California Overtime Law & Overtime Calculator (2025)

Do you need a reliable tool to calculate overtime wages in California?

Check out our free California overtime calculator that complies with the 2025 California overtime law.

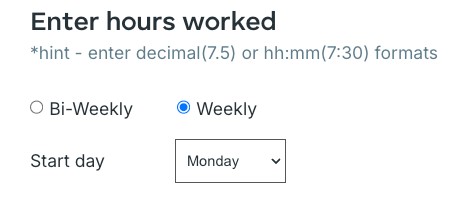

Enter hours worked

*hint - enter decimal(7.5) or hh:mm(7:30) formats

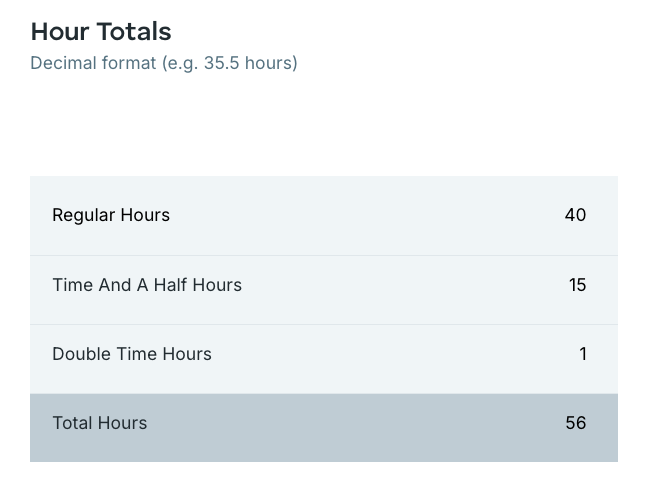

Hour Totals

Decimal format (e.g. 35.5 hours)

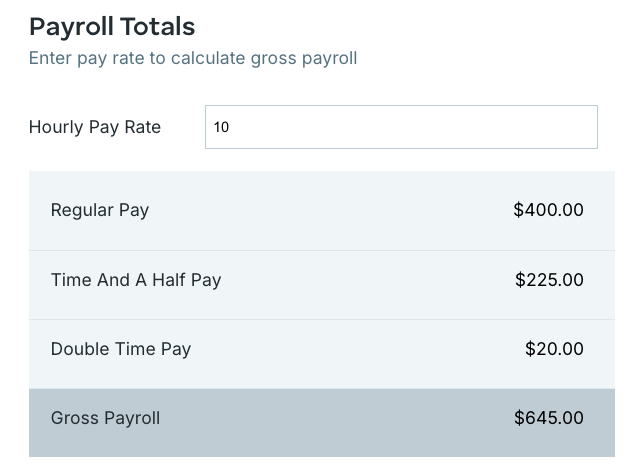

Payroll Totals

Enter pay rate to calculate gross payroll

As a business owner, HR manager, or payroll administrator, you certainly want to avoid any stress from compliance risks and ensure all employees get paid for their regular and overtime hours. This can be a hassle because US states are governed by both state and federal laws.

Therefore, each state has characteristic laws depending on its:

- Size,

- Political climate,

- Population, and

- Various industries.

California, the most populous US state, incorporates many state laws that often trump federal law in multiple areas, including California overtime law.

In the following article, we’ll go into detail on overtime calculations and California administrative exemption, as well as the correlation between rates and overtime.

General overtime rules in California

Before we dive into overtime rules, let’s highlight that in California, a regular workday equals 8 hours of work, while a workweek means 40 hours of work. To be considered overtime, any employment needs to be:

- Beyond 8 hours a day,

- Beyond 40 hours a week, or

- Beyond 6 days a week.

According to California overtime law, non-exempt employees are guaranteed overtime pay of one-and-a-half times (1.5) their regular pay rate. In particular cases, which we’ll explain shortly, non-exempt workers are entitled to double their regular pay rate.

California overtime rules mandate the one-and-a-half times rule in the following situations:

- If a non-exempt employee 18 years of age or older works more than 8 hours (up to and comprising 12 hours) in one day, and

- If a non-exempt employee 18 years of age or older works up to and including 8 hours on the seventh consecutive day of work in one workweek.

