Download Free Invoice Templates

So, you can easily create a multipurpose, simple invoice to provide your clients with estimates in advance, charge them for goods, services, and billable hours, divide the invoicing process of your project into multiple payments, or send reminders to belated payers.

But, as a quicker alternative, you can also download our ready-made Multipurpose Invoice Template.

Moreover, by adding a couple of modifications to the original invoicing template solution, you can also provide refunds and discounts, increase the original amount charged to the client, or offer the data necessary for cross-border sales. Here are the ready-made templates you can use for these purposes.

Multipurpose Invoice Credit Invoice Debit Invoice Mixed Invoice Commercial Invoice

01 • FREE INVOICE TEMPLATES

Multipurpose Invoice Template (Standard, Timesheet, Pro Forma, Interim, Recurring, Past Due)

What's it about?

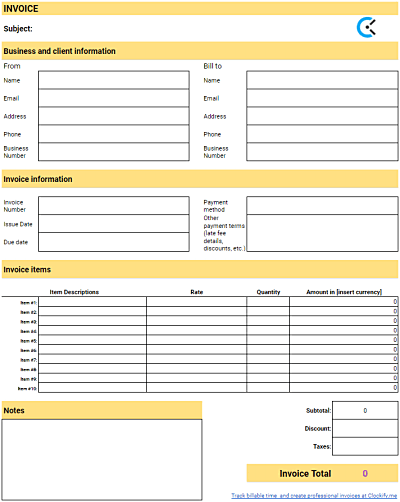

As an alternative to creating an invoice template from scratch, you can simply use our ready-made Multipurpose Invoice Template, created using the method described above.

Best for what and who?

This invoice template is great as a Standard, Timesheet, Pro Forma, Interim, Recurring, or Past Due Invoice.

Download: Google Sheet • Excel • Google Docs • Word • PDF

02 • FREE INVOICE TEMPLATES

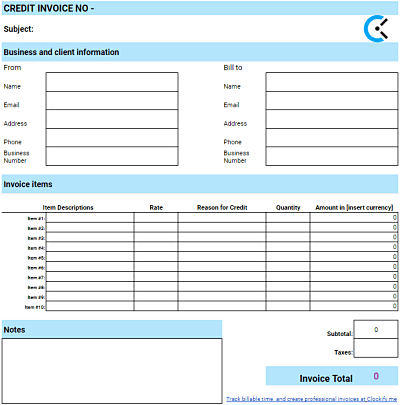

Credit Invoice Template

What's it about?

A freelance business issues a Credit Invoice (also known as a Credit Note) in order to provide a certain money return to a client. Such an invoice will always have a negative total number (e.g. for a total of $100 that need to be refunded, the total in the Credit Invoice will show -$100)

Best for what and who?

This invoice template is great for any freelancer in a situation to refund money for a product (or, less commonly, a service already provided). Alternatively, you can also use this template to provide a belated discount to a client or customer (e.g. in case of goods that got slightly damaged during transport), or in order to correct a previous invoice-related error (e.g. a miscalculated subtotal or total).

Download: Google Sheets • Excel • Google Docs • Word • PDF

03 • FREE INVOICE TEMPLATES

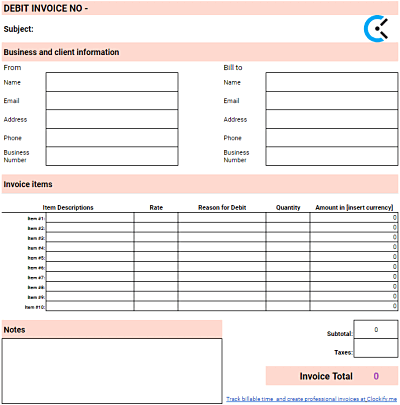

Debit Invoice Template

What's it about?

A freelance business issues a Debit Invoice (also known as a Debit Memo) in order to increase the amount originally estimated or invoiced to the client.

Best for what and who?

