A consistent and punctual payroll process is a big part of every successful business.

While companies typically get to decide what type of pay period fits them the best and when the payday will be, this decision still has to be in accordance with FLSA laws as well as any state-specific laws in terms of payroll standards.

For that reason, in this article, we will:

- Explain the pay period definition,

- Introduce you to different pay periods and how they work,

- State how many pay periods there are in a year,

- Help you choose the best pay period, and

- Answer other relevant questions on the matter.

- A pay period is a set time frame of work when employees get paid.

- There are 4 pay periods — weekly (happens 52 or 53 times a year), bi-weekly (happens 26 or 27 times a year), monthly (happens 12 times a year), and semi-monthly (happens 24 times a year).

- Depending on the payroll calendar that a company uses and the set paydays, some years will have 53 weekly or 27 bi-weekly pay periods.

- Aside from the federal and state laws, companies should refer to their cash flow and employee preferences when choosing the best pay period.

- It’s possible to follow different pay periods for different employees and teams.

Table of Contents

What is a pay period?

A pay period is a predetermined time frame when employees receive their pay.

Companies have the freedom to choose which pay period they will establish to meet their specific business needs but the important thing is that these pay periods are consistent and recurring. Pay periods directly affect the payroll process, such as how many paychecks employees receive annually.

💡 Clockify Pro Tip

Feel free to make use of our free calculator to estimate taxes for the current filing year and calculate paychecks:

Types of pay periods

When deciding on the payroll calendar, companies should balance the administrative costs associated with payroll rounds with the general employee preference for more frequent payments. This is why — according to the US Bureau of Labor Statistics (BLS) — bi-weekly payroll run is most common.

There are 4 payroll periods:

- Weekly — 52 pay periods a year (sometimes 53 due to leap years and company’s payroll cycle),

- Bi-weekly — 26 pay periods a year (sometimes 27 due to leap years and company’s payroll cycle),

- Monthly — 12 pay periods a year, and

- Semi-monthly — 24 pay periods a year.

Employers have to understand the nature of different payment rounds so that they can choose an option that works best for them and their employees. That said, let’s elaborate on each pay period individually.

💡 Clockify Pro Tip

With this comprehensive guide, you can easily learn how to calculate payroll and work hours:

Pay period #1: Weekly pay period

Weekly pay periods recur every week, meaning that weekly pay period employees receive their paycheck at the end of a pay period. Now, even if the weekly pay cycle begins and ends on Fridays, for example, the company decides what the payday will be, be it Friday, or maybe Monday or Tuesday. The crucial thing here is that the payday always remains the same once set and that it comes promptly after the end of a pay period.

This is a common pay frequency for construction workers, food delivery and rideshare drivers, and various online jobs. A weekly payroll schedule is often used in sectors that deal with manual labor. It’s also a good solution for organizations that have to hire lower-wage workers during busy periods.

Typically, there are 52 weekly pay periods in a year. However, some years, such as those that begin on Sunday for instance, will have 53 weekly pay periods. This is affected by leap years that start on Saturday or Sunday as well as the start of common years on a Sunday, and the beginning (and end) of the company’s payroll cycle. Use the following formula to calculate the number of paychecks in a year for a weekly payroll run:

Number of Annual Paychecks = Number of Weeks in a Year

Number of 2024 Annual Paychecks = 52

Pay period #2: Bi-weekly pay period

Bi-weekly pay period lasts for 2 weeks, which means that the employees will get paid on a chosen day after those 2 weeks. For instance, the pay schedule might be set for every other Thursday.

Mid to large businesses prefer this type of payment schedule as it provides the balance between administrative expenses and satisfactory payment frequency.

Typically, there are 26 bi-weekly periods in a year, but just like in the case of weekly pay periods, leap years will have 27 bi-weekly pay periods. Use the following formula to calculate the number of paychecks in a year for a bi-weekly payroll run:

Number of Annual Paychecks = Number of Weeks in a Year / 2

Number of 2024 Annual Paychecks = 26

Best-selling author and the founder and CEO of Z-Branding, Kraig Kleeman, believes that bi-weekly pay periods ensure financial stability:

“Paying our employees every two weeks balances regular paychecks and administrative simplicity. It ensures that our staff receives consistent income, which is essential for their financial stability. Plus, it’s easier for us to manage than a weekly schedule, providing a more frequent payout than monthly paychecks.”

