Indiana Labor Laws Guide

Ultimate Indiana labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Indiana Labor Laws FAQ | |

| Indiana minimum wage: | $7.25 |

| Indiana overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($10.875 per hour for minimum wage workers) |

| Indiana break laws | Rest periods or meal breaks not required by law |

Indiana wage laws

When it comes to wage laws in the state of Indiana, we’ll refer to the sections regarding:

- Indiana minimum wage,

- Tipped minimum wage in Indiana,

- Subminimum wage in Indiana,

- Exemptions to the minimum wage in Indiana, and

- Indiana payment laws.

| INDIANA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage (Training wage) |

| $7.25 | $2.13 | $4.25 |

Indiana minimum wage

Indiana does not have any state laws regarding minimum wages and, therefore, uses the minimum wage prescribed by the Fair Labor Standards Act (FLSA).

Thus, the minimum hourly wage rate in Indiana is $7.25 — the same as the federal minimum wage.

Tipped minimum wage in Indiana

According to a definition provided by the US Department of Labor, a tipped employee is someone who regularly earns more than $30 a month in tips. The same goes for tipped employees in Indiana.

The minimum wage for tipped employees in Indiana is the same as the federal one — $2.13 per hour.

However, the employer must cover the difference if the employee’s total earnings (direct wage plus tips) are lower than the minimum wage. This is also known as a “tip credit” against the minimum wage, and employers can claim a tip credit of up to $5.12 per hour.

Subminimum wage in Indiana (training wage)

Employers can pay a subminimum wage of $4.25 per hour to employees under 20 for their first 90 calendar days of employment. This is the so-called training wage in Indiana.

Exemptions to the minimum wage in Indiana

Indiana law provides certain exemptions regarding the types of employees covered by minimum wage laws. These exemptions include the following categories of employees:

- Minors under the age of 16,

- Employees with wages based on commissions,

- Persons employed by close family members,

- Persons performing services for a religious order they are a member of,

- Persons engaged in an independently established trade, occupation, and profession,

- Student nurses,

- Medical interns and resident physicians employed at an accredited hospital,

- Outside salespersons,

- Students performing services for their school, college, or university,

- Insurance producers and solicitors,

- Individuals doing agricultural labor, and

- Executives, administrators, and professionals working for $150 and more a week.

🎓 Indiana Labor and Safety Code

Indiana payment laws

Indiana employers are required to pay employee wages using the following pay frequencies:

- Semi-monthly, or

- Bi-weekly.

In addition, regular paydays need to be scheduled no later than 10 days after the end of a pay period for which the wages are due. If an employer fails to make timely payments or decides to withhold wages, the state law requires them to pay:

- Late wages,

- A reasonable fee for the plaintiff's attorney, and

- Court costs.

🎓 Semi-Monthly vs. Bi-Weekly Payroll Explained

Indiana overtime laws

Indiana regulates overtime requirements using FLSA provisions.

Unless exempt, this act states that every employee who works more than 40 hours in a workweek is entitled to 1.5 times their regular wage rate in overtime pay.

Overtime exceptions and exemptions in Indiana

The state of Indiana has certain exceptions and exemptions to overtime requirements following the federal FLSA overtime regulations.

Starting from January 1, 2025, certain categories of workers are not entitled to overtime pay based on federal law. These include:

- Executive employees who earn at least $1,128 per week,

- Administrative employees who earn at least $1,128 per week,

- Professional employees who earn at least $1,128 per week, and

- Highly compensated employees who earn at least $151,164 per year.

This threshold is set to increase on July 1, 2027, and every 3 years thereafter.

Indiana break laws

The state of Indiana follows federal break laws regarding breaks during the workday. These laws do not require employers to provide either rest periods or meal breaks.

Exceptions to break laws in Indiana

The state of Indiana recognizes only one type of break law: break laws for employed minors.

These laws require that all employees under 18 — who work 6 or more consecutive hours — have 1 or 2 breaks totaling at least 30 minutes.

