Just started a new business?

As you’re probably aware, this comes with many responsibilities, like billing clients.

To take the pressure off, here’s what you can do to ensure the entire process of billing clients for the first time goes smoothly.

Discuss the terms with the client

Before taking on a job, make sure you and your potential client are on the same page — this applies to:

- Client expectations,

- Services the client will receive,

- Billing rates,

- Payment deadlines, and

- When the client can expect the invoices.

The more detail your client receives about the billing methods and the work process, the less likely a dispute will arise once your client receives the invoice.

CEO and Founder Daniel Meursing thinks a successful client meeting touches on the client’s goals, project timeline, and communication preferences:

“First, discuss the client’s goals and vision — what does success look like for this project? Next, tackle budget and resources to understand the financial parameters. Then, establish a timeline with clear milestones. Don’t forget to determine communication preferences — how and how often should you touch base?”

Daniel Meursing also illustrated the importance of this initial meeting by likening it to a concert performance:

“Remember, this first meeting sets the tone for your entire relationship, much like an opening act at a concert. By addressing these areas, you’ll be well-prepared to deliver a show-stopping performance that leaves your client eager for an encore.”

Have a solid contract in place

Before you begin your work for the client and send out the invoice, you should make sure you have all the terms in writing. An email can work, but a contract is even better.

While an invoice contains payment information and terms, this document itself isn’t legally binding.

A contract, on the other hand, provides legal protection to both parties involved. It allows you to establish payment terms while giving the client a formal promise that you will carry out all the agreed-upon tasks.

Employ a time tracking and billing system

Tracking work time has numerous benefits, many of them related to invoicing. One perk of time tracking for billing purposes is that it gives you the tools to ensure accurate and detailed invoices.

Although you can track time using pen and paper or spreadsheets and create invoices by yourself, you can also leverage top-notch technology.

For illustration, a reliable billing system:

- Ensures accurate client billing,

- Provides precise data for analysis, and

- Allows for quick invoicing.

If the software also comes with a time tracking functionality — even better.

Some apps let you track and calculate billable hours and choose what data you want to appear in the invoice.

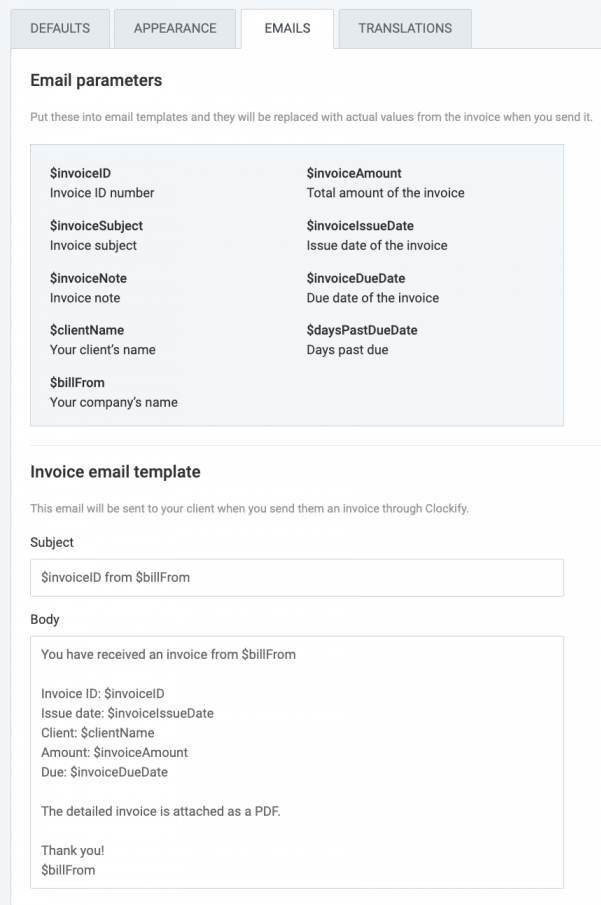

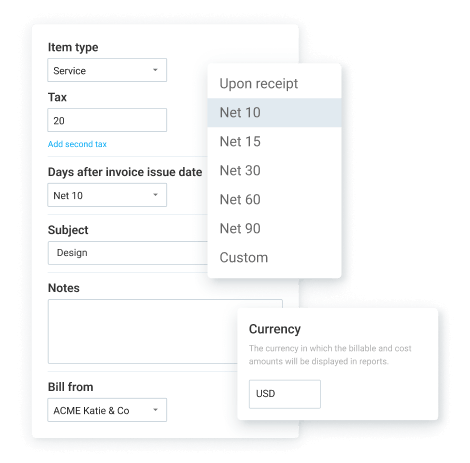

Once you’ve generated your invoice, it’s time to send it to your client. The most common way to issue an invoice is through email. Some invoicing systems allow you to create an email template, so you don’t have to type new email text for each invoice.

Billing software automates some steps in your invoicing process, making billing simpler, faster, and more accurate.

