Semi-monthly and bi-weekly are two popular payroll options, and whether you’re a business owner or an employee, knowing the difference between these two options is important for employee satisfaction and budgeting.

Although they sound similar, semi-monthly and bi-weekly payrolls have quite a few differences. So, in this article we’ll see exactly what sets these two payroll types apart.

We will also cover other important aspects of these two payroll systems, such as:

- The definitions of semi-monthly and bi-weekly payroll,

- The number of paydays for each of them in a month,

- Pros and cons of semi-monthly and bi-weekly payroll,

- The type of payroll that could be the right choice for you, and

- Frequently asked questions about semi-monthly and bi-weekly payroll.

- With the semi-monthly pay schedule, employees are paid twice per month on the same date, usually on the 15th and 30th.

- With the bi-weekly pay schedule, employees are paid on the same day every other week.

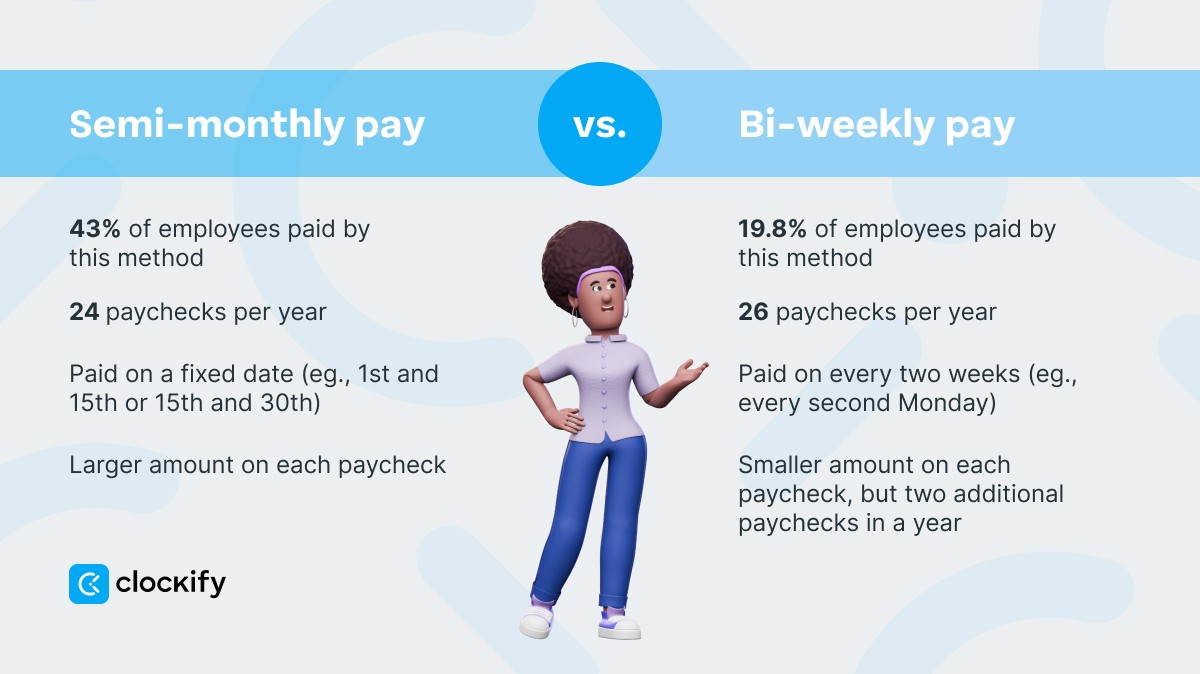

- Semi-monthly employees receive 24 paychecks a year, while bi-weekly employees get 26.

- Semi-monthly pay frequency is preferable for salaried employees, while bi-weekly is preferable for hourly employees.

Table of Contents

What is semi-monthly payroll?

Semi-monthly or bi-monthly payroll is a payment schedule through which employees receive payment twice a month.

These are usually fixed dates, such as the 1st and 15th day of the month or the 15th and 30th. When scheduled to receive their salary on a semi-monthly basis, employees receive 24 paychecks each year.

What is bi-weekly payroll?

Bi-weekly payroll is a payment schedule through which employees are paid every two weeks on a particular day of the week.

