California Labor Laws Guide

| California Labor Laws FAQ | |

| California minimum wage | $16.50–$20 |

| California overtime | 1.5 times the regular wage for any time worked over 40 hours/week and 8 hours/day up to and including 12 hours/day ($24.75–$30 for minimum wage workers) 2.0 times the regular wage for any time worked over 12 hours/day, and any time worked over 8 hours on the seventh consecutive workday in a workweek ($33–$40 for minimum wage workers) |

| California breaks | 10-minute rest periods for every 4 hours worked 30-minute meal breaks for every 5 hours worked |

California is a well-known haven for employee rights and benefits, as its laws provide arguably the best protection for employees among all US states.

In this California labor laws guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Leave requirements,

- Other miscellaneous labor laws, and

- General questions regarding California labor laws.

California wage laws

First on our list are regulations concerning wages.

We’ll begin by breaking down the minimum wage requirements and exceptions, and then explaining the specifics of California Reporting Time Pay Law, as well as what constitutes a Split Shift Premium.

Minimum wage in California in 2025

The state of California doesn’t rely on the Federal Minimum Wage and uses its state legislation to place restrictions around minimum employee earnings.

As of January 1, 2025, the minimum wage in California for all employers amounts to $16.50.

However, as of January 1, 2024, and October 16, 2024, respectively, fast food restaurant employees and healthcare workers are entitled to higher minimum wages, going up to $20 per hour.

Tipped minimum wage

The US Department of Labor defines a tipped employee as someone who “engages in an occupation in which he or she customarily and regularly receives more than $30 per month in tips.”

As such, many states allow employers to pay their tipped workers a special, reduced minimum wage, which cannot be lower than the federally prescribed amount of $2.13 per hour.

This is not the case in California, as it does not permit employers to pay their tipped employees at a rate lower than the minimum wage, which currently stands at $16.50.

Furthermore, under California Labor Code § 1182.12, employers are prohibited from using employees’ tips as credit toward their minimum wage. All in all, the employer is obligated to provide the employees with the full amount of their earned tips and wages.

Food delivery tips in California

California is the first state to pass legislation concerning food delivery businesses and their transparency around tipping.

Passed in October 2021, Assembly Bill 286 prohibits an online food delivery platform from retaining any amount designated as a tip or gratuity.

That is to say, the food delivery platform is required to pay out the entire amount of a tip to the person delivering the food or beverages, or to the food facility in case of a pickup order.

Local minimum wages in California

Municipal authorities can establish their own requirements for localminimum wages, which must be at least as high as the state-mandated ones.

In cases where there are overlapping requirements for federal, state, and local minimum wage standards, the employer is required to follow the strictest of the applicable standards, which is also the one most beneficial to the employee.

In other words, employee wages are calculated according to the highest applicable rates.

Here, we have a list of all California municipalities that employ special local minimum wage rates.

Note that these rates are subject to change, and you should always verify and confirm this information with the relevant local authorities.

| Municipality | Minimum wage |

| Alameda | $17.46 |

| Belmont | $18.30 |

| Berkeley | $19.18 |

| Burlingame | $17.43 |

| Cupertino | $18.20 |

| Daly City | $17.07 |

| East Palo Alto | $17.45 |

| El Cerrito | $18.34 |

| Emeryville | $19.90 |

| Foster City | $17.39 |

| Fremont | $17.75 |

| Half Moon Bay | $17.47 |

| Hayward | 25 or fewer employees: same as state minimum wage — $16.50 26 or more employees: $17.36 |

| Los Altos | $18.20 |

| Los Angeles City | $17.87 |

| Los Angeles County | $17.81 |

| Malibu | $17.27 |

| Menlo Park | $17.10 |

| Milpitas | $18.20 |

| Mountain View | $19.20 |

| Novato | 99 or fewer employees: same as state minimum wage — $16.50 100 or more employees: $17.27 |

