Minnesota Labor Laws Guide

Ultimate Minnesota labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Minnesota Labor Laws FAQ | |

| Minnesota minimum wage | $11.13 $9.08 for training wages |

| Minnesota overtime | 1.5 times the rate of the standard wage if the employee has worked over 48 hours ($16.695 for minimum wage workers) *exempt employees earn the standard overtime rate if they have worked over 40 hours |

| Minnesota break laws | 20-minute meal breaks (must be provided during 8-hour shifts) 30-minute meal breaks for minors 4-hour gap between restroom breaks |

Wage laws in Minnesota

The state of Minnesota has its own minimum wage law, which is adjusted for inflation each year by August 31.

The following are wage regulations in Minnesota concerning:

- State minimum wage,

- Tipped minimum wage, and

- Subminimum wage.

| MINNESOTA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $11.13/9.08 | $11.13 | $9.08 |

Minimum wage in Minnesota

Effective January 1, 2025, the minimum wage in Minnesota equals $11.13 per hour for large and small employers, as well as for employers of various establishments.

Every year, the Department of Labor and Industry commissioner is obligated to review the minimum wage and adjust it for inflation by August 31.

Although Minnesota has a statewide minimum wage, the localities of Minneapolis and Saint Paul have established their own minimum wages, which are slightly higher than the state’s.

Therefore, the minimum wage in Minneapolis equals $15.97 per hour for all types of employers.

On the other hand, the minimum wage in Saint Paul is set to $15.97 per hour for macro and large businesses. On July 1, 2025, the rate for small businesses will increase to $15.00 per hour, and the micro business rate will increase to $13.25 per hour.

🎓 Summary of Minnesota’s minimum wage laws

Tipped minimum wage in Minnesota

According to Minnesota law, all tipped employees are entitled to the state minimum wage of $11.13 per hour, the same as state minimum wage requirements.

Under no circumstances can the employer take a tip credit against the minimum wage. A tip credit allows employers to count tips as part of the employees’ minimum wage.

An employee must be paid at least the minimum wage per hour, plus any tips the employee might earn.

Subminimum wage in Minnesota

As of 2021, Minnesota has established a task force aimed at abolishing subminimum wages for workers with disabilities, regardless of whether they work part-time or full-time.

As of 2025, all employees are entitled to the state minimum wage of $11.13 perhour, with a training wage of $9.08per hour (a 90-day subminimum wage).

However, some localities can set their own wages, which is one of the issues that the Task Force on Subminimum Wages aims to address.

The deadline for the Task Force to develop an official plan is August 1, 2025. Nonetheless, the first draft of recommendations was submitted in March 2023.

Exemptions to the minimum wage in Minnesota

Minnesota is one of the US states that have exemptions to the minimum wage covered by federal and state laws.

When it comes to federal minimum wage exemptions, some of them include:

- Executive employees who earn at least $1,128 per week,

- Administrative employees who earn at least $1,128 per week,

- Professional employees who earn at least $1,128 per week, and

- Highly compensated employees who earn at least $151,164 per year.

Moreover, there are specific state laws that make certain professions exempt from the minimum wage standard, such as:

- Babysitters,

- Taxi drivers,

- Volunteers of nonprofit organizations,

- US Department of Transportation employees (drivers, mechanics, loaders), and

- Employees who provide police or fire protection.

🎓 Full list of Minnesota minimum wage exemptions

Payment laws in Minnesota

Under Minnesota law, employers must pay their employees at least once in a 31-day work period.

For new employees, all wages earned in the first period of a calendar month must be paid on the first regular payday.

However, the frequency of payments may vary based on the industry and the type of work. For example, school workers can agree with their employers in writing for different payment arrangements. On the other hand, first responders and firefighters can agree on longer payment intervals.

It’s important to note that migrant workers in Minnesota are entitled to a paycheck every 15 days.

Moreover, public service corporations (public utility companies) in the state of Minnesota can also pay their employees on a semi-monthly basis.

Overtime laws in Minnesota

To become eligible for overtime pay, a non-exempt employee must work at least 48 hours in a 7-day workweek.

According to state law, all hours worked above 48 must be paid 1.5 times the regular rate of pay.

