Alabama Labor Laws Guide

Ultimate Alabama labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Alabama Labor Laws FAQ | |

| Alabama minimum wage | $7.25 |

| Alabama overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Alabama breaks | Breaks not required by law |

Alabama wage laws

Alabama is one of the few US states without labor laws concerning wages. In such cases, federal rules established by the Fair Labor Standards Act (FLSA) stand.

The following are the regulations concerning the:

- State minimum,

- Tipped hourly wage, and

- Youth minimum wage in Alabama.

| ALABAMA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $4.25 |

Alabama minimum wage

Since Alabama doesn’t regulate minimum wages, employees are entitled to the federal minimum wage of $7.25 per hour, as defined by the FLSA.

Tipped minimum wage in Alabama in 2025

Regarding the employees whose compensation primarily comes from tips, the federal rules still apply. According to the FLSA, a tipped employee is “any employee engaged in an occupation in which he customarily and regularly receives more than $30 a month in tips.”

The minimum hourly wage for tipped employees in Alabama is $2.13. However, the total compensation amount per hour must be at least $7.25, including tips.

This means that an employer is allowed to take a maximum tip credit of $5.12 per hour from an employee.

Moreover, if a tipped employee doesn’t earn enough to reach the minimum wage of $7.25 per hour, the employer must pay the difference to bring their earnings up to the minimum wage.

Alabama subminimum wage in 2025

According to federal law, employers in Alabama can pay employees under 20 years of age a minimum wage of $4.25 per hour for the first 90 days of employment.

However, full-time students working in retail, agriculture, or at colleges and universities are entitled to 85% of the minimum wage, which translates to approximately $6.16 per hour in Alabama.

Moreover, the employer must obtain a certificate to employ a full-time student.

Also, full-time students can work up to 20 hours a week (8 hours a day) during school time and 40 hours per week when school is not in session.

Alabama payment laws

The state of Alabama doesn’t have payday regulations. Instead, here are the most common pay frequency schemes in the USA:

- Weekly — Employees are paid once a week (52 paychecks per year),

- Biweekly — Employees are paid every other week (26 paychecks per year),

- Semi-monthly — Employees are paid twice a month (24 paychecks per year), and

- Monthly — Employees are paid once a month (12 paychecks per year).

However, Alabama has a special regulation for public service transportation corporations. Such corporations that employ 50 or more workers are required to make payments to their employees every other week or biweekly.

Alabama overtime laws

The FLSA stipulates that employees who work more than 40 hours a week are entitled to receive overtime pay at one and a half (1.5) times their regular pay rate.

Overtime compensation is calculated on a workweek basis, and employers must pay overtime work on the regular payday.

The FLSA does not require employers to pay overtime for work performed on weekends, holidays, night shifts, or any other designated rest day.

However, if an employer and an employee mutually agree to work overtime on those days, the employer is obliged to pay overtime for such hours.

Additionally, employees aged 16 and above are permitted to work unlimited overtime hours.

🎓 Track Alabama overtime with Clockify

Overtime exceptions and exemptions in Alabama

Starting from January 1, 2025, according to the U.S. Department of Labor (DOL), employees who earn less than $1,128 per week will be considered nonexempt employees. This further implies that they will also be eligible for overtime pay.

This threshold is expected to increase every 3 years to keep pace with changes in the labor market.

Those who are exempt from overtime pay include:

- Employees with high compensation performing office or non-manual work who make more than $151,164 a year,

- Executives who are compensated on a salary basis and earn no less than $1,128 weekly,

- Administrative workers who receive a salary and earn no less than $1,128 per week,

- Learned and creative professionals who receive a salary and earn no less than $1,128 per week,

- Computer employees who work on a salary basis and earn no less than $1,128 weekly, and

- Outside sales employees.

The exemptions don’t apply to “blue-collar” workers, police officers, firefighters, paramedics, rescue workers, and similar community workers.

Also, overtime rules don’t apply to employees with varying schedules. Instead, the Fluctuating Workweek Method (FWW) is used.