Indiana breastfeeding laws

In Indiana, both federal and state laws regulate breastfeeding in the workplace. Under Indiana law, a woman can breastfeed her child anywhere she has the right to be.

In addition, employers are required to provide a paid break for employees who need to express breast milk for their child.

Employers must also provide a private location for employees to express milk. This location cannot be a toilet stall. Moreover, employers should attempt to provide cold storage where the employee can keep their expressed milk throughout the workday.

Furthermore, the FLSA gives breastfeeding employees in Indiana additional protection and allows them to pump milk for their child for up to 1 year after the child’s birth. Employees covered by this act should also be granted a place for breastfeeding that meets the following conditions:

- It is not used as a bathroom,

- It is shielded from view,

- It is free from intrusion, and

- It is private.

Employers are prohibited from retaliating against employees for using their breastfeeding rights under federal and state law.

Indiana leave requirements

Different US states have varying leave requirements. Let’s examine what types of leaves are mandatory and which ones are optional in Indiana.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — In Indiana, employees can take unpaid time off to serve jury duty without retribution from their employer. However, the employee must notify the employer about their jury duty leave in advance and may be required to show their jury summons. Additionally, if an employee’s absence can potentially cause their employer undue hardship, excusing the employee from jury duty can be justified. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — No laws require employers in Indiana to provide sick leave for their employees. However, if they decide to include a paid sick leave policy in their employment contract, both parties must comply with it, as it is considered lawful and valid under state law. |

| ✅ REQUIRED LEAVE |

|

Family and medical leave — Under The Family and Medical Leave Act of 1993, Indiana employees are entitled to up to 12 weeks of unpaid leave following major life events. Some of the types of events that might make employees eligible for family and medical leave in Indiana include:

This leave is unpaid and cannot be the cause for employment termination. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation and holiday leave — The same federal rule applies here; unless specifically stated in their contract, employees are not entitled to vacation or holiday leave. |

| ✅ REQUIRED LEAVE |

|

Family military leave — Employees whose family members serve in the military can take up to 10 days in a calendar year of unpaid leave during the following periods:

To be eligible for this family military leave, employees must have worked for the same employer for at least 12 months and for at least 1,500 hours in the 12 months preceding the leave request. Furthermore, the employer may require that this leave be taken as a substitute for other paid leave, excluding medical or sick leave. |

| ✅ REQUIRED LEAVE |

|

Military leave — Employees performing military service are eligible for paid leave of up to 15 days per calendar year when called up for active duty, training duties, or reserve call-ups. Employees must provide a written order or statement requiring military duty to be eligible for pay. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — Indiana employers aren’t required to provide bereavement leave unless specifically stated in their mutual contract. |

| ❌ NON-REQUIRED LEAVE |

|

Voting time leave — No federal or state regulations in Indiana are concerned with providing voting time off. |

Indiana child labor laws

Indiana has specific laws concerning wages, hours, and other terms of employment for minors. We present them below, separated into different age categories.

Labor laws for minors aged 14 and 15

According to Indiana law, minors aged 14 and 15 can work under the following conditions:

- 3 hours on a school day,

- 18 hours per week when school is in session,

- 8 hours on a non-school day, and

- 40 hours per week when school is not in session,

This age group can work from 7 a.m. to 7 p.m. during the school year, but these hours can be extended until 9 p.m. from June 1 to Labor Day.

Labor laws for minors aged 16

Regarding minors aged 16, Indiana child labor laws allow them to work under the following conditions without written parental permission:

- 8 hours on a school day,

- 30 hours per week, or up to 6 days per week, and

- Until 10 p.m. on nights followed by a school day.

If the minor provides written parental permission to the employer, the following rules apply:

- Up to 9 hours on days not followed by a school day,

- Up to 40 hours during a school week,

- Up to 48 hours while school is out of session, and

- Until 12 a.m. on nights not followed by a school day.

Additionally, minors aged 16 are not allowed to work before 6 a.m., whether or not they have parental permission.

