New York Labor Laws Guide

Ultimate New York labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| New York Labor Laws FAQ | |

| New York minimum wage | $15.00 for all New York City employees $15.00 for all Long Island and Westchester employees $13.20 for the remainder of New York State employees |

| New York overtime | 1.5 times the rate of the standard wage if the employee has worked over 40 hours ($22.5 for minimum wage earners in the city of New York, Long Island, and Westchester) $19.8 for the remainder of New York State employees |

| New York break laws | Factory workers: A 60-minute break between 11:00 a.m. and 2:00 p.m. A 60-minute break midway through shifts that start between 1:00 p.m. and 06:00 a.m. Non-factory workers: A 30-minute lunch break between 11:00 a.m. and 2:00 p.m. for shifts lasting 6 hours or longer during this period A 45-minute break midway through shifts that start between 1:00 p.m. and 06:00 a.m. All workers: An additional 20-minute break between 5:00 p.m. and 7:00 p.m. for shifts that start before 11:00 a.m. and extend after 7:00 p.m. |

Table of contents

New York wage laws

Firstly, we’ll go in depth into minimum wage laws regarding various professions and localities in the state of New York, which differ quite a bit from other US states.

Having the largest populated city in the US, the state of New York has many nuances worth investigating and noting — including miscellaneous laws for:

- The city of New York,

- Long Island, and

- Westchester.

New York minimum wage

As of December 31, 2016, the State Department of Labor has been continuously increasing the state minimum wage on an annual basis to compensate for inflation rates and improve the overall life quality of New York employees.

Before 2016, the changes were rather insignificant — i.e., small in comparison to the last couple of years.

During the reconstruction period in 2016/17, the Department of Labor set forth to stabilize the minimum wage at the rate of $15.00 for all New York employees in the following years.

However, the state of New York implements different minimum wage laws for various localities and professions, which is why the goal of reaching $15.00 takes more time for some than others.

To give you a clear perspective on the exact numbers, the New York minimum wage rate schedule goes as follows:

| Location | 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 | 12/31/20 | 12/31/21 |

| NYC — Big Employers (11 or more employees) | $11.00 | $13.00 | $15.00 | |||

| NYC — Small Employers (10 or fewer employees) | $10.50 | $12.00 | $13.50 | $15.00 | ||

| Long Island & Westchester | $10.00 | $11.00 | $12.00 | $13.00 | $14.00 | $15.00 |

| Remainder of New York State Workers | $9.70 | $10.40 | $11.10 | $11.80 | $12.50 | $13.20 |

As of December 31, 2021, Article 19 of the Minimum Wage Act states that all employees in the state of New York must receive at least $13.20 until the rate reaches $15.00. In case of violating the Act, an employer could be required to pay:

- Liquidated damages,

- Minimum wage underpayments, and

- Penalties up to 200% of the unpaid wages.

Tipped minimum wage in New York

The state of New York recognizes tipped employees as:

- Food service workers

- Service employees

As of the end of Q4 of 2021, both groups are entitled to the state $15.00 tipped minimum wage.

However, nuances behind the tipped payments are reliant on two factors:

- Location

- “Satisfaction” of the minimum wage.

New York employers are allowed to “satisfy” the minimum wage by combining cash wages with the tips that the employees receive during one hour.

For example, food service workers in the locality of Long Island can receive $10.00 in cash wages and an additional $5.00 tip credit to satisfy the tipped minimum wage.

The only exception is that the minimum cash wage must amount to $10.00 — except in the areas of the New York state where the minimum wage has yet to reach the ultimate goal of $15.00 — with the exception of Long Island, Westchester County, and NYC.

To get a clear picture, take a look at the following table:

| NYC | Long Island and Westchester County | The rest of New York State | |

| Service employees | $12.50 cash wage $2.50 tip credit |

$12.50 cash wage $2.50 tip credit |

$11.00 cash wage $2.20 tip credit |

| Food service workers | $10.00 cash wage $5.00 tip credit |

$10.00 cash wage $5.00 tip credit |

$8.80 cash wage $4.40 tip credit |

New York subminimum wage

According to the FLSA (Fair Labor Standards Act), subminimum wages are defined as payments lower than the state wage — and they can be paid to:

- Student-learners,

- Full-time students that work in retail, agriculture, and service establishments, and

- People with impaired productive capacity — i.e. people who are physically and mentally disabled.