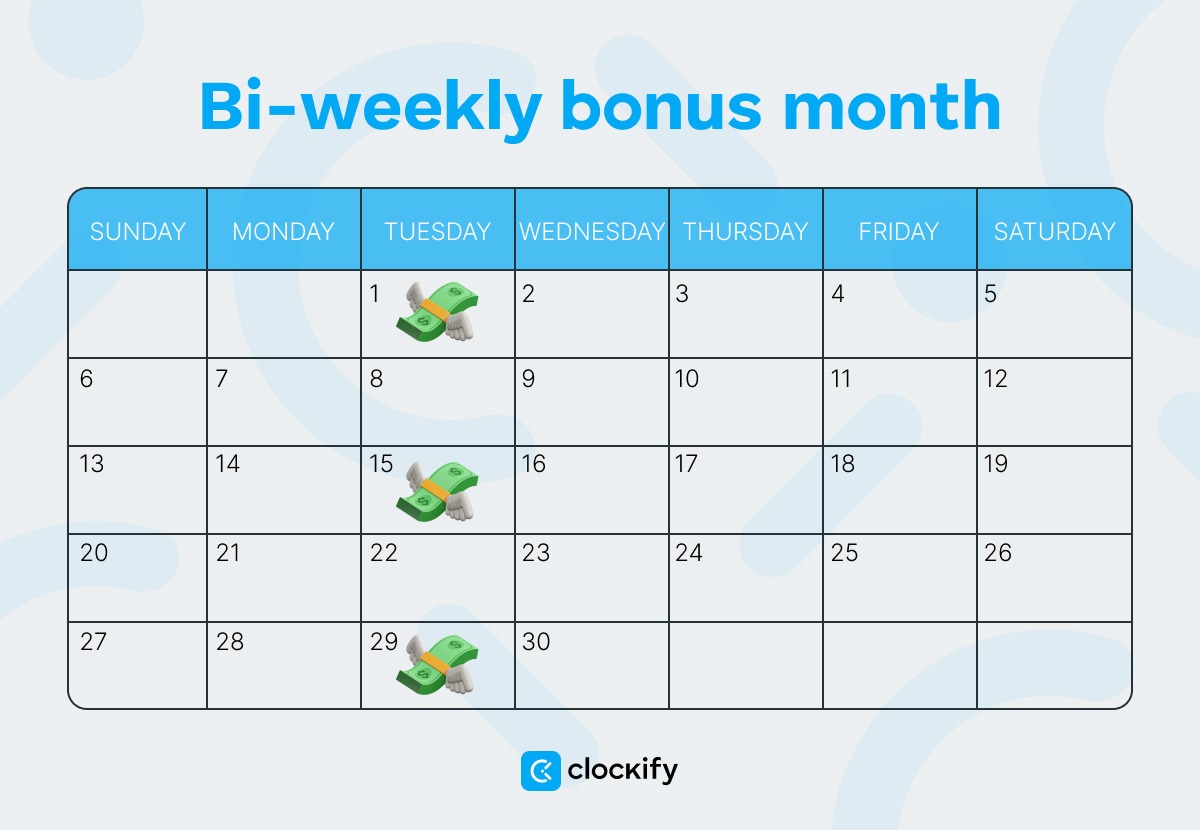

This can mean that employees are paid every second Thursday, for example. As there are 52 weeks (sometimes 53 weeks because of a leap year) in a year, employees on a bi-weekly pay schedule receive a total of 26 paychecks (sometimes 27 due to leap years and the company’s payroll cycle). However, due to a higher payroll frequency, paychecks are usually smaller compared to semi-monthly.

How many paydays in a month?

The number of paydays in a month usually depends on a specific payroll schedule the employer chooses: bi-weekly or semi-monthly.

Semi-monthly payroll includes 24 payments a year, meaning there are 2 paydays every month. Meanwhile, because there are 52 weeks (sometimes 53 weeks) in a year, employees who get paid bi-weekly receive 26 paychecks. This is because there are 2 months where they receive 3 instead of 2 paychecks and 10 months where they receive 2 paychecks.

To help you better understand the difference between bi-weekly and semi-monthly payroll frequency, we have made a table with all pay periods and pay dates for 2024.

