Wouldn’t it be nice if you could simplify your ongoing payments effortlessly?

A recurring billing system makes that possible. However, this convenient way of automating invoices has its challenges.

For instance, a single glitch could disrupt the payment flow, resulting in tech issues and delayed payments.

So, do the pros of automatic payments outweigh the cons?

In this article, we’ll define recurring billing and determine the best solution for managing recurring payments.

What is recurring billing and how does it work?

Recurring billing is an automated payment system that charges customers for your product or service at regular intervals. It generates and sends invoices on a set schedule (e.g., monthly or annually) until the customer cancels the service.

But who would benefit from automatic payment options? The answer is: Any company that offers goods or services regularly at a fixed price.

Enter subscription businesses.

A 2024 report on the subscription economy showed that subscription businesses have become big corporate players, contributing 40.8% to the overall market. They range from content streaming services to meal subscription boxes.

With the rise of subscription services, recurring billing has become hugely popular as their preferred billing solution. That’s why “subscription billing” and “recurring billing” are often used interchangeably.

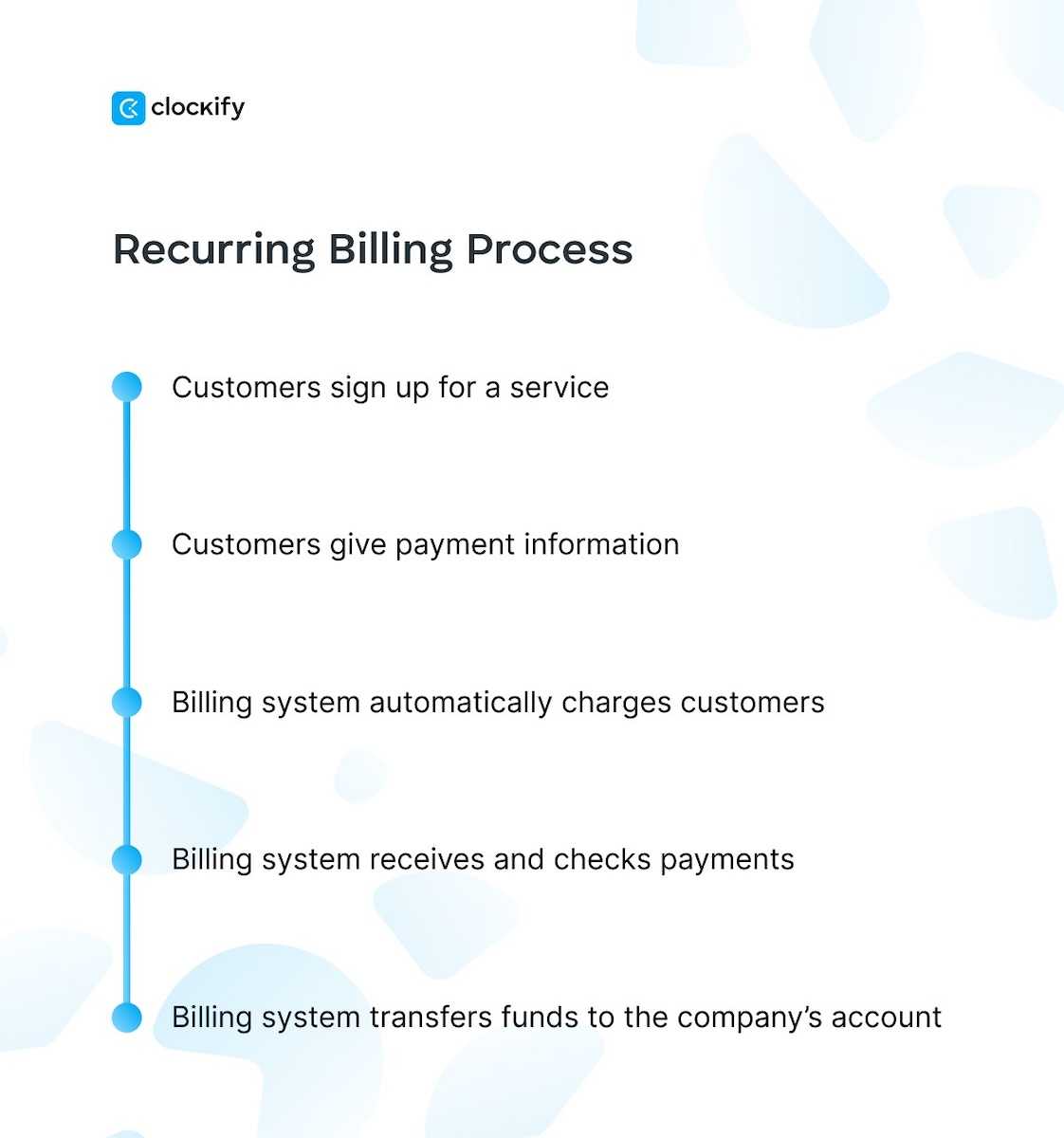

Still, how does subscription billing actually work? Accounting expert Francis Fabrizi breaks down how the system charges customers:

“Individuals sign up for a subscription or service and provide their payment details. Once enrolled, the system takes over, automatically charging the customer’s payment method (a credit card or bank account) at predefined intervals.”

Accountant Francis Fabrizi further explains how invoices are managed and processed through a payment gateway (a technology that enables secure transactions):

“Invoices are generated and sent to customers, detailing the charges incurred. The payment is then processed through a payment gateway, transferring the funds to the business’s account.”

For subscription companies, recurring charges ensure predictable income and customer convenience that requires minimal effort.

Types of recurring billing

Before setting up automatic payments, consider the types of recurring billing and their impact on your business.

According to a paper on subscription management, recurring payments are divided into:

- Fixed — the charged amount stays the same in every billing cycle, and

- Variable — the charged amount may change in every billing cycle.

In variable recurring billing, you can base payments on how much the customers use your services. Specifically, you can choose between 2 payment methods:

- Usage-based billing — charging customers based on service use. Take utility bills, for example, where you get billed for how much water you consume.

- Quantity-based billing — charging customers for the quantity they agreed upon at purchase. For instance, a software company will charge you for the number of users (seats) who can access their tool.

