Oklahoma Labor Laws Guide

| Oklahoma Labor Laws FAQ | |

| Oklahoma minimum wage | $7.25 |

| Oklahoma overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Oklahoma breaks | Breaks not required by law |

Labor laws regulate the rights and obligations of both employers and employees. In Oklahoma, laws concerning employment are primarily federal regulations, supplemented by some state laws, such as those related to leaves of absence and hiring practices.

In this Oklahoma labor law guide, we’ll be looking at the following areas:

- Wages, pay frequency, overtime, and breaks,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Leave requirements,

- Miscellaneous labor laws, and

- General questions regarding Oklahoma labor laws.

Oklahoma wage laws

In Oklahoma, the Fair Labor Standards Act (FLSA) establishes minimum wages that apply to employees in all sectors, except for specific occupations (see the section below for details on exempt occupations).

Take a look at the breakdown of Oklahoma minimum wages concerning:

- The state minimum,

- Tipped employees, and

- Subminimum wages.

| OKLAHOMA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25* | $2.13 | $7.25 (with some exceptions) |

Oklahoma minimum wage

First of all, let’s discuss the minimum wage in the state of Oklahoma. A minimum wage is the lowest remuneration that employers are lawfully obliged to pay their employees.

As of July 24, 2009, the minimum hourly wage in Oklahoma is$7.25, which is also the federal minimum hourly wage.

Note: Under Oklahoma law, employers must pay their employees the regular minimum wage if their company has at least 10 full-time employees or gross annual profits of more than $100,000. Contrarily, if a company has fewer than 10 employees and a gross profit of $100,000 or less, the minimum wage is as low as $2 per hour.

Exceptions to the minimum wage in Oklahoma

Not all employees qualify for the minimum wage of $7.25 per hour. In line with that, employees are grouped into 2 categories:

- Exempt employees — Employees who are paid on a salaried basis (executive or professional jobs) and don’t qualify for minimum wage or overtime.

- Nonexempt employees — Employees who are paid by the hour and must earn at least the minimum wage and overtime pay.

Including the condition for minimum wages stated above, employees who are exempt from minimum wage under the FLSA are:

- Executive, professional, and administrative employees who earn no less than $1,124 per week,

- Computer employees who earn no less than $1,124 per week,

- Highly compensated employees who earn $151,164 per year or more,

- Farm workers,

- Employees in the fishing industry, and

- Seasonal and recreational workers.

🎓 FLSA minimum wage exemptions

Tipped minimum wage in Oklahoma

While the term “tipped employee” is not specified in the state of Oklahoma, employees who receive tips from customers (such as waiters, servers, cleaning staff, etc.) are entitled to the federal tipped minimum wage of $2.13 per hour.

However, an employer may pay a tipped employee the hourly rate of $2.13 as long as the tipped employee receives at least the federal minimum of $7.25 per hour (when wages and tips combine).

If a tipped employee doesn’t make the federal minimum from the tipped minimum wage plus tips — the employer is obliged to pay the difference.

Oklahoma subminimum wage

In Oklahoma, trainees must be paid at least the current minimum wage ($7.25) for all hours of training — unless training is contracted with a third party and done away from the workplace.

In contrast, learners, apprentices, and messengers who are employed in delivering letters and messages can be paid wages lower than the current minimum.

What’s more, full-time students and workers with physical or mental deficiency or injury may also be paid lower wages.

Oklahoma payment laws

Oklahoma employers must pay their employees at least twice each calendar month on scheduled paydays.

However, the following categories can be paid once per month:

- State employees,

- County employees,

- Municipal employees,

- School district employees,

- Technology Center School District employees,

- Non-private foundation employees, and

- Exempt employees.

The employer must pay out wages due no later than11 days after the end of the payperiod (although a 3-day grace period applies).

🎓 Track employee payroll with Clockify

Oklahoma overtime laws

Under the FLSA, eligible employees who work more than 40 hours in a workweek are entitled to overtime pay at a rate of one and a half (1.5) times their regular rate.

🎓 Track Oklahoma overtime with Clockify

Overtime exceptions and exemptions in Oklahoma

Not all employees qualify for overtime pay — in fact, certain requirements must be met to have overtime-exempt employee status, including:

- Minimum salary requirement of $1,124 per week

- Fixed salary, no matter how many hours of work.