Here is a preview of the semi-monthly pay schedule for the first six months of 2024. starting from January 1st with paydays being on the 15th and 30th.

| Pay Period | Pay Date 1 | Pay Date 2 |

|---|---|---|

| January | January 15th, 2024 | January 30th, 2024 |

| February | February 15th, 2024 | February 29th, 2024 |

| March | March 15th, 2024 | March 29th, 2024 |

| April | April 15th, 2024 | April 30th, 2024 |

| May | May 15th, 2024 | May 30th, 2024 |

| June | June 14th, 2024 | June 28th, 2024 |

Here is a preview of the bi-weekly pay schedule for the first six months of 2024. The pay period starts on Monday and ends on Sunday, and the payday is Friday.

| Pay Month | Pay Period Start | Pay Period End | Pay Date |

|---|---|---|---|

| January | 12/18/2023 | 12/31/2023 | January 5th, 2024 |

| January | 1/1/2024 | 1/14/2024 | January 19th, 2024 |

| February | 1/15/2024 | 1/28/2024 | February 2nd, 2024 |

| February | 1/29/2024 | 2/11/2024 | February 16th, 2024 |

| March | 2/12/2024 | 2/25/2024 | March 1st, 2024 |

| March | 2/26/2024 | 3/10/2024 | March 15th, 2024 |

| March | 3/11/2024 | 3/24/2024 | March 29th, 2024 |

| April | 3/25/2024 | 4/7/2024 | April 12th, 2024 |

| April | 4/8/2024 | 4/21/2024 | April 26th, 2024 |

| May | 4/22/2024 | 5/5/2024 | May 10th, 2024 |

| May | 5/6/2024 | 5/19/2024 | May 24th, 2024 |

| June | 5/20/2024 | 6/2/2024 | June 7th, 2024 |

| June | 6/3/2024 | 6/16/2024 | June 21st, 2024 |

*These dates are just estimates. They may differ depending on the individual company’s policy.

Semi-monthly vs. bi-weekly payroll: key differences

When comparing bi-weekly vs. bi-monthly payrolls, you should take into account a few key differences. Let’s take a look at some of them in detail.

Difference #1: Different pay dates

Companies that choose to run payroll semi-monthly pay their workers on a fixed date every month (1st and 15th or 15th and 30th).

On the other hand, companies that process payroll bi-weekly pay their employees every 2 weeks on a particular day of the week. In contrast with the semi-monthly pay date, the bi-weekly payday can fall on a different date each month.

Difference #2: Total number of paychecks

The total number of paychecks employees on semi-monthly payroll schedules receive per year is 24. With the bi-weekly payroll, they collect 2 paychecks more — 26 per year.

Difference #3: Paycheck amount

It is important to note that the paycheck amount is not the same for bi-weekly and semi-monthly schedules. The paycheck amount is slightly smaller for the bi-weekly pay as it is more frequent.

For example, let’s imagine that your gross annual income is $70,000. If you decide to get paid semi-monthly, that income will be divided into 24 paychecks, which equals a gross pay of $2,916 for each payment.

However, if you choose the bi-weekly option, your annual income splits into 26 paychecks. This means that if you earn a gross income of $70,000 annually, you will get a gross pay of $2,692 with each paycheck.

Difference #4: Payment processing

Semi-monthly pay is processed twice per month on the same date. This means that payday can fall on a different day each month. For example, in one month, the 15th and the 30th can be Wednesday and Thursday, and in the next month, they can be Saturday and Sunday. Due to this, sometimes payments must be rescheduled for an earlier or a later day as banks don’t process transactions on the weekends.

There aren’t such issues with the bi-weekly payroll, as salaries are processed on the same day every second week. This makes it easier for the finance department to prepare and process payments on time. However, with the two added payments, they will also have two additional payrolls to process.

Difference #5: Popularity

According to the US Bureau of Labor Statistics, the bi-weekly pay frequency is the most popular pay method in the US between the weekly, bi-weekly, semi-monthly, and monthly payments. It tops the list, with 43% of US private establishments paying their employees every 2 weeks.

On the other hand, the semi-monthly payroll frequency comes in third place after the weekly payroll, with 19.8% of US private establishments paying their employees twice a month.

