Is working from home budget-friendly? Well, if you take a look at this survey, you’ll notice the financial pros and cons of telecommuting. This poll shows that, compared to working in an office, teleworking employees spend more money on groceries (an average of $182) and $121 more on utilities every month. On the other hand, working from home helps them save money on child care ($34) and gas and public transport ($33).

Whether you’re a freelancer or a permanent employee working from home, remember that in order to stay within the budget (and even save some money), you should start tracking your project expenses. In this article, we’ll share with you some tips and tricks that allow you to track project expenses:

- as a freelancer,

- as a permanent employee working from home.

Table of Contents

What are project expenses?

In general, project expenses include all the costs necessary to finish a project or business transaction. Project expenses cover costs of:

- hiring professionals for the said project (employees, freelancers, or contractors),

- equipment – all the tools that employees use during a project,

- materials – all the materials that workers need during a project,

- project management tasks – tasks that ensure the project will be finished on time,

- engineering tasks (if applicable) – assignments in the field of research and design work,

- transportation (if applicable),

- overhead expenses – office rent, utilities, office materials and equipment,

- annual salary – the desired amount of money a company or individual wants to make, apart from the amount needed to cover other expenses.

Project cost management helps you make estimates about the project, as well as take care of the allocation of project budget and project cost control.

Now, who’s in charge of paying for these project expenses when the job is not done on-site?

When it comes to working from home arrangement, this kind of setting doesn’t have to involve just freelance workers. In some cases, there are permanent employees – those who work for one company from home. In these situations, an employer usually provides employees with work equipment. Plus, these employees don’t have to pay any taxes because taxes get deducted from their wages.

But, if you’re a freelancer, you’re a self-employed worker. Thus, you’ll have some initial expenses at the beginning of your freelance career, like buying yourself a PC or a laptop, as well as the software you need for work. Besides, freelancing also means that you have to pay self-employment taxes and health insurance.

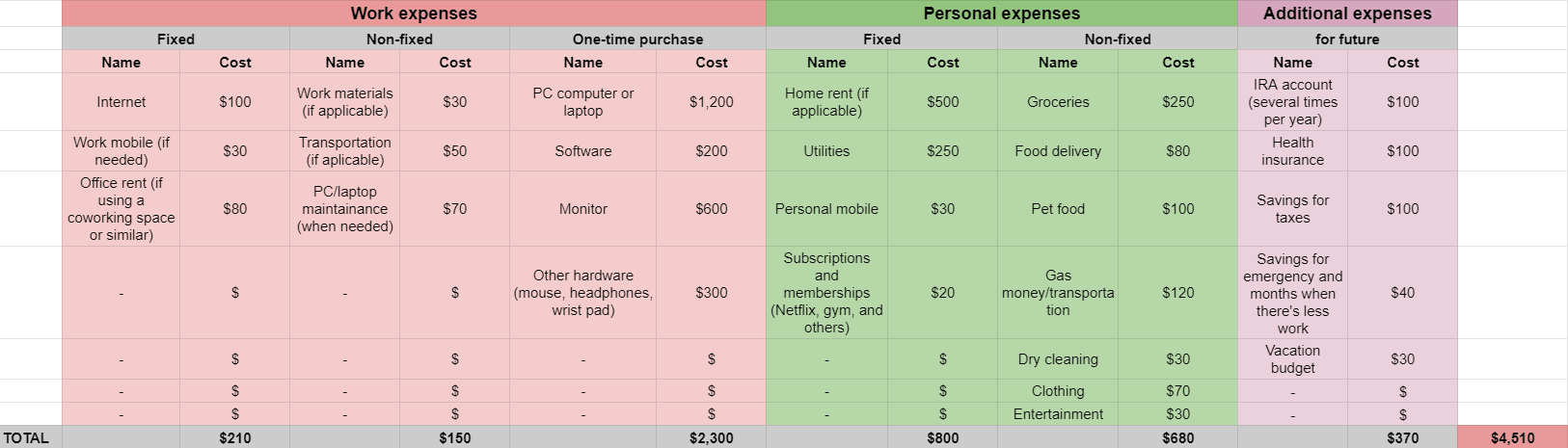

Here are the most common expenses for freelancers:

- Work expenses – internet, work mobile (if needed), office rent (if not working from home), work materials and transportation (if needed), PC or laptop maintenance, and one-time purchase.