When it comes to student-learners in the state of New York, they will be paid the subminimum wage if they work for a corporation or an association operated for:

- Religious,

- Charitable, and/or

- Educational purposes.

If that is the case, the employer is allowed to pay them 85% of the New York minimum wage, which amounts to $12.75 or $11.22, depending on the locality of their employment.

The New York State Assembly is also making strides towards abolishing subminimum wages for people with disabilities — the process went into effect during the month of November in 2021.

So far, employers are allowed to pay them subminimum wages if they are taking part in a rehabilitation program.

Track employee payroll with ClockifyExceptions to the minimum wage in New York

New York state laws abide by the federal standards when it comes to exceptions and exemptions to the minimum wage, in most cases.

However, there are some professions that also fall under these categories, in accordance with state laws.

Some of the federal examples include:

- Executive workers who are paid on a salary basis and earn not less than $1,125 per week,

- Administrative workers who are paid on a salary basis and earn not less than $1,125 per week,

- Learned and creative professionals paid on a salary basis who earn not less than $1,125 per week,

- Computer employees who earn $1,125 per week or at least $28.125 per hour,

- Highly compensated employees who earn $107,432 or more a year, and

- Outside sales employees — No minimum salary requirement.

The state of New York further exempts:

- Farm laborers,

- Babysitters,

- Taxicab drivers,

- Religious or charitable organization workers,

- Summer camp employees,

- Newspaper delivery workers, and

- Volunteers or part-time employees at amusement parks.

New York payment laws

According to section 191 of New York state laws, all employers in the state of New York are obligated to provide a specific frequency of payments — depending on the type of work their employees perform.

The said section does not cover:

- Federal,

- State, and

- Local government employers.

The frequency of payment for specific professions are expressed in the table below:

| Manual workers | Railroad workers | Commission salespersons | Executives, administrators, and professionals | Clerical and other workers |

| Once per week — profit entities Semi-monthly — non-profit entities |

Weekly on every Thursday | Not less than once per month/ not later than the last day of the month | Does not apply | Not less frequently than semi-monthly |

New York overtime laws

Similar to most US states, New York non-exempt employees are entitled to overtime pay if they have worked more than 40 hours per week. Overtime amounts to 1.5 times the rate of an hourly rate.

For example, if an employee works 50 hours per week for the state minimum wage of $15.00, the excess 10 hours will be worth $22.50.

All payments that are not a part of the standard wage will not be included in the overtime calculations. Such payments can include:

- Premium payments,

- Expenses,

- Gifts, and

- True premiums (Saturdays, Sundays, and holidays).

It is important to note that the overtime rate law does not cover:

- Federal,

- State, and/or

- Local government employers/employees.

However, it does cover:

- Non-profit organizations,

- Private schools,

- Charter schools, and

- Teachers working in school districts.

Also, residential employees — i.e. workers whose duties are directly related to the premises of the employing organization — have to work more than 44 hours per week to be eligible for overtime pay.

When it comes to holidays and night work, the employer is not required to provide overtime compensation as per New York labor laws, but can choose to do so, in which case the standard rules apply.

Overtime Pay CalculatorsOvertime exceptions and exemptions in New York

New York state law has a mixture of federal and state exceptions to the overtime rate. The list — Section 651— is quite extensive, but here are some of the exceptions and exemptions you should be aware of:

- Executive workers who are paid on a salary basis and earn not less than $1,125 per week,

- Administrative workers who are paid on a salary basis and earn not less than $1,125 per week,

- Learned and creative professionals paid on a salary basis who earn not less than $1,125 per week,

- Outside sales employees — no minimum salary requirement,

- Farm laborers,

- Volunteers, interns, and apprentices,

- Taxicab drivers,

- Religious and charitable organization employees,

- Camp counselors,

- Part-time babysitters, and

- Student organization employees — fraternities, sororities, and faculty associations.

New York break laws

All employees in the state of New York are entitled to a meal break under state law — including private and public sectors. According to Section 162 in New York labor laws, all meal and rest periods can be classified into three categories, based on the profession of the employee:

- Factory workers,

- Non-factory workers, and

- All workers, including factory and non-factory workers.

New York factory workers are eligible for a 60-minute meal break if they’re working the first, morning shift. The break can be taken between the hours of 11:00 a.m. and 2:00 p.m.