California overtime law mandates the double-time rule in the following situations:

- If a non-exempt employee 18 years of age or older works more than 12 hours of work in one day, and

- If a non-exempt employee 18 years of age or older works more than 8 hours on the seventh consecutive day of work in one workweek.

All these provisions also apply to any minor 16-year-old and 17-year-old employees:

- Who aren’t, by law, obligated to attend school, and

- For whom work is not prohibited by law.

| Time worked in total | The overtime rate |

| > 8 hours in a workday (up to and comprising 12 hours) | Regular hourly rate x 1.5 |

| The first 8 hours on the 7th consecutive day of work | Regular hourly rate x 1.5 |

| > 12 hours in a workday | Regular hourly rate x 2 |

| > 8 hours on the 7th consecutive day of work | Regular hourly rate x 2 |

For instance, if an employee works 9 hours on Tuesday, they’re entitled to get paid for 1 hour of overtime work.

But, if an employee works 13 hours on Wednesday, this is how to calculate their overtime:

- 1.5 times their regular rate for 4 hours (9th, 10th, 11th, and 12th hour), and

- Double times their regular rate for 1 hour, i.e., the 13th hour of work.

How do regular rates and overtime rates correlate in California?

The overtime rates in California are based on regular rates. Regular rates are affirmed at the beginning of contractual obligations and can be hourly salaries or fixed salaries.

For hourly employees, to get their regular rates, you need to include:

- The rates they get paid per hour during a 40-hour workweek,

- Shift differentials, and

- The “per hour value” for non-hourly compensation.

If employees get paid 2 different rates, overtime is calculated according to the average of the 2 rates, i.e., “weighted average.” To get the weighted average, you need to know your total amount for the workweek (including overtime amount) and divide it by the total hours worked (overtime hours are included).

For example, suppose you work 8 hours at $20 rate and 2 hours at $25 rate during the same week. Here’s how you can calculate your weighted average rate:

(8 hours x $20/hour) + (2 hours x $25/hour) = $210

$210/10 hours = $21 (weighted average rate)

For salaried employees, regular rates are calculated by dividing the annual salary by 52 weeks in a year, and 40 work hours in a week, for example:

$30,000 / 52 / 40 = $14.42

In addition, for employees who are paid by the piece or commission, you can use the following method to calculate regular rates:

- Divide the total earnings for one workweek (including overtime hours) by the total hours worked during a workweek (along with the overtime hours).

Here’s an example of an employee who worked 42 hours, including overtime, and earned $450 for 1 workweek:

$450 (total earnings including overtime) / 42 hours (total hours worked, with overtime) = $10,71

How do you calculate overtime in California?

As per California overtime law, non-exempt employees are guaranteed overtime pay if they work more than 8 hours per day or more than 40 hours per week.

🎓 Key Differences Between Exempt and Nonexempt Employees

It’s worth mentioning that California Labor Code 551 and California Labor Code 552 prescribe that employees must have at least 1 day of rest during the week.

Let’s see exactly how you can calculate your employees’ overtime hours.

How to calculate one-and-a-half times rates in California

To revise, employers need to pay their employees 1.5 times their regular hourly rate:

- For each hour worked over 8 per day (up to and including 12 hours a day), and

- For the first 8 hours on the 7th consecutive day of work.

Suppose your employee has a $30 regular hourly rate. Last week, they worked 9 hours over 5 weekdays.

If a regular rate is $30, then an overtime rate would be:

1.5 x $30 (regular rate) = $45 (overtime rate)

Since your employee has 5 hours of overtime in total (1 hour x 5 weekdays), the next step would be to multiply their overtime rate by 5:

$45 (overtime rate) x 5 overtime hours = $225

Now, let’s combine your worker’s regular weekly pay and overtime pay:

$30 (regular rate) x 8 hours = $240 (for 1 workday)

$240 x 5 workdays = $1,200 (for 5 workdays)

$1,200 (pay for regular hours worked) + $225 (pay for overtime hours worked) = $1,425

That amounts to $1,425 of total weekly pay.

How to calculate double-time rates in California

Employers need to pay their employees double times their regular hourly rate:

- If employees work more than 12 hours of work in 1 day, and

- If employees work more than 8 hours on the seventh consecutive day of work in 1 workweek.