This invoice template is great if you've already sent the client the estimated time and amount for your planned work, but you've found that you've eventually worked more than what you originally estimated, so you want to increase the total amount. You can also send the Debit Invoice in case the client has used the discount for early payment but failed to provide the said early payment, and you need to remove the discount from the original amount paid. Unlike the Credit Invoices, Debit Invoices are always positive and add to the amount originally estimated (e.g. for a total increase of $100, the total amount in the Debit Invoice will show $100).

Download: Google Sheets • Excel • Google Docs • Word • PDF

04 • FREE INVOICE TEMPLATES

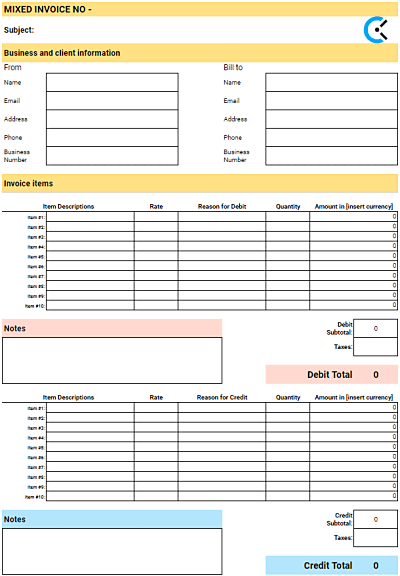

Mixed Invoice Template

What's it about?

A freelance business issues a Mixed Invoice in order to combine information from their credit and debit charges.

Best for what and who?

This invoice template is great if you want to combine information from your Debit and Credit Invoices, and simply put everything for the client in one invoice. This may occur if you're working on multiple projects for a client and want to provide a discount for one project, but want to increase the original amount (e.g. due to imprecise original estimates) for another project.

Download: Google Sheets • Excel • Google Docs • Word • PDF

05 • FREE INVOICE TEMPLATES

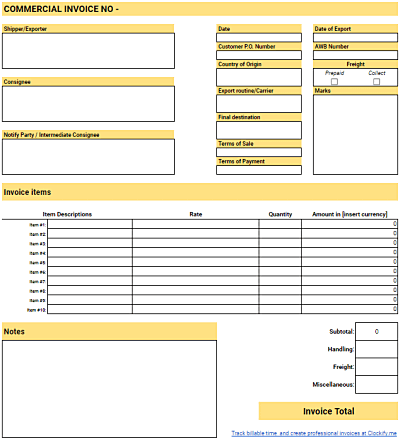

Commercial Invoice Template

What's it about?

A freelance business that needs to disclose details that will allow a package sent to a client to pass custom duties, will send a Commercial Invoice. Such invoices may include information such as:

- The number of units being shipped

- The weight or volume of the units

- The further description of the units

- The total value of the shipment

- A description of the packaging format

Best for what and who?

This invoice template is great for businesses that operate internationally and need to ship goods across borders.

Download: Google Sheets • Excel • Google Docs • Word • PDF

Invoicing resources

After working hard on a freelance project for a client, it's time that you charge for your work. Here's how you can speed up the process of creating invoices and make it easier, via our step-by-step guide on how to create invoice templates from scratch, our free invoice templates, and Clockify's efficient online invoicing options.

What is an invoice?

An invoice is a time-stamped document that lists and records all transactions between you as a freelance professional and your clients as the users of your services and/or goods.

From the point of view of the freelancer, the amount invoiced is an account receivable, as it is the amount the freelancer has yet to receive for the role as a supplier of goods and/or services.

From the point of view of the client, the amount invoiced is an account payable, as it is the amount the client is due to a supplier of goods and/or services that have not been paid for yet.

Invoices typically outline the following data:

- The subject of the invoice

- Itemized goods and/or services

- The logo of your freelance business (if applicable)

- Payment terms (e.g. payment due dates, early payment details, and explanations about possible additional charges that will ensue in the case of late payments)

- Issue date for the invoice

- Billable rates for the work completed or goods provided

- Quantity of items provided

- Shipping details

- The subtotal before the taxes and discounts

- Tax details

- Discount details

- Total amount owed

In order for a document to be considered an invoice, it must be stated that the said document is an "Invoice" on the front of the bill.

