Accepting a job offer means a mutual understanding between an employer and an employee. Dictated by a written and often verbal agreement, the employee agrees to perform their job at the highest level while the employer compensates them with a salary, adequate working conditions, and benefits. One such benefit is paid (personal) time off — PTO.

Even though it’s not mandatory by federal law, many US states and employers offer their respective employees PTO, which keeps everyone satisfied, motivated, and willing to contribute at all times.

However, employers must understand all the nuances behind PTO accrual and how it works to ensure the best possible outcome for both parties.

To make matters easier and more comprehensible, we’ve prepared an in-depth guide to help both employees and employers get to the bottom of PTO.

In this guide, you’ll learn more about:

- PTO and PTO accrual,

- Benefits of accrual time off,

- Setting PTO accrual policies, and

- Calculating PTO.

- The 2 most popular leave policies when it comes to time off are PTO accrual and lump sum.

- PTO accrual allows employees to earn vacation, sick, and personal days rather than receiving a fixed amount at the start of each calendar year.

- When designing a PTO leave, an employer will have to consider accrual rates, period, and cap.

- If PTO isn’t used in its entirety during a calendar year, employers can choose to either ‘rollover’ the remaining paid days or pay them out through their employees’ hourly wages.

What is PTO accrual?

PTO accrual represents an accumulation of personal time off over a period of time.

Paid time off is generally presented through employer-set policies that allow employees to earn paid time off by working a certain amount of time. However, what PTO is and how it works isn’t clearly defined by US law.

In most cases, PTO policies combine 3 types of leave:

- Vacation days,

- Sick days, and

- Personal days.

We contacted Levon L. Galstyan, Certified Public Accountant at Oak View Law Group, for help with defining PTO accrual, and he stressed that it varies from firm to firm:

“PTO accrual is a method used by employers to track and manage the amount of paid time off that an employee has earned and taken over a specified period. PTO accrual policies vary between companies, but the basic principle is that employees earn a certain amount of PTO for each hour, day, or pay period worked.”

Although US law doesn’t require employers to have PTO policies in place, some states have their own personal time off regulations. None of the state laws mandates that employers enforce PTO accrual, as the type of time off policy is completely up to them.

Additionally, the federal Family and Medical Leave Act (FMLA) clearly states that no employer is obligated to offer paid time off for qualifying reasons, such as family emergencies, recovering from an illness, or caring for an ill loved one.

However, it’s important to note that employers are free to offer paid FMLA and institute paid FMLA policies if they choose to do so. In such cases, the employer regulates the conditions and accrual method as they see fit.

PTO accrual vs. lump sum PTO

In general, employers often choose between one of the 2 popular leave policies:

- PTO accrual, and

- Lump sum (allotment) PTO.

Lump sum PTO is a paid time off policy in which workers receive a set amount of paid time off during a year. This policy can either expire or roll over to the next year. Moreover, some companies pay workers for unused allotted time off during the year.

CPA Armine Alajian explains that the difference between these two terms is in the way they are calculated:

“The main difference between PTO accrual and lump sum PTO is how your employer calculates the amount of paid time off you receive. With PTO accrual, your PTO is based on the number of hours you work, while with lump sum PTO, everyone gets the same fixed amount of PTO, regardless of how many hours they work.”

Levon L. Galstyan’s insights helped us create the following table with the main differences between accrual and allotment PTO policies:

| Differences | PTO accrual | Lump sum PTO allotment |

|---|---|---|

| Payment timing | Employees earn PTO over time. | Employees receive all of their PTO at once. |

| Cash value | A cash value equal to the employee’s hourly rate or salary multiplied by the number of hours accrued. | A cash value equal to the employee’s hourly rate or salary multiplied by the number of hours of unused PTO. |

| Employer liability | Employers must track employees’ accrued PTO and ensure that they are providing employees with the time off they are entitled to, which can create logistical challenges. | Employers must have the financial resources to cover employees’ PTO usage in a lump sum when an employee requests it, which can create financial challenges. |

Note: The data in this table isn’t official. The FLSA doesn’t contain any obligations to employees regarding PTO and the type of PTO policy they create for their employees.

Benefits of PTO accrual

Employers prefer PTO accrual leave policies for various reasons. These policies benefit both parties in several ways, some of which we’ll discuss below.

Stay tuned!

Benefit #1: PTO accrual encourages employee retention

PTO accrual allows you to organize a paid leave policy at your company however you want. If you want to encourage employee retention, you should create a policy that:

- Is based on the years of service, or

- Allows for a transfer of unused time off throughout the years.