If the employee starts their shift between the hours of 1:00 p.m. and 06:00 a.m., they can take the said break at the time midway between the shift. The only requirement is that they work at least 6 hours.

Non-factory workers are subjected to the same requirements, with the exception of the duration of the break. If they’re working the first shift, the lunch break will last for 30 minutes, and the midway breaks last for 45 minutes.

All workers are entitled to an additional 20-minute break between 5:00 p.m. and 7:00 p.m. if the workday started before 11:00 a.m. and lasted after 7:00 p.m.

The Commissioner of Labor and Industry can issue a permit to shorten meal breaks upon request by the employer.

This can happen in cases of undue hardships that the employer could go through because of the duration of the breaks or any type of special circumstances.

The time spent taking meal breaks is not mandatory to be included in the hours worked — therefore, the employer can choose whether the breaks will be paid or not. On the other hand, if the employee works through a meal, the break will be paid.

Meal breaks in New YorkExceptions to break laws in New York

Aside from the employees that work through their meal, an important exception is to be made regarding lactating/breastfeeding employees.

Certain accommodations have to be made in order to satisfy the needs of such mothers — i.e., a reasonable amount of time (paid or unpaid) has to be provided.

Mothers that come back to work are allowed to pump milk up to 3 years after childbirth and the employer must accommodate the request for a private place or an area to do so, which cannot be a bathroom stall.

In other cases, employers and/or employees may file a formal request to the Commissioner for a modified break schedule, if the nature of the job elicits such changes.

New York leave requirements

According to the FLSA propositions, most employers in the entire US are not required to pay for the time not worked. On the other hand, all employers are aware of the importance of providing paid time off to their employees.

Still, whether paid or unpaid, the leave requirements in the state of New York can be classified into:

- Required

- Non-required

New York required leave

Regardless of whether the leave is paid or unpaid, the following is the leave time that New York state employers are required to give to their employees:

- Sick day leave

- Family and Medical leave (FMLA)

- Jury duty leave

- Voting leave

- Witness and crime victim leave

- Emergency response leave

- Bone marrow and organ donation leave

- Military leave

Sick days leave

As of April 3, 2020, New York legislation established required sick days leave for all New York employees. If the employers own a business with 5 or more employees and the business has an income of $1 million or more, the employers are required to provide paid sick leave.

If the numbers are reversed — less than 5 employees and less than $1 million net income — the employees are still eligible for the sick leave, but it is unpaid.

Regardless of the payment of the leave, all employees accrue the hours in the same way — for every 30 hours worked, the employees will receive 1 hour of sick leave. The accrual starts from the moment of employment.

All employees are covered by the sick day legislation, regardless of the sector and the industry they work in.

Family and Medical leave (FMLA)

The state of New York has an amalgamated system of federal and state laws that greatly protects employees in terms of family and medical emergencies.

In fact, it is believed that the New York FMLA system is the most comprehensive out of all US states, as of November 2021, when it was last changed.

All New York employees are protected by the federal FMLA in case the state laws are not suited better for their needs. According to federal law, employees will be granted 12 weeks of absence for:

- Taking care of an injured or sick family member,

- Treating a serious health condition,

- Bonding with a newborn, or

- Providing care for a family member that was injured on active military duty.

Furthermore, an additional 14 weeks of absence (unpaid) will be granted to employees who are required to take care of a military family member that was injured in the line of duty.

When it comes to state laws, employees are granted further benefits with the paid FMLA, under the following conditions — the employee had to have worked for the employer for at least 26 weeks and the family (medical reasons) had to be:

- Caring for a family member with a serious health condition

- Bonding with a new child, or

- Handling obligations arising from a family member's military service or deployment.

In these cases, the employees will be granted 67% of their salaries with a certain limit, depending on the duration of the leave.

Furthermore, employees will be granted paid FMLA in the case of temporary disability — TDI (Temporary Disability Insurance) — if they’ve worked for the employer for at least 4 weeks. This program also covers pregnancy-related leaves of absence and the employees are granted 50% of their regular wages.

Another law that might be of interest to both employers and employees is that the adoption leave is treated in the same manner as parental leave — the same amount of time must be granted to employees for the birth or the process of adoption of a child.

Jury duty leave

New York employers are required by law to provide jury duty leave to all employees who are:

- US citizens,

- At least 18 years of age, and

- Residents of the county in which they are summoned to serve and attend.