Let’s say your worker tracked 13 hours of work on Monday. Again, their regular rate is $30. To calculate the double rate for this worker, you need to multiply their regular rate by 2:

$30 (regular rate) x 2 = $60 (overtime rate)

Since the employee had 13 hours, they’re eligible for overtime of both 1.5 times and double time. This worker has:

- 4 hours of 1.5 times overtime rate (9th, 10th, 11th, and 12th hour of overtime), and

- 1 hour of double overtime rate (13th hour).

Let’s calculate the overtime hours:

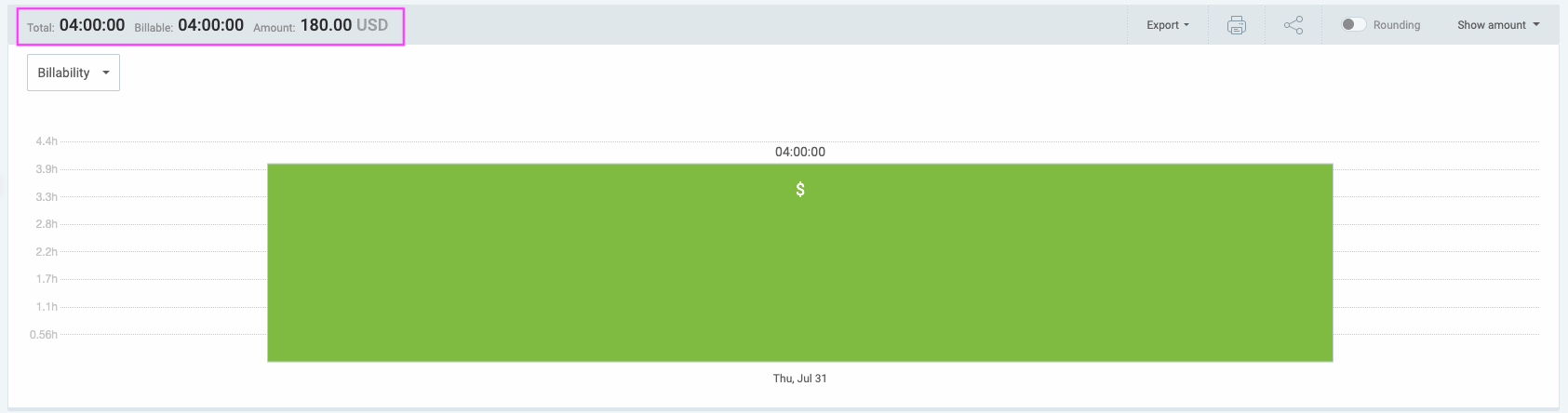

$45 (overtime rate of 1.5 times regular rate) x 4 hours of overtime = $180

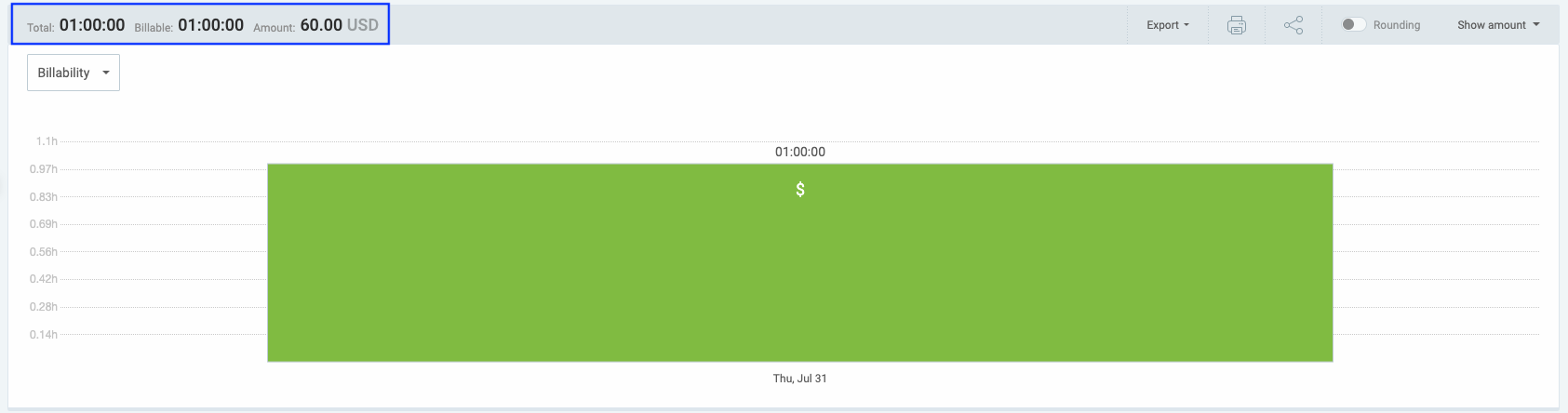

$60 (overtime rate of double time regular rate) x 1 hour of overtime = $60

Thus, the final calculation would be:

$180 + $60 = $240 (pay for overtime hours worked)

How to calculate overtime in California with the California overtime calculator?

If you’re wondering how to calculate overtime in California, we’ve got you covered with our free California payroll calculator. The calculator consists of the following:

- Regular overtime calculator (1.5 times rate),

- Double time calculator,

- Weekly overtime calculator, and

- Bi-weekly overtime calculator.

🎓 Semi-Monthly vs. Bi-Weekly Payroll Explained

To use our comprehensive California overtime calculator, first choose whether you want to input your weekly or bi-weekly hours, and select a start day.

Next, add all the hours you’ve worked during the week or 2 weeks.

Once you do that, the calculator will show you the total number of hours worked, including:

- Regular hours,

- Time-and-a-half hours (if you have any), and

- Double time hours (if you have any).

The next step is adding your hourly pay rate, i.e., your regular rate. And that’s it — the overtime calculator will do all the calculations for you, including:

- Regular pay,

- Time and a half pay,

- Double time pay, and

- Gross payroll, presented in dollars.

🎓 Gross Pay vs. Net Pay — Definition, Calculation, Key Differences

What is the minimum wage in California?

As of January 1, 2025, the minimum wage in California is $16.50 per hour. This applies to all employers, except employers working in industries with a higher minimum wage, like the fast-food and healthcare industries.

