Florida Labor Laws Guide

Ultimate Florida labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Florida Labor Laws FAQ | |

| Florida minimum wage | $13.00 |

| Florida overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($19.5 for minimum wage workers) |

| Florida breaks | Breaks not required by law |

Florida wage laws

Unlike certain states, Florida has state laws regarding employees' wages.

The following are the regulations concerning the state minimum, tipped hourly wage, and the youth minimum wage in Florida.

FLORIDA MINIMUM WAGE

Regular minimum wage: $13.00

Tipped minimum wage: $9.98

Subminimum wage: $4.25

What is the minimum wage in Florida in 2025?

As of September 30, 2024, all employees in Florida are entitled to the state minimum wage of $13 per hour.

However, the minimum wage in Florida will increase to $14 per hour on September 30, 2025, and will increase by $1 until it reaches $15 per hour by September 30, 2026.

Exceptions to the minimum wage in Florida

Certain employees are exempt from the minimum wage regulations under the Fair Labor Standards Act (FLSA).

Such exemptions from the minimum wage (together with certain requirements) include:

- Executive employees who earn a salary and make at least $1,128 per week,

- Administrative employees who earn a salary and make at least $1,128 per week,

- Learned and creative professionals who receive a salary of at least $1,128 per week,

- Computer employees who earn at least $27.63 per hour,

- Highly compensated employees who earn $151,164 or more a year, including a minimum of $1,128 per week,

- Outside sales employees (there is no minimum salary requirement for such employees),

- Tipped employees, and

- Minors.

What is the tipped minimum wage in Florida in 2025?

Tipped employees are employees who earn more than $30 per month from tips during their regular work.

Under Florida law, tipped employees are entitled to the state minimum cash wage of $9.98 per hour — provided that their hourly earnings (with tips) equal or exceed the state minimum wage of $13.

Furthermore, the FLSA requires an employer to pay the difference if an employee’s earnings don’t equal the state minimum wage of $13 per hour.

To conclude, employers are allowed to take a tip credit from employees of no more than $3.02 per hour.

What is the youth minimum wage in Florida in 2025?

Under federal law, employers are allowed to pay employees under 20 a minimum wage of $4.25 per hour for the first 90 calendar days after employment.

However, full-time students who work in retail, agriculture, or colleges and universities are entitled to 85% of the minimum wage.

The employer must obtain a certificate to employ a full-time student. Full-time students can work up to 20 hours a week (8 hours a day) during school hours and 40 hours per week when school isn’t in session.

Florida payment laws

Florida labor laws have no regulations regarding how often employers must pay wages to their employees.

Still, here are the most common pay frequency schemes in the USA:

- Weekly — employees are paid once a week (52 paychecks per year),

- Biweekly — employees are paid every other week (26 paychecks per year),

- Semi-monthly — Employees are paid twice a month (24 paychecks per year), and

- Monthly — Employees are paid once a month (12 paychecks per year).

Florida overtime laws

The state of Florida doesn’t have any state laws regulating overtime work.

Thus, employers must pay all non-exempt employees a federal overtime rate of time and a half (1.5) times the regular hourly pay for any hours exceeding 40 per week.

The FLSA doesn’t require overtime pay for work on the weekends, holidays, or any other regular days of rest.

🎓 Track Florida overtime with Clockify

Overtime exceptions and exemptions in Florida

Certain occupations are exempt from both minimum wage and overtime pay rules in Florida, and they include:

- Executives who are compensated on a salary basis and earn not less than $1,128 weekly,

- Administrative employees who receive a salary and earn not less than $1,128 per week,

- Learned and creative professionals who receive a salary and earn not less than $1,128 per week,

- Highly compensated employees who are paid on a salary basis and receive $151,164 (at least $1,128 weekly),

- Outside sales employees,

- Employees who work varying schedules, i.e., use the Fluctuating Workweek Method (FWW), and

- Computer employees who work on a salary basis and earn no less than $27.63 per hour.