However, employers are not obligated to pay the wages for an employee that is on jury duty — yet they are encouraged to do so.

If the employer has 10 or fewer employees, they can absolutely withhold wages on the account of undue hardship during the time that the employee has spent on jury duty.

If the business has more than 10 employees, the employer must pay the amount of $40 or a day’s wage (whichever is lower) for the first 3 days of jury duty.

If the daily wage is lower than $40, the state will make up the difference to the employee.

Voting leave

All employees in the state of New York are granted 2 paid hours to vote during the election day — but under certain circumstances.

Namely, if the employee has 4 consecutive hours to vote between the opening of the polls and the start of their shift, they are considered to have “sufficient time to vote” and will not be paid for the voting leave.

In the same manner, if there is a gap of 4 consecutive hours between the end of the working shift and the closing of the polls, they are considered to have “sufficient time to vote.”

For example, if the employee works 10:00 a.m.–6:00 p.m. shifts and the polls open at 06:00 a.m., they have enough time to vote before the beginning of the work day. Therefore, the cap of “2 paid hours” will be paid in conditions when, for example, the employee starts work at 08:00 a.m. and the polls open at 06:00 a.m.

Employees are obligated to notify the employer at least two days in advance if they wish to be granted the leave and it is usually understood as 2 business days.

Witness and crime victim leave

Witness leave in the state of New York protects employees from any adverse actions from the employers in the case of taking a stand or being subpoenaed in an ongoing criminal case.

However, the employer is not obligated to pay for the leave. The same conditions apply to crime victims who are called to testify in the court of law.

Emergency response leave

If an employee finds themselves in a situation where they can act as a “first responder,” the employer must provide a leave of absence under section 24/28 of the executive law.

Such policies are governed by the Office of Homeland Security and Emergency Preparedness, and they usually apply to people employed as:

- Medical personnel and technicians,

- Firefighters, and

- Law enforcement officers.

Bone marrow and organ donation leave

According to the state law approved by the New York Senate, section 202-B protects all employees’ right to leave in the case of bone marrow and organ transplants.

Namely, all employees are granted up to 7 days of paid leave to undergo medical procedures to donate bone marrow.

In the same manner, they are granted 30 days for organ donations, but they are required to notify the employer at least 2 weeks prior to the procedure.

Employers are forbidden from retaliation when the employees request the leave — and could face fines if they choose not to offer paid time off.

Military leave

Under the state FMLA, employees are also protected when it comes to military leave. For assistance during military deployment, employees are granted 67% of AWW — Average Weekly Wage for 12 weeks of absence on military duty.

The pay rate has been significantly improved during the last couple of years, rising from 55% of AWW in 2019 to 67% in 2021, and it is expected to continue to rise.

Furthermore, upon returning from the line of duty, employees will be granted:

- Job protection,

- Health insurance, and

- Protection from discrimination and retaliation.

To be eligible for military leave, a small contribution of 0.511% of weekly wages will have to be deducted from payroll and redirected toward the Family Leave for Military Service.

New York non-required leave

As is the case with most US states, New York also has non-required leaves of absence, and it is up to employers to choose whether they’ll implement them or not.

The non-required leaves in New York are:

- Bereavement leave

- Vacation leave

- Holiday leave

Bereavement leave

Bereavement leave is not a requirement in the state of New York — but if the employers choose to implement it, they must follow their established policies.

In most cases, this would refer to offering the time off for mourning of the death of a partner or family member.

However, sick leave extends to include bereavement, in the case of:

- Unplanned end or termination of confirmed pregnancy due to miscarriage,

- Unplanned end or termination of confirmed pregnancy of the employee’s partner, and

- Unplanned end or termination of confirmed pregnancy of the employee’s former partner.

Vacation leave

In the state of New York, employers are not obligated to provide vacation leave, paid or unpaid.

They can choose to lawfully implement a policy if they wish, in which case they have to abide by all the policy requirements.

Furthermore, the New York State Senate has no special instructions on forfeiture of accrued days upon termination, which is why employers can set clauses inside their policies regarding the payment of accrued days.

For example, New York employers can request that employees submit a 2-week notice if they wish to use their vacation leave before quitting their jobs.

Holiday leave

Employers are not obligated to provide paid or unpaid holiday leave — but they are required to provide time off for state holidays in New York if their policies explicitly state so.