- Personal expenses – rent, utilities, personal mobile, subscriptions and memberships (if any), groceries, food delivery, pet food (if needed), transportation, dry cleaning, clothing, entertainment.

- Additional expenses – IRA account, health insurance, savings for taxes, savings for emergency situations (the times when there’s less work), vacation budget.

As for the permanent employees working from home, the list of expenses doesn’t include office rent, transportation (for work purposes), IRA account, health insurance, and taxes.

💡 If you’d like to set a project budget, so that you have a better estimate of time and money you

need for a said project, you can use Clockify as the time and expense tracker.

What are the most common expenses for freelancers and permanent employees working from home?

Although we’ve already listed usual project expenses, let’s take a look at some real-life situations. Here’s what freelancers and employees working from home highlight as their key monthly expenses.“

My most common expenses are:

- internet,

- electricity,

- software to help me automate a lot of my processes like Acuity Scheduling, Zapier, etc.

- software to help keep me organized like Gsuite, Asana,

- website maintenance,

- ads.” – Kimberley Reyes, owner of Kimberley Reyes & Co Virtual Assistant Agency

“Actually, electricity! All the lights needed (especially if your office is in the basement) and screens, chargers, etc. Add up! Ordering groceries from Target once a week as well.” – Basheer Alebdy, founder of DaBash Deals

“Food delivery is definitely a big expense for me. The thing with freelance work is that sometimes it’s hard to set boundaries on your time. I always find myself working late at night or working very early in the morning to catch up with deadlines. So, without the time for food prep, food delivery is the easiest option for me.

Equipment is also another thing. If you’re a freelancer, you must have a laptop or desktop, a webcam, and a decent headset. The internet connection is another expense, and you have to pay for it monthly. Your service provider must be reliable, so you won’t lose connection in the middle of a task.” – Candace Helton, operations director at Ringspo

“Often, the hidden costs come from the intangible expenses and for me, the biggest of those is software subscriptions. The costs of the Pro versions of online productivity or creation tools can mount up. What seems like a ‘cheap’ purchase of around £8 per month soon adds up when you are using multiple tools in your business. I recently reviewed all my digital tools and saved £50 a month by canceling those that weren’t adding real value to my work.” – Alison Reay-Jones, business support

“As someone who has worked self-employed from home for years, my single biggest expense is rent. It’s simply that a home office is an allowable business expense (in most countries).

In a 2-bedroom apartment, I felt that 1/3rd of the rent bill (8 hours per day), and 1/2 of the high-speed broadband bills, were attributable to my business activities, so I record that and it’s allowable for tax purposes.” – Kevin Murphy, productivity consultant

“Working from home, the things that I spend the most on would have to be home office and furniture with a little bit of food delivery every now and then. Having the right equipment and simply being comfortable at work should be everyone’s priority.” – Simon Elkjær, the Chief Marketing Officer of avXperten

Here, at Clockify, we’re currently working from home, so I asked my colleagues what their most common expenses are when teleworking.

“Definitely food delivery. At least once a week I don’t feel like cooking or I don’t have time to prepare a meal.” – Nikola Radojcin, SEO assistant

“When working from home, I have fewer expenses than when working in an office – I’m not ordering lunch, nor have any transportation costs. As for the internet expenses at home, I would pay it in any case.” – Ljubomir Simin, CTO

My coworkers Luka Dejanovic and Natalia Tawfik Dedovic had also worked as freelancers. Here’s what they had to say about their major freelancing expenses.

“While working as a freelancer, my biggest expense was the internet connection or the lack of it. There were situations when I would lose a connection while having a call with a potential client, which would sometimes end up as losing a deal. Besides, ordering food was a major expense as well.” – Natalia Tawfik Dedovic, Social and Video Content Marketer

“The only expense I had was losing money during the money transfer.” – Luka Dejanovic, Illustrator

Now, I was also curious to find out if freelancers and permanent employees working from home track their monthly expenses. If so, what tools they use to write down all costs.

