage than usual.

- The federal tipped minimum wage amounts to $2.13 per hour but tipped employees must earn at least $7.25 per hour with their wage and tips combined.

- Some states in the US use the federal tipped minimum wage, while others have a higher minimum wage for tipped employees than the federal one.

General information about tipped minimum wages in the US

Before providing factual information on minimum tipped wages by state, we’ll first review general information you should know about this topic and go over the following questions:

- Who qualifies as a tipped employee,

- What qualifies as a tip,

- How tipped wages work, and

- What the federal minimum wage for tipped employees is.

Who qualifies as a tipped employee?

The US Department of Labor (DOL) defines tipped employees as those who regularly receive more than $30 in tips per month during their work.

Some examples of tipped employees include:

- Bartenders,

- Waiters,

- Delivery drivers,

- Hairstylists, and other positions — primarily in service industries.

What qualifies as a tip?

According to the Internal Revenue Service (IRS), tips are optional or extra payments that customers give to employees as a token of appreciation for their services.

The IRS further classifies tips as:

- Tips received through electronic payment (credit card, debit card, etc.),

- Cash tips,

- Tips received from other employees (tip pools, tip splitting, or other tip-sharing agreements), and

- Non-cash tips (e.g., concert tickets and lottery tickets).

How do tipped wages work?

In the US, a tipped wage is the base wage paid to employees who receive a significant portion of their compensation from tips.

The US Department of Labor states that an employer is only required to pay a tipped employee $2.13 per hour in direct wages if the employee earns at least the federal minimum wage combined with tips.

In other words, if you make a total of $7.25 per hour or more, your employer is allowed to pay you the tipped federal minimum of $2.13 an hour because your tips cover the amount needed to meet the federal minimum wage.

What is the federal minimum wage for tipped employees?

The federal minimum wage for tipped employees is $2.13 per hour. However, with their tips combined, tipped employees must earn at least the federal minimum wage of $7.25 per hour.

Here’s an example. A server named Lucy made $10 in tips during her 5-hour shift, and her hourly rate is $2.13. She made $20.65 in total wages for the day:

$2.13 x 5 hours = $10.65 (the amount Lucy earned for 5 hours)

$10.65 + $10 in tips = $20.65 (Lucy’s total wages for the day)

When we divide her total wages for the day ($20.65) by 5 hours worked, we see that Lucy made $4.13 per hour, which is below the federal minimum of $7.25 required by the Fair Labor Standards Act (FLSA).

Federal law mandates that the employer must compensate the employee for the difference if the employee’s tips combined with their direct wages of at least $2.13 per hour don’t equal the federal minimum hourly wage.

So, let’s see how Lucy’s employer calculates the difference:

$7.25 per hour – $4.13 per hour Lucy made = $3.12 per hour (the amount Lucy’s employer has to pay additionally for each hour worked)

Lucy worked 5 hours (5 x $3.12 per hour), so her employer will pay her an additional $15.60.

The amount of money Lucy earned in total is calculated this way:

$20.65 (her total wages for the day) + $15.60 (she got from her employer as the difference) = $36.25

Calculate payroll with Clockify

Tipped minimum wage by state for 2025

In this section, we will examine all state-individual tipped minimum wages for 2025. We have categorized the information into tables to make it easier for you to comprehend.

States with the same tipped minimum wage as the state wage

The following states require employers to pay tipped employees the full state minimum wage before tips. There is no maximum tip credit per hour or a definition of a tipped employee.

| State | Minimum wage rate and total tipped minimum wage |

|---|---|

| Alaska | $11.91 |

| California | $16.50 |

| Minnesota | $11.13 for large employers; $9.08 for small employers; |

| Montana | $10.55 for businesses with gross annual sales over $110,000; $4.00 for businesses not covered by the FLSA with gross annual sales of $110,000 or less; |

| Nevada | $12.00 |

| Oregon | $14.70 (standard); $15.95 (Portland metro area); $13.70 (non-urban counties); |

| Washington | $16.66 |

States with the tipped minimum wage above the federal tipped minimum wage

The following states require employers to pay tipped employees a minimum cash wage above the federal tipped minimum wage of $2.13 per hour.