The following is the list of state holidays:

- New Year’s Day — January 1

- Martin Luther King Jr. Civil Rights Day — observed on the third Monday in January

- Washington’s Birthday — observed on the third Monday in February

- Memorial Day — observed on the last Monday in May

- Independence Day — observed on July 4

- Labor Day — observed on the first Monday in September

- Columbus Day — observed on the second Monday in October

- Election Day — observed every other year

- Veterans Day — observed on November 11

- Thanksgiving Day — observed on the fourth Thursday in November

- Christmas Day — observed on December 25

Child labor laws in New York

New York state’s Division of Labor Standards serves to govern the type of work minors can perform and the number of hours they are allowed to work on a daily/weekly basis. In all cases, the provisions in the Labor laws serve to protect minors from:

- Physical,

- Moral, and

- Emotional hazards.

In general, minors are allowed to work in the state of New York under specific requirements and instructions. But, no minor under the age of 13 will be allowed to work, except in the case of a special permit issued by the Commissioner of Labor.

An employer is required to devise a schedule for all minor employees that shows a malleable timetable for work shifts and meal breaks.

New York law has no specific statute regarding breaks for minors — but it does state that employees of all ages are entitled to a 30-minute break.

Work time restrictions for minors in New York

Employees under the age of 18 are not allowed to work during school days, except if they have finished school or withdrawn from classes. This rule also refers to home-schooled children — they are not allowed to work during the hours of public schools.

Minors that are 14 and 15 years of age cannot work in the following conditions:

- More than 3 hours on a school day,

- More than 8 hours on a non-school day, and

- More than 18 hours/6 days per week.

Exceptions can be made for minors that work as:

- Babysitters,

- Bridge caddies at bridge tournaments,

- Farm laborers,

- Newspaper carriers,

- Performers, and

- Models.

Exceptions to work time restrictions for minors

Students can elect to be a part of CEP — Cooperative Education Program — a program for students that wish to apply their knowledge in real-life situations and scenarios.

In these cases, students can be allowed to work up to 6 hours on a school day, provided it doesn’t interfere with school hours and mandatory restrictions.

Once school is out, different restrictions are in place:

- Minors aged 14 and 15 can work up to 40 hours per week, and

- 15- and 16-year-olds can work up to 48 hours per week.

Minors aged 14 and 15 can also face restrictions if they’re employed in interstate commerce firms. Under federal legislation, they are not allowed to work:

- More than 3 hours daily/18 hours weekly when school is in session, and

- More than 8 hours daily/40 hours weekly when school is out.

The final restriction is related to 12- and 13-year-olds who have work permits issued by the Commissioner to pick fruits and vegetables. They are allowed to work from June 21 to Labor Day, 4 hours per day, between the hours of 07:00 a.m. and 7:00 p.m.

They are not allowed to work:

- More than 4 hours per day,

- Before 09:00 a.m. or after 4:00 p.m.,

- When school is in session from the day after Labor Day to June 20,

However, there are no hour regulations for farm work — this applies to minors 14 years of age or older.

Night work restrictions for minors

One of the oldest professions for minors in modern times is newspaper delivery. In the state of New York, newspaper carrier minors are not allowed to make deliveries between the hours of 7:00 p.m. and 5:00 a.m.

If the sunset was to occur before 7:00 p.m. due to weather differences in seasons, the delivery is to be stopped 30 minutes before the sunset.

Minors aged 16 and under are not allowed to work between 7:00 p.m. and 7:00 a.m. after Labor Day up to June 20. After June 21, they are allowed to work 2 hours longer — up to 9:00 p.m.

Prohibited occupations for minors in New York

In addition to federally prohibited occupations for all minors in the US, New York state laws also cover a variety of occupations that minors are not allowed to engage in.

Minors under the age of 18 cannot work in the following occupations:

- Construction

- Operation of circular saws, band saws, and guillotine shears

- Slaughtering and meat-packing establishment, or rendering plant

- Operating power-driven woodworking, metal-forming, metal-punching, metal-shearing, bakery, and paper products machines

- Operating power-driven hoisting apparatus

- Manufacture of brick, tile, and similar products

- Involving exposure to radioactive substances or ionizing radiation, or exposure to silica or other harmful dust

- Occupations in the operation of any sawmill, lath mill, shingle mill, or cooperage-stock mill

- Mining or in connection with a mine or quarry

- As a helper on a motor vehicle

- In the care or operation of a freight or passenger elevator — except that minors over 16 may operate automatic, push-button control elevators

- In manufacturing, packing, or storing of explosives, or in the use or delivery of explosives

- Packing paints, dry colors, or red or white leads

- In penal or correctional institutions — if the job relates to the custody or care of prisoners or inmates

Penalties related to employing minors in New York

If an employer makes any violations regarding the employment of minors, the first fine will amount to a maximum of $1,000.

