Billable hours are the hours you spend doing tasks for a particular project. Plus, you’ll charge your clients for these hours. On the other hand, whenever you’re doing tasks that are important for the overall success of your business, such as bookkeeping or looking for new clients, you will mark these hours as non-billable.

In this blog post, we’ll explain the importance of billable and non-billable hours, as well as cover these topics:

- How you can reduce non-billable hours,

- why you should track your non-billable hours, and

- how many billable hours is average for your industry.

Table of Contents

What are billable and non-billable hours?

As we mentioned earlier, the billable hours are the hours invested on assignments that are directly related to a project. As such, billable hours must be included in the invoice – a document that serves as an agreement between the buyer and the seller (of products or services).

💡If you’d like to learn more about an invoice, how to do it, and which tools to use, check out these blogs:

Here are several examples of billable hours:

- Project planning,

- client communication and meetings with them,

- research,

- revisions, and edits.

Remember, non-billable hours are equally important as billable hours. Think of non-billable hours as a photo frame and billable hours as a photo itself. It takes a lot of time to find the right angle and lighting to take a perfect photo. But, at the end of the day, it’s the frame that’s holding that photo and making it visible to others. Without the frame, your photo will be hidden in the drawer. So, non-billable activities, like administration tasks, will keep your business running smoothly.

And here’s what you would label as non-billable hours:

- Internal marketing activities,

- recruiting,

- invoicing,

- employee training,

- additional/unexpected changes during the project,

- and development.

Some of the industries that track their billable and non-billable hours to charge their clients are:

- accounting,

- law firms and legal professionals,

- advertising agencies,

- freelancers,

- web developers,

- public relations firms.

No matter the type of your industry, be sure to accumulate enough billable hours because they’ll cover your non-billables. Ideally, you should have more billable than non-billable hours.

Here’s an example for this. Let’s say that there are two accounting firms:

- AB accounting – a company with five employees. While they were tracking their working hours for the last month, they realized that, out of the total hours, 30% were non-billable hours.

- CD accounting- a company with the same number of employees like the AB accounting. Compared to the first company, the CD accounting generated less non-billable hours last month – 15% out of total hours.

Since their goal should be tracking more billable hours and reducing non-billable ones, we can conclude that the CD accounting will be more profitable than the AB accounting. The reason for this is simple – the CD accounting had less non-billable hours than AB accounting.

You might be wondering how to decrease the number of non-billables. We’ll give you some practical tips in the next section.

How can you reduce non-billable hours?

Reaching a perfect balance between billable and non-billable hours can be challenging. In fact, many studies show that lawyers usually have fewer billables than non-billables per day.

One of these reports is The 2017 Legal Trends Report, a survey done by Clio, which included around 3,000 legal professionals. According to this research, out of the 8-hour workday, only 2.3 hours of the day were marked as billable.

If you’re a business owner and you want to generate more billable hours, you and your team should start following these simple steps.

Make the list of requests at the end of each day

When running your own business, there will be situations when your employees will need your help with solving an urgent problem. Sometimes, you’ll have more than one issue to figure out, which can be incredibly stressful.

Plus, whenever you’re getting these back-and-forth emails or calls from your employees, you will all have to mark this period as non-billable. So, what can you do?

Encourage your team to send you a list of project updates at the end of each day. This list should contain all the latest news about your current project. For instance, if someone needs approval from you, or any additional data, they should include it in that list.

That way, you’ll be able to plan your next day and minimize your non-billable hours. Besides, your employees will get all the necessary information, which means more hours working on the project, less time spent on non-billable activities.

Automate certain tasks

There are some repetitive assignments, such as administration, which can consume a lot of your time and you’ll track them as non-billable hours. In this case, the best solution to lower these non-billable hours is automation.

Here are two major benefits of automation:

- By automating non-billables, both you and your team will be able to aim their attention to project-related tasks – which are billable.

- Your clients will receive automated invoices with all the details about the project and assignments that were billable.

So, this is what we suggest you do, to increase your billable and decrease non-billable hours. Of course, since every business is unique, it’s likely that you’ll discover some new practical ways to reduce non-billables yourself.

Speaking of working hours that you won’t charge your clients, be sure that tracking non-billable hours is essential for your company. We’ll elaborate on this topic in the following part of the article.

