Colorado Labor Laws Guide

| Colorado Labor Laws FAQ | |

| Colorado minimum wage | $14.81–$18.81 |

| Colorado overtime | Employers are required to pay 1.5 times the minimum wage for any time worked over 40 hours a week and 12 hours a day ($22.2 for minimum wage workers in Colorado) |

| Colorado breaks | 10 minute rest periods after 4 hours of work 30 minute meal breaks if the shift exceeds 5 consecutive working hours |

Colorado is one of the better-ranking US states in terms of employee protection policies and wage rates. To earn this reputation, Colorado has added plenty of state laws more favorable to the employees, on top of using some of the federal regulations.

In this Colorado labor law guide, we’ll be looking at the following areas:

- Wages, pay frequency, overtime, and breaks,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Leave requirements, and

- Miscellaneous labor laws.

Wages in Colorado

The minimum earnings a worker can make are calculated according to the federal, state, or local minimum wage requirements.

In Colorado, 2 of these types of requirements are in effect — a state minimum wage that applies to the entire state and a local minimum wage that is valid in the City of Denver.

So, in this segment on wages, we’ll be looking at:

- Regular and tipped minimum wage in Colorado,

- Regular and tipped minimum wage in the City of Denver, and

- Exceptions and exemptions to minimum wage requirements.

Minimum wage in Colorado in 2025

The minimum wage in Colorado is prescribed at the state level and covered and guaranteed by the Colorado Overtime and Minimum Pay Standards Order (COMPS).

As of January 1, 2025, the minimum wage in Colorado is $14.81 per hour for all nonexempt employees covered either by the COMPS or the Fair Labor Standards Act (FLSA).

The minimum wage rates in Colorado are increased each year, with consideration towards the Consumer Price Index of Colorado residents.

Tipped minimum wage in Colorado

Employers running establishments where workers regularly receive tips are allowed to pay their employees a lower minimum wage.

In Colorado, the minimum wage for tipped workers is $11.79 per hour.

This minimum wage rate applies to all employees earning at least $30 a month in tips.

However, the law doesn’t prevent the employer from requesting that tips be shared among other employees.

| COLORADO MINIMUM WAGE | |

| Regular minimum wage | Tipped minimum wage |

| $14.81 | $11.79 |

City of Denver minimum wage in 2025

We’ve previously mentioned that the City of Denver has its own local minimum wage requirement.

For employees not receiving tips, this rate amounts to $18.81 per hour.

This is a citywide minimum wage, and employers in Denver can’t use the state minimum wage as a basis for calculating wages.

City of Denver tipped minimum wage

Tipped workers in the City of Denver area are also entitled to a minimum wage higher than the state minimum wage requirement.

For them, the tipped minimum wage is $15.79 per hour.

| CITY OF DENVER MINIMUM WAGE RATES | |

| Regular minimum wage | Tipped minimum wage |

| $18.81 | $15.79 |

Minimum wage exemptions and exceptions

There are also categories of employees not covered by the COMPS who are exempt from minimum wage requirements. These exemptions apply to:

- Administrative employees,

- Executives or supervisors,

- Professional employees,

- Outside salespersons,

- Owners or proprietors,

- Taxi cab drivers,

- In-residence workers (such as casual babysitters, property managers, student residence workers, laundry workers who are inmates or residents of charitable institutions, field staff of seasonal camps or outdoor education programs),

- Bona fide volunteers and work-study students,

- Elected officials and their staff,

- Highly technical employees in computer-related occupations,

- High-earning employees, and

- National Western Stock Show employees.

Colorado subminimum wage in 2025

On July 1, 2021, the state of Colorado passed an act gradually phasing out the subminimum wage by July 1, 2025.

This means that employers will be prohibited from paying minors or employees with disabilities a lower minimum wage.

Currently, the only employers who still have the right to pay the subminimum wage are those who hold a certificate issued by the US Department of Labor before this act was passed.

These employers will be required to provide the Colorado Department of Health Care Policy and Financing with a transition plan outlining how they will manage the phasing out of the subminimum wage.

Colorado wage transparency

In an initiative to improve existing anti-discrimination laws, Colorado has issued the Equal Pay for Equal Work Act, requiring employees to:

- Include a range of compensation in job postings,

- Properly notify employees of any promotion opportunities, and

- Keep records of job descriptions and wage rates.

Out-of-state employers hiring remote workers from Colorado aren’t subject to this Act, and don’t have to provide a salary range in their job description.

