Connecticut Labor Laws Guide

| Connecticut Labor Laws FAQ | |

| Connecticut minimum wage: | $16.35 |

| Connecticut overtime laws: | 1.5 times the minimum wage for any time worked over 40 hours/week ($24.525 for minimum wage workers) |

| Connecticut break laws: | 30 minute meal breaks for every 7.5 hours worked a day |

The State of Connecticut primarily has its own laws concerning labor, but in some cases, it will follow federal regulations instead. What Connecticut takes the most pride in is its strong anti-discrimination and equality laws, having recently introduced another basis for this policy — hairstyle.

In this Connecticut labor law guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks,

- Leave requirements,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Miscellaneous labor laws, and

- General questions regarding Connecticut labor laws.

Connecticut wage laws

First things first, let's look at the general minimum wage.

| CONNECTICUT MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $16.35 | $8.23/$6.38 | $13.90 |

Connecticut minimum wage in 2025

Effective January 1, 2025, the Connecticut Wage and Workplace Standards states the minimum hourly wage requirement is $16.35. However, there are notable differences between tipped and non-tipped occupations, which we’ll get into in the following paragraphs.

Tipped minimum wage in Connecticut

We can define tips as certain sums of money that are voluntarily provided by customers to employees as a form of recognition for their service.

To be considered a tipped employee in the state of Connecticut, an individual must regularly receive gratuities.

In that case, there are 2 categories, according to 2019 legislation:

- Hourly minimum wage for bartenders — $8.23, and

- Hourly minimum wage for employees in the hotel and restaurant industry (other than bartenders) — $6.38.

These rates, however, do not apply if an employee’s tips, combined with the minimum wage basis ($8.23/$6.38), don’t amount to the minimum wage of $16.35. In such cases, employers are required to make up the difference.

Exceptions to the minimum wage in Connecticut

Here’s a complete list where minimum wage requirements don’t apply, referring to all individuals employed in the following categories:

- By the federal government,

- As volunteers for nonprofits,

- As members of the armed forces or performing any military duty,

- As head residents or their assistants by a university or college,

- As bona fide executives, administrative and professional staff,

- In camps or resorts open to the public for up to 6 months per year,

- As babysitters,

- In outside sales, as defined by the FLSA,

- By nonprofit theaters, if the institution is open for up to 7 months per year,

- In domestic service in or about a private home,

- In the training period lasting no more than 6 months,

- For high-salaried employees,

- If an employer provides tuition and/or fees for training in a destination that requires travel, provided the employer reimburses the travel costs as well.

Subminimum wage in Connecticut

The state of Connecticut also regulates the minimum wage for employees under the age of 18.

The minimum wage for minors is 85% of the regular minimum wage rate.

There are 3 exceptions to this rule:

- Minors working for the government,

- Minors working at farms, and

- Minors working over 200 hours for the same employer.

Connecticut payment laws

Generally, Connecticut employers are required to pay their employees on a weekly basis. The regulations also state that, if a regular payday falls on a non-working day, all payments must be made on the preceding day.

The only exceptions to this rule are for the employees of:

- Private and parochial schools,

- State-aided institutions, and

- Signed collective bargaining agreements.

Deductions to the payroll total can be made only in specific cases, provided that the employee has signed the official form, issued by the Connecticut Department of Labor.

Some examples of such instances include damaged or lost property, cash shortages, the cost of a uniform or a piece of equipment, etc.

Connecticut overtime laws

Regulations established by the Fair Labor Standards Act define a workweek as any seven consecutive working days and a total of 40 hours for this period.

Anything over 40 hours counts as overtime and must be compensated at a higher hourly rate. While many states also have a restriction on daily overtime, Connecticut doesn’t specify any number of hours as a daily limit. Meaning — employees can’t expect to be compensated at a higher rate for working more than 8 hours per day.

In Connecticut, overtime is set to 1.5 times the regular rate of pay. For example, the current overtime hourly rate for minimum wage employees in the state of Connecticut is $19.50.

There are some exceptions to this rule, and the reasons can vary, including underage employees, specific occupations, and certain industry sectors.

Read on and check out all the relevant categories.

🎓 Track Connecticut overtime with Clockify

Overtime exceptions and exemptions in Connecticut

Employees should always strive to be well-informed about their rights and responsibilities; this way, they can ensure they’re rightfully compensated for their work. Employers should also do the same to ensure they are complying with relevant labor laws.