Labor laws for minors aged 17

As with the previous age group, Indiana teenage employment laws do not require 17-year-olds to have parental permission to work:

- 8 hours per day,

- 30 hours per week, or up to 6 days per week, and

- Until 10 p.m. on nights, followed by a school day.

However, once they have provided written parental permission to their employer, these minors can work:

- Up to 9 hours on days not followed by a school day,

- Up to 40 hours during a school week,

- Up to 48 hours on a non-school week,

- Until 11:30 p.m. on nights followed by a school day, and

- Until 1 a.m. on nights followed by a school day, but not on consecutive days, and no more than 2 days per school week.

On school days, minors aged 17 cannot work before 6 a.m. All minors working in establishments open to the public after 10 p.m. and before 6 a.m. need to be accompanied by a coworker who is at least 18 years old.

Additionally, any employer who employs 5 or more minors must register them in the Youth Employment System (YES).

Prohibited occupations for minors

Special laws apply to minors, which forbid them from working in dangerous environments and occupations.

According to Indiana child labor laws, some of these hazardous occupations include:

- Manufacturing goods,

- Mining,

- Working with power-driven machinery,

- Working in boiler or steam rooms,

- Operating a motor vehicle,

- Washing outside windows,

- Working in a warehouse or storage,

- Working with ladders, scaffolds, or similar equipment,

- Preparing meats for sale, and

- Construction.

Hiring laws in Indiana

Covering employers with 6 or more employees, the Indiana Civil Rights Act prohibits hiring practices that discriminate based on:

- Race or color,

- Religion,

- Sex,

- National origin or ancestry,

- Disability, and

- Military veteran status.

The Indiana Civil Rights Commission also prohibits age discrimination for individuals over the age of 40.

However, certain types of organizations are exempt from employment discrimination, such as:

- Corporations organized for fraternal or religious goals,

- Establishments possessed or affiliated with a religious institution, and

- Non-profit social clubs, corporations, or associations.

If you suspect discrimination, it’s best to contact or visit the Indiana Civil Rights Commission within 180 days of the date the discrimination occurred.

Indiana Right-to-work law

Indiana is a right-to-work state, which means it’s illegal to require union memberships from employees as a condition of employment.

Additionally, before charging any representation fees, Indiana labor law requires unions to obtain written approval from employees.

Termination laws in Indiana

Indiana is one of the states in the US that follows the “employment-at-will” doctrine.

Thus, employees and employers in Indiana can terminate the employment contract at any time and for no reason — without notice or argumentation.

However, the reason for termination cannot be discrimination or retaliation against an employee.

Final paycheck

Under Indiana law, if an employer terminates the employment contract, he is required to pay the employee's wages by the next scheduled payday.

If an employee quits and the employer is unaware of their whereabouts, the employer must either pay the employee within 10 days after the employee's demand for final wages or when the employer receives an address to which the final earnings can be sent.

Indiana COBRA laws

Upon termination, the employee may be entitled to extended health insurance under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

The following major life events may qualify employees or their dependents for COBRA coverage:

- Termination or a considerable reduction in work hours,

- Employee death,

- Legal separation or divorce, and

- Loss of the status of a dependent child.

If eligible, employees or their families can have their health insurance (which they must still pay in full) extended for 18 to 36 months.

Occupational safety in Indiana

The Indiana Occupational Safety and Health Administration (IOSHA) regulates how hazardous substances are handled in the workplace and sets standards for training and behavior in dangerous work environments.

If you have any concerns about potentially dangerous workplace practices, you can file a complaint with IOSHA, and they will conduct a workplace investigation.

Miscellaneous Indiana labor laws

In this segment, we’ll review some miscellaneous Indiana labor laws that don’t strictly fit into the previously mentioned categories.

Whistleblower protection laws

No employer can take adverse action against a worker engaging in an activity protected by the Indiana Whistleblower Protection Unit.