You should consider adding higher PTO accrued rates for long-time team members. That way, your workers will be more motivated to stay within the company and collect more days off as time passes.

🎓 The Most Comprehensive Workers’ Compensation Guide

Benefit #2: PTO accrual prevents new employees from taking too much time off

With the way how PTO accrual works, your employees won’t be able to receive their PTO all at once. Therefore, they won’t have too many days off at their disposal when they first start working for your company.

This policy prevents new employees from taking too much time off in the beginning, as their PTO will accumulate as they continue working.

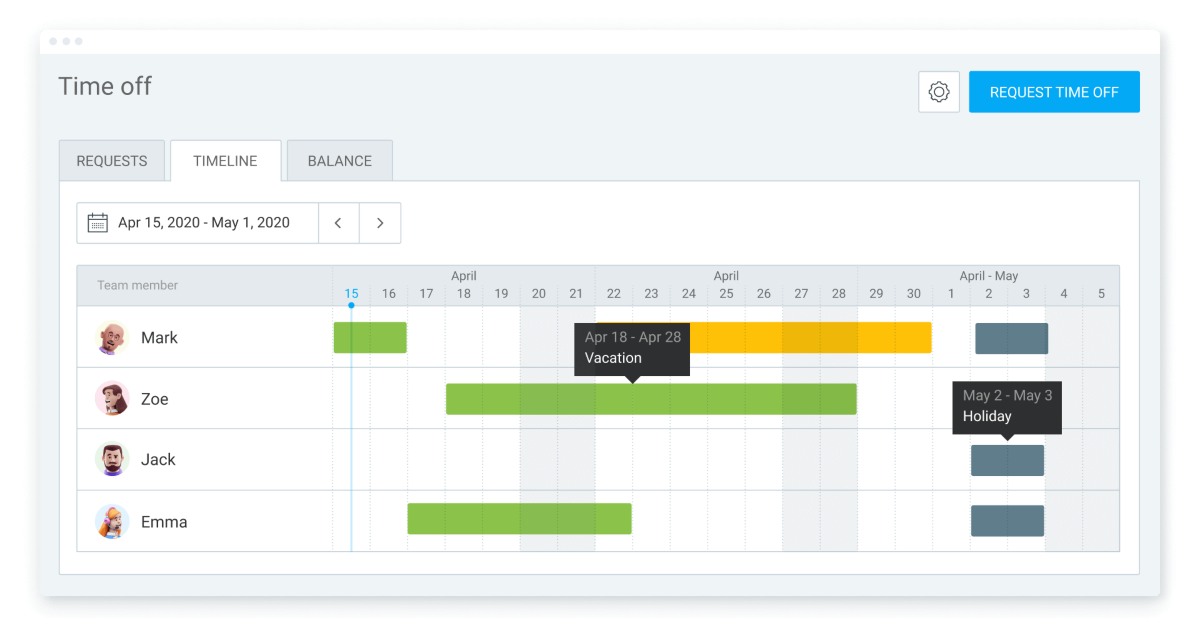

Track PTO accrual with Clockify

Benefit #3: PTO accrual provides a reward for loyal workers

Your employees accrue PTO over time. Therefore, the logical assumption is that your most loyal workers should have the most paid time off days during a calendar year.

If you choose to have a policy that allows for a higher accrual rate after certain milestones for years of service, employees who’ve been working at your company the longest reap the most benefits.

🎓 How to Do Unlimited PTO Right – Pros & Cons

How to set your PTO accrual policy

Before you sit down with accounting and other departments involved in designing your PTO accrual policy, here are a couple of things you should be aware of before you start. Check them out below.

Step #1: Check your state and local laws

Unfortunately, US federal law on personal leave doesn’t require employers to pay out any time not worked.

In most cases, employers have the freedom to create a PTO policy that works for them and their employees. Still, some local laws provide minimum eligibility requirements or give employers the option to limit the time off workers can accrue.

So, your first step in creating an accrual policy for your company is to check your state and local laws.

Step #2: Consider the potential accrual cap

Many employers use accrual PTO policies to reward loyal workers. Therefore, they usually set higher accrual rates for employees who have been working at their company for an extended period.

This kind of reward is great for employee retention. However, you should take your resources into account. If your policy is too generous, you may end up losing a lot of money on paying for the leaves. So, it’s wise to set a maximum number of days off an employee can accumulate.

In most European countries, the standard for paid vacation days is around 20 days. However, in the US, employees usually have 10 to 15 vacation days available. The actual number depends on the years of service and whether the employee works in the private or public sector.

