To err is human.

This may be humanity’s all-time favorite comfort adage about mistakes.

Yet, the words don’t soothe the mind every time — especially when a single error can put your entire business at stake.

If you own a company, you probably already have a hunch about the type of mistakes I’m referring to.

Spoiler alert: It’s the most dreaded kind — invoicing mistakes.

Read on and see for yourself where billing errors can take you, and why you should think twice before you process that invoice manually.

Spotting a faulty invoice may shake you to the core

You don’t need to be a perfectionist or easily scared to emit an internal scream once you spot a grave mistake in your invoice.

All you need are several employees whose paychecks depend on your business’s cash flow — and a few reputable clients you’ve worked for almost a decade to land.

You get bonus scare points if the client to whom you’ve just dispatched the faulty invoice is known for their lack of patience.

As a once-upon-a-time small business owner who may have had an incident or two with billing errors, I used to check all of those boxes.

And let me tell you, the shivers you get down your spine once you receive an angry email from your client are unmatched.

But don’t take my word for it.

If your business provides any kind of service to external parties, you’re already well-versed in the importance of staying in your clients’ good books — especially in uncertain times. After all, that strong client relationship is what keeps your business running.

But what breaks that tie better than the impression that you’re reckless about your data?

Or even worse, that you’re intentionally overcharging.

Correcting invoice errors will probably take hours

If you end up with a faulty invoice, it’s likely there was something rotten in the system to begin with.

You may have put your business’ fate into the hands of invoicing templates, relied on the good old paper timesheets, or both.

Back in the day, me and my team used to:

- Measure our hours with a stopwatch,

- Type in all the data in a spreadsheet, and

- Export it into the invoice template as the month ends.

Considering the internal screams mentioned in several lines above, we all know how that ended.

If you process your invoices manually, too — brace yourself.

As soon as you spot a billing error, you’ll need to figure out exactly where things went downhill. This may take a while.

Next, you’ll need to review an entire month’s worth of data to ensure that the numbers are correct this time. Only then you’ll be able to move on to actually creating a new invoice.

You may also decide to stick to the old invoice-generating methods that led you to the faulty invoice in the first place.

If you take that road, count in several additional minutes — just in case the numbers don’t add up (again).

💡 Clockify Pro Tip

If you’re looking for a way to avoid ever having to deal with faulty calculations, here’s a useful read on calculating your team’s billable hours the right way:

Straightening things out could cost you clients

This may seem counterintuitive, but bear with me.

After you dispatch an incorrect invoice, you’ll probably spend quite some time making things straight.

It takes a while to:

- Find out what went wrong,

- Create a new invoice from scratch, and

- Write the perfect it-was-an-honest-mistake-please-don’t-let-us-go email.

And what happens in the meantime?

You put everything else on hold.

When I made the same mistake, my team and I spent roughly four hours phrasing the email we’d dispatch to the client.

It was line after line of text, only for the entire paragraphs to be deleted because we thought the tone didn’t exactly match our remorse.

At one point, we even Googled How to apologize to a client after sending a faulty invoice.

In the meantime, nobody worked on anything else.

So, we put several projects on hold to patch up my initial mistake. Naturally, postponing things delayed the other clients’ payments, too.

Hadn’t my clients been understanding, my delay could have cost me more than money.

They could have ended our contracts, and my business would quickly have been back to square one — with 0 clients and no idea what to do next.

So, when you start filling up water buckets to put out the fire, don’t be caught off guard if that same water floods your entire business.

💡 Clockify Pro Tip

If your client relationship is still in the clear, you may want to consider keeping a clean record of your tasks to prevent ever having to waste time straightening things out:

Waiting for the invoice to clear may fuel mistrust

There’s a clear logic behind this one.

You send the corrected version of the faulty invoice. Your client shows understanding, and everything’s peachy once again.

Yet, now the invoice payment date gets pushed back.