| State | Tipped minimum wage rate | Maximum tip credit | Total tipped minimum wage | Definition of a tipped employee |

|---|---|---|---|---|

| Arizona | $11.70 | $3.00 | $14.70 | N/S |

| Arkansas | $2.63 | $8.37 | $11.00 | N/S |

| Colorado | $11.79 | $3.02 | $14.81 | Earns more than $30 in tips |

| Connecticut | $6.38 for hotel or restaurant staff; $8.23 for bartenders | $9.97 for hotel or restaurant staff; $8.12 for bartenders | $16.35 | N/S |

| Delaware | $2.23 | $12.77 | $15.00 | Earns more than $30 in tips |

| District of Columbia | $10.00 (set to increase to $12.00 on July 1, 2025) | $7.50 | $17.50 | N/S |

| Florida | $9.98 (set to increase to $10.98 on September 1, 2025) | $3.02 | $13.00 (set to increase to $14.00 on September 1, 2025) | Earns more than $30 in tips |

| Hawaii | $12.75 | $1.25 | Employees must receive at least $7.00 more in tips than the minimum wage ($14.00), currently $21.00 | Earns more than $20 in tips |

| Idaho | $3.35 | $3.90 | $7.25 | Earns more than $30 in tips |

| Illinois | $9.00 | 40% of the applicable minimum wage ($6.00) | $15.00 | N/S |

| Iowa | $4.35 | 40% of the applicable minimum wage ($2.90) | $7.25 | Earns more than $30 in tips |

| Maine | $7.33 | 50% of the applicable minimum wage ($7.33) | $14.65 | Earns more than $185 in tips |

| Maryland | $3.63 | $11.37 | $15.00 | Earns more than $30 in tips |

| Massachusetts | $6.75 | $8.25 | $15.00 | Earns more than $20 in tips |

| Michigan | 48% of the minimum hourly wage, which is $5.99 (starting from February 21, 2025) | $6.49 | $12.48 (starting from February 21, 2025) | N/S |

| Missouri | $6.88 | 50% of the applicable minimum wage ($6.88) | $13.75 | N/S |

| New Hampshire | $3.27 | $3.98 | $7.25 | Earns more than $30 in tips |

| New Jersey | $5.62 | $9.87 | $15.49 | Earns more than $30 in tips |

| New Mexico | $3.00 | $9.00 | $12.00 | Earns more than $30 in tips |

| New York (New York City) | $13.75 for service employees; $11.00 for food service workers; | $2.75 for service employees; $5.50 for food service workers; | $16.50 | N/S |

| New York (Long Island and Westchester County) | $13.75 for service employees; $11.00 for food service workers; | $2.75 for service employees; $5.50 for food service workers; | $16.50 | N/S |

| New York (Remainder of the NYS) | $12.90 for service employees; $10.35 for food service workers; | $2.60 for service employees; $5.15 for food service employees; | $15.50 | N/S |

| North Dakota | $4.86 | 33% of the applicable minimum wage ($2.39) | $7.25 | Earns more than $30 in tips |

| Ohio* | $5.35 | $5.35 | $10.70 | Earns more than $30 in tips |

| Oklahoma | $2.00 for employers not covered by the FLSA and with less than $100,000 in revenue; $2.13 for employers covered by the FLSA; | Maximum of $3.63 for covered FLSA employers with more than $100,000 in revenue | $7.25 | N/S |

| Pennsylvania | $2.83 | $4.42 | $7.25 | Earns more than $135 in tips |

| Rhode Island | $3.89 | $11.11 | $15.00 | N/S |

| South Dakota | $5.75 | 50% of the applicable minimum wage ($5.75) | $11.50 | Earns more than $35 in tips |

| Vermont | $7.01 | $7.01 | $14.01 | Earns more than $120 and works in a hotel, motel, tourist place, or a restaurant |

| Wisconsin | $2.33 | $4.92 | $7.25 | Regularly receives tips |

| West Virginia | $2.62 | 70% of the applicable minimum wage ($6.13) | $8.75 | N/S |

*Applies to employers with annual gross receipts of $394,000 or more. For businesses with smaller revenues, federal rules apply.

States with the same tipped minimum wage as the federal tipped minimum wage

In the following states, the state minimum tipped wage is the same as that required under the federal Fair Labor Standards Act ($2.13 per hour):

| State | Tipped minimum wage rate | Maximum tip credit | Total tipped minimum wage | Definition of a tipped employee |

|---|---|---|---|---|

| Alabama | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Georgia | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Indiana | $2.13 | $5.12 | $7.25 | N/S |

| Kansas | $2.13 | $5.12 | $7.25 | N/S |

| Kentucky | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Louisiana | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Mississippi | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Nebraska | $2.13 | $11.37 | $13.50 | Earns more than $30 in tips |

| North Carolina | $2.13 | $5.12 | $7.25 | Earns more than $20 in tips |

| South Carolina | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Tennessee | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Texas | $2.13 | $5.12 | $7.25 | Earns more than $20 in tips |

| Utah | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Virginia | $2.13 | $10.28 | $12.41 | Earns more than $30 in tips |

| Wyoming | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

Tipped minimum wage for inhabited US territories

Minimum wage regulations for 5 inhabited US territories in the Caribbean and the US Pacific Islands region are presented in the table below.