“I look at my bank and credit card transactions and write all expenses and earnings in a physical yearly journal/planner. Nothing better than the old-fashioned pen and paper!” – Basheer Alebdy

“While I’ve tried using budgeting apps before (like Wallet), I find the pen-and-paper method the most effective. There’s just something about writing down your expenses and bills that gives you a clearer picture of where your money is going.” – Candace Helton

“I use Excel to keep track of my balance. As a rule of thumb, I never expend more than 70% of what I earn. This way, I can save some money for emergencies.” – Steven Zhang, editor in chief at Luremefish

“In order to avoid overspending, I keep track of my expenses by creating sheets. I find this method to be really efficient as I get to see a clear view as to where my money goes.” – Simon Elkjær

How can you track project expenses?

Now that we’ve seen what expenses freelancers and permanent employees working from home usually have, we’ll explain how to track project expenses with ease.

As a freelancer

As mentioned above, freelancers are responsible for taking care of their taxes, but also setting aside some money for health insurance and IRA. Here’s how you can monitor all your freelancing costs.

Have a separate business and private account

This step is crucial. Whenever you have a business expense, like business travel or lunch with a client, you should charge it to your business account. Therefore, it will be much easier to cover your taxes and calculate your tax deductions.

Kimberley Reyes has been working remotely for 13 years. When it comes to her freelance expenses, here’s how she copes with them:

“I have a business credit card where all my business expenses are linked so I just download the monthly bill where all my expenses are logged. I also work with a tax support company that helps me file my taxes. I manually add all my expenses into their platform, and they track it for me for tax purposes.”

As you can see, if you’re struggling with calculating your taxes, you can hire a professional like a tax accountant or a tax company.

Keep track of your work, personal, and additional expenses

In line with our previous tip, remember to carefully write down all your expenses, including work-related, personal, and additional costs. We’ve already explained what each area covers.

In addition, many freelancers point out that allotting a part of your monthly income for taxes is vital. Some freelancers even say that they save 30% of any payment they receive for taxes.

To help you keep track of all your freelancing expenses, we created a template that combines all three areas of costs. All you need to do is note down each expense you have throughout the month, be it personal, work, or an additional one.

→ Download Project expenses for freelancers template

Now, if you’re a freelancer who frequently travels for business, you might be looking for a more detailed template for tracking business travel expenses or business mileage. In that case, we’ve got you covered with our various expense report templates.

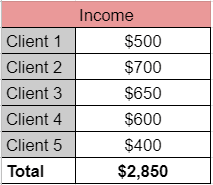

Keep track of your monthly income

Furthermore, you need to have a better understanding of how much you earn per month. That way, you’ll know whether you’re able to cover your expenses. Plus, you’ll know how much money you’ll have after paying all monthly expenses.

Therefore, you’ll realize whether you need to find another client or an additional project in order to have a higher paycheck. And, best of all, a higher paycheck also means you can treat yourself with a new phone or with a concert ticket for your favorite band.

Our Project expenses for freelancers templates has this feature, too, so be sure to write down all income amounts you get from various clients.

As a permanent employee working from home

Just like we’ve discussed earlier, unlike freelancers, remote employees working for one company tend to have fewer expenses. That’s because permanent employees don’t have costs like health insurance and taxes since these expenses automatically get reduced from their wages. In particular situations, employers also provide workers with laptops and other fundamental tools so that permanent employees can perform their work at home. If you’re a permanent employee, here are some valuable tips on how to track and capture project expenses.

