New Hampshire Labor Laws Guide

| New Hampshire Labor Laws FAQ | |

| New Hampshire minimum wage | $7.25 |

| New Hampshire overtime | 1.5 times the rate of the standard wage ($10.875 for workers earning minimum wages) |

| New Hampshire break laws | 30-minute meal break for all employees working for 5 consecutive hours 24-hour rest day after working for 7 consecutive days |

In this New Hampshire labor laws guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks

- Leave requirements

- Child labor laws

- Hiring and termination laws

- Occupational safety laws

- Miscellaneous labor laws

New Hampshire wage laws

Overall, employers in New Hampshire are obligated to adhere to federal laws and regulations regarding minimum wage. However, there are some state laws to keep an eye on, which offer additional benefits to employees.

The exact numbers for the regular minimum wage, tipped minimum wage, and subminimum wage in New Hampshire are shown in the table below.

| NEW HAMPSHIRE MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $3.27 | $7.25 |

New Hampshire minimum wage in 2025

New Hampshire’s state laws require that all New Hampshire employers, regardless of the profession, keep a true record of all work hours on a daily basis for all employees, except for employees exempt under 29 U.S.C. section 213(a) of the Fair Labor Standards Act.

The minimum wage rate in New Hampshire in 2025 matches the established federal rate, which is set at $7.25. The federal rate hasn’t changed since 2008, when it was last increased by $0.70.

Tipped minimum wage in New Hampshire

According to the federal law regarding tipped employees, all employees who earn at least $30 a month in tips, and therefore are considered tipped employees, are to be paid at least $2.13 in direct hourly wages.

However, tipped employees in New Hampshire have additional benefits under state laws, which require that at least 45% of the current federal and state minimum wage be paid on an hourly basis, i.e., $3.27.

To be eligible for the state’s tipped minimum wage, a person has to be an employee of food service facilities, such as the following:

- Restaurants,

- Motels,

- Inns,

- Cabins, and

- Hotels.

New Hampshire tipped employees are in no way required to participate in tip pooling or any sort of tip-sharing arrangements.

However, if they choose to do so, employers can serve as mediators regarding any confusion or dispute concerning the sharing pool.

🎓 Track work hours and hourly pay with Clockify

New Hampshire subminimum wage

The state of New Hampshire has no limitations regarding the subminimum wage, as defined by the Fair Labor Standards Act (FLSA), for individuals with disabilities.

Therefore, they will not be paid less than the federal minimum wage rate, which amounts to $7.25.

The same minimum wage applies to the following:

- Learners,

- Student-workers, and

- Apprentices.

When it comes to trainees, employers in the state of New Hampshire can pay a training wage of not less than 75% of the state minimum wage — if the trainee has less than 6 months of experience in the field.

Since the minimum wage amounts to $7.25, employers cannot pay trainees less than $5.44 per hour.

If an employee is enrolled in a high school or a post-secondary school, the employer can file for an application with the Department of Labor to pay the student subminimum wages or no wages at all if the student is working for practical experience.

Exceptions to the minimum wage in New Hampshire

Exceptions to the minimum wage can be made for employees exempt on a federal basis under 29 U.S.C. section 213(a).

In federal terms, the exceptions to the minimum wage include the following:

- Executive, administrative, and professional employees who receive a fixed salary of at least $1,124 per week(or $58,656 per year),

- Highly compensated employees who earn $151,164 per year or more,

- Household, domestic, and farm labor,

- Newspaper delivery,

- Outside sales,

- Summer camps, and

- Golf and ski track maintenance.

The list also includes tipped employees who receive $3.27 per hour and exempt organizations, such as non-profits and educational institutions.

New Hampshire payment laws

There are no specific laws regarding the frequency of payments. However, employers can choose whether they’ll make payments weekly, bi-weekly, or monthly.

If the employer opts for weekly payments, they must make them within 8 days after the workweek has expired.

If, on the other hand, they choose to pay employees on a bi-weekly basis, they must do so within 15 days after the expiration of the 2 workweeks.

Exceptions can be made for less frequent payments if the employer has filed for authorization from the Commissioner of the Department of Labor.

All payments must be made:

- In lawful US money,

- Via electronic fund transfers and payroll cards, and

- Through checks and direct deposits.

🎓 New Hampshire payment of wages

New Hampshire overtime laws

The state of New Hampshire follows federal regulations when it comes to overtime laws.