Some examples of adverse employment actions may include:

- Termination,

- Demotion,

- Denying overtime or promotions,

- Denial of benefits,

- Disciplinary action, and

- Harassment or intimidation.

Employees in Indiana who have been subjected to these actions can file a direct online complaint form.

Background check laws

Ruled by executive order, Indiana employers must give job applicants a “fair chance” of being hired.

Therefore, employers cannot ask the job candidates about their criminal history during their initial job application.

However, local cities and counties can invoke the Indiana code § 22-2-17-3 and choose to allow employers to do this — it’s best to check with the local authorities which laws apply.

Moreover, there are occupations where criminal background checks are required, and these include:

- Employees in childcare facilities,

- Home health agency personnel,

- Employees of personal services agencies, and

- School teachers.

If needed for a certain profession, Indiana State Police can provide a limited criminal history background check.

Employer use of social media regulations

Indiana has no legislation covering or protecting employee use of social media. This means that content posted on social media can be legally accessed by the employer and can, in some cases, be considered a cause for termination.

Drug and alcohol testing laws

There is no legislation that prevents Indiana employers from conducting random drug and alcohol testing of their employees.

However, there’s an exception where drug and alcohol testing is required — employees with a Commercial Driving License (CDL).

🎓 Indiana State Personnel Department

Record-keeping laws

According to the FLSA, employers must keep employee records for up to 3 years.

No specific requirements exist for the format or form in which these records are kept.

Employee information kept in the records should include:

- Full name and social security number,

- Address,

- Date of birth an employee younger than 19,

- Sex,

- Occupation,

- Hour and day of the beginning of the workweek,

- Total hours worked each workday and workweek,

- Total daily or weekly straight-time earnings,

- The base on which the employee is paid (e.g., $15 per hour, $200 per week),

- Regular hourly pay rate,

- The total amount of overtime pay per workweek,

- Any wage deductions,

- Total workers’ compensation for each pay period, and

- Date of wage payment along with pay period covered.

Moreover, the state of Indiana has Records Retention Schedules that determine how long certain records should be kept.

Frequently asked questions about labor laws in Indiana

While writing this guide, our objective was to give you detailed information about labor laws in Indiana. For this purpose, we have also included an FAQ section with some widespread questions about this topic.

How many hours can a salaried employee work in Indiana?

The state of Indiana has no set limit on how many hours an employee can work. However, employees who work more than 8 hours a day, or 40 hours per week, are entitled to overtime pay of one and a half (1.5) of their regular pay rate.

How many hours can you work without a break in Indiana?

The state of Indiana follows federal regulations regarding breaks. Therefore, employers are not required to provide employees with breaks during work hours. However, minors under 18 who work for 6 consecutive hours are entitled to a 30-minute break, which can be divided into 2 breaks.

How much notice does an employer have to give for a schedule change in Indiana?

As Indiana is an employment-at-will state, employers aren’t required to give advance notice to employees regarding schedule changes.

What are the labor laws in Indiana?

Indiana uses both federal and state laws to regulate working conditions. Here are some of the labor laws used in Indiana:

- Fair Labor Standards Act (FLSA),

- Family and Medical Leave Act of 1993 (FMLA),

- Indiana Civil Rights Act,

- Consolidated Omnibus Budget Reconciliation Act (COBRA), and

- Other state-wise employment laws and regulations.