Interestingly, recent data reveals that subscription companies have largely shifted to usage-based payment options. According to a 2025 survey on usage-based billing, 85% of SaaS (software-as-a-service) companies either adopted this billing model or are testing it.

The reason behind this trend is simple: It promotes product-led growth where the product alone attracts and retains users. Having your users pay only for what they use makes your product or service accessible to a wider audience.

In short, fixed recurring payments guarantee stable and long-lasting income. However, variable recurring bills foster growth opportunities and flexibility.

So, how you price your services will determine your best payment method.

💡 CLOCKIFY PRO TIP

Discover the fundamental steps to pricing your goods or services correctly.

Billing cycles vs. customer churn

Every business faces the risk of customer churn — the number of customers who stop buying your services over time. Luckily, there’s a simple way to keep customers loyal to your brand — reconsider your billing cycles.

First, look into the annual billing cycle.

The annual payment cycle helps you generate more revenue and encourage customer loyalty by allowing you to offer discounts for long-term commitments. It also lowers the need for frequent payment processing — steps for managing customer transactions. Hence, you save time for more important tasks, like improving customer service.

Second, analyze the monthly billing cycle.

A monthly recurring charge offers added flexibility for both you and your clients. You can track your cash flow and predict expenses more easily. Additionally, monthly invoices promote regular interaction with customers, which builds trust in your brand.

However, a 2024 US survey on consumers’ finances found that:

- 37% of Americans missed their monthly bill payments, and

- 61% of Americans blamed inflation for their financial struggles.

For businesses, the downside of monthly payments is that they require more time and effort — even with an automated system. After all, you should still personally check invoices for any billing errors.

Over the years, maintaining customer loyalty during inflation has become an important safety net for companies. Businesses that build consumer trust through quality service fare better during hard times.

Given these factors, annual plans may be more effective at reducing customer churn than monthly plans. With more customers on the yearly plan, companies would have extra time to focus on improving their products and creating better offers.

Nonetheless, consumers’ personal needs and buying power vary. By letting them choose the billing schedule, you can improve customer experience and, ultimately, customer retention.

Pricing methods and recurring billing

Different firms use different pricing models. So, it’s important to assess if recurring bills would benefit your business financially.

As frequent users of automated invoicing software, subscription businesses can help us identify pricing methods that work best with recurring billing.

Some of the most common pricing models used by a subscription service include:

- Freemium pricing — offering a basic version of your product for free and charging for premium features. This model hooks customers with free offers and encourages them to upgrade to paid services.