| Oakland | $16.89 |

| Palo Alto | $18.20 |

| Pasadena | $18.04 |

| Petaluma | $17.97 |

| Redwood City | $18.20 |

| Richmond | $17.77 |

| San Carlos | $17.32 |

| San Diego | $17.25 |

| San Francisco | $19.18 |

| San Jose | $17.95 |

| San Mateo | $17.95 |

| San Mateo County | $17.46 |

| Santa Clara | $18.20 |

| Santa Monica | $17.81 |

| Santa Rosa | $17.87 |

| Sonoma | 25 or fewer employees: $16.96 26 or more employees: $18.02 |

| South San Francisco | $17.70 |

| Sunnyvale | $19.00 |

| West Hollywood | $19.65 |

Exceptions to minimum wage in California

An employee can’t legally agree to work for less than minimum wage unless they belong to a particular category that is exempt from this requirement.

The employer is obligated to pay the state or local minimum wage, whichever offers the most benefits to the employee, and it can’t be waived by any agreement, including collective bargaining agreements.

However, a few exceptions to the rule exist:

- Outside salespersons,

- Employee who is the spouse, parent, or child of the employer,

- Apprentices indentured with respect to the California Division of Apprenticeship Standards (DAS), and

- Learner-employees during their first 160 hours of work in occupations where they have no previous experience — here, employers are allowed to pay learners a rate that amounts to 85% of the minimum wage. In California, this amounts to $14.025.

Subminimum wage in California in 2025

As of January 1, 2025, the California Code on minimum wages obligates employers to pay employees with disabilities the full applicable minimum wage.

Wages and Reporting Time Pay in California

In brief, California law acknowledges that “reporting time pay constitutes wages.”

This means that employers are required to pay out the employee if they’ve:

- Physically appeared at the place of work in time for the beginning of the shift,

- Logged on to their computer if working remotely,

- Appeared at a client’s job site,

- Set out on a trucking route, or

- Telephoned the store 2 hours before the shift.

Exceptions and exemptions to this rule apply in cases when there are imminent threats of violence, failures of public utilities, or weather emergencies.

Wages and Split Shift Premium in California

According to the California Department of Industrial Relations, employees working a split shift are entitled to a premium equal to 1 hour of pay at the state or local minimum wage rate.

This payment should appear as a separate item on the pay stub, and it’s the employer’s responsibility to keep track of any split shifts.

To qualify for the premium, the following conditions must be met:

- The work schedule must be interrupted with non-paid and non-working hours longer than a bona fide meal break, within a single workday.

- This interruption must be established by the employer. Voluntarily picking up an extra shift or requesting a break for their own convenience doesn’t qualify the employee for the premium.

- The employee doesn’t reside at their place of employment.

Additionally, employees earning more than the minimum wage can also be eligible for a split shift premium.

However, the higher their wage, the lower the premium will be.

California payment laws

In most circumstances, California requires employers to pay employees at least twice per calendar month on regular paydays.

It is the duty of employers to set these paydays in advance and to provide details on when, where, and how the compensation will be paid.

There are also requirements as to when the wages for particular pay periods will be paid, listed in the following table:

| PAY PERIOD | WAGES DUE ON |

| Between the 1st and 15th (inclusive) of any calendar month | No later than the 26th of the same month |

| Between the 16th and the last day (inclusive) of any calendar month | No later than the 10th of the following month |

| Other payroll periods (weekly, biweekly, semimonthly) | Within 7 days of the end of the pay period |

| Overtime wages | No later than the next regularly scheduled payday |

🎓 California Department of Industrial Relations website

California overtime laws

For all nonexempt employees, overtime in California refers to any additional hours worked beyond the limits of 8 hours in a workday, 40 hours in a workweek, or 6 days in a workweek.

The employer is required to pay the employee for overtime work at the following rates:

- One and a half times the regular rate of pay — This rate applies to all hours worked in excess of 8 hours, and up to and including 12 hours in a workday. Additionally, the same rate is used to calculate wages for the first 8 hours worked on the 7th consecutive day of work in a workweek.

