Ohio Labor Laws Guide

Ultimate Ohio labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| Ohio Labor Laws Guide FAQ | |

| Ohio minimum wage | $7.25 or $9.30 per hour |

| Ohio overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($18.60 per hour for minimum wage workers) |

| Ohio break laws | Breaks not required by law |

Table of contents

Ohio wage laws

To begin with, we will review the different aspects of Ohio wage laws. The specific areas we will cover include the following:

- Minimum wage in Ohio,

- Tipped minimum wage in Ohio,

- Subminimum wage in Ohio,

- Exceptions to the minimum wage in Ohio,

- Ohio payment laws.

| MINIMUM WAGE IN OHIO | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage (Training wage) |

| $7.25 or $9.30 | $4.65 | $4.25 |

Ohio minimum wage

Currently, the minimum wage in Ohio is $9.30 per hour.

This minimum wage rate is only applicable to businesses earning more than $342,000 in gross yearly sales.

Employers of businesses with lower earnings can pay their employees the federal minimum wage, which amounts to an hourly rate of $7.25.

Tipped minimum wage in Ohio

US law uses the term “tipped employees” to describe employees who regularly and customarily receive over $30 monthly in tips.

In Ohio, this type of employee earns a tipped minimum wage in Ohio of $4.65 per hour.

This amount of direct wages, when combined with the earned tips, must amount at least to the state minimum wage of $9.30.

If this is not the case, the employer must cover the difference.

Subminimum wage in Ohio (Training wage)

Under the Fair Labor Standards Act (FLSA), employers can pay a subminimum wage to employees aged 16 to 19 for the first 90 calendar days of employment.

This is the so-called training wage — and the current rate of the training wage in Ohio is $4.25.

However, after the time period of 90 days, employers must pay their employees a regular minimum wage rate, at the least.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Ohio

Ohio uses the federal FLSA regulations to regulate which categories of employees are exempt from the minimum wage.

These categories include:

- Farm workers and other agricultural workers

- Taxi drivers

- Outside salespersons

- Salaried employees — administrative, executive, and professional employees — if they earn more than $684 on a weekly basis

Ohio payment laws

When it comes to pay frequency, Ohio employers must:

- Pay wages earned during the first 15 days of the previous month before or on the first day of each calendar month.

- Pay all wages earned from the 16th to the last day of the previous month before or on the 15th day of each calendar month.

These requirements do not prevent daily or weekly payment of wages.

Ohio overtime laws

Overtime requirements, compensation, and exceptions in Ohio are regulated by Ohio Code.

Exceptions not included — all work in excess of 40 hours in a workweek is considered overtime, and needs to be paid at the rate of 1.5 times the regular pay.

Overtime exceptions and exemptions in Ohio

Recently passed and effective from July 6, 2022, Ohio’s Senate Bill 47 excludes the following occupations from overtime requirements:

- All occupations not covered under minimum wage requirements

- Employees of businesses earning less than $150,000 in yearly gross sales

- Agricultural workers

- Casual babysitters and live-in caretakers

- Recreational camp staff

- All public employees

- Administrative, professional, or executive employees

A notable difference introduced by this Senate Bill is that time spent traveling to and from work is not included in overtime calculations.

Track Ohio overtime with ClockifyOhio break laws

Employers in Ohio are not required to give lunch breaks or rest periods during working hours under federal law or any specific state requirements.

If the company does provide breaks, the employees must be released of all responsibilities during unpaid breaks.

Additionally, all breaks under 20 minutes must be paid at the regular rate.

Exceptions to break laws in Ohio

One exception when the employer is required to provide a break is for employees under 18 years of age.

According to the Ohio’ Minor Labor Laws, minors working 5 or more consecutive hours are entitled to at least 30 minutes for a meal or rest period.

Ohio breastfeeding laws

The federal FLSA laws include a chapter that establishes a required break time for nursing mothers.

Under these regulations, employers need to provide adequate facilities, as well as reasonable break time, for employees to express their breast milk.

Toilet stalls and restrooms are not considered appropriate for this purpose.

The right for nursing breaks extends to one year after childbirth.

Track employee productivity with ClockifyOhio leave requirements

Each US state has different rules when deciding if a certain type of leave is required by law or not.

