One of the main criteria when classifying employees is determining whether they are exempt or nonexempt. This classification specifies whether an employee is covered by the Fair Labor Standards Act (FLSA) in terms of minimum wage and overtime pay.

Employees classified as “exempt” are not covered by the FLSA minimum wage and overtime regulations, while the act covers “nonexempt” employees.

Some types of employees can only be exempt from overtime regulations, while others can be exempt from minimum wage, or both the minimum wage and overtime rules. In addition, some employees may also be exempt from child labor provisions.

In this article, we will take a detailed look into exempt vs non-exempt employees and help you classify them correctly according to the FLSA.

- Exempt employees are usually paid on a salary basis and are considered exempt from the FLSA overtime provisions.

- Nonexempt employees are usually paid on an hourly level and are covered by both minimum wage and overtime FLSA provisions.

- The FLSA includes several job categories which are considered exempt, such as executive, administrative, or professional employees.

- For an employee to qualify for the FLSA executive, administrative, or professional exemption, they must earn a salary of at least $844 per week.

- Some states have their own salary threshold for exemption status.

- There are different recordkeeping requirements for exempt and nonexempt employees.

What does “exempt” mean?

The phrase “exempt” refers to someone free from an obligation or a liability.

We should mention that “exemption” and “exception” have two different meanings. Exemption refers to someone being free from certain obligations and privileges, while exception refers to something or someone not being affected by a particular rule.

What is an exempt employee?

Exempt employees are employees who are not eligible for the FLSA overtime and minimum wage provisions. This means that exempt employees don’t have the right to the federal minimum wage of $7.25 per hour and the overtime rate of 1.5 times the regular rate of pay.

The reason why such employees are exempt is mainly because:

- They are paid a fixed salary every month,

- They work in fields that require advanced knowledge,

- They are considered highly compensated employees, and other reasons.

Whether an employee will be exempt or nonexempt is determined individually, and both the employee and the employer should check the terms and conditions of each exemption. Nonetheless, the responsibility for each exemption rests on the employer.

Examples of exempt employees

The FLSA has many categories of workers who can be viewed as exempt.

Here are a few examples of exempt occupations:

- Lawyers,

- Engineers,

- Seasonal workers,

- Salespeople,

- Architects,

- Doctors, and

- Teachers.

Exempt employees — pros and cons

Although exempt employees are not eligible for either minimum wage or overtime pay, there are certain benefits for this type of employment. Let’s look at the pros and cons of being an exempt employee in the table below.

| Pros ✅ | Cons ❌ |

|---|---|

| Constant income — exempt employees are usually full-time employees paid a fixed salary, giving them a steady and safe monthly income. | No FLSA coverage — exempt employees are not eligible for minimum wage or overtime provisions under the FLSA. Due to this, they don’t receive additional compensation for overtime work. |

| Career development — many exempt employees work in occupations that require advanced knowledge (e.g., managers, computer workers, and teachers), giving them further opportunities to develop and grow. | Additional pressure — due to exempt employees working in more senior positions, they are expected to perform at the best of their capabilities. This can cause a lot of pressure as companies depend highly on these employees. |

| Employer benefits — certain employees might include benefits to their employees as a part of their employment. Some of these benefits include pension plans, bonuses, healthcare programs, paid vacation and sick leave, and 401(k) retirement programs. |

What is a nonexempt employee?

Nonexempt employees are employees who are eligible for FLSA minimum wage and overtime provisions. This means that nonexempt employees are guaranteed a federal minimum wage of at least $7.25 per hour.

Moreover, nonexempt employees are guaranteed overtime pay for working over 40 hours a week and 8 hours a day. Such workers must receive overtime pay of 1.5 times their regular pay rate for every overtime hour worked.

Although nonexempt employees are often paid by the hour, they can sometimes be paid a salary or a commission.

🎓 Track overtime hours with Clockify

Examples of nonexempt employees

The federal law doesn’t feature a list of nonexempt employees, and many categories of employees can be eligible for this type of employment.

Here are a few common examples of nonexempt employees:

- Plumbers,

- Construction workers,

- Customer support agents,

- Police officers, firefighters, and other first responders,

- Retail workers, and

- Factory workers.