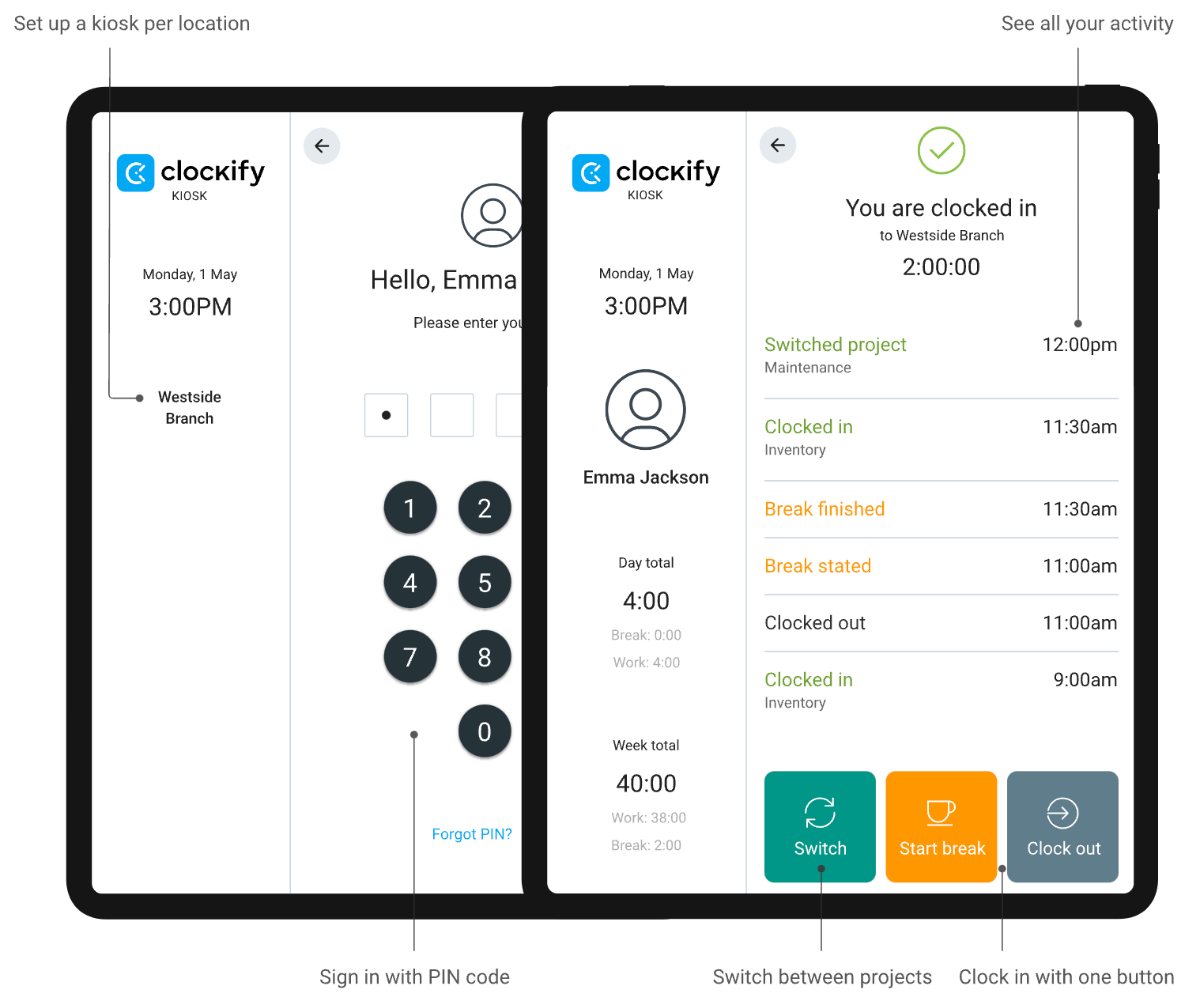

Need a simple time clock for employees? Try Clockify

Clockify is a simple and reliable software that allows you to track time, attendance, and costs with just a few clicks.

Your team can track work time personally via a web or mobile app — or you can set up a time clock kiosk from which employees can clock in and out.

By using the Clockify kiosk feature, you can set up a shared device from which your employees can clock in and out. Each employee will have a PIN code for the kiosk, which they can use to track their work hours, breaks, and activities.

Moreover, Clockify helps you:

- Approve timesheets and time off,

- Schedule shifts,

- Run time card reports, and

- Export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Indiana labor laws guide has been helpful. Please ensure you have paid attention to the links we have provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 of 2025, so any changes in the labor laws that were included later than that may not be included in this Indiana labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.