Time clock rounding or time rounding is a practice that allows supervisors or employers to get the best insight on their employee’s work hours and modify them to easier-to-tackle numbers for accounting when they calculate payroll. Naturally, it comes with its own set of rules and stipulations to ensure that the company doesn’t abuse the system for its benefit. The more familiar you are with the rules, the lesser the chances of making a mistake that could cost a lawsuit.

That being said, in this brief guide, we focus on explaining the core element of time rounding – the timesheet, how understanding between the employer and the employees affects the time rounding practice and what laws you should follow.

Here is a short rundown on what you can read here. If you’re already familiar with time rounding, you can easily jump to any section you want.

A word on timesheets

Timesheets are a digital (and in some cases, physical), records of how an employee spent their time at work. Employers use them to keep track of the time employees spend on certain tasks during a project, and their purpose varies.

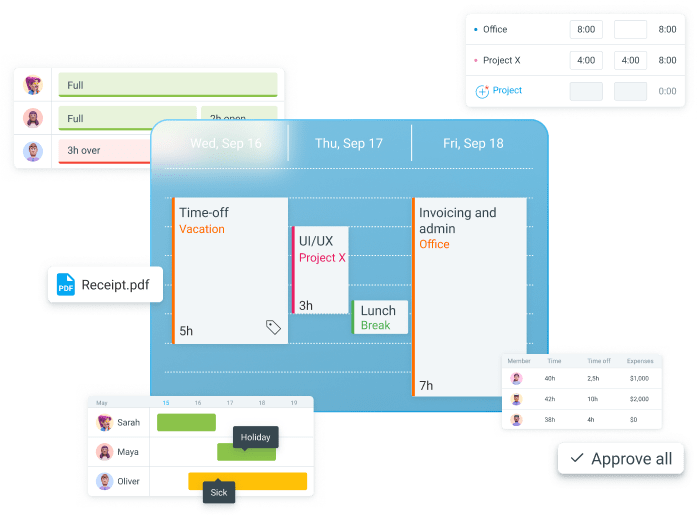

Track team time with timesheets

Are timesheets important?

The short answer – yes.

Slightly longer answer, timesheets serve more than one purpose for a company.

Timesheets:

- Help with project transparency;

- Are an important step in proper billing and invoicing;

- Factor in payroll calculation and processing;

- Identify problem areas in workflow;

- Help productivity, and

- Improve project management.

In more ways than one, a single timesheet helps improve a company’s day-to-day operation.

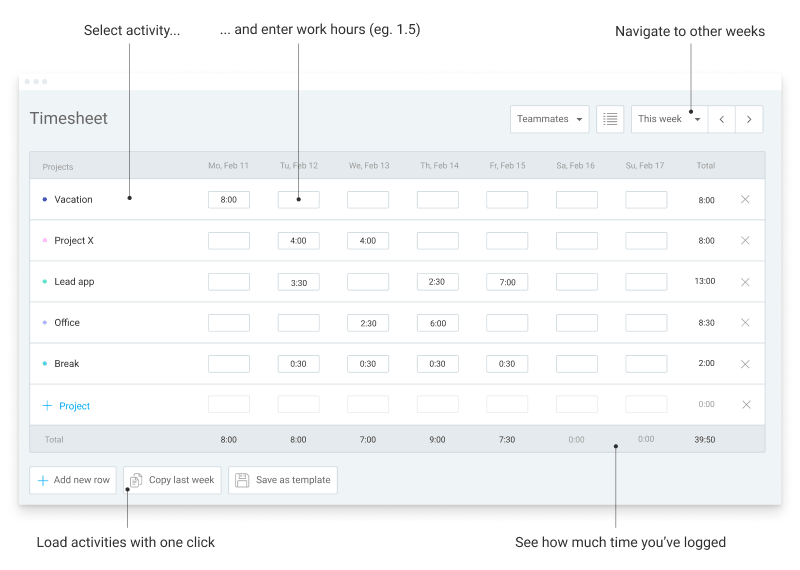

Here is a look at the Clockify timesheet app and its features. It gives employees maximum agency, and with all the tasks broken down into categories, you can easily see what happened each day, which can help with rounding.