🎓 The Average PTO in the US and Other PTO Statistics for 2025

Step #3: Choose the accrual period and the accrual rate

Your accrual policy should include the accrual period and the accrual rate.

The accrual period is how often your employees can accumulate their days off. The most common accrual periods are:

- Hourly,

- Weekly,

- Biweekly,

- Monthly,

- Yearly, and

- Per pay period.

Expert Levon L. Galstyan defines accrual rate as:

“The rate at which an employee earns or accrues paid time off over time. The accrual rate is typically based on a certain number of hours worked, and can vary depending on the employer’s policy.”

He also provided us with an example:

“An employer may have an accrual rate of 0.057 hours of vacation time earned per hour worked. This means that for every hour an employee works, they would earn 0.057 hours of vacation time. If the employee works 40 hours per week, they would earn 2.28 hours of vacation time per week (0.057 x 40), or 119 hours of vacation time over the course of a year (0.057 x 2,080, assuming a 52-week year).”

Our expert, Levon L. Galstyan, claims that It’s up to you, as an employer, to decide the accrual rates based on employees’ commitment and service:

“Accrual rates can vary based on the employee’s length of service or job title. For example, an employer may offer a higher accrual rate to employees who have been with the company for a certain number of years, or to employees in higher-level positions.”

Step #4: Regulate the PTO rollover or payout policies

You should consider 2 important aspects in your accrual policy:

- PTO rollover, and

- PTO payout.

PTO rollover

Founder of an accounting firm, Wendy Ha, defined the PTO rollover as “the unused time that the employee can take in the next period.”

Moreover, accountant Francis Fabrizi explained the ins and outs of rollover:

“PTO rollover can be subject to certain limitations such as a maximum number of hours that can be carried over, or a ‘use it or lose it’ policy where any unused PTO is forfeited at the end of the year. PTO rollover policies can vary widely between employers, so it’s essential to understand the specific policy in place at the company.”

While rollover is an amazing benefit to offer employees, Levon L. Galstyan warns about its potential liabilities:

“If too much PTO is carried over from year to year, it can create a large liability on the company’s balance sheet, as the company will eventually need to pay out the accrued PTO. Employers need to balance the benefits of a PTO rollover policy with the potential liabilities and ensure that their policies are sustainable over the long term.”

PTO payout

Wendy Ha explains PTO payout:

“PTO payout is the unused time that the company is required to pay out. Most companies choose to ‘rollover’ the unused paid time off to the next period and only pay out upon termination/resignation.”

Depending on their state or local laws, employers may be required to pay out unused PTO when an employee leaves the company, so keep that in mind as well.

An essential benefit to PTO payout is that it provides an additional source of income when leaving a job. But it also comes with downsides, as Levon L. Galstyan highlights:

“PTO payout policies can create potential liabilities for employers, as they will need to pay out any accrued PTO when an employee leaves the company. Employers need to ensure that their policies are sustainable over the long term and that they have a clear and consistent policy for PTO payout to avoid confusion or legal issues.”

How to calculate PTO accrual

Even if calculations aren’t your strong suit, managing time off and understanding how PTO is accrued represents a major part of the equation. If you’ve got that covered, calculating PTO time accrued will be easy with the following steps.

Step #1: Take the PTO accrual rate and period you decided on

As we mentioned, the accrual rate is an essential component of your policy. Let’s say that your employee accrual rate is 0.5 days of PTO for every month of service.

Many employers prefer keeping records of employees’ PTO in the number of hours. To do that, you’ll need to convert PTO days per month to the number of PTO hours.

In our example, we’ll assume that an employee works 8 hours a day. You need to multiply the total number of hours an employee works in a day by the accrual rate per day. So, the calculation is:

The total number of working hours per day x accrual rate per day = accrual rate per hour

Since this employee earns 0.5 days of PTO every month, that’s:

8 x 0.5 = 4

Thus, your workers’ PTO rate per month is 4 hours.

🎓 How to track your team’s time off

Step #2: Choose a timespan and calculate earned PTO

Your next step is to choose a time span for calculating the accrued time off. Suppose the interval for which you want to calculate PTO is 1 year or 12 months.

The calculation for earned PTO is:

Accrual rate x timespan = time earned

In our example, the rate is 0.5 days per month, and our timespan is 12 months. So, the calculation will be:

0.5 x 12 = 6 days off

Let’s see how the calculation will look like if we take the number of PTO hours instead. In this case, the accrual rate is 4 hours per month. So:

4 x 12 = 48 hours off

Step #3: Add the PTO earned to the employee’s balance

In case your company has a rollover policy in place, any unused PTO presents an employee’s initial balance. To complete the process, you should add the newly earned PTO to the worker’s previous balance.