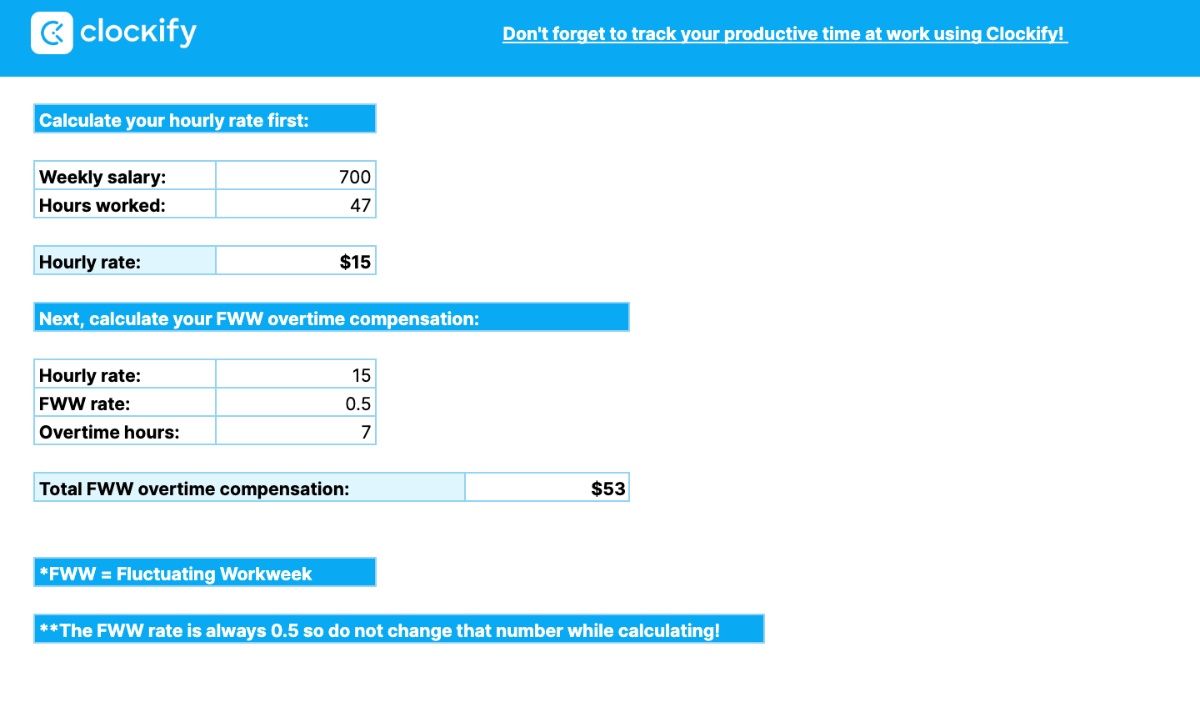

Fluctuating Workweek Method (FWW) in Alabama

As of May 20, 2020, salaried employees whose working hours fluctuate on a weekly basis are also entitled to overtime pay.

This work schedule is referred to as the “fluctuating workweek”.

For instance, a salaried, non-exempt employee will be paid $900 a week, regardless of whether they work 40 hours per week or fewer hours, such as 35.

If the same employee works more than 40 hours per week, they are entitled to an overtime premium of one-half (0.5) times the employee’s hourlyrate for each overtime hour, according to the FWW rule.

Employees are eligible for the FWW method if they meet the following criteria:

- Work hours vary from week to week,

- Receive a fixed salary no matter how many hours are worked per week,

- Hourly rate equals or exceeds the federal (or state) minimum wage, and

- Have a clear understanding of working terms and conditions.

In addition, employees who use the FWW are entitled to additional pay or benefits such as:

- Bonuses,

- Commissions, and

- Hazard pay.

Example of the Fluctuating Workweek Method (FWW) in Alabama

Let us say an employee has a fixed weekly income of $900, and their work hours for the previous month look like this:

- Week 1: 38 hours worked,

- Week 2: 40 hours worked,

- Week 3: 47 hours worked, and

- Week 4: 40 hours worked.

Since Week 3 had more than 40 work hours, such an employee is eligible for overtime compensation based on the FWW rule.