- Double the regular rate of pay — Paid out for all hours worked in excess of 12 hours inside a workday, and all hours worked in excess of 8 hours on the 7th consecutive workday in a workweek.

Under California law, all overtime hours mustbe paid, regardless of whether they’re authorized or not.

This is the case because the law holds that the employer is responsible for tracking all overtime hours worked and should be aware of the employee’s activities.

However, the employee is prohibited from undertaking unauthorized overtime work, hiding this information from the employer, and then claiming recovery.

Overtime exceptions and exemptions in California

California recognizes many cases where overtime provisions are calculated on a basis different than the state standard, or cases where they don’t apply at all.

In the first case scenario, where non-standard calculations are used, these are what we call overtimeexceptions.

These exceptions may apply to the following categories of employees:

- Employees working on an alternative workweek schedule,

- Employees within the health industry, working on an alternative workweek schedule,

- Employees working in hospitals and care centers with patients residing on the premises,

- Camp counselors,

- Personal attendants employed by a nonprofit organization,

- Resident managers in retirement homes with fewer than 8 beds,

- Employees providing 24-hour residential care for minors,

- Ambulance drivers or attendants,

- Employees in ski establishments, and

- Live-in employees.

🎓 California Overtime Exceptions

The other important category — the exemptions — includes employee cases and occupations where overtime provisions aren’t guaranteed.

Some of the employee categories included on this list are:

- Executive, administrative, and professional employees,

- Employees in the computer software industry,

- Employees of the State and any of its political subdivisions,

- Outside salespersons,

- Individuals who are the spouse, child, or parent of the employer,

- Drivers,

- Taxicab drivers, and

- Airline employees.

🎓 California Overtime Exemptions

California break laws

Employees in California are entitled to a rest period during work hours.

This rest period is calculated based on the total number of hours worked each day and must be at least 10 minutes long for each 4 hours worked, or if the employee has worked for a major fraction (more than 2 hours) of the 4-hour period.

All rest periods are considered working time, so employers are required to pay for them at regular rates.

The rest period is calculated from the moment the employee reaches the designated rest area and should be taken as close to the middle of working hours as possible.

Additionally, employers must provide adequate resting facilities for employees, and these must be in areas separate from toilet rooms.

California meal break law

California employment laws include a right to a 30-minute meal break after 5 consecutive hours of work.

This requirement only applies if the total number of hours worked in a day exceeds 6. In this case, the meal break can be skipped upon mutual agreement between the employer and employee.

If the number of hours worked exceeds 10, the employee is entitled to a second meal break.

This meal break can only be waived if the total number of hours worked doesn’t exceed 12, and there is an agreement between the employer and the employee.

If the employee isn’t relieved of all duties and/or required to stay on the work site, the meal break must be paid in total.

Meal break penalty in California

If the employer fails to provide the employee with adequate meal breaks, they must pay a meal penalty.

For each day the employee didn’t have a meal break, the employer must pay one additional hour at the regular pay rate.

Exceptions to break laws in California

Some exceptions also apply to resting periods.

Here are some of the occupations and situations where non-standard rules are applied to breaks:

- Employees whose total work time inside a workday is less than 3 and a half hours aren’t required to have a break.

- Employees working in residential care facilities may have their rest period limited.

- Dancers, skaters, swimmers, and other performers who do strenuous work are entitled to additional rest periods.

- Construction workers may have their rest periods staggered by the employer to avoid interfering with workflow.

- Crew members on commercial fishing boats are required to have at least 8 hours of rest time during an overnight trip.

California breastfeeding laws

When it comes to lactation accommodation, all employers are required to provide breaks for employees looking to express breast milk.

Additionally, the employer needs to provide a hygienic area and a reasonable amount of time for this activity.

If possible, the employee should take their lactation break in accordance with the break periods already provided by the employer.

However, if this isn’t a possibility, the employer is not required to pay for the lactation break.