The exemptions don't apply to “blue-collar” workers, police officers, firefighters, paramedics, rescue workers, and similar employees.

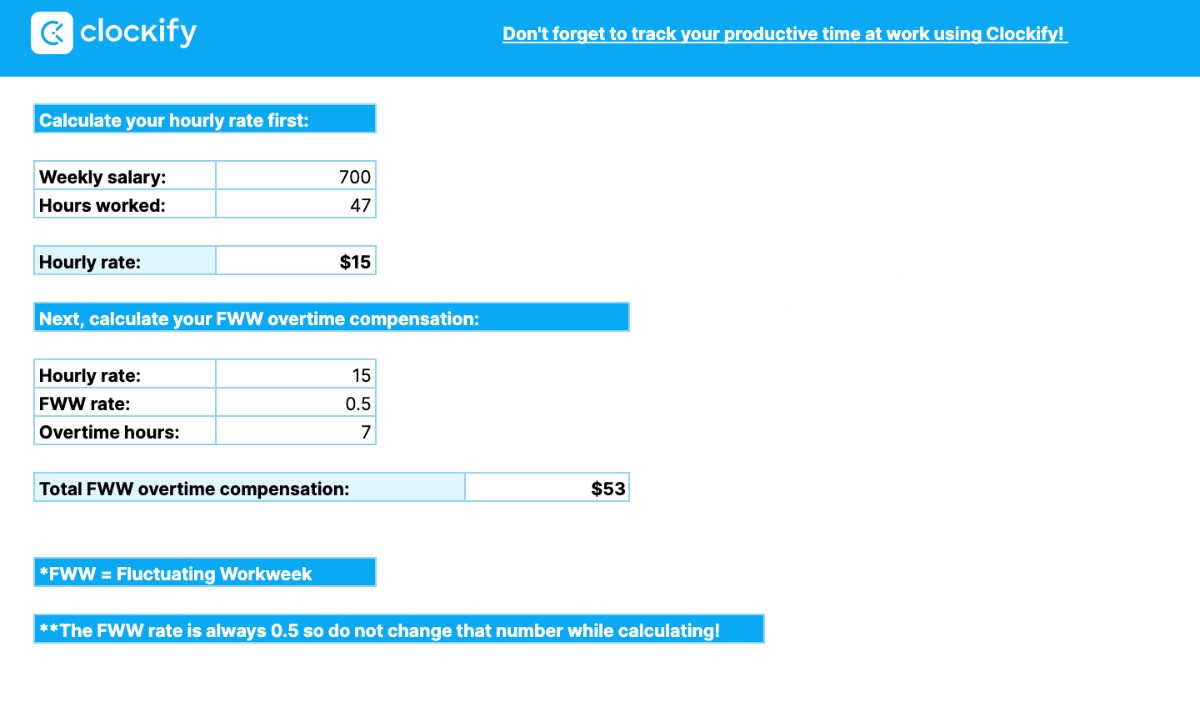

Fluctuating Workweek Method (FWW) in Florida

The Fluctuating Workweek Method, also known as the “Chinese overtime,” entitles salaried employees to an overtime premium of one-half (0.5) times their regular hourly rate.

So, if employees have a fixed salary and their workweek is “fluctuating” — sometimes they work 40 hours a week, sometimes more or less — they are entitled to this overtime rate.

For instance, employees who work 40 hours or less per week receive their regular weekly pay. But if they work for one week, let us say 45 hours — they are entitled to an additional 0.5 times their regular rate for those extra 5 hours of overtime.

Take a look at an example:

Let’s say an employee's weekly income is $900, and the employee worked 45 hours the preceding week.

To calculate overtime hours, calculate the hourly rate first.

Start by dividing the weekly salary ($900) by the number of hours worked that week (45):

$900 / 45 = $20 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week to determine the half-time rate:

$20 per hour x 0.5 = $10 for each overtime hour worked

Total overtime compensation goes as follows:

$10 x 5 overtime hours = $50

This means that the employee will get $50 for 5 additional overtime hours worked.