To calculate overtime compensation, first calculate the hourly rate.

Since employees who use the FWW method are salaried workers, they should simply divide their weekly salary by the number of hours worked for that specific week to calculate the hourly rate.

Weekly salary / Number of hours worked weekly = Hourly rate

$900 / 47 = $19 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

Therefore, the overtime compensation for Week 3 is:

$19 per hour x 0.5 = $9.5 for each overtime hour worked

Total overtime compensation for Week 3:

$9.5 x 7 overtime hours =$67

🎓 Fluctuating Workweek Calculator (Google Sheets)

Labor laws on breaks in Alabama

The state of Alabama adheres to federal law, as there are no state-specific break laws. Typically, the number and duration of breaks are determined through a mutual agreement between employer and employee.

Generally, most employers opt to offer breaks to enhance employee morale and productivity. According to the FLSA, an employer isn’t required to provide a lunch or coffee break during working hours.

Exceptions to labor laws on breaks in Alabama

According to the FLSA, when an employer provides a short break (5 to 20 minutes), they are required to compensate the employee for such breaks as regular work hours.

Still, the state of Alabama doesn’t regulate meal breaks. Moreover, meal breaks that last at least 30 minutes are not considered work hours — hence, they aren’t compensable. These are called rest periods, when employees must be completely relieved from their duties.

However, a meal break is compensable if a factory worker, who is required to remain at their machine while working, takes a meal break.

Alabama lactation laws in the workplace

Again, there’s no Alabama labor law that requires employers to provide breastfeeding support in the workplace. Therefore, federal law requires employers to providea reasonable break and a designated room for employees to express breast milk at work.

The room used for pumping breast milk at work has to be:

- Shielded from view,

- Free from intrusion from coworkers and the public,

- Available when an employee needs it, and

- A separate room rather than a bathroom.

Moreover, the new PUMP Act expands these rights to a few more eligible employees, such as:

- Agricultural workers,

- Nurses,

- Teachers,

- Truck and taxi drivers, and

- Home care workers and managers.

Breastfeeding employees are entitled to take breaks to pump at work for 1 year after thechild’s birth, whenever they need to do so.

This break time isn’t compensable unless the employee uses the compensated break to pump milk.

Alabama leave requirements

The state of Alabama provides the following types of leave:

- Required leave, and

- Non-required leave.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Holiday leave (public employees) — When it comes to public employees, Alabama state offices must be closed on federal and state holidays. However, employees are given compensatory leave if a state office works on said holidays. Employees who are unable to use their compensatory leave must be compensated at their customary pay rate. |

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave (FMLA) can be granted for the following cases:

All employers must grant their employees up to 12 weeks of unpaid leave for severe health conditions, the birth of a child, or to care for an ill family member. However, to obtain such leave, an employee must have worked at least 12 months (i.e., 1,250 consecutive work hours). |

| ✅ REQUIRED LEAVE |

|

Jury leave — Employers must grant paid leave to full-time employees when they receive a summons to serve on a jury. An employee cannot be punished in any way for serving as a juror. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — According to the FLSA, employers don’t need to pay for time not worked, including vacation leave, sick leave, or holidays. If an employee is entitled to paid leave of any kind, it’s typically a mutual agreement between the employer and the employee. If promised, the employer has to grant the employee vacation, and the conditions must comply with the employment contract. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — The above rules also apply to sick leave; employers aren’t required to provide employees with paid or unpaid sick leave benefits. |

| ✅ REQUIRED LEAVE |

|

Voting leave — Employers must grant up to 1 hour of unpaid leave to employees registered to vote. If the polls open 2 hours before an employee’s shift or 1 hour after the shift ends, the employer doesn’t need to provide time off, or may specify the hours during which the employee may take the leave. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave (private employers) — Private employers aren’t required to provide employees with holiday leave — either paid or unpaid. Additionally, employers aren’t required to pay premium wage rates if employees work on holidays. However, employers can offer these benefits to attract and retain employees. Both sides should be well-informed about their rights and obligations to maintain a healthy work environment. |

| ✅ REQUIRED LEAVE |

|

Military leave — Active military members are entitled to paid leave by private and public employers when called to duty. Although this statute applies to both public and private employees, the Alabama Supreme Court ruled that requiring private employers to pay for military leave would violate the state constitution. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave — Employers must allow employees emergency response leave if:

These employees are permitted to leave work without losing pay, overtime, vacation, or sick leave, as long as the absence doesn’t exceed 15 workdays in a 12-month period. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — Employers aren’t required to provide employees with bereavement leave. However, this doesn’t apply to individuals who are subject to the provisions of the state Merit System, legislative personnel, officers, and personnel of the Legislative Reference Service. They are granted up to 3 days of bereavement leave with pay. |

Labor laws for minors in Alabama

Alabama labor laws for minors do have some distinctions as opposed to the federal child labor law.

Employers wishing to employ individuals under 18 must obtain and display a proper Child Labor Certificate(s) on every premise where a person under 18 is employed. There are 2 types of certificates:

- Class I Certificate — for minors aged 14 and 15 (this certificate must be obtained and renewed annually), and

- Class II Certificate — for minors aged 16, 17, and 18.

Additionally, minors aged 14 and 15 must obtain an Eligibility to Work from their school, which the employee must retain for reference.

🎓 Apply for or Renew a Child Labor Certificate

Work time restrictions for Alabama minors

If an employer wishes to employ minors, several worktime restrictions need to be followed.

Time restrictions for minors aged 14 and 15 when public schools are in session:

- Up to 3 hours of work on a school day,

- Up to 8 hours of work on a non-school day,

- Up to 6 days of work weekly,

- Up to 18 hours of work weekly total,

- No work before 7 a.m. or after 7 p.m. on any day of the week, and

- No work during school hours (8 a.m. — 3 p.m.).

Time restrictions for minors aged 14 and 15 when public schools are NOT in session:

- Up to 8 hours of work a day,

- Up to 6 days of work weekly,

- Up to 40 hours of work weekly, and

- No work before 7 a.m. or after 9 p.m. each day.

Time restrictions for minors aged 16, 17, and 18 when public or private schools are in session:

- No work before 5 a.m. or after 10 p.m. on a school day (or the night preceding a school day).

Time restrictions for minors aged 16, 17, and 18 when public or private schools are NOT in session:

- No hour restrictions during this time.

Breaks laws for minors in Alabama

According to the Alabama Child Labor Law, minors aged 14 and 15 who work 5 consecutive hours are entitled to a documented 30-minute break.

For minors over 16, the Alabama Child Labor Law doesn’t require any break whatsoever.

Prohibited occupations for minors in Alabama

The Alabama Child Labor Law prohibits minors from working in any occupation deemed hazardous. The hazardous occupations are grouped into 2 categories:

- Occupations prohibited for minors under 16 include operating any sandpaper or wood polishing machinery, picking wool or cotton, manufacturing paints, colors, etc, and

- Occupations prohibited for minors under 18 include wrecking, shipbreaking, operating machinery over 3 tons gross weight, manufacturing alcoholic beverages, etc.

🎓 Hazardous occupations for Alabama minors

Note: These regulations don’t apply to minors aged 16 or 17 who are part of a work-study, cooperative education, or similar programs where employment is an integral part of the course of study and is registered by the Bureau of Apprenticeship and Training of the United States Department of Labor or to the employment procured and supervised through the Alabama Department of Education and approved by the Department of Labor.

Furthermore, minors whose parents are business owners are NOT exempt from the Alabama Child Labor Law.

Working near alcoholic beverages

Minors under 21 aren’t allowed to serve or dispense alcoholic beverages in any kind of establishment where alcoholic beverages are sold, served, or dispensed.

Minors aged 16 and above can work as:

- Busboys,

- Dishwashers,

- Janitors,

- Cooks,

- Hostesses, or

- Seaters.

However, minors aged 14 or 15 whose immediate family members are the owners or operators of such establishments can be employed, provided they do not serve, sell, or dispense alcoholic beverages.