Additionally, specific duties, industries, or job positions may affect an employee’s eligibility for overtime. That being said, here are employees who are exempt from overtime pay under FLSA:

- Executive, administrative, and professional employees who receive a fixed salary of at least $1,124 per week,

- Computer employees who earn no less than $1,124 per week,

- Highly compensated employees who earn $151,164 per year or more,

- Outside sales employee,

- Agricultural or horticultural employees,

- Commissioned sales employees in retail or service establishments who receive more than half of their earnings from commissions on goods or services, and

- Motor carrier employees (e.g, drivers, driver’s helpers, loaders, or mechanics providing services in transportation on highways in interstate or foreign commerce).

🎓 FLSA overtime pay exemptions

Fluctuating Workweek Method (FWW) in Oklahoma

Certain employees who receive a fixed salary are eligible for overtime pay one-half (0.5) times the regular hourly rateunder the Fluctuating Workweek Method (FWW).

The following conditions must be met for the FWW to apply:

- Fixed salary — Employees receive a fixed salary regardless of the number of hours they work.

- Fluctuating workweek — Employees sometimes work more or less than 40 hours a week.

- Minimum hourly wage must be $7.25 per hour.

Employees who calculate their overtime hours under the FWW provisions are entitled to:

- Bonuses,

- Commissions, and

- Hazard pay.