In this section, we’ll cover both the required and the non-required types of leave in Ohio.

Ohio required leave

First of all, we can take a look at types of leave required by Ohio law:

- Family and medical leave

- Jury duty leave

- Emergency response leave

- Military leave

- Family military leave

- Leave for victims of crime

- Bereavement leave (for State employees)

- Vacation and holiday leave (for State employees)

- Voting time leave

Family medical leave

Under the provisions of The Family and Medical Leave Act, some Ohio employees may be eligible for up to 12 weeks of unpaid leave following medical emergencies.

Some of the events that can be considered qualifying for an employee to receive family medical leave include:

- Childbirth and care for a newborn child

- Adoption or taking in a foster child

- Having a health condition that prevents the employee from working

- Caring for a family member with a serious health condition

Additionally, for employees to take family medical leave, federal law requires that:

- The employee has worked for the same employer for at least 12 months prior to the leave, and

- The employee has worked at least 1,250 hours in those 12 months.

Jury duty leave

Ohio employers cannot stop their employees from attending jury duty, nor can they in any way retaliate against the said employees if they choose to do so.

This means that employers are forbidden from threatening, disciplining, or discharging an employee who chooses to attend jury duty.

However, employers may ask their employees to use available vacation time for jury duty purposes.

Emergency response leave (for State employees)

Ohio State employees who are volunteer members of a fire department or emergency medical services are allowed to be absent from work when responding to an emergency.

The State cannot take any adverse action against an employee choosing to take the emergency response leave.

However, some requirements must be met by the employee before they request this leave:

- They must provide a volunteer firefighter or volunteer EMS provider certification within 30 days of acquiring it.

- They must make an attempt to notify the employer of their absence.

- If they couldn’t notify the employer due to severe circumstances, the employee must supply a written explanation from the chief of emergency services they belong to.

Additionally, the employer can subtract any hours the employee was absent on an emergency response from the total amount of wage calculations.

Military leave

Under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) law, employees who are members of the uniformed services are eligible for unpaid military leave.

These employees can receive full seniority credit for the duration of their deployment, if:

- The employer is provided with a notice of the employee’s military service,

- The total time spent in active military service is under 5 years,

- The military discharge is not dishonorable or disqualifying, and

- The return to work is timely.

Once the deployment term has finished, the employee may return to their previous position, with the same benefits and level of seniority.

Family military leave

Ohio’s law allows the parent, spouse, or legal custodian of a member of the uniformed services to take either 10 days or 80 hours of unpaid family military leave.

This leave can be used in cases when the family member of the employee is either called to active duty, or injured, or hospitalized during deployment.

To take family military leave, the employee must fulfill the following terms:

- Provide a written notice — unless the notice is provided by a military representative.

- Must have worked for the company for at least 12 consecutive months, and 1,250 hours in those 12 months.

- Does not have any other available leave, other than sick or disability leave.

Upon returning, the employee is entitled to all the benefits and seniority they held prior to the family medical leave.

Leave for victims of crime

In Ohio, employees who have been victims of domestic violence may take a leave of absence from work to:

- Attend criminal case court preparations, at the prosecutor’s request

- Attend grand jury, delinquency, or criminal proceedings they were subpoenaed to attend

- Testify as a witness in a criminal case they were victim of

However, the employee may withhold pay for the duration of the absence, unless the injury the criminal proceedings are for happend at the place of work.

Ohio Attorney General Guide for Helping Crime VictimsBereavement leave (for State employees)

State employees are allowed 3 days of paid bereavement leave following the death of a member of the immediate family.

Vacation and holiday leave (for State employees)

All full-time State employees, after having finished at least one year of service, are entitled to 80 hours of paid vacation leave.

State employees will receive additional vacation hours, in accordance with number of years served:

- After 8 years — the employee receives 120 hours of vacation.

- After 15 years — the employee receives 160 hours of vacation.

- After 25 years — the employee receives 200 hours of vacation.

In addition to this, State employees have a right to paid leave on national holidays.

Voting time leave

Employers in Ohio cannot interfere with their employee’s right to vote.