Record keeping and posting requirements

Each establishment that employs a minor under 19 must keep or display the following documents in a conspicuous place on the premises:

- Printed notice called Time Records, which states the maximum number of hours a minor is permitted to work each day during a workweek, break times, and start/end times.

- Employee Information Form that includes the employee’s personal information, date of hire, and school of attendance.

- Child Labor Certificate (Class I or Class II Labor Certificates).

- Proof of Age, including a copy of a birth certificate, driver’s license, or an ID card.

The Department of Labor has the right to enter, without prior notice, a business establishment that employs minors to make sure that everything complies with the act.

Penalties for employers (child labor laws)

If an employer violates or refuses to comply with the said regulations, the Department of Labor (DOL) may impose penalties of up to $100,000 or even imprisonment, depending on the severity of the violation.

Alabama hiring laws

Under federal law, each employer is required to comply with specific general provisions regarding hiring in Alabama. These provisions primarily apply to prohibited employment practices during the hiring process, such as discrimination.

For instance, under the Alabama Age Discrimination in Employment Act (AADEA), it’s unlawful to discriminate against individuals aged 40 and older while hiring, compensating, training, licensing, and similar.

Interestingly, another statute allows employers to have a “voluntary veterans’ preference” over other applicants during the hiring process.

Furthermore, job applicants who have been charged with a misdemeanor criminal offense, a traffic violation, or a municipal ordinance violation have the right to “expunge records” — provided that:

- The charge is dismissed with prejudice,

- A grand jury has not billed the charge,

- The person proves innocence, and

- The charge was dismissed without prejudice more than 2 years ago, and the person has not been convicted of any other felony in the preceding 2 years.

As soon as the charge is expunged, the job applicant is no longer required to disclose any information about the charge or its expungement during the job application process.

Finally, people with disabilities or visual impairments in Alabama have an equal opportunity to be employed. However, this only applies to public services such as public schools, political subdivisions of the state, etc. — provided that the person's disability does not prevent their job performance.

Right to work law in Alabama

A “right-to-work” state is a state where employees are allowed to make decisions whether or not to join a labor union. No one can force an employee to join a labor union as a condition of employment. Alabama adopted a right-to-work statute in 1953.

Any labor organization, employer, supervisor, executive, or administrative employee in Alabama isn’t allowed to:

- Force an employee to join or refrain from joining any labor organization, association, union, group, or similar as a condition or continuation of employment,

- Force or threat of violence to person or property,

- Collect, receive, or demand a fee or sum of money from any person as a condition for employment or getting a work permit, and

- Forbid an individual to work, go on strike, or have the freedom of speech.

Even though municipal or state firefighters in Alabama have the right to join and participate in labor organizations, they aren’t allowed to strike against the state or any state municipality or be a member of an organization that asserts the right to strike.

If any person or labor organization violates any of the provisions stated above, a penalty of not more than $1,000 for each such violation will be imposed, or imprisonment at hard labor of not more than 12 months.

Alabama termination laws

Most US states, including Alabama, don’t need a specific cause for dismissing an employee.

Under Alabama law, employees can be fired at any time and for no reason. This is called the “at-will doctrine”. Moreover, employees cannot file a suit for this kind of employment termination.

However, no employer can use this doctrine to fire someone based on factors such as race, age, or ethnicity.

If an employee is fired for one of the aforementioned reasons, this is referred to as wrongful termination. In this case, the employee can sue the employer and eventually collect compensation.

Moreover, an employee may choose to quit their job at any time for any reason without any losses, damages, penalties, or similar consequences.

Alabama final paycheck

Alabama doesn’t have labor and employment laws that dictate specific rules about the employee’s final paycheck. Consequently, according to federal law on last paycheck — employers aren’t required to give employees their final paycheck immediately.

However, this rule does not apply to sales representatives in Alabama. In that case, an employer must pay out any commissions to a sales representative within 30 days after the discharge, resignation, or expiration of a contract.

Any other concerns, such as unused paid leave or other benefits, are matters of mutual agreement between the employer and the employee.