🎓 Fluctuating Workweek Calculator

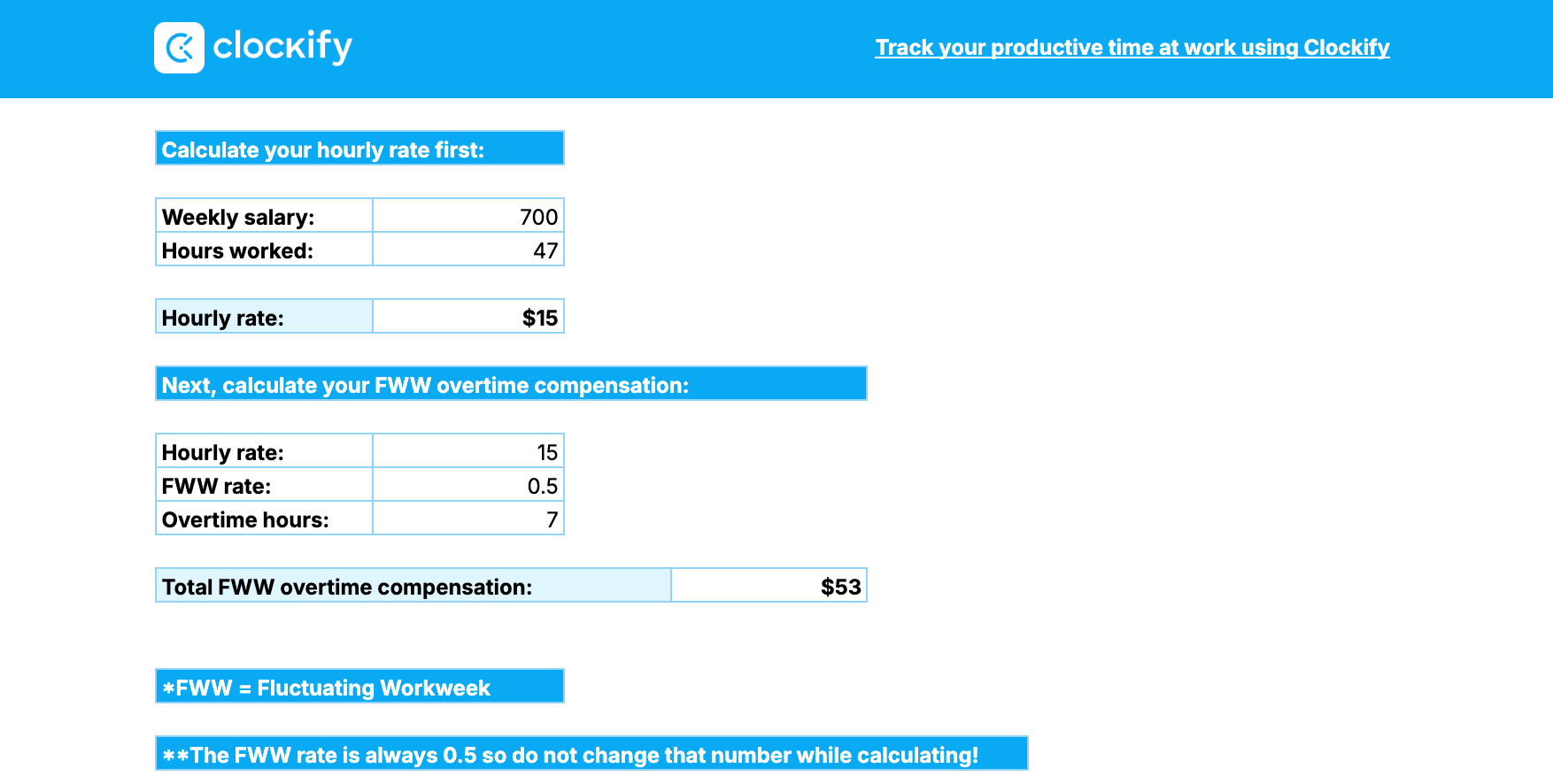

Let’s see how the Fluctuating Workweek Method (FWW) works in practice:

An employee’s weekly income is, for instance, $700.

In the preceding week, the employee worked 47 hours.

To calculate overtime hours, first determinethe hourly rate.

Simply divide the weekly salary by the number of hours worked for that week:

700 / 47 = $15 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week:

$15 per hour x 0.5 = $7.5 for each overtime hour worked

Total overtime compensation goes as follows:

$7.5 x 7 overtime hours = $53

🎓 Best ways to track employee hours

Oklahoma break laws

No federal or state law of Oklahoma requires an employer to provide rest or lunch breaks to workers above the age of 16. Yet, this doesn’t mean an employer shouldn’t provide breaks to their employees.

In fact, rest and meal breaks foster a healthy workplace environment and help prevent employee burnout. If a break or meal period is promised in the employment contract, the employer must comply with such a promise — otherwise it’s a breach of contract.

Exceptions to break laws in Oklahoma

When provided, rest periods or meal breaks lasting 30 minutes or more are not compensable, while breaks lasting less than 30 minutes (such as a coffee break) must be compensated.

Oklahoma breastfeeding laws in the workplace

When it comes to breastfeeding breaks and rights that nursing mothers have in the workplace — state and federal laws overlap.

Under Oklahoma breastfeeding law, an employer is required to:

- Provide unpaid break time to an employee to breastfeed or express breast milk in the workplace — during the employee’s lunch break or any other break (paid or unpaid). Still, if an employer believes a breastfeeding break will create “undue hardship” to the business — they’re not obliged to offer such a break.

- Provide a private room — other than an office bathroom — for an employee to breastfeed or express milk.

Unlike Oklahoma breastfeeding law, federal law concerning breastfeeding at work states:

- A breastfeeding mother receives a reasonable unpaid break time to breastfeed or express milk for 1 year after the child’s birth, each time she has the need to do so.

- Businesses with more than 50 employees — nonexempt employees — are covered by federal law.

Which law applies to you?

If an employee is subject to both laws, the one with the strongest protection for the employee will prevail.

Oklahoma leave requirements

In the state of Oklahoma, there are 2 types of leave days:

- Required leave, and

- Non-required leave.

Let’s see in detail how they work and what they actually are.

| TYPES OF LEAVES | |||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Annual leave — Refers to paid time off granted by employers to their employees to be used for any reason, such as vacation, personal time off, or due to an illness (when sick leave is used up). Probationary and permanent employees may accrue annual leave based on their years of service. The following is the annual leave accrual and accumulation schedule:

|

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Sick leave — There’s no sick leave law concerning private employers. However, full-time state employees may accrue sick leave days based on hours worked during a pay period, but overtime work isn’t included. Eligible employees may use sick leave in the following circumstances:

The following is the sick leave accrual schedule:

Even though eligible employees get 15 days of sick leave, whether they’ve worked less than 5 or more than 20 years, there’s no limit on sick leave accumulation. Still, temporary and other limited-term employees are not eligible for sick leave use or accrual. |

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Family and Medical Leave Act — The Family and Medical Leave Act (FMLA) is a federal law that obliges employers to provide eligible employees unpaid time off for certain family health or medical reasons. Under FMLA, employees are entitled to up to 12 weeks of unpaid, job-protected leave per year. FMLA covers:

Leaves of absence under the Family and Medical Leave Act (FMLA) may be given for the following reasons:

|

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Holiday leave — State employees in Oklahoma,except for temporary and other limited-term employees, are entitled to a day off from work without loss of pay on the following holidays:

* State employees in Oklahoma get 2 days off around Christmas. If Christmas falls on a workday, employees receive the day before or after Christmas off (including Christmas Day). If Christmas falls on a Saturday, they receive the preceding Thursday and Friday off. If Christmas falls on a Sunday, employees receive the following Monday and Tuesday off. If any holiday, other than Christmas, falls on a Saturday, the preceding Friday shall be considered a day off. If any holiday (again, other than Christmas) falls on a Sunday, the following Monday shall be a holiday. Finally, if an eligible employee is required to work on any of the said holidays, such an employee is entitled to a paid leave of absence on an alternative date. |

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Jury duty leave — Jury duty or jury service is a civic duty of each US citizen who receives a summons from a court to serve on a jury. In Oklahoma, employees have the right to take unpaid time off for jury duty without facing discrimination or being required to use sick, annual, or vacation time to serve as jurors. |

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Voting leave — Employers must grant employees who are registered to vote up to 2 hours of paid time for voting. However, employees won’t be granted time off to vote if there’s a 3-hour voting period before or after the employee’s regular working hours. For instance, if the polls are open from 6 a.m. to 9 p.m., and the employee works from 9 a.m. to 5 p.m.,the employer is not obligated to provide leave of absence for voting purposes. |

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Military leave — Employees who are members of the National Guard or reserve component of the Armed Forces (Army, Navy, Air Force, Marine Corps, and Coast Guard Reserves) are entitled to paid leave of absence to perform active or inactive military duty. However, eligible employees are only paid for the first 30 workdays of such leave (from October 1 through September 30). |

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Enforced leave — Permanent or probationary employees may be granted enforced leave of up to 10 paid working days in the following circumstances:

|

|||||||||||||||

| ✅ REQUIRED LEAVE | |||||||||||||||

|

Donor leave — Any employee of the state of Oklahoma, its departments or agencies, qualifies for a leave of absence for the following reasons:

|

Child labor laws in Oklahoma

Both federal and state laws make sure minors work in an environment that’s free from recognized hazards — but also limit child labor to foster regular school attendance.

The following are child labor provisions regarding:

- Hour restrictions,

- Break periods, and

- Prohibited occupations.

Work time restrictions for Oklahoma minors

Since Oklahoma minors are protected under the Fair Labor Standards Act (FLSA) concerning hours of work, there are no hour restrictions when it comes to the employment of workers aged 16 and older.

However, if an employer wishes to employ workers aged 14 and 15, such an employer must comply with the following hour restrictions and regulations:

- Work is allowed between 7 a.m. and 7 p.m. (or until 9 p.m., from June 1st to Labor Day),

- Up to 3 hours of work on a school day,

- Up to 8 hours of work on a non-school day,

- Up to 18 hours of work on a school week, and

- Up to 40 hours of work on a non-school week.

Breaks for Oklahoma minors

According to the Oklahoma law, minors under the age of 16 must be given:

- 1-hour break for shifts lasting 8 consecutive hours, or

- 30-minute break after 5 consecutive hours worked.

Workers aged 16 and above are not entitled to break periods of any kind.

Prohibited occupations for Oklahoma minors

Any employer who employs minors under 16 years of age must create a safe and healthy working environment, free of hazards.

That being said, no child under 16 years of age shall be employed in the following occupations:

- Manufacturing, mining, or processing occupations,

- Working with hoisting equipment or any other power-driven machinery (except for office machines such as typewriters or adding machines),

- Operating motor vehicles,

- Public messenger services,

- Occupations involving transportation of persons or property by rail, highway, air, water, pipeline, or other means,

- Warehousing and storage,

- Occupations in connection with communications and public utilities, and

- Demolition and repair.

Yet, minors under the age of 16 are allowed to work on farms or for their parents’ businesses, in the sale or delivery of newspapers.

In addition to the aforementioned hazardous occupations, occupations declared hazardous to all minors under the FLSA also apply in Oklahoma.

🎓 Child Labor Provisions of the Fair Labor Standards Act (FLSA) for Nonagricultural Occupations | Agricultural Occupations

Any employer or entity that disregards any of the restrictions or prohibitions stated above will be guilty of a misdemeanor and subject to a fine of not more than $500 for each offense, or imprisonment for not less than 10 nor more than 30 days.