🎓 Fluctuating Workweek Calculator

Florida break laws

What is the legal break for an 8-hour shift in Florida?

Florida work laws have no regulations specifying adult employee meal breaks.

Therefore, under federal law, employers in Florida are not required to offer rest breaks to their employees during the workday.

Exceptions to break laws in Florida

Although breaks aren’t required, employers are encouraged to offer them to promote a healthy workplace culture. Therefore, an employer may offer their employees the following types of breaks:

- Short breaks — rest periods of 5 to 20 minutes (considered compensable), and

- Long breaks — also known as bona fide meal periods, which last at least 30 minutes, aren’t considered work hours (not compensable).

For employees who eat during work — hotline workers, for instance — such time is considered compensable.

Florida breastfeeding laws

Under Florida law, a mother has the right to breastfeed her baby in any location — whether public or private — provided she is authorized to be in the said location.

However, Florida has no state laws supporting breastfeeding in the workplace. In that situation, FLSA proposes that breastfeeding employees are entitled to a reasonable break time and a separate room (other than an office bathroom) to express breast milk at work. These rules apply for up to one year after their child’s birth.

In addition, nursing mothers in Florida are exempt from public indecency laws.

Florida leave requirements

Florida offers the following types of leave:

- Required leave, and

- Non-required leave.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Holiday leave (public employers) — all Florida state branches and agencies don’t work during state and religious holidays and are entitled to paid days off. In 2025, paid state and religious holidays include:

If any of the said holidays fall on Saturday, the preceding Friday will be a day off. If a holiday falls on Sunday, the following Monday will be a day off. |

| ✅ REQUIRED LEAVE |

|

Parental and family medical leave — the state of Florida offices offer their employees:

State employers are required to grant employees up to 6 months of unpaid leave. For such leave to commence, the employee must obtain a written statement from a physician. An employer can’t terminate the employment contract of any employee because of pregnancy or refuse to grant family medical leave. According to the Family and Medical Leave Act (FMLA), employees are also guaranteed up to 12 weeks of unpaid leave in a 12-month period. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave (private employers) — unlike public employers, private employers in Florida aren’t required to give their employees holiday leave, paid or unpaid. In addition, employers don’t need to pay any premium wage rates if employees work during holidays. |

| ✅ REQUIRED LEAVE |

|

Jury duty — employers in Florida must grant their employees time off if they are called up to serve on a jury. However, full-time employees aren’t entitled to compensation for the first 3 days of juror service. In contrast, jurors who aren’t full-time employees receive $15 a day for the first 3 days of juror service. Finally, each juror who serves more than 3 days is paid $30 for the fourth day of service and $30 for each day thereafter. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — employers in the U.S. are not required to pay for time not worked, whether that is vacation leave, sick leave, or similar. Also, Florida has no state laws requiring employers to provide employees with vacation days. Thus, under federal law, employers don’t need to give their employees vacation leave — paid or unpaid. However, that doesn’t mean employers shouldn’t offer vacation or similar benefits to their employees. If granted, such leave is usually a mutual agreement between an employer and an employee. |

| ✅ REQUIRED LEAVE |

|

Military leave — All Florida employees are entitled to military leave without loss of pay, vacation, or sick leave. Leave of paid absence may not exceed 240 working hours during one year. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave — Employees of a state agency may be granted a paid leave of up to 120 working hours in a 12-month period to serve as volunteers. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — under federal law, employers don’t need to provide employees with sick leave benefits — paid or unpaid. Nonetheless, even though no federal or Florida laws guarantee this type of leave, many employers choose to grant sick leave to their employees. |

| ❌ NON-REQUIRED LEAVE |

|

Voting leave — the state of Florida doesn’t require employers to give their employees time off to vote, whether paid or unpaid. Yet, it is considered a third-degree felony for those who discharge or threaten to discharge an employee who wants to vote or not vote in any election. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — under federal and Florida law, employers aren’t required to provide employees with bereavement leave. |

Child labor laws in Florida

The regulations regarding child labor in Florida ensure that minors work in an environment that doesn’t pose any physical, emotional, or moral danger to them.

