Tracking monthly expenses is hard.

It entails a clear understanding of where your money goes, like:

- Monitoring and managing your business expenses,

- Creating and sticking to your monthly budget,

- Keeping track of transactions,

- Setting financial goals, and others.

While this may seem complicated at first, in practice, it doesn’t have to be.

Here, we’ll provide the most effective yet simplest ways to implement expense tracking for your monthly spending.

Let’s start!

#1: Categorize your expenses (with a workable budget)

To create a successful budget, think systematically. This means that you should group your monthly expenditures into different expense categories.

Categorizing your spending will later result in better budget control and transparency. Once you establish budget categories, confusion about where your money goes and how funds are allocated will become history.

Also, proper categorization of your expenses allows you to get better insight into tax-deductible costs. This may be useful when you try to lower your taxable income.

From now on, create budget categories such as:

- Operating expenses (often referred to as OpEx) — this expense category includes costs that keep the business operating. Examples include rent, utilities, office supplies, repairs, etc.

- Payroll expenses — list all expenses related to employee salaries and wages, bonuses, commissions, and employee benefits (such as health insurance and the like).

- Professional fees — these cover all payments to professionals that help you keep your business running. Such costs include accounting and bookkeeping services, legal fees, etc.

- Business travel expenses — these are costs related to business travel for you or your employees. Therefore, any travel expenses such as flights, accommodations, meals during such travels, etc.

- Taxes — this category includes tax-related expenses such as federal income taxes, state income taxes, property taxes, sales taxes, and similar.

- Savings and debt obligations — create a category that is solely intended for setting money aside or for paying out loans or debts.

- Miscellaneous expenses — here, you can put all the costs that don’t fit into any of the categories above. Those can be perhaps some subscriptions, paid software, and others.

When you keep a thorough record of your spending and have a more detailed insight into them — you make wiser financial decisions and stay on top of your budget.

💡 CLOCKIFY PRO TIP

Whether for business or personal expenses, learn how to track your expenses like a pro:

#2: Use a budget calculator (and budgeting system)

Now that you have your expenses grouped accordingly, it’s time to create a budget that will ensure your financial stability in the long run.

A well-planned budget makes tracking expenses straightforward, keeping business costs under control. As a manager, you must always be prepared for the unexpected. However, with a planned budget, you’ll never fear any out-of-line costs that might occur.

The 50/30/20 budget rule is a convenient way to plan your budget and track cash flow. This rule is about dividing your after-tax income into 3 different groups:

- 50% of the income is dedicated to needs — operating expenses, payroll expenses, professional fees, etc.

- 30% is dedicated to wants — this includes business travel expenses or any personal expenses such as dining, outings, etc.

- 20% is meant for savings and repaying debts — money you set aside for either retirement, rainy days or maybe a future investment. Also, this money is meant for paying any loans or mortgages.

Why the 50/30/20 rule to craft your monthly budget?

Well, it’s a simple, well-balanced, and safe way to manage and track monthly expenses.

For instance, if your monthly income is $20,000, here’s how you should craft your budget according to the 50/30/20 rule:

Needs: $20,000 x 0.50 = $10,000

This means you should allocate $10,000 to your needs.

Then, let’s calculate your monthly budget that is meant for wants:

Wants: $20,000 x 0.30 = $6,000

Feel free to spend $6,000 to buy yourself new clothes, go to a spa, or cover some travel expenses.

Finally, let’s calculate how much money you should set aside for savings and debt repayment:

Savings and repaying debts: $20,000 x 0.20 = $4,000

According to the 50/30/20 system, you should set aside $4,000 monthly to repay debts, loans, or for savings.

This is a convenient way to make sure you stay within your budget. It’s advisable to review it and adjust it based on your monthly income.

#3: Review bank and credit card statements

Another important aspect of tracking monthly expenses are your bank and credit card statements.

To make sure you know what we’re talking about — bank statements are bank summaries you receive every month that show each transaction made within your bank account.

On the other hand, credit card statements are summaries you receive from your credit card issuer that show every purchase made with that said card. Failing or ignoring emails with such summaries may cost you money and headaches.

Worryingly, only 56% of Americans review their account statements each month. Without checking your bank and credit card statements regularly, you won’t be able to have a real picture of your spending habits. Or see any fraudulent activity or unauthorized use for that matter.

Bank statements give you a better insight into your bank account activities (see cash flow, charges, what you’ve saved, etc.). Likewise, credit card statements showcase your business expenses, interest, and the like.

Therefore, make it a habit to check your bank and credit card statement emails as soon as you receive them. Mark these emails as “important” to ensure you never miss them.

#4: Utilize an expense-tracking app to keep all your receipts

You can manage all your expenses easily and trouble-free with an expense tracker. Such a tool eliminates the hassle of manual expense tracking and managing, making the process smooth and stress-free.

With an expense tracker app, everything is done automatically:

- Grouping and recording business expenses,

- Setting a budget,

- Running reports, and much more.