This means that all Ohio employers must provide a reasonable voting leave to all employees looking to take part in the election.

Ohio non-required leave

We can now move on to types of leave not mandated by Ohio law:

- Bereavement leave (private employees)

- Vacation and holiday leave (private employees)

Bereavement leave (private employees)

Private employers in Ohio are not required to provide bereavement leave to their employees.

Vacation and holiday leave (private employees)

Private Ohio employees are not entitled to vacation or holiday leave, unless otherwise specified in their contract.

Child labor laws in Ohio

Under Ohio regulations, all minors must provide an age certificate, a schooling certificate, as well as a work permit issued by their school to the employer.

Additionally, before starting their employment —the employer and the employee must sign a written agreement about the wage rate and payment details.

When it comes to legal working hours for minors, there are different requirements for these two age categories:

- Minors under 16, and

- Minors aged 16 and 17.

Ohio labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- Anytime from 7 a.m. to 9 p.m. on school days

- No more than 3 hours on a school day

- No more than 18 hours in a week while school is in session

- No more than 8 hours on a non-school day

- No more than 48 hours in a week while school is out of session

Ohio labor laws for minors aged 16 and 17

Minors aged 16 and 17 can work these hours:

- Before 7 a.m. when school is in session

- Before 6 a.m. when school is in session, and the person has not worked after 8 p.m. on the previous day

- After 11 p.m. on a night preceding a school day

Prohibited occupations for minors in Ohio

Ohio’s Minor Employment law also regulates occupations prohibited to minors, which have been deemed hazardous for this age group to perform.

In Ohio, the prohibited occupations for minors include:

- Construction operations

- Handling explosives

- Operating motor vehicles

- Operating power-driven machinery

- Working in confined spaces — such as silos, utility vaults, sewers, boiler rooms, etc.

Hiring laws in Ohio

Under the Ohio Civil Rights Act, employees hold the right to a fair hiring process. Discrimination is prohibited on the basis of:

- Race or color

- Religion

- National origin and ancestry

- Sex (including pregnancy, sexual orientation, and gender identity)

- Age

- Military status

- Disability

This means that Ohio employers cannot refuse to hire and cannot treat any job applicants or employees differently on the basis of the listed characteristics.

Ohio “Ban-the-box” law

Ohio has passed the so-called “Ban-the-box” law in 2017, in an effort towards a fairer hiring process.

Ban-the-box law enables a fairer hiring process by:

- prohibiting questions about prior arrests that did not lead to conviction during the initial job application, and

- delaying background checks.

Termination laws in Ohio

Ohio belongs to the majority of US states that use the principle of “at-will employment”.

Simply said, the employment relationship can be terminated by either the employer or the employee, at any time, and with no particular argumentation.

Private employees also fall under these terms of employment, unless otherwise stated in their contract with the employer.

Final paycheck in Ohio

If an employee is fired or leaves employment voluntarily, their employer needs to pay their final paycheck within 15 days, or by the next regularly scheduled payday — whichever comes first.

COBRA and Ohio Mini-COBRA laws

Ohio employees who are terminated or are going through some other significant stressful life event may be eligible for continued health insurance.

Provisions of either the federal COBRA (Consolidated Omnibus Budget Reconciliation Act), or the Ohio Mini-COBRA may allow the continuation of health insurance for up to 36 months.

This insurance is usually charged at 102% of the original cost.

Some types of events that may qualify an employee or their dependents for continued health insurance include:

- Termination

- A significant reduction of work hours

- Divorce

- A serious health issue that makes the employee unable to work

- A family member with serious health issues

Note that the time frame for enrollment in Ohio’s Mini-COBRA depends on the employee’s termination date and the notification from the individual’s employer.

Furthermore, the subsidies are available for a specific period of coverage — April 1 through September 30 of any given year.

Occupational safety in Ohio

Workplace health and security standards are enforced by the federal Occupational Health and Safety Administration (OSHA).

This state agency can conduct workplace inspections to ensure all of its requirements are being upheld.

Other than the OSHA, Ohio also has the Public Employment Risk Reduction Program (PERRP), which is a workplace safety agency for public employees.

This agency also offers workplace inspections, as well as imminent risk consultations.