Unlike other states, such as Alabama, Florida doesn’t require minors to obtain work permits or papers from schools or government agencies to be able to work.

The only exception applies to minors employed in the entertainment industry. If minors work as models, performers, or child actors, an employment certificate — Permit to Hire Minors in the Entertainment Industry — must be issued by the Florida Child Labor Program.

However, employers must keep a record of proof of the child’s age issued by the district school.

Moreover, Florida child labor laws regulate things like working hours, breaks, and similar stuff regarding child labor.

Work time restrictions for Florida minors

The state of Florida uses both state laws and the FLSA when it comes to regulating the working hours of minors.

These are the work time restrictions for minors aged 14 and 15 when public schools are in session:

- Up to 3 hours of work on a school day,

- Up to 8 hours of work on a non-school day,

- Up to 15 hours of work weekly,

- Up to 6 consecutive days of work weekly, and

- No work before 7 a.m. or after 7 p.m. but may not work during public school hours.

The following are work time restrictions for minors aged 14 and 15 when public schools are NOT in session (June 1 through Labor Day):

- Up to 8 hours of work a day,

- Up to 40 hours of work weekly,

- Up to 6 consecutive days of work weekly, and

- No work before 7 a.m. or after 9 p.m. each day.

Next are work time restrictions for minors aged 16 and 17 when public or private schools are in session:

- No work before 6:30 a.m. or after 11 p.m. on a school day,

- Up to 8 hours of work a day when school is scheduled the following day (no work during school hours),

- Up to 6 consecutive days of work weekly, and

- Up to 30 hours of work weekly. However, a minor’s parent or custodian may waive the limitation imposed by Child Labor Laws on a form prescribed by the department and provided to the minor's employer.

Finally, here are the work time restrictions for minors aged 16 and 17 when public or private schools are NOT in session:

- Minors may work until their shift is completed during non-school weeks, when a school day does not follow, or during summer vacation,

- Up to 6 consecutive days of work weekly, and

- There are no hour restrictions during this time.

Exemptions from time restrictions for Florida minors

The following are situations when minors are exempt from the said hour limitations:

- If they are enrolled in a high school work program,

- If they have received a partial waiver from the public school or the Child Labor Program,

- If they have been married,

- If they graduated from an accredited high school or hold a high school equivalency diploma,

- If they have served in the military, and

- If they have been authorized by a court order.

Breaks for Florida minors

Minors who work more than 4 hours continuously are entitled to a 30-minute meal break whether the school is in session or not.

Prohibited occupations for Florida minors

Together with the Fair Labor Standards Act (FLSA), the Florida Child Labor Law, and the Florida Rule, certain professions qualify as harmful to the health and safety of minors under 18 years of age.

The hazardous occupations for minors are grouped into 2 categories — see below.

| Occupations prohibited for all minors | Occupations prohibited for minors aged 14 and 15 |

|

|

Note: Minors who live on farms and whose parents or guardians manage a ranch or a farm with livestock are exempt from the hazardous occupations regulations, provided they don’t work during school hours.

Working near alcoholic beverages

Florida Child Labor Law prohibits minors aged 18 or younger from working in establishments where alcoholic beverages are sold and served on-premises.

However, these regulations do not apply to:

- Minors who work in drugstores, grocery stores, and similar, where alcoholic beverages are sold but not consumed on-premises,

- Professional entertainers 17 years of age who aren’t in school,

- Minors who have been granted a waiver,

- Minors 17 years of age or over with written permission from the principal employed by a bona fide food service establishment,

- Minors 18 years of age and underemployed as bellhops, elevator operators, and similar,

- Minors under the age of 18 employed in bowling alleys provided that they don’t serve, prepare, or sell such beverages, and

- Minors under 18 employed by a bona fide dinner theater provided they work as actors, actresses, or musicians only.

