Invoices are like god fairies for your business. They let you set up expectations, mark project milestones, remind your buyer of the overdue payment, and much more.

There are plenty of different types of invoices for businesses — and using them correctly is crucial for a regular cash flow.

That’s why we present detailed explanations and real-life examples of the most common invoice types.

Different types of invoices

Selling goods or services often involves diverse scenarios, from managing projects with multiple milestones to offering discounts or processing product returns.

For each of these situations, a specific type of invoice can provide clarity and efficiency in your transactions.

#1 Standard invoice

The standard invoice is a document that the seller sends to a buyer for goods or services as a formal payment request. It’s often referred to as a sales invoice or a regular invoice.

The document contains specific information about the price and quantity of the goods or services, payment due dates, tax payments, and discounts. It also includes contact information about the buyer and seller (name, address, phone number).

Example: Let’s say you’re an owner of a clothes manufacturing business and you receive an order for 10 T-shirts. You’ll then send a standard invoice to the buyer with the order details.

💡 CLOCKIFY PRO TIP

Issuing invoices doesn’t have to be complicated when you can do it automatically based on tracked time. Learn more about it here:

#2 Proforma invoice

The proforma invoice is similar to the standard invoice but it’s not legally binding — as it shows an estimate.

Before the purchase occurs, the seller can send a buyer this invoice to show the estimated price, delivery date, and other information about goods or services.

Based on the proforma invoice, the buyer can decide whether to proceed with the purchase, negotiate matters with the seller, or even back out of the purchase.

Example: A potential buyer wants to know how much it would cost to order 100 T-shirts and the estimated delivery date.

#3 Commercial invoice

The commercial invoice is a type of invoice that’s used for international purchases. It serves as tangible proof of the transaction and, as such, presents a crucial element of import and export customer clearance procedures.

Example: You’ve expanded your clothes manufacturing business globally. For out-of-state orders, you will issue a commercial invoice to the buyer.

💡 CLOCKIFY PRO TIP

If you’ve hired employees from around the world, it’s important to follow the time tracking laws. Read more about it:

Invoice types often used during projects

When a project has milestones and is expected to last for a few weeks or months, businesses should opt for the following types of invoices:

#4 Recurring invoice

The recurring invoice is a type of invoice sent periodically with the same information — except for the date. This implies that the buyer always gets the same goods or services, in the same amount, quality, and price, but — weekly, monthly, or even annually.

Sellers can use software to create invoices to send to the buyer to make invoicing less time-consuming.

Example: A construction company orders 10 employee T-shirts from you, every 3 months. So, instead of creating new invoices, you can send recurring ones.

💡 CLOCKIFY PRO TIP

Note that recurring invoices and recurring billing are different. Learn more about different types of billing here:

#5 Timesheet invoice

The timesheet invoice is a document that specifies how many billable hours the seller should charge the buyer. It’s often used for projects by companies or freelancers, but also in industries such as:

- Healthcare,

- Consulting,

- Hospitality, and

- Construction.

Precise time tracking is vital for this type of invoice to be successful, and software is used to invoice tracked time & expenses correctly.

Example: You hired an accountant who charges by the hour. At the end of the month, they will send you a timesheet invoice with the billable hours you need to pay.

#6 Interim invoice

The interim invoice is a type of invoice used in long-term projects or projects with milestones. It ensures the cash flow is steady and there’s enough money to continue the ongoing project.

This way, buyers don’t have to give the total amount of money at the end of the project, since they can pay in installments.

Example: You’ve agreed to produce 1000 T-shirts for a certain company in 3 months. At the end of the 1st month, you finish ⅓ of the entire project and ask for a partial payment to ensure the cash flow.

💡 CLOCKIFY PRO TIP

Invoices for businesses should always look neat. After all, this is one of the factors that will influence your clients to come back. Read more about it here:

Other types of invoices: Memos

There are 2 types of invoice memos — a credit memo (or credit invoice) and a debit memo (or debit invoice).

#7 Credit memo

A credit memo is a legally binding document used when the seller of a product or service owes money to the customer, or simply wants to offer a discount for the next purchase.

If the goods sold are damaged, the seller issues a credit memo, which acts as a voucher the next time a customer makes an order.

Example: If you sent 3 T-shirts and 2 of them arrived damaged, the credit memo will compensate that customer for the purchase of 2 new T-shirts.

#8 Debit memo

A debit memo, also called a debit invoice, is a legally binding document used when the seller of a product or service has undercharged the customer.

If the customer owes money to the seller due to additional service or tax change, for example, the debit memo will act as a new invoice requesting the customer to pay what’s needed.

Example: You accidentally invoiced the customer for $400, instead of $500. You then send them a debit note requesting the additional $100.

#9 Mixed invoice

A mixed invoice is a document that includes both a credit memo and a debit memo.

Example: If you, as a business owner, owe $200 to the customer, but the customer owes $300 to you, the mixed invoice will show this in detail, and request $100 from the customer.

The end-stage types of invoices

Now we’ll take a look at the invoices you’ll need to send at the end of the project or purchase, when the due date has passed.

#10 Final invoice

The final invoice is a document similar to a standard invoice. It’s sent at the end of the project to request payment for a product or service.