For easier record keeping and future reference, each invoice should also be stamped with a unique invoice number.

What are the types of invoices?

The types of invoices, in terms of how they are presented, include:

- PDF invoices — you print them out, fill them out with a pen, and then store their copies in a physical storage space.

- Invoices created in word processors — you fill them out on your devices manually, before storing their copies in digital folders.

- Invoices created in spreadsheets — you fill them out on your devices manually, before storing their copies in digital folders (may involve built-in formulas, for easier calculations).

- Software solutions with invoicing options — you fill them out online, before storing the invoice data in online electronic records.

The types of invoices, in terms of the data they cover, include:

- Standard invoices — the most common type of invoices that covers the basics, suitable for the majority of industries.

- Timesheet invoices — suitable for professionals who bill by the hour.

- Pro forma invoices — suitable for disclosing estimates, before providing the work.

- Interim invoices — suitable for charging smaller amounts over the course of working on a larger project.

- Recurring invoices — suitable in case you charge fixed amounts for service packages on a regular basis.

- Past due invoices — suitable for payments that are past their due dates.

- Credit invoices — suitable for belated discounts and refunds.

- Debit invoices — suitable for a subsequent increase of the original amount you've already invoiced to the client.

- Mixed invoices — suitable for charging multiple projects through one invoice (in the case that the said projects involve discounts, refunds, and subsequent amount increases)

- Commercial invoices — suitable for international shipments.

How to invoice your clients?

When you're a freelancer, there are several ways in which you can approach invoicing your clients:

- You can create your own invoice templates from scratch

- You can download ready-made invoice templates

- You can turn to a software solution with built-in invoice templates

How to make an invoice template in a word processor, Excel (or any spreadsheet), from scratch

Here are the steps you need to follow in order to easily create an invoice template in a word processor, Excel, or any other similar spreadsheet program, from scratch.

Step 1.

Be clear on how you'll use the invoice template

In order to decide the exact data you'll want to include in your invoice template, you'll first need to decide what you want to use this template for.

Will you use it as a Standard Invoice Template?

A freelance business issues a Standard Invoice for work completed or goods provided and then submits it to the client. It includes the number of goods (or the units of work) you're providing and their individual prices, plus the subtotal, the applicable taxes and discounts, and the total amount due.

Such an invoicing approach is a great solution for any freelancer looking for a straightforward way to bill clients, regardless of whether you are selling goods or billing your services. You may use it to charge one project or charge multiple projects you've worked on for this particular client, during a specific time period.

Will you use it as a Timesheet Invoice Template?

A freelance business issues a Timesheet Invoice in case the work is charged on an hourly basis. It includes the number of billable hours you've spent working and the hourly rates you charge for your billable time — your subtotals and totals are based on these numbers.

Such an invoicing approach is a great solution for any freelance professional who charges by the hour (e.g. lawyers & attorneys, psychologists, construction workers, accountants, creative agencies, etc.).

Will you use it as a Pro Forma Invoice Template?

A freelance business issues a Pro Forma Invoice to a client before providing the services, in order to provide the client with work estimates before actually starting work on their projects.

Such an invoicing approach is a great solution if you want to provide your clients with estimates before providing the work.

Will you use it as an Interim Invoice Template?

A freelance business may issue Interim Invoices when working on a large project, in order to divide the total payment into several smaller payments over a longer period of time.

Such an invoicing approach is a great solution when you're working on a large project, so you agree with the client to charge per specific time period (e.g. for each month separately), rather than to simply charge the entire sum upon completion of the project.

Will you use it as a Recurring Invoice Template?

A freelance business may use Recurring Invoices when in the position to charge the client the same amount, per predefined time period (e.g. on a weekly, bi-weekly, or monthly basis).

Such an invoicing approach is a great solution when you're providing fixed plans/packages of goods and/or services on a regular basis.