Apart from the fact that more than 8 hours per day doesn’t automatically count as overtime in Connecticut, employees should also know the following — employers aren’t required to compensate at an overtime rate for work during the weekends and holidays.

Following federal requirements for overtime exemptions, 4 main categories of employees are exempt from overtime laws — provided they earn at least $684 per week. Such employees are also referred to as white-collar employees.

The 4 categories of white-collar employees often require a college diploma and include positions in the fields of:

- Administration — non-manual work related to business operations, management policies, or administrative training (spending no more than 20% of the time on activities that are unrelated to the position) — such as accountants, HR team members, market research analysts, etc.

- Executives — direct supervision and management of 2 or more employees — business, general, and executive managers.

- Professionals — positions of advanced knowledge and extensive education, including artists, certified teachers, and skilled computer professionals, such as consultants, developers, engineers, etc.

- Outside sales — positions involved with making sales or taking orders outside of their employer’s main workplace, like outside sales representatives who visit potential and existing customers at their premises.

Besides the federal government exemptions, the state enforces overtime restrictions on the same categories mentioned above in the section regarding minimum wage exceptions.

The whole list of exceptions to the minimum wage applies to overtime as well, so here’s a reminder of employees who are exempt from overtime. We’re again referring to the people employed in one of the following categories:

- By the federal government,

- As volunteers for nonprofits,

- As members of the armed forces or performing any military duty,

- As head residents or their assistants by a university or college,

- As bona fide executives, administrative and professional staff,

- In camps or resorts open to the public for up to 6 months per year,

- As babysitters,

- In outside sales, as defined by the FLSA,

- By nonprofit theaters, if the institution is open for up to 7 months per year,

- In domestic service in or about a private home,

- In the training period lasting no more than 6 months,

- For high-salaried employees, and

- If an employer provides tuition and/or fees for training outside a destination that requires travel, and reimburses the travel costs as well.

In addition to the above-listed occupations, workers in agriculture, automobile salespeople, and drivers (if the US Secretary of Transportation has the power to establish minimum hours of service) are also exempt from overtime.

There are only 2 positions that should be under the exempt category, but are specifically protected — paralegals and nurses, as they’re both in the category of professional staff. That means they’re eligible for overtime pay after 40 hours worked in a week.

Connecticut break laws

In the state of Connecticut, employers are required to provide meal breaks lasting at least 30 minutes after an employee has worked consecutively for 7.5 hours. However, there’s an exception to this rule, and we’ll explain it in the following segment.

As for providing rest breaks, employers in Connecticut aren’t required to offer them.

Here’s what else employees and employers need to know about break laws in Connecticut.

Exceptions to break laws in Connecticut

There are certain situations when break laws in Connecticut don’t apply. Employers don’t have to offer a required break at all when:

- Only one employee can perform the necessary duties,

- The break creates a threat to public safety measures,

- The operation requires that employees be available to respond to urgent matters (provided they’re compensated during this time as well), and

- There are up to 5 employees in certain shifts in certain locations.

Connecticut breastfeeding laws

Working mothers with newborns who are still breastfeeding must have certain conditions to do so in the workplace.

The Connecticut Breastfeeding Law requires employers to provide an appropriate room or location with a door, to ensure privacy, which can’t be a bathroom stall.

These activities must be performed during an employee’s meal or rest period, if applicable.

As of October 1, 2021, the range of the employers’ obligations to mothers has been expanded, specifically in terms of the location where such activities happen.

In short, the following requirements must be met:

- Access to an electrical outlet,

- Location free from intrusion and shielded from the public, and

- Immediate access to a refrigerator or an employer-provided portable cold storage device for storing milk.

Connecticut leave requirements

Our next segment will cover the situations where an employee wants or needs to take a leave of absence from work. Reasons can vary and include sick leave, as well as vacations.

What are the employers entitled to do, and will the Connecticut employees be compensated for their time off?

Let’s check out the rules and regulations regarding required and non-required leave in Connecticut.