Colorado wage discussion law

To further protect employee rights, Colorado has approved the Wage Transparency Act, which prevents employers from retaliating against employees who discuss their wages with others.

This act also makes it illegal for employees to include a wage discussion ban in the job contract.

These requirements don’t apply to employers exempt from the National Labor Relations Act (NLRA), namely:

- Federal and state governments and all their agencies and subdivisions,

- Corporations owned entirely by the government,

- Federal Reserve banks,

- Employers with workers covered by the Railway Labor Act, and

- Labor organizations not acting as employers.

Colorado payment laws

Colorado employers and employees can agree upon specific periods during which wages and salaries are paid. However, if such an agreement isn’t established, the wage laws of Colorado require that compensations be due in no longer than one month or 30 days — whichever is longer.

The payday must also be regularly scheduled within 10 days after a pay period has ended.

Additionally, the employer is required to provide a pay notice with information detailing the regular payday schedule and the time and place of payment.

Also required from the employer is an itemizedpay statement containing the following information:

- Gross wages earned,

- All withholdings,

- All deductions,

- Net wages earned,

- Start and end dates of the pay period,

- Name of the employee or their social security number, and

- Name and address of the employer.

Colorado overtime laws

We’ve previously discussed the COMPS Order and its minimum wage requirements. This order also covers Colorado overtime requirements, which sometimes overlaps with FLSA provisions. When this happens, the law that applies is the one that is most beneficial to the employee.

Employees in Colorado need to be paid 1.5 times their regular pay rate for any work hours that exceed:

- 40 hours in a workweek,

- 12 hours in a workday, and

- Any 12 consecutive hours worked, regardless of workday.

For Colorado non-exempt employees, that would be $22.2 for every overtime hour worked.

The workweek is defined by the employer and is a fixed, recurring period of 168 hours, starting at the same calendar day and hour each week.

Still, there are some exceptions to the overtime rules, which we’ll explain in the following section.

🎓 Track Colorado overtime with Clockify

Colorado overtime exceptions

Colorado law exempts the following workers from overtime requirements of the COMPS Order:

- Certain salespersons, mechanics, and parts-persons,

- Sales employees of retail or service industries paid on a commission basis (provided that at least 50% of their total earnings are from commission sales),

- Ski industry workers performing duties related to ski area operations for downhill skiing or snowboarding,

- Medical transportation workers who work 24-hour shifts are exempt from the daily 12-hour overtime rule, provided that they receive the required weekly 40-hour overtime pay,

- Hospital or nursing home employees are exempt from the 40-hour a week overtime rule, but they’re paid time and a half for any work performed in excess of 80 hours in a 14-day period or for any work in excess of 8 hours per day,

- Drivers and their driver’s helpers,

- Direct support professionals/direct care workers who are scheduled for shifts of at least 24 hours, providing residential or respite services,

- Decision-making managers at livestock employers,

- Range workers who are paid at least the minimum range worker salary, and

- Voluntary shift trades by employees of interstate air carriers.

Colorado breaks

Rest periods and meal breaks are 2 types of breaks defined by Colorado law.

Arest period is a 10-minute break awarded after 4 hours of work or a “major fraction of thereof.”

Ideally, if it’s practical, the rest period will be as close to the middle of the 4-hour period as possible.

Here’s a convenient table of work hours and required rest periods:

| HOURS WORKED | NUMBER OF REQUIRED REST PERIODS |

| 2 or fewer hours | 0 |

| More than 2, up to 6 hours | 1 |

| More than 6, up to 10 hours | 2 |

| More than 10, up to 14 hours | 3 |

| More than 14, up to 18 hours | 4 |

| More than 18, up to 22 hours | 5 |

| Over 22 hours | 6 |

The meal break is required to be at least 30 minutes long if the shift exceeds 5 consecutive working hours.

During this period, the employee is to be relieved of all of their duties for this time to be uncompensated. This means that, if the circumstances make it so that the employee has to consume their meal while performing their duties, they need to be fully compensated for this time.

Additionally, if practical, the meal break should be at least 1 hour after the start and 1 hour before the end of the shift.

Colorado lactation laws in the workplace

The federal PUMP Act states that working mothers who are still lactating must be allowed a reasonable break period to do so.

Other than that, employers have to provide a private, enclosed space for this activity (said space can’t be a bathroom).

Moreover, according to Colorado state law and the Workplace Accommodations for Nursing Mothers Act, public and private employers are required to provide unpaid break time or at least permit an employee to use paid break time, meal time, or both each workday to express breast milk.