Will you use it as a Past Due Invoice Template?

A freelance business issues a Past Due Invoice in case the client doesn't provide payment within the prescribed billing cycle (e.g. within 30 days after the issue date) or before the disclosed payment due date (e.g. the 14th of February).

Such an invoicing approach is a great solution in case your client is late with a payment, and you want to ask for payment via a new invoice.

Step 2.

Open your spreadsheet or word processor program

Pick a spreadsheet or word processor program you'll use to create the template: Microsoft Excel, Microsoft Word, LibreOffice Calc, LibreOffice Writer, Google Sheet, and Google Docs are all great solutions.

Once you've made your choice, launch the program and start adding spaces for various types of information you want to include in your invoice template.

Step 3.

Add space for the title, subject, and business logo

In order to clear any doubts about what this document represents, you should write "Invoice" at the top of your template.

You can also add a subject, to later explain what the invoice is about (e.g. goods provided for January 2021).

If your freelance business has an official logo, you can also define a place to insert the said logo.

Step 4.

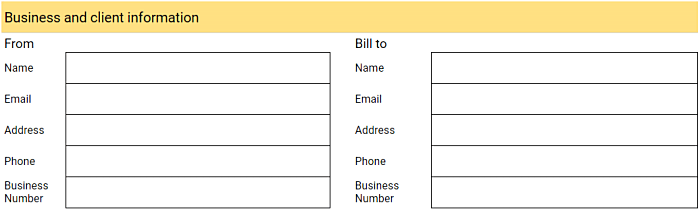

Include your business and client information

Below the space for the title, subject, and business logo, you should add your business and client information. You can order these two sections one after the other (with the client information being below the business information), or you can organize them next to each other.

Within this section, you'll describe who the invoice is from, and who you are billing to.

When it comes to your basic business information, you should include:

- Your name

- The name of your freelance company (if applicable)

- Your address

- Your phone number

- Your email address

- Your business number

When it comes to the basic information about the client you are invoicing, you should include:

- Their name

- The name of their company (if applicable)

- Their address

- Their phone number

- Their email address

- Their business number

Step 5.

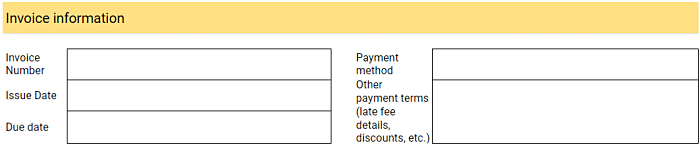

Include the invoice information and payment terms

Below your business and client information, you should add a space for invoice information and all relevant payment terms. Here, you'll specify the invoice number (for record-keeping purposes) and the relevant payment terms and details.

The unique invoice number

First, each invoice should include a unique invoice number — these invoice numbers will help you keep track of your invoice records easier.

There are several ways to approach generating unique invoice numbers, by using different types of identifiers:

- Ordinal numbers — a simple approach that still lacks additional layers of organization such as further identifying invoices based on various parameters.

Examples: "Invoice No.1", "Invoice - 0001", etc. - Your own or your client's initials — a great solution if you want your freelance business to stand out for the clients, or if you're working with repeat clients, and you want to organize your invoice records based on the clients.

Examples: "Invoice - KS0001138", "Invoice - KS24601", etc. - Your client's number — a great solution if you assign numbers to your clients (e.g. #221) for record-keeping purposes.

Examples: "Invoice - 221-No.1", "Invoice - 221-0001", etc. - The issue date and the ordinal invoice number for that date — a great solution if you want to keep your invoicing records organized by date (e.g. in a MM/DD/YYYY format).

Examples: "Invoice - 7312021-0001", "Invoice - 7312021-No.2", etc. - The combination of the above-listed elements — a great solution if you want to keep your invoicing records organized by several different parameters.