Nonexempt employees — pros and cons

Let’s look at the pros and cons of being a nonexempt employee in the table below.

| Pros ✅ | Cons ❌ |

|---|---|

| Guaranteed overtime pay — under federal law, employees with more than 40 hours worked in a workweek are guaranteed additional pay. This pay equals 1.5 times their regular rate of pay for each hour that exceeds 40. | Lower salary — nonexempt employees are usually paid an hourly wage that can be lower than the salary exempt employees receive. Many nonexempt workers are paid a federal minimum of $7.25 per hour. |

| Varying schedules — nonexempt employees usually work multiple shifts, which can be beneficial when scheduling time off. Moreover, because they perform straightforward tasks, they can easily swap shifts with other employees. | Limited career development — most of the employees who are classified as nonexempt work in manual labor occupations and perform straightforward tasks. Due to this, it is difficult to develop their careers and achieve higher rankings. However, some nonexempt employees, such as first responders, can achieve higher rankings and grow their careers. |

The Fair Labor Standards Act (FLSA) exemptions

In this section, we will take a closer look at the Fair Labor Standards Act (FLSA) exemptions, including:

- Executive, administrative, and professional employee exemption,

- Commissioned sales employees paid by retail establishments exemption,

- Computer-related professions exemption, and others.

🎓 Full list of FLSA exemptions

Executive, administrative, and professional employee exemption

The most common FLSA overtime and minimum wage exemption covers executive, administrative, or professional (EAP) employees.

To qualify for such exempt status, an employee must meet the following 3 criteria:

- They must be salaried employees,

- They must be paid at least the specified minimum salary threshold of at least $844 per week, and

- They must conduct executive, administrative, or professional duties.

In addition, the US Department of Labor also has an alternate test for highly compensated employees who qualify for the exemption if they earn at least $132,964 per year.

In April 2024, the US Department of Labor declared a final rule regarding the standard salary level for executive, administrative, professional employees, outside sales and computer employees. On July 1, 2024, this rule increased the salary threshold from $684 to $844 per week.

The salary level will increase again on January 1, 2025, and will grow to a minimum of $1,128 per week. After that, it will grow on January 1, 2027, and it is set to increase every 3 years to adjust for rising inflation rates.

When it comes to highly compensated employees, their annual salary threshold will also increase, growing from $132,964 to $151,164 per year starting January 1, 2025.

Commissioned sales employees paid by retail establishments exemption

Employees who work in retail establishments and are paid on a commission basis are exempt from overtime pay if more than half of their earnings come from commissions.

For an employee to qualify for exempt status, they must meet the following 3 criteria:

- They must work in a retail or service establishment,

- Their regular pay rate must be higher than 1.5 times the standard minimum wage for every overtime hour, and

- More than half of their earnings in a pay period must be from commissions.

To calculate the employees’ earnings accordingly, employers must keep certain records, such as the total number of work hours, earnings, and wages.

Computer-related professions exemption

Employees who work as system analysts, programmers, software developers, or in any similar position are exempt from overtime and minimum wage provisions if they earn at least $27.63 per hour.

For an employee to be qualified for this type of exemption, they must meet the following 3 criteria:

- They must be paid on a salary basis and earn at least $27.63 per hour,

- They must work as a programmer, software developer, or any other similarly skilled worker in the computer field, and

- Their primary duties must involve:

- Application of system analysis and procedures,

- Design, development, research, modification, creation, or testing of computer software,

- Design, documentation, testing, creation, or modification of operating systems, or

- Any combination of the duties above.

This exemption does not apply to employees who manufacture or repair computer hardware or related equipment.

Other FLSA exemptions

The list of FLSA exemptions is extensive, so we have included some additional exemptions in a table. The table includes employee categories exempt from overtime, minimum wage, or both (❌=nonexempt; ✅=exempt).

| Type of employee | Minimum wage | Overtime pay |

|---|---|---|

| Drivers, loaders, or mechanics | ❌ | ✅ |

| Employees working on farms | ✅ | ✅ |

| Seasonal workers | ✅ | ✅ |

| Babysitters | ✅ | ✅ |

| Airline workers | ❌ | ✅ |

| Employees with disabilities | ✅ | ❌ |

| Federal criminal investigators | ✅ | ✅ |

| Firefighters in small departments | ❌ | ✅ |

| Fishing workers | ✅ | ✅ |

| Elderly companions | ✅ | ✅ |

| Motion picture theater employees | ❌ | ✅ |

| Newspaper delivery employees | ✅ | ✅ |

| Police officers in small departments | ❌ | ✅ |

| Railroad workers | ❌ | ✅ |

| Taxi drivers | ❌ | ✅ |

| Switchboard operators | ✅ | ✅ |

Bear in mind that you can contact your local Wage and Hour District Office to apply for any of the previously mentioned exemptions.