However, under federal law, certain groups of employees are eligible for overtime compensation after 40 work hours in a workweek.

The employees who are eligible for this type of overtime protection include:

- Employees who produce or handle goods for interstate commerce,

- Employees who work in businesses that make at least $500,000 in gross annual income,

- Employees who work in hospitals and nursing facilities,

- Employees who teach in public and private schools, and

- Employees who work in higher positions in federal and state agencies.

For additional information regarding whether you fall into the federal or state overtime protection, consult the Minnesota Statutes 177.23, subdivision 7.

🎓 Track Minnesota overtime with Clockify

Overtime exceptions and exemptions in Minnesota

According to federal law, certain groups of employees are considered exempt from overtime protection, such as:

- Highly compensated employees who make more than $151,164 per year,

- Executive, administrative, and professional employees who make a salary of at least $1,128 per week,

- Computer professionals who earn at least $27.63 per hour, and

- Outside salespeople.

In addition to federal exemptions, the state of Minnesota also lists several professions that are exempt from overtime pay, such as:

- Mechanics,

- Taxi drivers,

- Seasonal employees,

- Sugar beet hand laborers,

- Babysitters, and

- Agricultural technicians.

Break laws in Minnesota

Following the Minnesota Department of Labor and Industry, all employers must provide enough time for employees to use the restroom and eat.

The employer is free to set the length of each break. However, the break must last at least 20 minutes to be unpaid — anything below 20 minutes is considered a paid break.

Furthermore, the time to use the restroom must be available to all employees who work for 4 consecutive hours.

As for meal breaks, they must be provided to employees who work 8 hours or more.

Exceptions to break laws in Minnesota

Although employers in Minnesota are required to offer meal breaks, it’s not strictly stipulated that the break must last 20 minutes.

Minnesota law states that “sufficient time to eat a meal” must be provided to all employees; however, a 20-minute break is a consensus among employers.

On the other hand, there are professions exempt from break laws, which are the same ones exempt from overtime and minimum wage laws.

Some of these professions are exempt because the nature of their job enables the employees to take rest on multiple occasions during the day.

The list includes:

- Taxi drivers,

- Babysitters,

- Seafarers,

- Religious employees, and

- Certain agricultural workers.

Minnesota breastfeeding laws

According to the Minnesota Department of Health, all breastfeeding employees are entitled to a reasonable amount of time to express breast milk.

In most cases, employers will strike either a verbal or formal understanding with their employees regarding the exact duration of the breastfeeding breaks.

Furthermore, the employer must try to provide a private room for breastfeeding that meets the following criteria:

- The room must be clean,

- The room must be free from intrusion and public view,

- The room mustn’t be used as a bathroom, and

- The room must have an electrical outlet.

If any of these conditions aren’t met, the employer may be charged with violations and a fine may be imposed by the court.

🎓 Minnesota breastfeeding laws

Minnesota leave requirements

The state of Minnesota combines state and federal laws, which often get mashed with the laws of larger cities in the area.

When it comes to leave laws and requirements, they can be grouped into required and non-required leaves, regardless of whether they are paid or unpaid.

Let’s look at different types of leaves in the table below.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave (FMLA) — Minnesota employees are covered by state and federal laws, which require employers to grant a leave of absence to employees in particular family and medical emergencies and instances. In situations where both federal and state laws apply, the law that affords employees the most protection will be considered. Under the federal Family and Medical Leave Act (FMLA), all employees are allowed to take 12 weeks of unpaid leave for specified family and medical reasons, such as:

Starting January 1, 2026, Minnesotans will be getting paid benefits as part of their Family and Medical Leave program. In January, payroll deductions will begin for both employers and employees, which will later be used to fund the program and provide support during times of health emergencies or when caring for family members. In addition, 12 weeks must be taken within a year of the child’s adoption or birth, which can be used for bonding time and general care. To receive FMLA benefits, an employee must have:

|

| ✅ REQUIRED LEAVE |

|

Sick leave — As of January 1, 2024, the new Earned Sick and Safe Leave law in Minnesota requires employers to provide employees with paid leave if:

For an employee to be eligible for this type of paid leave, they must meet the following conditions:

Employees can earn 1 hour of sick and safe leave for every 30 hours worked and a maximum of 48 sick and safe leave hours in a year. This type of leave can be used for reasons such as:

|

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — No state law issued by the Minnesota Legislature requires private employers to provide vacation leave for their employees. However, if they choose to implement a vacation leave, they must establish a formal policy and adhere to the conditions outlined in the employment contract. The employer can create a policy denying payment for accrued vacation days upon contract termination if the employee has not used them before termination. Also, the employer is free to:

|

| ✅ REQUIRED LEAVE |

|

Military leave — Employees working for the National Guard, Marine Corps, or any other federal military service are entitled to a paid leave of up to 15 days. In addition, military members are entitled to an unpaid leave of up to 4 years for performing their military duties. Upon completing their military duty, the employee has the right to be reinstated to their previous position and earn the same salary as if the leave had not been taken. |

| ✅ REQUIRED LEAVE |

|

Bone marrow and organ donation leave — If an employer has at least 20 employees working on at least one site or virtual space, they must provide a 40-hour work period for bone marrow and organ donation. The leave can be prolonged, if necessary, due to complications, but the state minimum is 40 unpaid work hours. To request leave, an employee has to provide verification from a physician that they’re eligible for a donation. Moreover, if the employer doesn’t qualify for a donation, his leave of absence won’t be forfeited. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday and bereavement leave — The state of Minnesota has no laws that require employers to provide either paid or unpaid leave for holidays and bereavement. |

| ✅ REQUIRED LEAVE |

|

School activity and conference leave — To qualify for this type of leave, an employee must have a biological or adopted child or be a legal guardian of one. Another precondition is that they have to work at least half of a full-time schedule for the employer. If the criteria are met, an employee will be given 16 unpaid work hours to attend conferences and school activities within a 1-year period. The leave is renewed yearly and applies to each child the employee has. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — Under Minnesota employment laws, no employer can penalize or terminate an employee for reporting to jury duty or jury selection. All employers must provide an unpaid leave of absence for jury duty, but employees might have to justify the leave by providing the jury summons. Employers aren’t required to pay for jury duty leave, but certain labor union members might get compensation if it’s clearly stated in the contract. However, all jurors in Minnesota receive a token reimbursement for their duty. |

| ✅ REQUIRED LEAVE |

|

Witness leave — Witness and Victims of Crime Leave Policy states that all employees who were either victimized or witnessed a crime are eligible to take a leave of absence to respond to the court. This leave can include:

The employee is obligated to provide 48 hours’ notice to their employer; however, if the situation requires immediate action, exceptions can be made. The employer is strictly prohibited from penalizing, threatening, disciplining, or terminating an employee who took the Witness and Victims of Crime leave. |

| ✅ REQUIRED LEAVE |

|

Voting leave — The state of Minnesota allows all employees to take paid time off from work during an election day if the employee is old enough and eligible to vote. The duration of the leave is dependent on the time it takes an employee to reach the polling place, vote, and return to work. Employees can’t be subjected to losing their wages and receiving penalties from their employers for taking time off to vote. |

Child labor laws in Minnesota

Child labor laws in Minnesota are designed to prevent the exploitation of minors in working conditions from any physical, moral, or emotional hazards.

In addition to numerous laws and statutes, all employers in the state of Minnesota are obligated to have:

- Employment Certificates issued by the state’s Labor Department, or

- Age Certificates that verify a minor’s age for working purposes.

Work Permits (Employment Certificates) are mandatory for all minors under the age of 16 as verification from their school that they are fit to work after school hours.

Age Certificates aren’t necessary, but can be provided as a means of keeping a record of the employee’s age.

🎓 Minnesota’s Child Labor Standards Act

Work time restrictions for Minnesota minors

When it comes to child labor, there are certain work-hour limitations based on age groups.

Both the state and federal law in Minnesota prohibit any type of work for minors under the age of 14, with certain exceptions:

- Newspaper carrier (at least 11 years of age),

- Agriculture workers (at least 12 years of age and with parental/guardian consent),

- Actors, actresses, or models, and

- Youth athletic program referees (at least 11 years of age and with parental or guardian consent).