Oklahoma hiring laws

By the Oklahoma law, it is a discriminatory practice for an employer, employment agency, labor organization, or training program to fail or refuse to hire, to discharge, expel from a labor organization, segregate, or treat an applicant, member of a labor organization, or employee less favorably merely because of such person’s:

- Race,

- Color,

- Religion,*

- Sex,**

- National origin,

- Age,

- Genetic information, or

- Disability.***

* Except for religious corporations, educational institutions, associations, or societies when it comes to employing individuals of a certain religion to perform religion-related activities or curriculum.

** Unless it is required or permitted by Oklahoma laws to make differences between sexes in terms of employment, it’s not discriminatory to provide different benefits and annuities to widows and widowers of employees.

*** Unless such disability can harm the normal operations of a business.

Furthermore, no employer, labor organization, or employment agency is allowed to print or publish a notice or advertisement indicating a preference, limitation, or otherwise discrimination based on the discriminatory practices above.

Still, such a notice or advertisement may display preferences, limitations, or discrimination based on religion, sex, or national origin where such factors are bona fide occupational qualifications necessary for a particular position.

Also, religion, sex, national origin, age, disability, or genetic information are considered bona fide occupational qualifications with respect to hiring, classifying, or referring for employment when such qualifications are reasonably necessary to the normal operations of a business.

Moreover, an employee 65 years of age who is employed in a bona fide executive or high policy-making position (2 years before retirement) may be retired compulsorily if such person is entitled to a nonforfeitable annual retirement of at least $44,000, and this is not a discriminatory practice.

Right-to-work law in Oklahoma

Oklahoma is another right-to-work state — this means that employees in Oklahoma may choose whether or not to join a labor union without being afraid of losing their job.

On that account, no person in the state of Oklahoma can be required, as a condition or continuation of employment, to:

- Join a labor union,

- Resign or refrain from a labor union membership,

- Pay money or any other compensation to a labor organization, charity, or other third parties (which are otherwise required of labor organization members), or

- Be recommended, approved, referred to, or cleared by a labor organization.

However, these regulations only apply to employees who were employed after Oklahoma’s right-to-work law took effect on September 28, 2001.

What’s more, fire and police department members aren’t entitled to engage in any work stoppage or slowdown strikes.

Any person or organization that violates any of the provisions stated above will be guilty of a misdemeanor.

Oklahoma termination laws

Oklahoma is another state that recognizes at-will employment. The at-will employment doctrine allows employers to discharge employees at any time and for good cause or no cause at all — without being legally responsible.

At the same time, an employee may terminate their employment at any time and for any reason.

Still, no employer may discharge an employee based on the employee’s:

- Skin color,

- Gender,

- Religion,

- Pregnancy, or

- Other protected status.

Such termination of employment is called wrongful termination.

In addition to said wrongful termination situation, no employer may terminate or otherwise take adverse action against an employee for the following reasons:

- If an employee files a complaint about occupational safety and health conditions in the workplace, such as poor office hygiene, missing protective equipment, etc.

- If an employee is called for jury duty, provided that such employee notifies the employer within a reasonable time after receiving notice.

- If an employee uses tobacco products while off-duty and away from work.

- If an employee takes a family or medical leave or military leave.

However, these are just a few of the most common legal grounds for suing an employer for wrongful termination in Oklahoma.

To learn more about wrongful termination and violations of employees’ rights, it is advisable to consult an employment lawyer.

Oklahoma final paycheck

Whenever a person’s employment ends in Oklahoma — whether voluntary or involuntary — the employer is obliged to pay the employee’s wages in full at the next regularly scheduled payday.

Health insurance continuation in Oklahoma

Upon termination of employment, eligible employees and their dependents are entitled to a temporary health insurance continuation under the federal Consolidated Omnibus Budget Reconciliation Act (COBRA) law.

Such health insurance may be extended for up to 36 months.

However, COBRA applies to plans offered by private-sector employers having 20 or more full-time employees.

For those not covered by COBRA, Oklahoma requires employers to provide healthcare insurance under the group policy to their employees (and their dependents) for at least 63 days after termination.