If the employee suffers any violation of this regulation, they can file a complaint with the Bureau of Field Enforcement (BOFE), which can then issue a citation for $100 for each day the employee was denied adequate room and time to express milk.

California Day of Rest Law

In 2017, a Nordstrom, Inc. employee filed a lawsuit against their employer, alleging that they were illegally scheduled to work more than 6 days a week.

Following this, the Supreme Court issued a clarification to the Labor Code, explaining that the prohibition on working more than 6 consecutive days is to be calculated according to the employer’s workweek.

This effectively means that working 7 days in a row in California can be legal. In fact, the worker can be scheduled to work for up to 12 consecutive days, provided the rest days are scheduled on the first day of the first week and the last day of the following workweek.

California leave requirements

Here is some information about the types of leaves that employers in California are and are not required to provide.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave and California Family Rights Act — The leave covered by the Family and Medical Leave Act (FMLA) guarantees certain employees the right to 12 weeks of unpaid, job-protected leave per year. Employees may be eligible for this type of leave in cases when:

The California Family Rights Act is a separate type of leave that further expands on the benefits offered by the FMLA, but the two overlap. Some noticeable differences include:

|

| ✅ REQUIRED LEAVE |

|

Sick leave — Employers are obligated to provide paid sick leave to employees who have worked for them at least 30 days in a calendar year, including part-time, per diem, in-home supportive services providers, and temporary employees. Sick leave is accrued at a rate of 1 hour for every 30 hours worked and can be capped at 80 hours. An eligible employee can use a minimum of 40 hours of accrued annual leave. The carryover of unused days is possible if established by the employer’s policy. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — The employer must allow their employee to be absent from work on days when they need to attend jury duty, though the leave itself doesn’t have to be paid. However, most employers tend to establish jury leave policies as a way to boost morale and not discourage employees from missing jury duty due to work obligations. |

| ✅ REQUIRED LEAVE |

|

Voting time leave — Employees are eligible for paid time off work to vote only if they don’t have enough time outside of working hours to vote, as polls are open from 7 a.m. to 8 p.m. The law aims to provide an opportunity to vote to workers who would otherwise be unable to do so due to their jobs. Employers need to provide at least 2 hours’ time for employees to vote, after receiving the employee’s notice 3 days in advance. |

| ✅ REQUIRED LEAVE |

|

Domestic violence or sexual assault leave — Victims of domestic violence or sexual assault can request to take the time off necessary to protect themself and their children. Additionally, you’re able to use any paid time off accrued in such instances. Employers with 25 or more employees also need to provide time off for medical examinations, or other domestic violence and sexual assault care services. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave — If an employee needs to attend to emergency duties as a volunteer firefighter, rescue personnel, or as a peace officer, the employer must provide them with unpaid leave. Additionally, employers hiring 50 or more employees must provide up to 14 days of unpaid leave for employees seeking to acquire training in these occupations. |

| ✅ REQUIRED LEAVE |

|

Organ and bone marrow donation leave — Under California Code, Labor Code - LAB § 1510, employers must provide up to 30 days a year to employees who are organ donors and 5 days a year to employees to donate bone marrow. |

| ✅ REQUIRED LEAVE |

|

School leave — Employers are required to allow employees to take unpaid time off to attend the disciplinary meetings or hearings of their school-age children. Eligible employees have to be employed at a place of business that employs at least 25 workers, and the qualifying criteria to take the leave include:

Under California Code, LAB 230.8., the employee is entitled to up to 40 hours of time off for school leave. |

| ✅ REQUIRED LEAVE |

|

Military leave — Employers are required to provide leave to active service members of the Armed Forces for the duration of their deployment, as well as the same conditions of employment once they return. For members of the National Guard or the Naval Militia, employers must provide 17 days of military leave, and 15 days for members of the state military reserve. Additionally, larger companies (with 25 or more employees) must provide the spouse of a military service member with 10 days of unpaid leave while their spouse is on leave due to deployment. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — There are no specific requirements for employers regarding employee bereavement leave. However, there’s an exception for 2 employee categories:

Upon notice, such employees are given bereavement leave with pay for the death of a person related by blood, adoption, or marriage, totaling 3 days. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — Employers aren’t legally required to provide vacation time. However, if their company policy promises such benefits, employers need to pay their workers for any unused vacation time. |

California child labor laws

To work in California, minors must obtain an Employment Certificate, also known as a Work Permit. These are issued by the California Department of Labor or the school attended by these minors.