💡Clockify Pro Tip

Gone are the days when payroll tracking was done with a pen and paper. Technology brings us many new ways to automate this process and save time. Here is our list of the best payroll software for small businesses in 2023. Make sure to check it out.

Pros and cons of semi-monthly payroll

Now that we’ve gone through the main differences between a semi-monthly and a bi-weekly payroll, let’s take a look at each schedule’s pros and cons.

| Pros of semi-monthly payroll | Cons of semi-monthly payroll |

|---|---|

| Predictability — semi-monthly payroll ensures that employees receive two paychecks every month. One is in the middle of the month and the other at the beginning/end. Larger paychecks — employees on a semi-monthly pay receive larger paychecks than with the bi-weekly pay. Calculating benefits — benefits and deductions (e.g., healthcare) are calculated every month. With a semi-monthly payroll, it is easier to calculate them as the paid amount is the same every month and is calculated at the end of each month. | Inconsistent paydays — with semi-monthly payroll, paydays can fall on different days. For example, one time, employees can get paid on Monday, and the next time, they can get paid on Friday. Challenging for new hires — depending on the day they start working, new hires will have to wait several weeks until they receive their first paycheck. For example, if the company pays on the 16th and the 30th of every month, and the employee starts on the 1st, they wouldn’t be paid until the end of the month. Not the best option for hourly employees — hourly employees have to log their hours every week. Once per month, there will be a cut-off time, and employees won’t be able to log their hours after it. If an employee works overtime after the cut-off, the overtime hours will not be calculated until the next payroll. |

Pros and cons of bi-weekly payroll

Let’s take a look at the pros and cons of bi-weekly payroll:

| Pros of bi-weekly payroll | Cons of bi-weekly payroll |

|---|---|

| Consistent paydays — bi-weekly payroll ensures that employees are paid every second week on the same day of the week. Two additional paychecks — with the bi-weekly payroll, employees receive two additional paychecks per year. Better for hourly employees — hourly workers are paid by the hour, and their work hours are calculated at the end of each week, making it easier to track them bi-weekly. | Budgeting — having three paychecks in a month might be great for employees, but employers must budget cautiously to avoid running out of funds when this occurs. Smaller paychecks — although there are two additional paychecks per year, they are smaller than the semi-monthly ones. |

What type of payroll should you choose?

Choosing between a semi-monthly and a bi-weekly payroll is mainly a question of preference and what fits you better. However, some factors can make one option more suitable than the other.

To provide you with an expert opinion on this topic, we have contacted Ruchi Pinniger, the Founder and CEO of Watch Her Prosper®. Ruchi claims that semi-monthly payrolls are better for salaried employees:

“Semi-monthly payroll is ideal for employees that have a set salary (salaried employees). The main benefit for the employer is that they can set this to run automatically (“set and forget”!) and they may save money on processing fees since there are only 24 pay periods per year.”

Pinniger also pinpointed the consistency that comes with the semi-monthly payroll which many employees appreciate:

“The main benefit for employees is that they always receive their paycheck on the same days every month to make budgeting easier (e.g., the 15th and last day of the month). In addition, their year-end W-2 will match their annual salary, assuming it has stayed consistent for the full calendar year.”

The bi-weekly option, on the other hand, may work better for hourly employees, but can be more expensive, according to Ruchi:

“Bi-weekly payroll works best for hourly employees since employers have to manually submit hours for each 2 week period rather than for a 15-16 day period if using a semi-monthly cycle. The disadvantage is that this could cost more in payroll processing fees since there are 2 additional payroll periods for the year than if choosing semi-monthly payroll.”

Ruchi also states the main benefit of bi-weekly pay — more paychecks per year:

“The main benefit for employees is that they will be paid the same day every 2 weeks and will receive 26 paychecks a year.”

💡Clockify Pro Tip

Doing payroll can be tricky and demanding for a small business owner. It requires you to be familiar with many laws and regulations and think of your employees’ well-being too. If this is a constant problem for you, check out our article on this topic.

Frequently asked questions about semi-monthly vs. bi-weekly payroll

To make this as comprehensive as possible, we have provided answers to the most common questions about bi-weekly and bi-monthly pay schedules.

Is it better to get paid semi-monthly or bi-weekly?

The answer to this question is — it depends.