Examples: "Invoice - 9222021-327-0001", "Invoice - KS0001-7162021"

The due date

Another crucial element of the payment terms you'll need to include is the due date. You may want to set:

- A specific due date (e.g. the 15th of next month)

- A specific billing cycle (e.g. all invoices sent on June 1st need to be paid within 30 days, i.e. by June 30th)

Other payment terms

This section should also include other payment terms, such as:

- Any possible discount perks, tied to early payment (e.g. for immediate payment upon receiving the invoice, the client gets a 10% discount from the original amount)

- Payment methods you accept (e.g. checks, credit cards, or PayPal)

- Any late fee terms (e.g. an additional 10% to the original amount, in case of missing the due date)

Whatever you want to include in your payment terms, it's best that you disclose these details to the client beforehand, and then include this data accordingly.

Step 6.

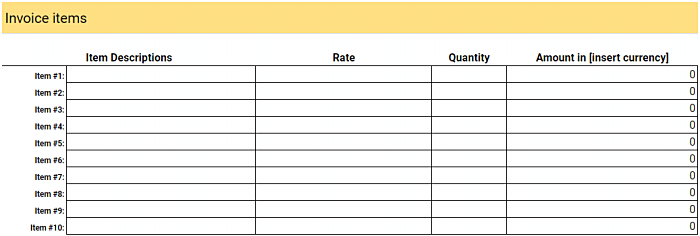

Specify an itemized list of goods and/or services provided

This may be the most important element of your invoice — in order to encourage your clients to pay you on time, you'll need to be transparent when it comes to what exactly they are paying for.

This section should be positioned at the center of your invoice (or near its end), as it is likely it will take up a lot of the template.

Your list should include:

- The descriptions of the goods and/or services provided + The date the goods and/or services were provided

- The number of hours spent providing the services/The quantity of goods provided

- The rate of your work/The price of the products (e.g. $20 per hour or $50 per product)

- A subtotal amount for the items listed

You should also include a space for specifying the currency in which you expect to be paid (if you and your client come from different countries, the currency is likely something you've already discussed).

Step 7.

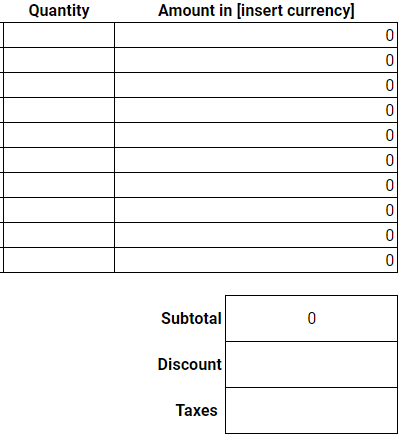

List the applicable taxes and discounts

The subtotal of your itemized goods and/or services is not the total amount you'll charge for. Your final price should be enhanced by applicable taxes, but also decreased by any early payment or other discounts that may apply to this particular client.

The percentage of taxes will depend on the location of your business, but also the type of your business. For more information, you can contact the IRS and ask for Taxpayer Assistance.

In any case, it's best that you add spaces for this data below the itemized list of goods and/or services provided.

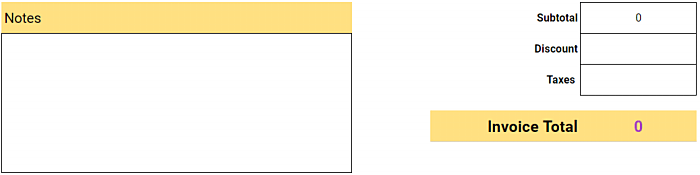

Step 8.

Add space for the total amount due

In the end, your invoice should place the total amount due to an easily visible spot within your invoice. This total amount should be the sum of your itemized goods and/or services provided, minus any discounts related to early payment, but enhanced with an appropriate percentage of relevant taxes.

It would be best if you were to further accentuate this total sum (perhaps with a different color, font, or font size) in such a way that the invoice total becomes the number the client first notices upon opening the invoice.

Step 9.

Add additional notes

This additional space is usually placed at the end of an invoice. Here, you can write a thank you note for the client, wish them Happy Holidays during the holiday season, and otherwise make the invoice friendlier, but still professional.