Why should you track non-billable hours?

In order to track both billable and non-billable hours, you can use Clockify – time and billing software. Be sure to encourage your employees to enter their working hours, too.

Here are the main reasons why keeping track of your non-billable hours is significant for your company and your clients.

To learn which clients/projects require more non-billable hours

When you and your staff monitor all your working hours, you’ll be able to compare the number of your billable and non-billable hours. This way, you can find out a lot about your clients and your projects.

Tracking non-billable hours will give you answers to these questions:

- Are your projects profitable? By analyzing how much time your employees are spending on a particular project (billable vs. non-billable hours), you’ll be able to decide if the project is worthy.

- How much do your clients cost you? You can figure this out by reviewing the non-billable hours of your employees. For instance, let’s say that client A has requested numerous updates during the project, which is why your staff had 20 non-billable hours last month. On the other hand, client B only had minor changes, which resulted in 5 non-billable hours for your employees. It’s quite logical, client A is costing you more.

To learn how to make non-billable hours more beneficial

Just because you won’t charge your clients for these periods, it doesn’t mean that non-billable hours don’t have any value to your business and your employees.

Here are two ways you can make non-billable hours more profitable:

- Think about your branding strategy and overall company performance. As a business owner, you can organize a quick all-hands meeting every week. This would be a terrific opportunity to discuss your branding strategy, plan your future moves, and exchange your ideas on how to achieve better results. But, you can talk about potential problems within the company and try to solve them.

- Employee development. Giving your employees a chance to dedicate a couple of hours per week to gaining new skills and extending knowledge is particularly important for their overall professional development.

As you can see, non-billable hours can be beneficial for your company and your employees. The key is to pick the right amount of non-billables, which you can do by tracking the hours and analyzing the results.

To learn more about employee availability and productivity

One of the major benefits of tracking working hours is the ability to determine your and the productivity of your employees. To figure out how productive your employees are, you can compare their billable and non-billable hours. If someone has too many non-billable hours, try to find out the reasons for that (it can be due to the client’s requests or something else).

So, by reviewing their non-billable activities, you’ll be able to identify:

- Employee availability. Some of the workers might be handling only one project, while others might be dealing with several. Depending on a type of a project, some employees can end up having less or more non-billable hours. If possible, you can reorganize workload so that no one is overwhelmed with work. Also, these insights can help you make plans for future projects.

- Employee productivity. Every staff member should keep track of his/her tasks (billable and non-billable). As a business leader, it’s your job to evaluate these data. By doing so, you’ll discover how effective your employees are. Plus, you’ll know how long the project will take.

To be better at project planning

When making plans and estimates for the next project, you’ll need to identify the number of employees needed for that project. In addition, having an accurate project plan is what your client will expect, too.

In this case, we suggest you evaluate two types of non-billables:

- Macro-level. For instance, if there are too many internal meetings, this can result in more non-billable hours. Consider cancelling unnecessary meetings.

- Micro-level. Education and training are essential, but these periods should be limited to only a few hours per week or per month.

If you believe that there are some unneeded non-billables, you can reduce them. This way, your employees will have more time to focus on project activities. Thus, you can plan the whole project with ease, too.

Now that we’ve learned why tracking non-billables is essential for your firm, let’s find out more about the average number of billable hours.

How many billable hours is average?

The number of billable hours depends mostly on the type of industry. Whether you’re a lawyer, a consultant, or a freelancer, your average billables will be different.

When working in a business that charges for its services by an hourly rate, be sure to keep an eye on the utilization rate of your employees.