The best payroll schedule depends on your personal preferences, whether you are a salaried or an hourly employee, your industry, your company’s policy, and more. The rule of thumb is to pick semi-monthly if you are a salaried employee and bi-weekly if you are an hourly employee.

Why do companies pay on the 15th and 30th?

Paying on the 15th and 30th is convenient for both companies and employees. For employees, it makes it easier for them to organize their finances and pay bills on time. On the other hand, companies have a set date in the middle and end of the month for when they process payroll.

Do you lose money getting paid bi-weekly?

No, you will not lose money if you are paid bi-weekly. Although bi-weekly payments are smaller than the semi-monthly ones, you get two additional paychecks in a year with the bi-weekly option. With these 2 added paychecks, bi-weekly and semi-monthly employees earn the same amount of money, which is only spread differently.

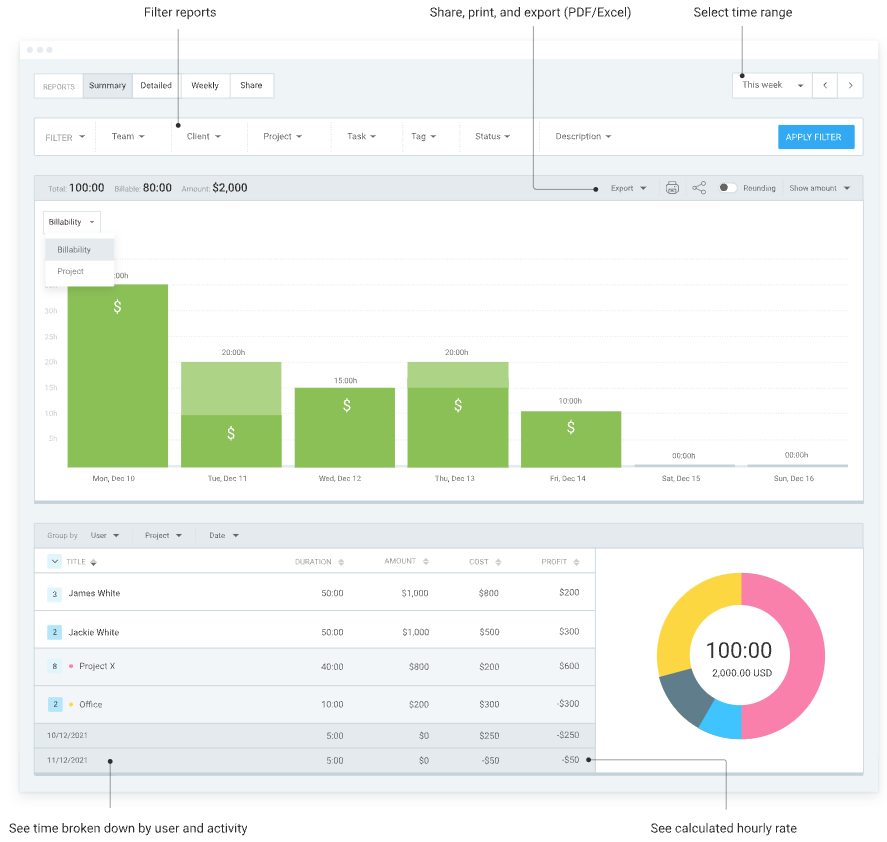

Track payroll hours in Clockify