You can also use this "Notes" section to include some additional details about the project or invoice, such as an invitation to contact you in case of any further questions or concerns.

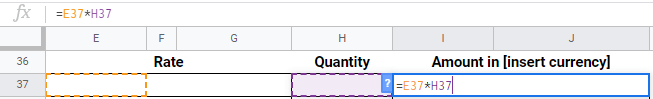

Bonus step for spreadsheet programs: Add formulas

This is more of an optional step that applies only if you're creating the template in a spreadsheet program. But, you can take it in order to make the invoicing process faster and easier.

Simply, add the formulas you need in order to carry out the calculations automatically after you're done adding your items, such as:

The formula that calculates the amount you're due per product or service

This formula is based on the rate you're charging for the number of goods provided or the hourly rate you're charging for the billable time you've spent providing the services. The correct cell in the "Rate" column is multiplied by the correct cell in the "Quantity" to get the amount for an individual itemized product or service (e.g "=E37*H37").

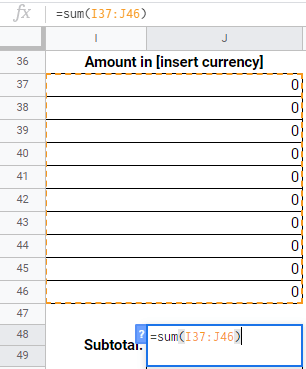

The formula that calculates the subtotal amount you're due for all goods and services covered by this invoice

This formula is based on the sum of the amounts you've made per individual goods and services (e.g. "=sum(I37:J46")).

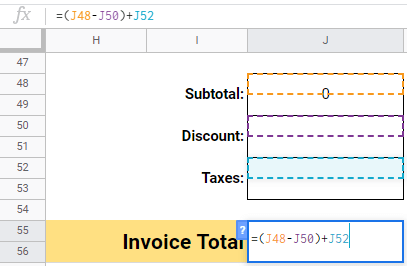

The formula that calculates the total

This formula is based on the sum of the subtotal and taxes, but minus any potential discounts (e.g. "=(J48-J50)+J52").

How to use software with invoicing options

Using ready-made invoice templates or creating your own invoice templates from scratch in a spreadsheet or word processor is a suitable approach for invoicing your clients.

But, it can only take you so far.

After all, creating your own templates takes time, and the amount of paperwork will eventually get overwhelming, even if you are reusing invoice templates. This is because your archive of paid and sent invoices will likely only grow over time, and it will eventually become difficult to find what you need, exactly when you need it.

Because of this, as an alternative, it's worth considering an online records keeping solution that offers invoicing features, because of the benefits it brings.

Benefit #1

Easier, faster, and more accurate billing

Entering the right information into the right places in your invoice template takes time, but may also trigger some costly mistakes.

Even if you've defined your formulas correctly, it only takes one wrong billable rate or quantity in your items table to result in erroneous invoice subtotals and totals.

Moreover, if you're using an invoice created in a word processor (i.e. without formulas), the time it will take you to enter and calculate everything will skyrocket.

On the other hand, a software solution will automate all invoicing processes, as you won't have to define formulas, carry out the calculations yourself, or even enter items manually (unless you really want to).

As a result, invoicing will become much faster, easier, and, most importantly, completely accurate.

Benefit #2

Easier to keep records of your invoices

We already mentioned the paperwork and logistical problems that come with paper, or even Excel invoices — even if you keep all your invoices in one folder, it will eventually become difficult to find what you need and keep everything organized.

However, keeping online records of your invoices means no extra paperwork, as everything is stored in a cloud, and easily accessible whenever you need to find a past invoice.

Benefit #3

Access your billable data anytime, across devices

When using templates, you'll need to look for them in a computer folder, or worse, in the right drawer or binder (in case you keep printed invoices). But, a software solution with invoicing options will allow you to access the billable time you are charging for across devices.

Benefit #4

Better data security

You can easily misplace your printed invoices, or even accidentally delete some of the invoices you are storing as word processor, spreadsheet, or PDF files.