Fast-food restaurant workers get a higher minimum wage of $20.00 per hour. Similarly, healthcare facility employees also receive a higher minimum wage, which depends on the type of healthcare facility — ranging from $18 to $25.

Apart from specific industries, some California cities and counties also hold a higher minimum wage. For instance, while Oakland has a minimum wage of $16.89, West Hollywood has a minimum wage of $19.65 per hour.

Interestingly, sheepherders have been eligible to receive a monthly minimum wage instead of an hourly one since 2001. On the other hand, goat herders became eligible for a monthly minimum wage in 2022. Such minimum wages are defined by AB 1066’s Overtime Phase-In.

In California, there used to be a difference between:

- Minimum wage for employers with 25 or fewer employees, and

- Minimum wage for employers with 26 or more employees.

However, since 2023, all rates have been the same for all businesses — check the table below.

| Year | 25 or fewer employees | 26 or more employees |

| 2019 | $11.00/hour | $12.00/hour |

| 2020 | $12.00/hour | $13.00/hour |

| 2021 | $13.00/hour | $14.00/hour |

| 2022 | $14.00/hour | $15.00/hour |

| 2023 | $15.50/hour | $15.50/hour |

| 2024 | $16.00/hour | $16.00/hour |

| 2025 | $16.50/hour | $16.50/hour |

Also, California mandates a higher minimum wage per hour ($16.50) than the federal one ($7.25). So, all employers who are subject to both federal and California state law must implement the state minimum wage, as this wage gives more benefits to California employees.

In addition, if a particular city or county has a higher minimum wage (higher than the federal or state minimum wage), employers must follow the local minimum wage.

Additional overtime rules in California

Let’s go through some additional overtime rules you need to know about California overtime law.

What is California Labor Code 511?

According to the California Labor Code Section 511, an employer may require the employees to work up to and including 10 hours per day, within a 40-hour workweek, as a norm. In such cases, employers won’t pay their employees for overtime hours.