State exemptions

All of the previously mentioned exemptions are listed in the FLSA. However, some states have their own salary requirements for classifying employees as exempt or nonexempt, and these states usually demand a higher salary than the federal government.

At this time, only several states have these laws in place, but it is expected that many other states might establish their own salary thresholds in the future.

| State | State law |

|---|---|

| Alaska | To qualify for the executive, administrative, or professional minimum wage and overtime exemption, employees must earn a salary of at least $938,40 per week. |

| California | Employees must earn at least $66,560 annually to qualify for overtime exemption. Moreover, the standard salary threshold for computer-related professions exemption is at least $55,58 per hour. |

| Colorado | The standard salary threshold for employees to qualify for exemption is at least $1,057 per week. Regarding computer professionals, the salary threshold is $31.41 per hour. |

| Washington | Washington also has its own salary threshold for overtime exemption, and it differs between small and large businesses. Employees must earn at least $1,302.40 per week to qualify for an exemption, regardless of business size. From 2025, this threshold is set to increase yearly, growing to $1,337.60 for small businesses and $1,504.80 for large businesses. |

| New York | The state of New York has its own salary threshold, which varies among cities. New York City, Nassau, Suffolk, and Westchester County require employees who work in administrative and executive occupations to earn at least $1,200 per week to qualify for exemption. On the other hand, employees who work in New York State must earn at least $1,124.20 per week to qualify for the abovementioned exemption. |

Recordkeeping requirements for exempt and nonexempt employees

Exempt and nonexempt employees also differ when it comes to certain recordkeeping requirements. As exempt employees are primarily salaried employees, the federal law isn’t too strict for employers.

Employers who employ exempt employees must keep the following records:

- Workweek duties,

- Beginning and end of a workweek,

- Employee wages,

- Personal information about the employee (e.g., name, address, social security number),

- Payment dates, and

- Payment period information.

On the other hand, employers who employ nonexempt employees must follow more strict recordkeeping requirements, which include:

- Personal information about the employee (e.g., name, address, social security number),

- Start and end time for every workday,

- Payment date,

- Payment period information,

- Basis on which the employee is paid (e.g., hourly rate),

- Overtime earnings,

- Wages for each pay period,

- Additional employee payment,

- Earnings per day,

- Total number of work hours, and

- Deductions.

Employers should keep the abovementioned payroll records for a period of at least 3 years.

🎓 Track employee work hours with Clockify

Frequently asked questions about exempt vs. nonexempt employees

To make this article as comprehensive as possible, we have included an FAQ section covering the most common questions about exempt and nonexempt employees.

Is a business owner considered an exempt employee?

Yes, under a special rule, business owners who own at least 20% of a company are considered exempt executive employees. The standard salary requirement doesn’t apply in this case.

How do you determine if a position should be exempt or nonexempt?

Misclassifying employees can lead to potential legal consequences and lawsuits. To determine if an employee position is exempt or nonexempt, employers must look at 3 different tests, which include:

- Salary basis test (employees must be paid a salary),

- Salary test (employees must earn at least $844 per week), and

- Duties test (employees must perform executive, administrative, or professional job duties).

What are the disadvantages of being an exempt employee?

Although exempt employees are usually paid more, there are several disadvantages to this type of employment.

Exempt employees are not eligible for overtime pay, meaning they might have to work additional hours without compensation.

Moreover, exempt employees tend to work in higher-ranking positions, which brings additional pressure and may lead to burnout.

Who is exempt from overtime pay?

Certain categories of employees are considered exempt from overtime pay. Some of these categories include:

- Executive, administrative, or professional employees who earn at least $844 per week,

- Computer experts who earn at least $27.63 per hour,

- Commissioned sales employees who work in retail establishments,

- Railroad workers,

- Taxi drivers, and others.