If you set the maximum amount of PTO time your employees can earn (accrual cap), you should keep this number in mind when calculating PTO. Once a worker reaches the cap, they can’t accrue any more time off.

Some employers allow unlimited accrual, but they cap the amount of time off you can use in a year. In such cases, an agreement is made to decide whether the additional accrued time will be rolled over or if a payout will ensue as accrued hours on their paycheck.

Let’s say that an employee had a PTO balance of 3 days of unused time off before and has earned 6 days of PTO in the past 12 months; their new balance would be:

3 days + 6 days = 9 days of PTO

The calculation is similar for PTO in hours. Your employee has 24 hours of unused time off and has earned 48 hours in the past year. Their new balance is:

24 + 48 = 72 hours of PTO

If the final PTO amount is a decimal number, you can round your employee’s hours to the nearest whole number.

🎓 Here’s How to Deal With a Surge of PTO Requests Easily

PTO accrual FAQ

Do you still have some questions about PTO accrual? We’ve got you!

Here’s what most employers wonder about when it comes to PTO accrual policies.

1. What is the average PTO accrual rate?

On average, employees in the private sector have 10 PTO days after one year of service. From this stat, we can calculate the standard PTO accrual rate for new workers:

10 (PTO days) / 12 (months in a year) = 0.8 days off per month.

In addition, the average PTO for those who’ve been working in the private sector for more than 5 years is 15 days. So, the average accrual rate for long-term employees is 1.25 days per month.

You can use these stats to come up with a fair accrual rate for your business.

2. How many days is 40 hours of PTO?

If an employee works 8 hours a day, 40 hours of PTO is equal to 5 working days.

You’ll calculate the number of days off an employee can take by dividing the number of hours of PTO they have by the number of hours they work in a week. In this case, the calculation is:

40 (PTO hours) / 8 (working hours a day) = 5 (days off)

3. How do you calculate PTO by hours worked?

You can calculate the amount of PTO a worker accumulates over time by multiplying the number of hours worked by the accrual rate per hour.

Let’s assume your employees can accrue one hour of PTO for every 40 hours they work. You want to calculate the amount of PTO for an employee who worked 80 hours.

First, determine the accrual rate for your company. The accrual rate is the number of PTO hours an employee can receive divided by the number of hours of work they have to input. So, it should look like this:

1 (hour of PTO) / 40 (hours) = 0.025 (accrual rate)

Then, you should multiply the accrual rate by the number of hours worked:

0.025 x 80 = 2

Your worker has earned 2 hours of PTO during 80 hours of work.

4. How do you calculate PTO by days worked?

In case your workers accrue their PTO by days worked, you’ll have to multiply the accrual rate by the period they worked to get their final PTO amount.

If the accrual rate is 0.8 days per month, the calculation for an employee who worked 6 months will be:

0.8 x 6 = 4.8 days off

You can round this amount to the nearest whole number: 5 — giving your employee 5 days off.

5. Is PTO accrual negotiable?

Most companies have non-negotiable clauses regarding PTO accrual. Keeping track of everyone’s accrual rates and PTO is rather troublesome, even for smaller businesses.

However, paid time off caps can be negotiable, depending on the employer’s decision, especially if they use the lump sum leave policy.

Use Clockify to track PTO accrual

Tracking accrued PTO for all of your employees can be challenging. Thus, you should consider using software to track workers’ PTO.

Clockify is a reliable time tracker that offers many extra features aside from simple time tracking.

After you clock in and start working, Clockify will help you:

- Track billable hours,

- Create invoices using advanced reports from expenses,

- Calculate earnings and set hourly rates, and

- Track project progress and budget status.

With a PTO and vacation tracker, you can set a time off policy for your company and track employees’ accruals and leaves. In addition, your workers can request personal time off and log attendance via Clockify. That way, you ensure everyone rests properly when they aren’t working and comes back to work relaxed and productive.

Conclusion/Disclaimer

By offering accrual PTO, employers can attract quality workers, improve employee retention, and prevent new employees from taking too many days off at the beginning of their job arrangement.

However, a successful PTO accrual policy requires careful planning and clear communication with employees. Aside from your company’s needs, you should also take into account legal requirements in your city and state. So, once you make sure you’ve double-checked the legalities, you can start creating an accrual PTO policy for your company!

We strongly advise you to consult the appropriate institutions and/or certified representatives before acting on any legal matters. Clockify isn’t responsible for any losses or risks incurred should this guide be used without legal guidance.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Updated: April 15, 2025

Updated: April 15, 2025