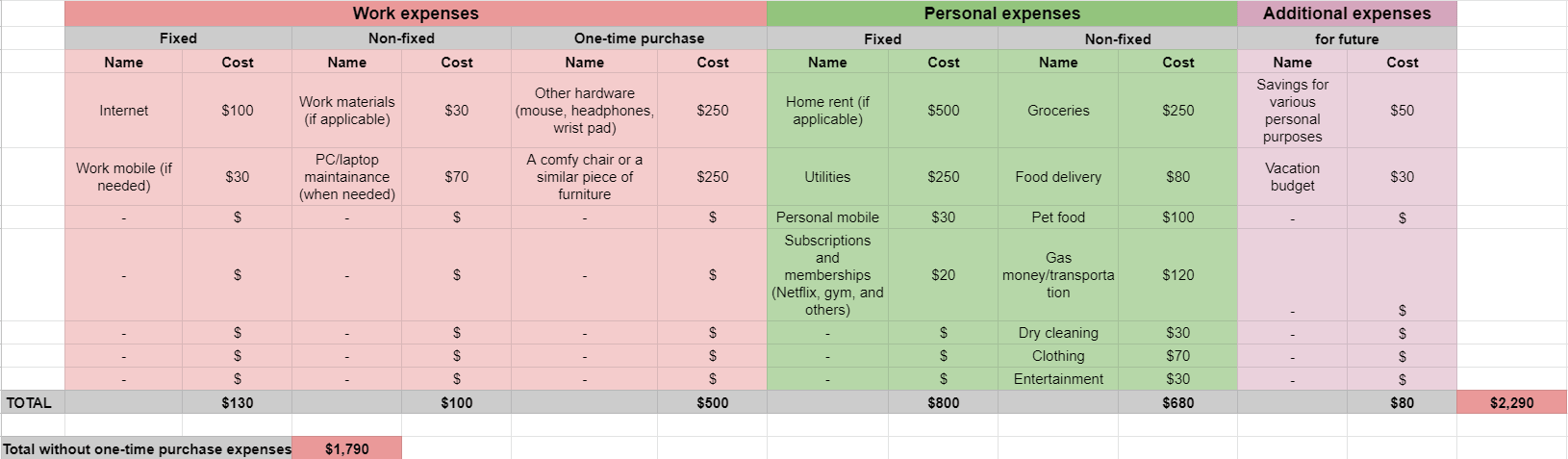

Keep a record of all work, personal, and additional expenses

This rule applies to both freelancers and permanent employees. If you don’t write down each little spending, soon you’ll have no clue how you spent your paycheck.

Speaking of the work expenses of permanent workers, the total amount is lower than in the case of freelancers. However, many permanent employees might invest in some quality piece of furniture for their home office, like a comfortable ergonomic chair for work. Personal expenses for both employment categories can usually be the same, especially if freelancers tend to work only from home, instead of a coworking space.

If you compare additional expenses of freelancers and permanent employees, you’ll notice that the latter usually have costs such as savings for vacation and for various personal emergencies (home or car maintenance). You’ll notice that our Project expenses for permanent employees template contains fewer costs per month, compared to the one for freelancers. Moreover, there’s no income calculator since permanent workers get fixed salaries.

→ Download Project expenses for permanent employees template

Bonus tip – claim your work expenses

When it comes to home office expenses, self-employed employees in the US are qualified to take a tax deduction for these costs. The self-employed category covers:

- those who work from home full time,

- those who have a freelance side gig (even if they also work for an employer)

- those who were self-employed for several months.

Your home office also needs to qualify for these deductions. But, keep in mind that employees working for one employer are not eligible for claiming their expenses.

So, if you’re among those who are eligible for the tax deduction, you can claim expenses such as buying a new laptop, a printer, an office chair, or a desk. If you’re interested in this subject, here are more details on how to calculate your home office deduction.

Wrapping up

When working from your home office, not only do your work and personal space get intermingled, but your expenses as well. To prevent this type of financial confusion, be sure to always keep your work expenses separate from private ones. Furthermore, keeping a record of all your payments, including work, personal, and additional, is the best way to stay within a monthly budget. Besides, having such a detailed monthly report will help you get your tax deductions if you work as a freelancer.

✉️ What about you? What are your most common project expenses when working from home? How do you track these expenses?

Send your answers, suggestions, and comments to blogfeedback@clockify.me and we may include them in this or future posts.