Before enabling such an alternative workweek, an employer must first organize a secret election in the workplace, giving their employees a chance to vote. If at least two-thirds of employees support the alternative workweek, then the employer has the right to start implementing this schedule.

For instance, employers can schedule 10-hour shifts for 4 days a week. In such a case, employees are NOT entitled to be paid 1.5 overtime for the 2 extra hours, considering that they’re not expected to work only 8 hours in the first place. Moreover, they’re still working at most 40 hours per week.

However, employees must receive overtime pay if they work:

- More than the scheduled hours defined in the alternative workweek, or

- More than 40 hours in a workweek.

🎓 Everything You Need to Know About the 4-Day Work Week Concept

Who is exempt from overtime in California?

According to the California overtime rules, there are some exemptions to the overtime law in California:

- Executive, administrative, and professional employees,

- Workers in the computer software field who are paid by the hour — there are specific requirements for this group of workers,

- City, county, or state employees, as well as workers in special districts,

- Outside salespersons,

- Employees who are a parent, child, a legally adopted child, or spouse of the employer,

- Workers partaking in a national service program (like AmeriCorps),

- Chauffeurs who have their work hours regulated by the US Department of Transportation Code of Federal Regulations, Title 49, and those who have their work hours regulated by the California Code of Regulations, Title 13,

- Workers protected by a collective bargaining agreement who also must follow specific requirements; in addition, employees who have joined a collective bargaining agreement under the Railway Labor Act,

- Employees with earnings greater than one-and-a-half times the minimum wage who hold more than half their compensation in commissions (minors aren’t included in this category),

- Student nurses working in schools accredited by particular boards (like the California Board of Registered Nursing or the Board of Vocational Nurse and Psychiatric Technician Examiners),

- Taxicab drivers,

- Airline workers with more than 40 but fewer than 60 work hours per week (due to temporary changes in their regular workweek schedule),

- Carnival ride employees working on a traveling carnival,

- Workers employed on a commercial fishing boat,

- Actors,

- Motion picture projectionists,

- Broadcasters, news editors, or chief engineers working on a radio or television station in a city of 25,000 people or fewer,

- Employees engaged in specific fields of work: creative, intellectual, or managerial, whose work requires discretion and independent judgement, and who get paid a monthly salary of no less than 2 times the California monthly minimum wage for full-time employment (however, this group also has some special additional requirements),

- Personal helpers not covered by the Domestic Worker Bill of Rights, and

- Babysitters under 18, who are employed in the employer’s house to look after the employer’s minor children.

Most of these groups have certain requirements they need to fulfill, which are all laid out in the official state overtime exemptions list.

Apart from California administrative exemptions, this state has some exceptions to the general overtime law. For example, employees who are part of an adopted alternative workweek schedule, which we covered earlier in this article.

Do salaried employees receive overtime in California?

It depends on whether salaried employees are classified as exempt or non-exempt from the Federal Labor Standards Act.

Usually, non-exempt employees are the ones paid by the hour. But some salaried employees may also be non-exempt. Keep in mind that:

- Non-exempt salaried employees ARE entitled to overtime pay, and

- Exempt salaried employees AREN’T entitled to overtime pay.

If salaried employees are getting paid at least twice the minimum hourly wage for a 40-hour workweek, they’re exempt from getting paid for overtime.

As mentioned above, this rule applies to salaried employees who work in creative, intellectual, or managerial fields of work and whose work mandates discretion and independent judgment.

Since we know that the minimum wage in California is $16.50, we can calculate the amount a worker needs to get paid to be exempt from overtime (twice the minimum hourly wage for a 40-hour workweek):

$16.50 (the minimum wage in California) x 40 h (one workweek) x 52 weeks = $34.320

$34.320 x 2 = $68.640

So, if a salaried employee currently makes less than $68.640 per year, they qualify as a non-exempt employee who is entitled to be paid overtime — unless they fall under exempt employees based on their position at work or choice of profession.

However, if a salaried employee makes at least $68.640 per year, they aren’t eligible for overtime.

🎓 Salary vs Hourly Pay – Pros and Cons

Overtime law changes in California — flat bonuses

California overtime rules also include flat sum bonuses. It’s a nondiscretionary bonus and should be included when calculating the regular rate of pay and overtime rates. The law further regulates that such a bonus is compensation for:

- Hours worked,

- Production or proficiency,

- A reward to remain in the same company.