| State | Tipped minimum wage rate | Maximum tip credit | Total tipped minimum wage | Definition of a tipped employee |

|---|---|---|---|---|

| American Samoa | $2.13 | / | Special minimum wage rates | Earns more than $30 in tips |

| Guam | $9.25 | / | $9.25 | N/S |

| Commonwealth of the Northern Mariana Islands | $2.13 | $5.12 | $7.25 | Earns more than $30 in tips |

| Puerto Rico | $2.13 | $8.37 | $10.50 | Earns more than $30 in tips |

| US Virgin Islands | 40% of the minimum hourly wage, which is $4.20 | $6.30 | $10.50 | N/S |

FAQs about tipped wages by state

To learn more about this subject, let’s examine some of the frequently asked questions about tipped minimum wage by state.

Do waiters get paid less than the minimum wage?

The federal minimum wage is $7.25 an hour, so paying employees less is illegal. However, if a waiter makes the minimum wage or more in tips, an employer can pay them at a lower rate.

Waiters earn the majority of their profits through tips. Their employer calculates their daily earnings based on state and federal laws by combining their tipped hourly rate and tips.

In certain states where tip credit is allowed, if a waiter earns more than $30 per month in tips, their employer can claim a tip credit and include tips in their wage calculation.

🎓 How to Calculate Work Hours: A Step-by-step Guide to Calculating Payroll and Hours Worked

Why do servers only make $2.13 an hour?

Servers only make $2.13 per hour in direct wages because the money they earn through tips usually exceeds the federal minimum wage.

In most cases, servers can earn far more than the federal minimum wage of $7.25 per hour. Sometimes, they can earn almost twice that amount (if a server earns less than the federal minimum, the employer must make up the difference).

This applies to states where the minimum cash wage is the same as that required under the federal FLSA ($2.13 per hour). However, in some states, employers are required to pay tipped employees a minimum cash wage above that amount.

🎓 Fair Labor Standards Act (FLSA) Regulations

What is tip credit against minimum wage?

A tip credit against the minimum wage allows employers to include employees’ tips in calculating their wages, allowing them to pay a lower cash wage than the established minimum.

According to the Wage & Hour Division, the maximum tip credit an employer can claim is $5.12 per hour ($7.25 – $2.13 wage = $5.12). This is on the federal level, but tip credit varies by state.

Here’s an example of a tip credit calculation. Let’s say Mary is a waitress who works 30 hours a week. She earns $370 in tips, which her employer calculates by dividing the total tips by the hours worked. The employer does it like this:

$370 in tips / 30 hours she worked = $12.33 tips per hour

As $12.33 per hour exceeds the maximum tip credit of $5.12 per hour, the employer can claim the full tip credit of $5.12 per hour (the amount the employer doesn’t have to pay).

If Mary earned, say, $100 in tips, the situation would be different:

$100 in tips / 30 hours she worked = $3.33 tips per hour

As $3.33 per hour is less than the maximum tip credit of $5.12 per hour, Mary’s employer isn’t allowed to claim the full tip credit of $5.12 per hour, and they also have to make up the difference. So, let’s see how much her employer has to add to her regular wages:

$5.12 the maximum tip credit – $3.33 per hour = $1.79 per hour

$1.79 per hour x 30 hours she worked = $53.70 (the total the employer has to add as the difference)

Which states allow tip credit?

The Department of Labor (DOL) lists the following states as the states where tip credit is allowed:

| Alabama | Hawaii | Maryland | New York | Tennessee |

| Arizona | Idaho | Massachusetts | North Carolina | Texas |

| Arkansas | Illinois | Michigan | North Dakota | Utah |

| Colorado | Indiana | Mississippi | Ohio | Vermont |

| Connecticut | Iowa | Missouri | Oklahoma | Virginia |

| Delaware | Kansas | Nebraska | Pennsylvania | West Virginia |

| District of Columbia | Kentucky | New Hampshire | Rhode Island | Wisconsin |

| Florida | Louisiana | New Jersey | South Carolina | Wyoming |

| Georgia | Maine | New Mexico | South Dakota |

The US territories that allow tip credit are:

- American Samoa,

- Commonwealth of the Northern Mariana Islands,

- Puerto Rico, and

- The US Virgin Islands.