Ohio OSHA Contact informationMiscellaneous Ohio labor laws

Last but not least, we can review some miscellaneous Ohio labor laws that do not strictly fit into the previously mentioned categories. These include the following:

- Whistleblower protection laws

- Background check laws

- Social Media Policy

- Drug and alcohol testing laws

- Record-keeping laws

Whistleblower protection laws

There is a section in Ohio Code dedicated to providing protection to employees who report suspected or witnessed violations of state or federal laws.

This act forbids employers from discharging, threatening, or in any other way retaliating against a whistleblower acting in good faith.

However, the whistleblower must fulfill the following conditions:

- Provide written or oral notification to their supervisor about the violations

- If there is no corrective action — contact the prosecuting attorney of the country or municipality, the peace officer, the inspector general, or other authorities

However, if there is an imminent hazard or criminal offense, the employee may directly contact the appropriate public authorities.

Background check laws

Before collecting pre-employment data, Ohio employers need to provide a written notice to the employee in advance.

Employers also need to make sure to follow the regulations provided in the federal Fair Credit Reporting Act (FCRA).

As was previously described, Ohio’s “Ban-the-box” law prohibits the employer from asking about the applicant's criminal history during the initial application.

However, some occupations where background checks are required include the following:

- Child care staff

- School employees

- Adult care services providers

- Home health agencies staff

- Staff working for agencies providing assistance to persons with developmental disabilities

Ohio’s Social Media Policy

As a general rule, Ohio employees can monitor their employee’s Internet activity on company-issued devices.

Additionally, workers are prohibited from using social networking websites during their working hours without the direct permission of the employer.

Furthemore, even off duty Internet usage is not considered “private”, if the activity can be seen by other people.

As such, employees are prohibited from some of the following actions:

- Posting a picture in their work uniform or an attire that may be mistaken for their uniform

- Posting images, videos, or comments that may be considered unlawful

- Posting false information about the employer, coworkers, supervisors, public officials (including mocking a fictional character or a computer-generated likeness that resembles the listed subjects)

- Posting anything about the training or work-related assignments

Drug and alcohol testing laws

Ohio has no laws concerning private employers’ drug and alcohol testing practices.

However, State workers must undergo:

- Reasonable suspicion testing — if the employer provides a valid cause for testing

- Applicant testing — before being appointed to their new duties

Record-keeping laws

Ohio Code requires that employers keep accurate and permanent employee records, including:

- The employee’s name and address

- The employee’s social security number

- Total amount of gross earnings (before deductions) for each pay period

- The date and amount of wages paid for each pay period

- The dates of hiring, rehiring, layoff, or termination

- All absences

- Type of service the employee provided

- Other payments or remuneration, excluding wages

All employee records must be kept for at least 5 years, and be readily available for inspection.

Conclusion/Disclaimer

We hope this Ohio labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Ohio labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

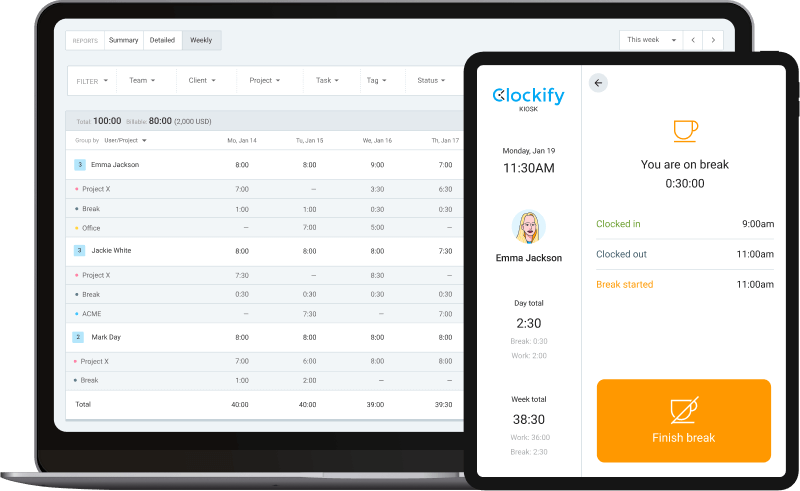

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).