The exception to this is minors working in entertainment, who can only get their certificate through the state Labor Department.

Some restrictions apply to minors when it comes to work hours and night work. These restrictions apply to 2 age groups: minors under 16 and minors aged 16 or 17.

Labor laws for minors under 16 years of age

Minors younger than 16 years can work up to 8 hours a day, 48 hours per week, or 6 days per week when school is not in session.

While the school is in session, this age group is restricted to 3 hours of work per school day, or 18 hours per week.

For the period ranging from 9 p.m. on June 1 through Labor Day, work is prohibited from 7 p.m. to 7 a.m.

Labor laws for minors aged 16 and 17

For minors aged 16 and 17, up to 8 hours of work per day and 48 hours per week are allowed, with a maximum of 6 days per week while school is out of session.

For the duration of a school week, these minors can work up to 4 hours per day, totaling 28 hours per week for work and school activities combined.

Work is prohibited during the following hours: 10 p.m. (or 12.30 a.m. before a non-school day) to 5 a.m.

Prohibited occupations for minors in California

California has adopted all federal regulations concerned with protecting minors from working in hazardous environments.

These regulations forbid employers from hiring minors for some of the following occupations:

- Handling explosives,

- Operating a motor vehicle,

- Mining,

- Quarrying,

- Logging,

- Operating a circular or band saw, or guillotine shears, and

- Operating power-driven machinery.

🎓 Guide to California Child Labor Laws

Hiring laws in California

As per regulations under the California Fair Employment and Housing Act (FEHA), employers are prohibited from discriminating against employees based on any of the following characteristics:

- Race (including hair texture, protective hairstyles, and other race-related characteristics),

- Religion, race, ethnicity, national origin, and ancestry,

- Physical or mental impairments,

- Medical problems,

- Information on the human genome,

- Relationship status,

- Pregnancy (including childbirth and related medical issues),

- Age,

- Sex (including breastfeeding and associated conditions),

- Sexual orientation,

- Gender identity/expression, or

- Military service status.

The FEHA prohibits any harassment and retaliation against people who report discrimination on any of these accounts.

Cal-COBRA laws

The Federal Consolidated Omnibus Budget Reconciliation Act (COBRA) is a law that allows employees and their families to continue group health benefits after they lose employer-sponsored coverage.

This law provides temporary health coverage (18-36 months) in circumstances of voluntary or involuntary job loss, a reduction in job hours, a job transition, divorce, family death, or other major life events.

In California, Cal-COBRA additionally extends the period of health coverage to 36 months if the employee’s federal coverage was 18 months.

Termination laws in California

California is one of the states that employs an “at-will employment” approach.

This means that neither the employer nor the employee needs to provide particular reasoning for terminating the employment relationship.

Concerning termination regulations, California has rules regarding the payment of final paychecks, as well as a recently mandated Mass Layoff Notification Act.

So, here’s some more information on these.

Final paycheck in California

Upon termination, the employer is required to pay the employee their final wage immediately if the employee has provided at least 72 hours’ notice of the intent to terminate.

If the employee provides the termination notice within 72 hours of resignation, the employer should pay the final wages within 72 hours of the moment of employment termination.

Any accrued, unused vacation time also has to be paid out at the end of employment.

Mass layoff notification in California

California utilizes the Worker Adjustment and Retraining Notification (WARN) Act to protect employees, their families, and communities by requiring employers to notify affectedemployees and other state and local representatives at least 60 days before a plant closure or mass layoff.