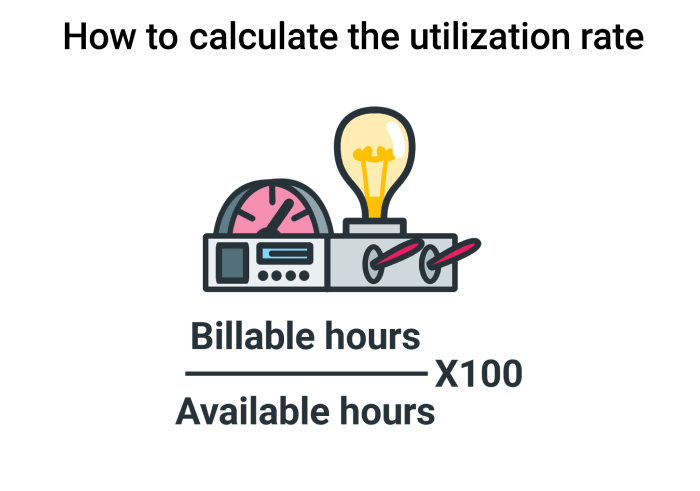

The utilization rate is the metric that shows you how much time (out of their total working hours) your workers have spent on billable work. In fact, there’s a formula you can use to calculate the utilization rate: you need to divide the total billable hours by the total hours available, then multiply that number by 100. The utilization rate is always expressed as a percentage.

So, the utilization rate presents the number of hours an employee has been productive.

💡Another way to calculate billable hours is by using Clockify. This way, you need to mark all your billable and non-billable activities. Check out this blog to learn more about this process.

Here are a few industries that monitor billables and non-billables, as well as how they calculate their utilization rate.

The utilization rate for consultants

Let’s say that there’s a consultant who bills 60 hours to clients per week (total billable hours). If there are 40 working hours in a week (total hours available), we’ll divide 60 hours by 40 hours. Then, we’ll multiply the quotient by 100.

60 ÷ 40 = 1.5

1.5 × 100 = 150

The result is 150 – 150%. So, that’s the utilization rate per week for this consultant.

Now, what about a whole fiscal year? If a consultant has a total of 2,500 billable hours, we’ll divide this number by 2,000 (total number of available hours per year).

2,500 ÷ 2,000 = 1.25

1.25 × 100 = 125

When we multiply the quotient by 100, we get the utilization rate of 125%. In the consulting industry, anyone who has the utilization rate of 150% or more is considered as a top performer.

But, there’s also a certain weakness of a utilization rate system, especially applicable to consulting businesses. Junior staff members or those who are at the lowest level of hierarchy in a consulting firm, usually have minimal chance to choose their work tasks. So, if their supervisors give them only non-billable administrative duties, the utilization rate of a junior staff member will be extremely low. Furthermore, their job will be underestimated.

The utilization rate for PR agencies

As stated in an annual survey by PR merger and acquisition consultancy Gould+Partners, PR firms improved their average hourly rates in 2018, compared to 2017.

When it comes to productivity levels in PR agencies, which is expressed by the utilization rate, it seems like productivity levels are still below perfect. For instance, the average utilization rate of presidents/CEOs of PR firms was 32.6% in 2017. One year later, there was a slight decrease – 32.4%. The similar situation happened to account executives. While their utilization rate was 87.4% in 2017, their productivity reduced in 2018 – 85.4%.

As for account managers, productivity levels went up. In 2017, their average utilization rate was 78.8%, but in 2018 – 79.3%. Aside from account managers, account coordinators also did well. Their average utilization rate was 86.6% in 2017. The next year, this number increased to 87%.

So, in the PR industry, the utilization rate depends on position within the business.

The utilization rate for law firms and legal professionals

Speaking of lawyers and legal professionals, their ideal utilization rate is 100 percent. So, their goal should be striving to achieve as high utilization rate as possible.

So, if a lawyer has 2,340 billable hours per year and a total yearly available number of 3,120 hours, we’ll divide 2,340 by 3,120.

2,340 ÷ 3,120 = 0.75

0.75 × 100 = 75

We multiply the quotient by 100. The utilization rate of this attorney is 75%.

But, besides the utilization rate, there is another metric in the law industry. It’s called the realization rate – how many hours an attorney tracks compared to the fees that are collected.

For example, if a lawyer has a total of 2,340 billable hours in a month, but he/she gets paid only for 1,755 hours, we’ll divide 1,755 by 2,340.

1,755 ÷ 2,340 = 0.75

0.75 × 100 = 75

Once we multiply the quotient by 100, the result will be the realization rate of 75%.

Administrators of law firms should track both realization rates and utilization rate of employees. In addition, there should be a monthly report that makes a comparison between the billable hours that are recorded, and fees collected. In general, when lawyers have less than 100 percent of their billable hours, this could be an indicator of a problem. These issues could happen due errors in pricing systems, or due to duplicate work, and etc.