According to the FLSA, all non-exempt employees who work more than 40 hours per week are entitled to overtime compensation that equals 1.5 times the minimum wage rate.

An important thing to keep in mind is that overtime is calculated on a weekly, not daily, basis, which is the case in some US states.

The minimum wage in New Hampshire is equal to the federal standard — $7.25 — which means that an hour’s worth of overtime amounts to $10.875.

🎓 Track New Hampshire overtime with Clockify

Overtime exceptions and exemptions in New Hampshire

Since the New Hampshire statute follows FLSA regulations on overtime pay, similar conditions apply when it comes to overtime exceptions and exemptions.

Generally, exemptions to overtime in New Hampshire include the following:

- Executive and administrative employees who make a minimum of $1,124 per week or $58,656 per yearon an annual basis,

- Outside sales employees,

- Professional employees (artists, teachers, skilled computer professionals, etc.), and

- Highly compensated employees who make more than $151,164 a year.

Furthermore, New Hampshire laws also include the following professions in overtime exceptions:

- Household, domestic, and farm labor,

- Newspaper delivery,

- Summer camps, and

- Golf and ski track maintenance.

Also, employees who work in seasonal, recreational, and amusement establishments are exempt from overtime laws if the establishment doesn’t operate at the location for more than 7 months during a calendar year.

New Hampshire break laws

Unlike overtime laws, the state of New Hampshire doesn’t adhere to federal laws when it comes to breaks.

All employees in the state of New Hampshire, regardless of the working sector, are entitled to a 30-minute meal break after working for 5 consecutive hours. As for any rest periods, the employer isn’t obligated to provide any.

Exceptions to break laws in New Hampshire

If the job description allows the employee to work and have a meal at the same time, the break time will be paid; otherwise, the break time is unpaid.

Although employers aren’t legally required to provide rest periods, the general consensus is that they’ll offer a 24-hour rest day after employees have worked for 7 consecutive days.

New Hampshire breastfeeding laws

According to New Hampshire law, all mothers are free to breastfeed in public if they’re legally allowed to be at the location. Furthermore, all New Hampshire employers with 6 or more employees are obligated to provide nursing mothers with 30-minute unpaid lactation breaks for every 3 hours of work.

New Hampshire leave requirements

The FLSA doesn’t require employers to provide time off. Still, many employers will offer paid time off as a way to keep employees satisfied.

On the other hand, certain regulations in each state require employers to offer certain types of time off, in general.

Depending on the circumstances, leave in the state of New Hampshire can be:

- Required

- Non-required

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave (FMLA) — Many US states have their own versions of the Family and Medical Leave (FMLA), but the state of New Hampshire isn’t one of them. Therefore, the standard federal leave laws apply. The Family and Medical Leave laws are designed to protect employees in cases of family and medical emergencies, including:

In order to receive FMLA benefits, an employee has to meet certain criteria, such as:

If the criteria are met, the employee will be granted 12 weeks of unpaid leave, which can be used once within 12 months. After a calendar year has expired, the FMLA renews and can be used again. Moreover, the FMLA covers military caregiver leave — a type of leave an employee can use if a spouse or a family member is injured on military duty. An important note: If the person were to be injured again, the military caregiver leave cannot be used again. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — New Hampshire employers are required to provide either unpaid or paid leave for jury duty and jury selection. Based on the time the employee has spent on jury duty, they may be required to provide a jury summons to their employer as proof of service. Also, if the absence from work may cause the employer undue hardship, the court can excuse the employee from jury duty upon providing the proper documentation. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave — If an employee finds themselves in a situation where they can act as a “first responder,” the employer must provide a leave of absence in the state of New Hampshire. Such policies are governed by the Office of Homeland Security and Emergency Preparedness, and they usually apply to people employed as:

|

| ✅ REQUIRED LEAVE |

|

Crime Victim Employment Leave Act — As of 2006, New Hampshire became one of the US states toincorporate the Crime Victim Employment Leave Act into its statute, offering assistance to employees who are crime victims. All employers in the state of New Hampshire are required to offer unpaid leave time to an employee under this act if the employee is:

After the employee has filed the proper documentation and provided it to the employer, they’ll be granted the leave for the required amount of time. If, however, the leave can put the employer in a position of “undue hardship,” the employer can limit the absence. |

| ✅ REQUIRED LEAVE |

|

Pregnancy and disability leave — New Hampshire state law obliges employers to provide leave to employees if they’re unable to work due to the following reasons:

A physical and mental examination by a professional will determine when the employee is fit to return to work, and they’ll be reinstated to their previous position at the workplace. |

| ✅ REQUIRED LEAVE |

|

Military leave — If a full-time employee is summoned to engage in military drills, training, and/or temporary duty, New Hampshire law states all employers are obligated to provide them with a 15-day absence with full pay. This provision applies to employees who haven’t been inducted or enlisted in active duty in the Armed Forces. After 15 days have passed, the employee will be granted an additional 30 days of absence, if needed, with partial pay, to finish the temporary duty in the Armed Forces. If the employee is an active soldier in the Armed Forces, the leave is indefinite — i.e., it lasts until the service in the Armed Forces has finished. |

| ✅ REQUIRED LEAVE |

|

Holiday leave (public employers) — Public employers aren’t obligated to provide paid holiday leave, but they’re required to provide time off for state holidays in New Hampshire. The following is the list of state holidays:

|

| ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Holiday leave (private employer) — A New Hampshire private employer isn’t required to provide a leave of absence during the holidays to their employees, but they generally choose to do so as a way of improving team dynamics and boosting morale. However, an employer can also request such employees to work during the holidays for an overtime wage of 1.5 times the hourly rate,if the contract of employment doesn’t specify otherwise. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — Employers aren’t required to provide sick days under their policies for leaves of absence. They can choose to do so, in which case they’ll have to comply with their sick leave policy since it will be reviewed by the Commissioner of Labor and Industry. The policy has to specify the use of sick days and the accrual methods. |

| ❌ NON-REQUIRED LEAVE |

|

Voting leave — The employers aren’t required to provide time off for voting purposes under any state law in New Hampshire. However, there’s a section in the statute regarding “absentee voting” — any employee who cannot physically be present at the voting stations due to employment obligations — e.g., traveling on business — will be considered an “absent voter” and granted the right to vote from a different location. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — In a similar fashion, employers aren’t required to offer paid or unpaid leave of absence for bereavement, funerals, grieving periods, etc. If they choose to do so, the exact information regarding the policy must be delivered to employees in writing or posted with the rest of the employment policies in a conspicuous place on the workplace premises. |

Child labor laws in New Hampshire

Child labor laws, whether federal or state, are always designed to protect minors from exploitation at work. This always includes protection from:

- Physical,

- Moral, and

- Emotional hazards.

The state of New Hampshire institutes a set of child labor laws prescribed by both the New Hampshire Department of Labor and the US Department of Labor.

Firstly, no minor under the age of 16 can be employed until they have acquired a New Hampshire Employment Certificate from the Superintendent of Schools in their hometown, i.e., the town/city where they go to school. The only exception is if the minor in question opts to work:

- For his or her parents, grandparents, or a guardian,

- As a farm laborer, or

- As a casual worker, for a brief duration of no more than 3 calendar days for any one employer.

The certificate must be obtained within the first 3 business days to avoid penalties.

No minor aged 16 and17 will be employed in the state of New Hampshire until 2 conditions have been met:

- The minor has graduated from high school or obtained a diploma from a school with similar equivalency, and

- The minor has provided the employer with a written statement confirming their permission to work.

The written statement has to be issued by the parents or the legal guardians of the minor.

Moreover, the employer must have proof of age at the working premises at all times. The documentation containing the age of the minor can be verified with:

- A birth certificate,

- A passport,

- An immigration record, and/or

- An official identification card — I.D.

Work time restrictions for New Hampshire minors

When it comes to minors under the age of 16, 2 different sets of restrictions apply, based on whether they fall under the mix of federal and state laws or only state laws.

To know which category the minor employee falls under, please contact the office of the Commissioner of Labor.

Work time restrictions for New Hampshire minors up to 15 years of age

According to the federal/state amalgamation of laws, minors aged 14 and 15 can’t work:

- Before 07:00 a.m. and after 07:00 p.m., except from June 1 up until Labor Day,

- During school hours,

- More than 3 hours on school days and 8 hours on non-school days, and

- More than 18 hours per week and 40 hours on non-school weeks.

If aged 12, 13, 14, and 15 and subjected to state laws only, minors may not work:

- Before 07:00 a.m. and after 09:00 p.m.

- During school hours,

- More than 3 hours on school days and 8 hours on non-school days, and

- More than 23 hours per week and 48 hours on non-school weeks.