Minors under 16 years of age have work-hour limitations based on whether school is in session or not.

When school is in session, minors under 16 have the following limitations:

- No work before 7 a.m. or after 7 p.m.,

- Maximum of 3 work hours a day, and

- Maximum of 18 work hours a week.

When school is not in session, the following limitations apply:

- No work before 7 a.m. or after 9 p.m.,

- Maximum of 8 work hours a day, and

- Maximum of 40 work hours a day.

Minors aged 16 and 17 have the same work hour restrictions, but they’re allowed to work up until 11:00 p.m. on a school night and can’t start work before 05:00 a.m. on any school day.

These limitations can be pushed by half an hour if the minor is employed by their parents or if they have a signed permission form from the Commissioner of Labor and Industry or the parents.

Breaks for Minnesota minors

All employees in the state of Minnesota are given a reasonable amount of time for meal breaks and restroom time, including minors, according to Minnesota law.

The employer determines the length of each break, but all meal breaks lasting 20 minutes or less are considered compensable.

However, the general consensus by employees and employers is that most meal breaks for minors last for 30 minutes.

Prohibited occupations for minors in Minnesota

According to federal law, no minor, regardless of age, will be allowed to work in an environment deemed hazardous by the US Secretary of Labor.

A minor can work in a non-hazardous environment under parental supervision or in a safe environment with proper supervision and permits.

When it comes to minors aged 16 and 17, they’re prohibited from working with:

- Explosives and cutting equipment,

- Motor vehicles (operating or repairing),

- Radioactive materials,

- Dangerous machinery (paper products machines, bakery machines), and

- Coal and logs.

Including the above, minors under the age of 16 are either prohibited or limited from working in:

- Agriculture,

- Construction,

- Warehousing,

- Storage, and

- Communications.

Minnesota’s state laws further limit minors’ ability to work in places that serve alcohol or have alcohol on the premises.

There are no state law age restrictions on selling tobacco in Minnesota.

Nonetheless, there are exceptions to the aforementioned laws regarding the employment of minors. Some of them include:

- A 17-year-old high school graduate,

- A minor who works in a business owned by one or both parents, and

- A minor who works on a site clear of hazardous equipment.

Penalties for people who employ minors in Minnesota

Employers in the state of Minnesota are subject to fines for violating child labor laws under the Minnesota Child Labor Act and will face misdemeanor charges if the violations occur on multiple occasions.

The lowest fine that an employer can get is $250 for employing a minor without proof of age — i.e., not obtaining Employment or Age Certifications.

Employers are subject to fines of $500 if they employ:

- A minor under the age of 14,

- A minor under the age of 16 during school hours,

- A minor under the age of 16 before 7 a.m. or after 9 p.m., and

- A minor under the age of 16 for more than 8 hours a day or 40 hours a week.

Employers are subject to fines of $1,000 if they employ minors to work in a hazardous environment or perform a line of work that is deemed “not safe” by state laws.

The same $1,000 fine applies to employing a high-school student under the age of 18 to work during school hours or the hours prohibited by state laws.

The largest fine is reserved for injuries that a minor under the age of 18 has received by working in a hazardous environment, which amounts to $5,000.

Hiring laws in Minnesota

The state of Minnesota does not differ from other US states when it comes to hiring laws.

In general, hiring laws are there to prevent discrimination in job interviews and the workplace.

The Minnesota Human Rights Act prohibits all employment practices that discriminate based upon:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Local human rights activity,

- Public assistance,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Furthermore, employers in the state of Minnesota are prohibited from discriminating against employees based on their use of legal, consumable products outside of work and work hours.

🎓 Minnesota Department of Human Rights

“Right to work law” in Minnesota

Minnesota isn’t in the group of “right to work” states in the US and, therefore, has no laws to clearly state and regulate the relationship between employers and union members.

However, the state of Minnesota does have a Labor Relations Act that serves to protect both employers and employees in case of:

- Strikes,

- Unfair labor practice,

- Labor disputes, and

- Lockouts.

Termination laws in Minnesota

Like most states in the US, Minnesota also employs the “employment-at-will" doctrine, meaning that employment contracts can be terminated at any time and for any reason.