This requirement applies to employers with 75 or more full-time or part-time employees, as well as to employees who have worked for at least 6 of the 12 months preceding the required notice date.

Additionally, necessitating notice are cases when a plant closes, plans a layoff, or relocation of 50 or more employees in less than 30 days, regardless of the percentage of the workforce.

Occupational safety in California

The standards for providing safe working conditions for California employees are regulated by the California Division of Occupational Safety and Health (DOSH).

To prevent injuries and illnesses resulting from work hazards, Cal/OSHA conducts on-site investigations.

The employee has every right to refuse to work under hazardous conditions and can report any violations to the appropriate authorities.

Miscellaneous California labor laws

Here, we’ll list some of the miscellaneous labor laws in California that don’t strictly fall into the previously explored categories.

In particular, we’ll mention the following regulations:

- California Warehouse Quotas Law,

- COVID-19 Exposure Act,

- COVID-19 Vaccination Order for Healthcare Workers,

- California whistleblower protection laws,

- California background check laws,

- Employer use of social media regulations,

- The Employee Monitoring Law,

- Drug and alcohol testing laws,

- Sexual harassment training laws,

- The Silenced No More Act,

- Cal-COBRA laws,

- Expense reimbursement laws, and

- Record-keeping laws.

California Warehouse Quotas Law

California’s Warehouse Quotas Law limits the quotas warehouse distribution center employers can place on their employees.

A single distribution center hiring 100 or more employees, or a distribution center with 1,000 or more employees across multiple locations, must comply with this law as of January 1, 2022.

A quota is considered illegal, and employees may pursue legal action against the employer requesting it if:

- It prevents employees from using meal or rest breaks.

- It prevents employees from using the bathroom facilities.

- It prevents employees from adhering to occupational health and safety standards.

Employees who believe the quotas their employers are mandating are violating their rights can file a report of a labor law violation with the California Department of Industrial Relations.

Whistleblower protection laws

When employees have reason to believe their employer is violating a state or federal statute, the California Whistleblower Protection Act encourages them to notify appropriate authorities.

These authorities might be:

- A law enforcement agency,

- A person with authority over the employee, or

- Another employee with the authority to investigate, discover, or correct the violation or noncompliance.

State officials and employers are prohibited under this act from retaliating against employees who file complaints.

Independent contractor ABC test

California recognizes the ABC test, which is used to determine whether a worker is considered an employee or an independent contractor.

A worker is considered an independent contractor only if the following conditions are met:

- While performing their work activities, they’re free from control and direction by the hiring entity, both in terms of the contract and in fact.

- The worker performs a type of work that is outside the usual course of the hiring entity’s business.

- The worker customarily engages in an independently established trade, occupation, or business of the same or similar type to the work being performed.

Misclassification of independent contractors carries penalties and damages, and employers may be required to pay $5,000 to $25,000 for each violation.

Background check laws

In California, the ban-the-box law regulating background checks by employers took effect in 2018.

This law applies to all employers with 5 or more employees and prohibits them from inquiring about job applicants’ criminal history before making a job offer.

Additionally, once a job offer has been made, it can’t be rescinded without a written report, even if it is based on gaining knowledge about the applicant’s criminal past.

Exceptions to this law apply for:

- All community care license applicants,

- Community care licensees,

- Adult residents of community care facilities, and

- Volunteers and employees of community care facilities who have contact with clients.

Individuals with convictions more serious than a minor traffic violation are prohibited from working or being present at community care facilities, unless they receive an exemption from the Care Provider Management Bureau (CPMB).

Employer use of social media

According to a law regulating the employer’s use of social media, California employers can’t request employees or job applicants to provide information that would allow them to access the worker’s private social media accounts.

Additionally, an employer can’t threaten, discipline, discharge, or retaliate against an employee who doesn’t comply with this kind of request.