Use Clockify to invoice and bill your clients faster

No matter your industry, you probably need to fix how you bill your work hours.

In fact, you should also reduce your non-billables and free up space for activities that help your company earn more revenue.

But how do you do that?

Introducing Clockify — a payroll tracker that does all of that for you, including invoice management.

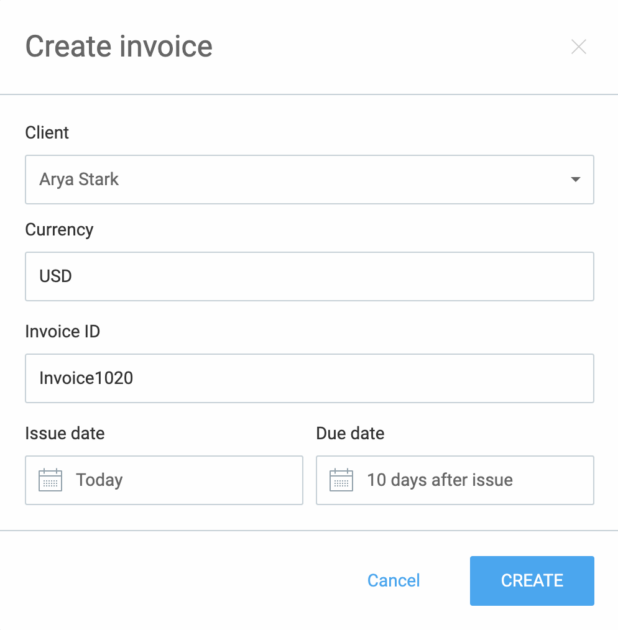

To start, go to your Invoices page and select Create invoice.

For illustration, here’s what creating your invoices looks like in action:

Creating invoices in Clockify

This feature allows you to create invoices from expenses and billable time.

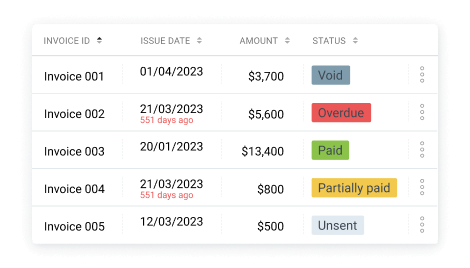

But if your client fails to pay you for the work you completed, you can check the status of your invoices. They can be marked as void, paid, unsent, sent, or any other way.

Marking invoices according to their status in Clockify

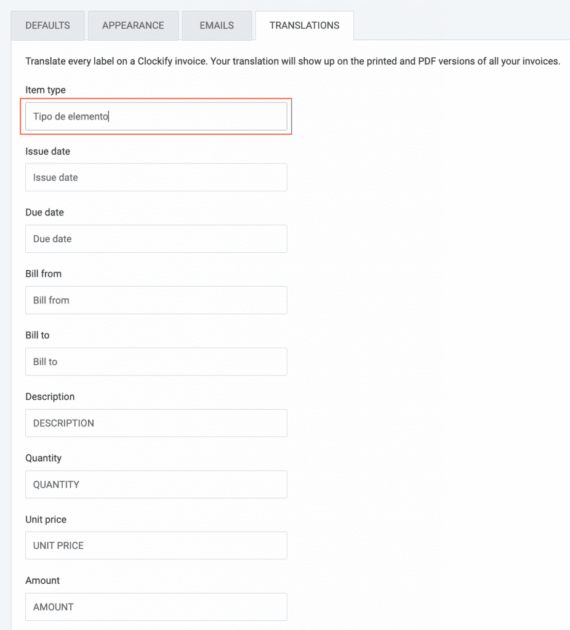

Suppose you’re working for clients who can’t speak English. In this case, Clockify lets you add translations in any language you like.

To do that, simply follow the steps below:

- Click on the Settings button on the Invoices page,

- Pick the Translations tab,

- Enter your translation in the field marked as Item type,

- Create your translations for as many relevant fields as you’d like, and

- Save your translations.

Creating translations for invoices in Clockify

Every hour counts, especially if you need to bill your client for it.

With invoicing software, you can improve your budgeting, increase client trust, and avoid overruns. A blend of these elements will help you ensure profitability in the long haul.

Start your journey toward effortless invoicing.