Colorado leave requirements

Now we’ll look at both required and non-required leaves in Colorado.

Required leave

Here’s a brief rundown of Colorado required leaves.

Sick leave

Under the Colorado Healthy Families and Workplaces Act (HFWA), employers must provide accrued sick leave for their employees — 1 hour of leave per 30 hours worked, up to 48 hours per year.

The employee can use this leave in case of:

- A mental or physical illness, injury, or condition that interferes with their ability to work,

- A need to get a diagnosis, care, or treatments for these types of conditions,

- A need for preventive care, including vaccination,

- Domestic violence, sexual assault, or harassment, and

- Caring for family members with any of the listed conditions or needs.

The employer must pay the employee for this time off at a regular rate and can’t hold these absences against the employee.

Holiday leave for public employers

State employees in the state of Colorado get paid leave on designated legal holidays, including:

- New Year’s Day,

- Martin Luther King Jr. Day,

- Washington-Lincoln Day (Presidents’ Day),

- Memorial Day,

- Independence Day,

- Labor Day,

- Veterans Day,

- Thanksgiving Day, and

- Christmas Day.

Jury duty leave

The employer is required to provide jury duty leave to the employee, and this type of leave can’t threaten their job in any way.

The time off should be paid at regular rates, but not exceed $50 per day unless there’s a different agreement between the employer and employee.

Voting time

The state law requires employers to provide workers with 2 hours of time off to vote, unless:

- The employee didn’t request the leave at least a day in advance,

- The employee has at least 3 hours to vote before and after their shift.

Military leave

Members of the National Guard or the military reserves are entitled to up to 3 weeks of military leave for military training or active service with compensation, after which they can return to their job with no consequences. This applies to public employees, while private employees are entitled to 3 weeks of unpaid leave for military training.

Emergency response leave

Colorado allows qualified volunteers registered with the local authorities to request up to 15 working days a year of leave to respond to an emergency.

Domestic violence or sexual assault leave

Under Colorado law, victims of domestic violence or sexual assault can request up to 3 days of unpaid leave in a 12-month period to obtain a restraining order, or seek medical and legal counseling and treatments.

This is a requirement for all employers with 50 or more employees.

Bereavement leave under the Healthy Families & Workplaces Act (HFWA)

Under HFWA, eligible employees may use accrued paid sick leave (1 hour for every 30 hours worked) of up to 48 hours per year for the purpose of:

- Grieving, attending funeral services or a memorial, and

- Addressing financial and legal matters that arise after the death of a family member.

Non-required leave

Here’s a brief rundown of Colorado non-required leaves.

Bereavement leave

Unless this requirement is in their own policy, private employers aren’t required to provide bereavement leave.

Vacation time

Colorado doesn’t have a state law requiring employers to provide paid or unpaid vacation for their employees.

However, if they offer this benefit, employers may implement a “use-it-or-lose-it” policy, requiring the employees to use their vacation time by a set date.

Holiday leave for private employers

If no previously established company policies exist, private employers don’t need to provide holiday leave to their employees.

Child labor laws in Colorado

In Colorado, working conditions for minors are regulated by the Colorado Youth Employment Opportunity Act (CYEOA).

This law defines “minors” as persons under the age of 18, other than those who have received a high school diploma or a passing score on the general educational development (GED) test.

Colorado doesn’t have any laws that would allow minors to request emancipation before the age of 19.

Different rules apply to work hours for minors in Colorado: for those under 16 and for those between 16 and 17.

Minors under the age of 16

For the age group under 16, the following rules apply:

- No more than 40 hours of work a week, or more than 8 hours in a 24-hour period,

- No more than 3 hours of work on a school day, no more than 8 on a non-school day,

- No more than 18 hours total of work during a school week,

- Can work 7 a.m. to 7 p.m. during the school year, evening hours extended to 9 p.m. from June 1 to Labor Day, and

- On school days and during school hours, minors need an employment permit, issued by the superintendent of their school district.

Minors aged 16 and 17

For those aged 16 and 17, these are the requirements:

- No more than 40 hours of work a week, or more than 8 hours in a 24-hour period, and

- No restrictions on times of day for work.

Prohibited occupations for minors in Colorado

Colorado law recognizes that some occupations are hazardous to employ minors. Among others, these occupations include:

- Manufacturing, storing, or in any other way handling explosives,

- Operating a high-pressure steam boiler,

- Operating a high-temperature water boiler,

- Mining,

- Logging,

- Quarrying,

- Operating power-driven machinery, etc.