Connecticut required leave

Here’s some information regarding the types of leaves that employers in Connecticut are and are not required to provide.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Sick leave — Paid sick leave is a requirement for all public and private sector employees except for seasonal employees and certain construction workers. Each employee is entitled to 1 hour of paid sick leave for every 30 hours worked. Employees are entitled to up to 40 hours of paid sick leave per year. Furthermore, an additional 40 hours of accrual can be carried over to the following calendar year. The qualifying reasons for taking paid sick leave include:

|

| ✅ REQUIRED LEAVE |

|

Jury duty leave — Employers in Connecticut aren’t allowed to penalize their employees in any way for the acceptance of jury duty. The first 5 days of participation in jury duty must be regularly compensated to an employee engaging in that activity. Moreover, if an employee has been engaged in jury duty for 8 hours or more, employers aren’t allowed to require them to come to work that day. |

| ✅ REQUIRED LEAVE |

|

Voting time leave — Employees in the state of Connecticut are entitled to 2 hours of leave to participate in the election of:

To be approved, time off for voting must be requested at least 2 days in advance by the employee. This category of time off is strictly unpaid. |

| ✅ REQUIRED LEAVE |

|

Domestic violence or sexual assault leave — According to the PFMLA Act, employees who are victims of family violence must be entitled to paid leave. Currently, it has been expanded to include:

|

| ✅ REQUIRED LEAVE |

|

Emergency response leave — Employers must offer this type of leave to employees who act as volunteer firefighters, ambulance drivers, and other emergency response personnel. A proof will be required, in the form of a letter from the supervisor or an institution where the employee performed the emergency work. |

| ✅ REQUIRED LEAVE |

|

Organ and bone donation leave — According to the PFMLA Act, employees serving as donors of organs or bone marrow must be entitled to paid leave for this reason. |

| ✅ REQUIRED LEAVE |

|

Military leave — There are 2 segments that the state of Connecticut requires all employers to provide, when it comes to military duty of their employees:

|

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — Employers in Connecticut aren’t required to offer bereavement leave to any of their employees. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — Employers in Connecticut aren’t required to offer vacation leave to any of their employees. If an employer chooses to offer vacation leave and benefits, specific terms and conditions must be stated in the signed contract. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave — Employers in Connecticut aren’t required to offer either paid or unpaid leave for the period of any holiday and celebrations related to it. |

Child labor laws in Connecticut

According to Connecticut Child Labor Laws, the term “minors” refers to young people under 18 who CAN be employed, but with a different set of rules and regulations.

Their main purpose is to ensure that education is a priority for minors, while employment is something that only enhances their academic and life experience.

Some of the most relevant limitations regarding the employment of minors are noted in the following categories:

- Maximum number of work hours,

- Nightwork, and

- Restrictions on specific industries.

There’s a complex set of rules and regulations for different age groups of minors, but 2 things can apply to all:

- Minors are forbidden to work in any hazardous positions, and

- Minors must have a working permit and/or statement of age.

With the exception of emancipated minors, the hourly minimum wage for minors must be at least 85% of the standard rate.

Next, let’s take a look at some rules stated in the Connecticut Child Labor Law.

Specific labor laws for minors

In Connecticut, child labor laws enforce specific rules for certain industries in question. One of the most important distinctions when it comes to the employment of minors is whether the school is in session or not.

For the employment of minors in restaurants, recreational and amusement institutions, theaters, retail establishments, hairdressing salons, bowling alleys, pool halls, photography galleries, manufacturing, and the mechanical sector, the following rules apply.

During school weeks:

- Working between 6 a.m. and 11 p.m.,

- Working 6 hours per day, and

- A total of 32 hours per week.

During non-school weeks:

- Working 8 hours per day, and

- Working 6 days per week.

For minors who aren’t enrolled in or graduated from a secondary school, there’s a slight difference in the limit of working hours.

For the retail industry, it’s 8 hours per day, 6 days per week.

For all the others we’ve mentioned above, it’s 9 hours per day, 6 days per week, or a total of 48 hours per week.

Prohibited occupations for minors

Apart from regulations restricting the hours of work for specific industries, there are 2 more categories of restrictions that apply to minors.

The first one operates at the federal level and refers to any and all occupations that are declared hazardous. Here are some examples of hazardous occupations that strictly prohibit employers from hiring minors:

- Electrical technicians,

- Boiler or engine room operators,

- Any work with flammable, toxic, or corrosive substances,

- Elevator-related work,

- Centrifugal machine operators,

- Any and all work that includes climbing,

- Any and all work that includes power-driven machinery, and

- Any and all work that includes glazing and glass cutting.