Pay period #3: Monthly pay period

Monthly pay periods last for a whole month. This means that the employers will pay their employees on a specific date once a month. That way, workers would get their paycheck on a specific date in February (for instance February 1st) for the pay period that lasted for the entire January, and so on. In case the pay date falls on a weekend, typical practice is to pay the employees on Friday when the pay date falls on Saturday, or on Monday, when the pay date falls on Sunday.

This particular pay period is not the most popular option, especially in lower-wage sectors due to longer pay intervals.

There are 12 monthly pay periods in a year. Use the following formula to calculate the number of paychecks in a year for a monthly payroll run:

Number of Annual Paychecks = Number of Months in a Year

Number of 2024 Annual Paychecks = 12

Speaking of monthly payments, we got some insights from Pamela Phillips, founder and MD at de Jong Phillips, who believes that monthly pay periods remain the most efficient due to several reasons:

“Monthly pay periods are the most efficient as it means less payroll processing time, less reporting to HMRC, fewer transactions to process through the accounting system, and it is easier to work out when and how something went wrong with the payroll if it ever does go wrong.”

Pay period #4: Semi-monthly pay period

Companies that use semi-monthly pay periods pay their employees twice a month. These are typically 2 predetermined dates for every month, such as the 10th and the 25th, for example.

This is a great solution for companies that wish to avoid the challenge of extra bi-weekly pay periods in certain years (calendar years where they would have an additional payroll round due to leap years and the specific start day of the payroll schedule), but still want to provide more adequate pay frequency. However, the potential issue with a semi-monthly payroll schedule is that the chosen pay dates don’t always fall on weekdays. As is the case with monthly payments, pay dates that fall on Saturdays should be processed the day before, while those that fall on Sundays get processed the following day.

There are 24 semi-monthly pay periods in a year. Use the following formula to calculate the number of paychecks in a year for a semi-monthly payroll run:

Number of Annual Paychecks = Number of Months in a Year x2

Number of 2024 Annual Paychecks = 24

💡 Clockify Pro Tip

Check out some known advantages and disadvantages of both salary and hourly employment:

How many pay periods are in 2024?

In 2024, there are:

- 52 weekly,

- 26 bi-weekly,

- 24 semi-monthly, and

- 12 monthly pay periods.

According to the National Finance Center’s website, longer years with extra pay periods are leap years that begin on Saturday or Sunday as well as common years that begin on Sunday. This is why, for companies that follow this principle, 2024 will have no additional weekly or bi-weekly payments, even though it’s a leap year.

Considering this principle, 2023 — when January 1st fell on Sunday — was more likely to have 53 weekly and 27 bi-weekly payroll rounds compared to 2024, even though it wasn’t a leap year. On the future side, 2025 will have 52 weekly and 26 bi-weekly pay periods, just like 2024. Semi-monthly and monthly periods always stay the same for all years.

💡 Clockify Pro Tip

Calculating how many work days there are in a year can help you organize your payroll schedule as well:

What are the years with extra pay periods?

A year can have 27 bi-weekly or 53 weekly pay periods if it starts or ends on a specific day of the week, depending on the payroll calendar’s start date. This is typically the case in years with 53 Thursdays (when the pay period ends on a Thursday), as most companies process their payroll on this day. Still, this can also apply to any day of the week depending on the company’s specific payroll schedule.

Years with extra weekly pay periods

To have 53 weekly pay periods, the year must start or end on the same weekday as the payroll day or start on the day before the payroll day if it’s a leap year. For example, 2021 was a common year that started on Friday, and it had the potential for 53 weekly pay periods for payrolls ending or starting on Friday.

Future years with extra pay periods

Given these principles, here are a few years to come that are likely to have 27 bi-weekly or 53 weekly pay periods, depending on the payroll’s start day:

- 2025: A common year starting on Wednesday, could potentially have 53 weekly pay periods for payrolls ending or starting on Wednesday.

- 2027: A common year starting on Friday, could potentially have 53 weekly or 27 bi-weekly pay periods for payrolls ending or starting on Friday.

- 2028: A leap year starting on Saturday, could potentially have 53 weekly pay periods for payrolls ending or starting on Saturday or Sunday (paydays would still be on Fridays or Mondays in this scenario).