Health insurance continuation in Alabama (COBRA)

Since Alabama doesn’t have a law that protects full-time employees and their health benefits after the termination of employment, the federal COBRA law comes to their aid.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) protects full-time employees who have terminated their employment due to job loss (voluntary or involuntary), death, transition between jobs, and similar reasons. Said employees can retain their health insurance for an additional 18 to 36 months, depending on the individual case.

However, this only applies to businesses with 20 or more employees.

Occupational safety in Alabama

Since no state law governs workplace safety, federal regulations provide protection for private-sector employees in Alabama.

Therefore, the Occupational Safety and Health Administration (OSHA) in Alabama requires that each private-sector employer provide employees with safe working conditions free from hazards that can cause death or serious physical harm.

The authorities are allowed to enter any facility during regular working hours and inspect its devices, machines, working conditions, and similar areas to ensure that the environment is free from any hazards.

Moreover, any employee who believes a safety violation has occurred in the workplace may submit a written notice to the authorities and request an inspection. This act protects employees who file a complaint from any disciplinary action.

If an employer violates any of the regulations under this act, a civil penalty of up to $70,000 may be imposed for each violation.

🎓 OSHA penalties for employers

Here are the types of work hazards recognized by OSHA:

- Biological hazards — mold, pests, insects, etc.,

- Chemical and dust hazards — pesticides, asbestos, etc.,

- Physical hazards — noise, radiation, temperature extremes, etc.,

- Safety hazards — slips, trips, falls, etc.,

- Ergonomic hazards — repetition, lifting, awkward postures, etc., and

- Psychosocial hazards — things that cause stress.

Miscellaneous Alabama labor laws

Certain labor laws don’t fall under any of the categories above, so we have placed them in the miscellaneous section.

The most significant include the following.

Alabama whistleblower laws

Alabama has statutes that encourage and shield public and private employees who come forward about illegal conduct.

Therefore, an employer cannot retaliate against an employee for reporting any fraudulent behavior within an institution. The code states explicitly: “Employee not to be terminated solely for action to recover benefits nor for filing a notice of safety rule violation.”

Furthermore, no one is allowed to threaten, harass, or discriminate against a person who “blows the whistle” and reports wrongdoing to the authorities within an institution.

What’s more, state employees are protected from being discharged, transferred, or discriminated against if they report any kind of violation of the law.

However, Alabama doesn’t have a state False Claims Act, so a whistleblower can file a federal False Claims Act instead.

The federal False Claims Act imposes liability on individuals or organizations that make a fraudulent record or falsely bill the government. It also encourages employees to file “qui tam” actions — lawsuits filed by private citizens who have strong evidence against those who conspire to commit an offense against the government.

A whistleblower can even receive a reward as an incentive to report fraudulent activities against the US government.

Alabama record-keeping laws

Each employer is responsible for keeping certain records, books, and accounts for service contract holders, i.e., employees.

Therefore, service contracts must include the following:

- Copies of each employee’s contract,

- Personal information, including the name and address of each service provider holder,

- A list of the locations where service contracts are marketed, sold, or offered for sale, and

- Recorded claims files.

The employer is required to retain all records for at least 3 years after the termination or expiration date of the contract.

Frequently asked questions about labor laws in Alabama

Throughout this guide, our goal was to provide all the necessary information about labor laws in Alabama. However, we have included an FAQ section to make this guide even more comprehensive.

Is it illegal to work 8 hours without a break in Alabama?

No. Regarding meal and rest breaks, the state of Alabama follows federal law. Under the Fair Labor Standards Act (FLSA), employers are not required to provide employees with breaks during work hours.

How many hours can you legally work in a day in Alabama?

In Alabama, there’s no time limit for work hours. Neither the state of Alabama nor federal law restricts the number of working hours an employee is allowed to have. Employees over 16 can work as many hours as they want.

What are the termination laws in Alabama?

In Alabama, there are no termination laws. This is because Alabama follows the at-will doctrine, which allows employers to terminate employees at any time, without providing a reason. Nonetheless, wrongful termination can occur if an employer fires an employee due to factors such as race, gender, age, or ethnicity.

How are employees protected in Alabama in the case of a layoff?