The Connecticut State Labor Department declared many other occupations hazardous, thereby expanding the list of prohibited occupations for minors. So, here are some state-specific examples of such occupations:

- Automotive maintenance and repair,

- Chemicals manufacturing,

- Construction,

- Experimental testing or control laboratories,

- Fertilizer manufacturing,

- Mining,

- Pharmaceuticals manufacturing, and

- Smelting, rolling, casting, and processing of metals.

🎓 There are many more prohibited occupations for minors in the state of Connecticut, so if this matter concerns you, check out the full list.

Termination laws in Connecticut

As is the case with many other states in the US, Connecticut also institutes an “employment-at-will” policy.

Apart from the reasons we’ve explicitly stated, or will later in the article, employers can terminate their employees’ work engagement anytime, for any reason, or perhaps for no reason at all.

It’s important to mention that this doctrine also applies to employees — they’re free to leave a job for any or no reason with no legal consequences.

On the other hand, if termination of employment occurs due to discrimination, it is illegal and punishable. We’ll examine that thoroughly and separately, just a couple of segments later.

Final paycheck in Connecticut

All employees are entitled to receive their final paycheck, which must include all wages and benefits.

If an employer decides to terminate someone’s employment, the check must be issued no later than the following business day.

Employees who quit on their own will receive the check on the next regularly scheduled payday.

Discrimination laws in Connecticut

The state of Connecticut has implemented strict regulations regarding anti-discrimination.

There are 2 categories of prohibited bases of discrimination against potential and existing employees — primary and secondary.

The list of primary reasons for discrimination includes:

- Race,

- Color,

- Gender,

- Sexual orientation,

- Religion,

- Age,

- National origin,

- Pregnancy,

- Physical disability,

- Mental disability,

- Citizenship and immigration status,

- Genetic information,

- Military or veteran status, and

- Spousal or child support withholding.

The list of secondary reasons for discrimination includes:

- Homeless status,

- Marital and civil union status,

- Wage garnishments,

- Credit report and information,

- Arrest records,

- Smoking, and

- Natural hair.

Occupational safety in Connecticut

The state of Connecticut ensures that all employees have a safe working environment. In addition to the federal Occupational Safety and Health Act, passed by Congress in 1970, the Connecticut Department of Labor provides further guidance to all employees within the state.

Employers must provide proper training, education, and ongoing support to their employees to ensure workplace safety.

The state of Connecticut has adopted all the federal regulations and standards and offers numerous cooperative programs, as well as on-site consultation.

The main goal is to reduce, or ideally, eliminate the possibility of workplace injuries, illnesses, and fatalities.

Special attention is paid to the enforcement of standards at construction sites, where compliance officers are more likely to conduct inspections.

Inspections can occur due to various factors and can be either scheduled or unscheduled.

Unscheduled inspections may result from worker complaints, imminent danger reports, or, in the worst case, fatalities.

Miscellaneous Connecticut labor laws

In addition to the most important categories of laws and regulations, the state of Connecticut enforces specific supplementary laws that may be applicable to your situation.

Here’s what else is regulated by the rule of law in Connecticut:

- Whistleblower protection laws,

- Background check laws,

- Employer use of social media regulations,

- The Employee Monitoring Law,

- Drug and alcohol testing laws,

- Sexual harassment training laws,

- Cal-COBRA laws, and

- Record-keeping laws.

Whistleblower protection laws

The primary purpose of this set of laws is to ensure that employees can exercise all their legal rights without facing negative repercussions as a result.

We’ll list the reasons for which an employee can’t be discriminated against or retaliated against, nor can their employment be terminated:

- Exercising their First Amendment rights,

- Reporting an alleged violation of the law,

- Opposing or complaining about discrimination in the workplace,

- Exercising their OSHA (occupational safety and health) rights, and

- Opposing or participating in an investigation of discrimination.

Background check laws

The state of Connecticut doesn’t require or prohibit employers from conducting background checks on their employees — potential and current.

If they decide to run background checks, employers must ensure they’re following all the procedures and requirements of the Fair Credit Reporting Act, which operates on a federal level.

While that is the case for the vast majority of occupations, there are several that do require running background checks. Here’s the full list:

- Private investigators,

- Retailers of firearms,

- Casino personnel,

- Correctional facilities personnel,

- Nursing home personnel,

- Foster care parents,

- School personnel,

- School bus drivers, and

- Childcare or daycare personnel.