- Usage pricing — charging for services based on customer usage. It’s perfect for services that cater to various customer needs.

- Tiered pricing — offering product bundles with varied prices and features. This revenue model can help you attract a wider audience.

- Perks pricing — introducing additional incentives that motivate customers to keep using the product or service, such as discounts or giveaways.

Naturally, as clients’ needs change, businesses become more open to combining pricing strategies. Here’s an example of how that works:

A software company may offer basic services for free along with 2 paid bundles that vary in the number of features. This means the business operates on a hybrid model — a blend of freemium and tiered pricing.

The bottom line: Recurring revenue businesses can grow their income by matching clients’ needs with more accessible products. To better personalize your services, you should try exploring various pricing options.

💡 CLOCKIFY PRO TIP

Discover how to build long-lasting client relationships for sustainable growth.

Pros of recurring billing

Both companies and customers are embracing recurring subscription fees for their general practicality. Here are the key advantages of this billing model:

#1: Predictable revenue is an obvious upside for business owners, making financial planning (managing resources and setting goals) easier. Regular invoices also provide business stability in changing market conditions. With a steady income, businesses can focus on brainstorming ideas to drive further growth.

#2: Customer convenience and retention are advantages that promote healthy and long business relationships, as CEO Anupa Rongala explains:

“Customers benefit from automatic payments, reducing the hassle of manual transactions. Recurring billing almost always equates to longer customer life cycles, a very important aspect for any subscription-based model.”

#3: Time and cost-efficiency are benefits often linked to automated invoicing systems. According to business experts on recurring billing, you can reduce administrative costs by using billing software that automatically generates and processes invoices. In turn, you lower the need for manual labor and save time for your employees.

#4: Affordable service pricing is another perk of implementing a recurring payment model. You can set lower prices in exchange for ongoing payments. By letting customers pay smaller amounts regularly, you can capture the attention of a larger audience.

Overall, recurring billing appeals to customers because of its simplicity and cost-effectiveness. Predictable invoices with reasonable prices also help companies cut costs and grow profits.

Cons of recurring billing

Automated invoicing software is a popular billing solution among recurring revenue businesses, but it isn’t flawless. In fact, its shortcomings could hurt your company’s reputation and profits, which warrants a closer look at them:

#1: Failed payments may occur while using this billing model, constituting a serious financial concern. In particular, failed subscription renewals can happen when a customer cancels their subscription or due to a system error. For example, the software will fail to charge an expired credit card.

#2: Additional administrative work is needed to fix payment failures. Ironically, problems caused by an automated payment system will require human intervention. Your team may end up spending excessive time correcting faulty invoices, which can cause customer distrust and delayed payments.

In this sense, manual billing can sometimes be more reliable, as filling out simple invoice templates makes it easier to catch mistakes.

#3: Complicated procedure — strong subscription billing systems are difficult to set up when you offer various discounts and bundles. Managing one-time payments is easier than recurring ones, especially for companies with customers on different pricing plans and billing schedules.

#4: Legal compliance issues may arise from using automated invoicing software. Legally speaking, you must have clear billing policies and protect your clients’ payment information. That’s why you should use compliant invoicing services that ensure data protection and fraud prevention.

On the complicated nature of laws around recurring billing, business owner Anupa Rongala notes:

“Companies will have to address the complex regulatory compliance introduced by subscription service, automatic renewal, and customer notification laws.”

In conclusion, while subscription billing works well for services with fixed prices, implementing a risk-free recurring payment system remains a challenge.

💡 CLOCKIFY PRO TIP

Follow this simple 5-step guide to ensure flawless billing.

Build a simple and safe recurring billing system with Clockify

Automated payments present a popular option for recurring revenue businesses. Yet, their questionable reliability may force you to consider an alternative.

Recurring bills have drawbacks, like invoicing errors and legal compliance risks, that could land you in hot water. For instance, customer disputes may arise over incorrect amounts.

While full automation could hurt your budget, a semi-automated system can safely manage it.

Meet Clockify — an all-in-one time and billing tool for your invoicing needs.