Recordkeeping and posting requirements

Each establishment that employs minors must keep or display Florida Child Labor Law posters in a conspicuous place on the property notifying them of the Child Labor Law, including:

- Weekly and daily hour restrictions when school is in session and out of session,

- Prohibited occupations for minors,

- Fines for employers who don’t comply with the law, and

- Required breaks for all minors.

Furthermore, employers must keep waiver authorizations, proof of age documentation (copy of driver's license, birth certificate, passport, or visa), and proof of exemption from minor status during the minor’s employment or until the minor turns 19.

Florida Waivers of the Law

The Florida Child Labor Law exempts minors who live in difficult life circumstances from specific regulations and allows them to work.

They may apply for waivers and receive a working license from the Child Labor Office. However, this doesn’t apply to minors working in the entertainment industry.

Each waiver application is carefully examined and granted on a case-by-case basis.

🎓 The Florida Department of Business & Professional Regulation

Penalties for employers

All employers must:

- Comply with child labor laws,

- Ensure children work in a safe environment, and

- Make sure the children are properly supervised.

If Florida child labor laws are violated, employers can be fined up to $2,500 per offense. Employers can also be fined for violating the FLSA regulations, which can go up to $11,000 per minor.

Moreover, if an injured minor is employed in violation of Florida child labor laws, an employer, not the insurance carrier, must compensate the injured employee. However, the total compensation can’t exceed double the amount payable prescribed by Florida Worker’s Compensation law.

Florida hiring laws

Florida protects job applicants from potential conspiracies to provide equal chances throughout the onboarding process, but italso carefully selects future employees.

Consequently, it’s considered a misdemeanor of the first degree if 2 or more persons conspire against a job applicant to obtain employment in any firm or corporation. The penalty for such conspiracy is a fine of up to $1,000 or even imprisonment for up to 1 year.

Background screening in Florida

Employers may request background checks to increase the odds of hiring a competent applicant. This is also known as background screening.

Background screenings in Florida can be:

- Level 1 screening — this level of background screening requires checking certain applicants such as law enforcement officers, people who work with children, the elderly, and similar. Said applicants may undergo employment history checks, statewide criminal correspondence checks through the Department of Law Enforcement, a check of the Dru Sjodin National Sex Offender Public Website, or local criminal records checks.

- Level 2 screening — applicants who usually undergo level 2 screening are persons who provide care to children, the developmentally disabled, or vulnerable adults (adults with mental, physical, or functional disabilities), persons who work on helplines, or those who have access to abuse records. Level 2 screening includes employment history checks, fingerprinting, national criminal history records checks, or local criminal records checks.

If an employer who conducted the screening finds out that an applicant has committed prohibited offenses — they are allowed by law to reject a candidate.

Employment practices

The state of Florida protects employees and job applicants from discrimination-based behavior during the onboarding process. For that reason, Florida law considers it unlawful to refuse to hire, limit, segregate, or classify someone because of their age, sex, race, national origin, pregnancy, handicap, or marital status.

However, under the same statute, Florida allows “giving preferences” while employing applicants who are members of certain religious associations or educational institutions to perform work connected with said institutions.

Moreover, an employer doesn’t have the right to require an applicant to take an HIV-related test while hiring unless the job in question carries the risk of transmitting the infection while performing work-related activities.

Likewise, if the results of the HIV-related tests turn out to be affirmative — an employer mustn’t discriminate against such applicants while hiring (unless that job carries a significant risk of transmitting the infection).

Florida employers have no legal duty to test their employees or job applicants for drugs or alcohol.

However, an employer may conduct drug testing to ensure the work environment is drug and alcohol-free. The employer must notify the applicant via written form 60 days before the testing. If a candidate refuses to undergo testing, or if they turn out to be positive, an employer may reject that candidate.

Right to work law in Florida

A “right-to-work” state is one in which employees have the freedom to decide whether or not to join a labor union. Under right-to-work law, no one can require an employee to join a labor union to get or keep a job. Florida enacted a right-to-work statute in 1943.