This law was established after the ruling in the Alvarado v. Dart Container Corp. of California case. The case was caused by a dispute over the bonus amount that employees in Dart Container Corp. were supposed to receive for completing their weekend shifts.

To explain the law (and its difference with old practices), let’s take the following numbers for our example calculations:

- $25 hourly rate,

- 50 hours worked in total, and

- A flat bonus of $200 as a base.

Dart Container Corp. total pay calculations

Dart Container Corp. used the federal formula to calculate the weekly pay of employees based on the total number of hours worked.

They calculated the regular pay rate by multiplying the regular rate per hour by the total number of hours worked per week:

$25 x 50 = $1,250

Then, they added this weekly amount to the received bonus and divided it by the number of total hours worked:

($1,250 + $200) / 50 = $29

According to the FLSA and the overtime rate for the employee ($29 x 1.5 = $43.5), the employee would then be entitled to an amount of $1,595 for that week (40 x $29 + 10 x $43.5).

However, that turned out to be a legally problematic calculation.

🎓 Pay Rates 101: Understanding How Pay Is Calculated in the Workplace

Alvarado’s total pay calculations

The other party in the case, Hector Alvarado, complained that the Dart Container Corp. was underpaying its employees because it wasn't following the California Division of Labor Standards Enforcement (DLSE) Manual.

According to Alvarado (and the said Manual), Dart Container Corp. should have used only the number of non-overtime hours worked for the divisions, and not the total.

If we take the same numbers from the previous example, that means $1,450 (weekly pay of $1,250 plus $200 bonus) should be divided by 40 and not 50:

($1,250 + $200) / 40 = $36.25

So, a regular rate is $36.25, which amounts to $1,993.8 of total weekly pay owed:

$36.25 x 40 = $1,450 (regular rate compensation)

$54.38 (i.e., $36.25 x 1.5) x 10 = $543.8 (overtime rate compensation)

$1,450 + $543.8 = $1,993.8 (total)

The ruling of the Alvarado v. The Dart Container Corp. of California case was added to the California overtime law. Hence, all overtime based on flat bonuses should be calculated accordingly.

What else do you need to know about overtime in California?

Here are some additional overtime information in California that might be of use to you:

- The employee’s right to collect overtime pay can’t be waived.

- If the employee receives less than the amount they’re entitled to (including both the legal minimum wage and overtime compensation), they have the right to demand this unpaid difference in a civil action.

- Commute time can count towards regular work or overtime, but only if employees are paid a fixed hourly rate for the work they perform (in such a case, travel time can be paid at a regular rate or overtime rate).

- Employers are obligated to pay their employees for overtime hours, both authorized and unauthorized.

- If an employee refuses to work on the 7th consecutive day in a workweek, an employer can’t punish the employee.

Frequently asked questions about overtime in California

Throughout this article, we’ve covered the most important aspects of California’s overtime law. Nonetheless, we’ve included an FAQ section with additional questions about California overtime calculation to make this guide as comprehensive as possible.

Is anything over 40 hours overtime in California?

Yes, any hours over 40 in a workweek are overtime. Non-exempt employees who work more than 40 hours in a workweek are qualified for overtime pay of one-and-a-half (1.5) times their regular pay rate, or double times their regular pay rate when applicable.

What is the “8 and 80” rule for overtime in California?

The “8 and 80” overtime rule is used in hospitals and residential care facilities, as they use a 14-day work period instead of the standard 40-hour workweek. Under this law, employers must pay overtime of 1.5 times the regular pay rate to employees who work more than 8 hours a day and 80 hours in 14 days. Also, a double time rate is mandatory for employees who work more than 12 hours in a workday.

🎓 How to Cope With Working Long Hours

Can you work four 10-hour shifts without overtime in California?

Yes, this is an alternative workweek schedule known as a 4/10 work schedule. Employees who work 10 hours in a workday and 4 days in a workweek are not entitled to overtime pay. However, this is only the case if they weren’t initially expected to work 8 hours a day.

Are 12-hour shifts legal in California?