However, the reasons for termination must be in accordance with labor laws, such as discrimination laws and the Minnesota Human Rights Act — or the employer will face potential violations and fines.

According to state law, there’s no legal requirement for employers or employees to provide notice of separation, but common practice is to give a 2-week notice.

Nonetheless, if the employee requests a reason for termination within 15 days after termination, the employer must provide a written document within 10 days of receiving the request, stating a valid reason for the termination.

Final paycheck in Minnesota

The state of Minnesota has a strict law regarding the payment of unpaid wages upon termination of employment.

If an employee requests the amount of all unpaid wages, the employer is obligated to pay them within 24 hours.

On the other hand, if employment is terminated and the employee doesn’t submit a written demand, all unpaid wages are due on the next payday.

However, if the payday is within 5 days of termination, the employer will have 20 days to pay the employee.

Health insurance continuation in Minnesota (COBRA)

The federal health insurance law that protects employees who have lost or quit their jobs is called the Consolidated Omnibus Budget Reconciliation Act (COBRA).

To be eligible for COBRA, several requirements must be met, and the result typically entails 18 to 36 months of continued group health coverage.

Some circumstances under which an individual can qualify for COBRA include:

- Loss of a job,

- Decrease in the number of work hours,

- Transition to another job,

- Divorce, and

- Death (in case of an employee’s death, immediate family members are covered).

However, the federal COBRA law relates only to businesses that have 20 or more employees.

Therefore, Minnesota has its own Mini-COBRA law that covers all businesses, regardless of their annual gross income and the number of employees.

The difference in Minnesota’s state laws is that COBRA covers all businesses, regardless of the annual gross income and the number of employees.

Moreover, the health plan continuation also covers:

- Recently divorced spouses,

- Families of employees who have passed, and

- Children who lost their dependent status when they turned 26 years of age.

Occupational safety in Minnesota

In 1970, when the original Occupational Safety and Health Act was enacted, all US states incorporated it into their laws.

The act is administered by the Occupational Safety and Health Administration (OSHA), and it ensures a safe workplace and hazard-free working conditions.

The state of Minnesota has its own OSHA laws and standards that serve to protect workers from the following types of hazards:

- Biological,

- Chemical,

- Psychosocial,

- Safety,

- Physical, and

- Ergonomic.

🎓 OSHA Hazard Identification and Assessment

Miscellaneous Minnesota labor laws

Since some of the laws that the state of Minnesota implements can’t be placed under the previously mentioned categories, this section will cover miscellaneous labor laws.

The most noticeable miscellaneous labor laws include:

- Background check law,

- Recordkeeping laws,

- “Ban-the-box” law,

- Whistleblower law,

- Drug and alcohol testing law, and

- Minneapolis Freelance Workers Protection Ordinance.

Background check laws

According to federal law and the Fair Credit Reporting Act, all information regarding an employee’s background is completely protected from being used by medical information companies, credit bureaus, and tenant screening services.

However, the state of Minnesota does require background checks for specific types of employees. Some of them include:

- Nursing home and home care personnel,

- Residential buildings’ managers,

- School personnel,

- Adult rehabilitation specialists, and

- Long-term health personnel.

🎓 Minnesota background check laws

Recordkeeping laws

The Department of Labor and Industry may occasionally inspect employers in Minnesota to verify compliance with recordkeeping laws.

Some of the documents each employer has to have at their disposal are:

- Names, occupations, and addresses of all employees,

- Payment information such as wage rates and dates of payments,

- Record of working hours of all employees,

- Proof of the minor employees’ age,

- Copies of earning statements,

- Meal credit records (if any),

- Personnel policies, and

- Signed contracts of employment.

All records have to be kept at the place of work or at a nearby location where they can be easily accessed in case the commissioner requests them.

“Ban-the-box” law

Several US states have adopted the “ban-the-box” law, including Minnesota. The term originates from the practice of checking boxes on contracts that were mandatory for ex-offenders and convicted criminals.

Due to a lack of employment opportunities, many US states have decided to “ban the box” and prohibit employers from inquiring about applicants’ criminal histories.