Therefore, under Florida’s right-to-work law, any labor organization, labor union, employer, corporation, or association in Florida isn’t allowed to:

- Deny employees the right to form, join, or assist labor unions and organizations or to refrain from such activity,

- Deny employment or discriminate against an employee based on membership or nonmembership in any labor union or organization,

- Forbid public employees to form, join, or participate in any employee organization of their choice or to refrain from such activities, and

- Discriminate against a public employee because of the employee membership or nonmembership in any labor union or organization.

However, unlike some other states, public employees do not have the right to strike in Florida.

If any person or labor organization violates any of the provisions stated above, a second-degree misdemeanor conviction will be obtained.

Florida termination laws

Florida is another “at-will” employment state, which means that an employee or employer can terminate the employment contract at any time without providing any specific reason.

However, no employer can discharge an employee based on the employee's age, gender, race, national origin, disability, or marital status. This is known as wrongful termination and an employee can file a lawsuit against the employer in such a case.

Florida final paycheck

There is no state regulation concerning the timing of the final paycheck in Florida. Therefore, the Department of Labor suggests that employers are not required to give former employees their final check immediately after the termination of their employment but on the next scheduled payroll day.

Employees who haven’t been paid on the next scheduled payday for the last pay period can contact the Department of Labor's Wage and Hour Division or the Florida Department of Economic Opportunity (DEO) for further information and assistance.

Health insurance continuation in Florida (COBRA)

Are employers obligated to provide health insurance after the employment termination?

Full-time employees (or their beneficiaries) who have terminated their employment due to job loss (voluntary or involuntary), death, divorce, and similar “qualifying events” are entitled to continue using their health benefits under federal law from 18 to 36 months after.

This act is known as the Consolidated Omnibus Budget Reconciliation Act (COBRA), and it only applies to businesses with more than 20 employees.

Luckily, the Florida Health Insurance Coverage Continuation Act protects employees who work in companies with fewer than 20 employees, also known as the “mini-COBRA” law. Said employees are required to notify their insurer within 30 days, and they can extend their health insurance for another 18 months after the termination of employment.

Terminal payment for accumulated sick leave in Florida

Regarding terminal payment for accumulated sick leave, the regulations favor state employees. All state employees are entitled to terminal incentive pay for accumulated sick leave upon normal or regular retirement.

In the event of death or disability, but only after 10 years of state employment, the employee or employee’s beneficiary is also entitled to terminal incentive pay for accumulated sick leave upon termination. The rate of the terminal pay must be equal to the rate of pay received by the employee at the time of retirement, termination, or death.

The statute permits terminal payout for sick leave equal to one-eighth of all unused sick leave credit accumulated before October 1st, 1973, plus one-fourth of all unused sick leave accumulated after October 1, 1973. However, sick leave can’t exceed a maximum of 480 hours.

This statute doesn’t apply to employees found guilty in court or involved in any embezzlement, theft, or similar activities.

Occupational safety in Florida

Florida is another state where private-sector employers and workers are under federal Occupational Safety and Health Administration (OSHA) jurisdiction. That being said, each private-sector employer must provide the employees with a hazard-free work environment.

According to OSHA, the hazards are grouped as follows:

- Biological hazards — mold, pests, insects, etc.,

- Chemical and dust hazards — pesticides, asbestos, etc.,

- Work organization hazards — things that cause stress,

- Safety hazards — slips, trips, falls, etc.,

- Physical hazards — noise, radiation, temperature extremes, etc., and

- Ergonomic hazards — repetition, lifting, awkward postures, etc.

The authorities are allowed to enter premises during working hours to ensure all the regulations are followed as stated in the act. Also, if an employee notices any safety violation in the workplace, they may send a written notice to inform the authorities.

Under OSHA, any employer who fails to provide the employees with a safe work environment, as stated in this act, can receive a penalty of up to $70,000 but not less than $5,000 for each violation.

🎓 OSHA penalties for employers

In addition, Florida has in-depth state-level guidelines regarding occupational safety for employees.