Such insurance provides:

- Hospital, medical, or surgical benefits,

- Christian Science care,

- Treatment expense benefits,

- Hospital, medical, or indemnity coverage,

- Prepaid health plan, and

- Health maintenance organization subscriber contract.

Occupational safety in Oklahoma

Regarding workplace safety in Oklahoma, both federal and state laws apply.

On that account, private sector employees are covered by the federal Occupational Safety and Health Administration (OSHA) law. In contrast, the Public Employees Occupational Safety and Health (PEOSH) law conducts safety and health provisions in the public sector.

Occupational Safety and Health Administration (OSHA)

Under the Occupational Safety and Health Administration (OSHA), private sector employersmust provide a hazard-free and healthy working environment to their employees.

Not only does OSHA enforce workplace safety laws and standards that must be followed, but it also provides education and assistance to reduce work fatalities and injury rates.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress, such as excessive workload, sexual harassment, workplace violence, etc.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

Public Employees Occupational Safety and Health (PEOSH)

The intent of PEOSH is the same as OSHA — ensuring healthy and hazard-free working conditions for public employees and reducing workplace fatalities to a minimum.

Apart from setting safety and health regulations in the workplace, PEOSH addresses the following:

- Fatalities in the workplace,

- Employers’ incident or illness rates,

- Complaints from employees,

- Common event hospitalization or sickness (five or more employees),

- Training and outreach activities, and

- State-driven rulemaking.

Miscellaneous Oklahoma labor laws

Finally, we’ll cover some of the miscellaneous labor laws concerning Oklahoma, such as:

- Whistleblower laws, and

- Recordkeeping laws.

Oklahoma whistleblower laws

Whistleblower laws protect employees from retaliation or any other adverse action taken against an employee who “blows the whistle,” i.e., reports any illegal or immoral activity to the authorities.

As previously stated, it’s considered a discriminatory practice if an employer — with respect to the Occupational Safety and Health Act (OSHA) — discharges or takes any adverse personnel action against an employee who:

- Reports any OSHA policy violation,

- Files a complaint about unsafe working conditions, or

- Testifies in any proceeding regarding a violation of OSHA policies.

Moreover, the Oklahoma Whistleblower Act encourages state employees who “blow the whistle” and report any suspected improper governmental activities to the authorities.

Therefore, no officer or employer shall prohibit or take any adverse personnel action against an employee of a governmental agency for:

- Disclosing public information, such as an employee believes is a violation of the Oklahoma Constitution or law,

- Reporting an abuse of authority in the workplace, waste of public funds, or mismanagement, and

- Discussing the operations of the agency with the Governor, members of the Legislature, the media, or any other person responsible for investigating.

Any aggrieved state employee may file an appeal with the Oklahoma Merit Protection Commission within 60 days of the alleged violation.

Oklahoma recordkeeping laws

Regarding the retention of employee employment records, federal provisions apply. Under the FLSA, each employer must preserve certain records of nonexempt workers for at least 3 years.

The following are records that every employer covered by the FLSA must maintain:

- Name, address, birthday (if younger than 19), and sex,

- Occupation,

- Hours worked each day and week,

- Exact time and day of the week when the employee’s workweek begins,

- Basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week),

- Hourly pay rate,

- Total overtime earnings,

- Additions or deductions from the employee’s wages,

- Total wages paid each pay period, and

- Date of payment and the pay period.

Frequently asked questions about Oklahoma labor laws

Let’s go ahead and address some questions that may still be on your mind regarding Oklahoma labor laws.

Stay tuned!

Is it illegal to work 8 hours without a break in Oklahoma?

Technically, no. Since there are no state laws that govern breaks for employees and federal regulations do not require employers to offer breaks, it is not illegal for any adult or minor over the age of 16. However, most employers do offer breaks as a way to motivate workers and improve productivity.

What is the 1 and 1/2 rule in Oklahoma?

The “1 and ½ rule” refers to one of the requirements that employees have to check in order to receive unemployment benefits after loss of a job. Essentially, the term refers to total wages an employee has received during their base period, which has to be at least one and a half times the wages in their highest-paid quarter.

Is 32 hours considered full-time in Oklahoma?

The number of hours required for an employee to be considered full-time varies from employer to employer. However, there are 2 reference points most employers rely on:

- FLSA recommendations, and

- IRS statistics.

Essentially, the FLSA states that 40 hours a week is the minimum for workers to be considered full-time employees, while the IRS considers 32 hours a week to be the minimum.