Additional state rules are listed below:

- In Hawaii, tip credit is allowed if the amount that the employee receives from the employer plus the tips they make is at least $7.00 more than the applicable minimum wage.

- In New Jersey, an employer can use a tip credit against the full state minimum hourly wage only if the tipped employees are first notified of the cash wage they receive and the tip credit the employer claims. Employees retain all tips, except in the case of tip pooling.

- In North Carolina, tip credit is allowed after the employer obtains a signed certification of the number of tips each employee received.

Which states don’t allow tip credit?

Although the majority of states allow tip credit, these are the states where tip credit isn’t allowed:

- Alaska,

- California,

- Minnesota,

- Montana,

- Nevada,

- Oregon, and

- Washington.

Also, Guam is a US territory that doesn’t allow tip credit.

What are the states that use the federal tipped minimum wage?

Certain states follow the federal rate of $2.13 per hour regarding tipped minimum wage.

In other words, the state minimum wage payment in the following is the same as the one required under the federal Fair Labor Standards Act ($2.13 per hour):

- Alabama,

- Georgia,

- Indiana,

- Kansas,

- Kentucky,

- Louisiana,

- Mississippi,

- Nebraska,

- North Carolina,

- South Carolina,

- Tennessee,

- Texas,

- Utah,

- Virginia, and

- Wyoming.

The US territories that use the federal tipped minimum wage are:

- American Samoa,

- Commonwealth of the Northern Mariana Islands, and

- Puerto Rico.

Some additional state rules stated by the DOL are covered below:

- The state minimum wage law doesn’t apply to tipped employees in Georgia. In this state, employers must pay employees covered by the federal FLSA at least the federal minimum wage.

- The tipped minimum wage in Oklahoma is currently $2.13, but the US Department of Labor classifies Oklahoma as a state with a higher rate than the federal rate. Contact the Oklahoma Department of Labor for more information.

What are the states that have their own tipped minimum wages?

The majority of states have their own tipped minimum wages. These states require employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal FLSA ($2.13 per hour):

| Arizona | District of Columbia | Iowa | Missouri | North Dakota | South Dakota |

| Arkansas | Florida | Maine | New Hampshire | Ohio | Vermont |

| Colorado | Hawaii | Maryland | New Jersey | Oklahoma | Wisconsin |

| Connecticut | Idaho | Massachusetts | New Mexico | Pennsylvania | West Virginia |

| Delaware | Illinois | Michigan | New York | Rhode Island |

The US Virgin Islands also has its own rules regarding tipped minimum wage.

Some additional state and US territory rules are as follows:

- In Connecticut, the minimum cash wage differs for employees working in hotels and restaurants ($6.38) and bartenders who customarily receive tips ($8.23).

- In New York, the minimum cash wage differs for tipped food service workers ($10.35 – $11.00 per hour) and tipped service employees ($12.90 – $13.75 per hour).

- In the US Virgin Islands, the Wage Board is authorized to increase the minimum wage for tipped tourist service and restaurant employees to a rate not greater than 45% of the minimum wage or less than the federal tipped minimum wage.

What is tip pooling?

Tip pooling is a form of tip distribution in which all of the tips are accumulated into one lump sum, which is then divided (mostly equally, but not always) among the tipped employees.

For example, tips can be split based on the hours worked or a point system where employees get a certain number of points, which determines the percentage of the tip pool they receive. These points are distributed to all workers who helped during that shift, such as:

- Bussers,

- Bartenders,

- Servers,

- Hostesses,

- Food runners, etc.

However, tip pooling must be legal and in accordance with state and federal regulations.

To create a proper tip pooling policy for your business, it has to cover the following details:

- Whether the tip pooling is mandatory or voluntary,

- Which employees must participate in tip pooling (if it is mandatory),

- How much must each employee contribute to the “pool,” and

- How you’ll divide the tips.

Once you have a tipping policy in place, communicate the rules clearly to your employees.

Can an employer force you to participate in tip pooling?

The short answer is — yes, they can.

Federal law allows employers to require employees to participate in tip pooling and share tips with other employees.

However, as the Code of Federal Regulations (CFR) states, employers must notify their employees of any required tip pool contributions and can’t retain any tips for other purposes.

How much do most servers make a shift?

Based on the latest US Bureau of Labor Statistics numbers, the hourly wage for waiters and waitresses in 2023 was $15.36 per hour.