If the offense occurs again, the maximum fine will be increased to $2,000.

The third and all subsequent violations will amount to the maximum of $3,000.

If a minor employee is injured or dies at work while being illegally employed, the fines can go up to thrice the value of the maximum — with the possibility of additional prosecution.

New York state worker protectionHiring laws in New York

According to federal law, all US employers are prohibited from discriminating in the workplace, whether it be during the interview process or the work itself.

According to federal law, discrimination is based on:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

The same principles apply to state laws, but there are some differences. For example, federal law states that Age Discrimination covers all employees aged 40 and more, while state laws protect all employees of age — over 18 years old.

Employers are also required to post-employment rights in conspicuous places on the working premises, including information about workers’ compensation, wages, breaks, etc.

The schedules that are a part of posting requirements can be changed by the employer to fit the needs of the employees — but under certain conditions.

For example, new employees that have been a part of the organization for at least 120 days can be entitled to request changes for 2 calendar days marked as “special occasions” or “personal events.” If an employee has requested the change on time, they cannot be retaliated against.

“Right-to-work” law in New York

In addition to previously stated hiring laws, it should be noted that New York is not a “right-to-work law” state — a state in which the legislative body guarantees that no employee will be forced to join or be associated with a labor union.

No employee in the state of New York abides by the “Workplace Freedom” law, meaning that union fees have to be paid, regardless of the employee’s decision to take part in union activities.

Termination laws in New York

Many US states classify themselves as “employment-at-will” states — meaning that employers in the said state can terminate an employee’s contract of employment without any reason, the only exception being an illegal reason.

In the same manner, New York employers abide by the employment-at-will doctrine and can fire an employee for any reason, if the reason is within legal boundaries.

However, some employees operate under “protected contracts” — contracts that protect them from any type of termination that doesn’t require a cause. This is usually the case with union contracts.

Furthermore, termination of a contract can be wrongful in the case of:

- Discrimination,

- Whistleblowing (in some cases),

- Participation in lawful political activities,

- Filing for a disability claim, and

- Taking a leave of absence which is required by the state.

Final paycheck in New York

When the termination is lawful, the employer is required to pay all remaining wages on the first regular payday.

If, for some reason, the employee cannot collect the wages in person, they can request the wages be sent by mail, and the employer has to agree.

If the employee has quit, a 2-week notice is a standardized way of terminating the agreement, and the wages will be paid on the first regular payday.

Health insurance continuation in New York (COBRA)

In addition to the federal COBRA laws — continued health coverage for businesses with 20 or more employees — the state of New York offers a health plan for smaller businesses for a limited amount of time after losing the federal coverage.

Namely, the qualifying events that make an employee and their dependables eligible for New York COBRA plan include:

- Voluntary or involuntary job loss,

- Transition between jobs,

- Reduction in hours,

- Death,

- Divorce, and

- Other life-changing events.

Depending on the qualifying event, an employee that is covered by the New York COBRA program can extend their health coverage up to 36 months.

“Age 29” health coverage continuation

In addition to the COBRA law, US citizens aged 29 or less can apply for the so-called “Age 29” extension, which allows them to extend their health coverage under a parent’s policy — by applying for the “make available” and young adult option.

Namely, young adults can use their parent’s policies if the parents or guardians decide to pay the premium fees and add them to their plan.

They can be a part of the “make available” option until they reach the age of 26 — then they have to switch to the young adult option up until the age of 29.

Health insurance in New YorkOccupational safety in New York

The right to a safe workplace is governed by the principles set forth by the OSH Act of 1970. Primarily, this act was passed to protect employees from getting harmed or killed in the workplace — but it has evolved since then to prevent certain types of hazards:

- Biological

- Chemical

- Work organization

- Safety

- Physical

- Ergonomic

New York OSHA further serves to provide crucial information to employees regarding safety standards, training, and various types of assistance in the workplace.

Furthermore, all OSHA offices in New York provide help for various departments, including:

- State,

- County,

- Town, and

- Village governments.