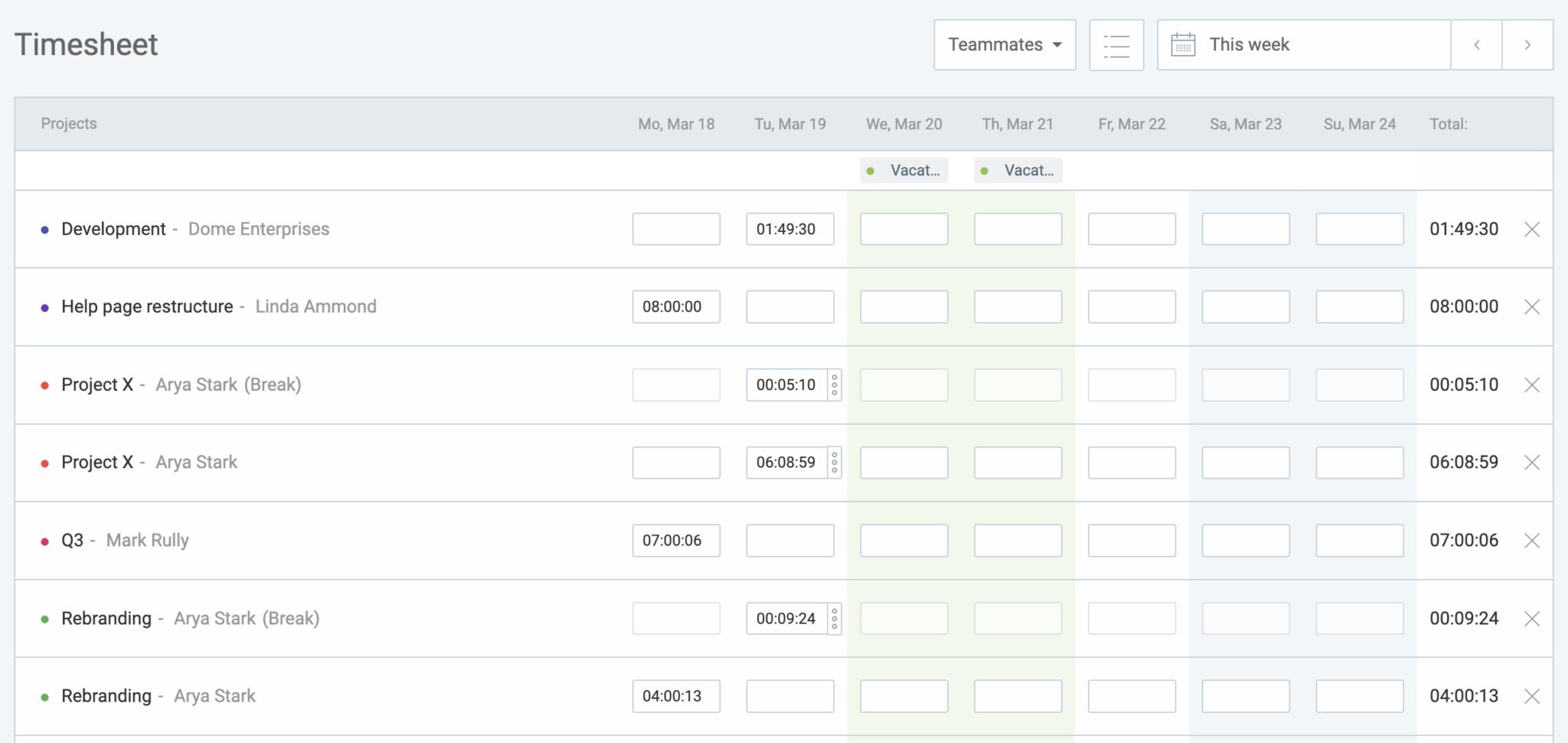

Whether you choose bi-weekly or semi-monthly, tracking work hours will be vital for both employees and employers.

As a time tracking software, Clockify gives you all the necessary tools to track time. In Clockify, it is easy to track time by using:

- Timer mode — by using a timer to track work time.

- Manual mode — by manually entering time.

- Timesheet view — by logging time in a timesheet.

In addition, Clockify has many other features, such as a free payroll tracker.

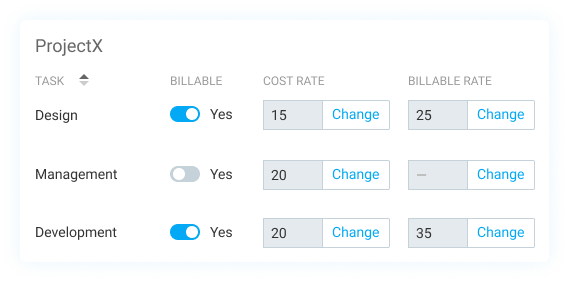

To be able to do payroll with Clockify, you first need to create and assign projects (you can assign as many people as you want for free). Then, you can set hourly rates and calculate how much you will get paid, or how much you should pay your employees.

Once payroll time comes, you can easily export all necessary data in CSV, PDF, Excel, or API formats. You can view the time spent on each project, overtime hours, breaks, start/end time, and time off.

When payroll comes, Clockify helps you save both time and money.