Several possible scenarios could happen here, and none of them are positive:

- You end up dealing with operational halts due to financial troubles,

- You stave off operational issues by getting a loan, or

- You dig deep into your business emergency stash — the one intended for actual emergencies, such as natural disasters or a pandemic.

Whichever the outcome, whenever things go rough, your employees will turn to you as a source of truth.

And if you aren’t exactly honest, you may raise suspicion.

Not to mention if all this goes on behind closed doors while your teams wait for their paychecks.

One possible outcome? You end up with people who are already one foot out the door.

To err may be human, but automation counteracts mistakes

Let’s now circle back to the To err is human adage from the beginning.

Given everything mentioned above, that particular saying is hard to refute — we humans definitely do make mistakes.

To avoid invoicing incidents altogether, your best option is to minimize the potential for human error and turn to machines.

Yes, it’s a tale as old as time — humans against machines.

But in this case, I’m not referring to bots taking over the world — it’s the invoicing software that can eliminate your blind spots before you even get to the invoice.

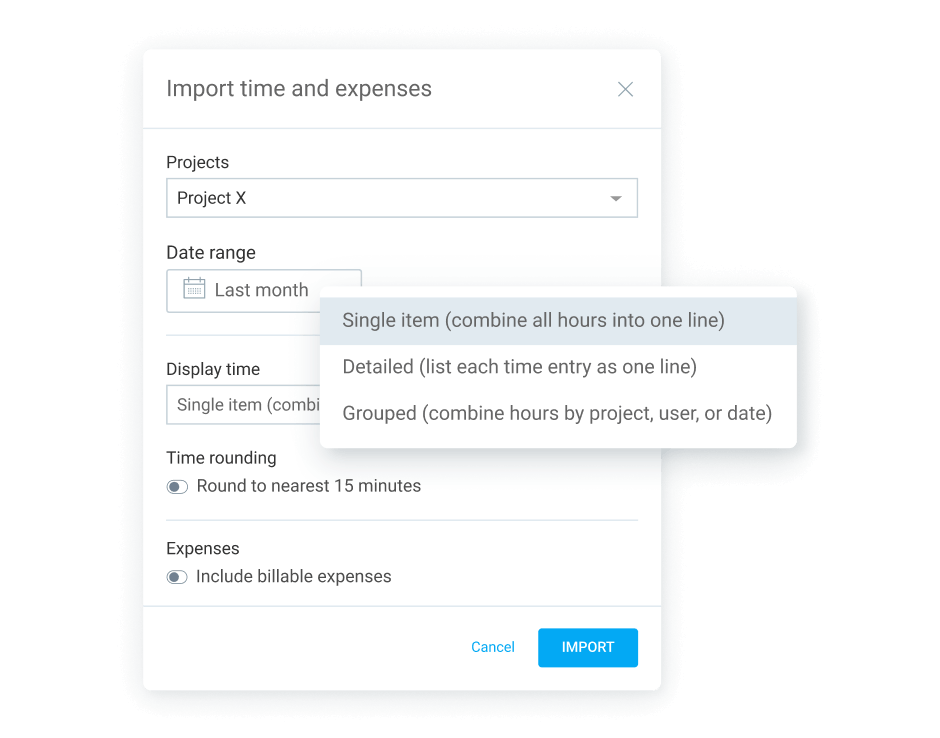

For example, Clockify by CAKE.com offers both time tracking and invoicing options. Immediately after you start using it, you reduce the chances of miscalculating someone’s hours and adding that incorrect total to the invoice.

Then, as the month ends and your team is done tracking their billable hours, you can simply import their time into an invoice.

Only this time, the invoice would get automatically generated from your data, so there wouldn’t be much room to fumble with numbers.

Then, you only need to download the PDF version of the invoice and email it to the client — and you’ve saved your business from the invoicing horrors above.

Just don’t forget to add the attachment to the email.

There still isn’t an app that’ll do that for you.