But, if you sent an interim invoice (or more of them) during the project, you would have to deduct the already paid amount from the final invoice.

Example: You agreed to make 1000 T-shirts in 3 months. The buyer paid a certain amount of the total price after each month. So, at the end of the 3rd month, you will send a final invoice requesting the last third of the payment.

#11 Overdue invoice

As the name suggests, the overdue invoice informs the buyer that the payment due date has passed.

This is how the buyer knows that the payment terms previously agreed weren’t fulfilled and they must pay for the total amount.

Example: You agreed to make 1000 T-shirts and receive a payment by April 15th, 2025. If you don’t receive the money by this date, you can send a past-due invoice to the buyer.

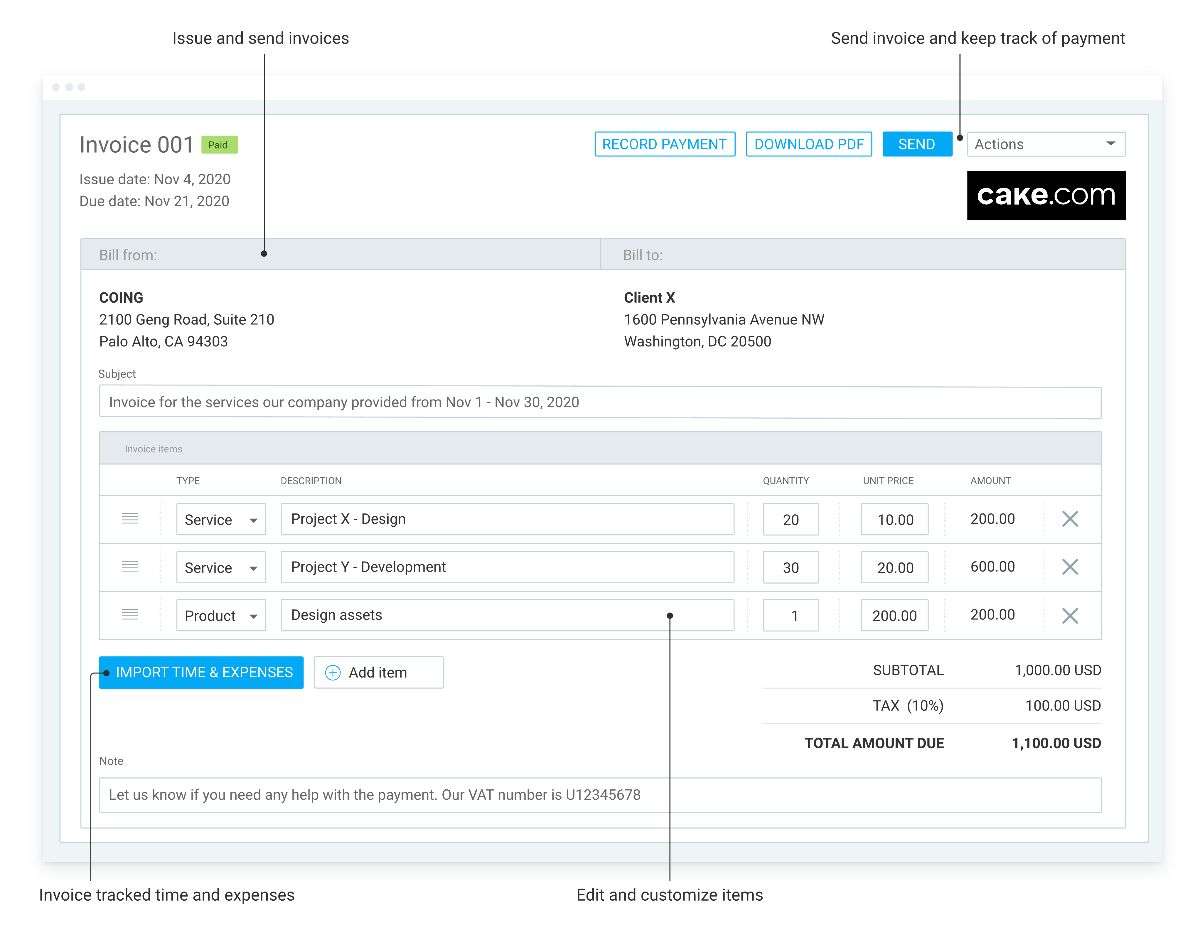

Use Clockify by CAKE.com for all types of invoicing

With plenty of different types of invoicing options, it’s vital to have powerful software that’s easy to use.

This is where Clockify by CAKE.com steps in — a reliable time tracking software that makes invoice-induced headaches disappear for good, regardless of what work sector you’re in.

Here’s just a glimpse of what you can do with the Clockify invoicing feature:

- Monitor the status — see whether the invoice is sent, unsent, paid, or void,

- Export invoices — as CSV or Excel files,

- Customize invoices — add your name, address, logo, and choose which fields to include in the invoice, and

- Send invoice emails — draft your own text for the client you’re invoicing.

What’s more, Clockify is an all-in-one solution for time tracking, scheduling, reporting, and vacation planning.

It also includes compliance safety with ISO certificate, GDPR compliance, and SOC2 report.

Make invoicing easy.