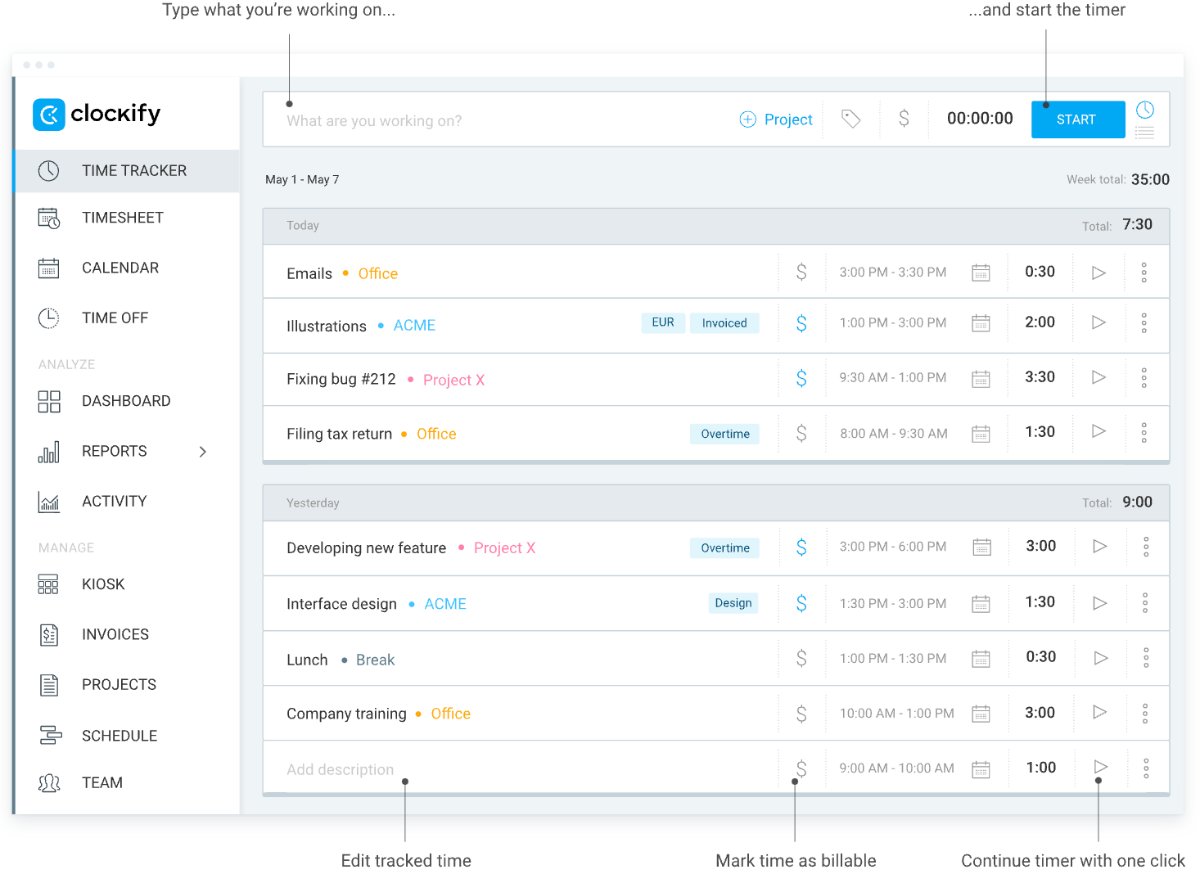

How Clockify helps you track employee work hours

According to federal law, employers must keep certain payroll records for every employee. One of these records is the employee’s work hours.

Tracking work hours for every employee can be daunting and time-consuming, and it can lead to certain legal problems if not done correctly.

That’s why you should use time tracking software to help you with the whole process and save you countless hours and money. For this purpose, you can try Clockify.

With Clockify’s time tracker, your employees can easily track their work hours with a simple click of a button.

Employees can simply write down what they are working on and start the timer, or they can enter work hours manually.

Later, you can see all this time data and track work hours for every employee individually without losing countless hours.

What are you waiting for? Start saving money and time by using Clockify!

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Published: October 11, 2024

Published: October 11, 2024