Work time restrictions for New Hampshire minors aged 16 and 17

When it comes to minors aged 16 and 17, 2 divisions can further be made — minors who are in school and minors who have graduated or don’t go to school.

If the employee is aged 16 and 17 and is enrolled in high school, they can’t work:

- More than 30 hours/6 days consecutively during a school calendar week,

- More than 48 hours/6 days consecutively during a vacation week,

- More than 10 hours per day in manufacturing,

- More than 10 ¼ hours per day in mechanical labor, and

- More than 8 hours per night if they’re working a night shift.

If the employee is aged 16 and 17 and doesn’t attend school, they can’t work:

- More than 10 hours per day/48 hours per week in manufacturing,

- More than 10 ¼ hours per day/54 hours per week in mechanical or manual labor, and

- More than 8 hours per shift/48 hours per week if working the night shift.

Breaks for New Hampshire minors

All employees in the state of New Hampshire, regardless of age, are entitled to a 30-minute meal break after working for 5 consecutive hours.

However, if the employee is a minor, their breaks can be prolonged at the employer’s discretion, in which case the standard New Hampshire break rule will be waived.

Prohibited occupations for minors in New Hampshire

The general consensus in all US states is that no minor can be employed in any occupation that presents a physical, emotional, or moral hazard.

The list of all prohibited occupations for minors in New Hampshire under the age of 18 includes:

- Manufacturing and working with explosives,

- Driving motor vehicles,

- Mining, logging, and sawmilling,

- Working with power-driven machinery — woodworking, metalworking, processing, etc.,

- Manufacturing bricks and tiles,

- Wrecking, demolishing, and any type of dangerous construction work, and

- Roofing and excavation.

Penalties for employing minors in New Hampshire

Employers in the state of New Hampshire can face penalties or even jail time if they violate the previously stated provisions regarding child labor laws.

The fines vary depending on the violation and can range from $500 to $10,000.

Furthermore, employers can be prosecuted and fined $50,000 in case a minor were to be injured and/or killed due to law violations on the working premises.

If the instance were to be repeated, the fine would be doubled to $100,000.

Also, according to federal law, any willful violation of child labor laws can be fined up to $10,000.

Hiring laws in New Hampshire

As the state of New Hampshire often relies on federal laws, it’s no surprise that hiring laws match the federal criteria described in the FLSA.

Namely, hiring laws are closely connected to discrimination laws that affect hiring decisions, job interviews, and regular employee workdays.

According to the federal law, all employers, regardless of the business sector, are forbidden from discriminating against employees based on:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Moreover, the state of New Hampshire is one of the few states that prohibit discrimination based on the use of tobacco and tobacco products outside of work.

Additionally, during the interview process, employers may use consumer credit reports for background checks under the New Hampshire Fair Credit Reporting Act. However, to receive the report, the employer must obtain written authorization from the employee.

“Right-to-work” law in New Hampshire

In addition, it’s important to note that the state of New Hampshire is not a “right-to-work law” state — a state in which the legislative body guarantees that no employee will be forced to join or be associated with a labor union.

🎓 New Hampshire Department of Labor laws

Termination laws in New Hampshire

The state of New Hampshire practices the “employment-at-will” arrangement that many US states have incorporated into their legal systems.

Practically, “employment-at-will” means that employers can terminate an employee’s contract of employment for any lawful reason without repercussions. However, there are exceptions to the rule, which include:

- Terminations that violate labor laws,

- Terminations that violate required leaves of absence, and

- Violating company policies approved by the commissioner.

In the case of massive layoffs — more than 25 employees terminated at the same time — the employer is required to notify the New Hampshire Department of Employment Security, regardless of whether the layoffs are temporary or permanent.

If the employee is wrongfully terminated, claims and lawsuits can recover:

- Lost wages,

- Back pay,

- 401 (k) contributions, and

- Lost benefits.

Furthermore, the claims can grant employees entitlement to compensation based on the pain, suffering, and emotional distress they may have experienced during the process.

Final paycheck in New Hampshire

According to New Hampshire Protective Legislation, all unpaid wages shall be paid in full in 3 days (72 hours) following the termination of employment by the employer.

If the employee has resigned, the wages will be paid in full on the next designated payday.

In case the wages aren’t paid by the next designated payday, the employer will be fined an additional 10% of the total wages for the days that followed the termination — excluding Sundays and non-working holidays.