However, how much a server makes per shift depends on several factors, such as:

- The location and popularity of the server’s workplace — Restaurants in major US cities with a lot of visitors usually provide a better opportunity for tipped employees than restaurants in, for instance, a small town in Alabama.

- The type of shift they work — The amount of tips a server can make largely depends on the time of day because not every shift covers a lot of customers. For example, someone who works on a busy weekend night has more opportunities to get tips than someone who works during a slower shift, such as a lunch shift.

- The server’s skill level — A server with a higher skill level will more likely be awarded for their service than a server with a lower skill level.

🎓 Overtime Laws by State — Guide for 2023

What is the lowest tipped minimum wage?

The lowest a tipped employee can be paid is $2.13 per hour. Nonetheless, such employees must receive the federal minimum of $7.25 when wages and tips combine.

What is the highest tipped minimum wage?

The state with the highest tipped minimum wage in the US is Washington; it amounts to $16.66 per hour. In addition, several states have high tipped minimum wages too, including:

- Illinois — $9.00 per hour,

- Maine — $7.33 per hour,

- Arizona — $11.70 per hour,

- Colorado — $11.79 per hour,

- California — $16.50 per hour, and

- Florida — $9.98 per hour.

Furthermore, the minimum tipped wage in the District of Columbia is currently $10.00 per hour and will increase to $12.00 on July 1, 2025.

🎓 District of Columbia Labor Laws Guide

Is it mandatory to give tips in the US?

Although tipping isn’t mandatory in the US, employees expect and appreciate it. In most states, leaving a tip is customary even if the service wasn’t the best.

In cases of large parties, some restaurants will even add an automatic gratuity. Gratuity is usually a set percentage of the pre-tax total. If it’s included, you don’t have to tip.

Do tips get taxed?

Tips are considered income, and like any other income, they are subject to federal income tax. Every employee is responsible for reporting their tips to their employer.

However, if your monthly tips are less than $20, you don’t need to report the tips for that month.

As the IRS states, as an employee who receives tips, you must do 3 things:

- Keep a daily tip record,

- Report tips to the employer (unless the total is less than $20 per month), and

- Report all tips on an individual income tax return.

According to the IRS, any tips the employee didn’t report to the employer must be reported separately on Form 4137 (Social Security and Medicare Tax on Unreported Tip Income) to include as additional wages with their tax return. The employer must also pay the employee’s share of Social Security and Medicare tax owed on those tips.

The amount the employer withholds from employees’ paychecks is based on their total wages plus tips, so employees must report all cash and non-cash tips received to the employer.

These are the tips that must be reported and taxed:

- Cash tips from customers,

- Charged tips (such as credit and debit card charges) given to the employee by their employer, and

- Tips received from other employees under a tip-sharing agreement.

🎓 Is Overtime Taxed More? Everything You Need to Know

What is the tipped minimum wage in NY?

According to the New York State Department of Labor, the minimum wage rates for the state of New York depend on the region:

| Minimum wages for tipped workers in New York State | New York City | Long Island and Westchester County | Remainder of New York State |

|---|---|---|---|

| Service Employees (Cash Wage) | $13.75 | $13.75 | $12.90 |

| Service Employees (Tip Credit) | $2.75 | $2.75 | $2.60 |

| Food Service Workers (Cash Wage) | $11.00 | $11.00 | $10.35 |

| Food Service Workers (Tip Credit) | $5.50 | $5.50 | $5.15 |

What is the minimum wage for waiters and waitresses in Florida?

As of September 30, 2024, the minimum wage in Florida sits at $13.00 an hour, according to the Florida Restaurant & Lodging Association (FRLA). The required cash wage for tipped employees is $9.98.

The minimum wage will increase to $14.00 an hour in September 2025, and cash wages for tipped employees will rise to $10.98.