Yes, 12-hour shifts are legal in California. However, employees who work more than 12 hours a day are eligible for overtime pay at double their regular rate for those extra hours.

What if my employer refuses to pay me overtime?

If the employer doesn’t pay you overtime, you have the right to either:

- File a wage claim, or

- Start a lawsuit against your employer in court.

Another option, if the company no longer employs you, is to file a claim for the waiting time penalty.

Can an employer force you to work overtime in California?

According to California overtime law, an employer has the right to force you to work overtime. In the same manner, if an employee refuses to work overtime, an employer can discipline the employee or even fire them.

However, rules are a bit different when it comes to the 7th day of a workweek. Namely, if a worker refuses to work their shift on the 7th consecutive day, an employer doesn’t have the right to discipline them.

As we’ve already mentioned, California Labor Code 551 and 552 mandate at least 1 day of rest during the week.

What state has the highest rate of overtime pay?

California is the only US state that has a double rate of overtime pay for non-exempt employees working more than 12 hours in one day, and more than 8 hours on the seventh consecutive day of work in 1 workweek.

All other US states have the rule that the overtime rate equals 1.5 times the regular rate of pay.

Does PTO count towards overtime in California?

No, PTO doesn’t count as overtime in California. According to the FLSA, employers aren’t obligated to provide their employees with holidays, vacation, or sick leave. However, if employers decide to allow PTO, these hours don’t count as overtime hours.

🎓 PTO vs. Vacation: What Is the Difference?

How to handle unauthorized overtime?

The rules are the same for authorized and unauthorized overtime. Employees working overtime must be paid for these hours, either 1.5 times or double times their regular rate.

California overtime laws regulate that all employees must be compensated for their overtime hours, i.e., any hours workers are “suffered or permitted to work, whether or not required to do so.”

What does the “suffer and permit” rule mean for employees and employers?

According to John-Paul Deol, Partner and Head of Employment Law at a nationally recognized law firm, the “suffer and permit” rule refers to when a non-exempt employee works overtime and the employer knows about it, or reasonably should know about it. Our interlocutor says that employers must pay their employees for overtime in such situations, even if the employer didn’t expressly authorize the work.

He also explains the purpose of the “suffer and permit” rule:

“The rule is designed to ensure employees are paid for all hours actually worked beyond their standard schedule. It imposes a duty on employers to monitor and prevent unauthorized overtime.”

Our expert interlocutor further explains that if the employer is aware of extra work by the employee, the employer is deemed to have “suffered or permitted” that work and must pay the applicable overtime rate.

How to track overtime hours in California?

As we’ve seen, California has an abundance of laws that make it difficult to track overtime, especially if you plan on doing mental math. Luckily, modern software has advanced to the point where there’s no need to do anything on your own.

Nowadays, all you have to do is input the variables, such as hours worked and your hourly rate — and time tracking software will do the rest for you.

Try Clockify, a reliable and powerful piece of software by CAKE.com.