For a detailed list of all prohibited occupations for minors, you can find all prohibited occupations in the Colorado Youth Employment Opportunity Act (CYEOA).

Colorado hiring laws

In addition to the federal anti-discrimination laws regarding hiring, Colorado has its own state-level rules and Ban the Box law.

First, the federal laws prevent employers from discriminating against employees based on:

- Race and color,

- Age,

- Sex, including pregnancy and related issues,

- Gender and gender identity,

- Sexual orientation,

- Religion,

- National origin,

- Genetic information, including family medical history, and

- Military or veteran status.

In addition to these, the state of Colorado also makes it unlawful to discriminate against employees due to:

- Out-of-work activities, provided they are lawful,

- AIDS or HIV status,

- Arrest or sealed conviction records,

- Civil Air Patrol membership,

- Marriage to a colleague, and

- Credit report and other credit information, wage garnishments, and consumer debt.

Colorado Ban the Box law

The so-called Ban the Box law, or the Colorado Chance to Compete Act (CTC), is applicable to all employers with more than 10 employees and forbids them from:

- Asking the candidate about their criminal history during the initial application,

- Requesting disclosure of a candidate’s criminal history during the initial application, and

- Stating in a job posting that applicants with a criminal history need not apply.

The employer can request this information at other points of the hiring process.

Candidates who believe their rights have been violated can submit a Colorado Chance to Compete Complaint Form.

Colorado termination laws

Colorado is one of the majority of states that use the doctrine of employment-at-will. This doctrine states that neither the employer nor the employee need to provide advance notice or explanation for ending the employment relationship.

Final paycheck in Colorado

If the employee decides to resign, the employer should pay out all their wages and compensation on the next regular payday.

However, if the employer terminates the employment relationship, the wages need to be paid immediately, unless:

- The employer’s accounting unit isn’t operational at the moment — the wage should be paid out within 6 hours of its next workday, and

- The accounting unit is located off-site — the wage should be paid no later than 24 hours after the start of the next business day.

The employer has up to 10 days to audit the value of any properties the employee has not returned or has damaged, and to deduct these costs from the final paycheck.

Colorado COBRA

Under the federal Consolidated Omnibus Budget Reconciliation Act (COBRA), employees may have the right to continue health insurance after situations such as:

- Involuntary loss of job,

- Reduction in work hours,

- Job transition, and

- Death, divorce, or other major life circumstances.

Employers may be eligible to pay for health insurance at the State of Colorado COBRA Medical Premiums rates for up to 36 months.

Occupational safety in Colorado

As with all US states, worker safety in Colorado is protected by the Occupational Safety and Health Administration (OSHA).

This agency regulates how dangerous substances must be handled and the standards for training and behavior in hazardous work environments.

The local Colorado OSHA can conduct on-site investigations to ensure compliance with its work safety requirements.

Miscellaneous Colorado labor laws

Here are a few different types of regulations that may apply to Colorado employees, which don’t fit into the previously mentioned categories. These include:

- Colorado background check laws,

- Employer use of social media use law,

- Whistleblower protection laws, and

- Keep Jobs in Colorado Act.

Colorado background check laws

Colorado laws allow employers to conduct criminal background checks at any time during the hiring process, except the initial application. This is defined by the previously mentioned Ban the Box law.

However, Colorado regulations prevent employers from using employeeconsumer credit information unless this information is “substantially related to the employee’s current or potential job.”

These were the situations where background checks may be restricted, but Colorado law also predicts cases where a background check is a necessary step to employment.

The following occupations require a criminal history record check:

- School personnel,

- Employees in childcare facilities,

- Camp employees,

- Foster care employees,

- Pharmacists,

- EMTs,

- All employees (including owners) of assisted living facilities,

- Home care agency workers,

- Massage therapists,

- Gaming equipment contractors,

- Real estate industry employees,

- Money transmitters,

- Lottery and racing commission employees,

- Bail bondsmen,

- Attorneys,

- Security guards, and

- Medical and retail marijuana vendors, manufacturers, and cultivators.

Employer social media use laws

In compliance with Colorado law, employers can’t require employees to provide their social media login information or change any of the privacy settings on their social media accounts.

Additionally, employers can’t require job applicants or employees to add anyone (including the employer) to their social media account contact list.

Whistleblower protection laws

There are different regulations and procedures for Colorado public and private employee whistleblowers, provided by the Colorado Whistleblower, Anti-Retaliation, Non-Interference, and Notice-Giving Rules (WARNING).