Employee monitoring law

According to a Senate Bill in effect since 2004, electronic monitoring of California employees without a court order is prohibited and constitutes a misdemeanor.

Without prior notice, the employer can legally electronically monitor the employee only if they suspect unlawful conduct, of which the electronic monitoring would provide evidence.

Drug and alcohol testing laws

California allows the administration of drug and alcohol testing.

However, the circumstances and necessity justifications are clearly defined and are as follows:

- Testing a job applicant during the hiring process,

- Testing upon reasonable suspicion,

- Testing after a serious injury,

- Testing employees and operators engaged in commercial transportation, and

- Testing an employee enrolled in a drug or alcohol rehabilitation program.

Sexual harassment prevention training

The Department of Fair Employment and Housing requires all California employers with 5 or more employees to provide sexual harassment prevention training.

At least 1 hour of training on preventing sexual harassment and abusive conduct is required for non-supervising employees, and at least 2 hours for supervisors and managers, every 2 years.

The training needs to include practical examples based on gender identity and expression, as well as sexual orientation.

Silenced No More Act

California’s Silenced No More Act prohibits separation agreements that would ban the disclosure of information about illegal workplace activities concerning:

- Sexual assault,

- Sexual harassment,

- Sex-based harassment,

- Sex-based discrimination, and

- Retaliation against reporting violations concerning these kinds of matters.

This law effectively banned confidential settlement agreements in sex-based claims.

Expense reimbursement law

Under the section on employee obligations, the California Labor Code deals with employee reimbursements.

It states that the employer must pay out all the necessary expenditures and losses an employee may incur while attending to their work duties.

In other words, the employer is responsible for all costs an employee needs to endure for their work, including:

- Travel expenses,

- Using a personal phone for business purposes,

- Conference fees,

- Cost of a work uniform,

- Entertaining business associates,

- Driving costs, mileage reimbursements, and tolls included,

- Postage, and

- Training and education fees.

Record-keeping laws

Effective January 1, 2022, Senate Bill No. 807 requires employers to retain job applicant personal information for 4 years (up from the previous requirement of 3 years).

Personal records that fall into this category can be used to determine an employee’s qualifications for promotion, additional compensation, disciplinary action, or termination.

Some examples of personal records employers should keep include:

- The employment application,

- Payroll authorization form,

- All types of notices, including absence, vacation, education, warnings, termination, etc.,

- Performance reviews, and

- Attendance records.

Frequently asked questions about California labor laws

Naturally, the state of California has an abundance of tricky laws that would even confuse a government official. Therefore, we’ve set aside this section to address some of the questions that may still concern you.

What is the 7-minute rule in California?

The 7-minute rule is a payroll rule that deals with clock rounding. In essence, employers can round employees’ work time to the nearest quarter-hour.

In practice, you have 7 minutes of leeway when it comes to tardiness. If you’ve clocked in at 9:07 am, it’ll still be considered as if you had clocked in at 9 am sharp. If you clock in at 9:08 am or any minute later, your starting time will be 9:15 am.

What is the 5th hour rule in California?

In most cases, the 5th hour rule is connected to the state laws regarding breaks in California. If an employee works at least 6 hours a day, they’re eligible for a meal break after 5 continuous hours of work. Additionally, the break must be asked for and must start before the 5th hour elapses.

What is the 72-hour rule in California?

The 72-hour rule refers to termination of employment in the state of California. If an employee’s contract gets terminated, they must be paid all remaining wages within the following 72 hours.

On the other hand, if an employee resigns, their wages must be paid out on their last day, unless they provide a notice of termination at least 72 hours in advance.

Looking for a simple time tracking solution? Try Clockify

Clockify is a simple and reliable time tracker that allows you to track attendance and costs with just a few clicks, all for free.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk for employees to clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).

In addition to reliable time tracking, Clockify gives you several great options for managing your employees.