Health insurance continuation in New Hampshire (COBRA)

The federal law regarding the Consolidated Omnibus Budget Reconciliation Act (COBRA) states that employees have the right to continue receiving their group health benefits in the case of both voluntary and involuntary job loss for 18 to 36 months following the termination.

All employers are required to provide employees with election notices for COBRA.

After the employee receives the notification, they have 60 days to apply for COBRA, pay a 2% administrative fee, and continue their health coverage.

This law applies to businesses that employ at least 20 workers, which is why many states, including New Hampshire, have incorporated mini-COBRAs.

Mini-COBRAs cover health costs for businesses of all sizes.

New Hampshire COBRA laws provide employees and their dependents with 39 weeks of health continuation coverage after paying the premium.

Occupational safety in New Hampshire

New Hampshire doesn’t have any state plans concerning occupational safety; therefore, the federal OSHA governs the safety measures in the public sector.

In brief, the Occupational Safety and Health AdministrationAct of 1970 is designed to protect all employees who operate and work on hazardous premises.

The most common workplace hazards recognized by OSHA can be classified into:

- Biological,

- Chemical,

- Physical,

- Ergonomic,

- Safety, and

- Work organization.

OSHA’s responsibilities include conducting regular inspections to ensure that all facilities and working premises are safe and that both employees and employers are complying with health and safety standards.

Miscellaneous New Hampshire labor laws

Some New Hampshire laws can’t be put into a specific category, which is why we’ll cover them in the miscellaneous section. The section includes:

- Background check law,

- Whistleblower law,

- Social media law, and

- Record-keeping law.

Background check law

Employers in the state of New Hampshire are permitted to conduct background checks when hiring new employees, but they must adhere to specific regulations.

All screenings and checks must comply with the Fair Credit Reporting Act and the Equal Employment Opportunity Commission (EEOC) regulations to be considered valid.

Some of the professions that require background checks include:

- School and daycare personnel,

- Foster care agency personnel,

- Residential and children’s camp personnel, and

- Nursing home personnel.

Additionally, as previously mentioned, consumer reports can be used during the hiring process if the job applicant has received written notification from the employer requesting their information.

The request has to be in accordance with the New Hampshire Credit Reporting Act.

Whistleblower law

The New Hampshire Department of Labor protects all employees under section 275-E:2 of the Whistleblower Protection Act who decide to act and report workplace violations.

According to the law, no employee can be harassed, intimidated, threatened, or discharged due to “blowing the whistle.”

An employee can’t be terminated due to:

- Refusal to participate in illegal activities,

- Refusal to break federal and state laws,

- Reporting workplace violations, and

- Participating in an open investigation regarding workplace violations.

Social media law

Employers in the state of New Hampshire can’t request personal information from employees regarding their social media accounts under the guise of “assessment,” such as:

- Usernames,

- Passwords, and

- Authentication information.

Record-keeping law

The state of New Hampshire has no specific laws regarding record-keeping; therefore, federal rules apply.

According to the FLSA, employers will keep records for 3 years of:

- Payroll information,

- Bargaining agreements,

- Sales and purchases,

- I-9 forms, and

- Certificates and notices.

For 2 years, employers will keep records of:

- Shipping and billing,

- Timecards,

- Wage rate information, and

- Additions and deductions from wages.

Finally, records that the employer is obligated to keep for 1 year are all employment information regarding:

- Hiring,

- Termination, and

- Any extra documentation that was kept during the course of employment.

Frequently asked questions about New Hampshire labor laws

We’ve covered some essential laws of interest regarding labor in the state of New Hampshire. However, there’s always something left unanswered.

Therefore, we’ve dedicated an FAQ section to answer some commonly asked questions.

What is the 2-hour rule in NH?

In essence, the 2-hour rule states that any employee who comes into work at the request of the employer has to be paid at least 2 hours’ wages.

In practical terms, if your employer asks you to come and close the shop and you’ve technically worked less than 2 hours, you’ll still be paid 2-hour wages.

How many breaks are in an 8-hour shift?

If your job requires you to work an 8-hour shift, you’ll technically be eligible for one 30-minute break. However, if the nature of the job is physically or mentally demanding, your employer might be able to offer an additional unpaid break, if such a break is previously incorporated into their company policy.

How many days in a row can you work without a day off in New Hampshire?

According to New Hampshire Revised Statutes, Section 275:33 titled ‘Day of Rest’, no employer can operate a business on a Sunday unless they have notified their employees early on and made a working schedule. Therefore, if an employee is required to work on a Sunday, they’ll be granted a day off sometime within the following 6 days after the said Sunday.