ℹ️ Timesheets are an essential part of every good time tracking software, as well as a person’s tracking habit. We’ve created an information base for any and all questions you could have.

How to enter time in timesheet

Filling out timesheets for teams

Timesheet timeplates

How to track and check attendance

What is timesheet compliance?

If you want to correctly implement this means of time reporting, you need to enforce timesheet compliance. This is a set of rules that ensures all timesheets are filled in and processed correctly, in compliance with the industry standards. Timesheet compliance helps the process go smoothly.

First, the employees are aware of the rules determining how a timesheet is best filled, when they should be done, etc.

Secondly, supervisors/team leads/employers who complete and round those timesheets can review the data for anomalies and analyze it for overall project management improvements.

Lastly, the accounting teams (or whoever does the billing and payroll) can use the locked and approved timesheets to correctly bill the clients and calculate the payroll without a hitch.

Timesheet compliance makes a world of difference as an embedded set of rules everyone in the company should abide by. Additionally, the company policy compliance is governed by a higher authority to make sure each industry has a standard to follow.

The Fair Labor Standards Act (FLSA) covers compliances concerning overtime, minimum wage, timekeeping, paid time off and sick leave, and much more. More information on which rules your company needs to follow to be FLSA compliant is on the official Department of Labor webpage.

The Defense Contract Audit Agency (DCAA) ensures that your company leaves an audit trail that records any and all changes made to the timesheets, including approvals and rounding. This preserves information integrity and transparency in audits. For more information on the DCAA rules, you can look at their official page as well.

What is the right way to do timesheets

Aside from company policy compliances and some mandatory standards, what should you and your employees do to make your timesheets legitimate and useful?

- Make sure everyone understands the purpose and importance of timesheets;

- Supplement timesheets with additional data for better information on the workflow;

- Use a universal timesheet form across departments;

- Use a designated software to track time worked and create timesheets (no pen and paper forms or complicated spreadsheets);

- Don’t micromanage, only raise awareness and promote good practice;

- Input times truthfully and on a regular basis.

There can be more guidelines on this list, as each company will have its own preferences when it comes to time reporting and calculation. However, the most important factor is that everyone is on the same page about proper timesheet creation and regular tracking.

The longer people wait to fill in their hours, the more inaccurate your reports will be. This can seriously affect your payroll and billing, as well as give a skewed perspective on how your project is going along. Ingraining good practice should be a “Day 1” priority.

After this rundown, if you have any doubts or concerns, you may find our article on most asked questions about timesheets especially useful.

The information we’ve seen here will come in handy in the following section. Keeping the general timesheet rules and practices in mind, let’s discuss time rounding in more detail.

Everything you should know about time rounding

What is time rounding?

Time or timesheet rounding is a practice of rounding up employee hours to account for times in the workday that can’t be logged in the timesheet.

Things like bathroom breaks, booting up the computer upon arriving to the office, going to the break room/kitchen for refreshments or snacks, taking a five-minute breather, etc.

The FLSA defines time rounding as following:

“In recording working time under the FLSA, infrequent and insignificant periods of time beyond the scheduled working hours, which cannot as a practical matter be precisely recorded for payroll purposes, may be disregarded. The courts have held that such periods of time are de minimis (insignificant). This rule applies only where there are uncertain and indefinite periods of time involved, a few seconds or minutes in duration, and where the failure to count such time is justified by industrial realities.”

Source: U.S. Department of Labor

For example, when an employee’s daily timesheet shows that they’ve started work at 8:45 AM and ended at 4:47 PM, the total of hours worked comes out at 8 hrs 2mins. The employer can then choose to round the time to the nearest 5, 10, or 15 minutes. In this case, it would be 8hrs 5mins.

| TIME ROUNDING EXAMPLE | |

| Clock in | 8:45 AM |

| Clock out | 4:47 PM

(this entry gets rounded to 5 PM) |

| Total | 8:02 |

| Rounded total | 8:05 |

In the U.S, time is usually rounded to the closest 10th-hour increment or the nearest 15 minutes.

Is time rounding necessary?

Time clock rounding is commonly used for two reasons:

- To make wage calculations easier, and

- To help employers avoid paying for labor not performed, which can result in financial loss.