With the intent to improve the health and safety of Florida's workforce, the Florida Department of Health offers different educational programs and research that include:

- Surveillance of work-related injuries and illnesses,

- Educating the workers, employers, and healthcare providers about the risks,

- Compensations for injured employers, employees, and insurers through Florida's Workers' Compensation division, and

- Training and research related to occupational health and safety through the Sunshine Education and Research Center.

Miscellaneous Florida labor laws

Certain labor laws don’t belong to any specific group above, so we have placed them in the miscellaneous section.

The most significant such laws in Florida include:

- Whistleblower laws, and

- Recordkeeping laws.

Let’s explore each.

Florida whistleblower laws

Florida’s Whistleblower Act prevents any state, regional, local, or municipal government entity or independent contractor from any adverse action taken against an employee who reports unlawful behavior inside an institution.

Adverse actions prohibited by this act include dismissing, disciplining, suspending, or demotion of the employee, reduction in benefits, and similar.

Who is protected under the Whistleblower Act?

The act protects the following types of employees:

- Employees who uncover information on their initiative in a written and signed complaint,

- Employees requested to participate in an investigation, hearing, or other inquiry conducted by a federal body,

- Employees who refuse to take part in any adverse action prohibited by this section,

- Employees who file a complaint via the whistleblower’s hotline or the hotline of the Medicaid Fraud Control Unit of the Department of Legal Affairs, and

- Employees who file a written form complaint to their supervisory officials or the Florida Commission on Human Relations.

If an employee suffers from said adverse actions, they may file a complaint within 180 days after the said adverse action to conduct a hearing and receive compensation for any lost benefits, attorney’s fees, and similar.

Florida recordkeeping laws

Florida has both federal and state recordkeeping requirements for employers. These requirements include:

- General information — employers should keep copies of employees’ documents that establish their identity and employment eligibility (I-9 form) for 3 years from the hire date or one year after termination.

- Payroll records — name, address, rate of pay, and date of birth should be retained for 3 years.

- Wage computation records — wage rate tables, work and time schedules, and records of additions or deductions from the employee's wages should be kept for 2 years.

- W-4 form — for federal income tax calculations, the employer should keep the W-4 tax form for 4 years.

- Dispute records — in the case of a dispute between the employer and employee, a record of the dispute should be kept for 3 years.

- Confidential documents — include documents relating to the Family and Medical Leave Act (FMLA) and should be kept for 3 years.

- Onboarding records of current and former employees — include application forms, resumes, tests, and background checks and should be kept for 1 year.

Employers can avoid potential consequences by keeping all these documents.

Frequently asked questions about Florida labor laws

This guide covered the most essential elements of Florida employment laws. Apart from that, we have included an FAQ section to make this guide even more comprehensive.

So, let’s explore a few common questions.

Can I work 6 hours without a lunch break in Florida?

It depends. If you are over 18, there are no legal requirements for lunch breaks during work hours in Florida. However, if you are a minor under 18, after working for 4 consecutive hours, you are guaranteed a 30-minute break.

Is it illegal to work 7 days a week in Florida?

It depends. There is no legal requirement for the number of consecutive work days for employees over the age of 18. However, the maximum number of consecutive work days for minors under the age of 18 is 6.

What is the maximum fine for violation of Florida child labor laws?

Violation of Florida child labor laws can lead to penalties of up to $2,500 per offense. Moreover, under the Fair Labor Standards Act (FLSA), the fines can go up to $11,000 per minor.

How many hours straight can you legally work in Florida?

The state of Florida has nodaily work hours limit, so employees can work as much as they want. However, if an employee works more than 40 hours in a workweek, they are entitled to overtime compensation — unless they are exempt.