Public employee whistleblowers

If the public employee provides information on illegal activities of their employer, they are protected from employer retaliation.

The employee must file a written complaint within 30 days of a retaliation incident and wait for its resolution before filing a lawsuit.

Employee protection doesn’t apply to cases when:

- The employee knowingly discloses false information, or information about the validity of which they have serious doubts,

- The employee discloses information from public records which is closed to public inspection, and

- The employee discloses other types of confidential information.

Private employee whistleblowers

Private employees are also protected from employer retaliation.

However, they must provide proof that they have first made an effort to supply this information to their direct supervisor or other internal authorities before contacting outside authorities.

Public employees don’t need to file a written complaint, but the same exceptions as to public employees also apply when it comes to protection limitations.

Keep Jobs in Colorado Act

Colorado has introduced the Keep Jobs in Colorado Act to subsidize workers and improve state employment rates.

This act imposes the rule that 80% of labor must come from Colorado employees on any public projects funded in some part by the state, counties, school districts, or municipalities of Colorado.

Exceptions to this rule can be made in cases of insufficient Colorado labor or when it would prevent the project from being completed.

Frequently asked questions about Colorado labor laws

If we haven’t answered some of your specific questions about working laws in the state of Colorado, here’s an additional section with extra information.

How many breaks do you get in an 8-hour shift in Colorado?

Employees in Colorado are entitled to 2 types of breaks during an 8-hour shift:

- Meal break (unpaid) — lasts for 30 minutes, and

- Rest break (paid) — lasts for 10 minutes.

Is 32 hours a week considered full time in Colorado?

Yes. The state of Colorado defines a full-time employee as someone who works 32 hours per workweek. Still, there are some exceptions to this rule regarding eligibility for certain benefits, such as health insurance and overtime.

Can I record my boss yelling at me in Colorado?

Since Colorado is a one-party consent state, this means that only one participant in the conversation needs to give consent for the recording. So, yes, you can record a conversation with your boss in case of a confrontation and use it as evidence later on.

Can I skip my lunch break in Colorado?

Since you’re legally entitled to a 30-minute break for every 5 hours of working, you can’t skip it, nor can the employer force you to skip your meal break.

How many consecutive days can you work in Colorado?

There’s no law in Colorado that limits the number of consecutive days you can work, provided your employer complies with labor laws, such as break time, overtime pay, and others.

What is the WARN Act in Colorado?

The Worker Readjustment and Retraining Notification Act (WARN) is a law that requires employers to give their workers experiencing employment loss 60 days’ notice prior to a layoff. This act protects workers, their families, and communities from the impact of mass layoffs.

Use Clockify to stay compliant with Colorado labor laws

To make sure you adhere to the labor laws and regulations in the state of Colorado, you need a reliable tool.

A powerful tool like Clockify can make your business a well-oiled machine. Clockify is a time tracking software at its essence, but you can also leverage its features to:

- Keep an accurate record of employees’ clock in/out hours,

- Monitor lunch and rest periods,

- Keep track of overtime hours,

- Retain records of hours worked,

- Manage payrolls and time off, etc.