In the event of a layoff, employees in Alabama are protected under the Worker Adjustment and Retraining Notification (WARN) Act. Under the Alabama WARN Act, employees must receive a 60-day notice before being laid off.

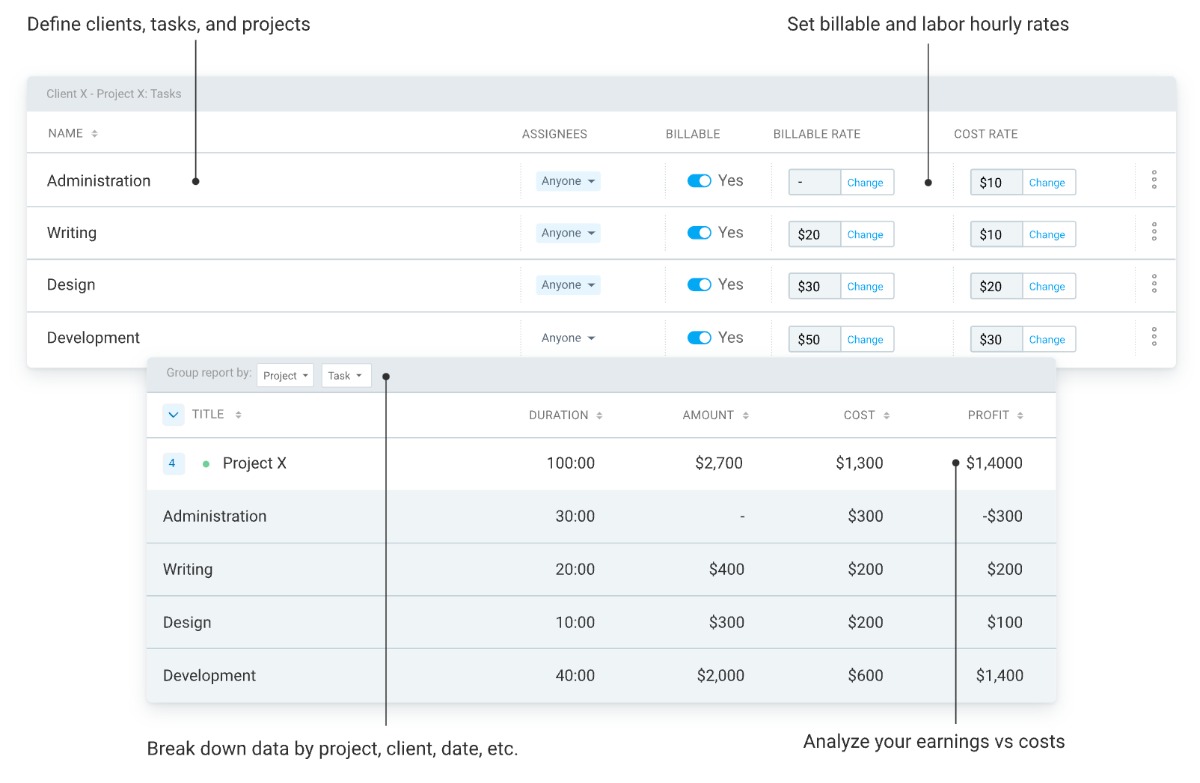

Use Clockify to stay compliant with labor laws

Clockify lets you track time, attendance, billable rates, and costs with just a few clicks, all for free.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk for employees to clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export all data for payroll (in PDF, Excel, CSV, as a link, or send to QuickBooks).

Moreover, Clockify allows you to set hourly rates for your employees, eliminating the need for unnecessary calculations once payroll is due. You can set rates for:

- Workspace,

- Members,

- Projects,

- Tasks, and

- Project members.

This functionality is particularly helpful when adhering to labor laws, such as minimum wage laws in Alabama.

Once the hourly rates are set, employees just have to track their work time, and their wages will be automatically calculated.

Conclusion/Disclaimer

We hope this Alabama labor law guide has been helpful. Please pay attention to the links provided, which will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 of 2025, so any changes in the labor laws that were included later than that may not be in this guide.

We strongly advise you to consult with the relevant institutions or certified representatives before taking action on legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.