- 2029: A common year starting on Monday, could potentially have 53 weekly pay periods for payrolls ending or starting on Monday.

- 2030: A common year starting on Tuesday, could potentially have 53 weekly pay periods for payrolls ending or starting on Tuesday.

- 2032: A leap year starting on Thursday, could potentially have 53 weekly pay periods for payrolls ending or starting on Thursday or Friday.

This list assumes a starting or ending payroll day matching the first or last day of the year or its adjustment for leap years. Actual results can vary based on the specific start day of a company’s payroll schedule and how holidays are handled. To keep track of pay periods properly, always refer to your organization’s specific payroll schedule.

💡 Clockify Pro Tip

Learn all about paid holidays in the US and the possibility to enjoy time off without cutting your income:

How do I choose the best pay period for my company?

Many factors should go into deciding the best pay schedule for your company and employees. Therefore, keep in mind the following:

- Your employee preferences,

- Whether you have hourly or salaried employees,

- Employee taxes and benefits,

- Company’s cash flow, and

- Your state’s payment requirements.

Keep in mind your employees’ preferences

Always survey your employees on the matter of ideal pay frequency. That way you can take into account their wishes and do whatever you can to make everyone happy.

Think about different types of employment

To choose the best payroll schedule you have to consider whether you want to have hourly or salaried employees, or both. What makes more sense for your business? Weekly pay rounds are more suitable for hourly workers, while salaried employees typically follow bi-weekly, semi-monthly, or monthly payroll schedules. Check their income for each pay period and type of work. Discuss this with your accounting team so that you can work out the processing costs, employee benefits, and taxes for each payment period as well.

Compare this information with your state’s payment requirements. The laws are not the same for every state, which you can check on the Department of Labor’s website. For instance, not all states allow a monthly payroll schedule.

Consider the company’s cash flow and administration

The actual business income is a big determining factor, too. Companies should consider their cash flow and other financial obligations before they decide on the best pay period for their organization. The ideal payment schedule should coincide with the high-revenue periods.

In terms of payroll for smaller businesses, bi-weekly pay periods may be more suitable, while larger companies may prefer semi-monthly or monthly pay periods. Weekly pay intervals are more suited to hourly workers.

The founder and CEO of Premier Staff, Daniel Meursing, tells us that his company decided on the best pay period while trying to balance more frequent pay intervals with associated costs:

“When determining the best pay period for our team, we prioritize finding a balance between providing regular income to employees and minimizing administrative burdens. Through surveys and feedback collection, we gather insights into our team’s preferences regarding pay frequency.”

A similar process was also noted by Matt Little, Managing Director at Festoon House. When deciding on a pay period, they considered employee satisfaction and administrative efficiency:

“We found that while some employees favored weekly pay periods for more frequent access to funds, others preferred the stability and predictability offered by monthly pay periods. Plus, we considered the administrative burden associated with processing payroll more frequently versus less frequently, balancing efficiency with employee preferences.”

FAQs about pay periods

Interested in learning more about pay periods? In the following section you will find more info about pay dates and further explanation of some pay period particularities.

What is the difference between a pay period and a pay date?

Unlike a pay period, which is a set length of time for which employees get paid, a pay date is the actual date when employees receive the paychecks that they earned for a specific pay period. For example, if a company uses a monthly pay period, the pay period would be the month of April, but the pay date could be the 1st of May or the first Monday in May.

Can I choose any day of the week as a pay period date?

Companies are allowed to choose any day of the week for their pay date as long as that date comes promptly after the pay period.

💡 Clockify Pro Tip

Streamline your payroll process with Clockify’s customizable payroll templates:

Can I change the previously chosen pay period during the year?

Yes, it’s possible to change previously chosen pay periods.

However, businesses need to have a legitimate reason for this change. It’s crucial to stay compliant with FLSA wage and labor laws. Also, refer to your state laws to ensure that the new frequency of the pay periods is allowed. Once everything is in order, notify your employees before proceeding with implementing the change.

Can I follow different pay periods for each of my employees?

Companies can follow different pay schedules for their employees if they find that to be the most efficient practice. It would be best to assign pay periods based on certain groups, such as different teams, employee locations, part-time vs. full-time employment, etc. This practice is more common and potentially useful in larger companies. However, don’t go overboard with too many varying pay periods as it can become difficult to track them all.