Craft a professional-looking invoice

We’ve briefly touched on generating an invoice using a time tracking and billing system, but how do you actually create an invoice from scratch?

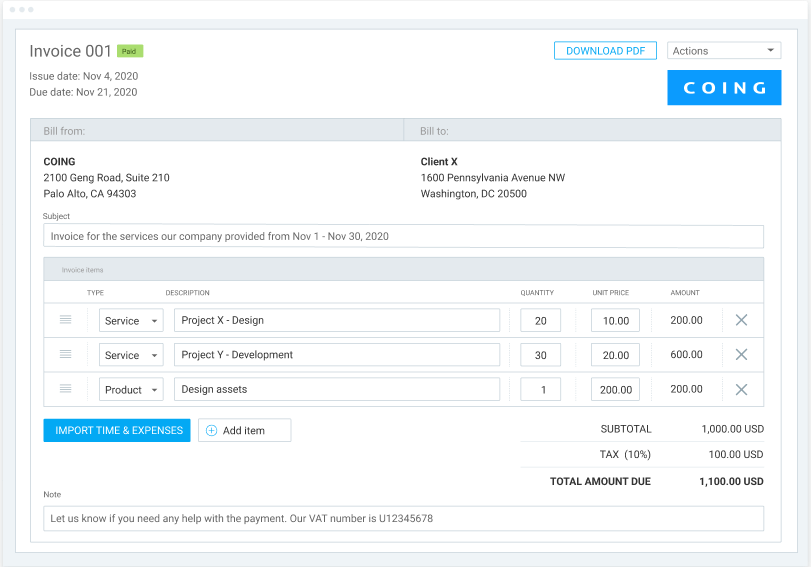

First off, you have to make sure you’ve included all the relevant items in it, such as:

- How much the client owes,

- Who the invoice is from,

- Who the invoice is for, and

- When the payment is due.

Bear in mind that these are only essential items to include in an invoice, and they vary depending on the industry or business.

For the sake of transparency, your invoice should show how the total amount due was calculated. So, include a description of each service provided, its cost, as well as any applicable tax or discounts.

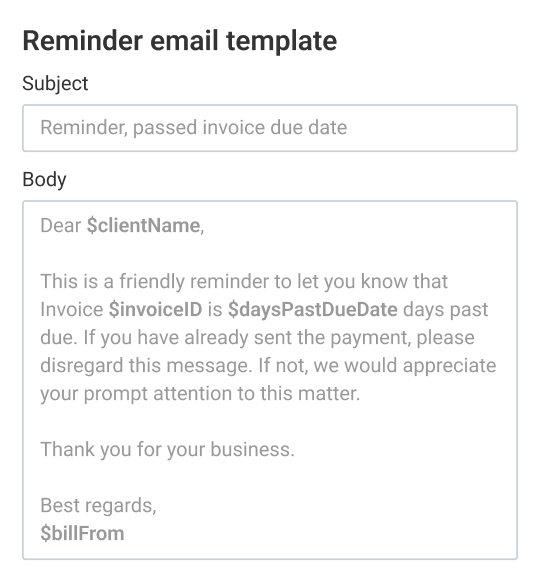

Sure, you can use some effective ways to motivate clients to pay on time, but you’re still likely to encounter past-due invoices. In that case, it’s best to send payment reminders.

You may be inclined to think that clients who don’t pay the invoice on time are trying to avoid paying for your services altogether. But before writing the reminder message, keep in mind other possible reasons the client didn’t pay you:

- Their inbox is overloaded with unread emails, so they didn’t see your invoice,

- They forgot to pay, or

- They had unexpected expenses and were thus unable to pay.

So, when crafting your reminder email, assume the missed payment wasn’t intentional. Even if it was, this way, you’ll stay on good terms with them and remain professional, which is more likely to encourage them to reimburse you for your services.

💡 CLOCKIFY PRO TIP

If you want to learn how to create professional-looking invoices through a few quick and easy steps, give this article a read:

Navigate the world of invoicing with Clockify by CAKE.com

As you saw, to properly bill a client for the first time, you’ll need to set expectations with the client and create an accurate and professional-looking invoice. Our powerful time tracking and billing software, Clockify by CAKE.com, can help with the latter.

The whole point of using Clockify when billing clients is to:

- Speed up invoicing, and

- Mitigate the risk of billing errors.

Incorporating our software from the start helps build trust with clients, as it enables you to always send accurate invoices on time.

Even if you’ve never invoiced clients before, Clockify gives you the tools to bill your clients like a pro.

For example, you can mark tracked time in Clockify as billable and import it into your invoice. This can be pretty useful if you’re charging an hourly rate.

Still, that’s not the only way to calculate the total price and add it to the invoice in Clockify. The app can also calculate the amount to be paid based on the quantity and unit price you input.

And that’s not all. You can look forward to more features that will make your first billing experience a big success.

Final note — you don’t have to be tech-savvy to invoice your clients with Clockify by CAKE.com. With a great deal of features, the platform was designed in a way that it’s easy to navigate.