However, this law does not apply to employers with a statutory duty to conduct background checks regarding criminal activity, nor does it apply to the Department of Corrections.

🎓 Minnesota Ban-the-Box and Criminal Records in Employment

Whistleblower laws

Minnesota implements whistleblower laws to protect employees from retaliation in cases where they disclose confidential and incriminating information regarding violations on the workplace premises or any type of illegal conduct by the employer.

In broader terms, employees are protected from retaliation when they:

- Report, in good faith, a suspected or planned violation,

- Participate in an investigation,

- Refuse to help, witness, or aid a violation, and

- Refuse to break federal or state laws.

Drug and alcohol testing laws

According to Minnesota law, an employer can request that an employee undergo a drug and alcohol test once a year, provided they deliver a notice at least 2 weeks prior.

However, there are additional situations in which employers can request such tests. Some of them include:

- Offering a position that entails testing all job applicants (according to the firm’s bylaws),

- Random drug testing as a means of preserving safety-sensitive environments,

- Reasonable suspicion testing, and

- Treatment program test.

Minneapolis Freelance Workers Protection Ordinance

Although an ordinance isn’t technically a law, it’s still an important authoritative decree that has become a strong pillar in the freelance workforce over the last few years.

Freelance Workers Protection ensures that everyone gets paid for the work previously agreed upon in the contract with the employer.

According to the ordinance rules, each contract between a freelance worker and an employer should include:

- Name and address of the hiring party and the employee,

- Itemized list of all obligations that the employee has to perform,

- Compensation, and

- Pay date of the agreed compensation.

Due to constant shifts and changes in working requirements, a contract should be created to allow for flexibility.

Required workplace posters in Minnesota

The Minnesota Department of Labor and Industry requires employers to put certain labor law posters in the workplace and provide work notices to employees.

Here is a list of required employee notices in Minnesota:

- Earned sick and safe time notice,

- Employee wage notice,

- Nursing Mothers, Lactating Employees, and Pregnancy Accommodations,

- Recruited Migrant Agricultural Worker Employment Statement,

- Safe Workplaces for Meat and Poultry Processing Workers Notice,

- Packinghouse Workers Bill of Rights explanation form, and

- Recruited meatpacking and poultry processing workers disclosure.

Here is a list of required workplace posters in Minnesota:

- Age discrimination poster,

- Minimum wage rates,

- Safety and health protections on the job,

- Unemployment poster,

- Workers’ compensation,

- Veterans’ benefits and services,

- Earned sick and safe time poster,

- Packinghouse Workers’ Bill of Rights, and

- Pregnant workers and new parents.

🎓 Minnesota workplace notices and posters

Frequently asked questions about labor laws in Minnesota

To make this Minnesota labor law guide as comprehensive as possible, we’ve included an FAQ section to answer some common questions.

What are Minnesota labor laws?

Minnesota uses both federal and state laws to regulate employment. Here are some of the most important labor laws in Minnesota:

- Fair Labor Standards Act (FLSA),

- Family and Medical Leave Act (FMLA),

- Consolidated Omnibus Budget Reconciliation Act (COBRA),

- Minnesota’s Child Labor Standards Act,

- Minnesota Human Rights Act, and

- Fair Credit Reporting Act.

What is considered a hostile work environment in Minnesota?

The Minnesota Department of Human Rights (MDHR) states that any undesirable conduct that affects the individual’s work performance or creates a hostile or threatening workplace can be considered a hostile work environment.

Does Minnesota have a WARN Act?

Yes, Minnesota has its own version of the Worker Adjustment and Retraining Notification (WARN) Act, which is similar to the federal one.

The federal WARN Act protects employees in case of a mass layoff or plant closing, and it requires employers to give a 60-day notice to employees in this case.

Under the Minnesota WARN Act, all employers who provide notice under WARN must provide the names, addresses, and occupations of the terminated employees to the Minnesota Department of Employment and Economic Development (DEED).

How many hours can you work without a break in Minnesota?

Minnesota doesn’t have a limit on the number of hours an employee can work without a break. However, employees in Minnesota are entitled to a restroom break after working for 4 consecutive hours. Also, employees who work 8 hours are entitled to a meal break.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs for FREE with just a few clicks.