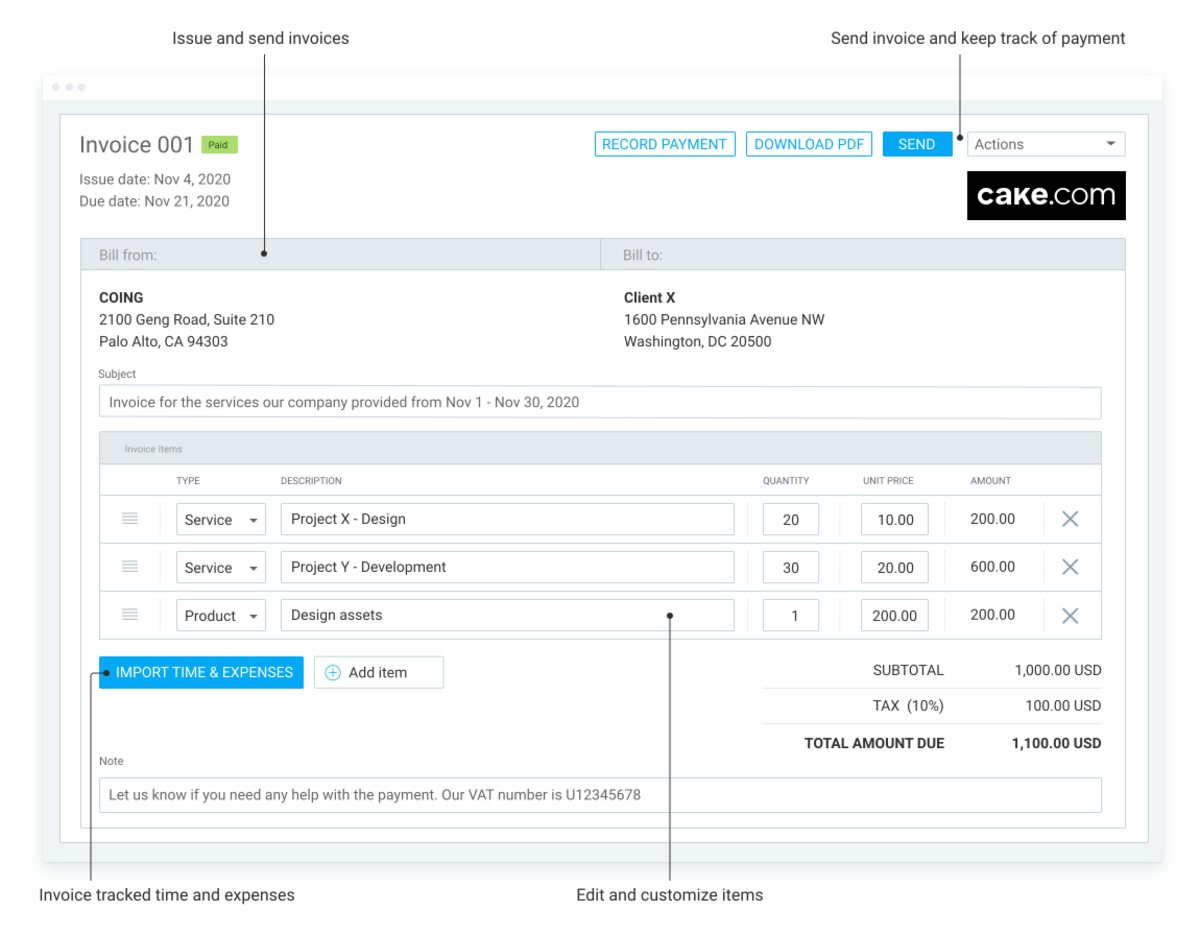

Clockify minimizes delayed payments and billing errors through quick manual invoicing. Within minutes, you can issue invoices based on tracked billable time. While generating invoices, you can add taxes or discounts, making Clockify flexible and customizable across many industries.

Our cost-effective app also offers a free plan with extensive features, allowing you to create and manage invoices for free.

Clockify’s detailed reports let you view the status of individual time entries as either invoiced or uninvoiced to avoid duplications. Bulk selection tools allow you to mark items as invoiced to keep them out of future billing. For full transparency, you can share these reports with your upper management or clients.

Our app’s powerful features also help you maintain data security. For instance, the business owner controls all permissions and can disable editing invoices for their employees. In a wider context, Clockify follows the highest data protection standards (ISO, GDPR, and SOC 2), allowing you to stay legally compliant.

Ultimately, Clockify is a safe space where time and billing combine into one optimal invoicing system for recurring revenue businesses.

Ensure your business has a clean bill of health!