In conclusion, a person can technically work 7 days a week, but the monthly average of working days won’t be 7 days.

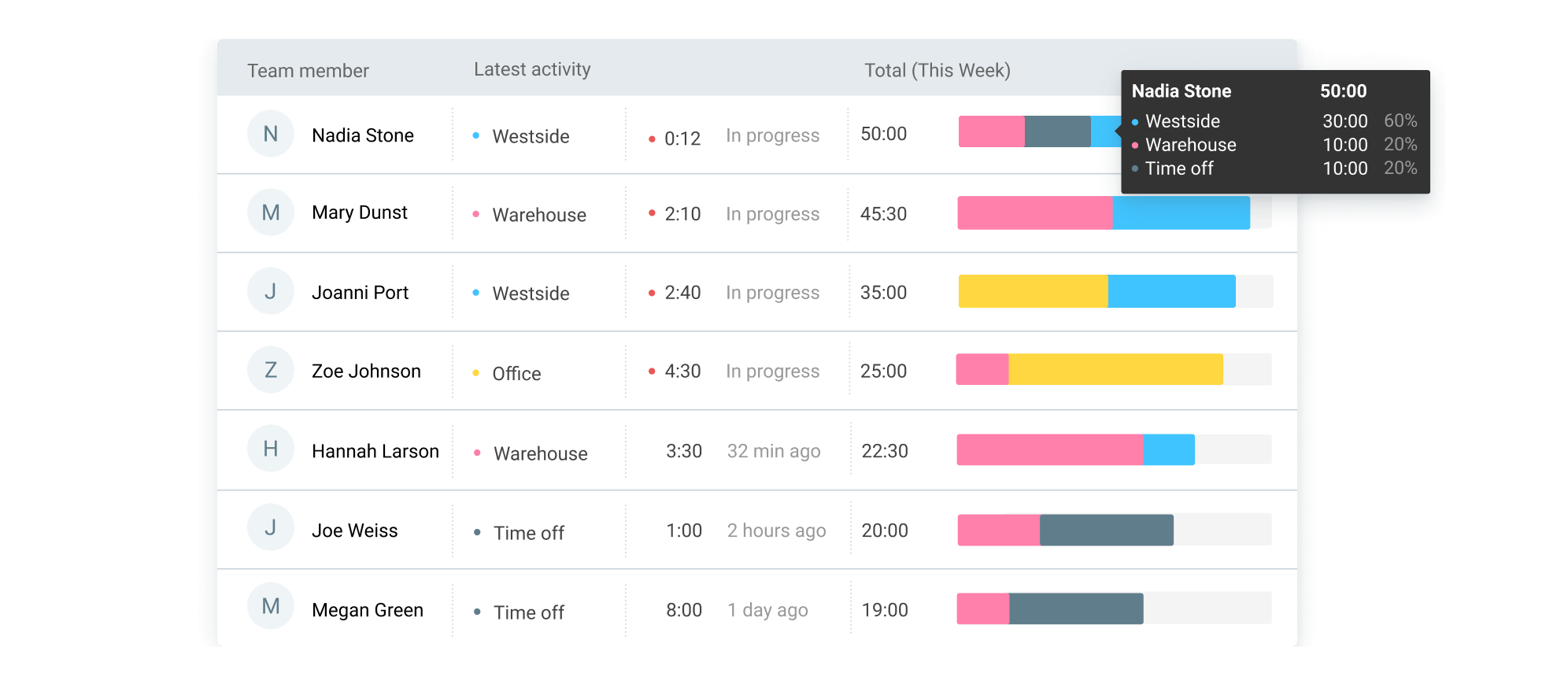

Looking for a simple and robust time clock for employees?

Try Clockify — an intuitive time tracker that allows you to track time, attendance, and costs with just a few clicks for FREE.

Your team can track work time via the web or mobile app, or you can set up a time clock kiosk that allows employees to clock in and out at the start and end of their work shifts.

Moreover, you can see the total number of accrued leave days for each employee and stay compliant with all the current labor laws in New Hampshire.

Additionally, Clockify lets you:

- Review timesheets,

- Approve time off,

- Schedule shifts,

- Run time card reports, and

- Export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this New Hampshire labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in June 2025, so any changes in the labor laws that were included later than that may not be included in this New Hampshire labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.