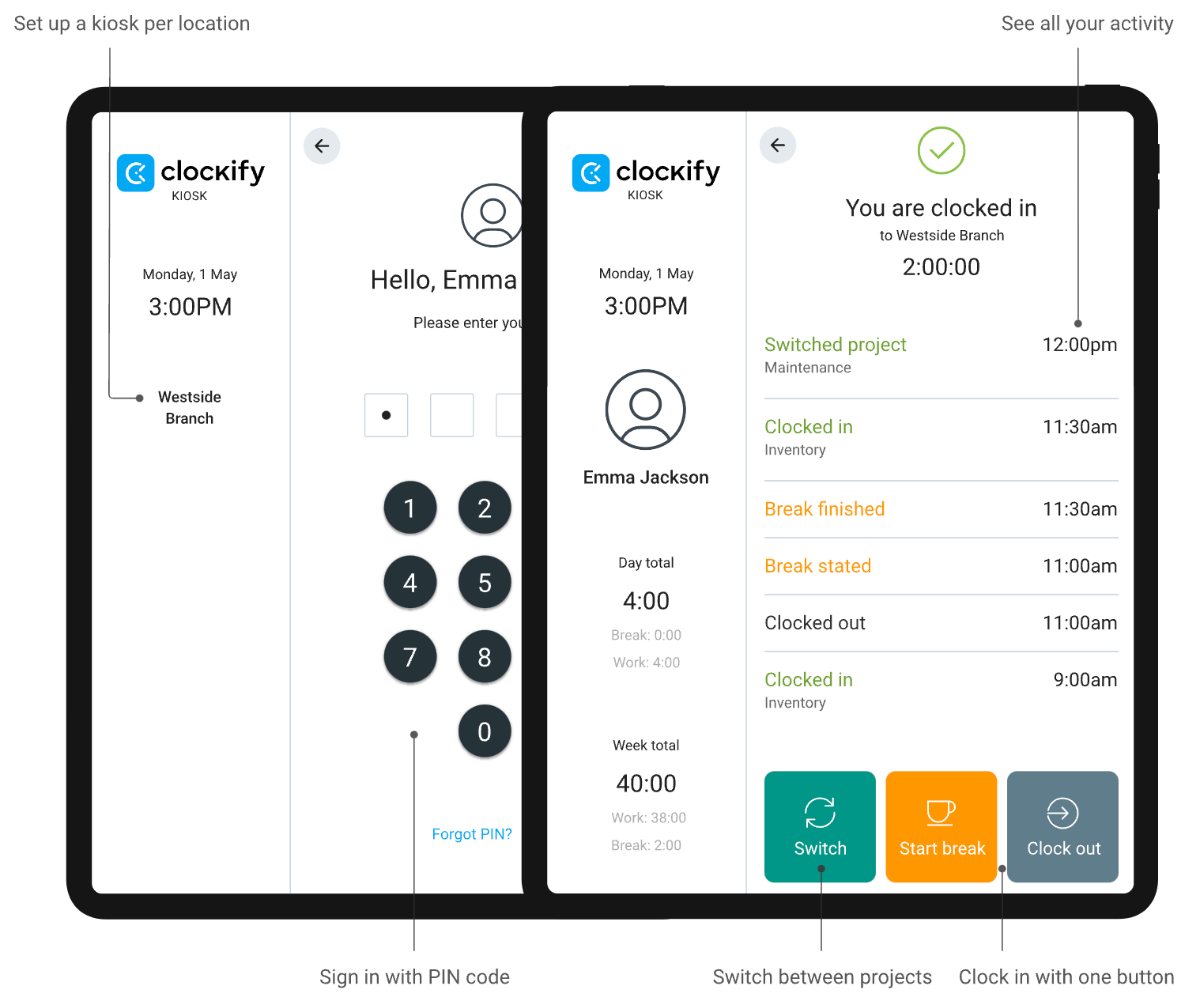

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

The kiosk feature can be easily set up on a tablet or mobile device, allowing employees to clock in and out using their PIN code.

With this, you can precisely track their work hours, breaks, and other activities.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Minnesota labor law guide has been helpful. We advise you to pay attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Minnesota labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.