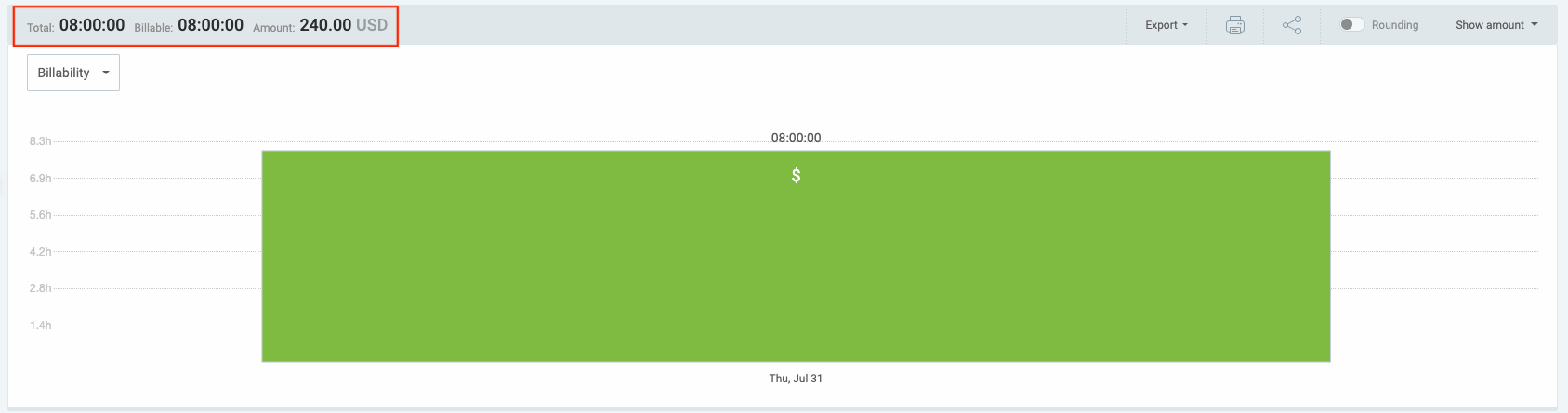

Tracking overtime with Clockify

Clockify helps you track the time you spend on individual tasks and projects — both regular hours and overtime.

To have your pay automatically calculated based on your hours worked, all you need to do is specify your hourly rates and mark time entries as billable or non-billable. Then, you'll be able to view your earnings in the reports section of the app.

🎓 How to calculate billable hours

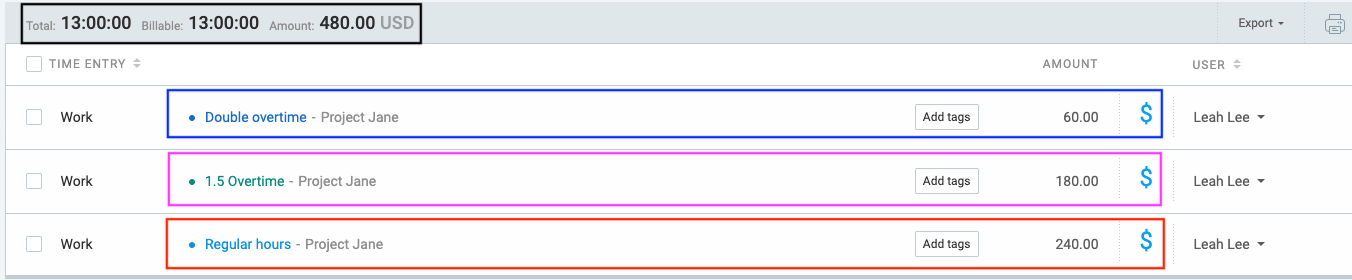

Let’s see how tracking overtime works if you have a regular rate of $30 per hour, for instance. For this purpose, we’ll create 3 projects:

- One for your regular hours,

- One for your 1.5 overtime, and

- One for your double overtime.

First, create a project for your regular hours, and define your regular hourly rate for it ($30). Here, you’ll be tracking your first 8 hours per day.

Then, create a separate project for your 1.5 overtime, and define your 1.5 overtime hourly rate (1.5 x $30 = $45).

Here, you’ll be tracking the time you spend working:

- Past 8 hours per day, but less than 12 per day, and

- The first 8 hours you spend working on the 7th consecutive day of work.

Next, create a separate project for your double overtime, and define your double overtime hourly rate (2 x $30 = $60).

Here, you’ll be tracking the time you spend working:

- Past 12 hours per day, and

- Past the first 8 hours on the 7th consecutive day of work.

As an alternative to tracking time in real time, you can also add time manually using the tracker or add it manually in the app’s timesheet page.

To add time manually in the timesheet, you can select the same 3 projects you've previously created.

Managing the overtime tracked with Clockify

After adding your time for that week, you can run regular visual reports to see how much time you’ve spent working overtime and regular hours for the whole week.

After all, you don’t want to overwork yourself to burn out or realize that you're working more than what your body and mind are allowing you to.

This way, you’ll also get a comprehensive breakdown of your work hours and pay.

🎓 Career burnout and its effect on health

You can further classify your time entries in Clockify with:

- Tags,

- Projects,

- Clients, and

- Tasks.

However, if you’re just unsure how to calculate overtime in California, the first 3 steps will be more than enough.

You’ll get your regular 1.5 overtime, and double overtime hours calculated according to California overtime law — fast and with complete precision.