Not only do you save precious time but also have a better insight into your spending habits. In fact, you can easily spot problem areas and cut unnecessary costs immediately.

Apart from being easy to use, expense trackers offer a wide range of reports that give you a detailed view of where your money goes.

#5: Track and lower your monthly expenses with Clockify

Speaking of a reliable expense tracker app, try Clockify by CAKE.com.

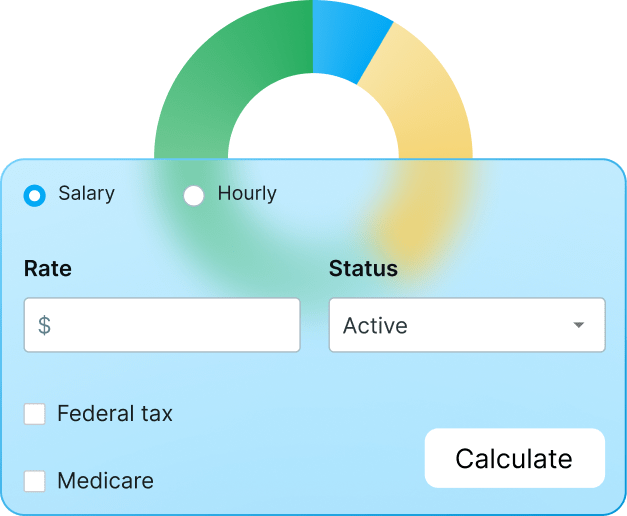

While primarily a time tracking app, Clockify is the best way to track expenses, too. With it, you can:

- Track expenses by unit or sum,

- Categorize your expenses,

- Save receipts in a safe place,

- Set project budget and estimates, and much more.

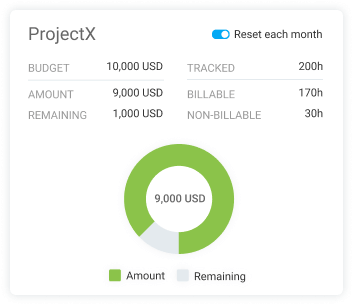

As shown below, after you set up a budget in Clockify, you get a clear picture of how much money you still have available, along with tracked billable and non-billable hours.

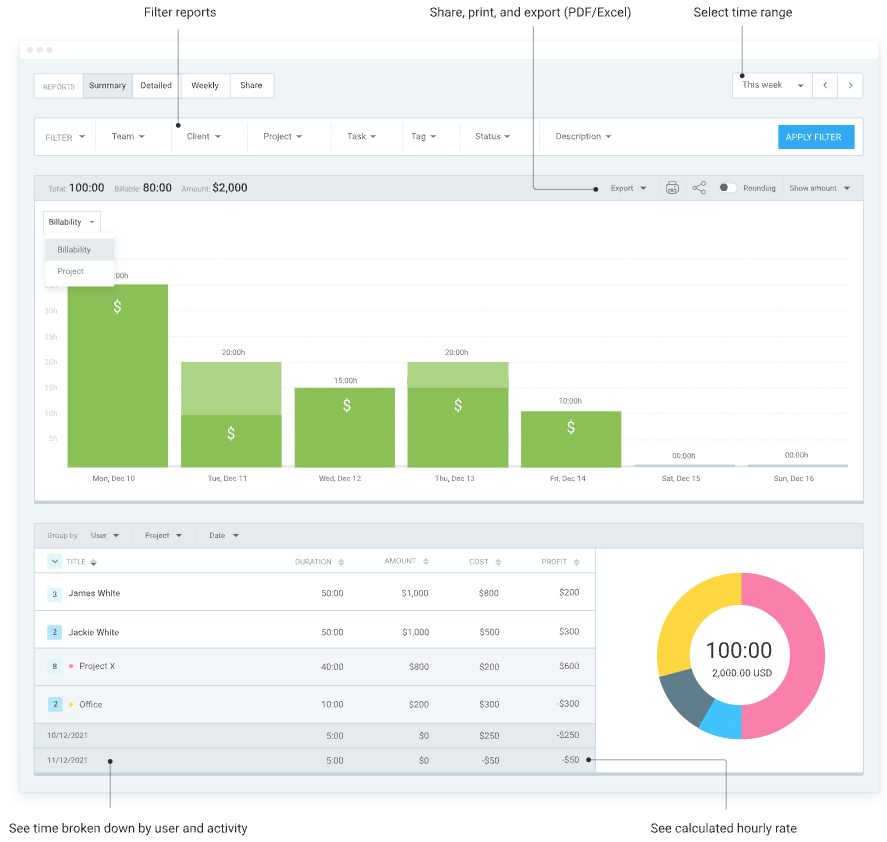

To be on the safe side, Clockify lets you see a detailed breakdown across your projects.

Whether you need monthly, weekly, or any other report, Clockify by CAKE.com will make sure you stay on top of your projects and never go over budget again.