Employer use of social media regulations

When it comes to personal social media accounts, employers in Connecticut aren’t allowed to request the following from both potential and current employees:

- Disclose the authentication means,

- Access the account in the employer’s presence, and

- Accept or send invitations from and to, in terms of joining any groups.

Employees who exercise their legal rights mustn’t be penalized in any way — discriminated against, retaliated against, disciplined, or discharged from employment.

The only exception to the rule is if there’s an ongoing investigation of that specific employee.

Also, there must be a reasonable belief that such data would contribute to the investigation in a relevant manner.

Additionally, if an employer provides any electronic devices to their employees or if an employee stores data on the employer’s network, employers have certain rights.

In such cases, there are no restrictions on employers' access to all information on those devices.

The Employee Monitoring Law

Employers are prohibited from monitoring their employees with electronic surveillance devices in personal areas of the workplace, including:

- Bathrooms,

- Lounges, and

- Locker rooms.

The state of Connecticut also regulates all listening devices in cases of negotiation of employment contracts, which are prohibited as well.

The only exception involves having a signed agreement that allows such monitoring from both sides.

Drug and alcohol testing laws

There are certain situations when employers with reasonable doubt can require employees to take a drug and/or alcohol test.

Employers are also authorized to conduct random drug testing of employees who work in high-risk or safety-sensitive positions.

Sexual harassment training laws

The state of Connecticut passed the Time’s Up Act in 2019, which regulates the segment of sexual harassment training and education.

According to the Act, employers with 3 or more employees are legally obligated to provide training to new employees within 6 months of their start date.

Training should last at least 2 hours.

Employers must also provide a copy of relevant information regarding sexual harassment and the procedure to follow in the event of such instances.

COBRA laws

Federal COBRA law allows employees to retain health care insurance and benefits after the termination of employment.

The Connecticut continuation of coverage is regulated like this:

- Expanded medical plan lasts 30 months for former employees who were fully insured,

- Expanded medical plan lasts 18 months for former employees who were self-insured, and

- Dental and vision plans last 18 months for all former employees.

This law applies only to employers with 20 or more employees. That’s why many states have their own version of this law, commonly referred to as the “mini-COBRA” regulation.

Mini-COBRA applies to small businesses with 2-19 employees as well and is applicable in Connecticut.

The state of Connecticut’s mini-COBRA allows employers to continue paying health insurance to former employees up to 30 months after the termination date. In Connecticut, continuation of coverage is regulated in the same manner as federal COBRA law.

Record-keeping laws

Employers in Connecticut are required to maintain records of all their employees for a period of 3 years.

Here’s a list of what types and categories of information such records should consist of:

- Employee name,

- Permanent address,

- Precise occupation and title,

- Total hourly (or daily, or weekly, as per agreement) wage,

- Overtime wage,

- Total wages for each pay period,

- Any additions and deductions from wages per pay period, and

- Total beginning and ending time of each work period.

Additionally, employers must keep the working certificates for their employees who are minors.

Frequently asked questions about Connecticut labor laws

We’ve covered some basic rules and laws regarding Connecticut labor laws in the previous paragraphs. However, we’ve reserved one last section for some questions that may still be on your mind.

Stay tuned, and we’ll try to answer them in the following sentences.

How much is a livable wage in Connecticut?

As of January 1, 2025, Connecticut’s minimum wage rests at $16.35 per hour. However, most reports from 2025 indicate that a single-income minimum wage job is insufficient to support a household.

Living wage calculators indicate that a single adult with no children needs a wage of at least $25.28 to cover their basic needs. Moreover, the number doubles if the person has a child and nearly triples, with the respective necessary wages resting at $50.45 and $64.64.

What is the 4-hour rule in CT?

Essentially, the 4-hour rule states that if an employee reports to work at the scheduled time and is released before the completion of the shift due to unforeseen circumstances (weather, inability to work due to business requirements, etc.), the employee must be paid for at least 4 hours of work at their standard hourly rate.

Is it illegal to not pay overtime in Connecticut?

Yes, according to federal regulations and state laws, all hours worked in excess of the standard 8 hours must be paid at a premium of 1.5 times the standard hourly rate per hour. There are federal and state exceptions to the rules.

Need a simple solution to track work hours? Try Clockify

Clockify is a simple and reliable time tracker that allows you to track attendance and costs with just a few clicks, all for free.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk for employees to clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).