The list extends to:

- Public authorities,

- School districts, and

- Volunteer fire departments.

Miscellaneous New York labor laws

Due to the unique nature of New York’s legal landscape, some labor laws cannot be placed in the previous categories, which is why we will list them in the miscellaneous section.

The laws we’ll cover in this section include:

- Record keeping law,

- Background check law,

- “Ban the box” law,

- Whistleblower law, and

- Uniform law.

Record keeping law

According to the Labor and Employment law in New York, all employers are required to keep certain records during employment and after the termination of contract. Such records include:

- Personnel records — job records, resumes, physical examinations, requests, and applications,

- I-9 forms,

- Payroll records,

- Collective bargaining agreements,

- Training records,

- Employee medical records,

- Social security numbers, and

- Applications pertaining to rates of pay, promotions, demotions, and terminations.

Background check law

Background checks are a crucial part of the employment process. Namely, New York employers are allowed to perform background checks if they are in regulation with the Fair Credit Reporting Act.

The state of New York, however, requires background checks before the interview for certain positions, such as for:

- School personnel,

- Security positions pertaining to the installation of alarm systems,

- Federal positions,

- Private detectives,

- Bail enforcement personnel, and

- Childcare personnel.

Arrest and conviction law

Based on the type of offense, the New York court may choose whether they want to keep the records open or sealed.

In both cases, employers are prohibited from asking the applicants about any charges that did not result in conviction or arrest.

“Ban the box” law

Many US states have adopted the “ban the box” law — New York included.

The term derives from the practice of checking boxes on contracts that were obligatory for ex-offenders and criminals.

Due to a lack of employment opportunities, many US states decided to “ban the box” and prohibit employers from asking an applicant about their criminal history, especially after the offer of employment.

Whistleblower law

Many US states have implemented the whistleblower law, but New York is one of the rare states that has a comprehensive guidebook on whistleblowing.

In fact, this law has seen an expansion in employee protection as of Jan 2022.

If an employee has a reasonable suspicion of illegal activity in the workplace, they can “blow the whistle” without the fear of retaliation.

Before the changes were made in 2022, employees were only protected in case of disclosure to a supervisor or a public body.

However, section 740 of NY labor laws now protects employees from retaliation in all cases, with the addition of compensation for any lost wages during the process and reinstatement of benefits and seniority rights.

Uniform law

If the job description requires employees to wear a uniform, employers can legally request it from their workers.

If the position is directly related to the hospitality industry, the employer will purchase or reimburse the employee for the cost of the uniform.

If the employer refuses to pay for the uniforms, they will have to pay the employees the following amount based on the amount of hours employees log in a week:

| 2021/2022 | 20 or fewer week hours | Over 20 and fewer than 30 hours per week | Over 30 hours per week |

| New York City | $8.90 | $14.75 | $18.65 |

| Long Island and Westchester | $8.90 | $14.75 | $18.65 |

| Remainder of New York | $7.85 | $13.00 | $16.40 |

Conclusion/Disclaimer

We hope this New York labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this New York labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

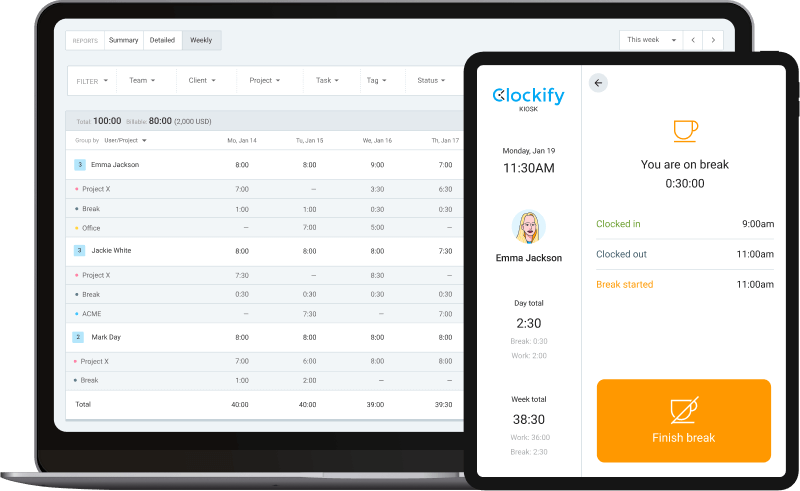

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).