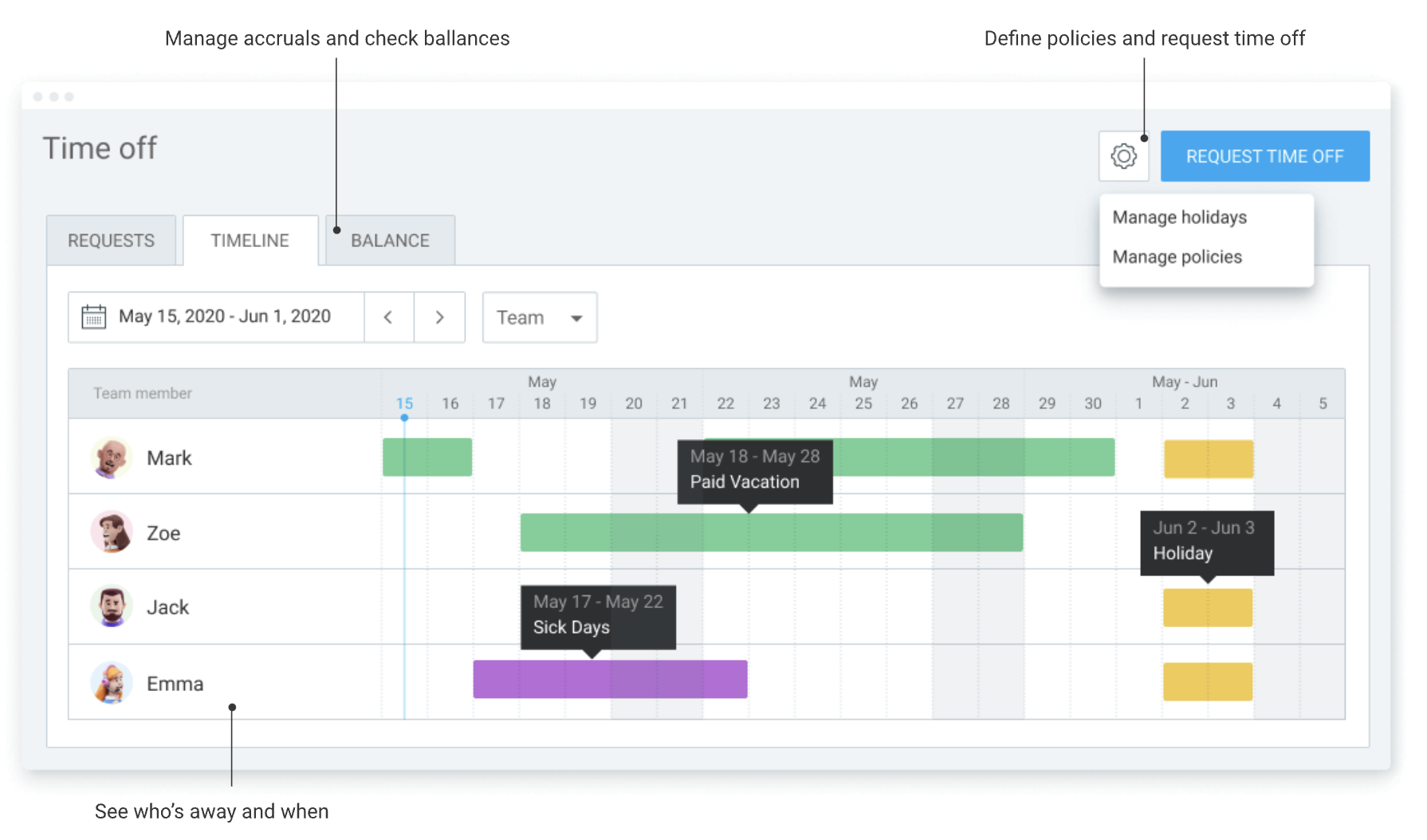

Need a simple time clock for employees? Try Clockify

Clockify allows you to track time, attendance, and costs with just a few clicks for FREE.

Your team can personally track work time via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).

In addition to reliable time tracking, Clockify gives you several great options for managing your employees.

One such feature is time off, which allows you to track employee time off and see who is available for work.

Conclusion/Disclaimer

We hope this Florida labor law guide has been helpful. Please make sure you have paid attention to the links we have provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 of 2025, so any changes in the labor laws that were included later than that may not be included in this Florida labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred if this guide is used without further guidance from legal or tax advisors.