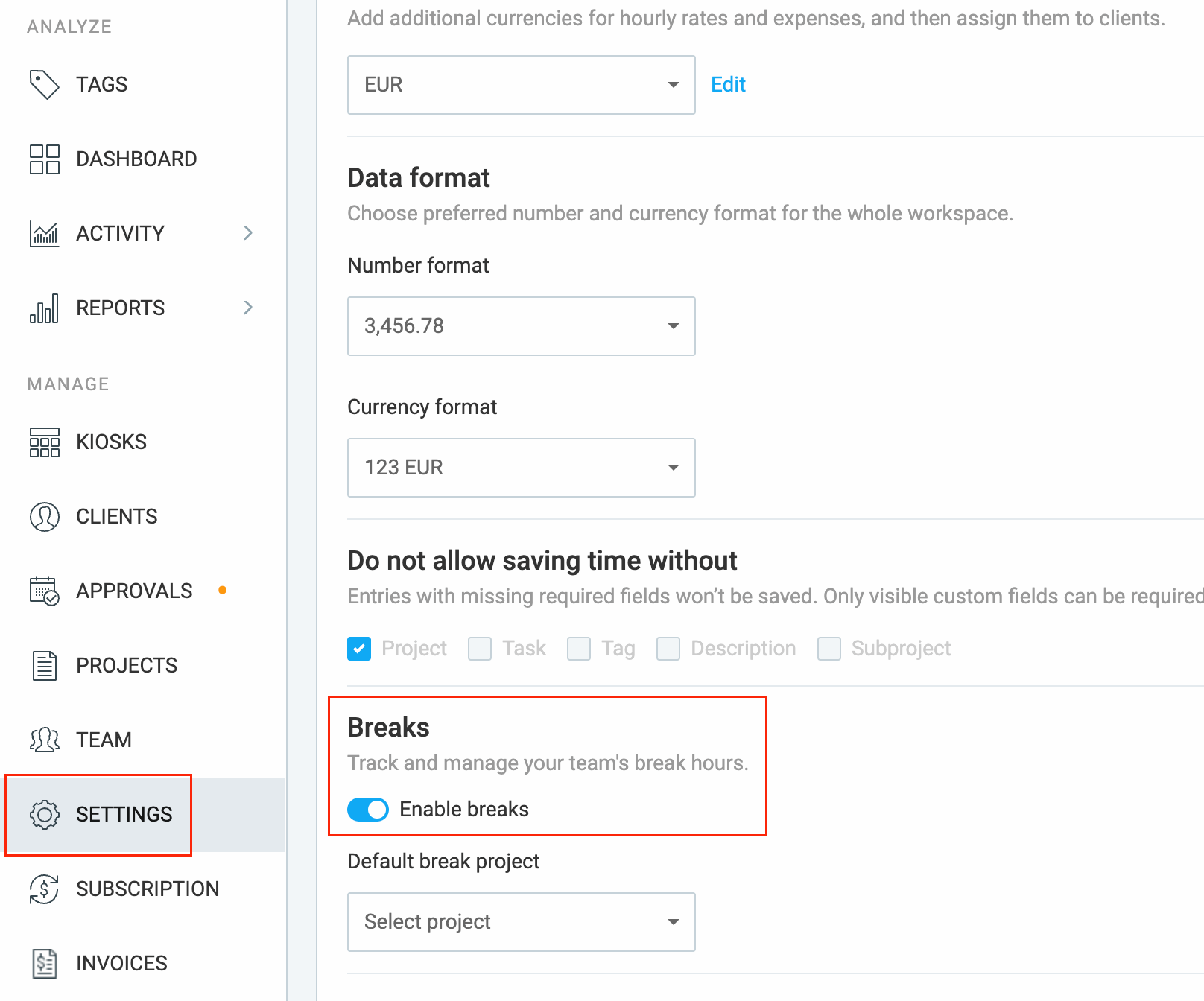

Clockify helps you monitor employee break time easily and automatically. First, you, as a manager, have to enable the break option in the app, as shown in the image below.

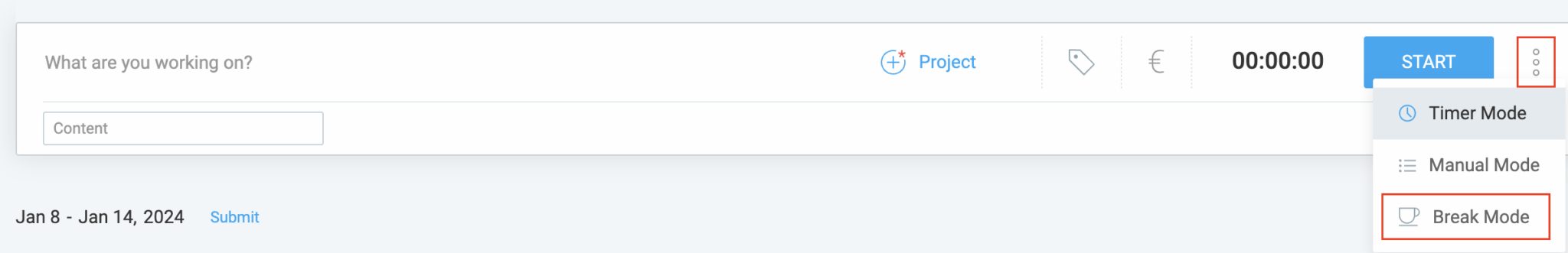

Then, for your employees to start tracking break time, all they need to do is:

- Hover over the 3 dots in the Time tracker,

- Select Break mode in the dropdown menu, and

- Start the break.

After your break is over, click the Stop button, and the time entry gets saved. Later, you can see how much break time your team took in the Reports section, making sure you always stay compliant with the regulations in your state.

Conclusion/Disclaimer

We hope this Colorado labor laws guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Colorado labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred if this guide is used without further guidance from legal or tax advisors.