However, with the automation of time tracking/punching in and out of work, few employers round time clocks for payroll calculation. The second reason is more prevalent nowadays. It’s mainly aimed at preventing employees from starting their timers a few minutes earlier and stopping them a little later, as a means to accumulate more work hours.

With all that being said, time rounding is useful for employees, because they cannot always start or end their timers at a precise time. Time clock rounding allows for some leeway.

One such example are teams that frequently work overtime, but by the time the project/product is finished, the supervisors realize more money was lost in production than was earned.

Is time clock rounding legal?

If you are an employee, you might be wondering: “Is it legit for an employer to adjust my hours?”

The answer is yes, under specific rules.

- The U.S. Federal Law states that employers are allowed to round the time to specific predetermined time intervals: nearest 5 minutes, nearest 10th of an hour (6 minutes), or quarter of an hour (15 minutes).

- In addition to these strict time rules, an employer cannot use time rounding in any way that can withhold an employee’s wage. The aim is to round the times in such a way that they benefit both the employer and employee.

Let’s take a look at specifics of legal and illegal time rounding. For supervisors, this is especially useful, as it can help them avoid making a mistake that can be interpreted as a purposeful illegal action.

Legal time rounding

Let’s take a look at the rules and some situations where time rounding is correct, impartial, and most of all – legal. If you don’t have a clock-in clock-out system in place, Clockify by CAKE.com can easily be set up to act as one, and doubles as a time tracker.

The following three rules follow the same concept. The only difference is the employer/supervisor’s personal choice in the time interval they want to round to.

The 5-minute rule

This rule helps you round logged time to the nearest 5-minute interval. To keep these examples simple, we’ll be focusing on an employee’s logged in start time.

| Start time | Rounded time (Five minutes) |

| 07:58 – 08:02 | 08:00 |

| 08:03 – 08:07 | 08:05 |

| 08:08 – 08:12 | 08:10 |

| 08:13 – 08:17 | 08:15 |

| 08:18 – 08:22 | 08:20 |

| 08:23 – 08:27 | 08:25 |

| 08:28 – 08:32 | 08:30 |

| 08:33 – 08:37 | 08:35 |

| 08:38 – 08:42 | 08:40 |

| 08:43 – 08:47 | 08:45 |

| 08:48 – 08:52 | 08:50 |

| 08:53 – 08:57 | 08:55 |

| 08:58 – 09:02 | 09:00 |

The 6-Minute rule/One-tenth of an hour

The aim of this rule is to round the time to the closest tenth of an hour. Using the above example, the table would look something like this:

| Start time | Rounded time (Five minutes) |

| 07:58 – 08:03 | 08:00 |

| 08:04 – 08:09 | 08:06 |

| 08:10 – 08:15 | 08:12 |

| 08:16 – 08:21 | 08:18 |

| 08:22 – 08:27 | 08:24 |

| 08:28 – 08:33 | 08:30 |

| 08:34 – 08:39 | 08:36 |

| 08:40 – 08:45 | 08:42 |

| 08:46 – 08:51 | 08:48 |

| 08:52 – 08:57 | 08:54 |

| 08:58 – 09:03 | 09:00 |

The 7-Minute rule/One-quarter of an hour

This is often the most common rule companies will use. As you’re about to see, it deals with a larger time interval, so it’s easier to keep track of clock in/out times. Overall, it makes the rounding process less tedious.

It’s important to note that this is called the 7-minute rule because in the first 7 minutes of a 15-minute interval you round the time back, and in the next seven minutes you round the time forward.

| Start time | Rounded time (Five minutes) |

| 07:53 – 08:07 | 08:00 |

| 08:08 – 08:22 | 08:15 |

| 08:23 – 08:37 | 08:30 |

| 08:38 – 08:52 | 08:45 |

| 08:53 – 09:07 | 09:00 |

Implementing one of these rules creates an unbiased system for time rounding. It will ensure that your employees get a fair timesheet report by the time payroll calculations come around. That being said, you will have to be mindful of your employees’ login/out times to make sure they aren’t inflating their minutes in an attempt at accumulating hours for overtime pay.