Looking for a simple and robust time clock for employees?

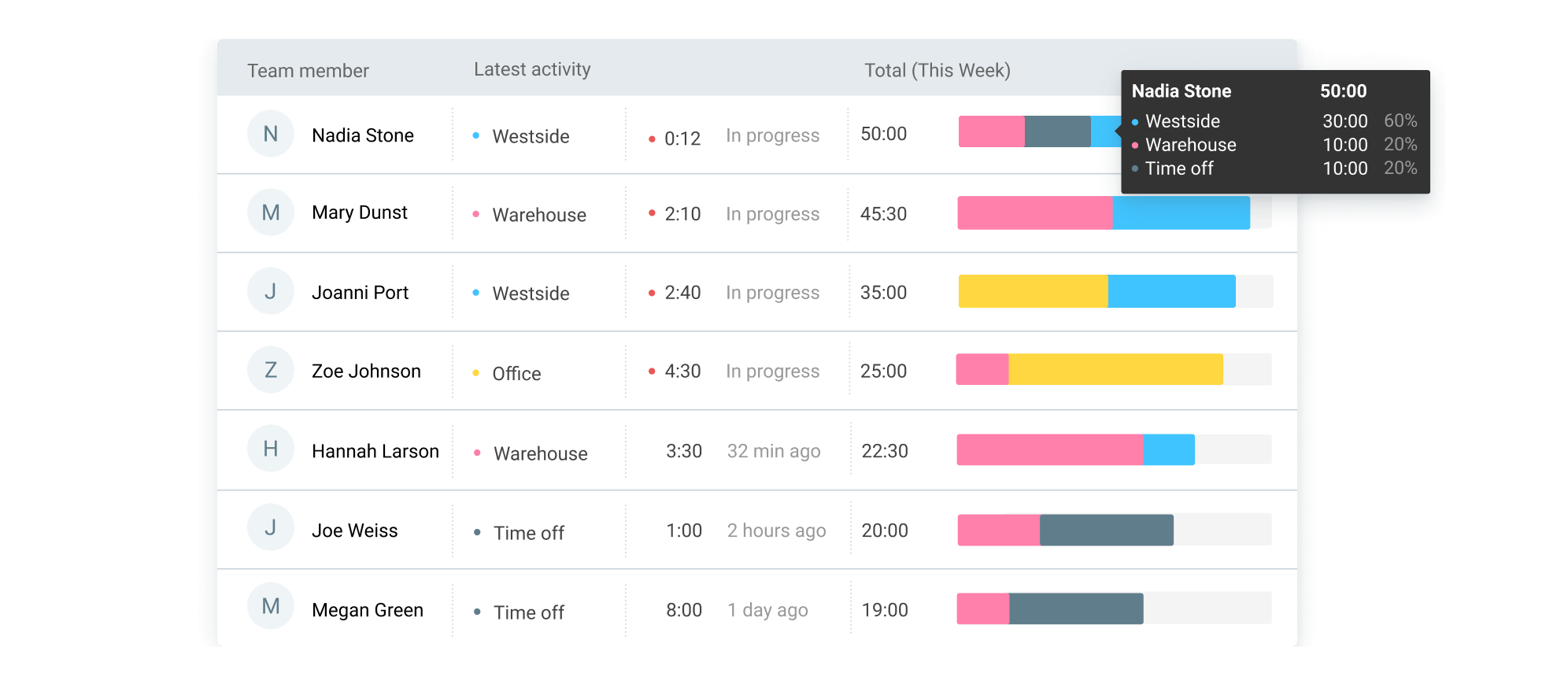

Try Clockify — a reliable and intuitive time tracker that allows you to track time, attendance, and costs with just a few clicks for FREE.

Your team can track work time via the web or mobile app, or you can set up a time clock kiosk that allows employees to clock in and out at the start and end of their work shifts.

Moreover, you can view the total number of accrued leave days for each employee and ensure compliance with all current labor laws in New Hampshire.

Additionally, Clockify lets you:

- Review timesheets,

- Approve time off,

- Schedule shifts,

- Run time card reports, and

- Export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Oklahoma labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in July 2025, so any changes in the labor laws that were included later than that may not be included in this Oklahoma labor laws guide.

We strongly advise you to consult with the relevant institutions and/or certified representatives before taking any action on legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.