Moreover, at some point, you may compromise your data by sending invoices to the wrong clients by accident, or having someone hack your computer and obtain/expose/lock the data you're keeping in folders.

On the other hand, a software offers added protection in the form of data encryption. At any time or anywhere, when you want to access your data, you'll just need to log in with your email and password on your device. For added security, you can also apply additional authentication methods for your software accounts, such as Single sign-on (SSO).

Benefit #5

Additional options

If you're using a simple invoicing tool, you will likely be able to create, send, and store invoices without a hitch. But, if you use a more robust system that offers a wider range of features, you will also be able to work on improving:

- Your project delivery, via better teamwork and project/task organization

- Your productivity, by tracking the time you spend on different tasks and projects during the workday and later analyzing your time use in reports

Benefit #6

Decreased costs

Creating invoice templates from scratch, or entering data in ready-made templates takes time, and time is money. A software solution will allow you to handle invoicing in just a couple of clicks, which will save you a lot of time and money in the process, especially in the long run.

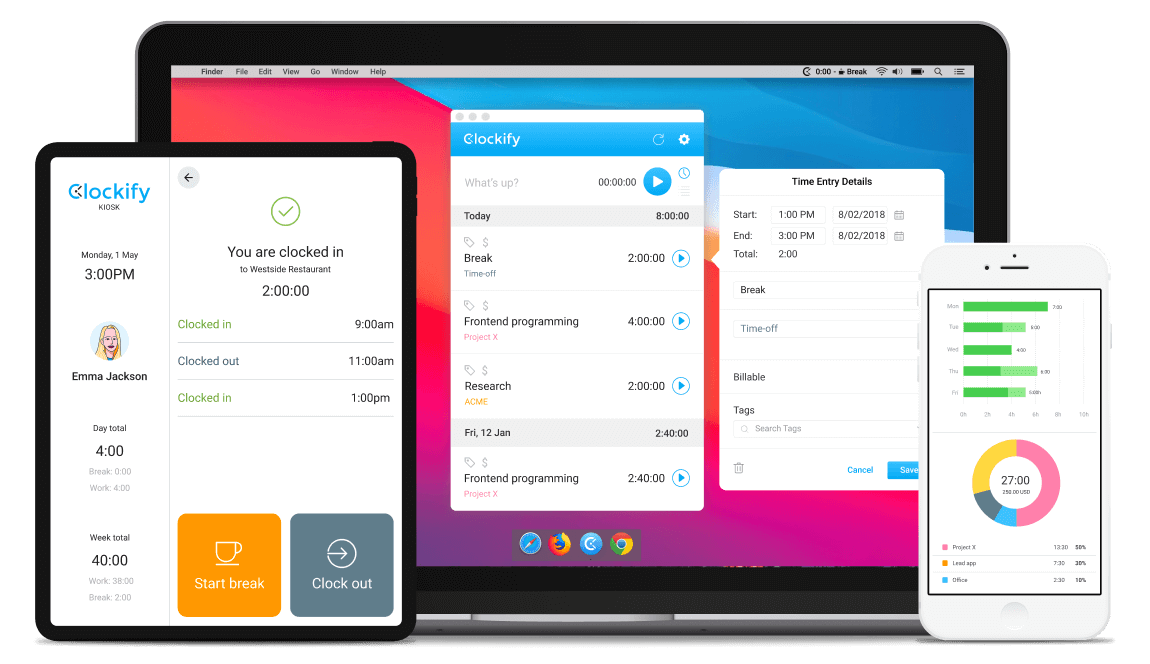

How to invoice billable time with Clockify

Clockify is a time tracking software that allows you to track the time you spend on projects, and then invoice the amounts you earn during this time.

Alternatively, you can add billable items manually, and define their quantity and price per individual unit, directly in the invoices you are currently creating.

Step 1.