The three time-rounding rules

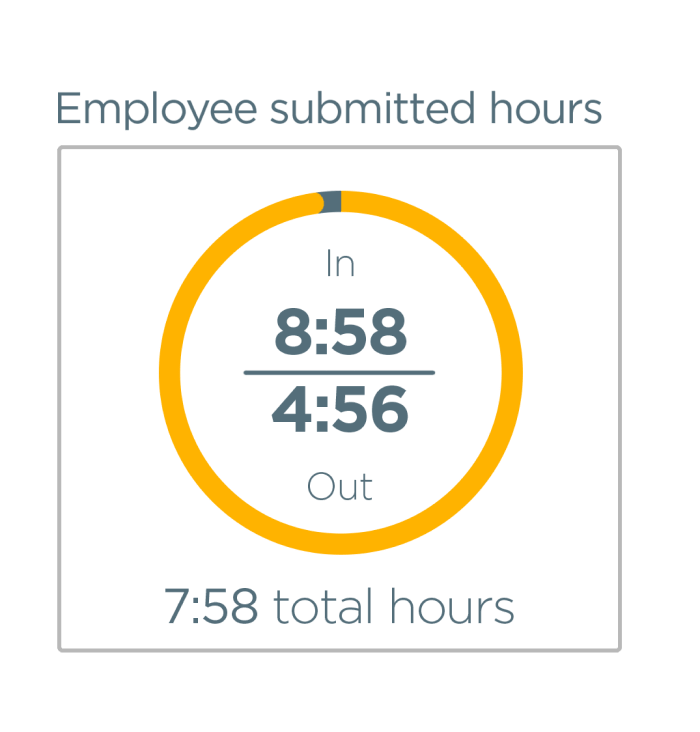

Let’s say that an employee clocks in at 08:56 and clocks out at 04:58. In reality, the person had worked for 8 hours and 2 minutes. To make the rounding fair and impartial, you should always keep in mind three things.

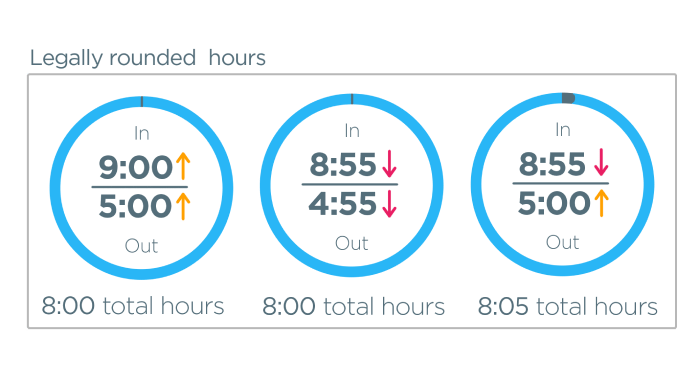

1. Round the time entry to the closest time increment.

This accounts for the most impartial time rounding. Taking the example above, if you choose the 7-minute rule, you will round the entries to 09:00 and 05:00.

2. Round the clock in time entry in favor of the employee, and the clock out time entry in favor of the employer.

While not completely impartial, it still achieves balance in the timesheet. The goal is to round down both time entries. You would first round the clock in from 08:56 to 08:55 as if the employee had arrived earlier. Then you would round the clock out time from 04:58 to 04:55 as if they had left earlier as well. Still, the result remains – it was a full 8hr work time.

Use time rounding with Clockify

3. Round the time entry in favor of the employee every time.

Following this rule, you would round down the time of arrival, and round up the time of leaving. So it would go from 08:56 to 08:55 and from 04:58 to 05:00. This adds up to 8hrs and 5mins of work time. Again, since it’s in favor of the employee, the time rounding is considered legal.