What to do if an employee starts working in the middle of a pay period?

The employers keep track of the hours and days worked, so if an employee starts working in the middle of the pay period, they will receive a paycheck at the end of that pay period and that reflects the number of hours worked.

What is the difference between bi-weekly and semi-monthly pay periods?

Bi-weekly pay periods occur 26 times a year (or 27) as the employees get paid every other week out of 52 weeks (or 53) in a year. Semi-monthly pay periods happen twice a month out of 12 months, so 24 times a year. Unlike bi-weekly payments, the number of semi-monthly periods always remains at 24 as there are always 12 months in a year.

💡 Clockify Pro Tip

Finding a reliable payroll software can automate the entire payroll processing, saving both time and money:

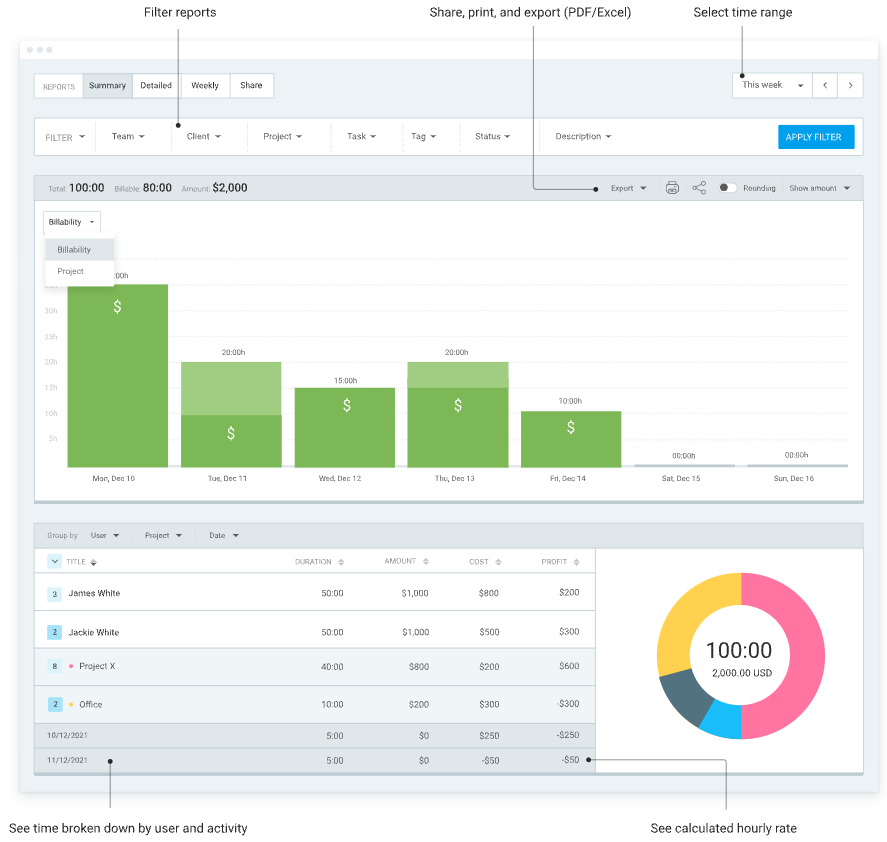

Track your pay periods with Clockify

Choosing the best pay period for your company is a secret ingredient to running a successful business. The key is to efficiently keep track of every employee’s work hours.

If you’re an employer and you’re not sure how to manage your staff’s work hours and payments, give Clockify a try to stay on top of your payroll schedule. It’s a free app used for tracking time and payroll that can help you automate the payroll calculation process.

Clockify’s payroll tracker feature will let you keep track of:

- Billable hours,

- Time,

- Invoices,

- Expenses,

- Clock-ins and clock-outs, as well as

- GPS location.

Using Clockify’s payroll feature involves a few straightforward steps:

- Create an account to start tracking payroll hours,

- Set up projects to categorize tasks and clients, and invite your employees to your workspace, assigning them roles and responsibilities, and

- Establish hourly rates for employees, projects, and tasks — employees can log their work hours using a timer, manually, or through a timesheet view.

You can track overtime, generate reports analyzing hours worked, and finally, export these payroll hour reports in various formats like PDF, CSV, or Excel for further processing.

Why miss out on the benefits of payroll tracking and automation when you can use an app to handle all the work and stress for you?