Define clients, projects, and tasks

First, create projects that reflect your real-life projects, in your Clockify workspace. Associate them with the right clients, and parse them into tasks, for easier management (if you're working together with a team, you can assign individual team members to individuals tasks, to avoid confusion about who should be working on what in the future.).

Define the hourly rates you want the system to use to calculate your earnings (e.g. specific hourly rates for specific team members working on this particular project). In the Settings section of the app, add your address — i.e. the address you want to use in your invoices and associate with client payments.

Step 2.

Track the time you spend working

When you start working on a project-related activity in real-life, go to the Time Tracker page in your Clockify workspace, select the project (and task) you are working on from the drop-down menu, and click "Start". Always make sure all the time you want to bill for is marked as billable.

Once done working on the said activity, click "Stop" to add this new, billable time entry to your list of time entries. Alternatively, you can add this time after you're done working manually, by duration, or in a simple timesheet view.

Step 3.

Watch your earnings get calculated

No matter whether you're tracking time as you work in the timer mode, adding it manually in the manual mode, or adding it in a timesheet, the system will remember your data. This includes the time you've spent working on the said activity and the amount you've earned during this time based on your hourly rates. This data will then be used to calculate your earnings automatically, as you work.

Whenever you want to view your earnings, simply go to the Reports section of the app, select the project you want, and the time period during which you worked on it. Once you filter by these parameters, you'll see your earnings and an overview of the billable time you've spent on this project.

Step 4.

Create Invoices

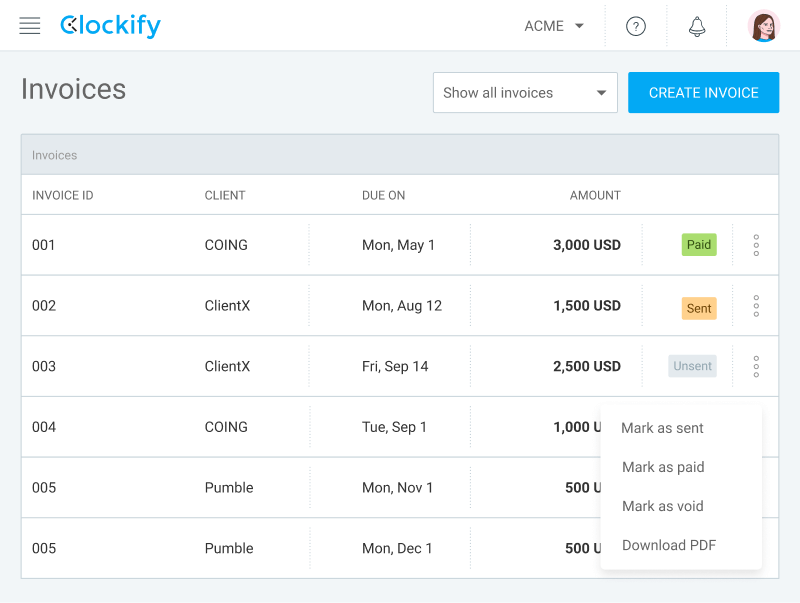

Once you're done working on this project, simply go to the invoicing section of the app and create a new invoice:

- Select the client you want to invoice

- Define the currency

- Specify the invoice ID and/or subject (e.g. Services provided in November and December)

- Define the issue date for the invoice

- Define the due date for the expected payment (e.g. 10 days after the issue date, or a specific date, such as the 14th of January)

Once you've created the invoice, simply import your billable time, or add new items manually. You can define the discounts and taxes (in the form of percentages) you want to apply to your invoiced subtotal, and you'll then get your total invoice amount calculated automatically.

In the end, add some accompanying notes if you want, download the invoice as a PDF, and send it to the client.

Step 5.

Keep records of your invoices

Clockify will save all the invoices you create. You'll be able to mark them as "sent" when you send them. Even more importantly, you'll be able to mark them as "paid" when you receive the payment from the client.

In addition, you'll also be able to add tags to categorize individual time entries as "invoiced" or "uninvoiced". At any point, if you want to find and reference old invoices, you'll be able to do so in just a couple of clicks.