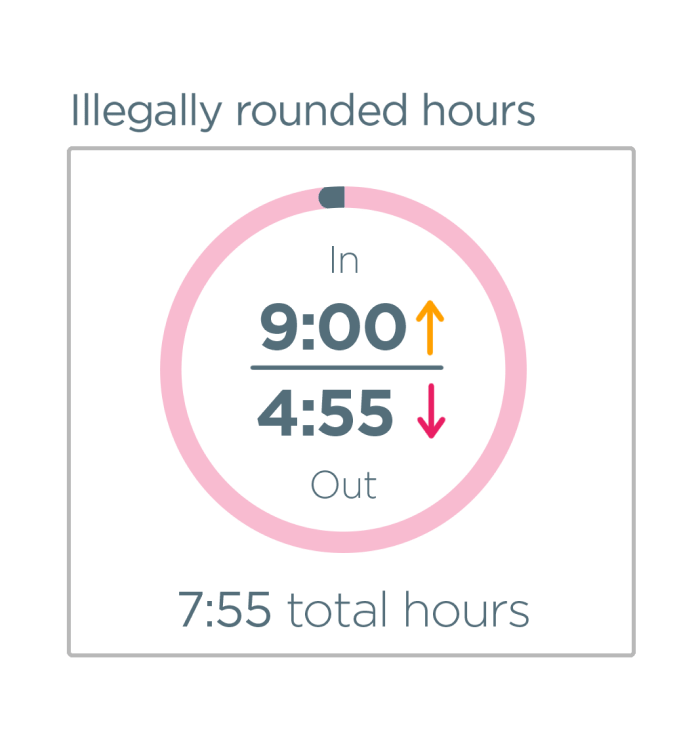

Illegal time rounding

Once you understand the rules of legal time rounding, it becomes fairly clear what would be considered illegal time rounding.

Any instance in which you round up the clock-in time and round down the clock-out time is considered a grievance, and the employee has grounds to file a complaint to FLSA.

In the example above, an unfair rounding would be from 08:56 to 09:00 and from 04:58 to 04:55. Once added up, the work hours come up to 7 hours and 55 minutes. The biggest thing to keep in mind is that time should never be rounded in favor of the employer. It should always be balanced (neutral) or in favor of the employee.

Things to keep in mind when rounding work hours

Time rounding is legal but not as common as before.

Digital time trackers like Clockify by CAKE.com were developed to make the whole process of payroll and invoicing much easier when it comes to calculating time. However, if you do want to round hours by yourself, take extra caution, as any hint of bias or employer-centricity can cause complaints among your staff and possible appeals.

Audit your rounding practices

Yearly audits are a great way to keep your practices in check, even if you’re doing best to keep up with the rules.

Don’t round hours blindly; analyze data

Even though you should always round hours in favor of the employees (if not neutrally), pay attention to how often the timesheets show over time and with which employees. If one or several people are constantly staying longer hours, maybe it’s time to have a 1:1 meeting.

This is simply to make sure that employees are not trying to abuse the system or find ways around it to add up time for their overtime hours.

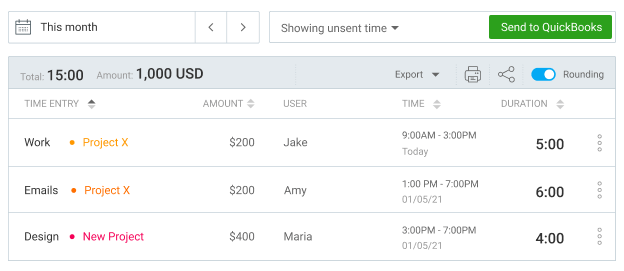

Use Clockify by CAKE.com to integrate time rounding with payroll software

Time rounding is here to stay.

And it’s up to you to use it and get a better glimpse into your employee’s workflow.

Ready for the kicker?

Here it is — to improve your time rounding, you can integrate time tracking software with a payroll platform like QuickBooks.

Here’s how it works:

- Create a Clockify account,

- Invite team members,

- Connect QuickBooks in Clockify Settings > Integrations,

- Sync users and customers,

- Set rates for employees, projects, or tasks, and

- Send time to QuickBooks.

Voila — you’re ready to go!

This integration will make your billing more accurate and simpler. In fact, it will allow you to track time on projects and transfer this useful data to QuickBooks.

That way, your accounting team can:

- Pay everyone fairly, and

- Reduce underpayment or overpayment.

Finally, this leads to an increase in trust and employee retention in your company.

What more could you possibly want?

Anyway, it’s time to make your payroll as precise as possible.