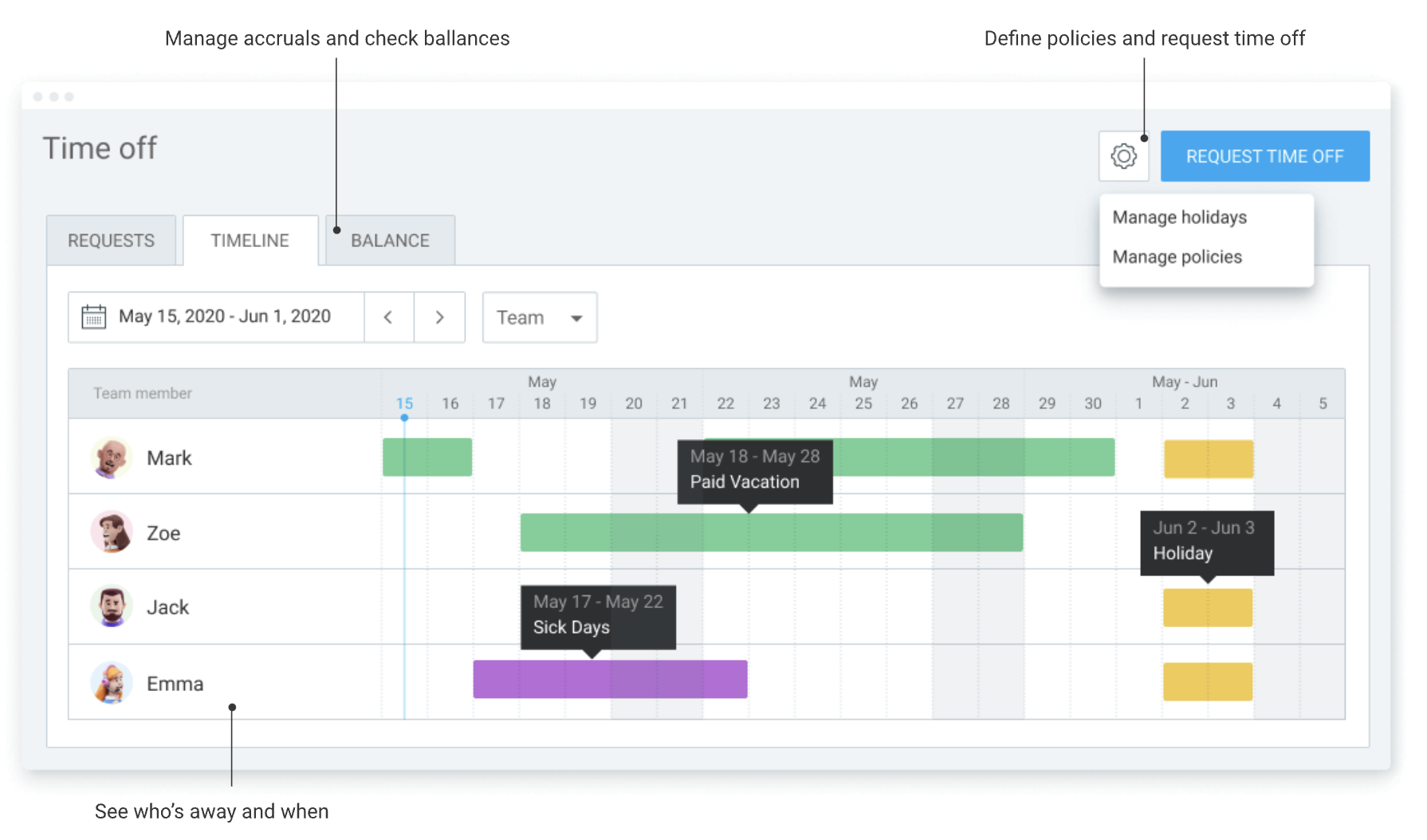

One such feature is time off, which allows you to track employee time off and see who is available for work.

Conclusion/Disclaimer

We hope this California labor laws guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in July 2025, so any changes in the labor laws that were included later than that may not be included in this California labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.