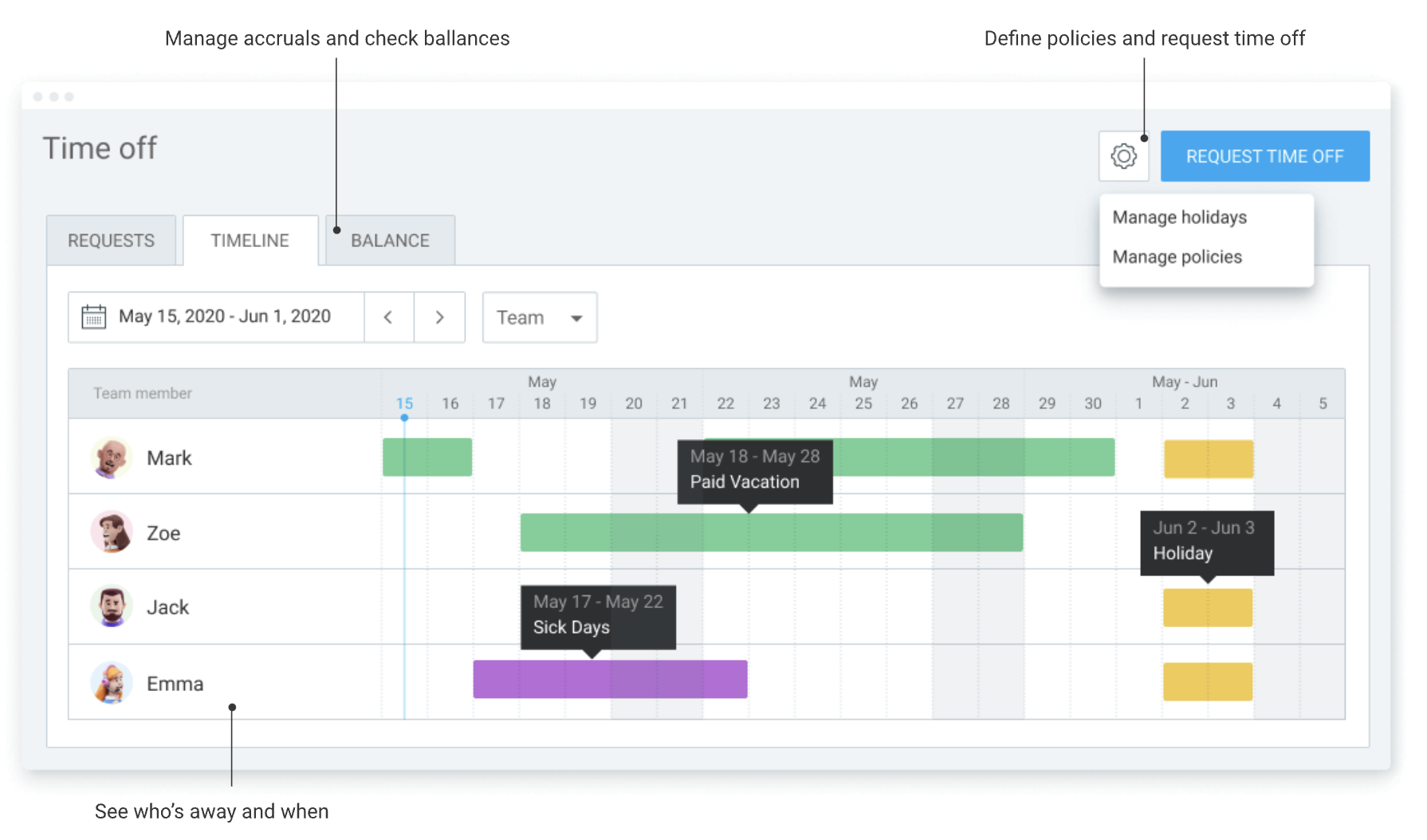

In addition to reliable time tracking, Clockify gives you several great options for managing your employees.

One such feature is time off, which allows you to track employee PTO, vacation, leave, and see who is available for work.

Conclusion/Disclaimer

We hope this Connecticut labor law guide has been helpful. We advise you to ensure that you’ve paid attention to the links we’ve provided, as most of them will lead you to official government websites and other relevant information.

Please note that this guide was written in July 2025, so any changes in the labor laws that were included later than that may not be included in this Connecticut labor laws guide.

We strongly advise you to consult with the relevant institutions and/or certified representatives before taking any action on legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.