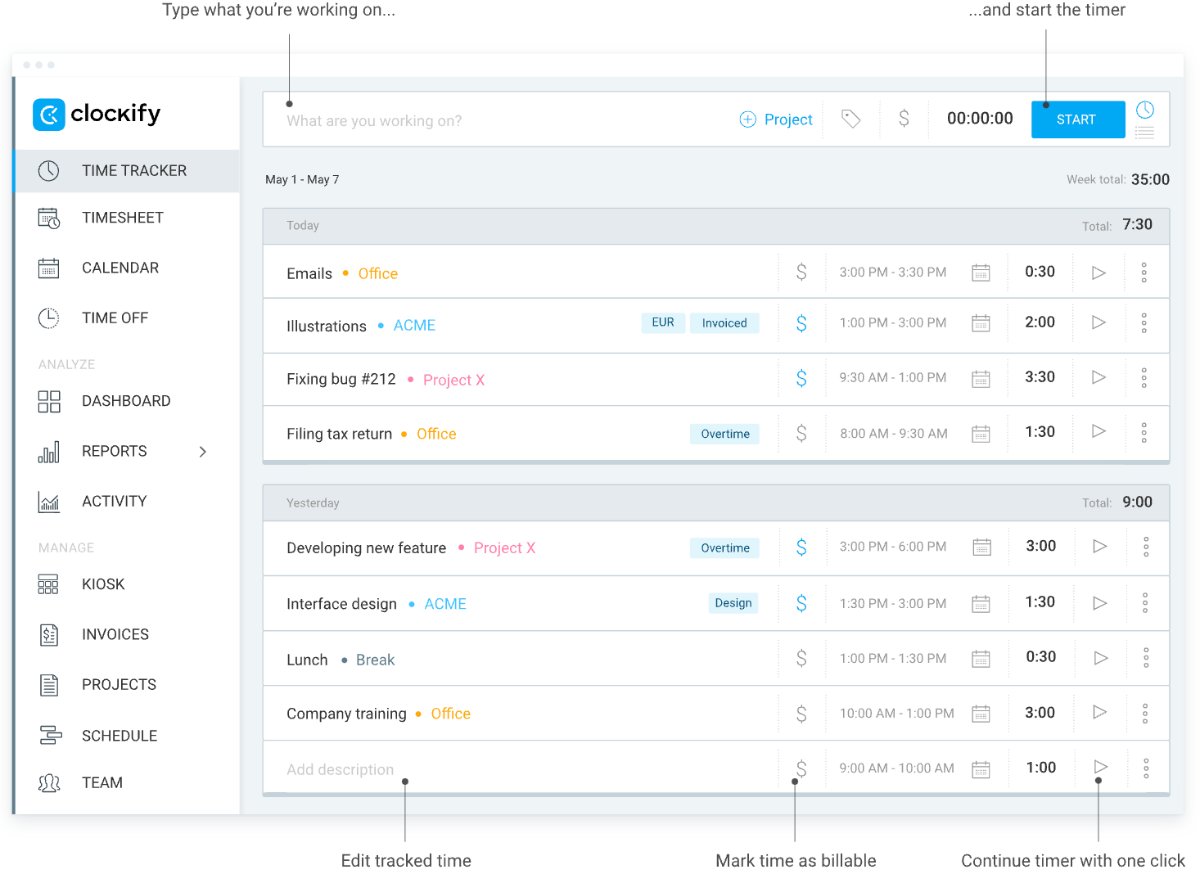

Track payroll hours with Clockify

Calculating payroll hours can be time-consuming — and even the smallest mistakes often lead to incorrect calculations and errors.

That’s why payroll tracking software, such as Clockify, can simplify this process and minimize unexpected costs.

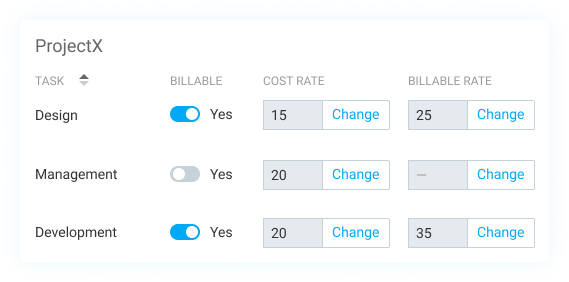

To get started, create projects and tasks you want your employees to work on.

Once your projects and tasks are set, you can determine hourly rates for each employee, project, or task.

Lastly, employees need to log their work hours by using:

- Timer mode,

- Manual mode, or

- Timesheet view.

Start tracking work hours for FREE!

Conclusion/Disclaimer

Rules regarding tipped wages in the US depend on where you’re working.

To be fully informed of all your rights as a tipped employee, be sure to check:

- Federal and state laws for tipped wages,

- State laws on tip credit, and

- IRS taxation regulations for tips.

For more detailed information, check out the links we’ve provided, as most of them lead you to the official government websites with other relevant information.

Please note that this guide was written in Q1 of 2025, so any changes in the labor laws introduced later may not be included in this guide.

This guide offers a general overview of information and does not constitute legal advice. Before taking legal action, consult the appropriate institutions and/or authorized representatives.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant.